Strategic Data Analysis – What is it? Why do it?

Data Analysis is certainly not new concept. It is a common practice and is just mathematically structured “common sense”. Strategic Data Analysis is different in that the person performing or directing it has an in depth knowledge and understanding of the industry gained from years of “street experience”. When you begin “Drilling into” data you are setting off on a pathway to a specific goal. Along the way, there will be forks in the data road. Strategic knowledge keeps you on the right path. It guides the analytical method and results in more targeted and effective recommended actions.

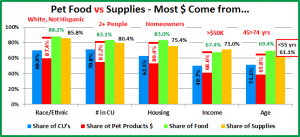

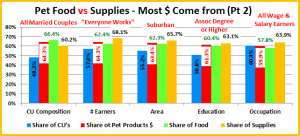

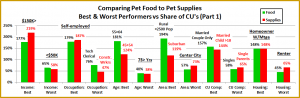

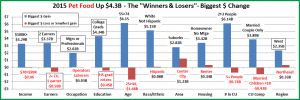

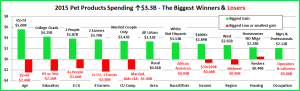

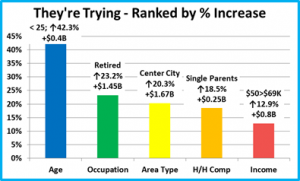

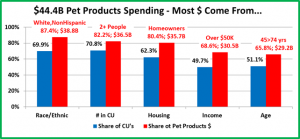

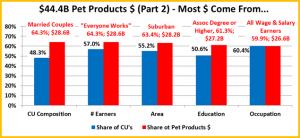

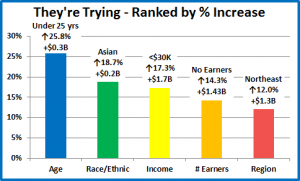

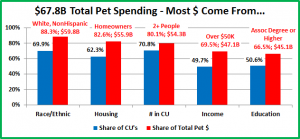

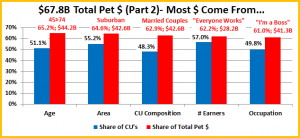

The “math” that I do with the data from the US BLS Consumer Expenditure Survey is Strategic Data Analysis at a very high level – a bird’s eye view of the marketplace. It still uncovers answers to spending questions. For example, in our analysis of the spectacular lift in Pet Food Spending we found that it was primarily driven by the Baby Boomers. Now, how you keep them spending and spread the word to other groups becomes a marketing problem, which requires more research.

When you do strategic data analysis of your own business, the results become more personal and much more actionable. You now know how and on what your customers are spending their money. The behavior and trends that you find are not necessarily “national” trends. They are your trends. You “own” them and you get to decide what actions to take.

Strategic Data Analysis will vary depending upon your place in the consumer products distribution pattern. Manufacturers, Distributors and retailers all have a slightly different set of analytical needs. However, they all do share one important commonality. Ultimately, the Consumer is driving their business.

Some typical elements in Strategic Data Analyses are:

- Category Management/sku Rationalization

- Consumer Decision Tree/Product Attributes

- SPPD – Sales Per Point of Distribution

- Sales/Profit per – sq ft, linear ft, size….

- ACV – All Commodity Volume

- Power Ranking

- Gap Analysis – Prioritized

- Average SKU – Straight or Blended

- Promotional Planning & Assessment

- GMROII & Turns

I’m sure that some of these are very familiar and relevant to you and your business and some are not. And remember, this list is just a sampling. To be effective, Strategic Data Analysis must always take into consideration the type of business. However, businesses, like people are unique. To maximize the effectiveness, it should also be customized specifically to your business -”Strategic”.

“Strategic Planning” is a term that I’m sure that all of you are familiar with. Once again, the strategic plan must fit the business. It includes specific Strategies in key areas like Products, Pricing, Positioning, Promotion, People and…Profit.

Strategic Data Analysis is a key element both in developing the plan, especially when you get down to the tactical level and in regularly monitoring progress. Strategic Data Analysis tells you what is happening at the ground level…where the battle is being fought. Plus, as everyone with a GPS knows, to get where you want to go, you first have to know where you’re at.

The monitoring of your progress is a critical element in Strategic Data Analysis. The Best Strategic Plans still require “tweaking”. It is literally impossible to foresee every element of the future. To be successful you need a great strategic plan and an organizational commitment to execute the plan. However, you must always be prepared to make changes. What these changes are and when they should be enacted is determined by conducting a strategic data analysis on a regular basis.

You may hire someone from outside to come in and do this for you. However, the best way is to set up an internal program that your organization runs. Not only is this a lot cheaper but you and your employees take ownership of the knowledge. This familiarity will work its way into everyday business decisions and generate more profit in unforeseen ways.

I hope that I have answered, “What” is Strategic Data Analysis? I think that there have also been some insights into the “Why”. The answer to “Why” is really quite simple. You should do it because it will help maximize the success of your business. However, it is a decision that each business must make for themselves. Let’s consider the Upside and Downside of the decision.

On the Upside –

- You will find aspects of your business that are performing exceptionally well and why. This will help you maintain this pace and perhaps find ways to spread this success to other areas.

- Some things may be running as planned, but show no elements that can be improved or transferred. In these cases you just monitor the situation and keep it up.

- You could find situations that are not performing. These are often masked by successes in other areas. Drill into the situation. Find out “why” and take corrective actions. These cases are truly “found” money and can make a big, unexpected impact on the bottom line.

- The results will allow you to update your Strategic Plan, including specific immediate actions to take. Strategic Data analysis keeps you on the path to success.

On the downside –

- Your Strategic Data Analysis may determine that everything is running perfectly. Nothing can be improved.

Whether to conduct or “pass” on Strategic Data Analysis presents a rather unique situation. How often in business or in life are you presented with a decision in which…

the worst case scenario is that it will produce mathematical evidence… …that you are a genius?

Get on board with a Strategic Data Analysis System. You have nothing to lose and everything to gain.

If you have questions or would like to discuss how Strategic Data Analysis can help your Pet Business, contact me through this site or at gpsforpetbusinesses@gmail.com. I also have some time available at the upcoming Global Pet Expo. If you would like to set up a brief meeting in Orlando, let me know. On site, you can contact me on my cell 303-909-9480. Texts are fine.

And Always Remember to…Do the Math!