2015 Millennial Pet $pending – A Closer Look!

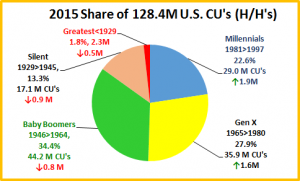

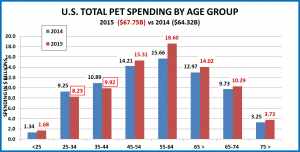

Generations have become a very “high profile” subject in our society and Millennials are by far the “lead” story. One thing that I have noticed is that we tend to “lump” them into one homogenous group. The Millennials are the largest, best educated and most technologically savvy group in the history of the world. They share many behavioral traits but in 2015 they ranged in age from 18 to 34, which can lead to some distinct differences.

For example: Two 24 year old “buddies” sharing an apartment, a newly married 28 year old couple looking to buy their first home and a 33 year old couple who own a nice 4 bedroom home in the suburbs and are expecting their second child…are all Millennials. Believe me, there are differences in their spending behavior.

While Generations share the same “world”, my research has shown that over a lifetime consumers reach key waypoints and go through “stages” which strongly affect their behavior. This is very noticeable in the developing years, as they are “setting the stage” and in the declining years as they approach and enter into retirement.

In 2015 the Millennials were definitely in various stages of development. With perfect timing, our friends at the US BLS produced a special, supplemental report to their Consumer Expenditure Survey. The report has a different division of age groups from their regular Age report. By melding the two reports together, I was able to generate base data and calculations for 3 distinct groups under age 35, covering all the Millennials. Specifically:

- Under age 25

- Age 25 to 29

- Age 30 to 34

In some data you may note a slight difference from my earlier Generations report. This is primarily due to the fact that when you ask someone their current age, it depends on what time of the year you ask. Ex: Last week I was 67. This week I am 68. The difference in data between the 2 reports is 1.4% or less so it is not significant for our purposes. Let’s get started with each group’s share of the under 35 financially independent Consumer Units.

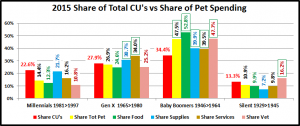

- The two older groups are the largest, are about equal in size and account for 73.5% of all the CU’s in the under 35 (Millennial) age group.

- The under 25 yrs group is exceptionally small and has the lowest share of total U.S. CU’s for this group in 31 years of record keeping. This mirrors recent years and may reflect the frequently mentioned Millennial trend….They have large numbers but are slow to gain financial independence from their parents. Now, let’s look at some demographic characteristics of these 3 groups which have been shown to impact pet spending.

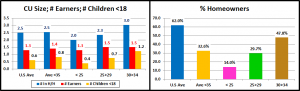

First: Size of the CU, # of Earners, # of Children under 18…and of course Homeownership

- CU Size – Overall the CU size of the total under age 35 group reflects the National average. However, it increases 50% in size by the time they reach their early 30’s due to…children. CU’s with 2+ members are more likely to have pets and spend more.

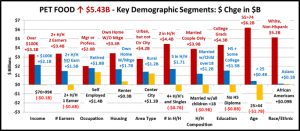

- # Children under 18 – The number of children peaks in the 35-44 age group at 1.4 but by the time they reach their early 30’s the average CU has more than 1 child. Their 1.2 avg is triple the 0.4 in the <25 group. Families with children under 18 have traditionally spent the most on Pet Products. Although the 2015 surge to upgrade their pet food by the 51+ year old Baby Boomers changed that, at least temporarily.

- # Earners – Most adults work in the under 35 age group. It’s simple. CU’s with 2 or more earners spend more on their Pets, both in Total Pet and in Pet Products (Food & Supplies Only).

- Homeownership – Homeowners have consistently accounted for more than 80% of Pet Spending. As you can see, the homeownership rate of the 25>29 age group was double that of the <25 group and the 30>34 group was 3 ½ times as high. However, please note that the homeownership rate of the 30>34 group was still 20% below the national average and more than 50% of them still rent.

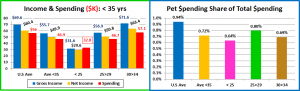

Now we’ll show you the money with income and spending.

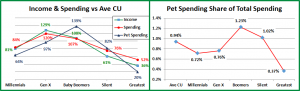

- Gross Income – The Under 25’s are making less than half of the National Average. Income moves up rapidly in the older groups but the 30>34 group still just barely exceeds the national average.

- Net Income – Most of the whole group is paying taxes but even the older members are only paying about 11% because of growing mortgage and dependent deductions.

- Spending – The under 25 group is “deficit spending”, even compared to their gross income. Although Income more than doubles by the early 30’s, spending does not quite keep pace. However, it is also important to note that over 90% of the net income for the whole 25>34 age group is already committed to regular expenditures. Therefore, additional, discretionary spending becomes less likely.

- Pet Spending as a percentage of Total Expenditures – In 1984 Pet Spending was 0.48% of total expenditures. It grew through the years and has been near or even above 1.0% since 2007. Why? Three primary reasons.

- Our companion animals have moved from being “pets” to integrated members of our family.

- The sheer number and variety of pet products and services has grown exponentially…and beyond.

- Pet Products and services are available in over 200,000 outlets and the internet. It’s easy to buy.

In 2015 the <25 group spent 0.64% of their total spending on their pets. This is 67% of the national average of 0.94% and is in line with the numbers over the last 30 years. That is not the case with the 25>34 group. There is good news with the 25>29 year olds. They appear to be adding pets to their households and spending in line with at least the Gen X group when they were this age. The 30>34 group is extraordinarily low and pulls the numbers down for the 25>34 group to 0.74%. This is 78% of the of the national pet share average. Gen X occupied all of the 25>34 age group for 10 years and averaged between 80>90% of the National average. Boomers actually exceeded the national average when they were in this group. Admittedly, this was the Millennials’ first year to occupy all slots in the 25>34 age group. We’ll have to see how they progress.

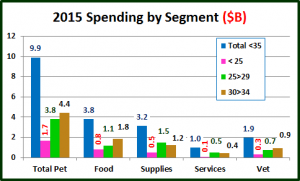

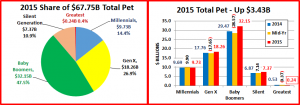

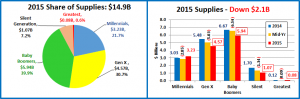

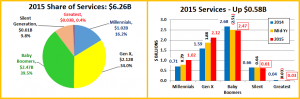

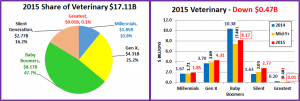

Now we’ll get Pet Specific with spending by industry segment.

- The 30>34 age group has the highest income and spends the most on their pets even though it’s a smaller % of their total spending..

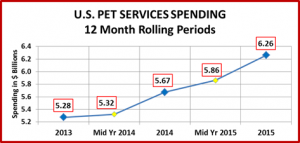

- The 25>29 age group value shops for food but is committed to their pet family. They actually spent more on pets & supplies and pet services than the wealthier 30>34 group.

- The <25 group prioritized their resources behind food, including upgrading the quality in 2015.

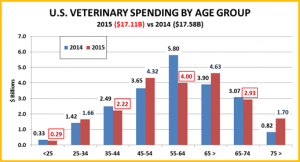

- Vet spending grows with age and income but is still a lower priority.

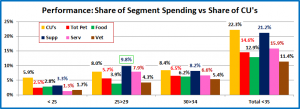

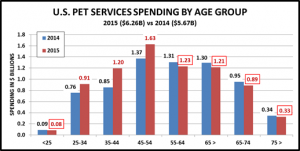

Finally, here’s a look at the Performance of the 3 age groups in relation to each Industry Segment.

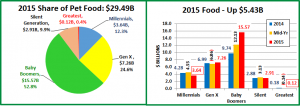

- Under 25 – This group is short on money as their overall spending exceeds even their before tax income so it is not surprising that they under-perform in spending in every segment. However, pets are still a growing part of their lives. They focus their spending on Food & Supplies. In a somewhat surprising move, in 2015 they opted to upgrade their food, which reflects the importance that they place on quality and natural products.

- 25 to 29 – This group is beginning their careers and establishing a base as homeownership doubles. They don’t have a lot of extra money but are no longer deficit spending. This is the time to think about a family and a new Pet family member is often a prelude to their people family. They value shop for Food so it is less than 1/3 of their Total Pet Spending. They are acquiring pets and “splurge” on the Supplies and Services to make sure they have all the “necessary” things to make their Pet Children happy and make Pet Parenting easier and more convenient. They spend more on Pets & Supplies than on Food and actually “over-perform” on spending in this segment . This is the only instance of this by any under 35 age group on any industry segment. They also begin to recognize the necessity of Veterinary Care.

- 30 to 34 – Their income has gone up but is still just above the national average and is not necessarily keeping up with their rapidly growing responsibilities – a career, homeownership and now…2 young children. Subsequently, the Pet share of their total spending has fallen. Their Pet Spending priorities have become more uniform across most industry segments, about 75% of what it should be considering their number of CU’s. Supplies is a notable exception as their market share is on par. Pressed for money and time this group’s priorities are supplies and services. (Overall, Millennials are more focused on Pets & Supplies…And Services after age 25)

Millennials are defined by birth years and a shared “world experience”. However, their spending behavior, including pet, evolves as their life unfolds. A significant share have become Pet Parents. Their <25 group has been spending on par with earlier generations. Their first year of “controlling” the 25<34 group was not equal in performance to past generations. We’ll see if they improve. Age 35>44 has been a true “turning point” in Pet Spending. Prior to 2011, this age group always spent more than their “share” on Pets. With the youngest Gen Xers, it has fallen to 90+%. Millennials begin to enter this age group in 2016…