Petflation 2023 – July Update: Slows again, but still +8.7% vs 2022

Inflation is no longer a “headline” but it is still news. The YOY increases in the monthly Consumer Price Index (CPI) that were larger than we have seen in decades are definitely slowing. July prices grew 0.2% from June and the CPI was +3.2% vs 2022, up slightly from +3.0% last month – a pause in the decline. Grocery pricing continues to slow. After 12 straight months of double-digit YOY monthly percentage increases, grocery inflation is down to +3.6%, now with 5 consecutive months below 10%. As we have learned, even minor price changes can affect consumer pet spending, especially in the discretionary pet segments, so we will continue to publish monthly reports to track petflation as it evolves in the market.

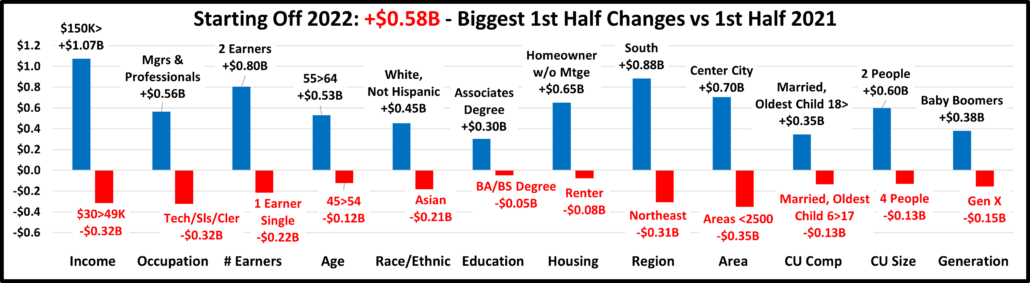

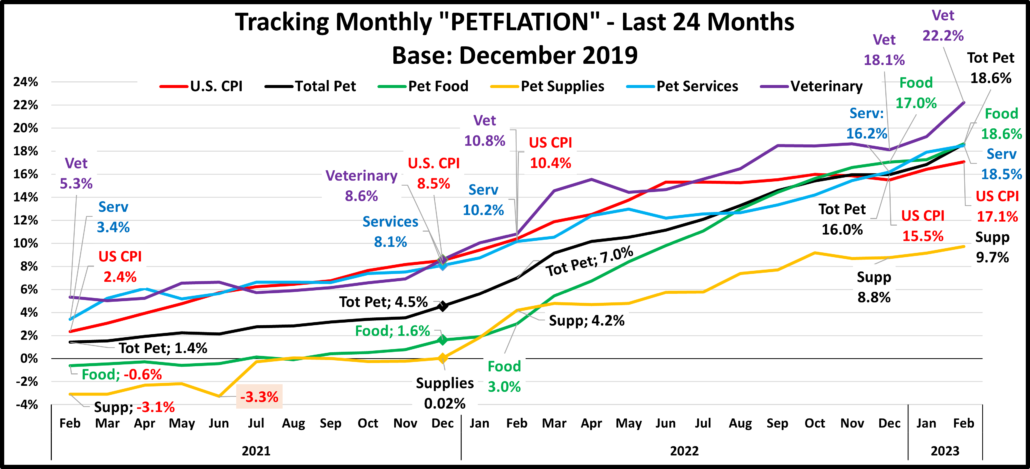

Total Petflation was +4.1% in December 2021 while the overall CPI was +7.0%. The gap narrowed as Petflation accelerated and reached 96.7% of the national rate in June 2022. National inflation has slowed since July 2022, but Petflation has generally increased. It passed the National CPI in July 2022 and is now +8.7% in July, 2.7 times the national rate of 3.2%. We will look deeper into the numbers. This and future reports will include:

- A rolling 24 month tracking of the CPI for all pet segments and the national CPI. The base number will be pre-pandemic December 2019 in this and future reports, which will facilitate comparisons.

- Monthly comparisons of 23 vs 22 which will include Pet Segments and relevant Human spending categories. Plus

- CPI change from the previous month.

- Inflation changes for recent years (21>22, 20>21, 19>20, 18>19)

- Total Inflation for the current month in 2023 vs 2019 and now vs 2021 to see the full inflation surge.

- Average annual Year Over Year inflation rate from 2019 to 2023

- YTD comparisons

- YTD numbers for the monthly comparisons #2>4 above

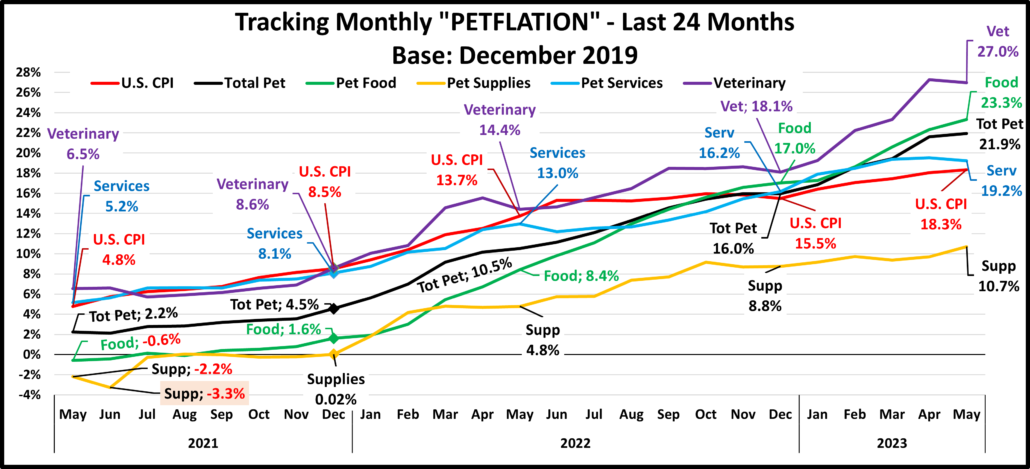

In our first graph we will track the monthly change in prices for the 24 months from July 2021 to July 2023. We will use December 2019 as a base number so we can track the progress from pre-pandemic times through an eventual recovery. Inflation is a complex issue. This chart is designed to give you a visual image of the flow of pricing. You can see the similarities and differences in patterns between segments and compare them to the overall U.S. CPI. The current numbers plus yearend and those from 12 and 24 months earlier are included. This will give you some key waypoints. In July, Pet Products prices were down again from last month, but they increased in both Service segments.

In July 2021, the CPI was +6.2% and Pet prices were +2.8%. Like the U.S. CPI, Veterinary and Services prices generally inflated after mid-2020, while Food and Supplies prices generally deflated until late 2021. After that time, Petflation took off. Pet Food prices consistently increased but the other segments had mixed patterns until July 2022, when all increased. In Aug>Oct Petflation accelerated. In Nov>Dec, Services & Food prices continued to grow while Veterinary & Supplies prices stabilized. In Jan>Apr, prices grew every month except for 1 dip by Supplies. In May Products prices grew while Services slowed. In June & July this pattern was reversed. Petflation has been above the CPI since November 22.

- U.S. CPI – The inflation rate was below 2% through 2020. It turned up in January 2021 and continued to grow until flattening out in Jul>Dec 2022. Prices turned up again in Jan>Jul but 36% of the overall 19.0% increase in the 43 months since December 2019 happened in the 6 months from January>June 2022 – 14% of the time.

- Pet Food – Prices stayed generally below Dec 2019 levels from Apr 20 > Sep 21, when they turned up. There was a sharp lift in Dec 2021, and it continued until the Jun/Jul dip. 93% of the 22.9% increase has occurred since 2022.

- Pet Supplies – Supplies prices were high in December 2019 due to the added tariffs. They then had a “deflated” roller coaster ride until mid-2021 when they returned to December 2019 prices and essentially stayed there until 2022. They turned up in January and hit an all-time high, beating the 2009 record. They plateaued from Feb> May, turned up in June, flattened in July, then turned up in Aug>Oct setting a new record. Prices stabilized in Nov>Dec but turned up in Jan>Feb, a new record. They fell in March, set a record in May, then fell in Jun>Jul.

- Pet Services– Normally inflation is 2+%. Perhaps due to closures, prices increased at a lower rate in 2020. In 2021 consumer demand increased but there were fewer outlets. Inflation grew in 2021 with the biggest lift in Jan>Apr. Inflation was stronger in 2022 but it got on a rollercoaster in Mar>June. It turned up again July>Mar but the increase slowed to +0.1% in April. Prices fell -0.3% in May then turned up again in Jun>Jul.

- Veterinary – Inflation has been pretty consistent in Veterinary. Prices turned up in March 2020 and grew through 2021. A pricing surge began in December 2021 which put them above the overall CPI. In May 2022 prices fell and stabilized in June causing them to briefly fall below the National CPI. However, prices turned up again and despite Oct & Dec dips they have stayed above the CPI since July. In 2023 prices slowly grew except for a dip in May.

- Total Pet – The blending of patterns made Total Pet appear calm. In December 2021 the pricing surge began. In Mar>June 2022 the segments had ups & downs, but Petflation grew again from Jul>Nov. It slowed in December, turned up Jan>May, then fell in Jun>Jul. Except for 7 individual monthly dips, including 4 in Jun>Jul, prices in all segments have increased monthly in 2023. It has been ahead of the cumulative U.S. CPI since November 2022.

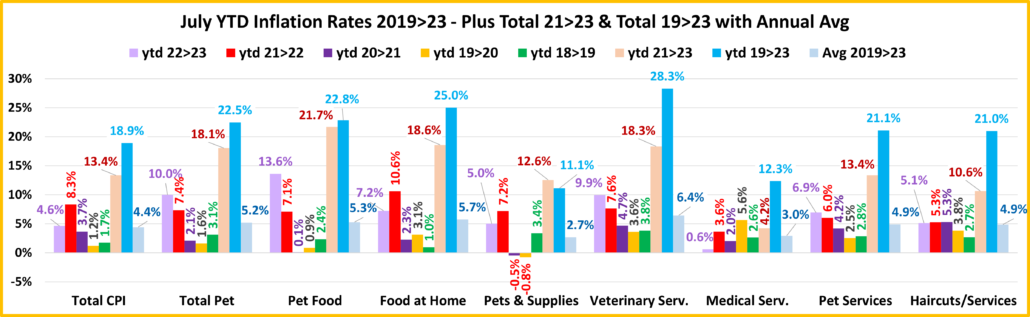

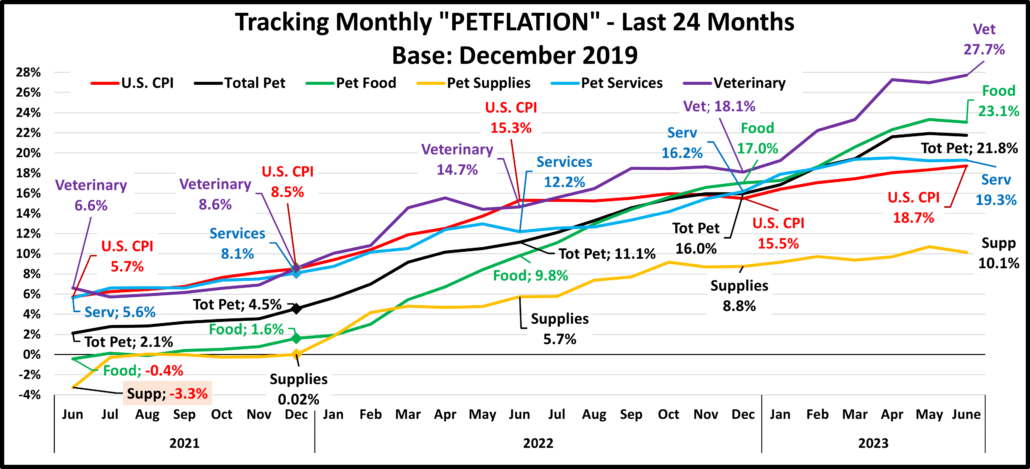

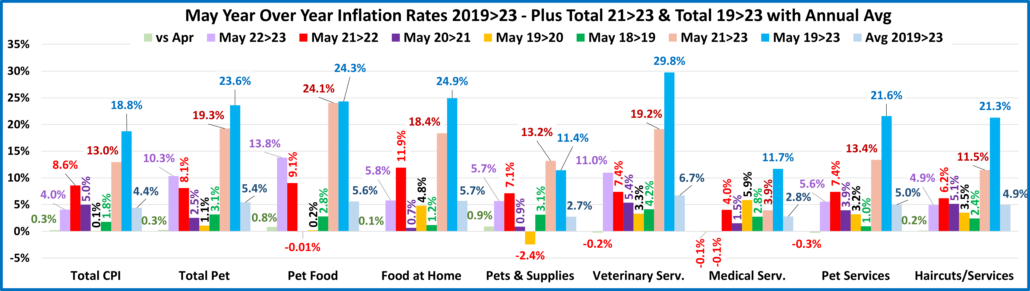

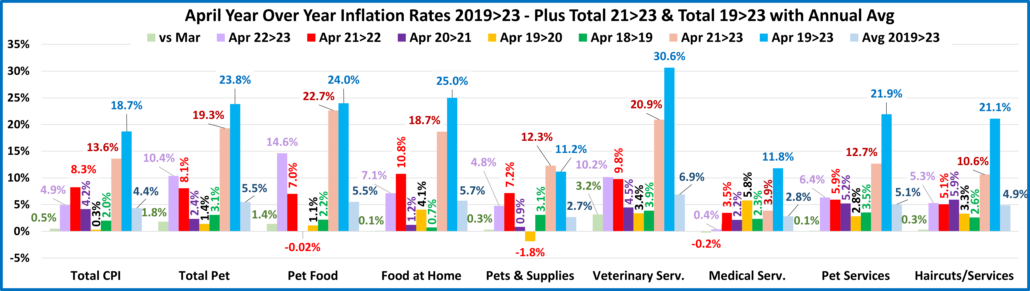

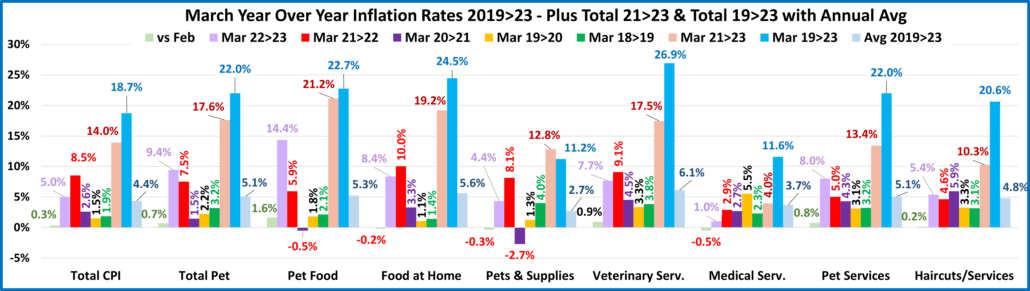

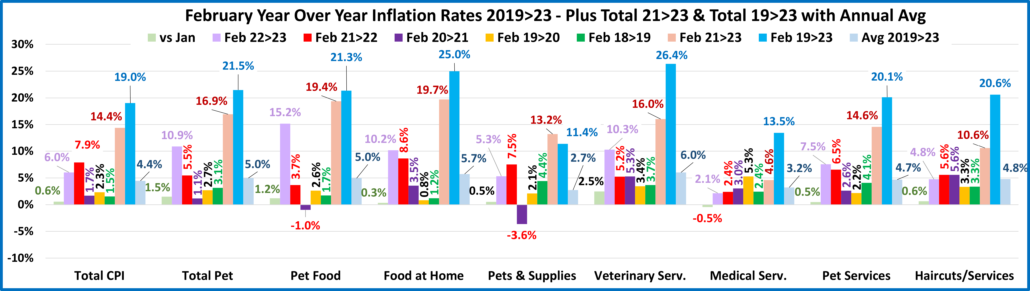

Next, we’ll turn our attention to the Year over Year inflation rate change for July and compare it to last month, last year and to previous years. We will also show total inflation from 21>23 & 19>23. Petflation was again below double digits at 8.7% in July but is still over 2.7 times the National rate. The chart will allow you to compare the inflation rates of 22>23 to 21>22 and other years but also see how much of the total inflation since 2019 came from the current pricing surge. Again, we’ve included some human categories to put the pet numbers into perspective.

Overall, Prices were +0.2% vs June and were up 3.2% vs July 2022. The Grocery increase is down again, to +3.6% from +4.7%, but still impacts consumers. Prices often rebound in July so it’s not surprising that only 3 of 9 categories had decreased prices from last month, compared to 5 in June 3 in May and 1 in April. Of the 6 categories with increases, 3 were from Pet – Veterinary, Services and Total. 3 of the 6 were over 0.3%, Haircuts: 0.6%; Groceries & Pet Services: 0.4%. The national YOY monthly inflation rate for July is up from June but is still much lower than the 21>22 rate. All but 3 categories – Veterinary, Non-Vet Services and Haircuts have a similar pattern. In the 2 Pet Categories the 22>23 inflation rate is higher than the 21>22 rate and is in fact the highest rate in any year since 2019. In our 2021>2023 measurement you also can see that over 67% of the cumulative inflation since 2019 occurred from 21>23 for all segments but Pet Services, Medical Services, Haircuts/Personal Services and the U.S. CPI. Note: These are service expenditures and show its increasing influence on the CPI. Pet Products are unique. The 21>23 inflation surge provided over 98% of the overall inflation since 2019. This happened because Pet Products prices were deflated in 2021.

- U.S. CPI– Prices are +0.2% from June. The YOY increase rose to +3.2% from 3.0%. It peaked at +9.1% back in June 2022. The targeted inflation rate is <2% so we are still 50% higher than the target. This is the 1st lift after 12 straight declines. Not good news. It’s good that the current inflation rate is below 21>22 but the 21>23 rate is still 12.0%, 63% of total inflation since 2019. How many households “broke even” by increasing their income by 12% in 2 years?

- Pet Food– Prices are -0.2% vs June and +10.6% vs July 2022. They are also 2.9 times the Food at Home inflation rate – not good news! The YOY increase of 10.6% is being measured against a time when prices were 11.1% above the 2019 level, but that increase is still an incredible 2.9 times the pre-pandemic 3.6% increase from 2018 to 2019. The 2021>2023 inflation surge generated 100% of the total 22.7% inflation since 2019.

- Food at Home – Prices are up +0.4% from June. The monthly YOY increase is 3.6%, down from 4.7% in June and considerably lower than Jul>Sep 2022 when it exceeded 13%. The 25.7% Inflation for this category since 2019 is 34% more than the national CPI and remains 2nd to Veterinary. 67% of the inflation since 2019 occurred from 2021>2023. The pattern mirrors the national CPI, but we should note that Grocery prices began inflating in 2020>2021 then the rate accelerated. It appears that the pandemic supply chain issues in Food which contributed to higher prices started early and foreshadowed problems in other categories and the overall CPI tsunami.

- Pets & Supplies– Prices fell -0.5% from June, and they still have the lowest increase since 2019. They also stayed in last place in terms of the monthly increase vs last year for Pet Segments. As we noted earlier, prices were deflated for much of 2021 so the 2021>2023 inflation surge accounted for 96% of the total price increase since 2019. They reached an all-time high in October then prices deflated. 3 straight months of increases pushed them to a new record high in February. Prices fell in March, bounced back in Apr>May to a new record high then fell in June & July.

- Veterinary Services – Prices are up 0.1% from June. They are +10.63% from 2022 and took over 1st place from Food (+10.61%) in the Pet Industry. Plus, they are still the leader in the increase since 2019 with 29.6% compared to Food at home at 25.7%. For Veterinary Services, relatively high annual inflation is the norm. The rate did increase during the current surge so 70% of the 4 years’ worth of inflation occurred in the 2 years from 2021>2023.

- Medical Services – Prices turned sharply up at the start of the pandemic but then inflation slowed and fell to a low rate in 20>21. In July prices fell -0.3% from June and are -1.5% vs 2022, the only 22>23 deflation in any category. Medical Services are not a big part of the current surge as only 33% of the 2019>23 increase happened from 21>23.

- Pet Services – Inflation slowed in 2020 but began to grow in 2021/2022. July 23 prices were up +0.4% from June and +6.3% vs 2022, which is the same as last month but much lower than 8.0% in March. Initially their inflation was tied to the current surge, but it may be becoming the norm as only 59% of the total since 2019 occurred from 21>23.

- Haircuts/Other Personal Services – Prices are +0.6% from June and +5.3% from 2022, the 2nd highest rate since 2019. However, inflation has been rather consistent so just 46% of the inflation from 19>23 happened from 21>23.

- Total Pet– Petflation is now 4% lower than the 21>22 rate, but 2.7 times the National CPI. For July, +8.7% is 2nd only to +9.1% in 2022. Vs June, Product Prices fell while Services increased so Total Pet was +0.03%. A June>July increase has happened in 19 of the last 26 years so a small increase was expected. Food & Veterinary are still the Petflation leaders, but only Service segments have a 22>23 rate above 21>22. Pet Food has been immune to inflation as Pet Parents are used to paying a lot. However, inflation can cause reduced purchase frequency in the other segments.

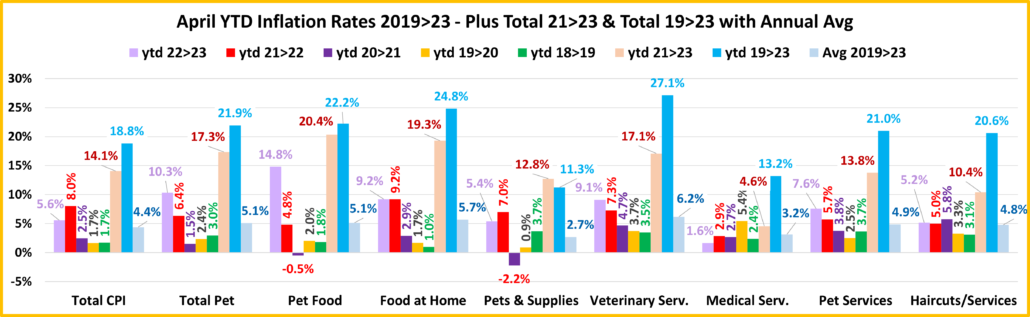

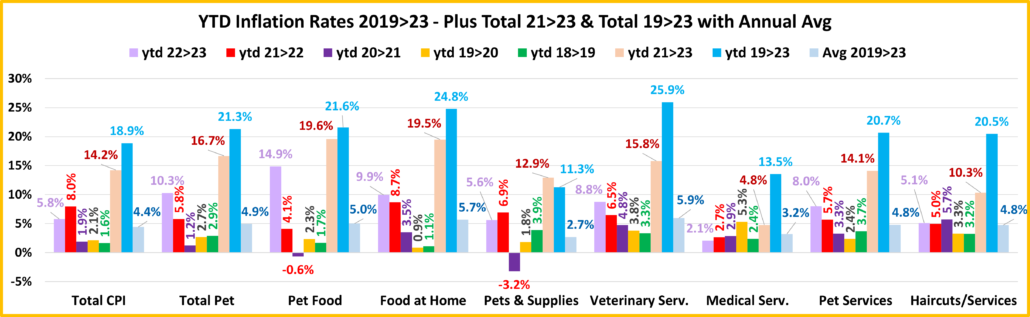

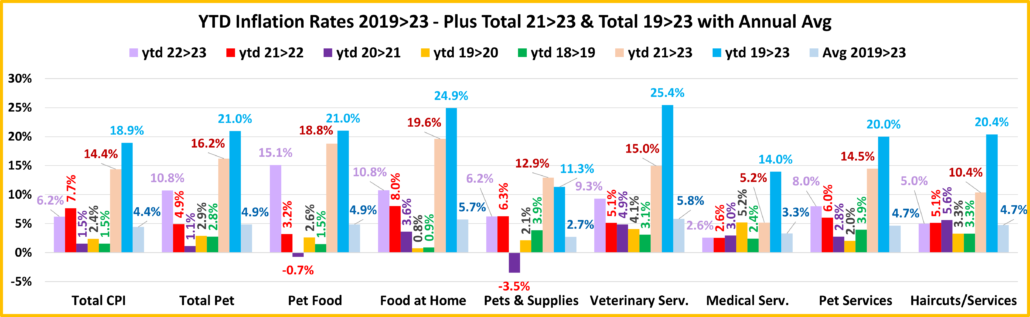

Now, let’s look at the YTD numbers

The increase from 2022 to 2023 is the biggest for 4 of 9 categories – All Pet. The 22>23 rate for Haircuts is slightly below 21>22. However, the Total CPI, Pet Supplies, Medical Services and Food at Home are significantly down from 21>22. The average annual increase since 2019 is 4.4% or more for all but Medical Services (3.0%) and Pet Supplies (2.7%).

- U.S. CPI – The current increase is down 45% from 21>22 and only 4.5% more than the average increase from 2019>2023, but it’s 2.1 times the average annual increase from 2018>2021. 71% of the 18.9% inflation since 2019 occurred from 2021>23. Inflation is a big problem that started recently.

- Pet Food – Strong inflation continues with the highest 22>23 & 21>23 rates on the chart. Deflation in the 1st half of 2021 kept YTD prices low then prices surged in 2022. 95.2% of the inflation since 2019 occurred from 2021>23.

- Food at Home – The 2023 YTD inflation rate has slowed but still beat the U.S. CPI by 57%. You can see the impact of supply chain issues on the Grocery category as 74% of the inflation since 2019 occurred from 2021>23.

- Pets & Pet Supplies – The inflation rate is down to 5.0% as prices fell again in July. Prices deflated significantly in in both 2020 & 2021 which helped to create a very unique situation. Prices are up 11.1% from 2019 but 114% of this increase happened from 2021>23. Prices are up 12.6% from their 2021 “bottom”.

- Veterinary Services – They are still #1 in inflation since 2019 but they have only the 3rd highest rate since 2021. At +6.4%, they have the highest average annual inflation rate since 2019. Except for a sight slowing in 2020, prices have consistently increased since 2019. Regardless of the situation, strong Inflation is the norm in Veterinary Services.

- Medical Services – Prices went up significantly at the beginning of the pandemic, but inflation slowed in 2021. In 2023 prices have been deflating and are now at a rate actually 77% below the pre-pandemic 2018>19 rate.

- Pet Services – May 22 set a record for the biggest year over year monthly increase in history. Prices fell in June but began to grow again in July, reaching record highs in Sep>Apr. The January 2023 increase of 8.4% set a new record. YTD July again slipped a little to 6.9%. Interestingly, although the rates are not as high, they have the exact same annual inflation pattern as Veterinary. The Services segments in the Pet Industry are definitely unique.

- Haircuts & Personal Services – The services segments, essential & non-essential were hit hardest by the pandemic. After a small decrease in March 22, prices turned up again. Since 2021 inflation has been a consistent 5+%, 90% higher than 18>19. Consumers are paying 21% more than in 2019, which usually reduces the purchase frequency.

- Total Pet – There were two different patterns. After 2019, Prices in the Services segments continued to increase, and the rate grew as we moved into 2021. Pet products – Food and Supplies, took a different path. They deflated in 2020 and didn’t return to 2019 levels until mid-year 2021. Food prices began a slow increase, but Supplies remained stable until near yearend. In 2022, Food and Supplies prices turned sharply up. Food prices continued to climb until Jun/Jul 23. Supplies prices stabilized Apr>May, grew Jun>Oct, fell in Nov, rose in Dec>Feb, fell in Mar, rose in Apr>May then fell in Jun>Jul. The Services segments have also had ups & downs but are generally inflating. The net is a YTD Petflation rate vs 2022 of 10.0%, 2.2 times the National rate. In May 22 it was 5.8% below the CPI.

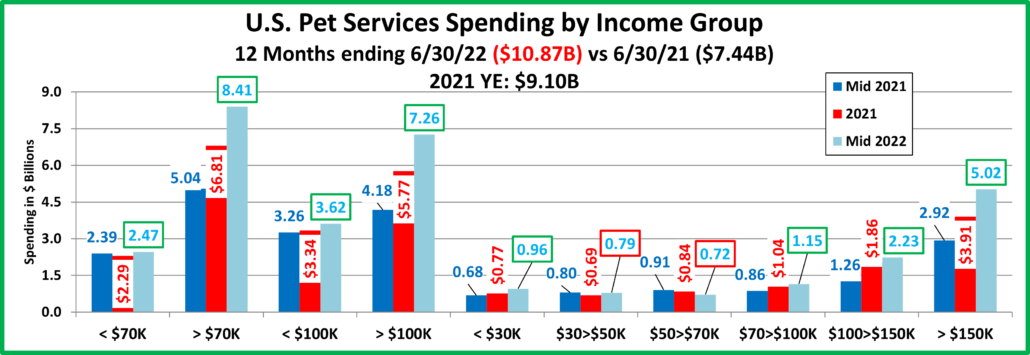

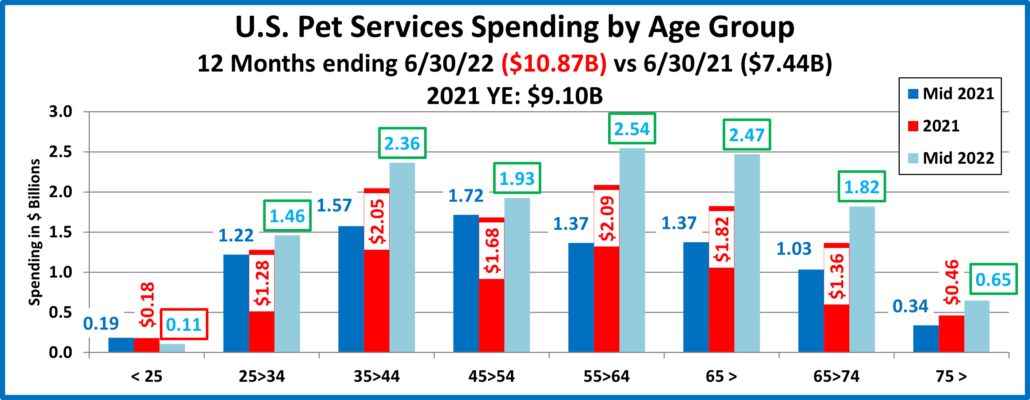

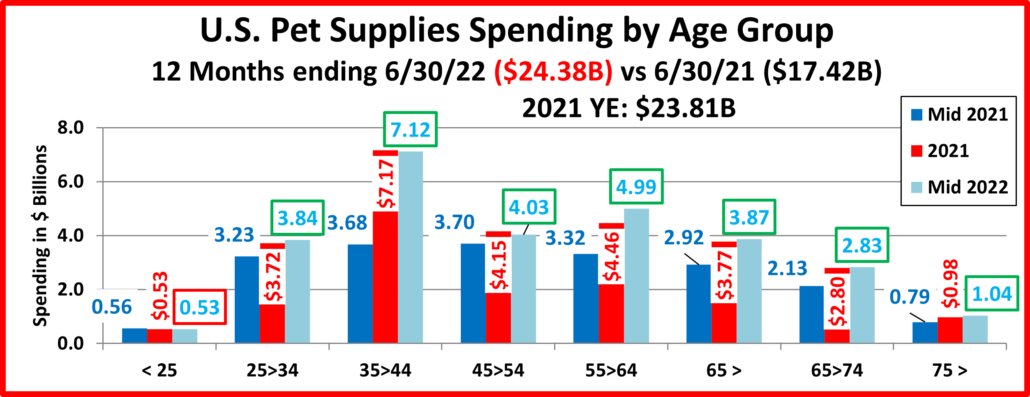

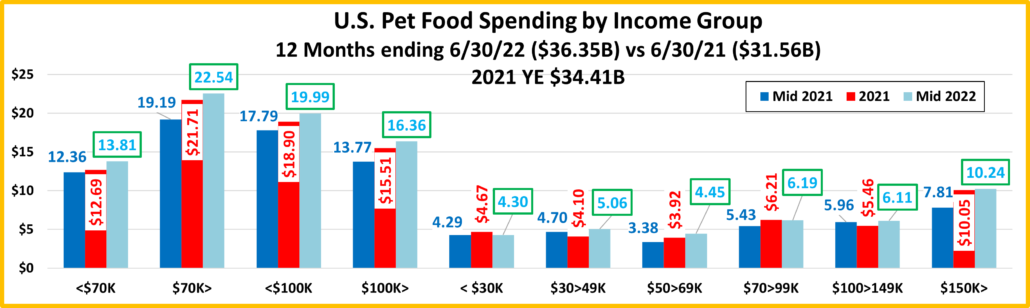

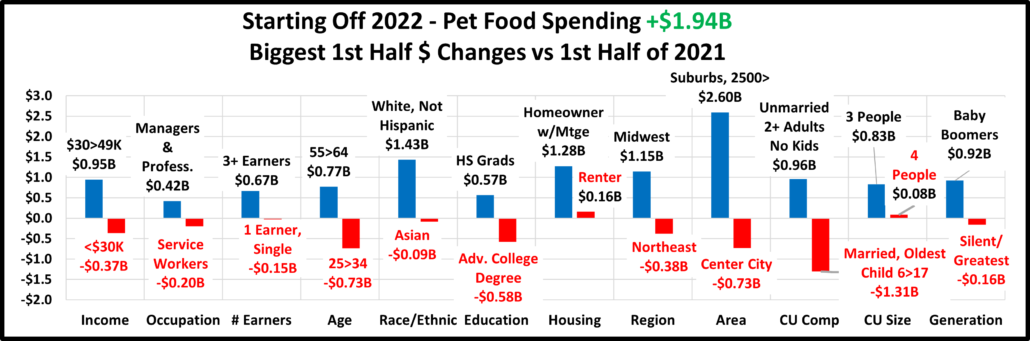

Petflation is still strong. Let’s put the numbers into perspective. Petflation slowed from 9.6% in June to 8.7% in July. This is below the record 12.0% set in November, but still 2nd highest for the month. More bad news is that 9 of the last 12 months have been over 10% and the current rate is still 5.4 times more than the 1.6% average rate from 2010>2021. It’s also 2.7 times the national rate. There is no doubt that the current pricing tsunami is a significant event in the history of the Pet Industry, but will it affect Pet Parents’ spending. In our demographic analysis of the annual Consumer Expenditure Survey which is conducted by the US BLS with help from the Census Bureau we have seen that Pet spending continues to move to higher income groups. However, the impact of inflation varies by segment. Supplies is the most affected as since 2009 many categories have become commoditized which makes them more price sensitive. Super Premium Food has become widespread because the perceived value has grown. Higher prices generally just push people to value shop. Veterinary prices have strongly inflated for years, resulting in a decrease in visit frequency. Spending in the Services segment is the most driven by higher incomes, so inflation is less impactful. This spending behavior of Pet Parents suggests that we should look a little deeper. Inflation is not just a singular event. It is cumulative. Total Pet Prices are up 8.7% from 2022 but they are up 18.5% from 2021 and 22.7% from 2019. That is a huge increase in a very short period. It puts tremendous monetary pressure on Pet Parents to prioritize their expenditures. We know that the needs of their pet children are always a high priority but let’s hope for a little relief – stabilized prices and even deflation. This is not likely in the Service segments but is definitely possible in products. It’s happened before. We need it again.