PET INDUSTRY $ALES IN 2015: $60.3B – TAKING A CLOSER LOOK

According to the numbers from the APPA, the total U.S. Pet Industry increased $2.24B (3.86%) in 2015. This was not quite the projected 4.4% increase and slightly less than recent years. If you factor in “Petflation”, the increase in the amount of goods and services sold was 2.86%. However, this means that 74.1% of the industry’s growth was “real”. Only 25.9% came from price increases. This is less than last year’s 83% real growth…but still very good.

In this post we’ll take a closer look at the performance of the total market and importantly, the individual segments. We’ll see which segments are “driving” or “retarding” the industry’s growth. The report will cover 2015 and also put this year’s numbers into perspective for the period from 2009 to 2015, the time since the great recession.

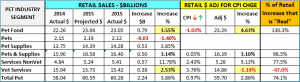

Here are the details for 2015. Some key data is highlighted:

Key Observations

- The ongoing deflation in the Food segment got markedly worse in 2015 (-1.03%).

- Good News – The consumer actually bought even more product at the deflated prices.

- Bad News – The deflation increases the competitive pressure on manufacturers, distributors and retailers.

- The Supply segment came within 1% of hitting the projected retail number and…prices were flat (a pause in the deflationary spiral) so 99% of the growth was real!

- The Service segment exceeded projected sales and while inflation was relatively high, 78% of the increase was real.

- The Veterinary Segment retail increase was only 55% of the projection and the high inflation rate resulted in Pet Parents actually buying less in terms of the amount of veterinary services in 2015!

- The Total Pet Market performance – up 3.9%…with 74% % of this being “real” looks pretty good. However, the high inflation rate in the Vet Segment has reached the point where it is depressing consumer sales, affecting the entire industry’s numbers. Food prices have been deflating for 2 consecutive years. Time for a change in these segments.

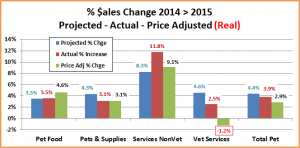

The Chart below may make it easier to visualize the situation…especially in the Vet & Food Segments

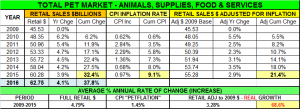

Now let’s take a look at the performance of the individual segments from 2009 to 2015 starting with Food!

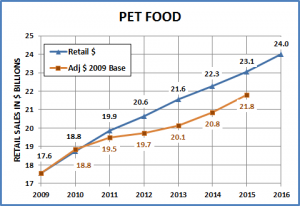

OBSERVATIONS

- When you look at the cumulative Pet Food Sales since 2009, it looks pretty good.

- 4.64% Annual Growth Rate

- Low average inflation – 1.02%

- 68% CPI adjusted Growth Rate: 79% of the growth since 2009 has been “real”.

- In the 6 years since 2009…

- 3 were deflationary (-0.6%) Average

- 3 were inflationary (2.5%) Average

The deflationary years are the most concerning. We have only had 4 deflationary years in Food (2000 was the other) and now we’ve had 2 in a row. The 2010 deflation came after a combined 20% Food CPI increase from 2007 to 2009 – in the heart of the recession and real growth ceased. The decrease in 2010 brought a positive response from the consumer – adjusted growth exceeded retail sales.

The years from 2011 to 2013 brought CPI increases in the 2+% range. The increases dropped the percentage of real growth below 50%. In 2014 & 2015, prices fell so the consumer paid less but the actual growth rate improved. The big concern with deflation is the impact on the supply and distribution channels and ultimately on the consumer… thru reduced choices.

Here’s what it looks like on a graph:

2016 Retail Food sales are projected to increase 4.2% to $24.01B. This may be a little high. The 3.5% range seems more likely unless we have a turnaround in pricing. I haven’t projected the CPI for this segment or others. It’s a little too early, especially with the volatility in Food and Supplies. Recently, the December and January Pet Food CPIs were up. February and March were down. Remember prices were pretty stable for the first half of 2015…then we had the biggest drop in history. If prices can stabilize or even turn up 0.5% in 2016, then the 4.2% increase in revenue becomes more likely.

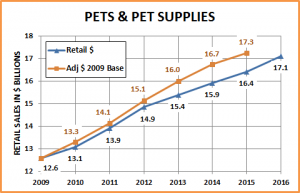

Let’s turn next to Pets & Supplies.

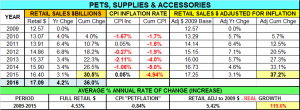

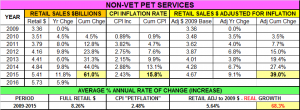

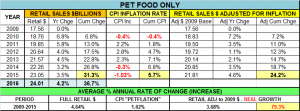

OBSERVATIONS

- DEFLATION

- Prices are 4.94% below 2009 (and about equal to what they were in April 2008)

- Falling at an annual rate of -0.84%

- Consumer is still buying more

- Retail Sales annual growth rate is 4.53%

- Price Adjusted annual growth rate is 5.42% – 20% higher than the retail rate

In Supplies the first deflationary year was 2010. However, we should remember that inflation has generally not been a big issue in this segment. From 1997 to 2004 Pet Supplies increased in prices at an annual rate of under 0.5%. Then in 2005 and continuing through 2009, the CPI increased an average of 2.75% per year. This doesn’t sound like much but remember it was 5 times the rate of the previous 7 years and 2 of the biggest increases (+3.0%) came in 2008 and 2009, in the heart of the recession. The consumer reacted – and bought less.

Prices fell 1.7% in 2010 and the consumer bought more. The prices briefly stabilized in 2011 and then began moving downward. The consumer’s reaction was to buy more. 2015 brought another pricing pause, almost exactly equal to 2010. Overall Retail growth slowed slightly to 3.1% and adjusted growth dropped from 4.6% to 3.1%. The good news for the sellers is that this growth was 99% real and more profitable, exactly the same consumer reaction as in 2011.

Here’s the graph:

In 2016 Pet Supplies are projected to increase 4.2% to $17.09 B. That seems a bit high. 3.5% may be closer. In 2015 there was some indication that this segment might be truly pulling out of the deflationary spiral. However, a record CPI drop in the second half produced a year similar to 2011. Remember, 3 years of deflation followed that year. However, January through March of 2016 have seen moderate monthly increases in the Supply CPI. I’ll update you throughout the year.

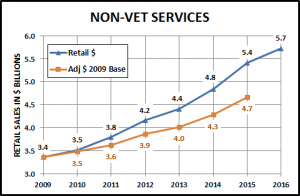

Now onto the Service Segments – First, NonVet Services.

OBSERVATIONS

- Growth

- Annual Growth rate 8.26% – Amazing!

- Inflation – a little high at 2.48%, but doesn’t seem to be significantly slowing consumer purchasing

- 68.3% “real” growth

- If price increases continue or accelerate, eventually the consumer will “push back”, but it hasn’t happened yet. Right now, a 2.5% inflation rate seems to be acceptable to the consumer.

There are no real negatives regarding this segment. It is growing strongly and consistently, especially since 2011. Last year the growth even reached double digits at 11.8%. However, it is a small segment, only accounting for 9.0% of the total market…but that’s better than 8.3% in 2014.

Here’s how the sales look on a graph:

2015 sales are projected to be $5.73 B, a 5.9% increase. This may even be a bit low. Based upon recent history 7-8% seems more likely. In regard to inflation rate, the average annual rate of 2.5% seems like a reasonable estimate for 2016. This would produce a “real” growth rate of 3.4% (42.4% of growth from price increases). The 2016 adjusted sales would be $4.83B.

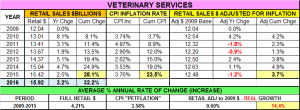

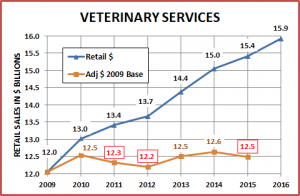

The final individual segment is Veterinary Services. This segment accounts for over 25% of the Total Pet Market.

Let’s take a closer look at the Veterinary Service Segment.

OBSERVATIONS

- Retail Growth

- Up 28.1% since 2009

- Annual growth rate 4.21%

- Inflation is the problem

- Annual average CPI increase 3.58%

- Price increases account for 85.6% of Veterinary Retail growth!

- “Real Sales”

- Consumers actually bought less in vet services in 2011, 2012 and 2015. They just paid more.

- Sales have been stagnant since 2009 – average annual growth rate 0.6%

- Even worse, 2015 sales were about equal to 2010. Consumers bought the same “amount”. They just paid almost $3B more,

Regular veterinary visits are generally viewed as a “need” not a “want”. The high inflation rate over the years finally generated a consumer response in 2011…they cut back on veterinary services. Consumers have turned to OTC medicines, supplements, treatments and home testing whenever possible. Pet Health Insurance is growing and there may be fundamental changes in Veterinary Clinics – more chains and groups. Major medical procedures and emergency care will always be needed but it seems steps should be taken to make regular veterinary care more affordable.

Here’s the graph of sales since 2009:

Veterinary Services are expected to hit $15.92 B in 2016, a 3.2% increase. If that happens, we will probably have another decrease in the amount of services. Prices are already up 1.7% from December and we’re only through April.

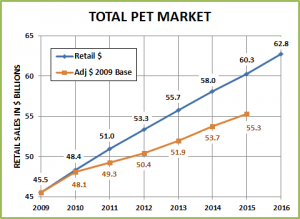

Now in our final section we’ll go back to the total pet market.

OBSERVATIONS

- Retail Growth expected to reach $62.75B in 2016

- ↑32.4% since 2009; Annual growth rate 4.79%

- Inflation: Only 9.1% since 2009; 1.45% annual CPI increase.

- “Real” Sales are 68.6% of Total Cumulative increase – a 3.28% annual growth rate.

The great Total Pet numbers are a big reason why so many people are attracted to the Pet Industry. The retail numbers are also consistently good across the segments. However, as I’ve said so often, when you look a little deeper into “petflation” and the actual amount of goods and services sold, you find that the total industry numbers are generated by two undesirable situations that tend to counteract each other when the numbers are combined. Specifically:

- Deflation in the Supplies Segment, which has paused after 5 yrs. We’ll see if it begins again or if we have reached a turning point. Commoditization, channel migration, consumer value shopping and lack of innovation have created extreme competitive pressure. Consumers have been buying more… but paying less.

- We now have had 2 consecutive years of deflation in the Food segment, including an all-time record monthly price drop in July of 2015. This is a big concern in the industry’s largest category. What will 2016 bring?

- The Veterinary segment has the exact opposite problem. Years of inflation have caught up. Consumers bought less in 3 of the last 6 yrs. 85% of growth is from price increases and 2015 “real” sales are equal to 2010.

In 2016 the Total Industry is expected to increase 4.1% to $62.75B. If the deflation and inflation both improve, we could see an inflation rate of perhaps 1.25%. This would generate a “real” increase of 2.85% and 2016 adjusted sales of $56.9B in the chart above. Bottom Line: We need moderation in the CPI trends for Pet Food and Veterinary Services.

Finally, always look beneath the surface in your business numbers. The headlines may not tell the whole story!