2021 U.S. TOTAL PET SPENDING $99.98B…Up ↑$16.23B

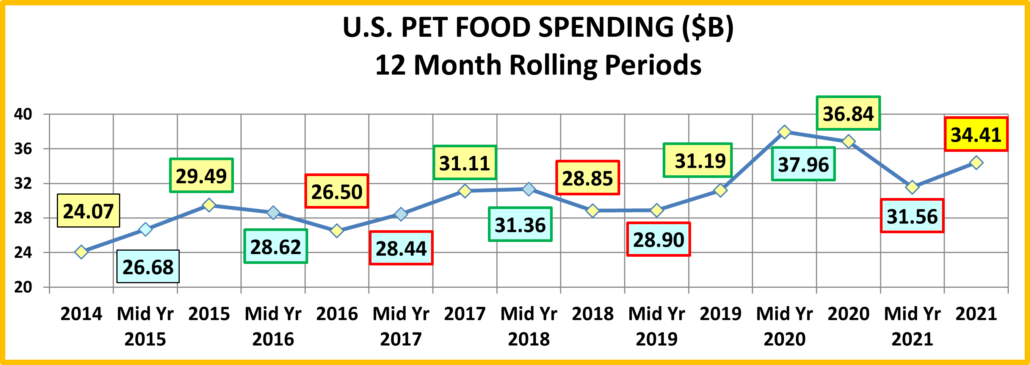

In 2021 Total Pet Spending in the U.S. was $99.98B, a $16.23B (19.4%) increase from 2020. Pet Food spending fell because there was no binge buying in 2021. However, spending in the other segments skyrocketed producing the industry’s biggest increase in history. Pet Parents began to use Pet Services again, got all of the Vet services that their “children” needed and bought all the supplies that they had been putting off during the pandemic.

- A $2.44B (-6.6%) decrease in Food

- A $8.65B (+57.0%) increase in Supplies

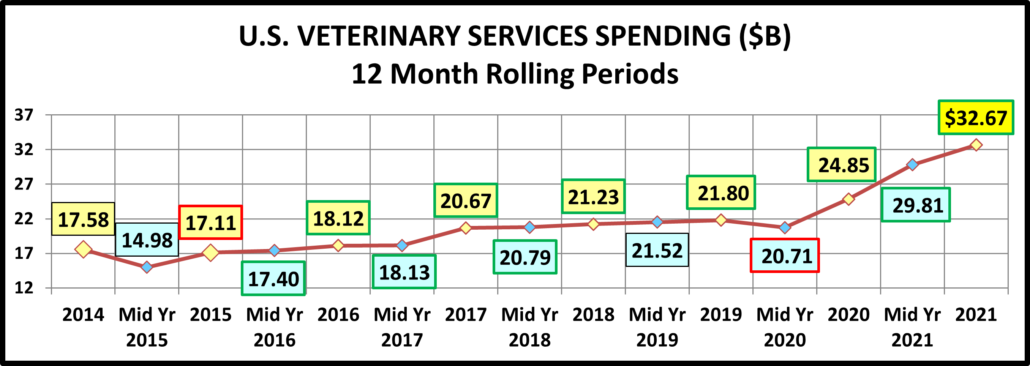

- A $7.82B (+31.5%) increase in Veterinary

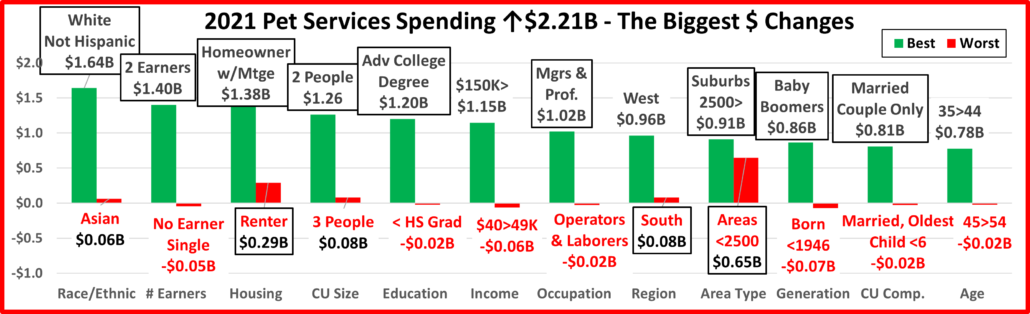

- A $2.21B (+32.0%) increase in Services

Let’s see how these numbers blend together at the household (CU) level. Weekly, 24.4 million CU’s (1/5) spent $ on their Pets – food, supplies, services, veterinary or any combination – up from 22.5M in 2020 but down from 27.1M in 2019.

In 2021, the average U.S. CU (pet & non-pet) spent a total of $748.93 on their Pets. This was a +17.4% increase from the $637.78 spent in 2020. However, this doesn’t “add up” to a 19.4% increase in Total Pet Spending. With additional data provided from the US BLS, here is what happened.

- 1.8% more CU’s

- Spent 9.5% more $

- 7.1% more often

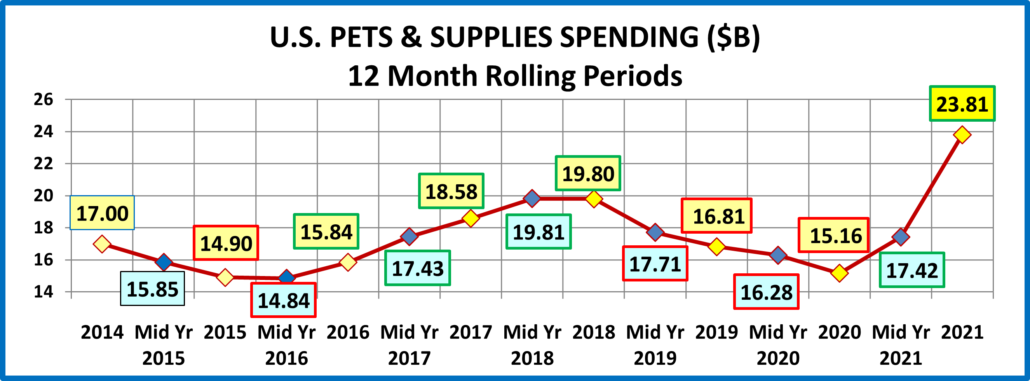

If 68% of U.S. CU’s are pet parents, then their annual CU Total Pet Spending was $1101.37. Now, let’s look at the recent history of Total Pet Spending. The rolling chart below provides a good overview. (Note: All numbers in this report come from or are calculated by using data from the US BLS Consumer Expenditure Surveys – The 2016>2021 Totals include Veterinary Numbers from the Interview survey, rather than the Diary survey due to high variation)

- We should note a 3-year pattern since 2010. 2 years of increases followed by a small decrease.

- In 2014-15, the Super Premium Food upgrade began, with the biggest lift coming in 2015.

- In 2016, they were intensely value shopping for super premium foods. They started spending some of this saved money on Supplies and Veterinary Services, but not quite enough as spending fell slightly for the year.

- In 2017, spending took off in all but Services, especially in the 2nd half. Consumers found more $ for their Pets.

- In 2018 a spectacular lift in Services overcame the FDA issue in Food, tariffs on Supplies and inflation in Veterinary.

- In 2019 a bounce back in Food and small lift in Veterinary couldn’t overcome the drop in Supplies from “tarifflation”.

- In 2020 consumers focused on necessities, Food & Veterinary (+$8.7B) while Services & Supplies suffered (-$3.4B).

- In 2021 there was no Food binge but in all other segments consumers made up for all the lost ground…and more!

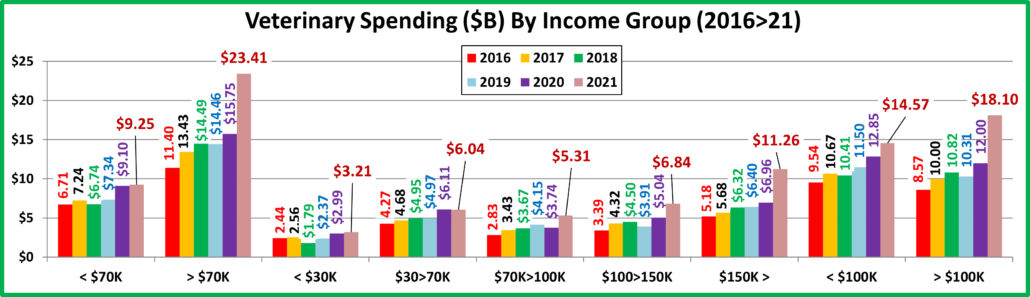

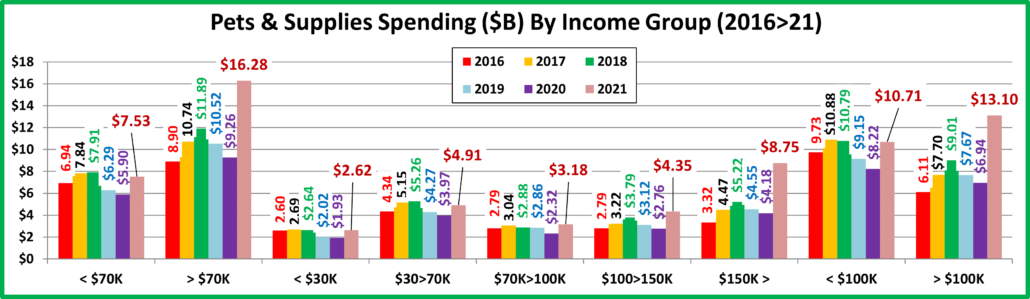

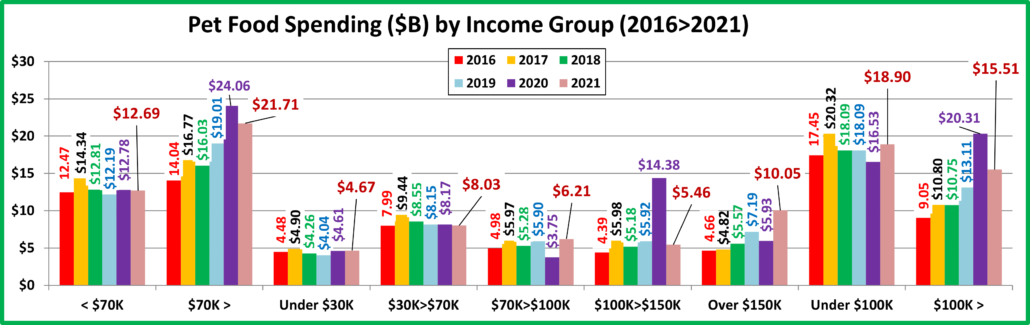

Now we’ll look at some Demographics. First, 2021 Total Pet Spending by Income Group

Only the $100>149K income group spent less, but $150K> accounted for 87% of the record $16.23B increase.

Nationally: · Total Pet: ↑$16.23B · Food: ↓$2.44B · Supplies: ↑$8.65B · Services: ↑$2.21B · Veterinary: ↑$7.82B

- < $70K – (55.2% of U.S. CUs); CU Pet Spending: $430.09, +6.3%; Total $: $31.77B, ↑$1.86B (+6.2%) ..

- Food ↓$0.09B

- Supplies ↑$1.63B

- Services ↑$0.17B

- Veterinary ↑$0.15B

- Money matters a lot to this group. In the pandemic they focused on Pet needs, especially Veterinary. In 2021 they spent less on food but more in all other segments, especially Supplies and they beat their previous $ high in 2017.

- >$70K – (44.8% of U.S. CUs); CU Pet Spending: $1143.31, +22.0%; Total $: $68.21B, ↑$14.37B (+26.7%) from…

- Food ↓$2.35B

- Supplies ↑$7.02B

- Services ↑$2.04B

- Veterinary ↑$7.67B

- This group continues to grow, up 4.9% in 2021. They accounted for 88.5% of the spending increase. However, it is more complicated. The $70>99K & $150K> groups had big increases, including lifts in all segments. The $100>149K had a big drop in Food because they binge bought in 2020 which turned their Total Spending down.

- < $30K – (25.5% of U.S. CUs); CU Pet Spending: $335.90, +7.0%; Total $: $11.26B, ↑$1.07B (+10.5%) from…

- Food ↑$0.05B

- Supplies ↑$0.69B

- Services ↑$0.11B

- Veterinary ↑$0.21B

- This lowest income group has had relatively stable spending in recent years but they remain committed to their pets. They spent more in all segments, especially Supplies & Veterinary, and beat their previous $ record in 2017.

- $30>$70K – (29.7% of CUs); CU Pet Spending: $509.14, +6.7%; Total $: $20.51B, ↑$0.79B (+4.0%) from…

- Food ↓$0.14B

- Supplies ↑$0.94B

- Services ↑$0.06B

- Veterinary ↓$0.07B

- Due to a big lift in Supplies they managed to eke out a small increase. The small drop in Veterinary spending comes after a 23% increase in 2020. By the way, they too set a $ record, barely – $20.51B over $20.46B.

- $70>$99K – (14.8% of CUs); CU Pet Spending: $794.91, +43.8%; Tot $: $15.74B, ↑$5.10B (+48.0%) from…

- Food ↑$2.45B

- Supplies ↑$0.86B

- Services ↑$0.22B

- Veterinary ↑$1.57B

- 2020 had double digit % drops in every segment. In 2021, all were up 26+%. A big turnaround for middle income.

- $100K>$149K– (14.2% of CUs); CU Pet Spend: $977.96, -21.1%; Tot $: $18.50B, ↓$4.87B (-20.8%) from…

- Food ↓$8.92B

- Supplies ↑$1.59B

- Services ↑$0.67B

- Veterinary ↑$1.80B

- They were the group leader in 2015 & 2017. In 2016, they were the worst performers. In 2018/2019 their Total $ were stable. In 2020 they drove most of the Food binge buying. In 2021 they had strong lifts in Supplies, Services & Veterinary but a huge drop in Food turned Total $ down. They are reactive and have the money to take action.

- $150K> – (15.8% of CUs); CU Pet Spending: $1621.19, +56.0%; Total $: $33.98B, ↑$14.14B (+71.3%) from…

- Food ↑$4.12B

- Supplies ↑$4.57B

- Services ↑$1.15B

- Veterinary ↑$4.30

- In 2020, the $150>199K group drove the overall spending in the highest income group down for the 1st time in my records going back to 2013. In 2021 they were spectacular. Both the $150>200K & $200K> groups had double digit increases in all segments and they generated 87% of the Total Industry Increase. This demonstrates the growing importance of higher income CUs to the Pet Industry. FYI – The $200K> group has 8.6% of CUs but generates 20.6% of all Pet $ and their 2021 increase was $9.0B, 55.5% of the $16.23B record lift.

- < $100K – (70.0% of CUs); CU Pet Spending: $507.21, +16.5%; Total $: $47.50B, ↑$6.96B (+17.2%)…

- Food ↑$2.36B

- Supplies ↑$2.49B

- Services ↑$0.39

- Veterinary ↑$1.72

- A spending sandwich, heavily loaded on the top. <30K: +$1.07B; $30>49K: -$1.90B; $50>99K: +$7.79B

- >$100K – (30.0% of CUs); CU Pet Spending: $1316.02, +16.7%; Total $: $52.48, ↑$9.27B (+21.5%) from…

- Food ↓$4.80B

- Supplies ↑$6.16B

- Services ↑$1.82B

- Veterinary ↑$6.10B

- We added the over/under $100K measurement last year because $100K> exceeded 50% of the $ for the 1st time. Their lead is growing. However, you see that the big Food $ drop by $100>149K still had a major impact.

Income Recap – The top 2 drivers in consumer spending behavior are value (quality + price) and convenience. That makes income , especially disposable income very important in Pet Spending. We also often see motivation brought by new product development. In 2020 we saw the results from perhaps the biggest human motivator – fear. This was the driver in the pandemic binge buying of pet food. The key results were the big drop from $70>99K and the huge lift from $100>149K. This helped drive the 50/50 $ divide up to $103K, a huge change from $94K in 2019. 2021 brought a record lift and record spending in all segments but Food. This increase was driven by the highest income groups, over $150K. The 50/50 spending divide moved up to $107K as CU income continues to grow in importance in Total Pet Spending.

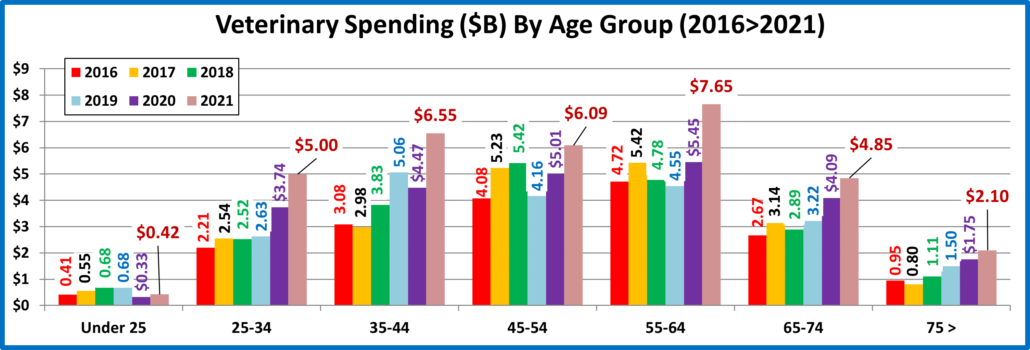

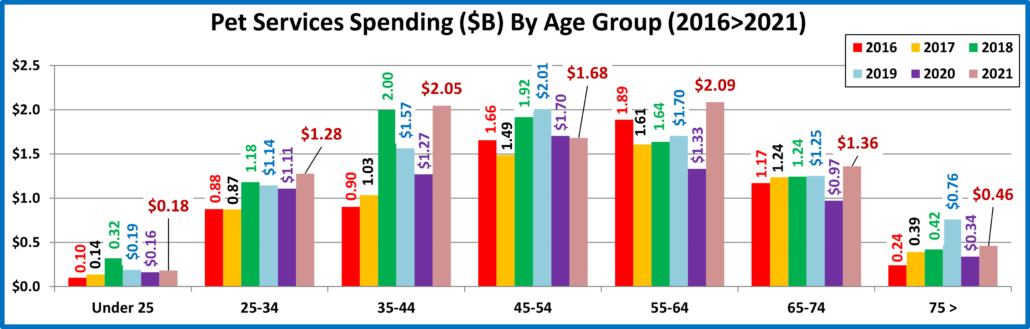

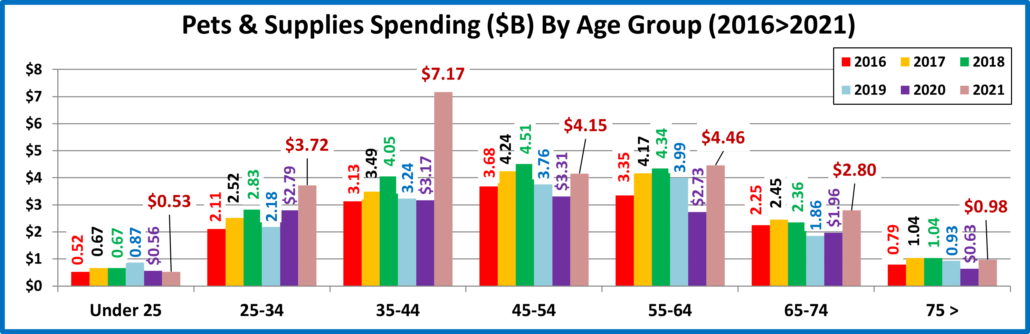

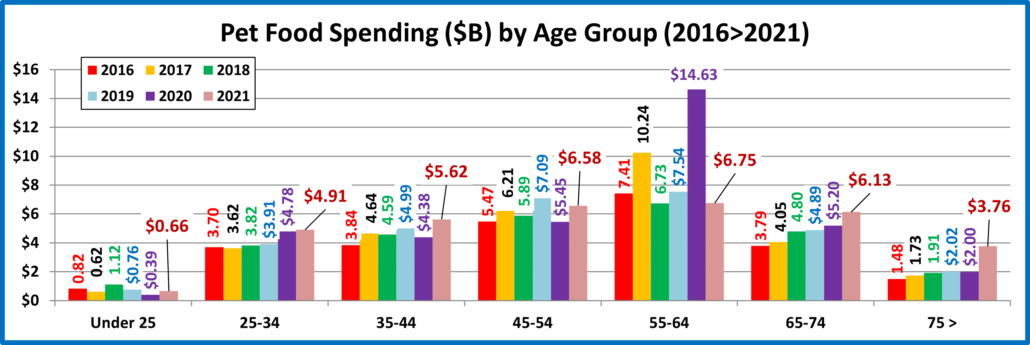

Next let’s look at 2021 Total Pet Spending by Age Group

Only the 55>64 year-olds spent less. Everyone else spent more.

Nationally: · Total Pet: ↑$16.23B · Food: ↓$2.44B · Supplies: ↑$8.65B · Services: ↑$2.21B · Veterinary: ↑$7.82B

- <25 – (4.9% of U.S. CUs); CU Pet Spending: $269.75, -4.7%; Total $: $1.79B, ↑$0.35B (+24.2%) from…

- Food ↑$0.27B

- Supplies ↓$0.03B

- Services ↑$0.02B

- Veterinary ↑$0.09B

- The increase came from a 31% gain in CUs as a huge number moved out of their parents’ home.

- 25-34 – (15.7% of U.S. CUs); CU Pet Spending: $701.04, +19.5%; Total $: $14.90B, ↑$2.48B (+20.0%) from…

- Food ↑$0.12B

- Supplies ↑$0.93B

- Services ↑$0.17B

- Veterinary ↑$1.26B

- These Millennials have often led the way in new food trends. In 2020 they stepped up in the pandemic and the lift continued into 2021, with spending increases in all segments & 20% overall.

- 35-44 – (17.2% of CUs); CU Pet Spending: $937.83, +57.7%; Total $: $21.39B, ↑$8.10B (+60.9%) from…

- Food ↑$1.24B

- Supplies ↑$4.00B

- Services ↑$0.78B

- Veterinary ↑$2.08B

- They have the largest families and are building their careers, so they are very sensitive to and cautionary in times of change. In 2020, they had double digit % decreases in all but Supplies. In the 2021 recovery they spent more in all segments, had the biggest increase of any age group and moved to the top in Total Pet CU $pending.

- 45-54 – (16.7% of U.S. CUs); CU Pet Spending: $828.19, +19.9%; Total $: $18.51B, ↑$3.03B (+19.6%) from…

- Food ↑$1.12B

- Supplies ↑$0.85B

- Services ↓$0.02B

- Veterinary ↑$1.08B

- This group has the highest income and occupied the top spot in Pet Spending in 2018. In 2019 & 2020 their spending and rank fell. In 2021, except for a minor decrease in Services $ due to fewer CUs, they spent substantially more on their pets. They fell to 3rd place in Total Pet spending but at a record level.

- 55-64 – (18.5% of U.S. CUs); CU Pet Spending: $849.56, -11.7%; Total $: $20.95B, ↓$3.20B (-13.3%) from…

- Food ↓$7.89B

- Supplies ↑$1.73B

- Services ↑$0.75B

- Veterinary ↑$2.20B

- 90% are still younger Baby Boomers and they are especially reactive. They were the primary drivers behind the 2020 binge spending on Pet Food. In 2021 they turned their attention to the other segments with a $4.7B increase in spending. However, it didn’t make up for the $7.9B drop in Food $.

- 65-74 – (16.1% of U.S. CUs); CU Pet Spending: $711.22, +20.1%; Total $: $15.14B, ↑$2.91B (+23.8%) from…

- Food ↑$0.93B

- Supplies ↑$0.83B

- Services ↑$0.39B

- Veterinary ↑$0.75B

- This group is growing, +5.1% and are all Baby Boomers. They are careful with their money, but their commitment to their pets is very apparent. They spent more in all segments in 2021 and are the only other age group besides the 25>34 yr-olds to spend more in both 2020 and 2021.

- 75> – (10.9% of U.S. CUs); CU Pet Spending: $504.45, +54.7%; Total $: $7.30B, ↑$2.57B (+54.4%) from…

- Food ↑$1.76B

- Supplies ↑$0.34B

- Services ↑$0.12B

- Veterinar ↑$0.34B

- Pet Parenting is more difficult, and money is tight for these oldest Pet Parents, but their commitment is still there. They had a 10% decrease in 2020 due to drops in Supplies & Services. In 2021 they came back strong with increases in all segments and the 2nd highest % increase of any age group.

Age Group Recap: In 2020 the age spending pattern in Total Pet matched Pet Food. It was generational, Boomers and Millennials spent more. Everyone else spent less. In 2021 it was radically different. Except for the 55>64 group’s big drop in Food and 2 other decreases of $0.03B or less, every age group spent more in every segment. Almost a universal lift.

Next, we’ll take a look at some other key demographic “movers” in 2021 Total Pet Spending. The segments that are outlined in black “flipped” from 1st to last or vice versa from 2020. The red outline stayed the same.

In 2021, 80 of 96 Demographic Segments (83%) spent more on their Pets. In 2020 only 46 segments (48%) spent more. That’s a huge improvement. However, it came with a lot of turmoil. 16 of the 24 segments (2/3) flipped from 1st to last or vice versa from 2020. Last year only 6 flipped. 10 of the 16 flipped to the bottom. Invariably, they binge bought pet food in 2020 and “paid for it” in 2021. Only 1 segment held its position. White, Not Hispanic stayed on top. This is not unexpected. They are perennial winners. You also see huge increases. 7 are over $10B. Despite the big drops in Pet Food $ by the losers, 9 of the drops are far smaller than the increases. There are 2 exceptions – Married, Oldest child over 18 and Self-Employed. Both binge bought Pet Food in 2020 but their 2021 increases in the discretionary segments were small. We should also note that in the # of Earners category, all segments spent more. In 2020, all Racial/Ethnic groups spent more. Let’s look at some specifics.

9 of the winners are the usual “suspects” with the only surprises being Retirees and No Earner, 2+ CUs. 35>44 is not usual, but they do have the 2nd highest income in the Age Category. In fact, 8 winners rank 1st or 2nd in income in their category, which is more evidence of the growing importance of income in Total Pet Spending.

10 of the 12 “losers” in 2021 had at least a $7B increase in Pet Food spending in 2020 and flipped from 1st to last in 2021. African Americans also spent 48% more on Pet Food in 2020 and gave it all back in 2021 but their Pet Spending is so small that it is often overlooked. In the # of Earners category, the only 2020 Food Binge Buying came from 2 Earner CUs. All segments obviously did well in 2021 with at least a $1.1B increase. By the way African Americans and 1 Earner Singles both have CU incomes at least 30% below the National Average.

Recap: After a slight downturn in 2019, Pet Spending turned up in 2020. There is no doubt that the onset of the COVID-19 pandemic was the major factor in the turnaround. It produced mixed results among the industry segments. Services took a big negative hit due to restrictions and closures in nonessential outlets. Consumers, including Pet Parents, focused their attention and spending on the most needed Products and Services. In the Pet Industry this resulted in a 10% drop in Supplies $ but strong lifts in spending for Veterinary Services and especially Pet Food. The Pet Food $ were even stronger because Pet Parents feared possible shortages like what happened to many other essential products. This caused some very select demographics to binge buy an extra $6.77B in the 1st half of 2020. That brought us to 2021 which became the strongest year in history. 2020 Food Binge buying didn’t increase the usage rate and obviously wasn’t repeated in 2021. However, Pet Parents spent a lot of time with their Pet “Children” during the pandemic. This caused them to have an even better understanding of what was needed to better improve the lives of their pets and strengthen the human animal bond between them. In 2021 virtually all Pet Parents decided to fill those wants and needs. The result was a record increase in Total Pet and in all segments but food which also produced annual spending records. Although 83% of all segments spent more, the higher their income, the more they spent.