U.S. PET FOOD SPENDING $37.96B (↑$9.06B): MID-YEAR 2020 UPDATE

Overview of Pandemic Impact on the Survey & Data

The Pandemic has had a tremendous impact on consumers. It also impacted information gathering, including the Consumer Expenditure Survey which is managed by the US BLS and conducted by Census Bureau personnel. After March 8th nothing was done in person. In person Interviews moved online or to phone calls. Hard copy diaries were no longer collected. This process was also moved online or to phone calls where consumers read their diaries to agents over the phone. This had little impact on the interview reports. Initially there was a 5% drop in the response rate but that soon returned to normal. The Diary collection was a different story. The response rate plummeted by 50%. The US BLS immediately added additional households to the survey to make up for nonrespondents. Things improved as consumers and workers adjusted to the new normal, but the initial months were difficult. Through conscientious selection of participants, the US BLS was able to generate unbiased results. The variation for Total Spending in the 2020 report was 0.94% which is actually better than 2019’s 1.2%. That’s not to say that there were not some exceptions. Pet Food was one. The variation is within acceptable levels but is still substantially higher than 2019. We will address this in the Pet Food spending report that follows.

To put Pet Food spending into better perspective, let’s look at the impact of COVID on Consumer income & spending.

INCOME – Avg CU income $83.9K, +3.3%; 61% of the increase did occur in the 2nd half of 2019.

- Total U.S. Income – $11.0T, Up $318B (+3.0%); 2nd Half 2019 was +$254B; 1st Half 2020 was +$64B.

SPENDING – Avg CU Spending – $61.7K, Down -1.1%; 2nd Half 2019 was +1.0%; 1st Half 2020 was -2.0%

- Total U.S. Spending – $8.1T, Down $116B (-1.4%); 2nd Half 2019 was +$108B; 1st Half 2020 was -$224B.

#CUs – 131.4M, Down 403K, -0.3% from a year ago but down 873K, -0.7% from the yearend 2019 all-time high of 132.2M. The onset of the Pandemic slowed the increased in income, but spending flipped negative, which is not unexpected.

Now Pet Food Spending

The report shows Pet Food (& Treat) Annual Spending at $37.96B, up $9.06B (+31.4%). The following charts and observations were prepared from calculations based upon data from that report and earlier ones. The first chart will help put the $37.96B into historical perspective and truly show you the roller coaster ride that is Pet Food Spending.

Here are the current numbers:

- Mid 2020: $37.96B; ↑$9.06B (+31.4%) from Mid-2019. The net +$9.06B in Mid 2020 came from:

- Jul>Dec 2019: Up $2.30B from

- Jan>Jun 2020: Up $6.76B from 2019.

Historical research has shown that Pet Food spending has been on a roller coaster since 2000, with 2 years up, followed by a flat or even declining year. This up and down “ride” has been driven by a succession of Food trends. The most recent were “Natural” in 2011 and “Super Premium” in 2014. Another factor was added in 2013 – deflation. As consumers opted for higher quality, more expensive pet food, competition became more intense, with the Internet now becoming a key player. 2013 was a definitely a game changer for this segment as it began an extended period of deflation which continued through 2018. Midway through 2018, Pet Food prices were still 2.3% lower than in 2013.

The spending drops in 2013 and 2016 were driven by pet parents value shopping for their recently upgraded pet food.

As it turns out, 2014 brought out yet another new factor in Pet Food spending. For over 30 years Baby Boomers have been the leaders in the Pet Food, both in spending and in adopting new products. They still spend the most, but it turns out that the 25>34 year old Millennials led the movement to Super Premium in late 2014. The older groups, especially Boomers followed in 2015 and spending rose $5.4B. At the same time, the Pet Food spending of the 25>34 yr olds dropped. At first, we thought they had rolled back their upgrade. However, it turns out they were leading the way in another element of the trend to Super Premium – value shopping. The Boomers once again followed their lead and spending fell -$2.99B in 2016. For consumers, the Super Premium upgrade movement consisted of 3 stages:

- Trial – The consumer considers the benefits vs the high price and decides to try it out. Usually from a retail outlet.

- Commitment – After a period of time, the consumer is satisfied and is committed to the food.

- Value Shop – After commitment, the “driver” is to find a cheaper price! – The Internet, Mass Market, Private label

This brought us to 2017. Time for a new “must have” trend. That didn’t happen but the competitive pricing situation brought about another change. Recent food trends have been driven by the higher income and higher education demographics. However, the “value” of Super Premium was established and now more “available”. Blue Collar workers led a new wave of spending, +$4.6B, as Super Premium more deeply penetrated the market. After the big lift in 2017, 2018 started off slowly, +$0.25B. Then came the FDA warning on grain free dog food. Many of the recent Super Premium converts immediately rolled back their upgrade and spending fell -$2.51B. This 2018 decrease broke a 20 year spending pattern. In the 1st half of 2019, Pet Food spending remained stable at the new lower level. In the second half of 2019 we started to see a recovery from the overreaction to the FDA warning and spending increased by $2.3B. Then came 2020. The recovery was continuing but a new outside influence was added which had a massive impact on U.S. consumers – the COVID-19 pandemic. In March nonessential businesses were closed. This also produced a wave of panic buying in some truly essential product categories. In the Pet Industry there is only 1 truly essential category – Pet Food. Coupled with the FDA “recovery” and the ongoing movement to Super Premium, this produced an incredible $6.76B lift in Pet Food Spending in the 1st half of 2020.

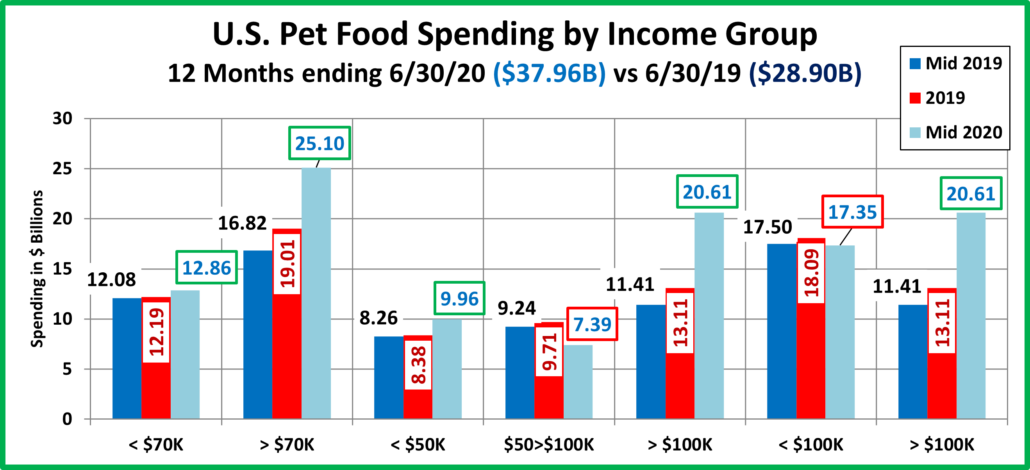

Let’s look at Pet Food spending by the 2 most popular demographic measures – age & income. The graphs are divided into larger groups than usual. This helps to mitigate any reporting anomalies. They still show both the current and previous 12 months $ as well as 2019 yearend. This will allow you to track the spending changes between halves.

The first graph is Income, which has been shown to be the single most important factor in increased Pet Spending. Here’s how you get the change for each half using the $70K+ group as an example:

$70K+ Mid-yr Total Spending Change: $25.10B – $16.82B = Up $8.28B (green outline = increase; red outline = decrease)

- 2nd half of 2019: Subtract Mid-19 ($16.82) from Total 2019 ($19.01B) = Spending was up $2.19B in 2nd half of 2019.

- 1st half of 2020: Subtract Total 2019 ($19.01B) from Mid-20 ($25.10B) = Spending was up $6.09B in 1st half of 2020.

- We see 2 distinct spending patterns. Both have a small increase in the 2nd half of 2019 which is then followed either by a bigger lift or a drop in the 1st half of 2020. The $50>$100K group is the driving force behind the 1st half drop and it was big enough to bring the whole <$100K group down.

- Perhaps the most obvious fact is the spending disparity due to income. Prior to the Super Premium era, $70K was the “halfway point” in Pet Food spending. In 2013 the under $70K group accounted for 67.8% of CUs and 51.3% of Pet Food spending (Performance: Share $/Share CUs = 75.7%). In the Mid-year 2019 report they had fallen to 59.1% of CUs and 41.8% of Pet Food $ (Performance = 70.7%). In this year’s report their share of CUs continued to drop to 57.0% but their share of Pet Food $ plummeted to 33.9% (Performance = 59.5%). Today’s true halfway point is probably about $120K but I added an under/over $100K measurement to get closer to the halfway point.

- < $70K > Surprisingly, the Pet Food spending patterns for both groups are the same. Both show a small lift in the second half of 2019 as spending begins to recover from the negative impact of the FDA warning. A larger lift then happens in the 1st half of 2019. The FDA recovery continued but we also see the panic spending due to the onset of the pandemic. Obviously, this binge buying came mostly from higher incomes, who could more easily afford it.

- < $50K This lowest income group closely matches the spending pattern of the highest income, $100K+ group. While income is increasingly becoming the most important factor in Pet Food Spending, it is not the only factor.

- $50 > $100K – This middle income group was going along fine, recovering from the FDA warning in the 2nd half of 2019. Then came the pandemic and their spending dropped in the 1st half of 2020. The -$2.31B decrease was big enough to drive their spending for the 12 month period down -$1.85B (-20.0%). Based upon the numbers for <$70K and <$50K groups this drop in spending was equally divided between $50>$70K and $70>$100K. Even in “normal” times these low to middle income groups face a lot of pressure trying balance their manifold responsibilities with their take home pay.

- $100K+ High income is increasingly becoming “where it’s at” in all Pet Spending. In Mid-2020, it went through the roof for Pet Food, +$9.2B (+80.6%). This is where the binge buying of Super Premium Foods happened.

- < $100K > Although the actual halfway point for this year’s Pet Food spending is probably about $120K, $100K is much closer than $70K. The $100K+ group has 28.3% of CUs but 54.3% of Food $. (Performance = 191.9%) That’s great performance but 1 year ago it was 149.0%, which is not too bad. If we go back to 2013, the $100K+ group had 18.3% of CUs and 28.7% of Pet Food $. (Performance = $156.3%) This shows that the spending pattern has always been there. However, the single biggest factor is the growth in number of CUs. Since 2013 that has increased by 14.1 million, +61.4%. When you break the $100K income barrier, you spend more on your pets and Super Premium Pet Foods are a great “opportunity” for your added disposable income.

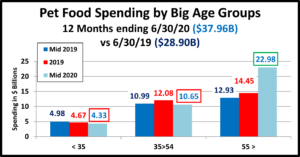

Now let’s look at Pet Food spending by Age Group.

Once again, we have bundled segments into larger groups to mitigate the impact of any larger percentages of variation that may be present in smaller segments.

- We have 3 groups and 3 different patterns so age has a definite impact on spending behavior.

- Under 35 – This group had a -$0.65B (-13.1%) drop in spending. The drop was basically equal in both halves of the 12 month period. However, most was driven by the <25 group, especially in the 1st half of 2020. Both the 25>34 and <25 groups spent a little less per CU, which may be due to value shopping, but the decline in spending was primarily due to a 2 million decrease in <25 CUs. 83% of this drop (1.7M) occurred in the 1st half of 2020. They likely moved back home with their parents and took their pets with them. This would explain part of the big lift in the 55+ group. Also, the 55+ yr olds likely spent more on premium foods.

- 35 > 54 – This is the highest income group, but they also have the highest level of career and family responsibilities. They were finishing their FDA recovery in the 2nd half of 2019, +$1.09B. Then came COVID and Pet Food $ dropped -$1.43B. Their income was unaffected, but they dialed back their total CU spending by 2.7% and Pet Food by 11.6%. Much of the 1st half pet food drop was undoubtedly due to value shopping, likely on the internet.

- 55 and older – This group, which includes all Baby Boomers, had a spending lift in both halves. The $1.52B increase in the second half of 2019 was largely driven by the ongoing recovery from the FDA warning. The spectacular $8.53B lift in the 1st half of 2020 came from a variety of factors. First and foremost was undoubtedly the panic buying of Super Premium pet foods. Remember, these are primarily Baby Boomers, the first Pet Parents. This type of reaction is to be expected. The other factors were a 2.1 million (+4%) increase in CUs and the 2+ million younger CUs who probably moved back home with their parents, bringing their pets with them. The increase was driven by the 55>64 year olds who have the highest income and were best able to handle the situation.

- Spending in the under 55 group was up slightly in the 2nd half of 2019 but down in the 1st half of 2020. The over 55 group was up in both halves and were the only driver of the massive 1st half increase.

That gives us the “big picture” for our 2020 Mid-year update of Pet Food spending. In a “normal” year we would drill down into the performance of individual segments. However, the variations caused by the initial pandemic information gathering problems show up in individual segments, especially smaller ones. This has less impact on the total numbers but makes comparing segment performance within categories difficult.

The big lift in the 1st half of 2020 may be a little overstated but it comes as no surprise. We all saw pictures of empty shelves from consumers panic buying certain essential items. In the Pet Industry there is no more essential item than Pet Food and the current preference is for Super Premium. It isn’t called Super Premium for no reason. It costs a lot and usually comes in smaller quantities so stocking for a possible emergency can mean spending big bucks.

It also is no surprise that Boomers are behind the big lift. Their unwavering devotion to their Pet Children is what largely built today’s Pet Industry. In my research of the data, I came across an interesting correlation. The overall variation in sampling for Pet Food spending was within acceptable guidelines. The problem showed up in some individual segments.

Here are a few with exceptionally high Pet Food spending and high variation:

- 55>64 Yr olds (Boomers)

- Married Couple, oldest child over 18

- Self-Employed

- 2 Earners

- Income $100>150K

- Live in area <2500 pop.

Based upon our past knowledge, a CU with these characteristics is basically the ultimate Pet Food spending household. These are Super Pet Parents. They are beyond conscientious regarding their pets so it would be expected that they would be the mostly likely to respond to a survey conducted under the difficult circumstances caused by the pandemic. This could give their big $ Pet Food spending a disproportionate share of the sample and significantly drive up the mean. We should also note that this big variation was in Pet Food and not widespread in their responses. The variation in Total Spending was low for these segments with a high of 3.27%. All others were below 2.5%. This means that the US BLS and Census Bureau successfully conducted a survey that was demographically representative with no overall bias. The pet food spending may be a little high, but it is extremely likely that there was a big lift in the 1st half of 2020.

We are left with the usual answer in the Pet Industry…It was the Boomers. They get the credit for the big lift and possibly the “blame” for the big variation.

Even with new techniques, the sampling response returned to a more normal level in the 2nd half of 2020. We look forward to seeing the full year data for 2020 in September.

Trackbacks & Pingbacks

[…] Pet food stuff expending by U.S. customers elevated by more than 31% yr around calendar year (YOY) by mid-2020, in accordance to data from the U.S. Bureau of Labor Statistics (BLS) documented and analyzed by John Gibbons, aka the Pet Business Professor. […]

[…] Pet food spending by U.S. consumers increased by more than 31% year over year (YOY) by mid-2020, according to data from the U.S. Bureau of Labor Statistics (BLS) reported and analyzed by John Gibbons, aka the Pet Business Professor. […]

Comments are closed.