U.S. PET SUPPLIES SPENDING $17.42B (↑$1.14B): MID-YR 2021 UPDATE

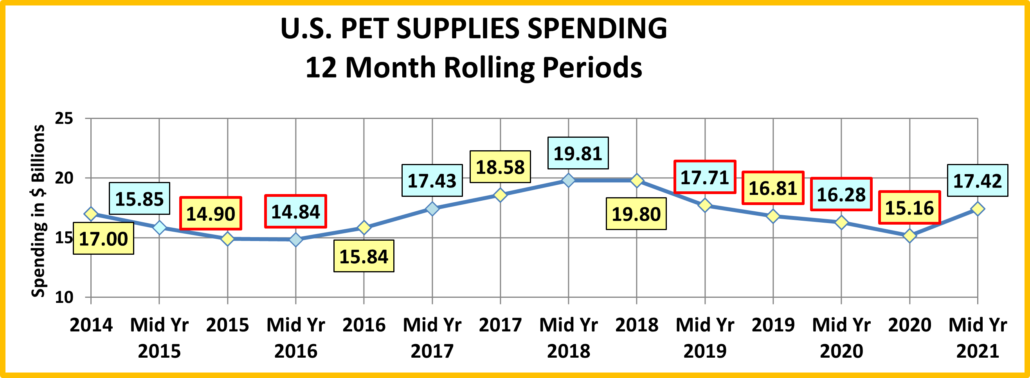

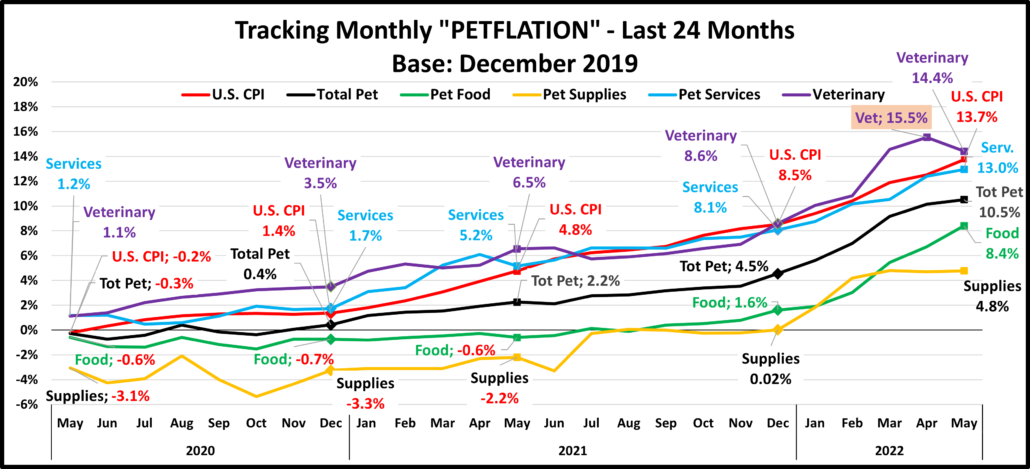

In our analysis of Pet Food spending, we saw that spending plummeted in the 1st half of 2021 compared to the panic buying at the beginning of the pandemic. Supplies took the opposite route. At the beginning of 2020, Supplies Spending was down due to Tarifflation. The pandemic caused consumers to focus on needs so Supplies $ continued its steady decline from its 2018 peak reaching a low point below 2016. In 2021, that all changed. Supplies Prices had been steadily deflating and Consumers finally responded. Mid-Year 2021 Pet Supplies spending was $17.42B, up $1.14B (+7.0%). The following chart should put the recent spending history of this segment into better perspective.

Here are this year’s specifics:

Mid Yr 2021: $17.42B; ↑$1.14B (+7.0%) from Mid Yr 2020.

The +$1.14B came from:

Jul > Dec 2020: ↓$1.12B Jan > Jun 2021: ↑$2.26B

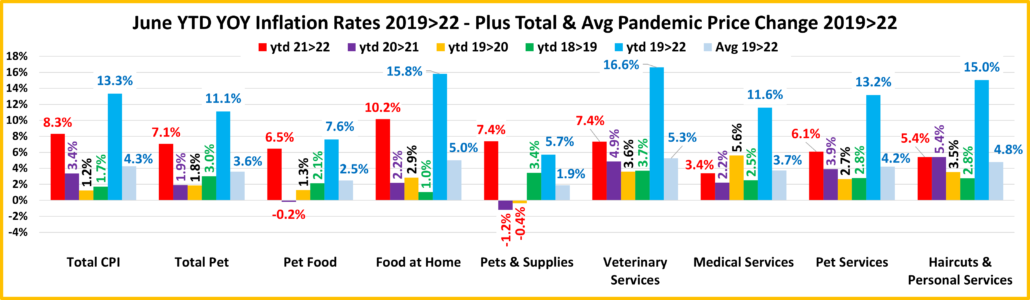

We should note that while the overall lift was relatively low, the lift in the 1st half of 2021 was the biggest YOY 6 month increase in history. Like Pet Food, Pet Supplies spending has been on a roller coaster ride, but the driving force is much different. Pet Food is “need” spending and has been powered by a succession of “must have” trends and the emotional response to the Pandemic. Supplies spending is largely discretionary, so it has been impacted by 2 primary factors. The first is spending in other major segments. When consumers ramp up their spending in Pet Food, like upgrading to Super Premium, they often cut back on Supplies. However, it can go both ways. When they value shop for Premium Pet Food, they take some of the saved money and spend it on Supplies. The other factor is price. Before breaking the record in 2022, Pet Supplies prices reached their peak in September of 2009. Then they began deflating and in March 2018 were down -6.7% from 2009. Price inflation in this segment can retard sales, usually by reducing the frequency of purchase. On the other hand, price deflation generally drives Supplies spending up. Innovation can “trump” both of these influencers. If a new “must have” product is created, something that significantly improves the pet parenting experience, then consumers will spend their money. Unfortunately, we haven’t seen much significant innovation in the Supplies segment recently.

Recent history gives a perfect example of the Supplies roller coaster. In 2014 Supplies prices dropped sharply, while the movement to Super Premium Food was barely getting started – Supplies spending went up $2B. In 2015, consumers spent $5.4B more on Pet Food. At the same time, Pet Supplies prices went up 0.5%. This was a “killer” combination as Supplies spending fell $2.1B. In 2016 consumers value shopped for Food, saving $2.99B. Supplies spending stabilized by mid-year then increased by $1B in the second half when prices fell sharply. Consumers spent some of their “saved” money on Supplies. Supplies prices continued to deflate throughout 2017. Food spending increased $4.61B in 2017 but this came from a limited group, generally older CUs, less focused on Supplies. The result was a $2.74B increase in Supplies spending. This appeared to be somewhat of a break with the overall pattern of trading $ between segments.

In the first half of 2018 Pet Food spending slowed to +$0.25B. Supplies’ prices switched from deflation to inflation but were only up 0.1% versus the first half of 2017. During this period Supplies Spending increased by $1.23B. Prices began to climb in the second half of 2018 due to impending new tariffs in September. By June 2019 they were 3.4% higher than 2018. The impact of the tariffs on the Supplies segment was very clear. Spending became flat in the second half of 2018, then took a nosedive in the 1st half of 2019, -$2.09B. Prices stayed high for the rest of 2019 and spending fell an additional -$0.9B. In 2020 prices turned up again through March before plummeting, -3.8% by June. However, due to the pandemic focus on “needs”, spending dropped an additional -$0.54B. The situation not only didn’t change in the 2nd half, it worsened as the $ fell an additional -$1.12B. However, 2021 brought a new beginning as Supplies spending increased +$2.26B over the 1st half of 2020 and reached a level above pre-pandemic yearend 2019.

Let’s take a closer look at the data, starting with two of the most popular demographic measures – age and income. The graphs that follow will show both the current and previous 12 months $ as well as 2020 yearend. This will allow you to track the spending changes between halves.

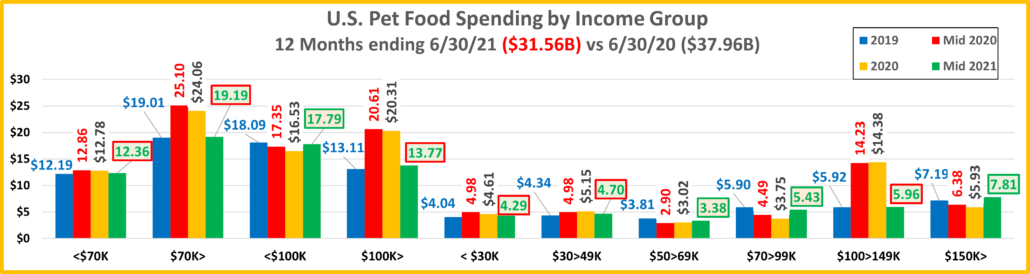

The first graph is for Income, which has been shown to be the single most important factor in increased Pet Spending, especially in Pet Supplies and both of the Service segments.

Here’s how you get the change for each half using the $70K>100K group as an example:

Mid-yr Total Spending Change: $2.76B – $2.65B = Up $0.11B (Note: green outline = increase; red outline = decrease)

- 2nd half of 2020: Subtract Mid-20 ($2.65B) from Total 2020 ($2.32B) = Spending was down $0.33B in 2nd half of 2020.

- 1st half of 2021: Subtract Total 2020 ($2.32B) from Mid-21 ($2.76) = Spending was up $0.44B in 1st half of 2021.

- Comparing the under/over $100K to the under/over $70K shows that the share of Supplies spending “flips” based upon the $70>$100K group. That means that the “halfway” dividing line is probably slightly above the average CU income of $84.7K. The Supplies $ of CUs with above average income, 33% is equal to the 67% of CUs below average.

- The spending patterns <$70K are mixed. For $70K> they are same, with a dip at yearend but a bounce back in 2021.

- The increase in Supplies Spending was widespread across income groups but the bulk of the lift came from lower incomes, especially <$30K and $50>70K. The two segments with decreases were an unlikely pair – $150K+ and $30>$50K. They had the only increases last year. In both cases the spending decrease was due to a big drop in Supplies $ in the 2nd half of 2020.

- The spending movement is generally up but only 2 segments had increases in both halves, <$30K & $50>70K.

- Inflation/deflation has less impact on the $100K> group. The negative impact of the pandemic didn’t happen for them until the 2nd half of 2020 but they largely recovered. The biggest positives came from the <$30K and the $50>$70K groups. In 2020, their spending fell -$1.43B, due to a reduced purchase frequency. In 2021 they increased frequency and spending as they returned to a near normal level. We’ll see if the lift continues in the 2nd half of 2021.

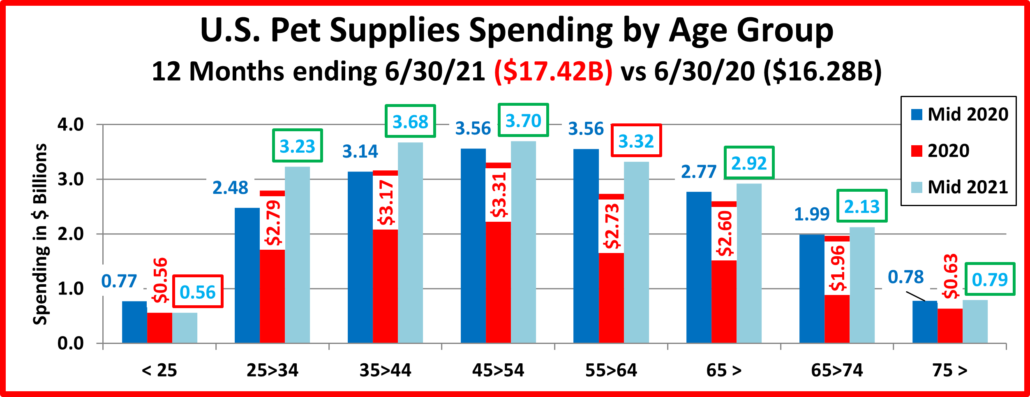

Now let’s look at Pet Supplies spending by Age Group.

- There were 2 primary patterns. For 45> spending fell in the 2nd half of 2020, then rebounded in 2021. For the 25>44 yr-olds, spending grew in both halves. The <25 group had a big drop in the # of CUs in 2020 which affected spending.

- The 25>34 year olds had strong growth in both halves.

- Spending by the 54>64 yr olds decreased the most in the 2nd half of 2020 and their rebound fell a little short. They also fell from the top spot in Supplies spending to #3.

- The 65> group was the most stable. Spending fell slightly in the 2nd half of 2020 but turned positive in 2021.

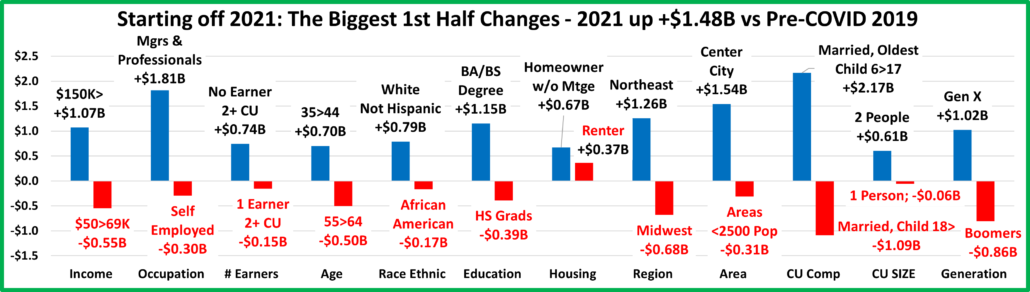

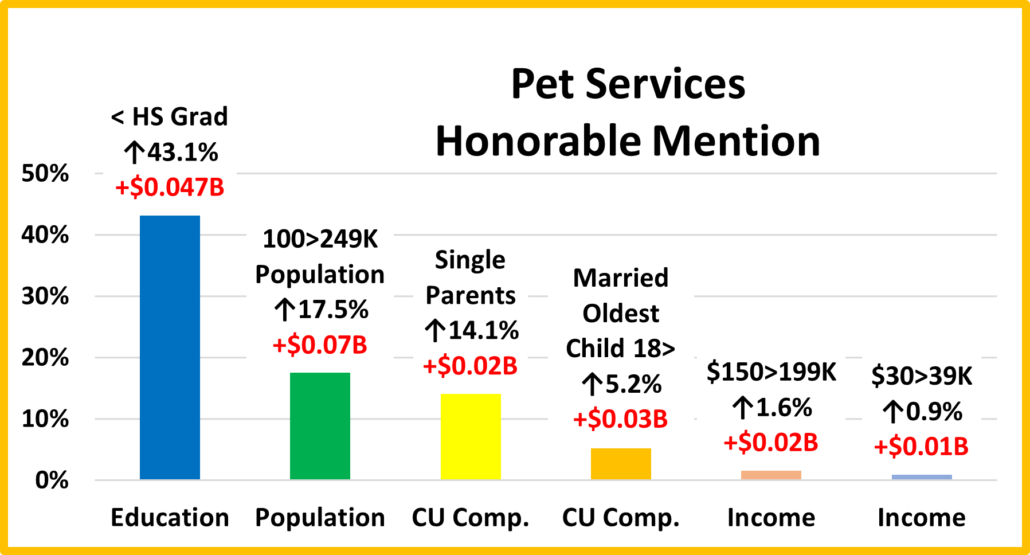

Now let’s look at what happened in Supplies spending at the start of 2021 across the whole range of demographics. In our final chart we will list the biggest $ moves, up and down by individual segments in 12 demographic categories.

- It’s obvious that the biggest increases are radically larger than the biggest decreases, the complete opposite of 2020.

- The increase is widespread which is very apparent as all segments in 7 categories spent more. In 2020 there were 5 categories in which all segments spent less. This reinforces that the 1st half of 2021 increase was the biggest ever.

- Most of the winners are the “usual suspects”, like Mgrs/Professionals & Adv College Degree but there are a couple of surprises – $50>69K & 2+ Adults, No Kids.

- In regard to the losers, African Americans & Center City are not unexpected but when all segments in 7 categories spent more there are very few true losers.

- The Age category is a great example of the widespread lift. The 2 groups with a decrease in spending from Mid-yr 2020, <25 and 55>64 both spent more in the 1st half of 2021. Plus 55>64 had the biggest increase.

- The Housing category is also of particular interest. Not only did all segments spend more in the 1st half of 2021, they all spent at least $0.5 billion more than they did in 2020.

The 24 month Spending winning streak for Supplies which began in the second half of 2016 came to an end in the second half of 2018. Pet Supplies increased $4.97B (+33.5%) and the lift was widespread. Only 1 of 82 demographic segments, spent less on Supplies – the Greatest Generation. This group is now too small to be accurately measured.

Since the Great Recession the Supplies segment has become commoditized and very sensitive to inflation/deflation. Plus, since most categories are discretionary, Supplies spending can be affected by spending changes in other segments as Pet Parents trade $. In 2018, the Pet Industry was introduced to a new “game changer” – outside influence. The FDA warning on grain free dog food caused a big decrease in food spending but the government also radically increased tariffs which drove Supplies prices up and spending down, a record $2.98B.

However, we weren’t done yet. That brought us to 2020 and a new, totally unexpected outside influence, the COVID pandemic. This affected all facets of society, including the Pet Industry. Consumers, including Pet Parents, focused on needs rather than wants. In the Pet Industry, this meant that their attention was drawn to Food and Veterinary Services. This led to a huge lift in Pet Food $ due to binge buying but also a big increase in Veterinary spending. The more discretionary segments, Supplies and Services, suffered. Services had an extra handicap. Many outlets were not considered essential, so they were subject to restrictions and closures. Supplies were still available, but many were considered optional by consumers so spending continued to decline throughout 2020. By yearend, $ had reached the lowest level since 2015. This all happened while prices continued to deflate. That brought us to 2021. The retail economy had largely recovered and spending patterns were returning to “normal”. This was also true in Pet Supplies. Pet Parents opened their wallets and bought the Pet Supplies that they had been holding back on for a year. The result was the biggest YOY 6 month increase in history. We don’t know what the 2nd half will bring but Pet Supplies are back!