Petflation 2024 – October Update: Slows to +2.0% vs 2023

The monthly Consumer Price Index peaked back in June 2022 at 9.1% then began to slow until turning up in Jul/Aug 2023. Prices fell in Oct>Dec 23, then turned up Jan>Oct 24. With a 0.1% increase in prices from last month, the CPI rose in October to +2.6% from +2.4% in September. Grocery prices rose 0.1% from September but inflation slowed to 1.1%. After 12 straight months of double-digit YOY monthly increases, grocery inflation has now had 20 consecutive months below 10%. As we have learned, even minor price changes can affect consumer pet spending, especially in the discretionary pet segments, so we will continue to publish monthly reports to track petflation as it evolves in the market.

Petflation was +4.1% in December 2021 while the overall CPI was +7.0%. The gap narrowed as Petflation accelerated and reached 96.7% of the national rate in June 2022. National inflation has slowed considerably since June 2022, but Petflation generally increased until June 2023. It passed the National CPI in July 22 but fell below it from Apr>Jul 24. It exceeded the CPI in August, but Sep>Oct are again below it. We will look deeper into the data. The reports will include:

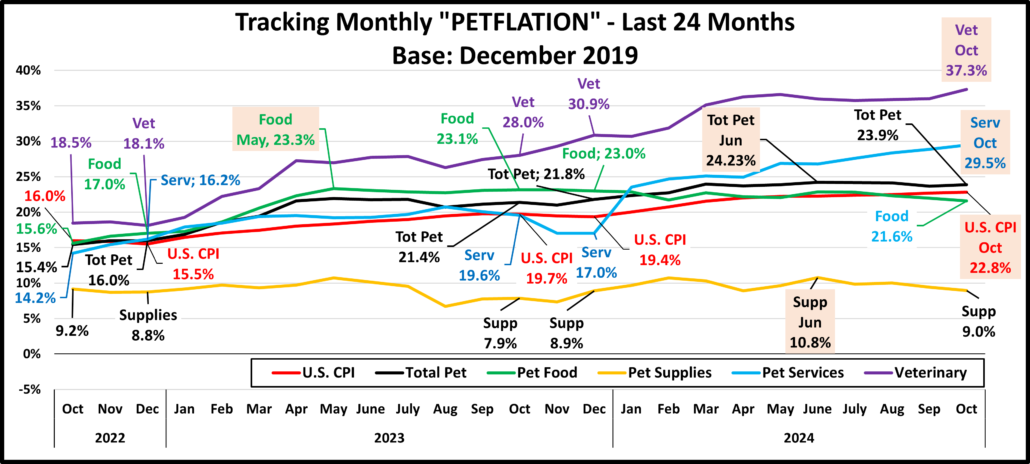

- A rolling 24 month tracking of the CPI for all pet segments and the national CPI. The base number will be pre-pandemic December 2019 in this and future reports, which will facilitate comparisons.

- Monthly comparisons of 24 vs 23 which will include Pet Segments and relevant Human spending categories. Plus

- CPI change from the previous month.

- Inflation changes for recent years (22>23, 21>22, 20>21, 19>20, 18>19)

- Total Inflation for the current month in 2024 vs 2019 and vs 2021 to see the full inflation surge.

- Average annual Year Over Year inflation rate from 2019 to 2024

- YTD comparisons

- YTD numbers for the monthly comparisons #2>4 above

In our first graph we will track the monthly change in prices for the 24 months from Oct. 22 to Oct. 24. We will use December 2019 as a base number so we can track the progress from pre-pandemic times through an eventual recovery. This chart is designed to give you a visual image of the flow of pricing. You can see the similarities and differences in segment patterns and compare them to the overall U.S. CPI. The year-end numbers and those from 12 and 24 months earlier are included. We also included and highlighted (pink) the cumulative price peak for each segment. In Oct., Pet prices were up 0.2% from Sep. The price lift was driven by Pet & Vet Services. The Product segments were both down.

In October 22, the CPI was +16.0% and Pet was +15.4%. Prices in the Services segments generally inflated after mid-2020, while Product inflation stayed low until late 21. In 22 Petflation surged. Food prices consistently grew but the others had mixed patterns until July 22, when all increased. In Aug>Oct Petflation took off. In Nov>Dec, Services & Food prices grew while Vet & Supplies prices stabilized. In Jan>Apr 23, prices grew every month for all segments except for 1 dip by Supplies. In May Products prices grew while Services slowed. In Jun/Jul this reversed. In Aug all but Services fell. In Sep/Oct this flipped. In Nov, all but Food & Vet fell. In Dec, Supp. & Vet drove prices up. In Jan>Mar 24 Pet prices grew despite a few drops. In April, prices in all but Vet fell. In May, all but Food grew. In June, Products drove a lift. In July, all but Services fell. In August, Food drove a drop in prices. In Sep, Products fueled a drop. In Oct, Services drove a lift.

- U.S. CPI – The inflation rate was below 2% through 2020. It turned up in January 21 and continued to grow until flattening out in Jul>Dec 22. Prices turned up Jan>Sep 23, dipped in Oct>Dec, then rose Jan>Oct 24, but 31.6% of the 22.8% increase in the 58 months since Dec 2019 happened from Jan>Jun 2022 – 10.3% of the time.

- Pet Food – Prices were at Dec 19 levels from Apr 20>Sep 21. They grew & peaked in May 23. In Jun>Aug they fell, grew Sep>Nov, fell Dec>Feb, rose in Mar, fell Apr>May, grew in June, fell in Jul>Oct. 99% of the lift was in 22/23.

- Pet Supplies – Supplies prices were high in Dec 19 due to tariffs. They had a “deflated” roller coaster ride until mid-21 when they returned to Dec 19 prices & essentially stayed there until 22. They turned up in Jan and hit a record high, beating 2009. They plateaued Feb>May, grew in June, flattened in July, then turned up in Aug>Oct to a new record. Prices stabilized in Nov>Dec but grew in Jan>Feb 23. They fell in Mar, but set a new record in May. The rollercoaster continued with Dec>Feb lifts, Mar/Apr drops, May/Jun lifts, July drop, Aug lift & Sep/Oct drops.

- Pet Services– Inflation is usually 2+%. Perhaps due to closures, prices increased at a lower rate in 2020. In 2021 consumer demand increased but with fewer outlets. Inflation grew in 21 with the biggest lift in Jan>Apr. Inflation was strong in 22 but prices got on a rollercoaster in Mar>Jun. They turned up Jul to Mar 23 but the rate slowed in April and prices fell in May. Jun>Aug: ↑, Sep>Dec: ↓, Jan>Mar 24: ↑, Apr: ↓, May: ↑, June: ↓, Jul>Oct: ↑.

- Veterinary – Inflation has been consistent. Prices turned up in Mar 20 and grew through 21. A surge began in Dec 21 which put them above the overall CPI. In May 22 prices fell and stabilized in June causing them to fall below the CPI. However, prices rose again and despite some dips they have stayed above the CPI since July 22. In 23>24 prices grew Jan>May, leveled Jun/Jul, fell Aug, grew Sep>Dec, fell Jan, grew Feb>May, fell Jun>Jul, grew Aug>Oct.

- Total Pet – Petflation is a sum of the segments. In Dec 21 the price surge began. In Mar>Jun 22 the segments had ups & downs, but Petflation grew again from Jul>Nov. It slowed in Dec, grew Jan>May 23 (peak), fell Jun>Aug, grew in Sep/Oct, then fell in Nov. In December prices turned up and grew through March 24 to a record high. Prices fell in April, rose May>June (a record), fell Jul>Sep, rose in Oct, but Petflation is still below the U.S. CPI.

Next, we’ll turn our attention to the Year Over Year inflation rate change for October and compare it to last month, last year and to previous years. We will also show total inflation from 21>24 & 19>24. Petflation fell to 2.0%, from 2.1% in September, and it is again below the National rate (-13.1%). In August, it was +12.0%. The chart will allow you to compare the inflation rates of 23>24 to 22>23 and other years but also see how much of the total inflation since 2019 came from the current pricing surge. We’ve included some human categories to put the pet numbers into perspective.

Overall, prices were up 0.1% from September and were +2.6% vs Oct 23, up from +2.4% last month. Grocery inflation slowed to +1.1% from 1.3%. Only 2 had price decreases from last month – Pet Food and Pet Supplies. There were 3 drops in Aug & Sep, but 5 in July. The national YOY monthly CPI rate of 2.6% is up from 2.4%, but it is 19% below the 22>23 rate and 66% less than 21>22. The 23>24 rate is below 22>23 for all but Pet Supplies, Medical Services and Pet Services. In our 2021>2024 measurement you also can see that over 65% of the cumulative inflation since 2019 has now only occurred in Total Pet and all Pet segments. Except for Pet Services, where prices are skyrocketing, Service Segments have in the past generally had higher inflation rates so there was a smaller pricing lift in the recent surge. Pet Products have a very different pattern. The 21>24 inflation surge provided 95% of their overall inflation since 2019. This happened because Pet Products prices in 2021 were still recovering from a deflationary period. Services expenditures now account for 64.6% of the National CPI so they are very influential. Their current CPI is +4.7% while the CPI for Commodities is -1.0%. This clearly shows that Services are driving all of the current 2.6% inflation. There is a similar situation in Pet. Petflation: 2.0%. The CPI for the 2 Service Segments is 6.1%. The Pet Products CPI is -0.7%.

- U.S. CPI– Prices are +0.1% from Sep. The YOY increase is 2.6%, up from 2.4%. It peaked at +9.1% back in June 2022. The targeted inflation rate is <2% so we are now 30+% higher than the target. The October increase was a big change after 6 consecutive drops from Apr>Sep. The current rate is below 22>23 but the 21>24 rate is still +14.1%, 62.1% of the total inflation since 2019. Inflation was growing in October 2021, +6.2%

- Pet Food– Prices are -0.3% vs Sep. and -1.3% vs Oct. 23, down from -0.9%. They are still significantly below the Food at Home inflation rate, +1.1%. The YOY drop of -1.3% is being measured against a time when prices were 23.1% above the 2019 level and the current decrease is actually less than the -1.7% drop from 2019 to 2020. The 2021>2024 inflation surge generated 98% of the 21.3% inflation since 2019. Inflation began in 2021.

- Food at Home – Prices are up 0.1% from September but the monthly YOY increase slowed from 1.3% to 1.1%. This is radically lower than Jul>Sep 2022 when it exceeded 13%. The 27.2% Inflation for this category since 2019 is 19.8% more than the national CPI but tied for 3rd place behind 2 Services expenditures. 59.2% of the inflation since 2019 occurred from 2021>24. This is lower than the CPI, but we should note that Grocery prices began inflating in 2020>21 then the rate accelerated. It appears that the pandemic supply chain issues in Food which contributed to higher prices started early and foreshadowed problems in other categories and the overall CPI tsunami.

- Pets & Supplies– Prices were -0.4% from Sep and inflation fell to +1.0% vs Oct 23 from 1.5%, and they have the lowest rate vs 2019. Prices were deflated for much of 20>21. As a result, the 2021>24 inflation surge accounted for 92% of the total price increase since 2019. Prices set a record in October 2022 then deflated. 3 monthly increases pushed them to a new record high in Feb 23. Prices fell in March, rose in Apr/May to a new record, fell in Jun>Aug, grew Sep>Oct, fell Nov, grew Dec>Feb, fell Mar>Apr, rose May>Jun (record), fell in July, rose in Aug, fell in Sep>Oct.

- Veterinary Services– Prices are +1.0% from Sep and +7.3% from 2023. They are #2 in inflation vs 23 but still the leader in the increase since 2019 with +38.5% and since 2021, +28.8%. For Veterinary, relatively high annual inflation is the norm. However, the rate has increased during the current surge, especially in 22 & 23. It is still high in 24, so 74.8% of the cumulative inflation since 2019 occurred from 2021>24.

- Medical Services – Prices turned sharply up at the start of the pandemic but then inflation slowed and fell to a low rate in 20>21. Prices rose +0.4% from Sep and inflation vs last year rose to +3.8% from +3.6%. Medical Services are not a big part of the current surge as only 55.3% of the 13.2%, 2019>24 increase happened from 21>24.

- Pet Services – Inflation slowed in 2020 but began to grow in 21. In 24 prices surged Jan>Mar, fell in April, rose in May, fell in June, then rose Jul>Oct. to a new peak of 8.3%. This is up from Sep: 7.3% & Aug: 6.3%. 67.3% of their total 19>24 inflation has occurred since 21. In Dec 23, it was 49%. Plus, they again have the highest 23>24 rate.

- Haircuts/Other Personal Services – Prices are +0.2% from Sep and +4.5% from Oct 23. 8 of the last 10 months have been 4.0+%. Inflation has been pretty consistent. Just 58.8% of the 19>24 inflation happened 21>24.

- Total Pet– Petflation fell to 2.0% from 2.1% due to price drops in Products. It is still 62% less than the 22>23 rate and 13.1% less than the U.S. CPI. 2.0% is 35.5% below the 3.1% average rate since 1997. Vs Sep, prices rose 2%, driven by Vet & Services. The biggest Aug>Sep price increase was +0.7% in 2022 but a lift was to be expected. It has occurred in 15 of the last 20 years. A big factor in the small CPI drop was that the Sep>Oct price lift in 23 was a little bigger than 24. 2024 appears to be moving back towards a more normal pattern, but there is still a ways to go.

Now, let’s look at the YTD numbers.

The inflation rate for 22>23 was the highest for 4 of 9 categories – All Pet – Pet Food, Services, Veterinary & Total Pet. The 23>24 rate is usually much lower than 22>23 for all but Medical Services. 21>22 still has the highest rate for Food at Home, the CPI & Pet Supplies. The average annual national inflation in the 5 years since 2019 is 4.2%. Only 2 of the categories are below that rate – Medical Services (2.7%) and Pet Supplies (2.1%). It comes as no surprise that Veterinary Services has the highest average rate (6.7%), but all 5 other categories are +4.3% or higher.

- U.S. CPI – The 23>24 rate is 3.0%, the same as September, but it is down 30% from 22>23, 64% less than 21>22 and 29% below the average YOY increase from 2019>2024. However, it’s still 27% more than the average annual increase from 2018>2021. 72% of the 22.7% inflation since 2019 occurred from 2021>24. Inflation is a big problem that started recently.

- Pet Food – Ytd inflation is 0.5%, down from 0.7% in Sep. and 96% less than the 22>23 rate. Now, it is also 95% lower than 21>22 and 43% below the average rate from 2018>2021. Pet Food has the highest 22>23 rate on the chart and remains in 2nd place in the 21>24 rates. Deflation in the 1st half of 2021 kept YTD prices low then they surged in 2022 and especially in 2023. 96% of the inflation since 2019 occurred from 2021>24.

- Food at Home – The inflation rate has slowed remarkably. At 1.1%, it is down 81% from 22>23, 90% from 21>22 and 62% from 20>21. Also, it is even 49% lower than the average rate from 2018>20. It is only tied for 3rd place for the highest inflation since 2019 but still beat the U.S. CPI by 17%. You can see the impact of supply chain issues on the Grocery category as 71% of the inflation since 2019 occurred from 2021>24.

- Pets & Pet Supplies – In 24, prices rose Jan>Feb, fell Mar>Apr, rose May>Jun, fell in July, rose in Aug, fell Sep>Oct. Inflation in 24 is 0.7% and is only higher than 19>20. Supplies have the lowest inflation since 2019. The only significant increases were 7.5% in 22 & 3.3% in 23. The 2021 deflation created a unusual situation. Prices are up 11.2% from 2019 but 105% of this increase happened from 2021>24. Prices are up 11.8% from their 2021 “bottom”.

- Veterinary Services – Inflation was high in 2019 and steadily grew until it took off in late 2022. The rate may have peaked in 2023, but it is still going strong in 2024, +7.6%, the highest on the chart. They are also #1 in inflation since 2019 and since 2021. At +6.7%, they have the highest average annual inflation rate since 2019. It is 1.6 times higher than the National Average but 2.5 times higher than the Inflation average for Medical Services. Strong Inflation is the norm in Veterinary Services.

- Medical Services – Prices went up significantly at the beginning of the pandemic, but inflation slowed in 2021. Ytd it is 2.7%. In a non-pandemic year, “normal” is between 2.1>2.9%. We are still seeing the impact of 2023 when prices actually deflated (-0.3%). This was the only deflationary year since the US BLS began tracking this category in 1935.

- Pet Services – After falling in late 2023, prices surged in 2024, except for drops in Apr & Jun. The 23>24 inflation rate of 6.1% is 2nd to Veterinary on the chart. It is 8% less than 22>23 but now equal to 21>22. Also, it is 1.9 times higher than the 2018>21 average rate. Pet Services is 2nd in 19>24 inflation but only 4th in inflation since 21.

- Haircuts & Personal Services – The services segments, essential & non-essential, were hit hardest by the pandemic. The industry responded by raising prices. Ytd inflation is 4.5%, which is 13% below its 21 peak, but 30% above the 18>20 average. Consumers are paying over 25% more than in 2019, which usually reduces the frequency.

- Total Pet – Ytd Petflation is 2.6%, down from 2.7% Jul>Sep. It is 70% less than 22>23 but 13% higher than the 2018>21 average rate. Plus, YTD it is still 13% below the CPI. Despite the YOY lift in August, Petflation has slowed in 24. This is primarily being driven by drops in Pet Food prices, but Ytd Supplies inflation is also low. Services & Vet prices reached new record highs in October. The mix of patterns has produced stability in the Aug>Oct Ytd Pet CPIs.

The Petflation recovery paused in Aug. then came back in Sep>Oct. At 2.0%, October was 35.5% below the average rate for the month and is again lower than the National CPI. We continue to focus on monthly inflation while ignoring one critical fact. Inflation is cumulative. Pet prices are 19.8% above 2021 and 24.5% higher than 2019. Those are big lifts. In fact, in October prices for Vet & Services set new records while prices for Total Pet & all other segments are less than 1.4% below the highest in history. Only Supplies prices (+10.0%) are less than 23% higher than 2019. Since price/value is the biggest driver in consumer spending, inflation will affect the Pet Industry. Services will be the least impacted as it is driven by high income CUs. Veterinary will see a reduction in visit frequency. The product segments will see a more complex reaction. Supplies will likely see a reduction in purchase frequency and some Pet Parents may even downgrade their Pet Food. Products will see a strong movement to online purchasing and private label. We saw evidence of this at both GPE 24 & SZ 24 as a huge # of exhibitors offer OEM services. Strong, cumulative inflation has a widespread impact.