Comparing the Spending Demographics of the Pet Industry Segments – SIDE BY SIDE

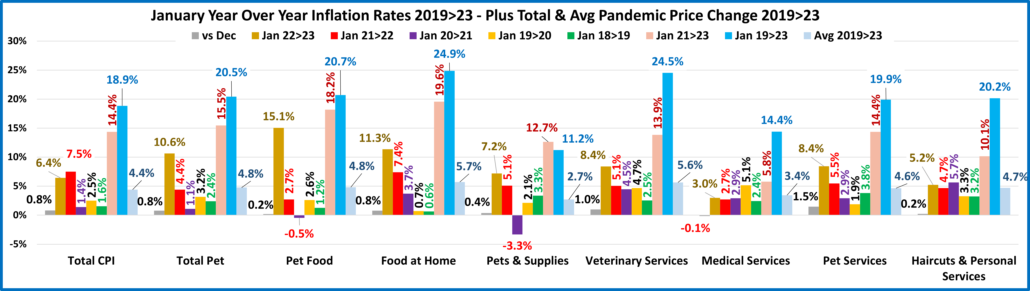

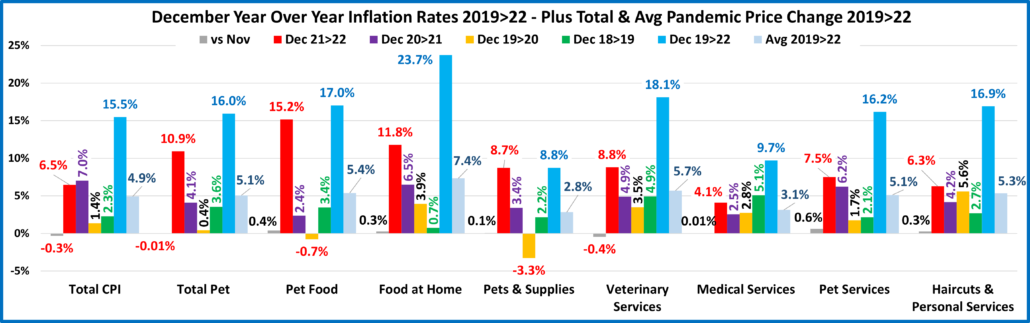

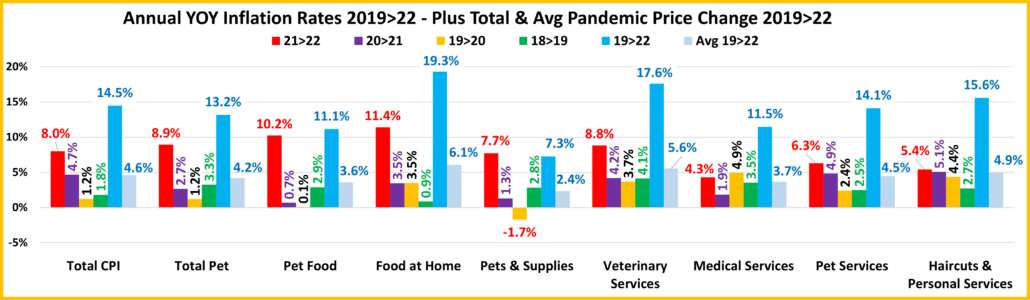

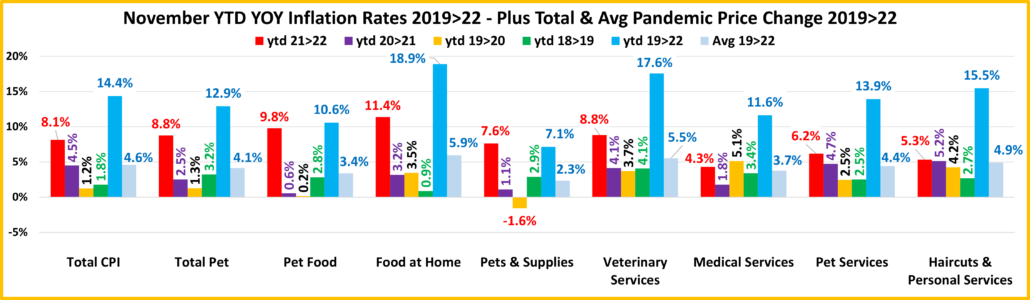

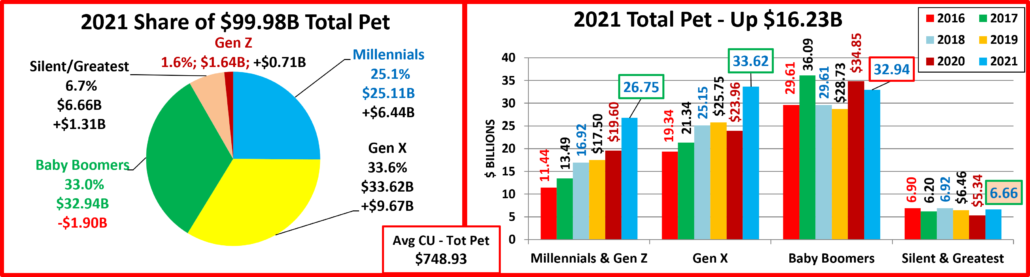

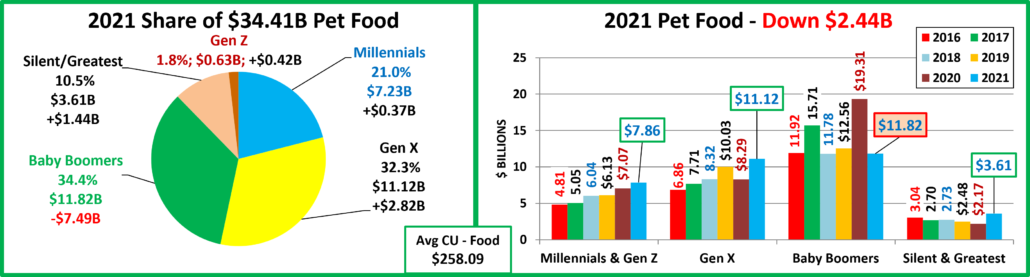

The first 5 reports of our Pet Spending Demographics analysis have been very detailed and intense. We looked at the industry as a whole and each of the individual segments. Recent years have seen some turmoil. We have seen the very real impact of outside influences on the industry. In the 2nd half of 2018, the FDA warning on grain free dog food caused a $2.3B drop in Food $ and new Tariffs flattened Supplies $, but Services had a record lift. In 2019, Food rebounded but the tariffs really hit the Supplies segment with a $3B drop. Veterinary $ grew slightly while Services $ fell a bit. The net was -0.2% drop in Total Pet. The 2020 pandemic had varied impacts as Pet Parents focused on needs. This caused a lift in Veterinary and a huge increase in Food because some demographics binge bought out of fear of shortages. Services spending plummeted due to outlet closures and restrictions while Supplies $ continued to fall because consumers saw them as more discretionary. 2021 brought a big change, Food $ fell because there was no “binge” repeat. However, Pet Parents focused on their “children” producing a widespread record lift in all other segments and a record $16B increase.

We have often referenced the similarities and differences in spending between Total Pet and the individual industry segments. Total Pet Spending is a sum of the parts and not all parts are equal. In this final report we are going to put the segments side by side to make the parallels, differences and changes from 2020 more readily apparent. We will address:

- “The big spenders” – those groups which account for the bulk of pet spending.

- The best and worst performing segments in each of twelve demographic categories

- The segments with the biggest changes in spending $ – both positive and negative

- And of course, the “Ultimate Spending CUs”

The emphasis is on “visual” side by side comparisons to allow you to quickly compare the industry segments. We’ll try to minimalize our comments. You can always reference one of the specific reports for more details. We’ll also break the charts up into smaller pieces that are demographically related to make the comparison more focused and easier.

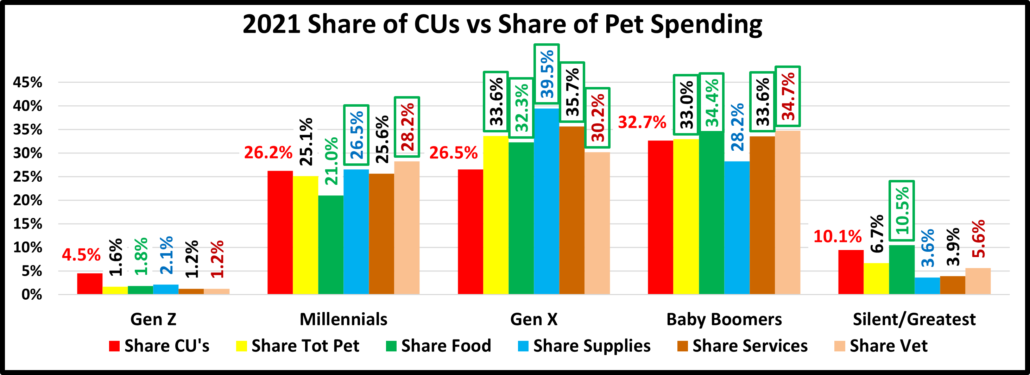

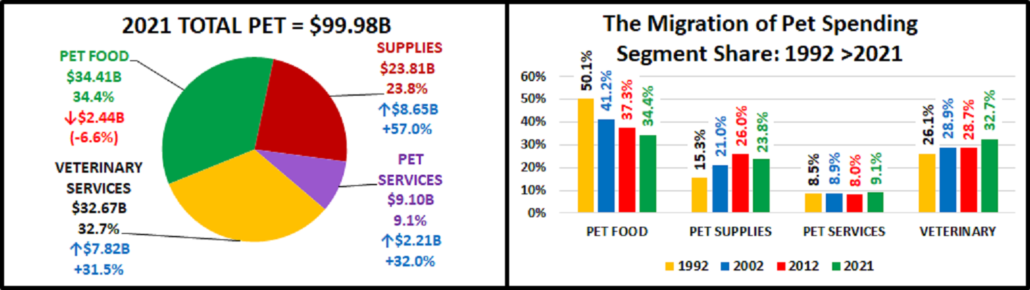

Before we get started, let’s take a look at the current market share of the industry segments. The following 2 charts show the 2021 share of spending for each segment and the evolution over the past 29 years. 1992 was the last year that the Food Segment accounted for 50% of Total Pet Spending. By the way, Total Pet Spending was $16.2B in 1992. We have come a long way – +517%; annual growth rate of 6.48%. This will help put our comparisons into better perspective.

Food: 34.4%; Down from 44.0% Veterinary: 32.7%; Up from 29.7%

Food: 34.4%; Down from 44.0% Veterinary: 32.7%; Up from 29.7%

Supplies: 23.8%; Up from 18.1% Services: 9.1%; Up from 8.2%

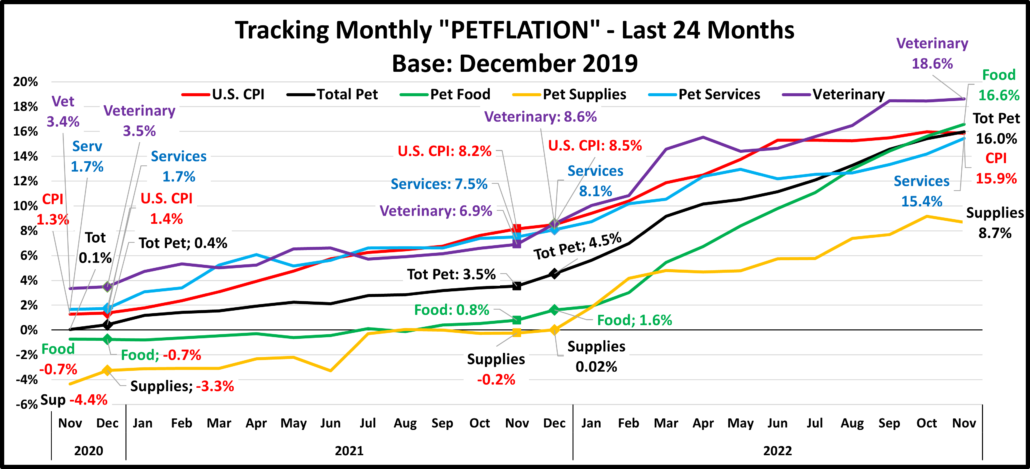

In 2021, Food lost almost 10% of share in Total Pet $ which was gained by all other segments. The most notable trend from 1992 to 2012 was the decline in Food share while Supplies gained in importance. In the 90’s Pet Owners became Pet Parents. At the same time, Pet Chains and Super Stores came to the forefront and there was a big Pet Product expansion into the Mass Market. In recent years, the Product Segments have been on a rollercoaster. Food reached 44% in 2020, the highest level since 44.8% in 1998. Supplies have been trending down since 2012, hitting bottom at 18.1% in 2020. The Services segments have been more stable. They have generally trended up since 2012. Non-Vet Services peaked at 11+% in 2018>19 then fell to 8.2% in 2020. They turned sharply up in 2021. Veterinary has been in the 25>27% range since 2012 but with a big lift in 2021, they broke the 30% mark and now trail Food by only 1.7%. Big Trends in Food and Petflation in Supplies tend to make the Product Segments more volatile than the Services Segments.

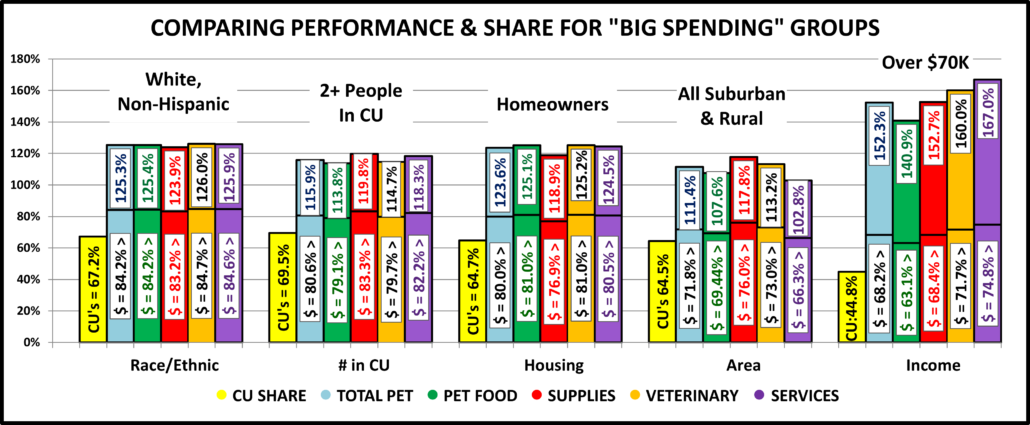

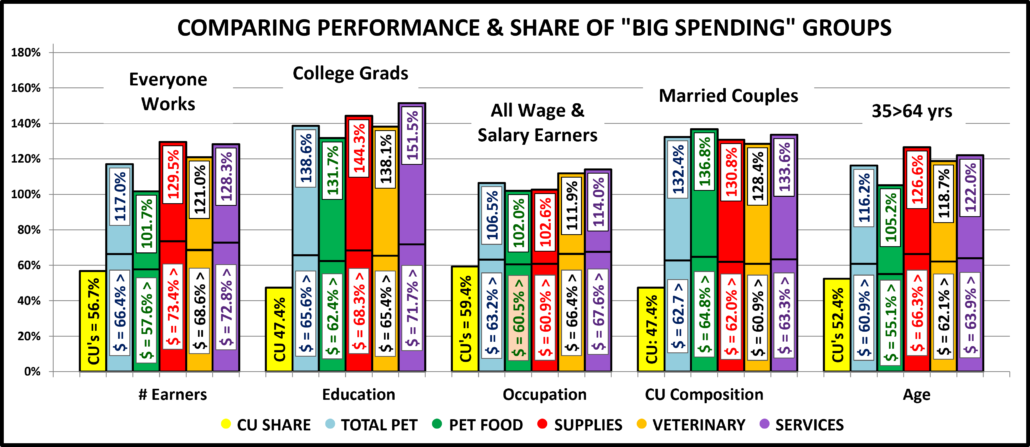

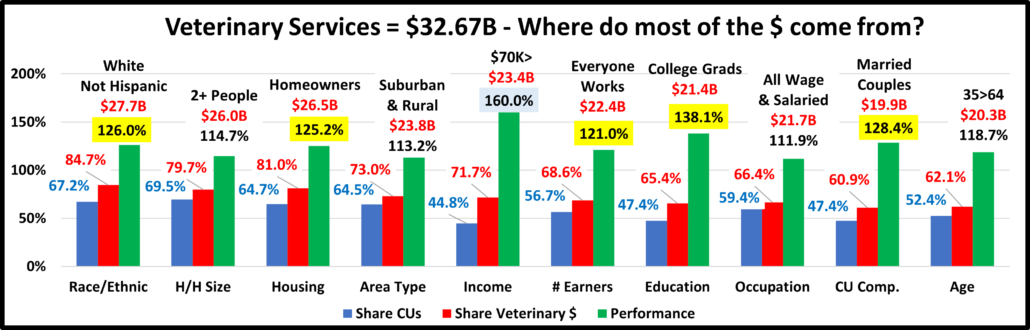

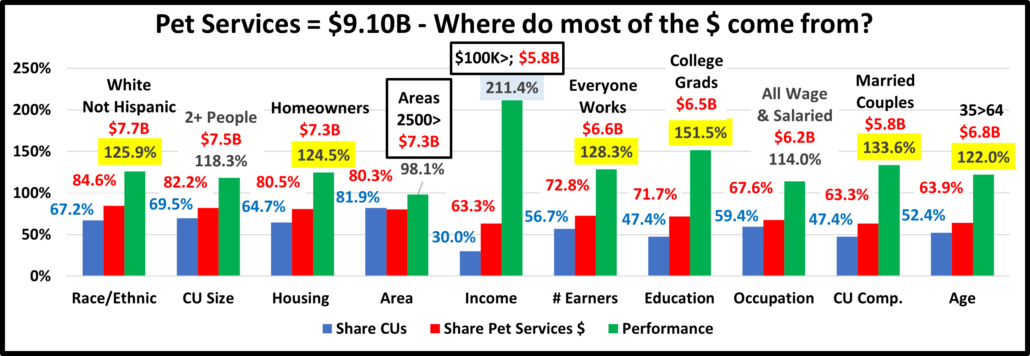

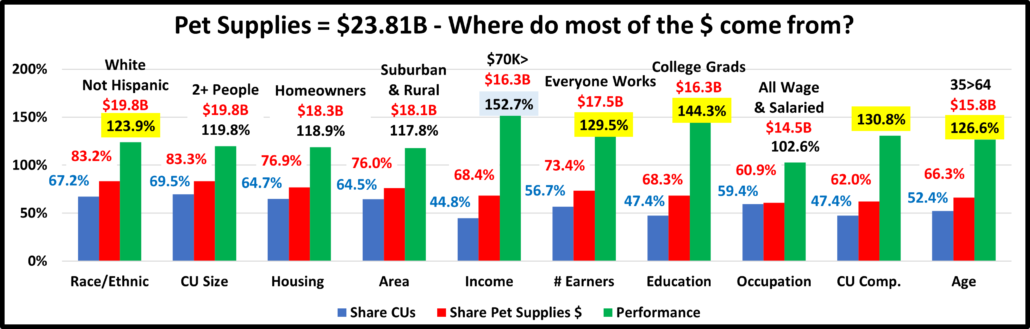

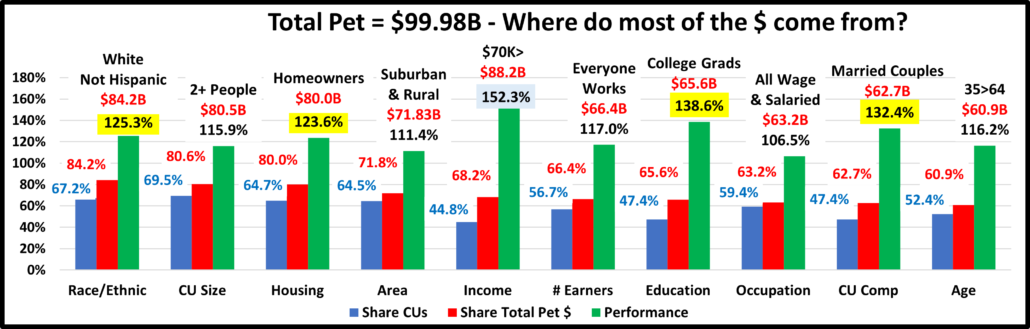

Now let’s get started with a look at the “Big Spenders”. The following 2 charts will compare the market share and performance in all Pet Industry segments by the groups responsible for the bulk of the spending in 10 demographic categories. These are the groups that we identified in our Total Pet analysis to generate at least a 60% market share of spending. As you recall, to better target the spending we altered 2 groups in Services and 1 in Food. However, to have a true side by side comparison we need to use the same groups for all. The market share dips below 60% twice, both in Food spending. One is because Food spending by Age is more balanced but skewed a little older than other segments. The other is in # of Earners, where the number of Earners in a CU mattered less. Even the low point of 55.1% is within 5% of our target and 96% of all measurements meet or exceed the 60% requirement, so the comparison is very valid.

The chart makes it especially easy to compare performance across categories. Remember, performance levels above 120% show a very high level of importance for this category in terms of increased spending. Unfortunately, it also indicates a high spending disparity among the segments within the category. There are 2 charts, each with 5 categories.

- White, Non-Hispanic – This group has an 83+% market share in every Segment. Minorities account for 32.8% of CUs but only 15>17% of spending in any segment. Factors: Lower income for Hispanics and African Americans and lower Pet ownership in Asians and African Americans. Whites lost 2>4% in share in all segments but Supplies which fell 0.1%. Hispanics made the biggest gains. Asians also had increases but African Americans generally lost ground.

- 2+ People in CU – 2+ is still the key in pet ownership. However, the results were mixed by size. Singles lost ground in all but Food so 2+ CUs had the opposite pattern. 2 People had big gains in all but Supplies. 3 People had big drops in all but Food. 4 People gained in Supplies and Veterinary but fell in Services and plummeted -18.7% in Food which produced the biggest drop in Total Pet. 5 People were up in all but Food. Truly, a mixed bag by CU size.

- Homeowners – Homeownership is very important in Pet Ownership and subsequently in all Pet Spending. It also increases with age. This group’s share of Total Pet fell below 80% for the first time in 2018. It bounced back in 2019>20 but fell 3 points in 2021. All but Services lost share with Food having the biggest drop, -5.7%. Services gained 2% and is again above 80%. Supplies remains at the bottom. Those w/o Mtge drove the big decrease.

- Suburban & Rural – They gained 0.2% in Total Pet. Both the Suburbs 2500> and Areas <2500 had strong gains in Veterinary but the other segments were divided. The Big Suburbs had strong gains in Food, Supplies & Total but lost ground in Services. The less populated areas increased share of Services but their share fell in Food, Supplies & Total.

- Over $70K Income – INCOME MATTERS MOST IN PET SPENDING! Income has grown in importance in recent years and all Industry segments performed at 140+%. Food lost 2% in share and replaced Supplies at the bottom in share and performance. It was the only segment with decreased share and performance. The other segments gained at least 5.6% in share, led by an 8.3% gain by Veterinary. Food spending became slightly more balanced while the income spending disparity gap significantly widened for the other segments. Services is still the least balanced.

- Everyone Works – Income is important, and the importance of # of Earners grew for the discretionary segments, Supplies & Services. Veterinary held its ground but Food performance fell 22%, driving Total Pet below 120%. The drop in Food was due to no binge buying while the big discretionary lifts came from the record pandemic recovery.

- College Grads – Higher education often correlates with higher income and a College degree is 2nd in spending importance for all but Food. The group grew in share and performance in all segments, but Veterinary. Veterinary lost 4.1% in share and 6.9% in performance while the product segments, led by Food, gained 18.4% in share and 37.2% in performance. Total Pet gained 13.0% in share and 26.0% in performance. College is now a key factor.

- All Wage & Salary Earners– Incomes vary widely in this group, so performance is often lower. Supplies fell sharply in share and performance. Veterinary lost share due to fewer CUs but gained in performance. Services had slight gains in both. Food gained 12% in share and 22% in performance which pushed performance again above 100% – also for Total Pet. The group spent more in all segments, including Food but the bulk of the lifts came from White Collar.

- Married Couples – Marriage has been important to spending in all segments. In 2021 all segments but Food & Total Pet gained in share and performance. The lift was widespread in Married segments with 1 big negative exception, Married Couples with an oldest child 18 or older.

- 35 to 64 yrs – Includes the 3 highest income segments. This group had the same pattern of gains/losses as CU Composition – Food & Total down, all other segments up. The “bad guys” were 55>64 yr-olds. However, Food is a little more balanced by Age and in fact skews a little older. 35>64 only has a 55% share of the $.

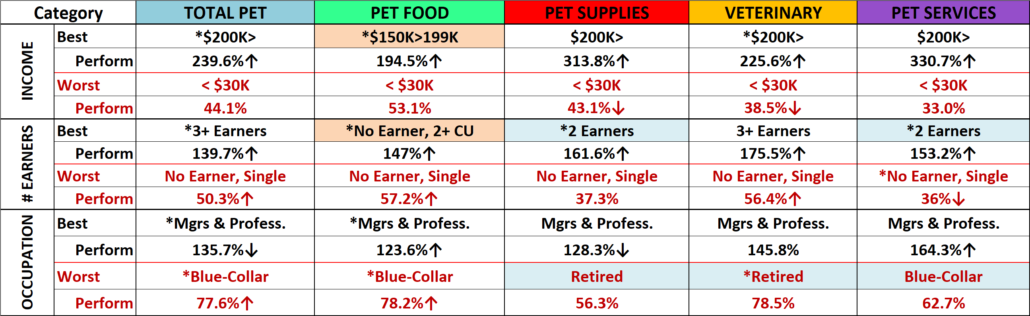

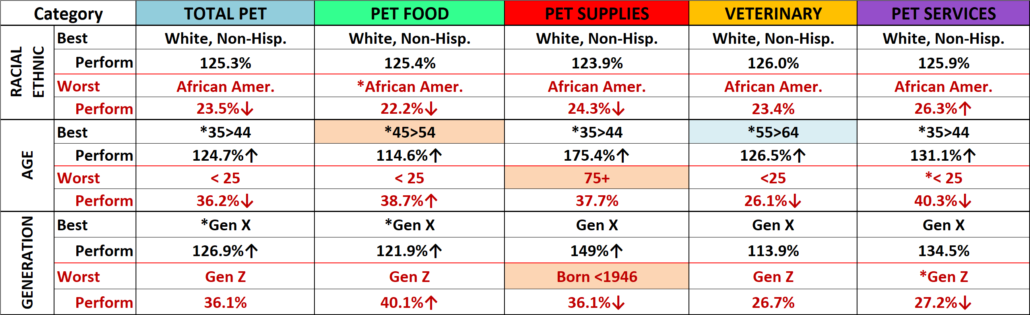

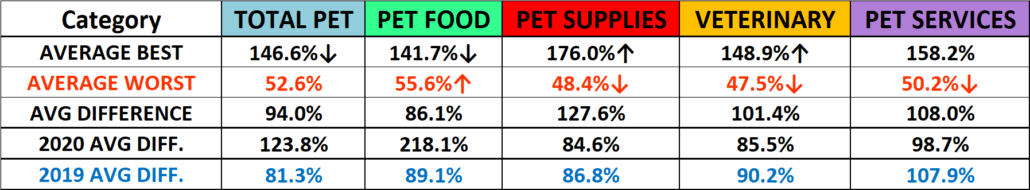

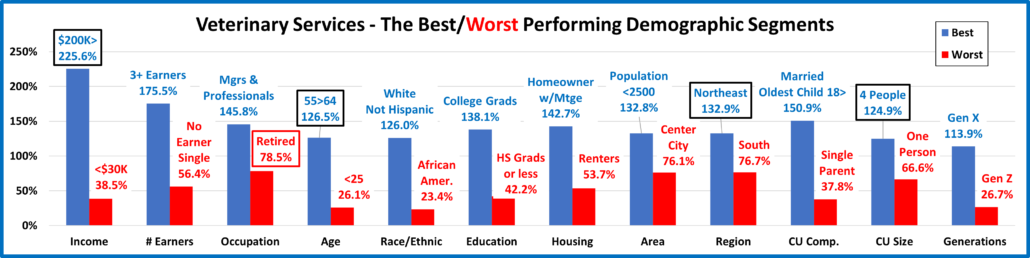

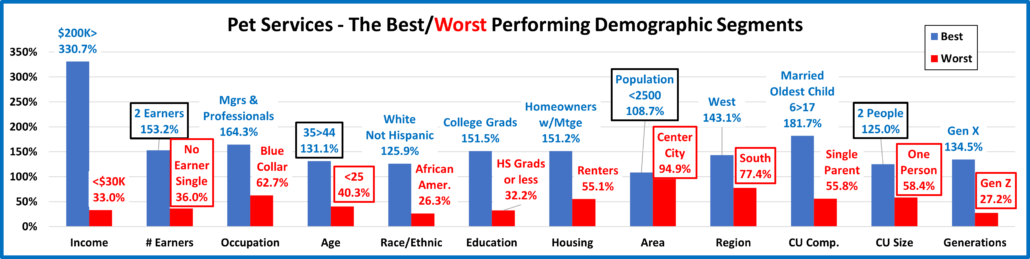

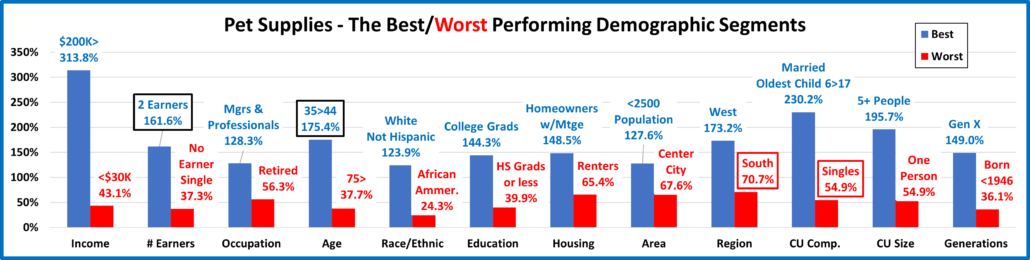

Now we’ll drill a little deeper to look at the Best and Worst performing segments in each category. Color Highlighted cells are different from Total Pet; * = New Winner/Loser; ↑↓ = 5+% Performance Change from 2020. We will divide the categories into related groups. First, those related to Income.

- Income – Income matters, and its importance is growing in the Industry. The Food winner was up $150>199K from $100>149K in 2020 but the disparity between first and last place fell by 80%. The disparity in Services and Veterinary was 40+% more but Supplies was up 100+%. This pushed Total Pet up +50%. Income Matters the Most.

- # Earners – More earners = more income. 2+ Earners is the usual winner and reflects the importance of Gen X and Millennial CUs. The turmoil in Food is reflected by the No Earner, 2+ CU win. In all segments but Food & Total Pet the disparity and importance of the number of Earners grew. The biggest gain occurred in Veterinary.

- Occupation– Mgrs & Professionals and Self-Employed are #1 and #2 in CU income and expenditures. Self-Employed binge bought food in 2020 so they were replaced by Mgrs/Professionals in 2021. The bottom spots are again occupied by either Retirees or Blue-Collar workers. No Binge in 2021 caused the disparity to drop by 100+% in Food and Total Pet. It also decreased in all but Services. Income is important in Pet Spending but how you earn it is less so.

Next are demographics of which we have no control – Age, Generation and Racial/Ethnicity

- Racial/Ethnic– As expected, White Non-Hispanics are the top performer in all segments and African Americans replaced Asians in Food so they occupy all the bottom slots. They have the lowest income and only 25% own Pets. The disparity grew sharply in Supplies so now it is basically a 100% performance difference in Total & all segments.

- Age – The winners are all new. 35>44 had a strong year, but the winners are mixed. At the bottom in all but Supplies are <25 yr-olds. Food and Veterinary spending skew a little older. There are still big disparities in all segments but Food, which has more balanced spending at least by age, as all age groups over 35 have at least 95% performance.

- Generation – Gen X now rules. Gen Z is at the bottom in all but Supplies, which skews younger. The disparity gap closed significantly in Food but increased by 20% in Services & Supplies. It grew by 4% in Veterinary and Total Pet.

- Education – Winning and losing is closely tied to more and less Education which generally correlates with income. The disparities are huge. The biggest change is in Food which skewed towards lower education in the 2020 binge.

- CU Composition – In 2021 Pet Spending was all about CUs with kids, except for Food. The oldest kid 6>17 aligns with the middle age groups. Single Parents remain at the bottom in all but Supplies and the disparities are huge, 100+%.

- CU Size– The top CU number in Pet is now 4+ but “1” remains solidly on the bottom. 2 people CUs are still important as they replaced 4 people CUs at the top in Food & Services. The disparity is also smaller in all but Supplies.

- Housing – We’re back to normal as Homeowners w/Mortgage and Renters are the perennial winner and loser.

- Area– Areas <2500 population performed the best. This is surprising in Services as that usually skews towards higher population. Another surprise is Suburbs 2500> replaced Center City at the bottom in Food with a huge disparity.

- Region – 3 new winners, but no surprises. The South is again at the bottom in all but Food.

Here are two summary charts. The first compares the averages.

The big changes in Food & Supplies are immediately apparent. The 2021 difference in Food is less than half of 2020 while it increased by 40+% in Supplies. Pre-pandemic, the performance difference grew as you moved from Products to Services, peaking in the most discretionary, Non-Vet Services. In 2021, Food flipped from highest to lowest disparity, while Supplies moved to the top. However, both Veterinary and Supplies now have a difference of 100+%. Spending became significantly less balanced in every segment but Food. While the Total Pet disparity fell, it is still high at 94%.

- Food – After the 2020 binge, the disparity gap returned to a more normal, pre-pandemic level.

- Supplies – The record increase produced a record disparity between best and worst.

- Veterinary – The Winners performance grew while the losers fell pushing the difference over 100%.

- Services – The performance gap widened but essentially returned to a normal level for this segment.

This chart shows the number of new winners/losers.

Total Pet had many changes, especially in winners. Total Pet is a sum of the segments. However, you see how influential the Pet Food segment is with the turmoil from the drop in 2021 $ after the binge buying by specific segments in 2020.

- Pet Food spending fell because there was no repeat of the 2020 panic buying. As a result, over 80% of the winners changed and almost half of the losers are new.

- Even with a record increase, Supplies is the most stable with very little change in top or bottom performers.

- The Veterinary spending increase was also huge but there was also only a small number of changes.

- Services had a strong spending recovery and some turmoil mostly on the “losing” side.

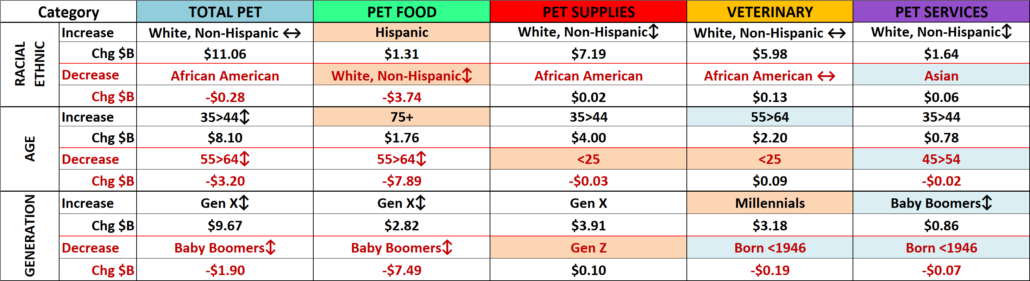

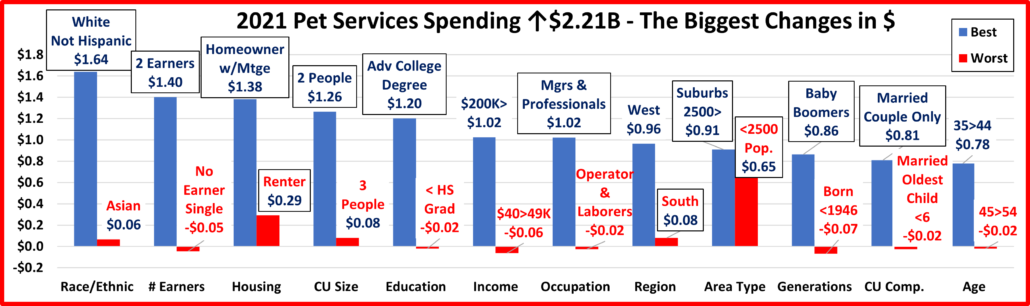

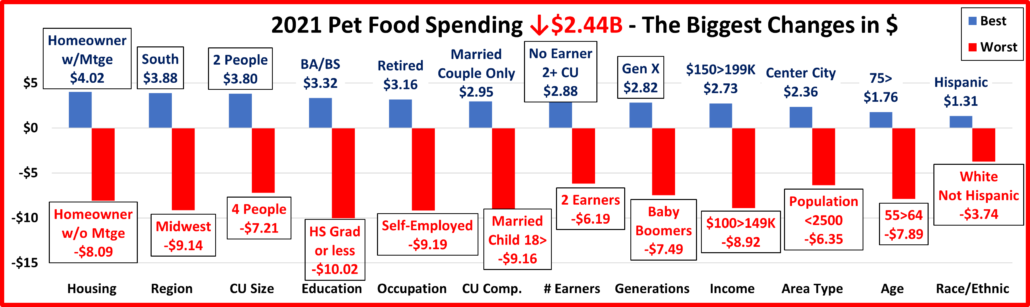

Now, let’s look at the Demographic Segments with the Biggest Changes in $. We’ll truly see some differences between the Industry Segments. We have color highlighted differences from Total Pet. Plus: ↔ = Winner/Loser same as 2020 ↕= Flipped from 1st to Last or vice versa

- Income – All winners & losers were new with 3 flips from 1st to last. The winners returned to high income groups and the losers to low income, with 2 exceptions. In Food & Total, $100>149K lost due to Food binge buying in 2020.

- # Earners – All new with 4 flips. In Non-Food Segments, the winner & loser were driven by income. In Food, 2+ CU Retirees finally upgraded which put them on top. They also spent more in other segments which led to a Total win.

- Occupation – 2 were repeats while 3 flipped. In a pattern similar to # Earners, the Non-Food winners (Managers & Professionals) were high income while the losers were low income. In Food & Total we saw the winning efforts by Retirees as well as the loss for Self-Employed as they didn’t repeat their 2020 extreme Food binge buy in 2021.

Now the Age and Racial/Ethnic Categories

- Racial Ethnic – White, non-Hispanics won in all but Food, where they were the big loser. They have high income & pet ownership and drove the 2020 Food binge so this is no surprise. African Americans have low income and Pet ownership and lost 3 times (2 were small increases). Asians have high income but had the smallest Services increase.

- Age – All new with 3 flips. 35>44 had 3 wins while 55>64 won in Veterinary and the 75+ Retirees won in Food. <25 lost in 2 segments and 55>64 paid for their 2020 Food binge, no surprise. 45>54 was an unexpected loser in Services.

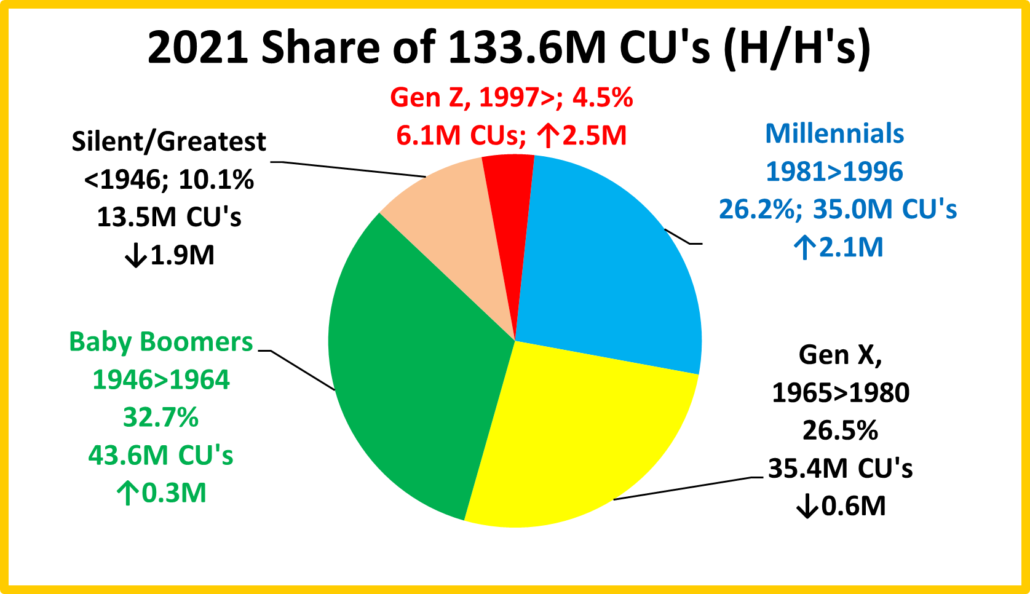

- Generation – Gen X won Food, Supplies & Total and Millennials won Veterinary. Boomers did have the biggest increase in Services but lost in Food & Total Pet. Those born before 1946 came in last in Veterinary and Services. Gen Z did finish last in Supplies, with the smallest increase. However, winning skewed younger while losing skewed older.

Now, here are more Demographic Categories in which the consumers can make choices.

- Education – Higher education, especially a College degree is tied to increased income and pet spending. We had 4 flips which returned this demographic to a more normal pattern of winners & losers.

- CU Comp. – While CUs with Children were the best performers in Total Pet and all segments but Food, 2021 was also a strong year for Married Couple Only. They had the biggest increase in Total and all segments but Supplies.

- CU Size– Bigger CUs performed best, but with 4 last to 1st flips, 2 person CUs had the biggest increases across the board.

- Housing – 6 flips returned Housing to a more normal pattern with Homeowners w/Mtges at the top. Renters are often at the bottom, but in 2021 those w/o Mtges had 3 losses. Food & Total Pet came from their 2020 Food Binge.

- Area – The flip winner with 8. Big Suburbs flipped to their normal spot on top in Total and 3 segments. Center City was a surprise winner in Food but the 2020 Binge put <2500 at the bottom in 2021 Food & Total. Center City losses in Supplies & Veterinary are no surprise. The <2500 loss in Services is usual, but a loss with +$0.65B lift is surprising.

- Region – 6 flips and a more normal pattern with some exceptions. The South is an unusual Food winner and the 2020 Food binge flipped Midwest to the bottom in Food & Total. However, the strangest situation was that losers in 3 categories spent more, 2 with lifts of a $B or more. The big winner was the West and Midwest was the big loser.

The next chart compares the number of repeats, “flips” and new segments among the 12 winners and 12 losers for each industry segment. The idea is to look for patterns in the data that cross segments. Let’s take a look.

- 3 Segments were up a lot while Food $ fell. The overriding pattern was turmoil.

- In terms of repeats Supplies (5) and Veterinary (8) led the way while Food and Services had NONE!

- Due to the 2020 binge, Food led the way in flips (17) with all 2020 winners flipping to last in 2021. Services was 2nd (12). Veterinary had the fewest flips (3) while Supplies had (6) but 5 of the Supplies flips were from last to 1st.

- You can see how the combined segments put Total Pet in turmoil – 17 flips and only 1 repeat

- There are a total of 24 winners and losers. The number different from 2020 was: Food: 24; Supplies: 19; Veterinary: 16; Services: 24; Total: 23. It appears that the record recovery caused as much or more turmoil than the pandemic.

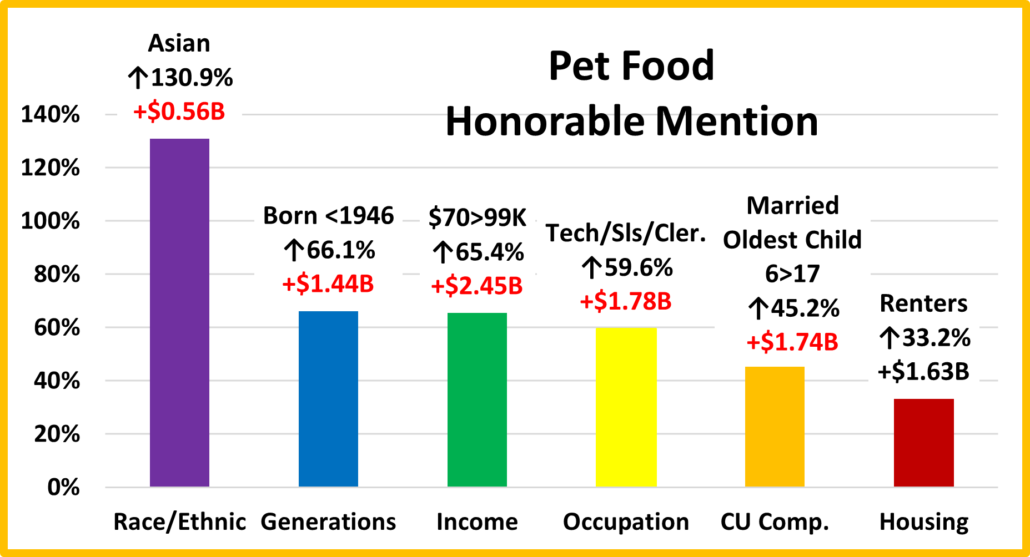

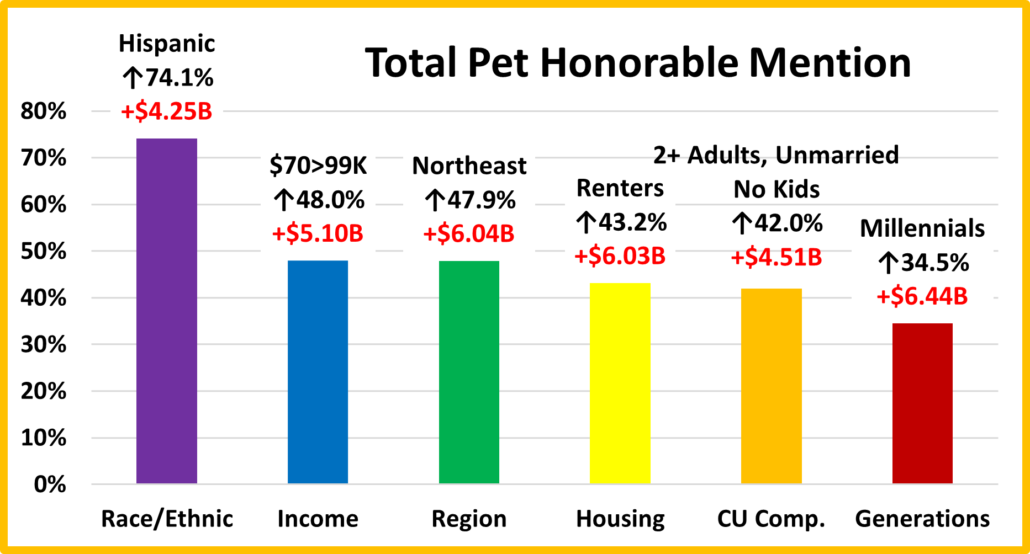

Next, there were so many positive contributors that in each individual report we recognized 6 segments that didn’t win but still performed so well that they deserved Honorable Mention. I reviewed that list again and came up with segments that won Honorable Mention at least twice. Here are the 9 “SUPER Honorable Mentions” for 2021…

You can immediately see that it was an unusual year as 9 segments made the list. Supplies had the biggest increase, +57% and led the way with 6 segments on the list. Supplies became more skewed towards higher income but 97% of demographic segments spent more. Except for Millennials, the segments on the list are generally “low profile” but contributed notably to the industry. We should give special kudos to Millennials, Renters and Unmarried 2+ All Adult CUs. These 3 groups won Honorable Mention in 2 Industry segments and Total Pet.

Although the results were mixed, with numerous individual changes, I saw these trends of note:

- Youth Movement – Boomers must inevitably fade. The Gen Xers have stepped up, with the Millennials close behind.

- Sub-Urbanization – The Suburbs are the key. Areas <2500 are the top performers but the Suburbs 2500> spend the most. With the exception of pandemic 2020, they are the only area that increased $ every year since 2016.

- The “Magic” number is 4+ – As spending skews younger the best performers in all but Food tend to be larger CUs. However, 2 person CUs still have the largest share of $ in every segment and Total Pet. They’re not done yet.

- Changes in spending balance – The performance gap between the best and worst narrowed in Food but expanded in the other segments, especially in Supplies. This happened despite a demographically widespread increase.

- Income is still the most important factor – The gap between best and worst narrowed in Food, but widened in all other segments, again especially in Supplies. The best performer is always $150K+, while the worst is <$30K.

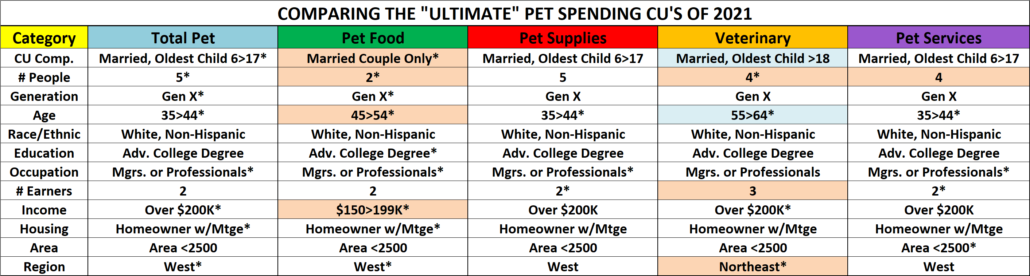

And Finally, What you have all been waiting for…

THE ULTIMATE 2021 PET SPENDING CUs – Side by Side

Color Highlighted cells are different from Total Pet; * = New in 2021

Methodology – The segments are chosen because they have the highest annual CU spending of any segment in the category. They may or may not have the most total dollars. That would depend upon the number of CUs in the group.

Final Comment – These “winners” further reinforce the key factors in increased pet spending:

Marriage– A commitment to another person demonstrates that you can make a commitment to your pet “children”.

CU Size – The “magic” number continues to increase. It’s now 4+ people in a CU

Homeownership – Owning and controlling your own space has long been a key factor in Pet Parenting.

More space – Small suburbs near a big metro area offer the convenience of the city, plus room for more pets.

Income Matters Most – High Income, A High Paying Occupation, A College Degree, At least 2 Earners. These are characteristics present in all of the Ultimate Pet Spending CUs.

Generation– Boomers have passed the torch to Gen X. Age Note: All 45>54, 50% of 35>44 and 20% of 55>64 are Gen X.

I hope that this Visual Comparison helped you to get a “satellite view” of Pet Industry Spending in 2021. Please refer back to the individual segment reports to get more details.