Tracking Pet Food Pricing – The PPI (Mfg) vs CPI (Retail)

Changes in the price manufacturers charge for a product obviously impact the retail price for consumers. However, it is not always a direct correlation and often there is a significant delay in the response. The retailers who sell high demand products like Pet Food are under intense competitive pressure.

In this brief report we will look at how changes in the Producer Price Index (PPI) for Pet Food match up to the changes in the retail CPI from December 2019 to 2022. Pre-pandemic December 2019 is used as the base number in all graphs to facilitate comparisons.

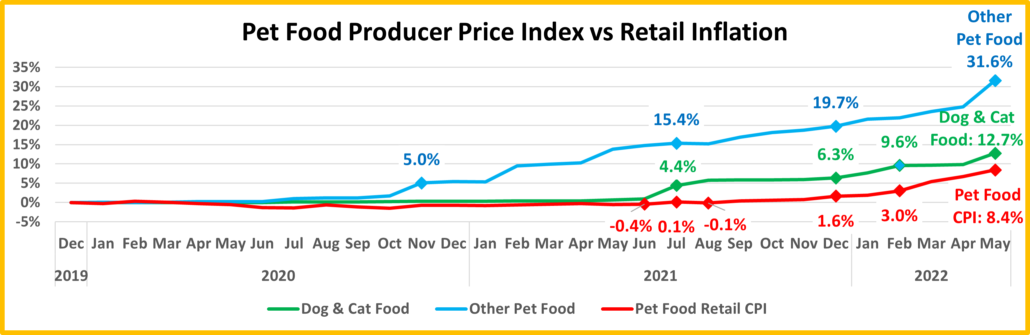

The first graph plots the PPI pricing path of Dog & Cat Food and Other Pet Food vs the Pet Food Retail CPI.

- Pricing remained essentially stable for all groups through most of 2020. The first change was that the PPI for Non-Dog/Cat Pet Food began moving up in November. This lift has continued but this small category has little impact on overall Pet Food Retail Prices.

- The Dog & Cat Food PPI moved up sharply in July 2021 then essentially stabilized until the end of the year. This turned Retail Prices up slightly, only +1.6% vs 2019 by December 2021.

- In 2022, the Dog & Cat PPI turned up in Jan/Feb, stabilized in Mar/Apr, then rose sharply in May. Pet Food Retail prices began growing in February. This increase accelerated in March and continues through May. The Retail inflation rate for Pet Food is now 66% of the PPI increase for Dog & Cat Food. In February it was 31.6% and only 25.4% back in December 2021. This gap is definitely narrowing as the Retail price increases are more closely matching the increase in manufacturing costs. By the way, the increase for Other Pet Foods is a meteoric +31.6% vs 2019. This is huge and by far the biggest increase in any Pet Food category, but it is only 29% of the 109% increase in the Gasoline PPI over the same period.

Obviously, it takes a while for a rise in the PPI to impact retail prices. Also, as we saw in most of 2020 and in the 2nd half of 2021, stability in the PPI usually generates stability in Retail prices.

Dogs & Cats “rule” the pet food segment just like they “rule” the overall Pet Industry. However, the lift in prices for manufacturing Food for Other Pets has now gotten so large that it is having an impact in pushing Pet Food Retail Prices up.

We will now drill a little deeper into the “ruling” Dog & Cat Food categories. We will look at the individual PPI history for Dog Food and Cat Food and the 2 largest sub-categories in each – Dry/Semi-moist and Canned. Our chart will track and compare the Pet Food CPI and the PPI history for all groups from December 2019 to March 2022. The detailed data release for these specific groups is 2 months behind the overall PPI release.

- The PPI for all categories was essentially unchanged from December 2019 until October 2020. At that time manufacturers’ prices in the Canned Dog Food category moved up 1.1%.

- In October 2020 Pet Food retail reached bottom in their deflationary movement. The price increase in Canned Dog Food slowed overall Pet Food deflation and essentially stabilized prices.

- Both the individual PPIs and the overall Pet Food CPI plateaued from November 2020 through May 2021.

- All prices moved up slightly in June 2021 but the PPIs took off in July. The Pet Food CPI also was above December 2019 for the 1st time since February 2020.

- Canned Dog Food led the skyrocketing PPI prices in July 2021 but all categories had a significant increase. The increase continued in August, but the CPI unexpectedly dipped slightly below December 2019.

- The PPIs for all groups essentially stabilized from September through December 2021 while the Pet Food CPI began to increase, especially from Nov>Dec.

- In January 2022, the PPIs for all but Canned Dog Food turned up again. Their increase continued in February, with Canned Cat Food skyrocketing up to +12.7%, almost equal to the overall increase by Canned Dog Food. The Pet Food CPI moved up slightly in January and then inflation took off in February.

- The PPIs stabilized again in March, but we should note that prices for Canned Dog Food have been stable since August, after the spectacular Jun>August lift. While manufacturing prices have stabilized, inflation in Pet Food Retail is accelerating. From our 1st chart we know that this trend continued through May.

- Once again, we see that there is obviously a timing delay from the PPI to the CPI. It takes time for the impact to work its way from manufacturer to retailer to consumer.

- We also see that the Canned Food categories have significantly more pricing volatility than Dry Food for both Dogs and Cats. While Canned Dog Food led the way in the PPI lift and ended up with the biggest increase, +13.3%, Canned Cat Food finished a close second at +12.7%.

- However, when you look at how these individual PPIs compare to the overall PPI for Dog or Cat, it is readily apparent that Canned Cat Food has a much larger share of total Cat Food than Canned Dog Food has of Total Dog Food.

In terms of what will happen in the future, we turn again to our first chart. The PPI for Dog/Cat Food was stable through April but turned sharply up again in May. When Mfg prices go up, Distributors & Retailers must take a closer look at their product mix. For those items with increasing prices, they can raise their prices, accept lower margins or some combination of both. The Retail CPI is spiking. It’s likely that rising manufacturing prices will cause Retail Pet Food inflation to continue to grow. We need the PPIs to flatten for the CPI to stop increasing. Ultimately, we hope that any supply chain issues will be fixed, returning Pet Food Retail and Manufacturing to a more price competitive market.

Trackbacks & Pingbacks

[…] also tracks producers’ costs via the Producer Price Index (PPI), and John Gibbons, aka the Pet Business Professor, has helpfully extracted and compared both CPI and PPI pet food data through May […]

[…] also tracks producer costs with the Producer Price Index (PPI) and John Gibbons, also known as Animal business professorextracted and compared pet food CPI and PPI data for May […]

[…] also tracks producers’ costs via the Producer Price Index (PPI), and John Gibbons, aka the Pet Business Professor, has helpfully extracted and compared both CPI and PPI pet food data through May […]

[…] tracks producers’ prices by way of the Producer Value Index (PPI), and John Gibbons, aka the Pet Enterprise Professorhas helpfully extracted and in contrast each CPI and PPI pet meals knowledge by way of Could […]

[…] also tracks producers’ costs via the Producer Price Index (PPI), and John Gibbons, aka the Pet Business Professor, has helpfully extracted and compared both CPI and PPI pet food data through May […]

Comments are closed.