Retail Channel Monthly $ Update – February Final & March Advance

Time for our monthly update on U.S. retail sales by channel. The current COVID-19 crisis has caused turmoil in the Retail Marketplace. Consumer spending behavior has changed and continues to evolve. In this report we will track the changes and migration between channels. We will do that with data from two reports provided by the U.S. Census Bureau.

The Reports are the Monthly Retail Sales Report and the Advance Retail Sales Report. Both are derived from sales data gathered from retailers across the U.S. and are published monthly at the same time. The Advance Report has a smaller sample size so it can be published quickly – about 2 weeks after month end. The Monthly Final Report includes data from all respondents, so it takes longer to compile the data – about 6 weeks. Although the sample size for the Advance report is smaller, the results over the years have proven it to be statistically accurate with the final monthly reports. The biggest difference is that the full sample in the Final report allows us to “drill” a little deeper into the retail channels.

We will look at the latest release of both reports. We will begin with the Final Retail Report from February and then move to the Advance Retail Report for March. Remember, February 2020 was pre-pandemic, but in March the impact began. We will continue to compare 2021 to both 2020 and 2019 to track the ongoing evolution of the retail market.

Both reports include the following:

- Total Retail, Restaurants, Auto, Gas Stations and Relevant Retail (removing Restaurants, Auto and Gas)

- Individual Channel Data – This will be more detailed in the “Final” reports and we fill focus on Pet Relevant Channels

The information will be presented in detailed charts to facilitate visual comparison between groups/channels of:

- Current Month change – % & $ vs previous month

- Current Month change – % & $ vs same month in 2020 and 2019

- Current YTD change – % & $ vs 2020 and 2019

- Monthly and Year To Date $ will also be shown for each group/channel

First, the February Final. Retail hit bottom in April then began to recover, hitting record $ in December. January & February $ fell but were monthly records. Here are the major retail groups. (All Data is Actual, Not Seasonally Adjusted)

The final total is $1.7B more than the Advance report projected a month ago. All Groups were up slightly but most of the positive change came from Auto: +$1.0B; Restaurants: +$0.5B; Relevant Retail: +$0.1B; Gas Stations: +$0.1B. All groups were down vs January, but Total Retail still set a February record. Total $ales broke $600B for the first time in December and continued to set monthly records in both January and February thanks to strong performances by Relevant Retail and Auto. Restaurants and Gas Stations continue to struggle although Gas Stations are now above both monthly and YTD 2019 $. Throughout the pandemic, Relevant Retail has been the driving force in the recovery.

Now, let’s see how some Key Pet Relevant channels were doing in February.

- Overall– All 11 channels were down vs January. However, 9 of 11 were up vs February 2020 and 2019 and all but one were up in YTD $ vs 2020 and 2019. 2021 continues its strong start.

- Building Material Stores – Their strong lift continues. The ongoing surge came as a result of pandemic spending patterns developed in 2020. Consumers began focusing on their homes. They’re still showing double digit % increases. Farm Stores are leading the way, with 20+% increases in all measurements. Sporting Goods stores are not in this group, but they have a similar spending pattern. Sales took off in May, hitting a record peak in December. The lift continued into 2021. They are up 21.0% vs February 2020 and +28.8% YTD.

- Food & Drug – Supermarkets finished 2020 up +$77.7B. Sales dipped slightly in both January and February but are still +8.4% YTD vs 2020. Drug Stores ended up +$17B (+5.7%) for 2020. Their $ also fell in January and February but are still +4.7% YTD vs 2020.

- General Merchandise Stores – $ in all channels continue to fall from their December peak. Discount Department Store $ in February were down vs 2020 and 2019. In fact, their YTD $ are now essentially even with 2020. This shows that this channel was having problems even before the Pandemic. The growth slowed in Clubs/SuperCtrs and $ Stores. Combined, they were up 3.0% vs February 2020. However, their YTD sales are still up 8.8%.

- Office, Gift & Souvenir Stores– Sales dropped again in February. They have negative numbers in all measurements. Recovery is a long way off.

- Internet/Mail Order – The pandemic has accelerated this channel’s growth. Last February they were up 10.3% YTD vs 2019. This year they are up 29.0%. The pandemic lift spending pattern almost tripled the rate of increase.

- A/O Miscellaneous – This is a group of small to midsized specialty retailers – chains and independents. It includes Florists, Art Stores and Pet Stores (22>24% of total $). Pet Stores were usually essential, but most stores were not. Stores began reopening in May and the $ grew. Their 2020 total sales were up +11.6%. February YTD sales are +$1.6B (+11.6%) vs 2020. However, that is down from 2020 when they were +$2.5B (+21%) vs 2019.

The Relevant Retail Segment began recovery in May and reached a record level in December. $ plummeted in January & February but still set monthly records. Almost all members of this group are showing growth, but the key drivers are the Internet, Supermarkets, SuperCtrs/Clubs/$ Stores and Hdwe/Farm. Now, here are the Advance numbers for March.

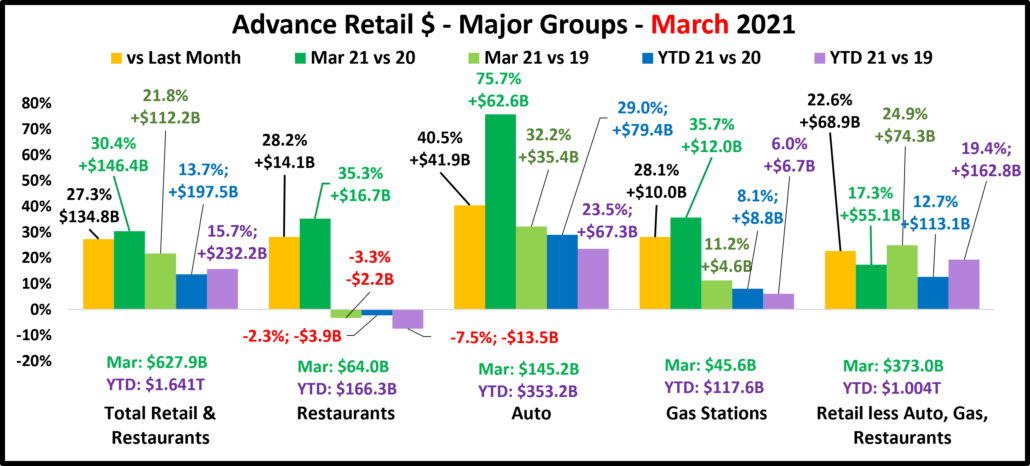

2020 will always be a memorable year for both its traumas and triumphs. In April & May we experienced the 2 biggest retail spending drops in history, but the problems actually began in March. Sales increased slightly from February but were $34.1B less than March 2019. Retail sales began to recover in June and in October, YTD Total Retail turned positive for the 1st time since February. In December, Total Retail broke the $600B barrier – a historic first. While sales fell from their December peak, monthly sales records were set in both January and February. Then they took off again in March, breaking $600B again while setting a new monthly sales record of $627.9B. A March lift in sales from February is pretty normal but this is the first time in records going back to 1992 that March sales have exceeded those from the previous December. All of the major groups increased sales from February and Restaurants were the only group to register any negatives vs 2020 or 2019. As we progressed through 2020 and now into 2021, we have seen real evidence of the strength and resiliency of the U.S. Retail Market.

2020 will always be a memorable year for both its traumas and triumphs. In April & May we experienced the 2 biggest retail spending drops in history, but the problems actually began in March. Sales increased slightly from February but were $34.1B less than March 2019. Retail sales began to recover in June and in October, YTD Total Retail turned positive for the 1st time since February. In December, Total Retail broke the $600B barrier – a historic first. While sales fell from their December peak, monthly sales records were set in both January and February. Then they took off again in March, breaking $600B again while setting a new monthly sales record of $627.9B. A March lift in sales from February is pretty normal but this is the first time in records going back to 1992 that March sales have exceeded those from the previous December. All of the major groups increased sales from February and Restaurants were the only group to register any negatives vs 2020 or 2019. As we progressed through 2020 and now into 2021, we have seen real evidence of the strength and resiliency of the U.S. Retail Market.

Total Retail – As we said, the Total Retail $ for March set a record for the most spending in any month in any year. The $627.9B was up $134.8B (+27.3%) from February and $146.4B (30.1%) more than March 2020. If you compare the YTD 2021 spending to 2019, you see an increase of $232.4B (+15.7%). That is an average annual spending increase of 7.6%. If you just looked at these topline numbers, you would not suspect that a spending crisis had ever happened. Always look below the surface.

Restaurants – This is the only big group with any negative measurements. Last February YTD sales were up 8.1% vs 2019. The Pandemic changed that. Restaurants started to close or cease in person dining in March and sales fell -$33.3B (-52.5%) compared to March 2019. Sales bottomed out in April at $30.1, the lowest April sales since 2003. Sales started to slowly increase in May but never reached a level higher than 88% compared to the previous year. 2021 did not start off well. Through February, YTD sales were down -16.7% from pre-pandemic 2020 and -10.0% from 2019. That brings us to March. Sales took off, up $14.2B, 28.2% from February and 35.2% from March 2020. They reached $64.0B, the highest level since December of 2019. However, the $ were still down vs March 2019 and YTD $ were still below both 2020 and 2019. We’ll see how their recovery progresses in April. YTD Avg Growth Since 2019 = -3.8%

Auto (Motor Vehicle & Parts Dealers) – Staying home causes your car to be less of a focus in your life. Sales began to fall in March and hit bottom in April. Auto Dealers began combating this “stay at home” attitude with fantastic deals and a lot of advertising. It worked. They finished 2020 up 1% vs 2019 and have returned to a strong positive pattern in 2021. The “attitude” grew amazingly positive in March as sales reached $145.2B. This was by far the biggest month in history. It beat the former leader, July 2020, by $28B. To show how well consumers responded to their campaign you just need to look at the data. This group has exceeded $110B in monthly sales only 9 times in history. 7 of those occurred after the onset of the pandemic. YTD Avg Growth Since 2019 = +11.1%

Gas Stations – Gas Station $ales are a mixed bag. Obviously, if you drive less, you visit the gas station less often. Sales turned down in March 2020 and reached their low point in April. They moved up but generally stayed about 15% below 2019 levels for the rest of 2020. In February they were still behind 2020 in monthly and YTD $ but ahead of 2019 in both measurements. In March, sales skyrocketed to $45.6B, 28.4% more than February and a 35.7% increase over March 2020. They turned positive in all measurements vs both 2019 and 2020. It looks like they are beginning their comeback. However, there is another factor that must be considered – inflation. Gas prices can be pretty volatile. They dipped in the first 2 months of the pandemic but then returned to more normal levels for the balance of 2020. They began inflating in 2021 and spiked in March. The March 2021 prices were 22.5% above March 2020. That means that 63% of the 35.7% year over year lift came from just higher prices. Analyzing retail can be complicated. YTD Avg Growth = +3.0%

Relevant Retail – Less Auto, Gas and Restaurants – This is what we consider the “core” of U.S. retail and has traditionally accounted for about 60% of Total Retail Spending. When you look at the individual channels in this group, you see a variety of results due to many factors – non-essential closures, binge buying, online shopping and a consumer focus on “home”. However, overall, April 2020 was the only month in which spending in this group was down vs 2019. Monthly $ales exceeded $400B for the first time ever in December ($411B). They finished 2020 up $251B, +6.8%. Their performance was the only reason that Total Retail was able to finish 2020 with positive numbers, +0.6%. Sales fell in January but continued to set monthly records through February. In March they turned sharply up again, +22.6% from February. Currently, they are up $55.1B, +17.3% vs March 2020 and +$113.1B, +12.7% YTD. The $373B spending in March is the third highest monthly total of all time, trailing only December 2020 and December 2019. We should also note that the Relevant Retail group has posted positive numbers versus last year and YTD for every month since April 2020 and their average YTD growth rate since 2019 now stands at +9.3%. More channels are turning positive, but the primary drivers continue to be Nonstore, Grocery, SuperCenters/Clubs/$ Stores plus a never ending “spring lift” from Hardware/Farm and Sporting Goods.

Now let’s look at what is happening in the individual retail channels. March was a spectacular month. Let’s see where the $ came from. These groups are less defined than in the Final Monthly reports and we will look across the whole market, not just pet relevant outlets. We will continue to track 2021 monthly and YTD sales vs both 2020 and 2019.

Sales in all 13 channels were up vs February. 11 channels beat March 2020 $ and 12 beat March 2019 $. In YTD $ales, all channels beat 2020 and 10 were ahead of 2019. (Relevant Retail YTD Avg Annual Growth Rate since 2019 = +9.3%)

After hitting bottom in April 2020, Relevant Retail has now beaten the previous year’s $ for 11 consecutive months. The group set an all-time record of $410.9B in December and finished 2020 +$250.9B vs 2019. They have also started 2021 strong, with record sales in every month. Essential channels are still primarily responsible for the continued lift:

- Nonstore Retailers – The biggest driver. Online shopping continues to grow in # of households and in $.

- Food & Beverage – Grocery– Restaurant $ are improving but consumers continue to eat & drink more at home.

- Bldg Materials/Garden/Farm– Their “Spring” lift continues unabated as consumers focus on their home.

- SuperCtrs/Club/Value/$ Strs – They keep the GM channel positive. Value is still a major consumer priority.

Regarding the Individual Large Channels (Includes YTD Avg Annual Growth Rate since 2019)

General Merchandise Stores – Sales surged up from February producing all positive numbers overall. Department Stores $ were up vs 2020 but down vs 2019. They were having problems before the Pandemic. The growth by Club/SuperCtr/$ stores has slowed to +2.5% in March, down from +9.6% in January but these stores are still the key.

- YTD Avg Annual Growth: All GM = +5.7%; Dept Stores = -4.3%; Club/SuprCtr/$ = +7.7%

Food and Beverage, plus Health & Personal Care Stores – Sales in Grocery were up 9.8% from February but down 16.6% from 2020 – No surprise, as March 2020 was a binge month. The Health, Personal Care group finished 2020 at +1.7%. 2021 has started even better. With a strong March, YTD they are +4.2% vs 2020 and +8.2% vs 2019.

- YTD Avg Annual Growth: Grocery = +6.3%; Health/Drug Stores = +4.0%

Clothing and Accessories; Electronic & Appliances; Home Furnishings – March was a spectacular month for all these channels. Home Furnishings is now positive in all measurements. Electronic & Appliance had a strong March but still remains slightly below 2019 in YTD $. Clothing Stores more than doubled their 2020 $ but are still -5.4% YTD vs 2019.

- YTD Avg Annual Growth: Clothing = -2.7%; Electronic/Appliance = -0.2%; Furniture = +8.5%

Building Material, Farm & Garden & Hardware – Their Spring lift began on time in 2020 and it has essentially never stopped. They have greatly benefited from consumers turning their focus to their home needs. They finished 2020 +53B (+13.8%). In March sales took off, +43.5% from February, +32.4% vs 2020 and +20.9% YTD. Avg Annual Growth = +13.0%

Sporting Goods, Hobby and Book Stores – Book & Hobby stores are open but Sporting Goods stores have driven the lift in this group. Consumers turned their attention to personal recreation and sales in Sporting Goods outlets took off. The group ended 2020 +5.5% vs 2019. The growth accelerated in 2021. January & February set monthly sales records, but March had the most $ of any non-December month in history, +78.2% vs 2020. YTD Avg Annual Growth = +15.1%

All Miscellaneous Stores – Pet Stores were deemed essential but most other stores were not, so closures hit this group particularly hard. Sales hit bottom at -$3.8B in April then began to rebound. They finished with a strong December and ended 2020 down $1.0B, -0.7%. January sales were +6.9% vs 2020 but February sales were down -0.01% vs 2020. In March Sales took off. They were +27.3% from February, +30.3% from March 2020. Their YTD sales are now 13.7% above 2020 and 22.1% more than 2019. It appears that their recovery has gained traction. YTD Avg Annual Growth = +10.5%

NonStore Retailers – 90% of the volume of this group comes from Internet/Mail Order/TV businesses. The COVID-19 crisis accelerated the movement to online retail. In February 2020 NonStore $ were 8.6% YTD. In December monthly sales exceeded $100B for the 1st time. They ended 2020 at +21.9%, +$173.9B. Their increase was 69% of the total $ increase for Relevant Retail Channels. Their 2020 performance far exceeded their 12.9% increase in 2019 and they started off 2021 even better. March is +30.7% vs 2020 and YTD $ are +27.8%. YTD Avg Annual Growth = +19.2%

Note: Almost without exception, online sales by brick ‘n mortar retailers are recorded with their regular store sales.

Recap – 2020 was quite a year. April & May had the 2 biggest year over year sales decreases in history while December sales broke $600B for the first time. Restaurants, Auto and Gas Stations suffered the most. Auto had recovered by yearend but Gas Stations and Restaurants were still struggling. Relevant retails had segments that also struggled but overall, they led the way for Total Spending to finish the year +0.6% vs 2019. 2021 started out even more positive, especially in March when Total Spending of $627.9B broke the record set in December – an unheard feat for March. Auto also set a spending record in March. Gas Stations $ are now all positive and YTD Restaurant $ are only slightly below 2020 and 2019. The recovery in Relevant retail has also become much more widespread and monthly sales continue to set records. We’ll see if the trends continue but the Retail economy has come back strong.