Why Invest in the Pet Industry?

Why Invest in the Pet Industry? To answer that question, let’s look at the numbers.

In sheer numbers, America has a lot of pets – 400M – more companion animals than people. According to the APPA there are:

- Cats – 95.6M

- Dogs – 83.3M

- Birds – 20.6M

- Small Animals – 18.1M

- Freshwater Fish – 145M

- Saltwater Fish – 13.6M

- Reptiles – 11.5M

- Horses – 8.3M

But how widespread are they in society? In September of 2014 the U.S. Census Bureau released updated data. In 2013 there were 125,670,000 Consumer Units (Households) in the U.S.

The APPA reports that the % of pet ownership among U.S. Households is:

68% have a pet(s) = 85.4M H/Hs

- 46.7% have a dog = 58.7M

- 36.3% have a cat = 46.9M

- 5.7% have a bird = 7.1M

- 5.7% have a small animal = 7.1M

- 11.8% have freshwater fish = 14.8M

- 1.5% have saltwater fish = 1.9M

- 4.5% have a reptile = 5.8M

- 2.3% have a horse = 2.9M

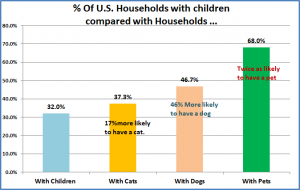

As expected, Dogs and cats are by far the most popular. Let’s put some of these numbers in perspective:

As you can see, Pets are a major part of American life and have become part of the family. However, we are talking about business so how much do Americans spend on their pets?

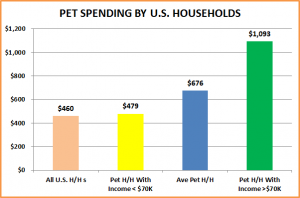

The U.S. Census bureau just released their annual study on consumer spending which found that the average U.S. Consumer Unit (household) spent $460 annually providing for their pets. That’s for all households – with and without pets. ..and does income matter? Let’s take a look:

Income does matter as the rate of pet spending increases radically with an increase in income.

So what is the top line? According to the APPA, Pet Spending in the U.S. in 2013 was $55.72B The U.S. Census Bureau’s estimate is actually higher…$57.95B. Either way, it is a lot of $…and more than is spent on alcoholic beverages (at home), non-alcoholic beverages, dairy products or men’s clothes…to name a few categories that Americans are fond of.

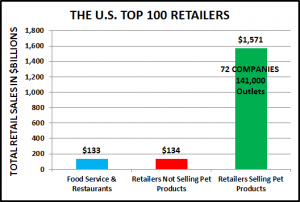

Where do we spend all this money? A review of a recently published list of the top 100 U.S. Retailers from the National Retail Federation is very enlightening. Before we take a look at the summary results, we should note that this report just reflects the top 100 Retailers. It doesn’t include approximately 8000 other Pet Stores and thousands of other outlets selling pet products across many distribution channels.

So how do the Top 100 Retailers feel about selling Pet Products? Let’s see…

Obviously, Pet Supplies are sold in a huge number and wide variety of outlets…all across America. There is another factor to consider. How important is shopping for Pet Supplies to the U.S. consumer? A.C. Nielsen has done a survey which gives some insight into how the consumer feels and acts.

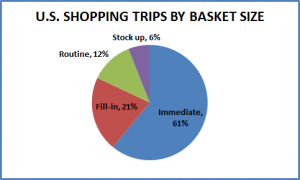

The Nielsen survey addressed the nature and number of consumer shopping trips. They divided them into 4 segments:

- Immediate(need) – $15 ave.

- Fill-in – $51 ave.

- Routine – $98 ave.

- Stock up – $242 ave.

Here’s how the trips broke out.

As you can see most trips are smaller – with 82% at $51 or less. Let’s take a look at the immediate trips. These are “need” driven and make up 61% of all of Americans’ “forays” into the retail market. What “needs” motivate these trips?

According to A.C. Nielsen, 9 of the top 10 are for “food”. Ranked in order, the top 10 reasons for an immediate shopping trip are:

- Milk

- Bakery (bread)

- Pet Care

- Cheeses

- Salty Snacks

- Soft Drinks

- Frozen Meals

- Fresh Produce

- Ice Cream

- Cereal (ready to eat)

Number 3…behind Milk and Bread…It looks like their companion animals are pretty important to American Consumers or should I say “pet parents”.

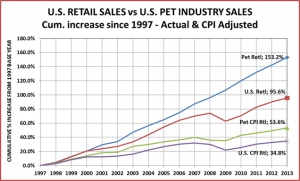

What then is the bottom line for the Pet Industry? How does it stack up against the total U.S. retail industry? One last chart…

Through good times and bad, at full retail or adjusted for inflation, since 1997 the Pet Industry has performed at least 50% better than the overall U.S. retail market.

It is different from many industries because of the emotional element in caring for and providing for companion animals. Americans have almost a “family like” connection to their pets. They also have proven that they are very willing to put their money where their heart is.

So to answer the question, “Why invest in the Pet Industry?”… Because it makes $ and sense!

I wonder what the continued growth, even during the recession, says about the psychology of modern consumers. Is the isolating nature of electronic entertainment given rise to our pets becoming our “social” loutlet? Or is it the result of us moving into the decadence phase of the cycle of empires. Or could it simply be animals provide an escape mechanism…

Great article, many people scoff at the idea of a pet centric business because it doesn’t carry to connotation of a more traditional business such as medical billing, wealth management, or anything else above the shoulders type of work, but the numbers clearly show it’s a serious industry with some serious money. And at the end of the day, business is just about taking your input dollars and making more output dollars, it really doesn’t matter what the vehicle is.

The pet industry is sure to see more players enter as the numbers continue to grow even in downturns, I’m sure we will see many more acquisitions of these smaller players in the coming years. Consumer awareness also seems to be growing regarding the quality of ingredients that goes into a lot of commercial brands. Perhaps this will lead to a more diverse market with many smaller players carving out their place.