2021 Veterinary Spending was $32.67B – Where did it come from…?

Now we will turn our attention to the final Industry Segment – Veterinary Services. For years, Veterinary Services prices have had high inflation. This has resulted in CU income becoming the most dominant factor in spending behavior and a reduction in visit frequency. Consumers paid more, just used Veterinary Services less often.

In 2017 low inflation spurred an unusual 7.2% increase in visit frequency and a $2.5B increase in spending. In 2018 inflation returned to more normal levels. Consumers spent $0.56B more (+2.7%), but inflation was 2.6% so virtually all of the lift was from increased prices. In 2019 the situation got worse. Consumers spent $0.58B (+2.7%) more but inflation was 4.14%. This means that there was an actual decrease in the amount of Veterinary Services purchased. In 2020 the pandemic hit, and Pet Parents focused on needs – Food & Veterinary. Veterinary spending grew $3.05B, (+14.0%). In 2021, this behavior grew even stronger and produced a record $7.82B (+31.5%) increase.

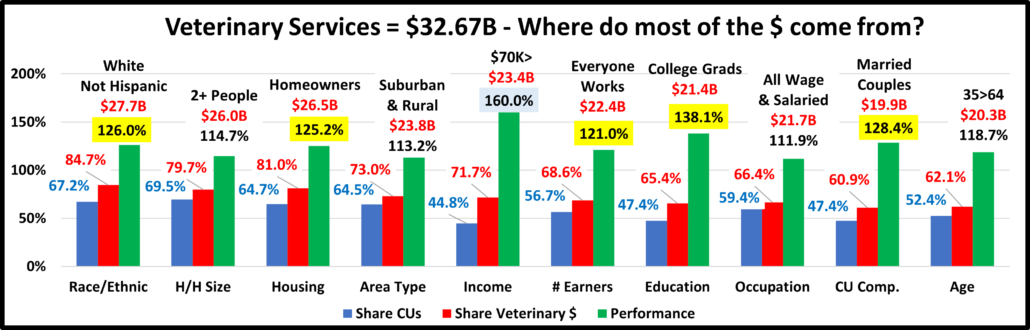

We’ll start our analysis with the groups who were responsible for the bulk of Veterinary spending in 2021 and the $7.82B increase. The first chart details the biggest pet Veterinary spenders for each of 10 demographic categories. It shows their share of CU’s, share of Veterinary spending and their spending performance (Share of spending/share of CU’s). In terms of performance – 6 of 10 groups perform above 120%, the same as 2018>2020. This is equal to Supplies and more than Food (5) but less than Services (7). This means that these big spenders are performing well but it also signals that there is still a large disparity between the best and worst performing demographics in this “needed” segment. The groups are the same as those for Total Pet and categories are listed in the order that reflects their share of Total Pet $pending. As with all Industry Segments, High Income is the most important factor in Spending.

- Race/Ethnic – White, not Hispanic (84.7%) down from 87.2%. This group accounts for the vast majority of spending in every segment, but they lost significant share in 2021. Their 126.0% performance is also down from 127.5% and they fell from 3rd to 4th in importance in Veterinary Spending but it still reflects the disparity in spending. Minorities did narrow the gap in 2021 primarily due to a $1.5B, 91% lift by Hispanics. However, all groups spent more.

- # in CU – 2+ people (79.7%) up from 77.9% This group, which is 69.5% of U.S. CUs, gained share and their performance grew from 111.0% to 114.7%. Their rank in terms of importance in Veterinary Spending stayed at #8. All sizes spent more. The biggest $ lift, +$3.43B, came from 2 person CUs. 4 people had the biggest % gain, +75.8%.

- Housing – Homeowners (81.0%) down from 83.1% Homeownership is a major factor in pet ownership and spending in all industry segments. In terms of importance to Veterinary spending, their 125.2% performance rating is down from 126.3%, and they fell from to 4th to 5th place. All segments increased spending by over $2B. This is impressive. However, the percentage increase for Renters was +47.7%, while Homeowners’ spending grew only 28.2%. This difference is what drove the drop in share and performance. We should note that Homeownership is not nearly as important to Veterinary Spending as it once was. In 2015 their share was 88.4% with performance of 141.8%.

- Area – Suburban & Rural (73.0%) up from 67.1% Suburban CU’s are the biggest spenders in every segment. All areas spent more but those <2500 had a great year, +53.9%. This drove the big increase in share and their performance grew substantially to 113.2%, from 106.4%.

- Income – Over $70K (71.7%) up from 63.4% Their performance also grew significantly from 145.8% to 160.0%. Higher income became even more important in increased Veterinary spending. Only the $30>49K group spent less. The <$30K group had a slight lift, +$0.2B (+7.2%) but the other groups, over $50K all had 40+% increases. $150K> led the way with a $4.3B (+61.8%) spending increase.

- # Earners – “Everyone Works” (68.6%) down from 69.7% However, their Performance grew from 120.3% to 121.0% and they stayed at #6. In this group, all adults in the CU are employed. All segments spent more. Their share fell but performance increased because of a big $ lift from No Earners combined with a drop in the number of Earner CUs.

- Education – College Grads (65.4%) up from 61.3%. Income generally increases with education. It is also important in understanding the need for regular Veterinary care. Performance also grew from 131.2% to 138.1% and they stayed 2nd in importance. Once again, all segments in the category spent more. However, College Grads spent $6.13B more. That means that 47.4% of all CUs generated 78.4% of the increase. The BA/BS group led the way with +$3.8B. BTW, Associate Degrees also spent $0.8B more, emphasizing the importance of formal, after HS education.

- Occupation – All Wage & Salaried (66.4%) down from 68.1% but their performance increased from 110.7% to 111.9% due to 1.4M fewer CUs. All segments spent more. They lost share but gained in performance because of fewer CUs and a strong year by Retirees and non wage/salaried workers. The top 3 lifts were certainly a mixed bag: Mgrs/Professionals, +$2.27B; Retirees, +$1.59B; Service Workers, +$1.55B.

- CU Composition – Married Couples (60.9%) up from 58.6% Their performance also grew to 128.4% from 120.8% and they moved up to #3 from #6 in importance. After 2 years, Married Couples market share returned to 60+% while their # of CUs fell by 1%. Only Single Parents spent less, -$0.1B. Married Couples with Children were +$2.57B but all Married Couple CUs with no children were +$2.75B. Singles & All Adult, Unmarried CUs were +$2.59B.

- Age – 35>64 (62.1%) up from 60.1% Their performance also grew from 112.7% to 118.7% but they stayed in 7th place. For the 8th time all groups spent more and all had double digit % increases. The 55>64 yr olds led the way, +$2.20B but 35>44 was a close second, +$2.08B. Both of these segments had increases of 40+%.

Spending disparity grew in 8 categories and higher income became even more important in Veterinary spending. The most notable change was that Married Couples again reached a 60% share and moved from 6th to 3rd in importance. There was also a strong showing by 35>44 (Mostly young Gen Xers) and 55>64 (Mostly young Boomers).

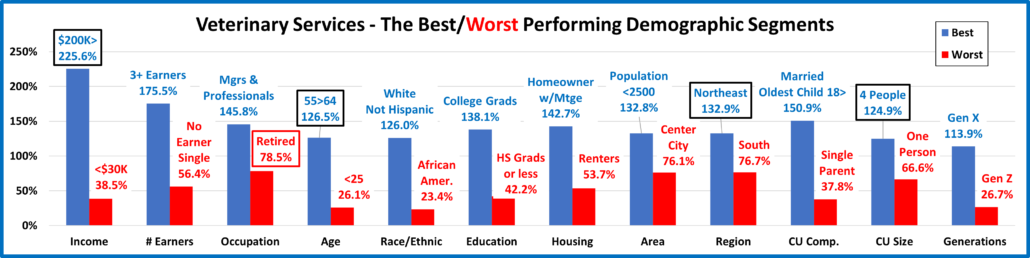

Now, we’ll look at 2021’s best and worst performing Veterinary spending segments in each category.

Almost all of the best and worst performers are those that we would expect and there are only 5 that are different from 2020. This is 1 more than Supplies but far fewer than the 10 in Services and the 15 in Food. This suggests considerably less spending turmoil. The changes from 2020 are “boxed”. We should note:

- Income– The winner is up from $150>199K. Winner & Loser are not surprises but the gap is 40% more than 2020.

- Earners – An expected repeat winner and loser. They have the highest and lowest incomes.

- Occupation – Retirees replaced Blue Collar at the bottom but once again, it’s all about income

- Age – The 55>64 yr-olds edged out 35>44 and replaced the highest income group, 45>54 yr-olds at the top. These 3 groups have the highest income and are the only segments performing above 100% in Veterinary Spending.

- Race/Ethnic; Education; Housing– The expected winners & losers but the performance gap grew for all but Renters.

- Area – Another set of repeats but the difference in performance (disparity) increased by over 35% from 2020.

- Region –Northeast replaced West at the top and has now won for 6 of the past 7 years. The South has finished last for 6 years in a row. The win/lose gap increased by 20%, but 2 regions performed at 100+% – the 1st time since 2019.

- CU Composition – No change here but again the performance gap widened, by 20%.

- # in CU – 4 Person CUs edged out 2 People for the win but now 2, 3 and 4 person CU’s all perform above 100%.

- Generation – No change again and the performance gap only widened by 4%.

It’s time to “Show you the money”. Here are segments with the biggest $ changes in Veterinary Spending.

We saw little turmoil in performance. That’s also true here. There were 8 repeats and 3 segments flipped from 1st to last or vice versa. Last year they had 4 repeats and 10 flips. There were no surprise losers and 1 surprise winner – Millennials. In fact, in 9 categories all segments spent more, up from 4 in 2020. You should note that like 2020, the increases were significantly larger than the decreases. Plus, 94% of 96 demographic segments spent more. Here are the specifics:

- Race/Ethnic – Both groups held their spots as White, non-Hispanics maintained their dominance in this segment.

- Winner – White, Not Hispanic – Veterinary: $27.65B; Up $5.98B (+27.6%) 2020: White, Not Hispanic

- Loser – African American – Veterinary: $1.00B; Up $0.13B (+14.9%) 2020: African Americans

- Comment– In 2019 only African Americans spent less. In 2020 & 2021 all spent more. This shows that Pet Parents commitment to the health & wellbeing of their Pet Children is widespread across all racial/ethnic groups.

- Area Type – Center City, last year’s surprise winner flipped from 1st to last and big Suburbs returned to the top.

- Winner – Suburbs 2500> – Veterinary Spending: $15.97B; Up $4.40B (+38.1%) 2020: Center City

- Loser – Center City – Veterinary Spending: $8.83B; Up $0.66B (+8.1%) 2020: Suburbs 2500>

- Comment – All groups also spent more. The Suburbs 2500> went from a 3% increase in 2020 to a 38%, $4.4B increase in 2021. However, the Areas <2500 had the biggest % increase, +56.1%, up $2.2B.

- Education – BA/BS Degree replaced Advanced College Degree at the top while <HS Grads stayed on the bottom.

- Winner – BA/BS Degree – Veterinary Spending: $11.62B; Up $3.79B (+48.4%) 2020: Adv. College Degree

- Loser – <High School Grads – Veterinary Spending: $0.37B; Up $0.03B (+8.3%) 2020: <HS Grads

- Comment – All Education levels spent more but the lift was very much skewed towards higher Education. College grads generated 78.4% of the lift but those with at least an Associate’s Degree were responsible for 88.9%.

- Housing – Homeowners w/Mtges held their usual position at the top.

- Winner – Homeowner w/Mtge – Veterinary: $17.56B; Up $3.49B (+24.8%) 2020: Homeowner w/Mtge

- Loser – Renter – Veterinary: $6.19B; Up $2.00B (+47.7%) 2020: Renter

- Comment – Every segment spent more and had an increase of at least $2B. You know that it was a great year when the “loser” spent 47.7% more.

- # in CU – 2 Person CUs held on to the top spot.

- Winner – 2 People – Veterinary Spending: $13.16B; Up $3.43B (+35.2%) 2020: 2 People

- Loser – 3 People – Veterinary Spending: $5.02B; Up $0.22B (+4.7%) 2020: 1 Person

- Comment: For the second consecutive year all groups spent more. 4 Person CUs went from a $0.04B (+1.5%) increase in 2020 to up $2.22 (+75.8%) in 2021.

- Region – The Northeast flipped from last to 1st. This is 4 consecutive years of flips for this Region.

- Winner – Northeast – Veterinary Spending: $7.52B; Up $3.42B (+83.5%) 2020: West

- Loser – Midwest – Veterinary Spending: $6.45B; Up $1.19B (+22.5%) 2020: Northeast

- Comment – All Regions had double digit percentage increases of at least $1.19B. The Midwest replaced the Northeast at the bottom and the South fell to 3rd place after 4 consecutive years at #2.

- Generation – No flips and the winner and loser were both new.

- Winner – Millennials – Veterinary: $9.23B; Up $3.18B (+52.5%) 2020: Baby Boomers

- Loser – Born <1946 – Veterinary: $1.83B; Down $0.19B (-9.2%) 2020: Gen Z

- Comments – In a bit of a surprise, Millennials replaced Boomers at the top. The oldest Generation had the only decrease as the Silent/Greatest replaced Gen Z at the bottom. In 2021, Millennials, younger Gen Xers and younger Boomers all had a strong year in Veterinary spending.

- # Earners – Both the winner and loser are new, but not surprising.

- Winner – 2 Earners – Veterinary Spending: $13.19B; Up $3.17B (+31.6%) 2020: 3+ Earners

- Loser – 1 Earner, Single – Veterinary Spending: $4.22B; Up $0.19B (+4.7%) 2020: No Earner, Single

- Comment – The winner and loser reflect their income levels. Income is of primary importance to increased Veterinary Spending & # of earners is tied to income. In 2021 all CUs, with or without earners, spent more. 1 Earner, Singles had the only single digit % increase.

- Income – Both the winner and loser are new.

- Winner – $200K> – Veterinary Spending: $6.32B; Up $2.58B (+69.0%) 2020: $100>149K

- Loser – $30>39K – Veterinary Spending: $1.24B; Down $0.61B (-33.1%) 2020: $70>99K

- Comment – Only the $30>39K group spent less. We got off last year’s spending rollercoaster as the size of the increase in Veterinary spending generally grew with income, peaking at $200K> in both $ and percentage.

- CU Composition – Married Couple Only held their spot at the top.

- Winner – Married, Couple Only – Veterinary: $9.31B; Up $2.28B (+32.4%) 2020: Married, Couple Only

- Loser – Single Parents – Veterinary: $0.61B; Down $0.09B (-12.6%) 2020: Married, Oldest Child <6

- Comment – After a 68% increase in 2020, Single Parents were the only group to spend less in 2021. Overall, Marriage became more important as 47.4% of CUs generated 60.9% of Veterinary $ and 68% of the increase.

- Occupation – The winner held on while the loser changed from White Collar to Blue Collar.

- Winner – Mgrs & Professionals – Veterinary Spending: $12.14B; Up $2.27B (+23.0%) 2020: Mgrs & Profess.

- Loser – Construction Workers – Veterinary Spending: $0.65B; Up $0.06B (+9.9%) 2020: Tech/Sales/Clerical

- Comment – Retirees finished in 2nd place, +$1.59B and not all Blue Collar workers had small increases. Service Workers were +$1.55B (+64.5%), the highest % increase of any segment.

- Age – A new winner and loser.

- Winner – 55>64 yrs – Veterinary Spending: $7.65B; Up $2.20B (+40.4%) 2020: 25>34 yrs

- Loser – <25 yrs – Veterinary Spending: $0.42B; Up $0.09B (+28.2%) 2020: 35>44 yrs

- Comment: Last year 2 groups spent less. In 2021 all segments increased Veterinary spending. 55>64 replaced 25>34 at the top while <25 replaced 35>44 on the bottom. This seemed to indicate that the $ were skewing a little older. In fact, the 25>55 age group generated 56% of the spending increase while 55 and over accounted for 42%. The younger groups are still strongly growing.

We’ve now seen the winners and losers in terms of increase/decrease in Veterinary Spending $ for 12 Demographic Categories. The 2020 pandemic brought strong growth in Veterinary spending which grew even stronger in 2021. However, the lift came with little turmoil as most segments held their spots in performance and there were no significant surprises in $ changes. The surprise was in just how widespread the spending lift was. In 2020, 4 categories, had no segments that spent less and 85% of all demographic segments spent more. In 2021 these increased to 9 categories and 94%. This means that there were even more “hidden” segments that didn’t win but made a significant contribution to the $7.82B increase. These groups don’t win an award, but they certainly deserve….

Honorable Mention

Racial/Ethnic spending became a little more balanced thanks to a 91% increase by Hispanics. Veterinary spending is driven by income but the lowest income group, No Earner, Singles had the biggest % increase. Low income Service Workers also had a huge, 64.5% lift. Although they are the 2nd highest income segment, they are rarely the winner. In 2020 their increase in Veterinary $ was only 1%. In 2021 they exploded with a $1.72B (53.5%) lift, but this was only good enough for 3rd place in the income category. The 35>44 yr-olds had a great year, finishing 1st a number of times in other industry segments. In Veterinary they had to settle for 2nd place behind the 55>64 yr-olds. They are a perennial 2nd place finisher. In 2021, even a $2.1B increase was not enough to move them up. It was also a strong year for all Homeowners.

Summary

2016 & 2017 produced a combined increase of $3.6B in Veterinary Spending as inflation moved to record low levels. In 2018 & 2019 a Baby Boomer Spending “Bust” impacted Food & Veterinary. Fortunately, Gen X and Millennials stepped up to produce a 2.7% increase in both years. In 2020 the pandemic focused Pet Parents on the needed segments. This drove a $3B increase in Veterinary $. Boomers & Millennials led the way, but the lift was widespread as 85% of demographic segments spent more. In 2021 the lift grew to a record $7.82B with 94% of all segments spending more.

There was also less turmoil in the segment, but spending became a little less balanced in most demographic categories. The size of the increases far exceeded the size of the decreases. However, in 9 categories all segments increased spending. Income and Education remain of primary importance in terms of increased spending.

Income: Performance generally increases with income and reaches its highest level, 225+% at $200K>. The “halfway” point (50%) in $ fell below $100K for the 1st time in 2020. It turned up sharply in 2021 to $113K. Spending is less balanced in most categories in 2021 due to income.

Higher Education: Performance increases with Education but now reaches 100% when you have an Associates degree. Those with a BA/BS or higher perform at 138%. The performance of those with no “formal” College Degree is 57%. The disparity is not quite as bad as Income but still big. Equality in both categories is a long way off.

The performance of other big spending groups is also very important in the Veterinary segment. We again identified six demographic categories with high performing large groups. There were 6 for Supplies, 7 for Services but only 5 for Food. Consumers have no control over Race/Ethnicity but in addition to Income and Education, Homeownership, # Earners & Marriage are also important factors in Veterinary spending. All groups but Marriage are tied to income and their high performance demonstrates that there are still big spending disparities among segments within these categories.

There was really only 1 change of note. Marriage returned to prominence moving up from 6th to 3rd in importance.

In 2019 Veterinary spending increased +2.7% while prices rose 4.14% – a net decrease in the amount of Services. In 2020 spending grew +14.0% while inflation was 3.7%. That’s over 10% in real growth, a very positive situation. In 2021 inflation rose to 4.9% but spending skyrocketed, +31.5%. That means 26.6% in “real” growth, 84% of the total record increase – truly spectacular. Although the lift was demographically widespread, Veterinary spending became a little less balanced. We’ll see if Pet Parents continue to spend heavily on Veterinary Services with the high inflation rates in 2022.

Finally – The “Ultimate” Veterinary Services Spending Consumer Unit consists of 4 people – a married couple with an oldest child over 18. They are 55>56 years old. They are White, but not of Hispanic origin. At least one of them has an Adv. College Degree and works as a Mgr/Professional. Their oldest child also works. Their total income is $200K>. They live in a small suburb, adjacent to a big city in the Northeast U.S. and are still paying off the mortgage on their home.