2023 Pet Services Spending was $13.42B – Where did it come from…?

Next, we will look at Pet Services. It is still by far the smallest Segment, but like Supplies and Veterinary, it had a record increase in 2021. However, unlike them, there was no $ drop in 2022. The lift grew stronger, up $3.26 (+35.8%). After the great recession, Services’ annual spending slowly but steadily increased. During this time, the number of outlets offering Services strongly grew as brick ‘n mortar retailers looked for a way to combat the growing influence of online outlets. After all, you can buy products, but you can’t get your dog groomed on the Internet. This created a highly price competitive market for Pet Services. In 2017 there was a slight increase in visit frequency, but Pet Parents just paid less. This resulted in a 1.0% decrease in Services spending. In 2018 consumer behavior changed as a significant number decided to take advantage of the increased availability and convenience of Pet Services and spending literally took off, +$1.95B (+28.9%), the biggest increase in history. In 2019 Pet Parents, especially the younger ones, value shopped, and spending turned down $0.10B. In the 2020 pandemic Services outlets were often deemed nonessential and were subject to restrictions and closures which drove a huge drop in $. In 2021 things opened up and Services spending rebounded with 2 consecutive record lifts in 2021 & 2022. In 2023, the growth continued but it slowed, +$1.05B (+8.5%).

Services spending is the most discretionary, but its reach is expanding. Let’s look deeper into the demographics.

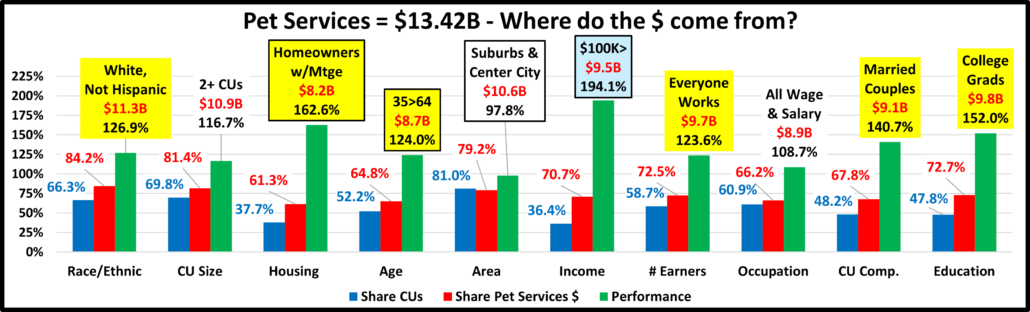

Let’s start by identifying the groups most responsible for the bulk of Services spending in 2023 and the $1.05B increase. The first chart details the biggest Pet Services spenders for each of 10 demographic categories. It shows their share of CU’s, share of Services spending and their spending performance (Share of spending/share of CU’s). In order to better target the bulk of the spending we had to alter the groups in 4 categories – income, area, age & housing. The performance level should also be noted as 7 of 10 groups have a performance level above 120%. This is 1 more than 2022 and the most for any segment. Supplies has 6. Veterinary and Total Pet have 5 but Food has only 3. This indicates that the disparity between the best and worst performing segments grew a little in 2023 and is still the highest of any segment. Income is still the biggest factor in Services Spending. The categories are presented in the order that reflects their share of Total Pet $ which highlights the differences of the 6 matching groups. For Services, the biggest share ranking differences from Total Pet are that the # of Earners and Education are more important in Services.

- Race/Ethnic – White, not Hispanic (84.2%) down from 84.9%. This big group accounts for most of the spending in all segments. Their performance grew from 126.3% to 126.9% but they dropped from 4th to 5th place in importance. Only Hiispanics spent less. Big lifts by the other groups caused the share drop but fewer CUs improved performance.

- # in CU – 2+ people (81.4%) up from 80.2% Their performance also increased from 116.0% to 116.7% but they stayed #8 in importance. All sizes spent more. The small lift in share and performance happened because 2+ CUs had a bigger % lift than 1 Person CUs.

- Housing – Homeowners w/Mtge (61.3%) up from 56.7%. Homeownership is a big factor in spending in all industry segments. This special group was created because those w/Mtge reached the 60% target. Their performance grew from 148.9% to 162.6% and they moved up from #5 to #2 in importance. Homeowners with and without a mortgage spent more. Renters spent -12.3% less.

- Age – 35>64 (64.8%) up from 60.0%. Their performance grew from 115.0% to 124.0%. They re-joined the 120+% club and moved up to #6 from #9 in importance. 25>34 & 65>74 spent less. This concentrated spending in the 35>64 group. Their $1.27B spending lift drove the increases in share & performance and put them in the 120% club.

- Area – City/Suburbs >2500 (79.2%) up from 77.8% in share, and performance grew from 96.2% to 97.8%. Again they didn’t earn their share of $pending. Services is an Urban Segment. All Areas spent more but the Suburbs had the biggest lift and drove Share and Performance up. The group’s performance is <100% due to Center City.

- Income – $100K> (70.7%) up from 64.2% This group’s performance rating is 194.1%, up from 193.6%. CU income is still by far the most important factor in increased Pet Services Spending. Only the $50>69K, $100>149K & $200K> income groups spent more. At +$1.16B, $200K> was the big driver in the share gain. The peformance increase was small because the number of CUs <$100K fell -4.5% while those $100K> increased by 10.2%.

- # Earners – “Everyone Works” (72.5%) up from (72.2%) All adults in the CU are employed. Income is important so a high market share is expected. Their performance dropped to 123.6% from 123.7% and they fell from #6 to #7 in importance. All CUs within the group spent more. Only No Earner, Singles spent less. The slight performance drop was due to an increase in CUs.

- Occupation– All Wage & Salary (66.2%) down from 70.3% and their performance rating fell from 116.5% to 108.7%. They dropped fro #7 to #9 in importance. Only Tech/Sales/Clerical and Service Workers spent less on Services in 2023. Managers & Professionals had the biggest $ increase, +$0.18B but it was only +3.3%. Retirees and A/O, Unemployed were +$0.76B. In fact, the Wage Group was only +$0.20B while those outside the group were +$0.85B. This caused the big drops in share and performance.

- CU Composition – Married Couples (67.8%) up from 63.6%. Married couples are a big share of $ and have 123+% performance in all segments. Their performance increased to 140.7% from 133.1% but they fell from #3 to #4 in importance in Services spending. Led by Couples Only (+$0.51B), all Married CUs spent more. They were +$1.24B (+15.7%) while Unmarried CUs were -$0.19B. This drove the big lifts in share & peformance.

- Education – College Grads (72.7%) up from 69.8%. Income generally increases with education so Services spending grows with increasing education. Performance grew from 149.3% to 152.0% but Education fell from #2 to #3 in importance. Only Assoc Degree spent less but the drop made <College -$0.07B. College Grads were +$1.12B, +13.0%

We changed 4 of the groups for Services – Income, Area, Housing & Age to better target the biggest spenders. We should also note that Income is still more important to spending in Services than in any other segment. In the Big Groups, only Occupation fell in both share and performance. Also, Services now has 7 groups performing at 120+%, up from 6 in 2022. Overall, in 2023 Services spending became less demographically balanced.

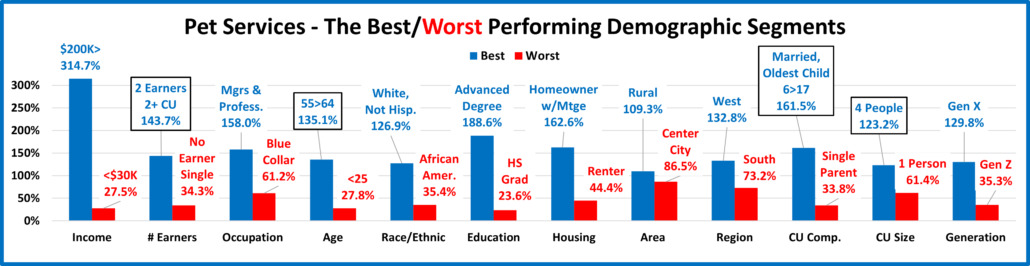

Now, we’ll look at 2023’s best and worst performing Pet Services spending segments in each category.

Except for CU Comp & Size, the best & worst performers are not a surprise. There are 4 that are different from 2022, all in the best group, 1 more than last year. CU Comp & Size show the move towards “family” CUs. Income is a big factor for almost all categories. Gen X is still on top, but spending shifted towards their oldest members, 55>64.(and young Boomers) The average difference between Best & Worst is 111.8%, the highest of any segment and up from 100.3% in 2022. Pet Services spending became less balanced in 2023. Changes from 2022 are “boxed”. We should note:

- Income is even more important to Pet Services. 314.7% is the highest performance by any group in any segment.

- # Earners – 2 Earners returned to the top but No Earner, Singles stayed on the bottom.

- Age – 55>64 is a mixture of the oldest Gen Xers & youngest Boomers. They have the 3rd highest income. All groups from 35>64 performed at 100+%. The lowest performers were at both ends of the age spectrum.

- CU Composition – Married, Oldest child 6>17, the 2021 winner, returned to the top while Single Parents remain firmly entrenched at the bottom.

- CU Size – The key is having 2 or more people in the CU. 4 People is the current leader but all 2+ CUs perform above 100%. 1 Person CUs Services’ performance is 61.4%.

- Generation – Gen X retained the Top Spot and Gen Z stayed at the bottom. Both Boomers and Millennials earned their share with 100+% performance. Born <1946 was next to last with 39.1%.

In Pet Services spending performance, income is still the major factor. Spending began skewing younger in 2018. They slipped a little in 2019, but they basically held their ground during the 2020 pandemic. In 2021, Boomers, Millennials and the younger Gen Xers got on board. In 2022 & 2023, spending skewed towards the older Gen Xers.

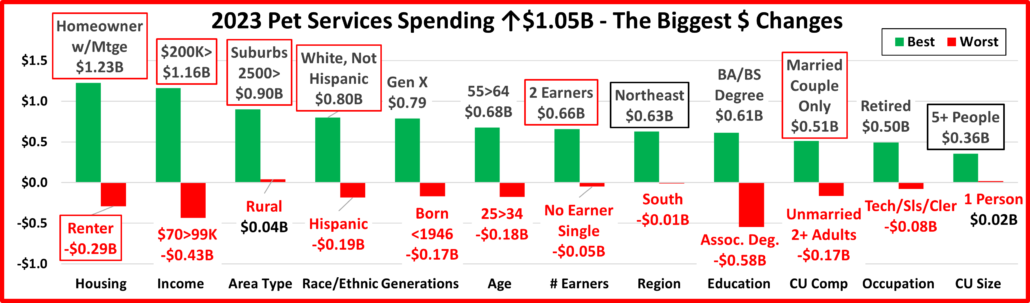

It’s time to “Show you the money”. Here are segments with the biggest $ changes in Pet Services Spending.

In this chart you immediately see the difference from last year. In 2023 you see a little less stability. There were 7 repeats. In 2022 there were 13. Also, 2 segments flipped from 1st to last or vice versa. In 2022 there were no flips. While 2021 & 2022 had record increases, the lift in 2023 was only $1.05B, +8.5% and less widespread. In 2 categories all segments spent more compared to 9 in 2022. Also, 75% of 96 demographic segments spent more, down from 93% in 2022. Another thing is definitely worse. The biggest drop was -$0.58B. In 2022 it was only -$0.12B.

Here are the specifics:

- Housing – Both winner and loser are the same as 2022.

- Winner – Homeowner w/Mtge – Services: $8.23B; Up $1.23B (+17.5%) 2022: Homeowner w/Mtge

- Loser – Renter – Services: $2.08B; Down $0.29B (-12.3%) 2022: Renter

- Comment – Homeowners w/o Mtges were up $0.12B, +4.0%.

- Income – $200K> won again but $70>99K replaced $30>39K at the bottom.

- Winner – $200K> – Pet Services Spending: $4.82B; Up $1.16B (+31.8%) 2022: $200K>

- Loser – $70 to $99K – Pet Services Spending: $1.24B; Down $0.43B (-25.8%) 2022: $30 to $39K

- Comment – Only $50>69K, $100>149K & $200K> spent more, but their lifts were substantial, totaling $1.95B. This more than made up for the total drop by the other groups, -$0.90B.

- Area Type – Suburbs 2500> stayed on top while Rural replaced Center City at the bottom.

- Winner – Suburbs 2500> – Pet Services Spending: $6.62B; Up $0.90B (+15.7%) 2022: Suburbs 2500>

- Loser – Rural – Pet Services Spending: $2.79B; Up $0.04B (+1.5%) 2022: Center City

- Comment – Center City was +2.9% & Rural was +1.5%. All spent more but the Suburbs drove the lift.

- Race/Ethnic – White, Not Hispanic stayed on top while Hispanics replaced Asians at the bottom.

- Winner – White, Not Hispanic – Services: $11.30B; Up $0.80B (+7.6%) 2022: White, Not Hispanic

- Loser – Hispanic – Services: $0.92B; Down $0.19B (-16.8%) 2022: Asian

- Comment– Asian were +$0.29B & African Americans were + $0.15B so Minorities were up $0.26B, +13.7%.

- Generation – Gen X replaced Boomers on top and Born <1946 replaced Gen Z at the bottom.

- Winner – Gen X – Services: $4.78B; Up $0.79B (+19.8%) 2022: Baby Boomers

- Loser – Born <1946 – Services: $0.44B; Down $0.17B (-28.0%) 2022: Gen Z

- Comment – In 2022, all generations spent more. In 2023, only Born <1946 spent less. Millennials finished in second place with a $0.29B, +8.7% increase.

- Age – Both winner and loser are new.

- Winner – 55>64 yrs – Pet Services Spending: $3.22B; Up $0.68B (+26.5%) 2022: 65>74 yrs

- Loser – 25>34 yrs – Pet Services Spending: $1.65B; Down $0.18B (-9.6%) 2022: <25 yrs

- Comment: In 2022 only the <25 group spent less. In 2023, 25>34 & 65>74 had drops. The lift continues to skew a little older, up to 64 but it was actually pretty balanced between the 3 groups from 35>64. They dominate Services spending, 64.7% of the total. Their 22>23 lift was +$1.27B. That’s 121% of the $1.05B lift in Services.

- # Earners– 2 Earners held their spot at the top while No Earner, Singles replaced No Earner, 2+ CUs at the bottom.

- Winner – 2 Earners – Pet Services Spending: $6.15B; Up $0.66B (+12.0%) 2022: 2 Earners

- Loser – No Earner, Single – Pet Services Spending: $0.60B; Down $0.05B (-7.7%) 2022: No Earner, 2+ CU

- Comment – Only No Earner, Singles spent less, but the biggest % lift was from No Earner, 2+ CUs, +26.9%

- Region – Northeast flipped from last to 1st and the South replaced them at the bottom.

- Winner – Northeast – Pet Services Spending: $2.53B; Up $0.63B (+33.0%) 2022: Midwest

- Loser – South – Pet Services Spending: $3.87B; Down $0.01B (-0.3%) 2022: Northeast

- Comment – In 2021 & 2022, all spent more. In 2023 only the South spent less, and it was a minuscule drop.

- Education – BA/BS replaced Adv. College Degree on top. Assoc Degree replaced HS Grads at the bottom.

- Winner – BA/BS Degree – Pet Services Spending: $4.47B; Up $0.61B (+15.9%) 2022: Adv. College Degree

- Loser – Associate’s Degree – Services Spending: $0.93B; Down $0.58B (-38.3%) 2022: HS Grads

- Comment – Associate’s degree had the only decrease. The drop was not unexpected as they more than doubled their spending in 2022, +116%. College Grads have 47.8% of CUs but generated 107.1% of the increase.

- CU Composition – Married, Couple Only stayed on top. Unmarried, 2+ Adults replaced Single Parents at the bottom.

- Winner – Married, Couple Only – Services: $4.31B; Up $0.51B (+13.5%) 2022: Married, Couple Only

- Loser – Unmarried, 2+ Adults – Services: $1.60B; Down $0.17B (-9.4%) 2022: Single Parents

- Comment – Single Parents also spent less. All Married CUs had double digit % increases. The biggest % lift was by Married, Oldest Child <6, +29.7%. In 2022, they were the only segment that spent less on Services.

- Occupation – Both winner and loser are new.

- Winner–– Retired – Pet Services Spending: $2.34B; Up $0.50B (+26.9%) 2022: Mgrs & Profess.

- Loser – Tech/Sales/Clerical – Pet Services Spending: $1.48B; Down $0.08B (-5.0%) 2022: Blue Collar

- Comment – Service Workers also spent a little less, -$0.02B. The biggest surprise was that All Other, Unemployed had the 2nd biggest $ lift and the highest % increase, +$0.26B (+45.9%).

- # in CU – 5+ People flipped from last to first and 1 person replaced them at the bottom.

- Winner – 5+ People – Pet Services Spending: $1.36B; Up $0.36B (+35.4%) 2022: 2 People

- Loser – 1 Person – Pet Services Spending: $2.49B; Up $0.02B (+0.7%) 2022: 5+ People

- Comment: All segments spent more. The biggest lifts were from CUs with 3 or more people.

We’ve seen the winners and losers in terms of change in Services Spending $ for 12 Demographic Categories. The growth slowed after 2 record lifts but was still widespread. Here’s some data which shows the evolution from 2019 to 2023. Services were hit hard by the pandemic but recovered stronger than ever with 2 record lifts. In 2023 the situation has become more “normal” but is markedly better than pre-pandemic 2019.

Total $: 2019: $8.62B 2020: $8.69B 2021: $9.10B 2022: $12.36B 2023: $13.42B

% Segmts ↑$: 2019: 49% 2020: 21% 2021: 90% 2022: 93% 2023: 75%

Avg Big ↑$: 2019: $0.25B 2020: $0.05B 2021: $1.10B 2022: $1.43B 2023: $0.73B

Avg Big ↓$: 2019: -$0.27B 2020: -$0.89B 2021: $0.07B 2022: $0.16B 2023: -$0.16B

We found the winners in performance and $, but there were others who performed well but didn’t win. They deserve…

HONORABLE MENTION

Services is the most driven by high income. The performance of the low-income segments in this group gives evidence that Service usage is becoming more widespread. < HS Grads more than doubled their spending. The $50>69K group was up 48.9%. Blue Collar Workers and No Earner, 2+ People CUs had lifts over 25%. The other 2 segments tell a different story. Asians have the highest income but lowest % of Pet ownership. That may be changing as they doubled their Services spending. Married, with an oldest child <6 also have a higher income, but their expenditures are high, 31% above average. This increases their financial pressure. Pet Services prices are high, but they are a great benefit, so more demographics are finding the $ to spend.

Summary

For years, Services’ spending slowly but steadily increased. However, the number of outlets offering Services was radically increasing. In 2017, this competitive pressure caused Pet Parents to shop for value and spending fell 1%. In 2018, the abundance of outlets and competitive prices finally had their intended impact. Many more consumers took advantage of the convenience of Pet Services and spending literally took off with a record increase to a new all-time spending high. In 2019 Consumers held their ground at the new higher level but we saw turmoil similar to 2017. Again, value shopping likely contributed to the small decrease.

In 2020, pandemic Services outlets were often deemed nonessential, so they were subject to restrictions and closures. Services are definitely needed by some groups. However, for most demographics, Services are a convenience, and spending is very discretionary in nature. The reduced availability and the pandemic driven focus on the “needed” segments – Food and Veterinary caused a 20% drop in Services $.

In 2021 the Retail Marketplace opened up again and many Pet Parents strongly returned to their previous Services mantra, “I need help with my Pet “children” and I have the money to pay for it!”. This behavior was widespread as 90% of all demographics spent more on Services, producing a record increase. In 2022 Services showed that it was different from other segments. All had record lifts related to the Pandemic followed by drops, except for Services. 2022 spending didn’t decrease, it grew even stronger, +$3.26B and more widespread as 93% of demographics increased spending. That brings us to 2023. Growth continued, but slowed considerably, +$1.05B (+8.5%). The lift was also less widespread as 75% of CUs spent more. That’s still very good. There was 1 definite negative in 2023. Services is the segment where spending is the most driven by income, so it has always had a big disparity between segments. This improved slightly in 2022 but definitely worsened in 2023. Performance differences are a key measurement of disparity. Let’s consider the performance of the big groups. There were 7 categories with a 120+% performing big group, up 1 from 2022, and now 1 more than Supplies (6), 2 more than Veterinary (5) and 4 more than Food (3). There is an even better measure of the worsening. In 2023, the average difference between best & worst performers was 111.8%. In 2022 it was only 100.3%.

Another key trend in 2023 was that 35>64 is still the dominant group, but spending continues to skew older.

Services were hit the hardest by the pandemic, but they had a record, widespread recovery in 2021>22. They are the segment most driven by high income so the high inflation in 2022>23 had less of an impact. It did affect the spending of some financially challenged groups, but in 2023, Services spending seems to have returned to a more normal pattern.

At Last – The “Ultimate” Pet Services Spending Consumer Unit consists of 4 people – a married couple with children. Their oldest child, still at home, is <18. They are 55>64 yrs-old and White, but not of Hispanic origin. They both work and at least one of them has an Advanced College Degree and is a Manager or Professional. They have an income of over $200K. They live in a small suburb in the Western U.S. and are still paying off their home mortgage.