U.S. PET SUPPLIES SPENDING $19.81B (↑$2.38B): MID-YEAR 2018 UPDATE

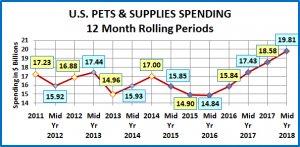

In our mid-year analysis of Pet Food spending, we saw that the latest spending increase slowed in the 1st half of 2018 . Pet Supplies spending tells a different story, and it is all positive. Mid-Year 2018 Pet Supplies spending was $19.81B, up $2.38B (+13.6%). This comes on the heels of a $2.59B increase in the previous 12 months. Pet Supplies spending is now at the highest level since 2009, prior to the great recession. The following chart should put the recent spending history of this segment into better perspective.

Here are this year’s specifics:

- Mid Yr 2018: $19.81B; ↑$2.38B (+13.6%) from Mid Yr 2017.

- The +$2.38B came from:

- Jul > Dec 2017: ↑$1.15B

- Jan > Jun 2018: ↑$1.23B

Like Pet Food, Pet Supplies spending has been on a roller coaster ride. However, the driving force is much different. Pet Food is “need” spending and has been powered by a succession of “must have” trends. Pet Supplies spending is largely discretionary, so it has been impacted by 2 primary factors. The first is spending in other major segments. When consumers ramp up their spending in Pet Food, like upgrading to Super Premium, they often cut back on Supplies. However, it can go both ways. When they value shop for Premium Pet Food, they take some of the saved money and spend it on Supplies. The other factor is price. Pet Supplies prices reached their peak in September of 2009. With a few brief exceptions they have been generally deflating since then – down -5.3% from 2009 at the end of 2017. Although it is not a hard and fast rule, Price inflation in this largely discretionary segment can retard sales, usually by reducing the frequency of purchase. On the other hand, price deflation generally drives Supplies spending up. Innovation can “trump” both of these influencers. If a new “must have” product is created, something that significantly improves the pet parenting experience, then consumers will spend their money. The perfect example of this is the successive waves of new food trends. Unfortunately, we haven’t seen much significant innovation in the Supplies segment recently.

Recent history gives a perfect example of the Supplies roller coaster. In 2014 Supplies prices dropped sharply, while the movement to Super Premium Food was barely getting started – Supplies spending went up $2B. In 2015, consumers spent $5.4B more on Pet Food. At the same time, Pet Supplies prices went up 0.5%. This was a “killer” combination as Supplies spending fell $2.1B. In 2016 consumers value shopped for Food, saving $2.99B. Supplies spending stabilized by mid-year then increased by $1B in the second half when prices fell sharply. Consumers spent some of their “saved” money on Supplies. Supplies prices continued to deflate throughout 2017. Food spending increased $4.61B in 2017 but this came from a limited group, generally older CUs, less focused on Supplies. The result was a $2.74B increase in Supplies spending. This appeared to be somewhat of a break with the overall pattern of trading $ between segments.

That brings us to the first half of 2018. The spending increase in Pet Food slowed to +$0.25B. However, Supplies’ prices switched from deflation to inflation. Prices increased 0.6%, but not until May so most of the spending in the 1st half was already done. During this period Supplies Spending increased by $1.23B so there was no major impact from the upturn in prices. Although, we should note that the less price sensitive over $150K group accounted for $0.91B of the increase. If the Supplies segment could become less sensitive to minor inflation and increased spending in other segments it would be great news for manufacturers and retailers, encouraging stronger, stable growth like the last 24 months.

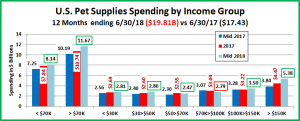

Now we will take a closer look at the two most popular demographic measures – age and income. In the graphs that follow we will compare spending for the Mid-year 12 months ending 6/30/18 to the previous period ending 6/30/17. In our graphs we will also include the 2017 yearend $pending. This will also allow you to see the spending changes in the 2nd half of 2017 and the 1st half of 2018.

The first graph is for Income, which has been shown to be the single most important factor in increased Pet Spending, especially in Pet Supplies and both of the Service segments.

Here’s how you get the change for each half using the $50>70K group as an example:

Mid-yr Total Spending Change: $2.47B – $2.30B = Up $0.17B (Note green outline = increase; red outline = decrease)

- 2nd half of 2017: Subtract Mid-17 ($2.30B) from Total 2017 ($2.55B) = Spending was up $0.25B in 2nd half of 2017.

- 1st half of 2018: Subtract Total 2017 ($2.55B) from Mid-18 ($2.47) = Spending was down $0.08B in 1st half of 2018.

- The increase in Supplies Spending was widespread across income groups. The only yearly decrease came from the $70>100K group. They were down in both halves. They did have a big increase in Food spending during this time so they may have been dialing back their Supplies spending.

- The biggest increase came from the over $150K group. Their $1.54B lift (+40.2%) accounted for 65% of the segment’s total increase while they only have 11.9% of the CU’s. However, we also should note that this group is gaining members faster than any other income segment. Their CU count is up 13.9% from a year ago.

- There are 2 other minor dips in spending. Pet Supplies spending fell -$0.06B in the second half of 2017 for the upper middle income $100>150K group and by -$08B in the first half of 2018 for lower middle income $50>70K group.

- Another interesting situation is the remarkably even distribution of Supplies spending among the under $100K groups. In fact, the under $50K group spent $5.7B while the $50>100K group only spent $5.3B. However, the <$50K group accomplished this with 47.6% of the CU’s in the U.S., while the $50>100K group only has 27.6%. There is no doubt that Money Matters in Supplies Spending.

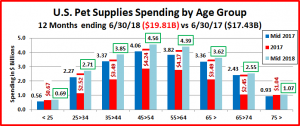

Now let’s look at Pet Supplies spending by Age Group.

- This is very consistent. Every Age group had an overall increase and an increase in each half. The groups from 25>64 each increased Supplies spending by approximately a $0.5B. The older and younger groups had smaller increases.

- Obviously, the factors affecting Pet Supplies Spending in the last 12 months were relatively evenly dispersed across America, at least in the 25 to 64 year olds.

Now let’s look at what is happening in Supplies spending at the start of 2018 across the whole range of demographics. In our final chart we will list the biggest $ moves, up and down by individual segments in 11 demographic categories. Remember, the increase in the 1st half of 2018 was $1.23B, slightly more than the $1.15B in the 2nd half of 2017.

- In 4 of the 11 categories all segments increased Supplies Spending. Actually, only 9 of 82 demographic segments started out 2018 by spending less on Supplies. That means 89% are ↑. Very widespread growth.

- There are a lot of the usual “suspects”. Winners: $150+K, Homeowner w/Mtge, White, Not Hispanic, Suburban, 2 earners. Losers: Single Parents, Retirees, Hispanic.

- There are a couple of surprise losers: $70>99K & Advanced College Degrees. Both had a big lift in Food – Trading $ ?

- The lift is demographically widespread but Supplies Spending does skew slightly younger: 35>44, 4 People, Gen X

The Supplies segment had a great 12 months and 2018 is off to a good start but the “winning streak” is actually 24 months. It began in the second half of 2016. Since then, spending on Pet Supplies has increased $4.97B (+33.5%). It has also been widespread across America. Of 82 separate demographic segments, only 1 has spent less on Supplies in the last 24 months – the Greatest Generation. The reason for this decline is unfortunate but can’t be helped. The number of CU’s for these 91+ year old Americans has decreased by over 40% during the period.

What are the market conditions that helped to foment this “wave” of Supplies spending? We have to first note that the world changed for Supplies because of the great recession. Prices have been generally deflating since then and spending in the segment has become more sensitive to changes in price. Prices go up…spending drops, usually due to reduced purchase frequency. Prices go down… spending turns up. This situation did not exist prior to the recession.

The other factor is spending in other segments, especially Food. Whether it is a conscious decision or not, pet spending comes out of “one bucket”. A big increase in one segment can result in a cut back in others and big savings can generate more spending. The recent upgrade to Super Premium Food was such a big $ commitment that it magnified this effect.

In Mid-2016, the market was just coming off the first big wave to Super Premium and consumers were starting to value shop so $ were available. Supplies pricing turned down and continued to decline for 22 months. The time was ripe for a big lift in Supplies Spending, and it happened. At the same time a new wave was starting in the Super Premium movement, which could have derailed the Supplies lift. However, it turned out that the demographic segments that were upgrading to super premium food were less focused on Supplies, so the impact was negligible. Supplies Spending continued to grow. That brings us to mid-2018. What comes next?

A new food trend may be starting but the lift may be minimal in 2018. Of bigger concern is inflation. Supplies prices turned up in May and by year end had increased +2.3%. We have not seen anything like this since the pre-recession, price glory days of 2009 when prices increased (+3.2%). Unless price sensitivity has gone away, this does not bode well for Supplies spending in the second half of 2018. We will have to wait and see. We’ll get the data in September.