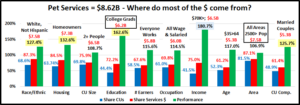

2019 Pet Services Spending was $8.62B – Where did it come from…?

Next, we will look at Pet Services. They are by far the smallest Segment at $8.62B. Spending turned down $0.10B in 2019 after a $1.95B (+28.9%) lift in 2018, which was by far the biggest increase in history. The number of outlets offering Services has been strongly increasing in recent years as brick ‘n mortar retailers look for a way to combat the growing influence of online outlets. After all, you can certainly buy products, but you can’t get your dog groomed on the Internet. This created a highly price competitive market for Pet Services. In 2017 there was a slight increase in visit frequency, but Pet Parents just paid less. This resulted in a 1.0% decrease in Services spending. In 2018 consumer behavior changed as a significant number decided to take advantage of the increased availability and convenience of Pet Services and spending literally took off. In 2019, Services $ essentially held their ground at this new higher level. However, there was some turmoil as the demographic segments spending more or less were almost equally divided. We saw evidence of some value shopping as the younger groups spent less. However, the older age groups stepped up to take advantage of this new more convenient and affordable marketplace.

Pet Services maintained their stronger “presence” at the Pet Industry “table” and spending in this highly discretionary segment became a little more balanced. Let’s look a little deeper into the demographics.

Let’s start by identifying the groups most responsible for the bulk of Services spending in 2019 and the $0.10B decrease. The first chart details the biggest Pet Services spenders for each of 10 demographic categories. It shows their share of CU’s, share of Services spending and their spending performance (Share of spending/share of CU’s). The differences from the products segments are immediately apparent. In order to better target the bulk of the spending we had to alter the groups in two categories – education and area. The performance level should also be noted as 5 of 10 groups have a performance level above 120%. This is the same as Food but less than the 6 for Total Pet & Veterinary, and 7 for Supplies. Last year they had 7 over 120% which indicates that there is a little less disparity between the best and worst performing segments in 2019. Income is absolutely the biggest factor in Services Spending. The categories are presented in the order that reflects their share of Total Pet Spending which highlights the differences of the 8 matching groups.

- Race/Ethnic – White, not Hispanic (87.3%) up from 85.5%.This big group accounts for the vast majority of spending in every segment. Services Spending became slightly less diverse in terms of race and ethnicity in 2019 as their performance grew from 123.8% to 127.4% and they moved up from 5th to 4th in terms of importance.

- Housing – Homeowners (84.5%) up from 80.8%. Homeownership is a big factor in pet ownership and spending in all industry segments. The Homeowners’ share of Services rebounded sharply in 2019 as did their performance, which grew from 127.3% to 132.6%. Homeownership moved up to 3rd from 5th in terms of importance for increased Services $. Homeowners w/o mtge spent 25% more, but those w/mtge spent 4% less and … Renters $ were down 20%.

- # in CU – 2+ people (75.9%) down from 77.3% The share of market for 2+ CU’s is over 75% for all segments. It is lowest in Veterinary (75.0%) and Services (75.9%). Their performance of 108.7% is down from 109.6% and is also next to last. The explanation is that Singles (30.2% of CUs) spent 5% more while 2+ CUs spent -3% less.

- Education – College Grads (72.2%) up from 68.9% Income generally increases with education. Services spending moves up with each increasing level of education. This is why we again shifted the group up to College Grads. Performance of 162.6% was up from 157.9% and a college education is still the 2nd most important factor.

- # Earners – “Everyone Works” (67.6%) down from (71.5%) All adults in the CU are employed. Income is important so a high market share is expected. However, their performance fell to 115.6% from 123.8% and they are no longer in the 120% club. This was due to a 56% increase by No Earner, Singles and a 6% increase by 1 Earner, 2+ CUs.

- Occupation– All Wage & Salaried (69.8%) down from 71.4% – Blue Collar workers spent more but couldn’t overcome the decrease by White Collar workers, Managers and Professionals. Retirees also spent 18.5% more on Services. All of this contributed to All Wage & Salaried workers’ performance rating decreasing from 116.9% to 114.5%. Services spending became a little more balanced in terms of Occupation.

- Income – Over $70K (75.0%) up from 72.3% This group’s performance rating is 180.7%, up from 179.4% which shows that CU income is still the single most important factor in increased Pet Services Spending. <$70K was down -$0.26B. $70K> was up $0.16B but Services $ were on an income rollercoaster. <$30K was -$0.07B; $30>39K was +$0.19; $40>69K was -$0.38B; $70>149K was +$0.25B; $150K> was -$0.09B.

- Age – 35>64 (61.2%) down from 63.7%. Their performance fell from 120.4% to 117.0% and they dropped out of the 120% club. There was a clear age dividing line. <45 spent less. 45> spent more. In 2018 the 35>44 yr olds had the biggest increase. In 2019, they had the biggest decrease, -$0.43B. Spending by the 75+ group was up +$0.34B.

- Area – City/Suburbs >2500 (87.1%) up from 85.3% in share, while performance increased from 104.7% to 106.9%. Services is an Urban Segment. After a strong 2018, Central City $ fell -13% in 2019. The large Suburbs were the only segment to spend more, +$0.55B (+14.8%). All areas <2500 spent -$0.17B (-13.4%) less.

- CU Composition – Married Couples (61.4%) down from 62.8%. Married couples are a big share of $ and have 120+% performance in all segments but Veterinary. Their performance dropped to 125.7% from 126.6% and they fell to 5th place in terms of importance to Services spending. Married Couples with children spent -$0.28 less on Services while all CUs without children spent +$0.23B more.

We changed 2 of the groups for Services – Education and Area, to better target the biggest spenders. We should also note that Income is more important to spending in Services than in any other segment but the performance in categories related to income – # Earners, Occupation and Education was mixed. # Earners and Occupation became less important while higher Education grew in importance. In some categories, spending was slightly more balanced in 2019.

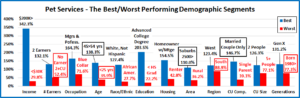

Now, we’ll look at 2019’s best and worst performing Pet Services spending segments in each category.

Most of the best and worst performers are not a surprise. There are 7 that are different from 2018 – 3 of the best and 4 of the worst, down from 8 last year. The 3 new winners are high income and big pet spenders. You can see the move away from youth after the big lift in 2018, but not completely as Gen Xers, including the 45>54 yr olds are still on top. Changes from 2018 are “boxed”. We should note:

- Income is even more important to Pet Services. While the 342.3% Performance by the $200K> group is less than last year’s 364.0%, it is 45% higher than Supplies and 78% higher than the best performing income segment in Food.

- Generation – Gen X retained Top Spot and Millennials/Gen Z returned to the bottom. 2019 reversed some of the gains made by the younger generations in 2018.

- Age – The 45>54 group reflects the move to more expected winners. They spend the most $ and are by far the best performers. All groups from 35>64 perform at 100+%. The low income <25 group returned to the bottom.

- Area –Suburbs 2500> kept the lead in $ and regained the lead in performance from Center City. As we have said Services is an Urban segment. Areas 2500> perform at 106.9%. Areas <2500 perform at 69.6%.

- CU Composition – Married Couples Only returned to the top by eking out a small, 2.2% increase. Married couples with children spent less on Services in 2019 but Marriage and children are important factors in Services spending. Married Couples only and those with children of any age all perform over 100%. They all earn their share.

In Pet Services spending performance, income is still the major factor. After the youth movement in 2018, spending skewed towards older groups in 2019.

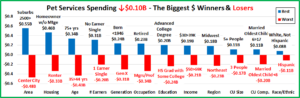

It’s time to “Show you the money”. Here are segments with the biggest $ changes in Pet Services Spending.

Pet Services Spending was down $0.10B, essentially flat. In this chart you immediately see a difference from last year. In 2018, six categories had no segments that spent less on Services. In 2019, there were none. You also see that in most cases the changes for the winner and loser tend to cancel each other out. Although the total $ change was small, the spending was more tumultuous than in 2018. There were only 2 repeats, compared to 7 last year. Also, 9 of 24 segments switched their position from first to last or vice versa. There were only 5 in 2018. Here are the specifics:

- Area Type – Center City flipped from 1st to last. They have flipped every year since 2016.

- Winner – Suburbs 2500> – Pet Services Spending: $4.28B; Up $0.55B (+14.8%) 2018: Center City

- Loser – Center City – Pet Services Spending: $3.23B; Down $0.48B (-12.9%) 2018: Suburbs <2500

- Comment – The large Suburbs won and were also the only area to spend more on Services in 2019.

- Housing – Homeowners w/o Mtge flipped from last to first.

- Winner – Homeowner w/o Mtge – Services: $2.33B; Up $0.46B (+24.9%) 2018: Homeowner w/Mtge

- Loser – Renter – Services: $1.34B; Down $0.33B (-20.0%) 2018: Homeowner w/o Mtge

- Comment – Renters and Homeowners w/mtge spent less. The lift by Homeowners w/o mtge is tied to Retirees.

- Age – The 35>44 yr olds flipped from 1st to last…

- Winner – 75+ yrs – Pet Services Spending: $0.76B; Up $0.34B (+80.5%) 2018: 35>44 yrs

- Loser – 35>44 yrs – Pet Services Spending: $1.57B; Down $0.43B (-21.7%) 2018: 65>74 yrs

- Comment: In 2018, all age groups spent more on Services. The 35>44 yr olds led the way, followed by 45>54. In 2019 all groups under 45 yrs old spent less, -$0.60B, while all groups over 45 spent more, +$0.50B. The 75+ year olds led the way and like 2018, the 45>54 yr olds came in second.

- # Earners– No repeats or flips. No Earner, Singles and 1 Earner, 2+ CUs had the only increases.

- Winner – No Earner, Single – Pet Services Spending: $0.86B; Up $0.31B (+56.0%) 2018: 2 Earners

- Loser – 1 Earner, Single – Pet Services Spending: $1.22B; Down $0.20B (-14.4%) 2018: No Earner, 2+ CU

- Comment – The # of Earners became slightly less important as “Everyone Works” CUs spent -$0.40B less.

- Generation – Gen X flipped from 1st to last.

- Winner – Born <1946 – Services: $0.95B; Up $0.24B (+33.0%) 2018: Gen X

- Loser – Gen X – Services: $3.04B; Down $0.31B (-9.1%) 2018: Baby Boomers

- Comment – Despite their drop in $, Gen X maintained their position as the biggest Services Spenders. 2019 saw a clear Generational divide in Pet Services spending. Gen X & Millennials spent less while Boomers and those born before 1946 spent more,

- Occupation – Both the winner and loser flipped.

- Winner–– Retired – Pet Services Spending: $1.46B; Up $0.23B (+18.5%) 2018: Mgrs & Professionals

- Loser – Mgrs & Professionals – Pet Services Spending: $3.55B; Down $0.34B (-8.6%) 2018: Retired

- Comment – Retirees & Blue Collar workers spent more while White Collar workers & Self-Employed spent less.

- Education – Advanced College Degree held their spot on top.

- Winner – Adv. College Degree – Pet Services Spending: $3.30B; Up $0.20B (+6.6%) 2018: Adv. College Degree

- Loser – HS Grad w/some College – Pet Services Spending: $0.93B; Down $0.24B (-20.3%) 2018: HS Grad

- Comment – Again we have a clear dividing line on Services Spending. All those with a formal college degree, from Associates on up, spent more. All other education levels spent less.

- Income – The winner flipped from last to first.

- Winner – $30 to $39K – Pet Services Spending: $0.46B; Up $0.19B (+69.9%) 2018: $200K+

- Loser – $50 to $69K – Pet Services Spending: $0.63B; Down $0.21B (-24.8%) 2018: $30 to $39K

- Comment – The win by the $30>39K is not surprising. This income range corresponds to the average income of Retirees, so they undoubtedly were the primary driver. However, as we stated earlier, we had a rollercoaster in Pet Services spending in 2019. <$30K was down -$0.07B: $30>39K was up $0.46B; $40>69K was down -$0.38B; $70>149K was up $0.25K; $150K> was down -$0.09B.

- Region – The Midwest won while flipping for the second consecutive year.

- Winner – Midwest – Pet Services Spending: $1.82B; Up $0.18B (+11.3%) 2018: South

- Loser – Northeast – Pet Services Spending: $1.45B; Down $0.23B (-13.8%) 2018: Midwest

- Comment – Last year all regions spent more. This year it was only the Midwest and West.

- # in CU – 5+ Person CUs flipped from last to first.

- Winner – 5+ People – Pet Services Spending: $0.63B; Up $0.11B (+21.5%) 2018: 2 People

- Loser – 3 People – Pet Services Spending: $1.29B; Down $0.17B (-11.6%) 2018: 5+ People

- Comment: The winner was a bit of a surprise and narrowly edged out Singles to come out on top.

- CU Composition – The winner and loser are both new.

- Winner – Married, Oldest Child 6>17 – Services: $1.16B; Up $0.11B (+10.3%) 2018: Singles

- Loser – Married, Oldest Child <6 – Services: $0.41B; Down $0.20B (-32.8%) 2018: Single Parents

- Comment – Although Gen X had the biggest decrease, they are still strong. The winner in this group was likely produced by the 45>54 yr old group. The loser was more likely to be younger.

- Race/Ethnic – White, Not Hispanics held their position at the top.

- Winner – White, Not Hispanic – Services: $7.53B; Up $0.08B (+1.0%) 2018: White, Not Hispanic

- Loser – Hispanic – Services: $0.53B; Down $0.11B (-17.6%) 2018: African American

- Comment – Higher incomes – Whites & Asians spent more. Lower incomes – Hispanics & Blacks spent less.

We’ve now seen the winners and losers in terms of increase and decrease in Services Spending $ for 12 Demographic Categories. After a fabulous 2018, Services $ essentially flattened out in 2019. 49% of segments spent more compared to 88% in 2018. The winning increase in each category averaged +$0.25B, down from +$1.04B in 2018, while the biggest decreases averaged -$0.27B, up from -$0.02B. The spending also flipped from younger to older groups. Income is still of primary importance, but we saw a mixed bag of results for different levels. Urban areas are still the primary spenders but in 2019 more $ moved to the big Suburbs. The -$0.10B decrease was minor and we have detailed the best segments in performance and $. However, there were others who performed well but didn’t finish on top. They deserve….

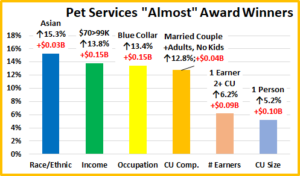

HONORABLE MENTION

Higher income is important, but the results were mixed in 2019. The $30>39K group won but there were also positive performances by the high income Asians, the middle income $70>99K group and Blue Collar Workers. Also, unless your oldest child was between 6>17, CUs with kids spent less on Services. CUs with no children spent more. 1 Earner, 2+ CUs was 1 of only 2 segments in the Earners category to spend more and are the only segment to increase Services spending for 4 consecutive years. The largest, 5+ Person CUs narrowly edged out the smallest, 1 Person CUs for the win. Spending increases, 49% and decreases, 51% were evenly split.

Summary

The Services segment has usually been “above” changes in other segments. Since 2010 prices have steadily increased but so did Spending …until 2017. An increase in outlets offering Services created a much more competitive environment. While prices didn’t deflate, inflation slowed significantly, and “deals” abounded as Retailers began a pitched battle for Consumers’ Services $. The net result was turmoil and a 1% decrease in spending. In 2018, the abundance of outlets and competitive prices finally had their intended impact. Many more consumers took advantage of the convenience of Pet Services and spending literally took off. In 2019 Consumers held their ground at the new higher level but we saw turmoil similar to 2017. Value shopping likely contributed to the small decrease.

Pet Services are definitely needed by some groups. However, for most demographics, Services are a convenience and spending is very discretionary in nature. The result of this is that usually CU income is of real importance to increased Services spending. While we saw mixed results according to income level in 2019, higher incomes still won out. 41.5% of CUs make over $70K and account for 75.0% of Services spending. This is a performance rating of 180.7% – the highest rating earned in any industry segment.

Performance is an important measurement. There were 5 categories with high performing big groups, down from 7 in 2018. This is equal to Food but less than Supplies (7) & Veterinary (6). This indicates less disparity in Services Spending.

- Income · Higher Education · Homeownership · CU Composition · Race/Ethnicity

The two categories that dropped out were Age and # of Earners. They surpassed the 120% marker in 2018 because there was a strong youth movement. In 2019 the increases came from groups over 45 so the Age category became more balanced. Younger CUs also have more earners, so this category became less important as spending skewed a little older. However, we should note that while Gen X had the biggest decrease, they are still #1 in Services Spending.

2018 saw the biggest lift in history and it was widespread as 88% of all demographic segments spent more on Services. In 2019 Services essentially held their ground, only falling -$0.10B (-1.1%). The small decrease is reflected in the mixed demographic spending pattern. 51% of the segments spent less while 49% spent more.

The Services segment has seen a radical increase in the number of outlets. Services is the most discretionary industry segment and much of the spending is driven by the consumers’ need for convenience. The increase in outlets certainly made things more convenient, but it also created a more competitive market. This produced “deals”, the biggest driver for all Americans. This made Services an option for more Americans and drove the huge 2018 lift. “Value shopping” was probably a factor in the small decrease in 2019. The 2020 pandemic probably hit this segment rather hard. We’ll see.

At Last – The “Ultimate” Pet Services Spending Consumer Unit consists of 2 people – a married couple, only. They are White, but not of Hispanic origin. At least one of them has an advanced College Degree. They are 45 to 54 years old and both of them work, in managerial positions. They’re doing well with an income over $200K. They live in a large suburb of a metropolitan area of over 2.5 million in the Western U.S. and are still paying off their mortgage.