The Pet industry has grown fantastically, from just over $2B in 1971 to almost $68B in 2015, according to data from the US Bureau of Labor Statistics. The oldest Boomers turned 25 in 1971 and began to establish households and families, which included Pet Children. Pet ownership took off and so did spending. I came into the industry on April 19, 1989. The oldest Boomers were just turning 43 and fast approaching the time when income peaks and children start leaving home.

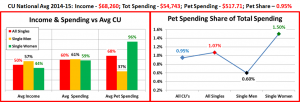

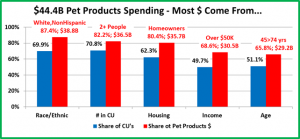

In recent years, there has been a great deal of concern about the future. Will succeeding generations grab the baton when it is passed and maintain the spending level of the Boomers? It’s a valid question and concern. We all know that Boomers still account for a tremendous share of pet spending (48%). In fact, in 2015 they upgraded their Food to Super Premium. The result was a $5B increase and Boomers (34% of CUs) accounted for 53% of Pet Food Spending in the U.S.

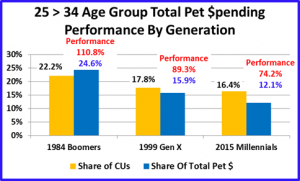

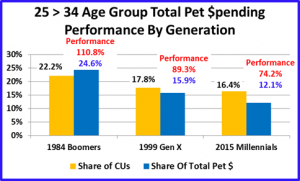

That is now. Gen Xers and Millennials are much younger. How does their spending compare to the Boomers when they were the same age. Such comparisons can be difficult if you just compare $. There has been considerable inflation through the years and face it, the available product mixture of 30+ years ago was minuscule compared to today. One fair way to compare is to look at the share of Total Pet spending when each group was the same age. Pet Spending starts to take off in the 25 to 34 year old age group. In 2015, the oldest Millennials turned 34 and they “owned” this age group. For Gen X this happened in 1999. The Boomers did the same in 1980. We don’t have detailed data until 1984. However, the comparison is still reasonable as everyone aged 25 to 34 in 1984 was a Boomer.

Take a look at this graph. It shows the share of CUs, the share of total pet spending and the performance for all three generations when they first owned the 25 to 34 age group. Note: Performance = share of spending/share of CUs

- The first thing to note is that all measurements decline with succeeding generations.

- Share of CU’s – Gen X share of CU’s was 20% smaller than the Boomers and Millennials are down 26%.

- Performance – Gen X was 19% lower than Boomers and Millennials dropped off by 33%.

- Share of Total Pet Spending – Here’s the result. Compared to Boomers, the share of Total Pet Spending for…

- Gen X is 64.6% of the Boomers. – less than 2/3

- Millennials is 49.2% of the Boomers. – less than half

Of note, in 1984 the 25 to 34 age group (Boomers) ranked second in Total Pet $spending at $2.36B. They were edged out by the 35 to 44 group (half Boomers) at $2.38B. The Gen Xers fell to 3rd place in 1999. The Millennials fell to 5th in 2015, only beating out the Over 75 and Under 25 groups.

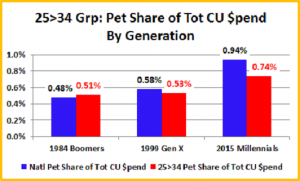

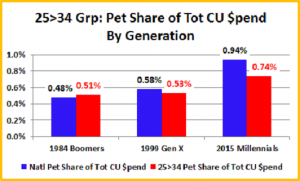

Let’s look at one other comparison – The pet spending share of total CU spending.

The next chart compares the Pet Percentage of Total CU spending, nationally and for the 25>34 group by generation.

- Nationally, Pet Spending as a share of CU spending doubled to 0.94% from 1984 to 2015.

- The Boomers are the only generation to exceed the National Average for the 25>34 group.

- The Pet Spending share for this age group has increased about 50% but the younger generations have not kept pace with the Boomers.

- In fact, it the Boomers who were the primary drivers in National Pet Spending, as they grew older, their income increased and their human children left home.

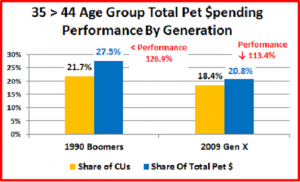

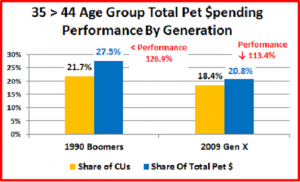

Speaking of aging, we can go one step further in our generational comparison – the 35>44 age group – Boomers vs GenX. The 35>44 age group is the time when family responsibilities are reaching a peak. Careers are also being built but income has not quite caught up. As a result, this group has a great deal of financial pressure.

- The Gen X 35>44 age group is 15% smaller than the Boomers.

- The Pet Spending Performance by the Gen Xers is 11% lower than the Boomers but both generations “earned their share” with 100+%.

- The net result is that the share of Pet Spending is significantly lower for the Gen X group – 25%.

- Although not quite at the Boomer “level”, Gen Xers obviously still have a strong commitment to their Pet Children.

Finally let’s compare the Pet Percentage of Total CU spending for the 35>44 age group for the two generations.

- From 1990 to 2009 the Pet Spending share of Total CU Spending almost doubled to 1.11%’

- The Boomers, in their day, kept pace with the national number.

- The Gen Xers increased the percentage of Pet Spending by this group 79% to 1.04%. However…

- They couldn’t keep pace with the national level being driven up by the older Boomers in their peak earning years.

- Of Note: Pet Spending share of Total CU spending broke the 1% barrier and peaked in 2008 at 1.13%. The Boomers were at the peak of their earnings. Their human children had left the nest and their attention and spending turned to their Pet Children. With the onset of the great recession, the Pet share of total Spending began to decline, falling below 1% in 2012 and currently stands at 0.944 % in 2015. However, Boomers still spend 1.23% of their total expenditures on their Pets – far more than any other generation.

Boomers’ spending on their animal companions shows a commitment that exceeds both earlier and later generations. They were the driving force in the industry’s spectacular growth. Let’s consider the “why” behind that commitment.

To answer the “Why?” question we will get away from math. We’ll look at one key national event and then I’ll get “personal” with some of my own remembrances about growing up as a Boomer with Pets. In the end, Pets are a very personal experience. Every Pet Parent has their own memories of their introduction to Pets and how they became an integral part of their life and a full-fledged member of the family. Now, for that “National Event”

The key event leading to the strong bond between Baby Boomers and their Pets happened before the first Baby Boomer was born. Boomers were born from 1946 through 1964. Here’s a picture of what happened on June 22, 1944.

This is a President Franklin Roosevelt signing the Servicemen’s Readjustment Act of 1944, The G.I. Bill. While World War II was not over, Victory seemed to be only a matter of time. The law was designed to help the returning servicemen readjust to society and reward them in a small way for their service and sacrifice on behalf of the country.

The law had two key elements that radically impacted U.S. Society. The first was Education Benefits which provided financial assistance for Veterans in gaining higher education and training. By 1956 7.8 million Americans had taken advantage of this program. This increased their level of education and the income for millions of families. With more income, came increased spending. There was more money available for necessities and discretionary spending on their families and ultimately in acquiring and maintaining pets.

The second key feature was VA Home Loans. This provided low interest, zero down payment home loans for servicemen. The terms were even more favorable for new construction compared to existing housing. This encouraged millions of families to move out of urban housing into new housing. There was a boom in new construction and the result was a new living space – the suburbs. These were planned communities with schools and public works in place. The growth was truly explosive as some builders were completing as many as 30 houses a day. The communities were near Urban areas but they became self-sufficient from the Urban “core”, both as a place of work and a place of dwelling. This was a new way of living for Americans, with more space and convenience.

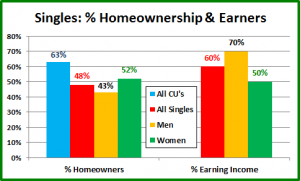

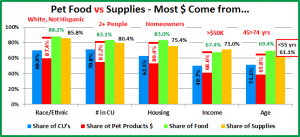

Homeownership in the U.S. reached its low point of the 20th century in 1940 at 43.5% of households. By 1960 it had reached 60%. It continued to climb, reaching a peak of 68% in 2004. It remained basically stable at or near this level until the economic crash. Since then it has fallen and stood at 62.3% in 2015. (In 2015, Homeowners accounted for 82.6% of Total Pet $)

Space that you own and control is a key factor in pet ownership. The Suburban environment had an additional benefit …. a yard – more room for pets. Also remember that years ago most rental properties had a simple rule – no pets. This only changed when landlords had to respond to the pressure from the high percentage of the population who own pets.

Now, let’s take it down to a personal level. My Mom and Dad were both of the Greatest Generation, born in the early 1920’s. They met, married and ultimately lived in Kansas City, Kansas. My Dad served in the Army in WW II, fighting island to island in the Pacific Theater until he was “knocked out action” and sent home to recuperate. My Mom fought on the “Home-front”, including working in a defense plant, where she used her nimble fingers to install flight instruments in PBY “Flying Boats”.

My brother Jacque was born in July of 1945 so he is not a “true” Boomer. However, we shared the same experiences, the same values and usually the same “Boomer” ideas so he has earned an “honorary” membership in the club. I came along in December of 1948. In the early years my family moved (so I am told) through a succession of rental situations.

That all changed forever in 1951. Taking advantage of a VA Loan, my parents bought a home in a rural/suburban area. It was a small, 2 bedroom house, typical for the time. We lived near, but not in a housing tract and had a huge quarter acre lot. Ten years later we would move to a traditional suburban neighborhood, which gave my brother and I easier access to our friends but still with a big yard. This yard space was always an important factor in our interaction with our pets.

Our first pet came along shortly after moving into that first house in 1951. She was a small black and white “mixed breed” dog which came from a friend of my parents whose dog just had a litter. Apparently, I get credit for her name. I was only two at the time and had trouble pronouncing some letters. When I first saw her I tried to describe her as a “little bitty” puppy. What came out was “Jiddle Biddy”. This was shortened and her name became “Jid”.

Many of my earliest memories are playing with Jid. She was the first pet in our household but soon got company. Both my brother and I wanted more and we nagged our parents about it. We got Jid when I was 2 years old. By the time that I was 8 and in third grade, we had 2 dogs, 2 cats, a canary, a parakeet, a hamster and…a raccoon. I know that date because I remember taking Robbie, the raccoon to “show and tell” at school. The dogs and cats all came from friends. The canary was my Mom’s idea. Her mother always had one so she “grew up” with a singing canary in the house. The Parakeet and Hamster both came from Woolworth’s. The argument that my brother and I made for getting these pets was simple and effective. “All our friends have one.” The Raccoon was another story. My Dad accepted him from friends. His parents had been killed by hunters. I guess he was about 4 to 6 weeks old. I set up his home in a cardboard box with old clothes to sleep on and a ticking alarm clock to mimic his mother’s heartbeat. I hand fed him milk from a doll’s bottle that I borrowed from my cousin, Cindy. Raccoons are truly incredible. They are smart, mischievous and their paws are more like hands than paws so he was always getting into “trouble”.

Except for the birds and the hamster, all our pets lived outdoors. They had access to the basement in inclement weather but spent the vast majority of their time roaming the yard and neighborhood. This is where the dogs became “leaders of the pack”. It was a different time then. There was no air conditioning so everyone’s windows and front door were open when they were at home. We relied on screen doors to keep out the bugs and let in any breeze as a relief from the blistering Kansas summer heat. There were no leash laws and fewer fenced yards so dogs roamed free. We kids also were free. In the summer my brother and I ate breakfast then left to go play. We grabbed lunch at whoever’s house we were playing at and made it home for dinner. Our dogs were literally our constant companions. Wherever we went, they went. I remember that my Mother once said that she always knew where to find us. She just looked for our dogs lying in the front yard. When we played pick up baseball games, everybody’s dog was there, lying patiently on the sidelines.

The bond between Boomers and our pets, especially our dogs was forged in our formative years. My brother and I spent more waking hours with our dogs than we did with our parents, especially in the summer. They were always there both with us and for us, our constant friends and companions. They were ready to play at any time, to listen to our childhood rants when no adults would and always ready to extend a paw or a friendly lick when things weren’t going so well.

Is it any wonder that when we Boomers grew up that we welcomed the friends and companions of our youth into our households – not as pets, but as full-fledged members of the family. To do anything else would have been unnatural and go against everything that we learned growing up.

My adult life differs from the vast majority of other Boomers in that I have spent most of it “on the road”. I got involved in Consumer Products Sales and Marketing shortly after finishing college. As a travelling salesman, I first hit the highways then moved up to the airways. I estimate that I have put in over 750,000 miles driving for business and over 2.5 million air miles, in and out of 157 North American Airports…plus some foreign travel. I have spent Over 4000 nights in hotels. I am not bragging. I only mention this because Pet Parenting is a big responsibility. You need to be there for your Pet Children. They depend on you for both care and companionship, especially dogs.

Without exception, during the “family” years of my life, pets were always a welcome and integral part of the household. When I lived alone, usually they were not. Looking back, they would have helped but my decision was based on concern for their welfare, not mine. Why we have pets truly hit home to me a few years ago. I got home on a Friday night after a tough week on the road. No one was home so I collapsed on the couch. Licorice, my black, long haired feline companion came over, curled up on my lap and began to purr. I began to stroke him. Within seconds, I felt noticeably better; less tired, mentally and physically. Besides all the benefits of having Pets that HABRI has documented, the simple fact is that our relationship with our Pets just makes us feel better. This applies to everyone but I think we Boomers are even more susceptible because of those free, open years in our youth spent with our pet companions.

Well, that’s my pet connection story. What’s yours?