Price Matters: Petflation Update – Mid-Year 2018

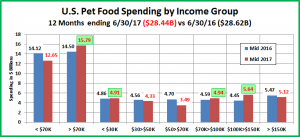

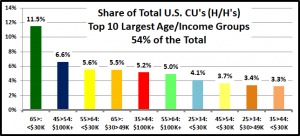

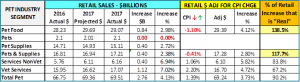

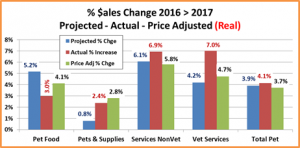

Does price matter in Pet Spending? Currently, it is the primary factor in 75% of all consumer buying decisions and household income is the most influential demographic in Pet Spending so I think that we can safely say that price matters. However, petflation can have a distinctly different impact on different industry segments. For example, the cumulative effect of years of strong price inflation in Vet Services has caused a reduction in frequency of Vet visits and 74% of the revenue increase since 2009 is from price increases. Also, the Pet Supplies segment has become increasingly commoditized and sales are driven up or down from even minor changes in the CPI.

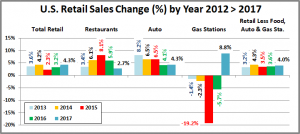

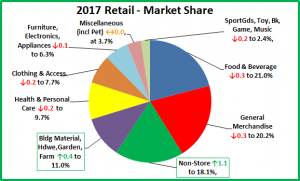

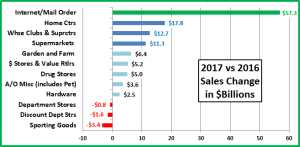

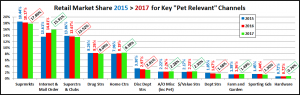

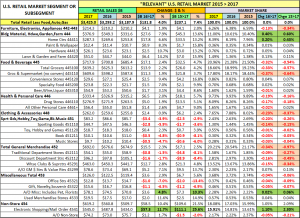

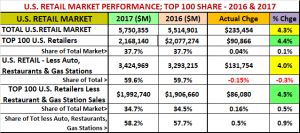

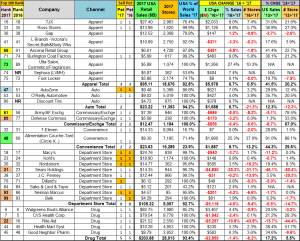

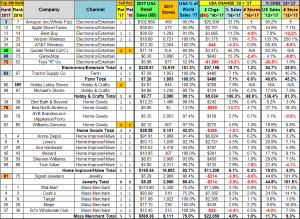

Needless to say the retail marketplace has become a competitive battleground, unlike any time in our history. The ongoing fight for the consumers’ $ is between manufacturers, brick ‘n mortar retailers and retail channels, which now includes the internet. It is literally a “free for all” to fulfill the consumers’ need for Price, Convenience and Selection.

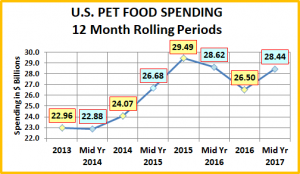

In this report we will update both our long range view of petflation and take a closer look at what has happened in the most recent 24 months as of June 2018. We will look at individual industry segments but we will also compare their performance to the overall market and some other relevant industries.

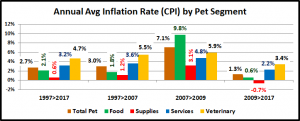

We will try to make this number intensive report more palatable by presenting the data in graph form, followed by brief commentaries. In our first graph we’ll look at the path of petflation since 2007. Certain numbers have been included to better illustrate key trends in specific industry segments. The numbers that are “boxed” in red indicate deflation from the previous period.

- Overall – The period from 2007 to 2009 was a very economically “flush” time. Prices in the industry were increasing at a record rate. Then came the “Recession”. Only the Great Depression in the 1930’s had a bigger impact on the U.S. retail marketplace. For most industries, the effect on prices and revenue was felt in 2009. In the Pet Industry the impact was delayed until 2010. Only the Veterinary segment continued with no apparent effect on their high inflation rate. However, the Supplies segment saw a lasting change. In fact the current Supplies prices are equal to those in September of 2007. While the paths of the two Service segments are similar, the food and supplies segments are definitely different.

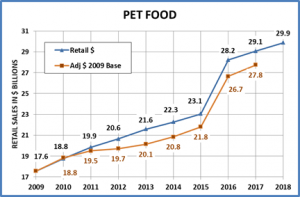

- Pet Food – The 20+% price increase from 2007>2009 was a direct result of the melamine recall. Consumers began insisting on products made in America with all U.S. ingredients. This radically increased production costs and retails. Prices dropped slightly in 2010 in reaction to the “crash” but from 2011 to 2013 inflation rates moved back to a normal range. In 2014 prices dropped. This began a continuing trend of flat to falling prices. The primary cause was and is…the incredible competition in this segment between manufacturers, retailers and whole retail channels. In the old days, deflating prices in a “need” category would mean reduced sales. However, this is not the situation today in Food as we also began a trend of high priced upgrade options. This became very evident with a $5B spending lift in 2015 driven by the move to Super Premium Foods while prices dropped a record -1.0%. Prices have generally continued this deflationary trend including setting a new record of -1.1% in 2017. Despite a number of mergers and acquisitions, competition is still fierce creating more pressure to find the next “must have” upgrade.

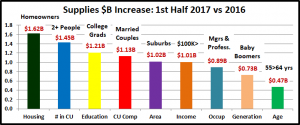

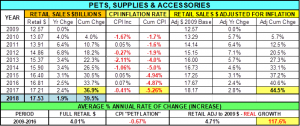

- Pet Supplies – No other industry segment was more impacted by the great recession. The consumers’ number 1 focus is price. This brings to the forefront the current weaknesses in the Supplies category. Most of the products are discretionary and many categories have become commoditized. This makes them sensitive to even short term price increases and susceptible to “trade out” spending from other categories. In 2015 supplies prices went up 0.5% at the same time that pet parents were upgrading to super premium foods. Supplies spending fell -$2.1B. This recent price sensitivity is also highlighted by the fact that in 5 of the last 8 years prices have deflated and supplies reached their all-time pricing peak 9 years ago in 2009.

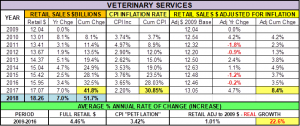

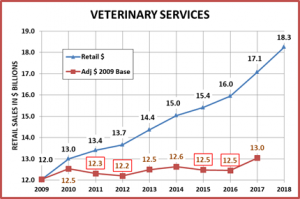

- Veterinary – This segment has by far the highest inflation rate and was seemingly unaffected by the recession. However, the effects are there. They are just not as visible. The cumulative inflation for Veterinary since 2007 passed Pet Food in 2013 for the industry lead but in 2018 it is almost double. The unseen impact of Veterinary inflation is that 74% of the segment’s growth since 2007 is solely due to price increases. Clinic visits have decreased in frequency and are more driven by higher income groups. In effect pet parents are visiting less often but paying more. The inflation rate did slow slightly in 2017 but appears to be moving back close to “normal”

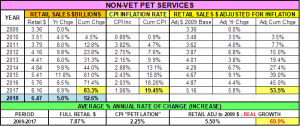

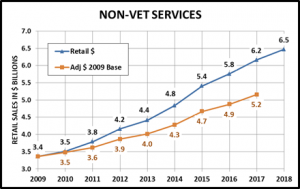

- Services – Spending on services is even more discretionary than supplies but it is also more driven by higher income groups so it is less sensitive to price increases. The inflation pattern is very similar to Veterinary, but at a lower rate. There was a dip in the inflation rate in 2017 due to increased competitive pressure as a result of services being offered and promoted in more retail outlets. However, prices appear to have bounced back in the 1st half of 2018.

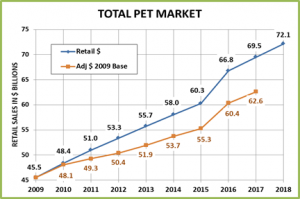

- Total Pet – The smooth pathway is the sum of 4 different roads and once again shows that we must always look beneath the topline numbers to find out what is truly happening in the industry.

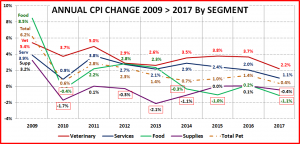

Now let’s look at the most recent 24 months in much greater detail – month to month!

- Overview – The 4 segments were closely bunched for the first 8 months then began divergent paths. In a highly unusual circumstance, prices in all segments have gone up in the first half of 2018, especially the 2nd quarter. This could depress the spending in the more sensitive segments.

- Pet Food – For the first 18 months, Pet Food prices continued to deflate, reaching the low point in November of 2017. Then they turned upward and maintained a slow, but steady increase in pricing. In June they are slightly above what they were 1 year ago. As we have seen, sales are not directly tied to pricing in this segment. They are more of an indication of competitive pressure, which could be easing due to mergers and acquisitions.

- Pet Supplies – This segment was up and down over the first 12 months but for much of the time remained at or near 0% inflation. After a strong increase in July of 2017, prices began another deflationary trend reaching (-1%) in February of 2018. Prices then turned sharply upward – an amazing (+2.1%) in the second quarter. If sales in this segment remain as price sensitive as they have been in the past, this data suggests that the second half of 2017 will be strong but the first half of 2018 could bring a significant drop. (The US BLS data for 2017 will be out in a week so we’ll have an answer shortly to the 2017 question.)

- Veterinary – For the first 6 months, prices were flat, an unheard of situation. This ended and prices began moving up again in 2017 at a 2.8% rate. However, this is still below the 3.5% rate of recent years.

- Pet Services – The competitive environment really showed in the first 12 months as the inflation rate was 0.67% compared to their usual rate of 2.5%. In the second half of 2017 prices inflated at a 2.8% annual rate then flattened out for the first 4 months of 2018. In May 2018 Pet Services prices increased 2.55%. This is the single biggest one month change in prices that I have noted in any segment in all my research. I don’t have a specific explanation for it. Prices continued to rise in June so apparently it is not an anomaly. Perhaps, Services are just returning to “normal” after a brief foray into intense competition.

- Total Pet – For the first 18 months Total Pet showed record low inflation rates, ranging from 0.05% to 0.13% at the 6 month waypoints. This low rate came basically as a result of products vs services. However, the situation changed in 2018 as all segments registered increased prices which produced 92% of the overall 24 month 1.7% increase. In fact, the second quarter alone generated 57% of the increase. 2018 is setting itself up to be very different from the past 2 years, at least in terms of petflation.

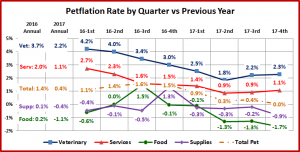

Thus far, we have focused solely on the CPIs for the Pet Industry. Let’s see how they compare over time to the National CPI and other relevant industries. The next chart compares the CPI change from 2009, a pivotal year, to June of 2017.

- The annual inflation rate of Total Pet is only 1.33% – 30% lower than the overall national CPI. This looks great but we know that the story behind the Total Pet number is a complex mixture of inflation and deflation.

- The inflation rate for Pet Food is only 30% of the rate for Food & Beverages. Pet Food entered a deflationary spiral in 2014 which resulted in this big disparity.

- Pet Supplies entered a different, deflationary world after the great recession. This is of great concern because of the extreme pressure that it puts on both manufacturers and retailers.

- Even with the recent slowing of inflation in the Veterinary segment, prices have increased 13.6% faster than Human Medical care. This has an even greater impact on consumers because Pet Insurance is not as effective as Human healthcare policies in lowering out of pocket expenses. Plus, the participation percentage is far lower.

- Except for a recent brief slowing due to competitive pressure, the inflation rate for the Service Segment has remained relatively constant over this time frame with little to no impact on revenue – so far.

Finally, let’s look at recent history – the last 24 months

- Total Pet – Like the overall CPI, total pet prices have turned upward in the past 24 months. However the big change for Pet occurred in 2018, which produced 92% of the overall price inflation.

- Pet Food – The deflation really shows up in this short term look. Now Pet Food, not Pet Supplies is the outlier in the group. Even though Pet Food prices have turned upward in 2018, Pet Food pricing most definitely does not correlate to the situation in the “human” Food & Beverage segment.

- Pet Supplies – If an outside observer was looking at this, they would probably think that the recent inflation rate for Pet Supplies looks reasonable, perhaps even good. However, taken into the context of a -5.1% CPI since 2009 and demonstrated hyper price sensitivity, alarm bells start going off. The Pet Supplies CPI went from -1.0% to +1.3% with a 2.1% increase in the 2nd quarter of 2018. Even small price increases have decreased sales. This does not bode well for Supplies sales in the first half of 2018.

- Veterinary – We have noted that inflation in this segment has slowed. This short term look truly puts that statement into context. Take note of this date. You are seeing a true rarity. The inflation rate over the past 24 months for Vet Services is 15% below the rate for Human Medical Services. Indications are that the Vet rate is moving back up to more “normal” levels but for a brief time it was in synch with the overall market.

- Pet Services – The 2.3% looks pretty normal for this category. However, once again appearances can be deceiving. After a year of radically slowed inflation from competitive pressures, the bulk of the total increase came from a 2.5% lift in prices in May of 2018. We should also note another unusual circumstance. The increase in the CPI for Pet Services over the past 24 months actually exceeds that of Veterinary Services. This is not normal.

A Final thought and a question. We have noted some unusual pricing trends in recent months. However, the most significant one may be what has happened in the first half of 2018. Prices in every segment increased, especially in the second quarter. This included spectacular increases in Supplies and Services. How will this affect consumer spending? Will we see a significant drop as consumers cut back on $ or frequency. We’ll just have to wait and see.