U.S. Retail Trade – 2019 $ales Update by Channel – Internet/Mail Order Wins Gold!

The Total U.S. Retail Market in 2019 reached $6.2 Trillion dollars – up $214B (+3.6%). This is less than last year’s (+4.9%). For this report, we will focus on the “Relevant Retail” Total – removing Restaurants, Auto and Gas Stations from the data. This segment totals $3.7 Trillion. Driven by the Internet/Mail Order Segment, Non-Store Retailers moved to the top of the chart. 2019 will forever be seen as a major waypoint in the U.S. Retail Marketplace.

How are specific Retail Channels performing? We’ll start with a market overview and then work our way down.

(Base Data is from the U.S. Census Bureau Retail Trade Report)

Remember: This data is very relevant to the Pet Industry. According to the last Economic Census:

- Retailers other than Pet Stores generated 66.9% of all the Pet Products revenue in the U.S.

- Pet Products, on average, generated 1.94% of the total revenue of all non-pet stores that chose to stock them.

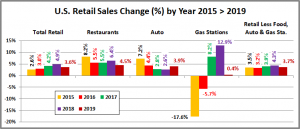

- Restaurants (Food Service) – 12.4% of Total Retail – Up $33B, +4.5%, down significantly from last year’s (+6.4%).

- Automobile Sales – 20.1% of the Total – Revenue grew $48B, +3.9%. A turnaround from recent slowing growth.

- Gas Stations – 8.2% of the Total – Up $2B, +0.4% from 2018. In 2019 Gas prices stabilized and growth flattened out after 2 years of strong inflation had driven sales up.

- Retail, Less Food, Auto and Gas – Up $132B, +3.7% to $3.7 Trillion, down from last year’s +4.3%, but this segment did outperform the total market for the first time since 2016. This segment is 59.3% of the Total U.S. Retail market.

To put this year into perspective, let’s look at the overall performance over the last 5 years.

The growth rate of the U.S. retail market increased each year until 2019. Each segment contributes but has a different pattern. Restaurants have the highest overall growth rate, but it has generally slowed since 2015, especially in 2019. The Automobile segment rate also peaked in 2015 and slowed every year until 2019, when they were the only segment to beat their 2018 rate. Gas Stations are the smallest segment but also the most volatile. Double digit deflation drove sales down in 2015-2016. Then double digit inflation drove sales up in 2017-2018. In 2019 prices stabilized and so did sales. Our “Relevant Retail” Segment has been the most consistent, at or near 4% growth each year. The growth rate fell in 2019 but it exceeded the growth rate of the total market for the first time since 2016. The 2019 Relevant Retail growth rate will serve as a benchmark as we review the performance of the individual channels. Above 3.7%, a channel is gaining market share. Below 3.7%, they are losing ground.

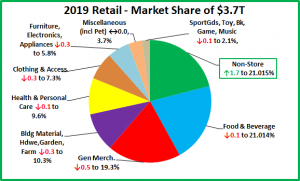

Now, we’ll slice up the U.S. “Relevant Retail” Channel “Pie”

These are large slices of the U.S. Relevant Retail pie. If you look closely you will see a troubling situation. 1 division maintained its share but 7 lost ground. Only 1 division, Non-Store retailers increased their share of the total retail market…a lot. They moved up from 3rd to 1st, edging out Food & Beverage by 0.001% ($28B) – a virtual tie for #1. Three divisions – General Merchandise Stores, Food and Beverage and Non-Store account for 61.3% of the total. This is up slightly from 60.2% in 2018. The increase is all due to Non-Store Retailers as the other two segments continue to lose market share. All three are very important to the Pet Industry. Based upon the last U.S. Economic Census, these three major divisions produced 59.7% of total Pet Products sales. Consumers spend a lot of money in Pet Specialty Stores – 33.1% of their Pet Products $. However, they spend over 80% more in these 3 major retail channels. Pet products are “on the list” wherever the consumer shops.

Because they are so huge, major Divisions of the market generally don’t show much movement in market share in just one year so the changes in Non-Store, General Merchandise, Furniture/Electronics, Clothing and Bldg Materials are very significant. Each of the major divisions includes a number of sub segments. For example, General Merchandise includes Traditional Department Stores, Discount Department Stores, Supercenters and Clubs as well as $ and Value Stores. These specific retail channels can have even greater movement in share because this is the level that the consumer “views” when making their initial shopping choice. Change at this level is where any ongoing consumer shopping migration first becomes apparent.

Here is the Market Share change “Rule” for 2019: To gain 0.1% in Market Share your $ increase must exceed the amount generated by a 3.7% sales increase PLUS an additional $3.7B. Example: If a channel did $100B in 2018, they need to do $100 +$3.7 + $3.7 = $107.4B to gain just 0.1% in 2019 share. You will see channels with revenue increases that still lose share because their increase was less than 3.7%. It shows that even small changes in share are significant.

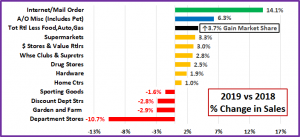

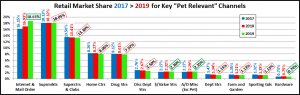

With that overview, we’re ready to drill deeper into the data. Let’s look at the 2019 performance of some of the specifically “Pet Relevant” Channels to see which are doing the best…and worst in gaining consumer spending. Eleven of the twelve were chosen because they generated at least 1% of the Total Pet Products (food & supplies) spending in the last Economic Census – 2012. I have also included Traditional Department stores on the list. Even though they have never truly embraced Pet Products, they have long been a fixture in the U.S. Retail Marketplace. Their continued decline, as consumers migrate to outlets which better fit their needs, has profoundly affected U.S. retail shopping as generally they were the “anchor” stores for the Shopping Malls across America.

We will use 2 graphs to illustrate the situation in these Pet Relevant Channels. The first will show the % change in sales in 2019 vs 2018. The next will “show us the money” – $ gained or lost. Then we will have observations on each segment.

Remember, you must be up at least 3.7% or you’re losing market share!

8 of these pet relevant channels are showing increased sales. However, in market share, only 2 are gaining, while 10 are losing. It is no surprise that internet/mail order is the breakaway winner. However, in addition to moving online, the other trend that is apparent is that consumers are also shopping more frequently at retail specialty stores, like Pet. In the next chart, we’ll “show you the money!” Remember, the Total increase for the “Relevant Retail” Market was $132B and you must be up 3.7% PLUS $3.7B just to gain just 0.1% in Market Share.

The spectacular growth of the Internet is obvious and becoming more dominant as the $ increase in this segment was more than double the combined increase of Supermarkets, SuperCenters/Clubs and Home Centers. The increase by $ Stores slowed in 2019 but their continued growth is evidence that consumers want value plus the convenience offered by these smaller outlets. The A/O Miscellaneous segment continues to maintain and gain as consumers desire more personalized service in certain categories – like Pet Products. One bit of information is concerning. Farm stores declined in sales for the second consecutive year. They are a small retail channel, but a key outlet for Pet Products.

OBSERVATIONS BY CHANNEL (Note: % of Total Business from Pet Products for stores that stock Pet)

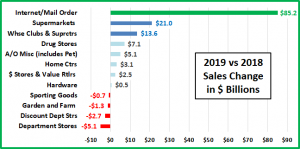

- Internet/Mail Order – $688.9B, Up $85.2B (+14.1%) – 64.7% of the total increase for the $3.7T Relevant Retail Market came from Internet/Mail Order. In fact, they generated 39.8% of the increase in the Total U.S. Marketplace. The Consumer Migration to this channel continues and is even accelerating as they gained +1.7% in Market Share. In 2016 they passed SuperCtrs/Clubs in sales and this year they edged out Supermarkets for the top segment spot in the entire market. Note: Sales on TV are also included in this group. (1.2% Pet)

- Super Markets – $667.4B, Up $21.0B (+3.3%) Despite increasing sales, this large sub-segment continues to lose ground. Sales are up $80B since 2015 but Market Share is down 0.41%. The Internet/Mail order channel has increased focus on grocery products and became the leading retail channel in 2019. (1.6% Pet)

- Department Stores – $42.6B, Down $5.1B (-10.7%). Their decline continues. 50 years ago, they “ruled” the GM category. However, they failed to adapt to the changing wants and needs of the consumer. One small example of this is their failure to address America’s growing relationship with our companion animals. (N/A Pet)

- Discount Department Stores – $92.5B, Down $2.7B (-2.8%). The rise of this segment started the downhill slide of Department Stores but their tenure at the top of GM was relatively brief as the SuperCtrs/Clubs offered true 1 stop shopping. Now, they have to battle the Internet. After a small lift in 2018, sales turned down again. (2.3% Pet)

- SuperCenter/Club Stores – $491.9B, Up $13.6B, (+2.8%). These outlets, with their broad mixture of grocery and general merchandise…at great prices, quickly became a dominant force in the retail market – second only to Supermarkets in Market Share for many years. In 2016 they were passed by Internet/MO. Consumers still like them as their sales are still growing, but not enough. They continue to lose market share – Down 0.1% (2.4% Pet)

- $ & Value Stores – $85.2B, Up $2.5B, (+3.0%). – A Great Value and easy to shop – 2 of U.S. Consumers’ major “wants”. This segment has shown steady growth in recent years, but it slowed in 2019. (4.3% Pet)

- Drug Stores – $292.1B, Up $7.1B, (+2.5%). There still is a lot of turmoil in this segment. Intense competition has led to a large number of mergers and acquisitions, which have slowed growth. (0.3% Pet)

- Sporting Goods – $1.8B, Down -$0.7B, (-1.6%). A Minor player in Pet. The turmoil in the category caused by mergers, acquisitions and store closings has slowed but they continue to lose share. (N/A Pet)

- Home Centers – $298.2B, Up $3.1B, (+1.0%). These large, “project driven” outlets have never done a significant Pet Business. The top 2 retailers, Home Depot & Lowes are the drivers, but overall, they lost -0.2% in share. (0.6% Pet)

- Hardware – $27.3B, Up $0.5B, (+1.9%). Extensive weather damage in 2017 & 2018 had a huge impact on this channel, turning sales sharply upward. 2019 was a little calmer and sales plateaued. (2.6% Pet)

- Farm and Garden Stores – $42.0B, Down -$1.3B, (-2.9%). This segment has been growing in recent years in both overall sales and in Pet, but it was largely driven by Tractor Supply. However, like 2018, a strong increase by TSC in 2019 couldn’t overcome the decline in sales from other outlets. Market share is down 0.2% since 2017. (8.9% Pet)

- A/O Miscellaneous Stores $87.0B, Up $5.1B, (+6.3%). Florists, Pet Stores, Art Dealers…are typical of the segments bundled into this group. Pet Stores account for over 20% of the $ in this segment. These stores, whether chain or independent, tend to be small to medium in size. Their increase again exceeded the market so these stores, which focus on another consumer trend – a more personalized shopping experience, are “holding their own” against the large format retailers and the internet. +0.1% in share since 2015. (Pet Stores $ are 91% Pet Products)

The chart below puts the Market Share of each of these segments for 2019, 2018 & 2017 in a visual format so that it is easier to appreciate the relative sizes. Growth in share since 2017 is indicated by a green box, a decline is boxed in red.

Now we’ll wrap it up with a brief summary and a detailed chart for future reference.

SUMMARY

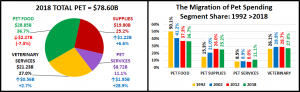

Pet Stores remain the #1 channel for Pet Products. However, in the Relevant Retail Market, there are 3 Olympic Medalists. SuperCenters & Clubs are firmly entrenched with the Bronze medal. Since 2016, the race for the Gold has been between SuperMarkets and the Internet/Mail Order Channel. In 2019, Internet/Mail Order gained 1.7% in share and took the Gold away from Supermarkets/Grocery for the first time… ever. Supermarkets and other channels are trying to fight back by creating and emphasizing online ordering programs. However, it appears to be too little, too late to stave off the internet juggernaut.

In 2019 the annual increase in the Relevant Retail market slowed to 3.7%, after 2 years of increasing rates. Although, like that last slow year, the increase in the “Relevant Retail” market was larger than the increase in the Total Retail Market. In 2019 Gasoline prices were again a major factor as they stabilized and flattened sales, which lowered the Total Retail increase. The Internet/Mail Order Channel provided the only excitement and 64.7% of the growth in Relevant Retail. SuperMarkets, SuperCenter/Clubs, Drug and Home Centers increased sales by $44.8B but all lost market share. Traditional & Discount Department stores continued their decline while sales growth in the easy to shop and save, $ Stores also slowed. Besides Internet/ Mail Order, only the small to medium A/O Miscellaneous Stores (Includes Pet) gained ground in the market by appealing to consumers desiring a more personalized shopping experience.

The U.S. Retail Market continues to grow and evolve as the consumer migrates to the channels which best fulfill their current wants and needs. This is not a new phenomenon. It has always been that way. In 2019, the “Channel of Choice” is Internet/Mail Order. Now, with the current health crisis and resulting retail shut down, the environment has radically changed. Internet/Mail Order will prosper but shopping in many Brick ‘n Mortar stores may be changed forever.

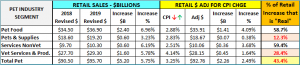

Finally, the Chart below contains Detailed 2017 > 2019 Sales Performance Data for over 30 U.S. Retail Channels.