U.S. Pet Services Spending (Non-Vet) $7.87B (↑$1.3B): 2018 Mid-Yr Update

The US BLS just released their Mid-Year Update of the Consumer Expenditure Survey covering the period 7/1/2017 to 6/30/2018. In our analysis of Pet Supplies Spending we saw that it remained “gold”. Spending was up across virtually every demographic segment for the second consecutive year. Pet Food Spending was also strong for the year but growth had slowed significantly in the first half of 2018. Now we turn our attention to Pet Services. The Mid-year numbers show that spending in this segment was $7.87B, up $1.30B (+19.9%) from the previous year. This segment is known for consistent, albeit small increments of growth. In 2017 spending fell 4% at mid-year and was down 1% for the year. This was the first decline in any 12-month period in 4 years and the first annual decline since 2011. Then, driven by a spectacular 1st half of 2018, Services rebounded with literally the single biggest $ increase in history. This deserves a closer look. First, we’ll review recent Services spending history.

Here are the Mid-Year 2018 Specifics:

- Mid-Year 2018 vs Mid-Year 2017: ↑$1.30B (+19.9%)

- Jul > Dec 2017: ↑$0.20B

- Jan > Jun 2018: ↑$1.10B

Pet Services is by far the smallest industry segment. However, except for 2010 and 2011, the period immediately following the Great Recession, it had consistent annual growth from 2000 through 2016. Spending in Food and Supplies have been on a roller coaster ride during that period. Service Spending more than tripled from 2000 to 2016, with an average annual growth rate of 7.6%. Spending in the Services Segment is the most discretionary in the industry and is more strongly skewed towards higher income households. Prior to the great recession, the inflation rate averaged 3.9% with no negative impact. The recession affected every industry segment, including Services. Consumers became more value conscious, especially in terms of discretionary spending. Services saw a slight drop in spending in both 2010 and 2011, but then the inflation rate fell to the 2+% range and the segment returned to more “normal” spending behavior. In mid-2016 inflation dropped below 2% and continued down to 1.1% by the end of 2017. This was primarily due to increased competition from free standing businesses but also an increase in the number of Pet Stores and Veterinary Clinics offering pet services. While prices still went up slightly, there were deals to be had and consumers shopped for the best price. There was no change in purchase frequency. Consumers just paid less. There are 2 periods on the chart which best illustrate the impact of this behavior. In the 1st half of 2013, inflation fell to 0.7% and spending decreased by -$0.44B. In the first half of 2017, inflation dropped to a record low 0.4% and spending fell -$0.28B. Obviously, some inflation is necessary in Services. In the 2nd half of 2017 spending turned up again. That brings us to the huge $1.1B lift in 2018. This is unprecedented. Only increased purchase frequency and and/or deeper market penetration could have produced this spectacular increase.

Let’s take a closer look at some spending demographics – Age and Income.

In the graphs that follow we will compare spending for the Mid-year 12 months ending 6/30/18 to the previous period ending 6/30/17. In our graphs we will also include the 2017 yearend $pending. This will also allow you to see the spending changes in the 2nd half of 2017 and the 1st half of 2018.

The first graph is for Income, the single most important factor in increased Pet Spending, especially in Services. Here’s how you get the change for each half using the Over $70K group as an example:

- Mid-yr Total Spending Change: $5.62B – $4.53B = Up $1.09B (Note green outline = increase; red outline = decrease)

- 2nd half of 2017: Subtract Mid-17 ($4.53B) from Total 2017 ($4.82B) = Spending was up $0.29B in 2nd half of 2017.

- 1st half of 2018: Subtract Total 2017 ($4.82B) from Mid-18 ($5.62B) = Spending was up $0.80B in 1st half of 2018.

- Both the Over and Under $70K groups had a 12-month spending increase. However, Over $70K was responsible for 84% of the $1.3B national lift. The Under $70K group decreased spending in the 2nd half of 2017 so their overall increase was produced solely by a big lift in the 1st half of 2018.

- The individual groups over $70K all showed growth in both halves. The over $150K had a minimal increase in the second half of 2017 but made up for it with a big lift in 2018. This group is also growing in CU’s, up +13.8%.

- The lower income, $30>50K group had the only 12-month spending decrease, which was driven down by a drop in the 2nd half of 2017. The $50>70K group mirrored this pattern but their 2018 lift was enough to put them on the plus side. These groups caused the 2nd half spending drop in under $70K. Both had a big lift in Pet Food Spending during that time so they either found great values or cut back on discretionary spending.

- Perhaps the most significant fact on the chart is somewhat “hidden”. If you look closely, you will see that every income group, from top to bottom, posted an increase in Services spending in the 1st half of 2018. In the industry segment that is most driven by income, this is a truly rare occurrence. Something was happening.

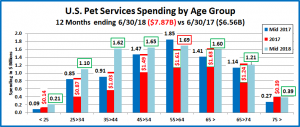

Now, Services’ Spending by Age Group.

- The overall spending lift is being driven by the under 54 group, especially the 35>44-year olds. All of these groups had a small increase in the last half of 2017 followed by a big jump in spending in 2018.

- The over 65 group also increased overall spending, but their lift occurred in the 2nd half of 2017. Spending actually fell in 2018. Retirees had a big lift in Pet Food spending in 2018 so the drop may be the result of trading $.

- The 55>64-year-old Baby Boomers had the only decrease in Services spending. It was driven down by a sharp drop in the 2nd half of 2017. This corresponds with a movement to upgrade Pet Food by a substantial portion of this group. Their Services spending bounced back in the 1st half of 2018, but they may be in danger of losing the overall lead in Services spending to the 45>54-year olds. Their lead is down to $0.04B. ($1.69B to $1.65B)

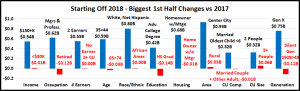

Now let’s look at what is happening in Pet Services spending at the start of 2018 across the whole range of demographics. In our final chart we will list the biggest $ moves, up and down by individual segments in 11 demographic categories. Remember, the increase in the 1st half of 2018 was $1.1B, much more than the $0.2B in the 2nd half of 2017.

The first thing that is readily apparent is that the increases dominate. The decreases are minor. In fact, in 5 demographic categories all segments increased Services spending. It is actually even better than that. Only 7 of 82 individual demographic segments spent less on Services in the 1st half of 2018. That means that 94% spent more. That is a strong indication that the Services segment is making a deeper penetration into the market. Further evidence is that Services spending increased or held their ground in all segments in these 4 critical categories:

- Income

- Race/Ethnic

- Area (Rural>City)

- CU Size

At the same time, the importance of high income to significant increases in Services spending is also right out front. The “winners” group is a virtual list of demographic groups with high income. Including:

- $150+K Income

- Mgrs & Professionals

- 2 Earners

- 35>44 year olds (#2 Income)

- White, Not Hispanic

- Advanced College Degree

- Homeowner w/Mtge

- Gen X (#1 income)

We also see a definite connection in some of the “losing” groups. Retirees, 65>74-year olds, Homeowners without mortgages and the Silent Generation are all related in that they are primarily older Americans.

There are 2 other winners that deserve some notice – Center City and Married Couples with an oldest child under 6. Both of these segments had the biggest $ increase in their category and are also the top performers in terms of share of spending vs share of CU’s. Both demonstrate the “convenience” appeal of Pet Services, even in the younger groups.

So, what happened to cause the record lift in Services spending in the 1st half of 2018 and what comes next? We have noted the number of outlets offering Pet Services has radically increased. This created a highly competitive market and the inflation rate dropped to near record lows. Today’s value conscious consumers saw that deals were available, and they took advantage of the situation. However, they didn’t increase the frequency of purchase. They just paid less. This drove overall Pet Services spending down in the 1st half of 2017. The segment started to recover in the 2nd half but not enough to prevent the first annual decrease in Pet Services spending since 2011. However, it was a start. In 2018, consumers started to recognize the convenience offered by more outlets. The latest big food upgrade was also winding down. The result was that Services started a deeper penetration into the market. Much of it was in their existing prime segments, but it also spread to some lower income groups. The result – a $1.1B explosion in Pet Services spending.

Will this continue? What can we expect in the 2nd half of 2018? We can’t say for sure, but inflation could be a factor. Services prices turned up sharply in May 2018, +2.5% in 1 month. By year end the CPI was up +3.4%. This is a pre-recession rate. The last time we saw this was 2011. At that time, post-recession, value driven consumers rejected it and spending fell -7.2%. High income groups may not be affected by the price increase. We’ll see if it impacted other segments and total Services $pending.