By 2021, the market had generally recovered from the impact of the pandemic. Now we are being hit by extreme inflation, with rates higher than we have seen in 40 years. Obviously, this can affect retail sales, so we’ll continue to track the retail market with data from two reports provided by the Census Bureau and factor in the CPI from US BLS.

The Census Bureau Reports are the Monthly and the Advance Retail Sales Reports. Both are derived from sales data gathered from retailers across the U.S. and are published monthly at the same time. The Advance Report has a smaller sample size so it can be published quickly – about 2 weeks after month end. The Monthly Final Report includes data from all respondents, so it takes longer to compile the data – about 6 weeks. Although the sample size for the Advance report is smaller, the results over the years have proven it to be statistically accurate with the final monthly reports. The biggest difference is that the full sample in the Final report allows us to “drill” a little deeper into the retail channels.

We begin with the Final Report for September and then go to the Advance Report for October. Our focus is comparing 2022 to 2021 but also YTD 2019. We’ll show both actual and the “real” change in $ as we factor inflation into the data.

Both reports include the following:

- Total Retail, Restaurants, Auto, Gas Stations and Relevant Retail (removing Restaurants, Auto and Gas)

- Individual Channel Data – This will be more detailed in the “Final” reports, and we fill focus on Pet Relevant Channels

The information will be presented in detailed charts to facilitate visual comparison between groups/channels of:

- Current Month change – % & $ vs previous month

- Current Month change – % & $ vs same month in 2021

- Current Month Real change – % vs same month in 2021 factoring in inflation

- Current YTD change – % & $ vs 2021

- Current YTD Real change – % vs 2021 factoring in inflation

- Current YTD change vs 2019 – % & $

- Current Real change YTD vs 2019 – % factoring in inflation

- Monthly & YTD $ & CPIs which are targeted by channel will also be shown. (CPI details are at the end of the report)

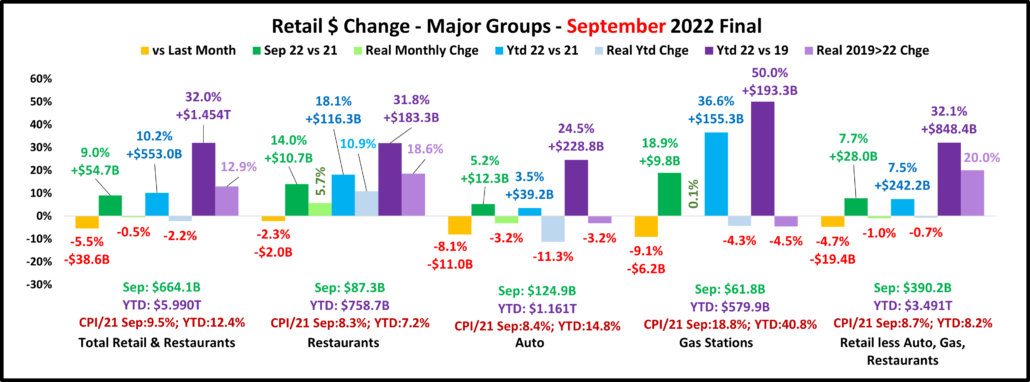

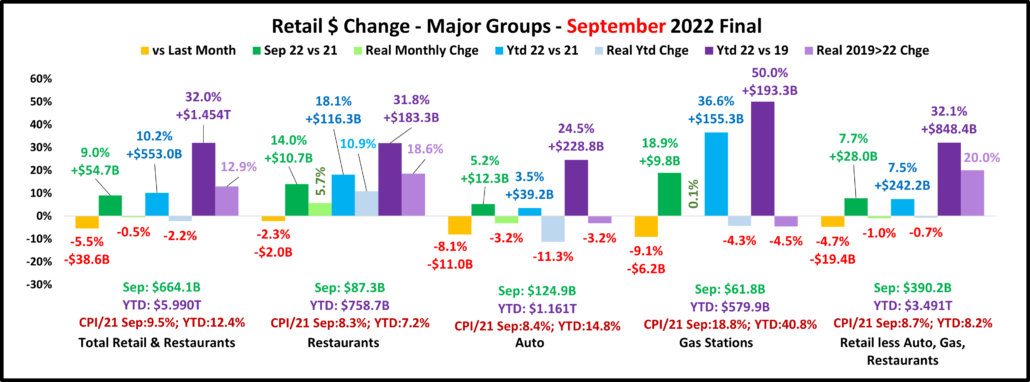

First, the September Final. All groups were down from August but the $ for all were up for September and YTD vs 2021. However, factoring inflation into the data, only Restaurants and Gas Stations were up for the month and in YTD $, only Restaurants were up. Here is the September data for the major retail groups. (All $ are Actual, Not Seasonally Adjusted)

The September Final is $2.2B more than the Advance. Relevant Retail had the biggest change: +$2.5B; Restaurants: +0.8B; Auto: No Chge; Gas Stations: -$1.0B. Sales are down from last month, but consumers continue to spend more vs 2021. However, the “real” numbers tell a slightly different story. Only Restaurants and Gas Stations (just barely) are really up for the month but again only Restaurants are really up in YTD $. Auto & Gas Stations also remain really down YTD vs 2019. The inflation impact on Relevant Retail is significant and concerning. Their Real YTD $ales vs 2021 have been negative for 6 months. They do have the best performance since 2019 as 62.3% of their 32.1% growth is “Real”.

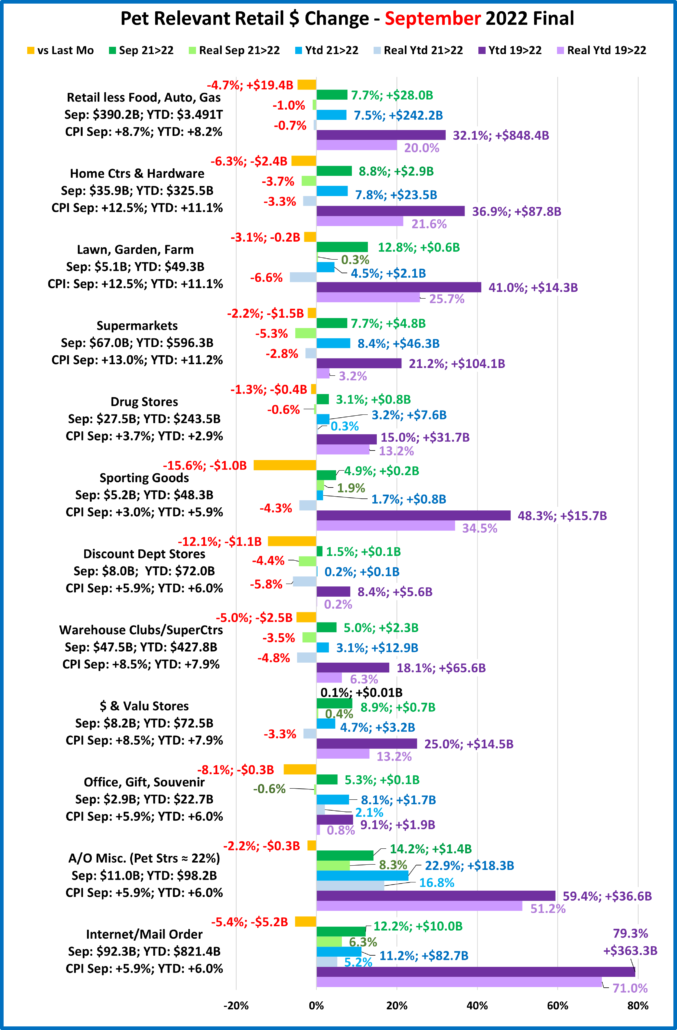

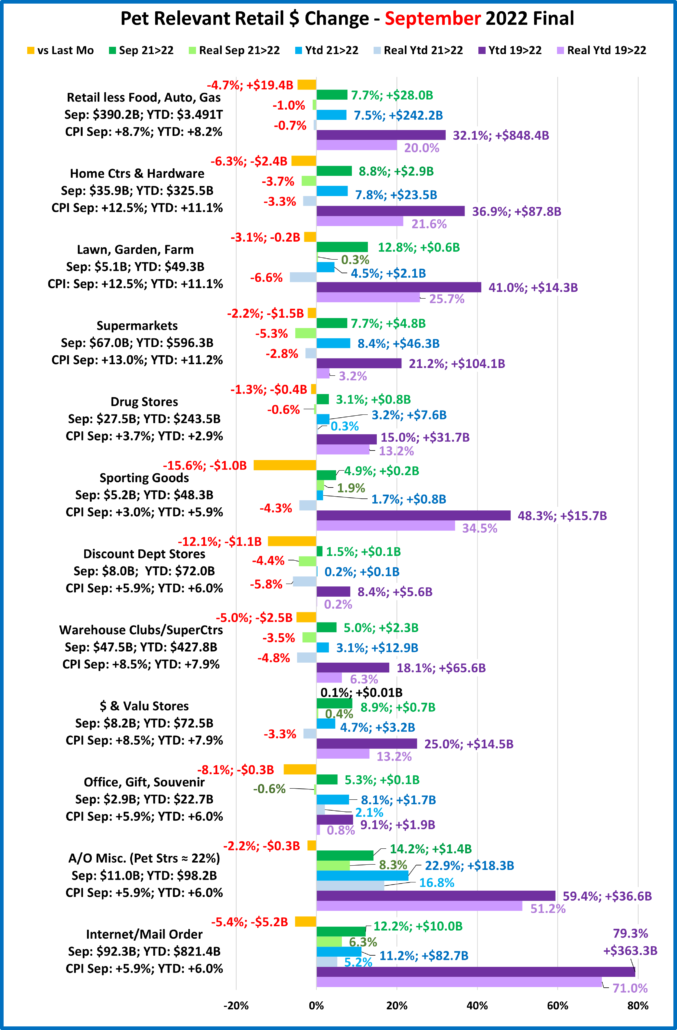

Now, let’s see how some Key Pet Relevant channels did in September

Overall – 10 of 11 were down from August. Vs Sept 2021, all reported more $ but only 5 were really up. In YTD vs 2021, all reported increases but only 4 were real. Vs 2019, for the 1st time in 2022, all were “really” up.

- Building Material Stores – Sales are down from August but YTD Home Ctr/Hdwe is up 8.8% vs 21 and Farm stores are +12.8%. The Bldg/Matl group has a YTD inflation rate of 11.9% which has produced negative real numbers. The pandemic caused consumers to focus on their homes which has produced sales growth over 37% since 2019. Importantly, 60% of this lift was real, primarily because the bulk of the lift came from 20>21, prior to the inflation wave. Avg Growth Rate: HomeCtr/Hdwe: 11.0%, Real: 6.7%; Farm: 12.1, Real: 7.9%

- Food & Drug – Both channels are truly essential. Except for the pandemic food binge buying, they tend to have smaller fluctuations in $. However, they are radically different in inflation. The YTD rate for Grocery products is 4 times higher than for Drugs/Med products. Drug Store $ are down from August but up vs 2021. Real sales are down vs Sept 2021 but 88% of their growth since 2019 is real. The Real Sales for Supermarkets are down for the month & YTD. Also, only 15% of their growth since 2019 is real. Avg Growth Rate: Supermarkets: +6.6%, Real: +1.1%; Drug Stores: +4.8%, Real: +4.2%.

- Sporting Goods Stores – They also benefited from the pandemic in that consumers turned to self-entertainment, especially sports & outdoor activities. Their sales fell $1B from August but 2022 YTD sales are still 1.7% above 2021. Their current inflation rate is 3.0% which is down from 7.5% in April but YTD it is still 5.9%. It was also high in 20>21, +4.8%. However, 71% of their 48% lift since 2019 is real. Their Avg Growth Rate was: +14.0%; Real: +10.4%.

- Gen Mdse Stores – Only $/Value store sales were up from August. However, all are now up for the month and YTD vs 2021. All real numbers for all channels except the monthly for $ stores vs 2021 are negative. Disc. Dept Stores were hurting before COVID but their YTD sales are again “really” up vs 2019. The other channels have 38% real growth. Avg Growth Rate: SupCtr/Club: 5.7%, Real: 2.1%; $/Value Strs: +7.7%, Real: +4.2%; Disc. Dept.: +2.7%, Real: +0.05%

- Office, Gift & Souvenir Stores – Their recovery didn’t start until the spring of 2021. Sales are down from August but up vs 2021. Real sales are down vs September 2021 but the growth vs 2021 has been strong enough that it turned real YTD sales positive vs 2021 and finally vs 2019. They still have a ways to go. Avg Growth Rate: +2.9%, Real: +0.3%

- Internet/Mail Order – The growth of the “hero” of the Pandemic is slowing. Sales are down from August but up for all other measurements. Their YTD growth rate is only half of their average since 2019, but 90% of their 79.3% growth since 2019 is real. Avg Growth Rates: +21.5%, Real: +19.6%. As expected, they are by far the growth leaders since 2019.

- A/O Miscellaneous – This is a group of specialty retailers. Pet Stores are 22>24% of total $. In May 2020 they began their recovery which reached a record level by December 2021 as annual sales reached $100B for the first time. Their sales dipped in January, July and now September but all measurements have been positive for every other month. In 2022, they are by far the Sales increase leaders over 2021. Plus, 86% of their 59.4% growth since 2019 is real. Average Growth Rate is: +16.8%, Real: +14.8%. They are 2nd in growth since 2019 to the internet. I’m sure Pet Stores are helping.

There is no doubt that high inflation is an important factor in Retail. In actual $, all channels reported increases in monthly and YTD sales over 2021. When you factor in inflation, the number with any “real” growth falls to 5 for monthly & 4 for YTD. This is a clear indication of the ongoing strong impact of inflation at the retail channel level. Recent data indicates that Inflation again slowed a little. Let’s look at the impact on the Advance Retail $ numbers for October.

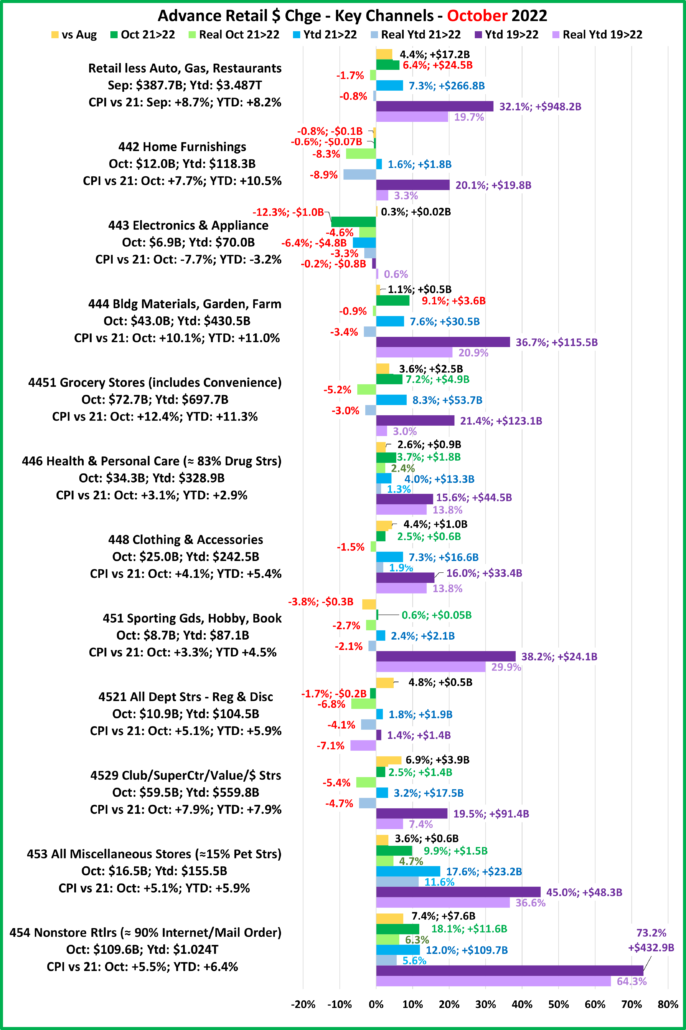

We have had memorable times since 2019. Some big negatives, including the 2 biggest monthly drops in history but a lot of positives in the Pandemic recovery. Total Retail reached $600B in a month for the first time and broke the $7 Trillion barrier in 2021. Relevant Retail was also strong as annual sales reached $4T and all big groups set annual $ales records in 2021. Now, radical inflation is a big factor with the largest increase in 40 years. At first this reduces the amount of product sold but not $ spent. We saw this again in October. $ grew from September and all groups were up vs October & YTD 2021. However, in the actual amount of product sold, monthly & YTD vs 2021, all but Restaurants were down.

Overall – Inflation Reality The monthly increase vs 2021 continues to be lower than the inflation rate. The spending for all groups increased from September and all are up for the month and YTD vs 2021. Restaurants are all positive, but for all others, the monthly sales are really down vs 2021 and the real YTD sales vs 2021 are down for the 7th straight month.

Total Retail – Every month in 2022 has set a monthly sales record. October $ are $688B, the 6th highest of all time. 2022 has become somewhat normal as sales dipped slightly in September then bounced back in October. October $ are +3.6% vs September but are up 7.9% vs October 2021 and 9.9% vs YTD 2021. However, when you factor in inflation, monthly sales are down -0.7% and YTD sales are down for the 8th consecutive month. Plus, only 40% of the 32% growth since 2019 is real. The Avg Growth Rate is: +9.7%, Real: +4.1%. Even as inflation slows slightly it continues to have an impact.

Restaurants – They were hit hard by the pandemic and didn’t truly start to recover until March 2021. Sales in the last 9 months of 2021 exceeded $70B and 2021 was the biggest year in history, $876B. January sales fell from December but then turned up, setting new all-time monthly records in March>May. $ fell in June, set a new record in July and then fell again in Aug>Sep. October brought a new record as sales hit $90B for the 1st time. They are the only big group that is positive in all measurements vs 2021 & 2019. Inflation is high at 8.5% for October and 7.4% YTD and contrary to the trend, it is getting worse. 58% of their 32.4% growth since 2019 is real. Their Avg Growth Rate: +9.8%, Real: +5.9%. They only account for 12.7% of Total Retail $ales, but their strong performance helps to improve the overall retail numbers.

Auto (Motor Vehicle & Parts Dealers) – This group actively worked to overcome the stay-at-home attitude with great deals and a lot of advertising. They finished 2020 up 1% vs 2019 and hit a record $1.48T in 2021. In 2022 sales got on a rollercoaster – Jan down, Feb/Mar up, Apr>May down, then flipping monthly with October being up. They have 4 down months in actual sales which are the only reported sales negatives by any big group vs 2021. This is bad but their real YTD sales numbers are much worse. Extremely high inflation has pushed their real YTD sales down -10.2% vs 2021, the worst of any group. Plus, their 24.3% growth since 2019 is really down -7.1%. Their Avg Growth: +7.5%, Real: -2.4%.Inflation has slowed in the last 5 months. It is likely that the 4 drops in $ales vs 2021 were tied to high inflation.

Gas Stations – Gas Stations were also hit hard. If you stay home, you drive less and obviously need less gas. This group started recovery in March 2021 and reached a record $584B for the year. Sales fell Jan>Feb, turned up Mar>Jun, fell in Jul>Sep, now up in Oct. They have the biggest increases vs 2021 and 2019 but it is not reality. Gasoline inflation has slowed but $ are still really down vs 2021. Inflation is still 18.1% and 38.3% YTD, the highest of any expenditure category. It has even caused consumers to buy 4.1% less than they did in 2019. Avg Growth Rate: +14.3%, Real: -1.4%. The YTD numbers show a big impact of inflation. Consumers spend more but buy less, even less than they bought 3 years ago.

Relevant Retail – Less Auto, Gas and Restaurants – This the “core” of U.S. retail and accounts for 60+% of Total Retail Spending. There are a variety of channels in this group, so they took a number of different paths through the pandemic. However, their only down month was April 2020. They finished 2020, up +7.1% and 2021 got even better as they reached a record $4.50T. They have led the way in Total Retail’s recovery which became widespread across the channels. Sales fell in Jan>Feb, then went on an up/down roller coaster from Mar>Oct with October up 4.4%. All months in 2022 set new records but their YTD increase is 21% below their 9.7% avg growth since 2019. Now, we’ll look at the impact of inflation. 61.4% of their 32.1% growth since 2019 is real. However real sales vs 2021 are down -1.7% for the month and -0.8% YTD. This shows that inflation is only a 2022 problem. Their Avg Growth Rate: +9.7%, Real: +6.2%. The performance of this huge group is critically important. This is where America shops. Real YTD sales are down almost 1% so the amount of products that consumers bought in 2022 is less than in 2021. They just paid more. That’s not good.

Inflation is slowing slightly but the impact is still there. All groups but Restaurants have no YTD real growth vs 2021 and Auto & Gas Stations are still “really down” vs YTD 2019. We’ve now had 8 straight months of real YTD drops for Total Retail and 7 straight for Relevant Retail so we are still in Phase II of inflation. Consumer spending grows but the amount bought declines. Actual Auto sales in 4 of the last 8 months were down vs 2021. However, inflation slowed so they have avoided Phase III, when consumers actually cut back on spending. If inflation grows again, Phase III could become reality.

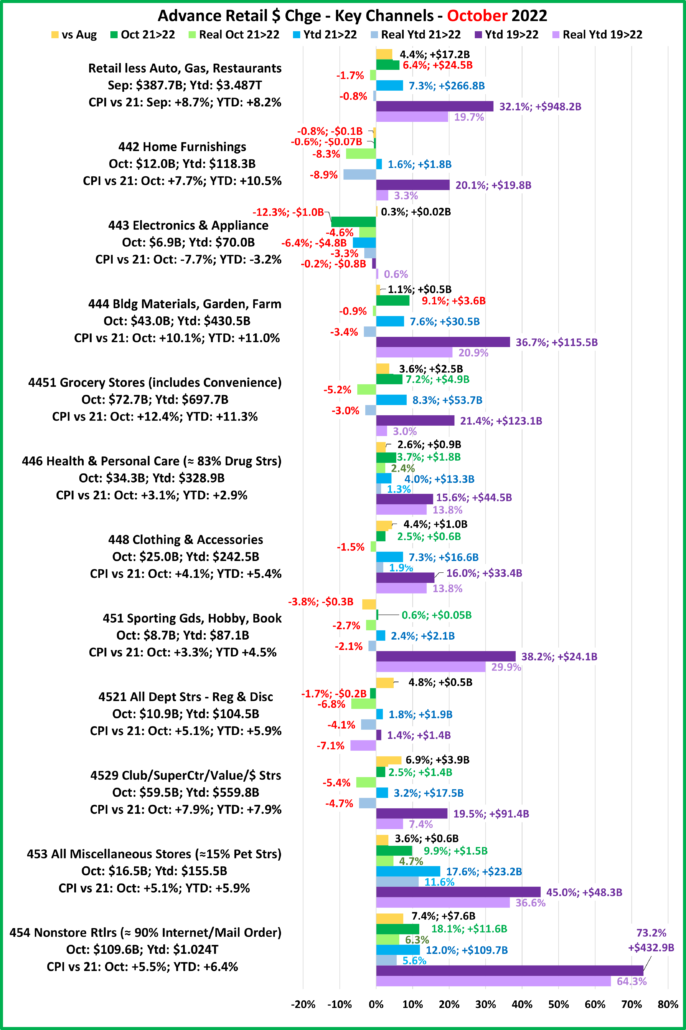

- Relevant Retail: Avg Growth Rate: +9.7%, Real: +6.2%. 9 of 11 channels were up from September but only 8 were up vs October 2021. 10 were up YTD vs 2021. The negative impact of inflation is less but still there in the “real” data.

- All Dept Stores – This group was struggling before the pandemic hit them hard. They began recovery in March 2020. They are up from September but down vs October 2021. Their YTD reported numbers have been positive vs 2019 since April but they are still “really” down in all measurements vs both 2019 & 2021. Avg Growth: +0.5%, Real: -2.4%.

- Club/SuprCtr/$ – They fueled a big part of the overall recovery because they focus on value which has broad consumer appeal. Inflation is a big factor in their current numbers. Sales are up from September and vs 2021. Their real numbers are all down vs 2021 and only 37.9% of their 19.5% lift from 2019 is real. Avg Growth: +6.1%, Real: +2.4%.

- Grocery- These stores depend on frequent purchases, so except for the binge buying in 2020, their changes are usually less radical. Inflation has hit them hard. $ are up from September. The increases vs 2021 are strong but inflation is stronger. Real sales are down and only 14.0% of the growth since 2019 is real. Avg Growth: +6.7%, Real: +1.0%.

- Health/Drug Stores – Many stores in this group are essential, but consumers visit far less frequently than Grocery stores. Sales increased from September and are ahead in all measurements vs 2021 – actual & “real”. Their inflation rate is low so 86% of their 15.6% growth from 2019 is real. Their Avg Growth is: +5.0%, Real: +4.4%.

- Clothing and Accessories – They were nonessential, and clothes mattered less when you stayed home. That changed in March 2021 and resulted in explosive growth through May 2022. October sales are +2.5% from 21 but real sales are down -1.5%. YTD $ are up 7.3%% and 86% of their growth from 2019 is real. Avg Growth: 5.1%, Real: 4.4%.

- Home Furnishings – Sales dipped Mar>May in 2020. Then as consumers’ focus turned to their homes, furniture became a priority. Inflation has been high. Sales are down for the month and only slightly up YTD vs 2021. All of their real numbers vs 2021 are very negative. Only 16.4% of their growth since 2019 is real. Avg Growth: +6.3%, Real: +1.1%.

- Electronic & Appliances – This channel has problems beyond the pandemic. Sales fell in Apr>May of 2020 and didn’t reach 2019 levels until March 2021. Sales are up from September but down in all measurements vs 2021. Actual $ are even down vs 2019, but deflation kept their “real” YTD sales up +0.6% vs 2019. Avg Growth: -0.4%, Real: +0.2%.

- Building Material, Farm & Garden & Hardware –They truly benefited from the consumers’ focus on home. This year’s spring lift ended in May. Sales rose slightly after dropping in September. Monthly & YTD sales are up vs 2021, but when you factor in double-digit inflation, the real amount sold is down for both measurements. However, 56.9% of their strong 36.7% sales growth since 2019 is real. Their Avg Growth is: +11.0%, Real: +6.5%.

- Sporting Goods, Hobby and Book Stores – Consumers turned their attention to recreation and Sporting Goods stores sales took off. Book & Hobby Stores recovered more slowly. October $ fell 3.8% from September but are still ahead of 2021, monthly & YTD. However, real $ are down again vs 2021. Inflation in this group is lower than most groups and most comes from Sporting Goods. 78.3% of their 38.2% growth since 2019 is real. Avg Growth is: +11.4%, Real: +9.1%.

- All Miscellaneous Stores – Pet Stores have been a key part of the strong and growing recovery of this group. They finished 2020 +0.9% but sales took off in March 21. They set a new monthly $ales record in December. Sales are up 3.6% from September and since April they have held the top spot in YTD increase vs 2021. Their YTD growth since 2019 is 2nd only to NonStore. Plus, 81.3% of the 45.0% growth since 2019 is real. Their Avg Growth is: +13.2%, Real: +11.0%.

- NonStore Retailers – 90% of their volume comes from Internet/Mail Order/TV. The pandemic accelerated online spending. They ended 2020 +21.4%. The growth continued in 2021. In December monthly sales exceeded $100B for the 1st time and they broke the $1 Trillion barrier for the year. Their YTD Growth has slowed significantly in 2022 but all measurements are positive. 87.8% of their 73.2% increase since 2019 is real. Their Avg Growth is: +20.1%, Real: +18.0%.

Note: Almost without exception, online sales by brick ‘n mortar retailers are recorded with their regular store sales.

Recap – The Retail recovery from the pandemic was largely driven by Relevant Retail. While the timing varied between channels, by the end of 2021 it had become very widespread. In late 2021 and now in 2022, a new challenge came to the forefront – extreme inflation. It isn’t the worst in history, but it is the biggest increase in prices in 40 years. Overall, and in most product categories it has slowed in Jul>Oct. Services also slowed a little in October. On the surface, the Retail impact is almost invisible. Sales in the total market and in the Relevant Retail group continue to grow but the growth rate has markedly slowed compared to last year. Overall, the retail market is generally in phase II of strong inflation – spending grows but the amount purchased falls. The channels in the graph illustrate this perfectly and show how widespread that it has become. 8 of 11 channels are up for the month & 10 YTD vs 21. However, if you factor in inflation, only 3 are up for month and 4 YTD. Inflation is real and there are real and even worse consequences if it continues.

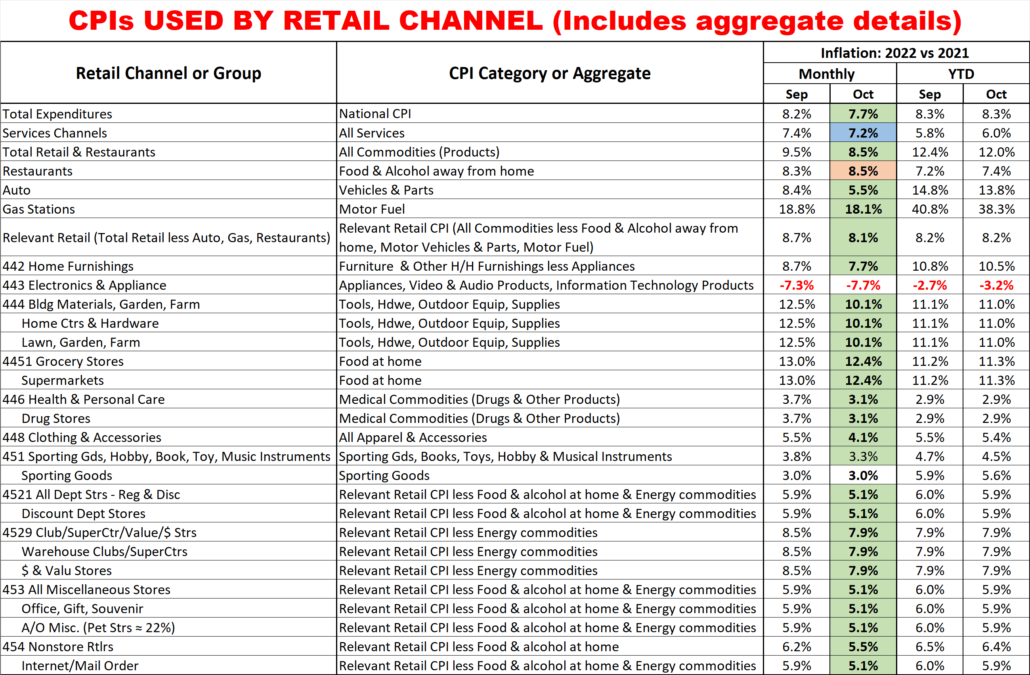

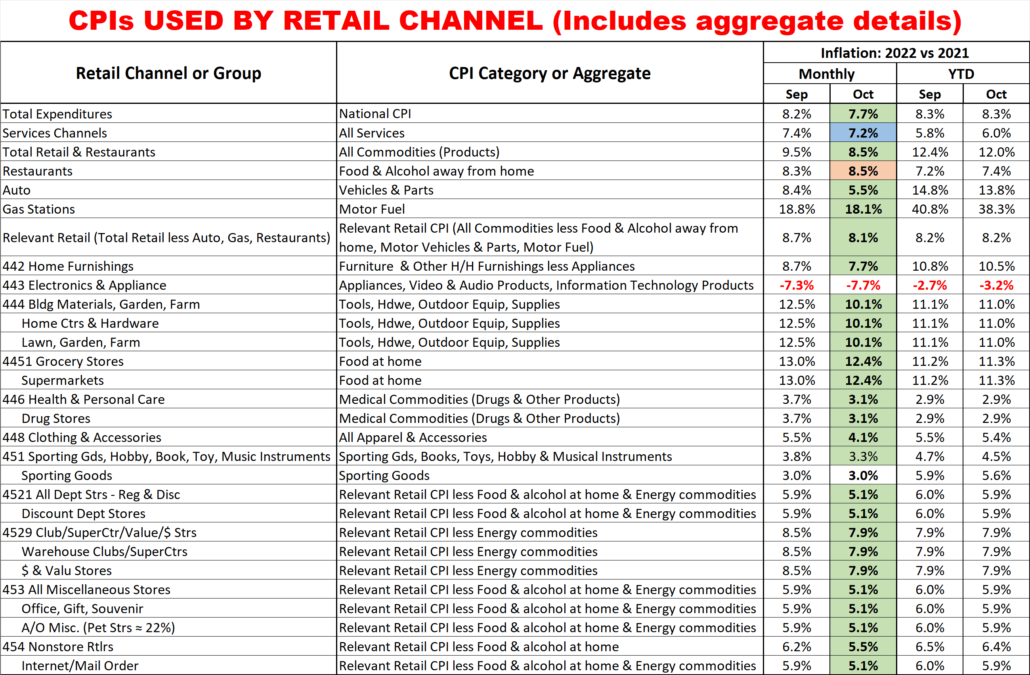

Finally, here are the details and updated inflation rates for the CPIs used to calculate the impact of inflation on retail groups and channels. This includes special aggregate CPIs created with the instruction and guidance of personnel from the US BLS. I also researched data from the last Economic Census to review the share of sales by product category for the various channels to help in selecting what expenditures to include in specific aggregates. Of course, none of these specially created aggregates are 100% accurate but they are much closer than the overall CPI or available aggregates.

Monthly CPI changes of 0.2% or more are highlighted.

I’m sure that this list raises some questions. Here are some answers to some of the more obvious ones.

- Why is the group for Non-store different from the Internet?

- Non-store is not all internet. It also includes Fuel Oil Dealers, the non-motor fuel Energy Commodity.

- Why is there no Food at home included in Non-store or Internet?

- Online Grocery purchasing is becoming popular but almost all is from companies whose major business is brick ‘n mortar. These online sales are recorded under their primary channel.

- 6 Channels have the same CPI aggregate but represent a variety of business types.

- They also have a wide range of product types. Rather than try to build aggregates of a multitude of small expenditure categories, it seemed better to eliminate the biggest, influential groups that they don’t sell. This method is not perfect, but it is certainly closer than any existing aggregate.

- Why are Grocery and Supermarkets only tied to the Grocery CPI?

- According to the Economic Census, 76% of their sales comes from Grocery products. Grocery Products are the driver. The balance of their sales comes from a collection of a multitude of categories.

- What about Drug/Health Stores only being tied to Medical Commodities.

- An answer similar to the one for Grocery/Supermarkets. However, in this case Medical Commodities account for over 80% of these stores’ total sales.

- Why do SuperCtrs/Clubs and $ Stores have the same CPI?

- While the Big Stores sell much more fresh groceries, Groceries account for ¼ of $ Store sales. Both Channels generally offer most of the same product categories, but the actual product mix is different.