2015 Total Pet Spending Was $67.75B – The Demographic “Winners & Losers”

Consumer spending on Pets in 2015 totaled $67.75B, an increase of $3.43B (5.3%) over 2014. In our last report, we established who was doing most of the spending (60>80+%) in the major demographic categories. In this report, we will drill deeper into the data to determine:

- Which segments performed best…and worst in each demographic category

- Which segments had the biggest gain or loss* in Total Pet Spending $. (*or smallest gain)

- Some non-winners whose performance merits “Honorable Mention”

- The “Ultimate” Pet Spending Consumer Unit in 2015

Performance

We’ll get started with the best “Performing” segments. To determine a segment’s performance we simply compare their share of the overall Pet Spending to their share of the total CU’s. (Financially independent Consumer Units) Example: If a segment spends 15% of all Pet $ and has 10% of all the CU’s, then their performance rating is 15/10 = 150% – very good. If their share of spending was only 5%, then their performance rating is 5/10 = 50% – not so good. This method puts every segment on a level playing field…then, may the best one win. Once again, all numbers in this report were calculated from data provided by the US BLS in their Consumer Expenditure Survey.

Here are the best and worst performers for 11 demographic categories, ranked by performance – from high to low.

Most of the “winners and losers” are the same as last year. Changes from 2014 are “boxed”. We should note:

- The average winning performance is 8% higher than last year and the average” loser” is 2% lower so the differences are becoming more extreme.

- The influence of the “older” Baby Boomers’ upgrade in Food is apparent across several demographic categories

- Age – This year age has more impact. It is ranked 6th in terms of winning percentage. Last year it was 10th.

- # in CU – Last year the winning number was 3 people. This year it is down to 2

- CU Composition – Last year it was “all married couples with children”. This year, it’s those with a child over 18.

- Occupation – The Self-employed, which always rank high, had a big spending increase in all categories. Managers & Professionals dropped out of the top spot in 2015 primarily because of a big decrease in Veterinary Spending.

- Race/Ethnic – In 2014, Asians had the lowest spending performance. In 2015, African American bought 10% more food but their spending was down significantly in all other segments which resulted in an overall decrease of 27%.

- Region – The South actually had the largest increase in $ but it couldn’t keep pace with an increase of 1.9M CUs.

Now let’s truly “Show you the money”. In the next chart, we’ll look at the biggest $ changes in spending from 2014. As a rule there are both positive and negative situations. However, in 1 category every segment spent more in 2015.

In this chart, we truly see the impact of the Boomer’s food upgrade on Pet spending and how 2015 was radically different from 2014. There are new winners and losers in virtually every category. In a few cases they just switched positions. 2015’s winner was 2014’s loser and vice versa. We’ll take a look at one demographic category at a time.

- Education – Pet Parents are widespread across all education levels. You can see that from the 2014 winner.

- Winner – College Grads – Pet Spending: $38.93B; Up $6.41B (+19.7%)

- 2014: < Less than College grad

- Loser – High School Grads or less – Pet Spending: $10.36B; Down 3.08B (-22.9%)

- 2014: BA/BS Degrees

- Comment – In 2015 Education level seemed to truly matter. Perhaps the value of upgrading to the nutritionally superior, but higher priced foods, as well as the need for regular Vet visits was more apparent. With generally lower income, the big drop in the less educated group could have been a result of increased financial pressures.

- Winner – College Grads – Pet Spending: $38.93B; Up $6.41B (+19.7%)

- Age – This category had the 2nd biggest influence of any category. In 2014 it was ranked 9th.

- Winner – 45> yrs – Pet Spending: $47.92B; Up $5.08B (+11.8%)

- 2014: 65+ yrs

- Loser – 25>44 yrs – Pet Spending: $18.15B; Down $1.99B (-9.9%)

- 2014: 45>54 yrs

- Comment: This category most shows the influence of the Boomers since they are all in the winning segment. The 25>44 yr age group is at the peak of their family responsibilities and feeling financial pressure. It also appears that the 25>34 group were the first to upgrade their Pet Food in 2014, then backed off in 2015…probably price.

- Winner – 45> yrs – Pet Spending: $47.92B; Up $5.08B (+11.8%)

- # in CU – In 2014 all CU sizes had an increase in Pet Products Spending. That was not the case in 2015.

- Winner – 2 People – Pet Spending: $29.06B; Up $5.0B (+20.8%)

- 2014: 2+ People

- Loser – 4+ People – Pet Spending: $12.96B; Down $2.87B (-18.1%)

- 2014: 1 Person

- Comment: In 2014, more people meant more spending. In 2015 it was the opposite story. Only CU’s with 3 or fewer people had an increase. Financial pressures are once again the likely cause for the spending decrease in the larger CUs. Of note, a 2 person CU is very common in the older age groups and in the under 25.

- Winner – 2 People – Pet Spending: $29.06B; Up $5.0B (+20.8%)

- Race/Ethnic – The vast majority of Spending comes from the White, Not Hispanic group.

- Winner – White, Not Hispanic – Pet Spending: $59.81B; Up $3.87B (+6.9%)

- 2014: White. Not Hispanic

- Loser – African American – Pet Spending: $2.45B; Down $0.93B (-27.5%)

- 2014: Hispanic

- Comment – Hispanic and Asian spending was up. African Americans had the only decrease.

- Winner – White, Not Hispanic – Pet Spending: $59.81B; Up $3.87B (+6.9%)

- Housing – Homeowners dominate. Last year all groups were up. In 2015 Renter’s spending fell due to Veterinary.

- Winner – Homeowner, No Mtge – Spending: $18.4B; Up $3.69B (+25.1%)

- 2014: Homeowner w/Mtge

- Loser – Renter – Pet Spending: $11.82B; Down $0.74B (-5.9%)

- 2014: Renter

- Comment – Usual winner is Homeowner w/Mtge. Those with No Mortgage are usually older and often retired.

- Winner – Homeowner, No Mtge – Spending: $18.4B; Up $3.69B (+25.1%)

- Income – Increasing Income usually increases spending…but not always. In 2015, Middle income spending dropped.

- Winner – Over $100K – Pet Spending: $27.12B; Up $3.57B (+15.2%)

- 2014: Over $70K

- Loser – $50 to $99K – Pet Spending: $19.95B; Down $1.64B (-7.6%)

- 2014: Under $30K

- Comment – The over $100K segment had a huge increase. However, the <$50K group was also up $1.5B (+8.0%).

- Winner – Over $100K – Pet Spending: $27.12B; Up $3.57B (+15.2%)

- CU Composition – You will see a strong interrelationship between this group and the # Earners and Age groups.

- Winner – Married Couple Only – $21.69; Up $3.47B (+19.0%)

- 2014: All Married Couples

- Loser – Married, with all children <18 – $10.4B; Down $2.8B (-21.2%)

- 2014: Singles

- Comment – The Married Couple only group tends to be under 25 or over 55. Both of these groups had a big lift from upgrading Food in 2015. The Married w/children <18 drop was primarily in Food & Supplies due to financial pressures. We also saw this in the 25>44 age group, which is the age range for the vast majority of this group.

- Winner – Married Couple Only – $21.69; Up $3.47B (+19.0%)

- # Earners – Usually more earners means a higher income and more Spending.

- Winner – 2 Earners – Pet Spending: $25.88B; Up $2.76B (+11.9%)

- 2014: 2+ in CU w/1 Earner

- Loser – 2+ in CU with 1 Earner – Pet Spending: $14.18B; Down $1.12B (-7.3%)

- 2014: 2 Earners

- Comment – In this category we are seeing the impact of a couple of trends. The huge 2014 lift in Food and subsequent drop in 2015 by the 25>34 yr olds due to financial pressures and the Boomer Food upgrade in 2015. Note: In the 25>34 group one person often suspends employment for a time to devote themselves to child care.

- Winner – 2 Earners – Pet Spending: $25.88B; Up $2.76B (+11.9%)

- Occupation – Pet Parents are widespread across occupations. Spending depends both on income and commitment.

- Winner – Retired – Pet Spending: $13.14B; Up $2.57B (+24.3%)

- 2014: Retired

- Loser – Operators & Laborers – Pet Spending: $2.76B; Down $0.78B (-22.1%)

- 2014: Tech/Sales/Clerical

- Comment – The Retired group wins 2 years in a row with big lifts in Food and Veterinary. This is not just the Boomers. The Silent Generation is a big part of this. All occupations bought more food but only Managers & Professionals had an increase in Supplies. The overall decrease by Operators/Laborers was due to a big drop in Veterinary spending.

- Winner – Retired – Pet Spending: $13.14B; Up $2.57B (+24.3%)

- Region – Regions vary in size and demographics like race/ethnicity and income. Plus, the South is growing rapidly.

- Winner – South – Pet Spending: $24.28B; Up $1.75B (+7.8%)

- 2014: Midwest

- Loser – Midwest – Pet Spending: $14.84B; Down $0.69B (-4.4%)

- 2014: South

- Comment – All regions had a lift in Food, especially the West and South. Quite frankly, the South “won” because of an increase of 1.9M CU’s. The Midwest was driven down by a big drop in Supplies after a big lift in 2014.

- Winner – South – Pet Spending: $24.28B; Up $1.75B (+7.8%)

- Area Type – All areas showed an almost equal increase in $.

- Winner – Rural (Pop <2500) – Pet Spending: $8.57B; Up $1.23B (+16.8%)

- 2014: Center City

- Loser – Suburban – Pet Spending: $43.74B; Up $1.08B (+2.5%)

- 2014: Suburbs

- Comment – All areas had an increase in Food and a drop in Supplies. The largest segment, Suburban, has been last for 2 years in a row.

- Winner – Rural (Pop <2500) – Pet Spending: $8.57B; Up $1.23B (+16.8%)

We’ve now seen the best overall performers and the “winners” and “losers” in terms of increase/decrease in Total Pet Spending $ for 11 Demographic Categories. Not every good performer can be a winner but some of these “hidden” segments should be recognized for their outstanding performance. They don’t win an award but they deserve….

Honorable Mention

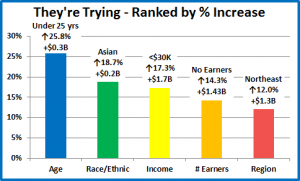

- Age – <25 yrs – Pet Spending: $1.31B; Up $0.3B (+25.8%)

- Comment – This small group is just getting started with life and Pet Parenting. Their percentage of increase was the largest of any age group. They had a huge increase in the average CU spending for Food as well as increases in both Supplies and Services, so they are adding pets and even buying upgraded Food. The only reason that their increase in $ wasn’t greater is that there was a 9% drop in the number of CU’s.

- Race/Ethnic – Asian – Pet Spending: $1.34B; Up $0.2B (+18.7%)

- Comment – This small group has the CU highest income but perennially has the lowest average spending on companion animals. With strong increases in Food & Veterinary Spending they moved out of last place in 2015.

- Income – <$30K – Pet Spending: $11.3B; Up $1.67B (+17.3%)

- Comment – Much of this segment consists of older and younger consumers. With all segments but Supplies showing an increase, this is evidence that spending on our Pet “Children” is not just about income.

- # of Earners – No Earners – Pet Spending: $11.45B; Up $1.43B (+14.3%)

- Comment- The vast majority of this group are retired. Their 14.3% increase was the largest of any segment in the category. Still more proof that the motivation for increased Pet Spending is not limited to increased income.

- Region – Northeast – Pet Spending: $11.82B; Up $1.3B (+12.0%)

- Comment – This densely populated area benefited from a strong performance by the Center City areas, which even had an increase in Supplies. Their 12% overall gain was by far the best of any Region.

Summary

2015 was a year of extremes which is best illustrated by the situation in 2 Industry Segments – Food and Supplies.

- Plus: Food Spending ↑$5.4B. The Baby Boomers upgraded their Food and their Food spending went up $5.8B.

- Minus: Supplies Spending fell almost across the board, primarily due to a drop in purchase frequency– ↓$2.1B

Spending in the other 2 segments basically cancelled each other out. Services continued their steady growth ↑$0.58B, driven primarily by convenience in the under 55 age group, but with income always a factor. Veterinary spending was down ↓$0.47B and continued to be negatively impacted by a high inflation rate. This was somewhat mitigated by the strong commitment from the oldest Americans to the care of their companion animals.

You have seen the individual demographic winners and losers. However, when you step back it often seems to be 2 ends against the middle. Let’s look at what that means in terms of 2 important demographic measures – Income and Age:

- Income: The increase is coming from the Over $100K group and the Under $50K group. It is middle income America, $50>99K, with the biggest financial pressures of housing, children and career that is feeling the pinch.

- Age: The increase is coming from the >45 and the <25 groups. The older crowd has both high and low incomes but smaller families. The <25 group generally has lower incomes but also fewer responsibilities. The middle 25>44 age group had a significant drop in spending, but they are building careers, buying houses and taking care of most of the under 18 children in America. Their income is growing but not as fast as their responsibilities.

- One other trend should be noted – Education: This came to the forefront in 2015. It may be that the better educated were quicker to see the value of the upgrading their pet food – at a substantially higher price.

AND NOW…FINALLY, WHAT YOU HAVE ALL BEEN WAITING FOR…THE “ULTIMATE” PET CONSUMER UNIT

The “Ultimate” Pet Spending Consumer Unit consists of 3 people – a married couple with an 18+ year old child, still living at home. Mom and Dad are in the 55 to 64 age range. They are White, but not of Hispanic origin. At least one of the Parents has an advanced College Degree. Everyone works in the CU. Mom and Dad have their own business but their child also works, at least part time. They’re doing very well with a total Household income in excess of $150K. They own their home or to be more accurate, share ownership with the bank. They live in a rural area (under 2500 pop.) in the West, but it is adjacent to a good sized metropolitan area. This gives them plenty of space for their companion animals, but they are still close enough to commute to the City for business, shopping and entertainment – the benefits of the Urban environment…We all wish that there were more of them.

(↓Here are some CU Spending Fun Facts↓)

That “wraps it up” for this report. We look forward to the US BLS Mid-Year 2016 Update in May.