U.S. Pet Services Spending (Non-Vet) $10.87B (↑$3.43B): 2022 Mid-Year Update

In our analysis of Pet Food & Supplies Spending, we saw strong growth in the 2nd half of 2021 which sent Supplies to a record high and returned Food to near its Pandemic binge high. Both had continued but slowed growth in early 2022. Strong inflation may have been a factor. Now we turn our attention to Pet Services. The Mid-year numbers show that spending in this segment was $10.87B, up $3.43B (+46.2%) from the previous year. Up until 2018, this segment was known for consistent, small growth. In 2018, increased outlets and competitive prices brought on a wave of new users and spending increased +$1.95B. Spending remained near this new high normal until we reached 2020. Closures due to the pandemic drove spending down $1.73B by yearend, essentially returning to the level of 2017. In 2021 things opened up and spending began to rebound. This deserves a closer look. First, we’ll look at Services spending history since 2014.

Here are the 2022 Mid-Yr Details:

Mid-Year 2022: $10.87B; ↑$3.43B (+46.2%) vs Mid-Yr 2021

Jul > Dec 2021: ↑$1.66B

Jan > Jun 2022: ↑$1.77B

Pet Services is by far the smallest industry segment. However, except for 2010 and 2011, the period immediately following the Great Recession, it had consistent annual growth from 2000 through 2016. Spending in Food and Supplies have been on a roller coaster ride during that period. Services Spending more than tripled from 2000 to 2016, with an average annual growth rate of 7.6%. Spending in the Services Segment is the most discretionary in the industry and is more strongly skewed towards higher income households. Prior to the great recession, the inflation rate averaged 3.9% with no negative impact. The recession affected every industry segment, including Services. Consumers became more value conscious, especially in terms of discretionary spending. Services saw a slight drop in spending in both 2010 and 2011, but then the inflation rate fell to the 2+% range and the segment returned to more “normal” spending behavior. In mid-2016 inflation dropped below 2% and continued down to 1.1% by the end of 2017. This was primarily due to increased competition from free-standing businesses but also an increase in the number of Pet Stores and Veterinary Clinics offering pet services. While prices still went up slightly, there were deals to be had and consumers shopped for the best price. There was no decrease in purchase frequency. Consumers just paid less so spending fell slightly. In the 2nd half of 2017 spending turned up again. More Consumers began to take advantage of the value and convenience of the increased number of outlets offering Services. This deeper market penetration caused Services Spending to take off in 2018, up $1.95B, the biggest annual increase in history. Prices turned up again in the 1st half of 2019, +2.8% from 2018. However, Services spending inched up $0.09B. In the 2nd half of 2019 consumers Value Shopped again so spending fell -$0.19B. Then came 2020 and the pandemic. Many of these nonessential businesses were forced to close and spending fell precipitously, -$1.73B to $6.89B, about the same as yearend 2017. In 2021 things opened up again and spending bounced back, +$0.55B vs the 1st 6 months of 2020. Unlike Food and Supplies the increase continued to accelerate even into 2022, despite an inflation rate of 6+%. This produced a record 12-month increase and a new record high, $10.87B.

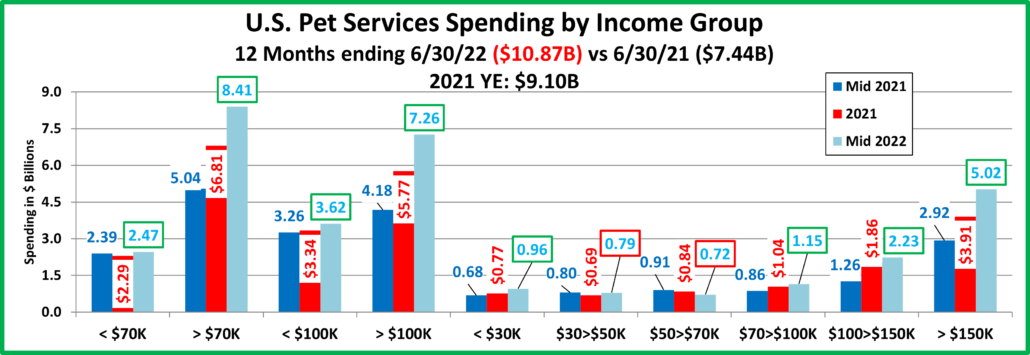

Let’s take a closer look at some key spending demographics – Age and Income.

In the graphs that follow we compare spending for the 12 months ending 6/30/22 to the previous 12 months. The graphs also include the 2021 yearend $, so you can see spending changes in the 2nd half of 2021 and the 1st half of 2022.

The first graph is for Income, the single most important factor in increased Pet Spending, especially in Services.

Here’s how you get the change for each half using the Over $70K group as an example:

Mid-yr Total Spending Change: $8.41B – $5.04B = Up +$3.37B (Note green outline = increase; red outline = decrease)

- 2nd half of 2021: Subtract Mid-21 ($5.04B) from Total 2021 ($6.81B) = Spending was up $1.77B in 2nd half of 2021.

- 1st half of 2022: Subtract Total 2021 ($6.81B) from Mid-22 ($8.41B) = Spending was up +$1.60B in 1st half of 2022.

- With the Over/Under $100K measurement, you see how Services Spending is definitely skewed towards higher incomes. The halfway spending point is about $141K so about 20% of CUs spend 50% of Services $. However, spending in both the under & over $100K groups grew in both halves.

- All groups $70K> had steady growth. The <$70K groups had basically 2 different patterns. Surprisingly, the <$30K had growth in both halves. The $30>70K groups had decreased spending despite a 2022 lift by $30>50K.

- The $50>70K group had the worst performance. They had the biggest decrease, -20.9% and decreases in both halves. In fact, they were the only segment with decreased spending in the 1st half of 2022.

- The over $150K group has 16.7% of the CUs but accounts for 46.2% of Services $. This is actually a much larger share than the 37.6% that they had in pre-pandemic 2019. The pandemic has increased the importance of this group.

- Income, especially when it is over $150K, is by far the biggest factor in the discretionary spending in the Services segment so Services spending is more unbalanced in regard to income. The highest income groups are more driven by convenience than value so high inflation rates are likely to actually increase spending because of higher prices.

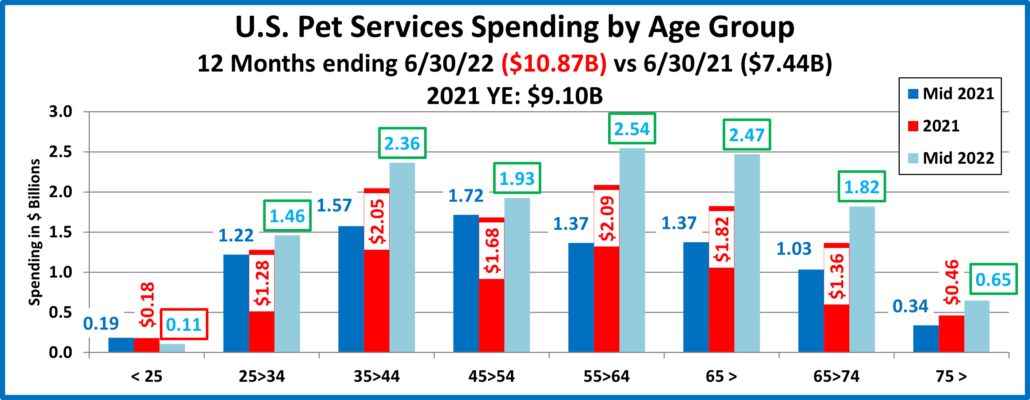

Now, Services’ Spending by Age Group.

- Basically the <25 yr-olds spent less while everyone else spent more. Their spending fell slightly in both halves.

- The 55>64 group had the biggest increase, up +$1.17B (+85.4%) and held on to the top spot in Services spending.

- The 35>44 yr-olds spent +$0.79B more (+50.3%) and held on to the 2nd spot in spending.

- The 45>54 yr olds had a small increase despite a drop in the 2nd half of 2021. They are #3. In Mid-2021 they were #1.

- Although their lift was small this year, 25>34 yr-olds are the only group with consecutive mid-year increases.

- The 65> groups were up $1.1B (+80.3%) with lifts in both halves, including a +$0.65B increase in the 1st half of 2022. The 65>74 yr-old Baby Boomers led the way – No Surprise.

- All groups but <25 had a spending lift in the 1st half of 2022, a big change from Food & Supplies.

Now let’s look at what is happening in Pet Services spending at the start of 2022 across the whole range of demographics. In our final chart we will list the biggest $ moves, up and down by individual segments in 12 demographic categories. Remember, the lift in the 1st half of 2022 was +$1.77B vs 2021 and +$2.32B vs 2020.

2022 has started even better than 2021 as spending continues to grow. In 5 categories all segments spent more. Last year, only all income segments spent more. In 2020, there were 4 categories in which all segments spent less on Services. Also, the $ changes from the winners are overwhelmingly larger than the negatives of the losers. The +$1.77B increase in Pet Services came from 74 of 82 demographic segments (90%) spending more. Last year it was 78% and in 2020, 88% spent less. The strong recovery has become a growth tsunami, +58% from 2020 and even +23% from 2019.

The usual winners have overwhelmingly returned with only 2 minor surprises

- The South

- Tie: 55>64 & 65>74

Virtually all of the Losers were also expected. Here are the surprises:

- Gen X

- Northeast

The older groups, specifically Baby Boomers are driving the 1st half lift. The 55>74 yr-olds are essentially all Boomers. Most Boomer CUs are 2 people, with no kids. The younger groups had the best performance in the 1st half of 2021 and 2020. It appears that the Baby Boomers have at least briefly “taken back the torch”.

Services $ are at a record high and growing. Let’s review how we got to this point and speculate on what comes next.

Except for the trauma caused by the Great Recession which hit Services in 2010>11, from 2000 to 2016 the Services segment had slow but consistent growth. The number of outlets also was increasing. Services were gaining in popularity and many retail pet stores were looking for a competitive edge over the growing pet product sales of online retailers. Afterall, you can buy product, but you can’t get your dog groomed on the internet. By 2017 the number of outlets offering Pet Services had radically increased. This created a highly competitive market and the inflation rate dropped to near record lows. Value conscious consumers saw that deals were available, and they took advantage of the situation. However, they didn’t increase the frequency of purchase. They just paid less. This drove overall Pet Services spending down in the 1st half of 2017. The segment started to recover in the 2nd half but not enough to prevent the first annual decrease in Pet Services spending since 2011. However, it was a start. In 2018, more consumers started to recognize the convenience offered by more outlets. The latest big food upgrade was also winding down. The result was that Services started a deeper penetration into the market, especially in the younger groups. The <45 groups spent $1.47B more on Services in 2018, 74% of the total $1.95B increase in the segment. After such a big lift, a slight downturn in 2019 was not unexpected and it happened, -$0.1B. Then came 2020 and COVID. Although the consumer use of Services was becoming increasingly widespread, many Services outlets were deemed nonessential and were subject to pandemic restrictions and closures. Services Spending fell -$1.73B (-20.1%) in 2020 and nearly wiped out the big gain made in 2018.

In 2021, things opened up and Services spending began to rebound with a +$0.55B lift in the 1st half. This lift accelerated in the 2nd half and even the 1st half of 2022. Spending reached a new record high of $10.87B, with an annual growth rate of 7.3% since mid-yr 2019. That’s 43% higher than the 5.1% rate from 2009 to 2019. Pet Services have become an important option that is exercised by an increasing number of Pet Parents. However, much of the growth is increasingly being driven by higher incomes. There is some good news in this trend. Higher incomes are less negatively impacted by strong inflation. They buy the same amount, just pay more. This means that Services $ are likely to continue to grow.