2020 U.S. TOTAL PET SPENDING $83.74B…Up ↑$5.31B

In 2020 Total Pet Spending in the U.S. was $83.74B, a $5.31B (6.8%) increase from 2019. The biggest driver was the pandemic. Pet Parents focused on necessities and binge bought Pet Food in the 1st half of the year. In the 2nd half they turned their attention to the other necessary segment – Veterinary. The two more discretionary segments, Supplies and Services, suffered. Services was impacted the most with restrictions and closures but Supplies $ continued their decline due to a reduction in both $ per transaction and purchase frequency. However, there was still a net gain in Total Pet $.

- A $5.65B (+18.1%) increase in Food

- A $1.65B (-9.8%) decrease in Supplies

- A $3.05B (+14.0%) increase in Veterinary

- A $1.73B (-20.1%) decrease in Services

Let’s see how these numbers blend together at the household (CU) level. In any given week, 22.5 million U.S. CU’s (1/6) spent money on their Pets – food, supplies, services, veterinary or any combination – down from 27.1M in 2019.

In 2020, the average U.S. CU (pet & non-pet) spent a total of $637.78 on their Pets. This was a +7.5% increase from the $593.51 spent in 2019. However, this doesn’t “add up” to a 6.8% increase in Total Pet Spending. With additional data provided from the US BLS, here is what happened.

- 0.8% fewer CU’s

- Spent 29.0% more $

- 16.6% less often

If 67% of U.S. CU’s are pet parents, then their annual CU Total Pet Spending was $951.91. Now, let’s look at the recent history of Total Pet Spending. The rolling chart below provides a good overview. (Note: All numbers in this report come from or are calculated by using data from the US BLS Consumer Expenditure Surveys – The 2016>2020 Totals include Veterinary Numbers from the Interview survey, rather than the Diary survey due to high variation)

- We should note a 3-year pattern since 2010. 2 years of increases (yr 1 the largest) followed by a small decrease.

- In 2014-15, the Food upgrade began, but early in 2015 consumers were trading $ in other segments to pay for it.

- In 2016, they were intensely value shopping for super premium foods. They started spending some of this saved money on Supplies and Veterinary Services, but not quite enough as spending fell slightly for the year.

- In 2017, spending took off in all but Services, especially in the 2nd half. Consumers found more $ for their Pets.

- In 2018 a spectacular lift in Services overcame the FDA issue in Food, tariffs on Supplies and inflation in Veterinary.

- In 2019 a bounce back in Food and small lift in Veterinary couldn’t overcome the drop in Supplies from “tarifflation”.

- In 2020 consumers focused on necessities, Food & Veterinary (+$8.7B) while Services & Supplies suffered (-$3.4B).

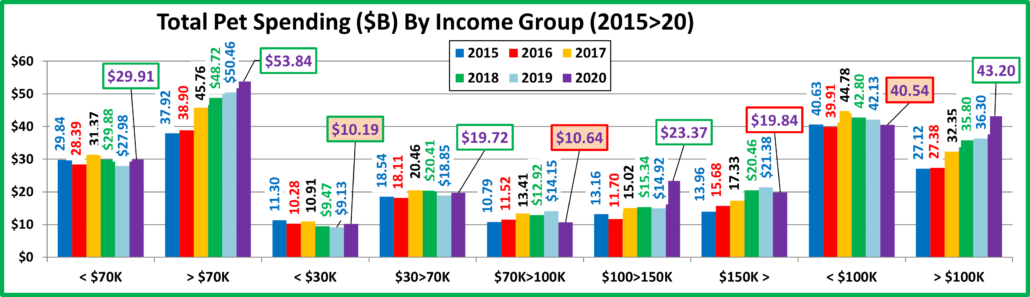

Now we’ll look at some Demographics. First, 2020 Total Pet Spending by Income Group

<$70K spending was up. Middle income was down. $100>150K had a huge lift but $150K> spent less. Definitely mixed.

Nationally: · Total Pet: ↑$5.31B · Food: ↑$5.65B · Supplies: ↓$1.65B · Services: ↓$1.73B · Veterinary: ↑$3.05B

- < $70K – (56.5% of U.S. CUs); CU Pet Spending: $404.76, +11.1%; Total $: $29.91B, ↑$1.93B (+6.9%) ..

- Food ↑$0.59B

- Supplies ↓$0.39B

- Services ↓$0.03B

- Veterinary ↑$1.76B

Money matters a lot to this group, but the pandemic caused them to focus on Pet needs, especially Veterinary. After a 2 years of declines, they spent more in 2020 and are once again ahead of 2015 $.

- >$70K – (43.5% of U.S. CUs); CU Pet Spending: $937.46, +2.7%; Total $: $53.84B, ↑$3.38B (+6.7%) from…

- Food ↑$5.05B

- Supplies ↓$1.26B

- Services ↓$1.70B

- Veterinary ↑$1.29B

This group continues to grow, up 4.0% in 2020. On the surface, this accounted for most of their spending increase. However, it is more complicated. There were 2 big swings. The middle income $70>99K group spent significantly less in all segments while the $100>149K group spent $9.6B more in Food & Veterinary, driving much of the lift.

- < $30K – (25.4% of U.S. CUs); CU Pet Spending: $314.01, +19.5%; Total $: $10.19B, ↑$1.06B (+11.6%) from…

- Food ↑$0.57B

- Supplies ↓$0.09B

- Services ↓$0.05B

- Veterinary ↑$0.62B

Although still behind 2015 $, this lowest income group demonstrated their committment to their pets with strong increases in Food and Veterinary spending and only minimal $ drops in the more discretionary segments.

- $30>$70K – (31.1% of CUs); CU Pet Spending: $477.03, +6.4%; Total $: $19.72B, ↑$0.87B (+4.6%) from…

- Food ↑$0.02B

- Supplies ↓$0.30B

- Services ↑$0.01B

- Veterinary ↑$1.14B

This lower income group essentially maintained their spending level in Food and Services. They did spend 7% less on Supplies but they had a 23% increase in Veterinary, which drove their overall spending lift.

- $70>$99K – (15.0% of CUs); CU Pet Spending: $552.88, -25.1%; Tot $: $10.64B, ↓$3.52B (-24.9%) from…

- Food ↓$2.15B

- Supplies ↓$0.54B

- Services ↓$0.42B

- Veterinary ↓$0.41B

This middle income group had the biggest negative pandemic reaction with double digit % drops in every segment

- $100K>$149K– (14.4% of CUs); CU Pet Spend: $1239.36, +54.2%; Tot $: $23.37B, ↑$8.45B (+56.6%) from

- Food ↑$8.46B

- Supplies ↓$0.36B

- Services ↓$0.79B

- Veterinary ↑$1.14B

They were the Star of the income groups in 2015 and 2017. In 2016, they were the worst performers. In 2018 & 2019 their Total $ were stable. The 2020 pandemic obviously motivated them. They drove most of the binge buying on Food and much of the lift in Veterinary. They are very reactive and have the money to take action.

- $150K> – (14.1% of CUs); CU Pet Spending: $1038.91, -14.8%; Total $: $19.84B, ↓$1.55B (-7.2%) from…

- Food ↓$1.26B

- Supplies ↓$0.36B

- Services ↓$0.49B

- Veterinary ↑$0.56

The results in this big group were also mixed. The $200K> group was up +0.6% due to drops in the discretionary Supplies & Services segments which were overcome by slightly greater increases in Food & Veterinary. The $150>199K group drove the overall spending in the high income group down for the 1st time in my records going back to 2013. They spent 1% (0.06B) more on Supplies, Services & Veterinary but $1.7B less on Food. Income is becoming increasingly important in Pet spending but the behavior can vary between the higher income groups.

- < $100K – (71.5% of CUs); CU Pet Spending: $435.56, -0.7%; Total $: $40.54B, ↓$1.59B (-3.8%) ..

- Food ↓$1.56B

- Supplies ↓$0.93B

- Services ↓$0.45

- Veterinary ↑$1.35

The spending dividing line was clearly $50K. All Groups Under $50K: +$2.98B; All groups from $50>99K: -$4.57B

- >$100K – (28.5% of CUs); CU Pet Spending: $1127.64, +12.0%; Total $: $43.20B, ↑$6.90B (+19.0%) from…

- Food ↑$7.20B

- Supplies ↓$0.72B

- Services ↓$1.28B

- Veterinary ↑$1.69B

We have detailed the variations but the net result is that their focus was on Pet Needs. We added the over/under $100K measurement because of the growing importance of income. For the 1st Time >$100K $ exceeded 50%.

Income Recap – The top 2 drivers in consumer spending behavior are value (quality + price) and convenience. That makes income , especially disposable income very important in Pet Spending. We also often see motivation in the opportunity brought by new product development. In 2020 we saw the results from perhaps the biggest human motivator – fear. This was the driver in the pandemic binge buying of pet food. Although the spending was mixed, the key results were the big drop from $70>99K and the huge lift from $100>149K. This combination was instrumental in driving the 50/50 $ divide up to $103K. That’s up considerably from $94K in 2019. Even with spending increases from the lower income groups, CU income continues to grow in importance in Total Pet Spending.

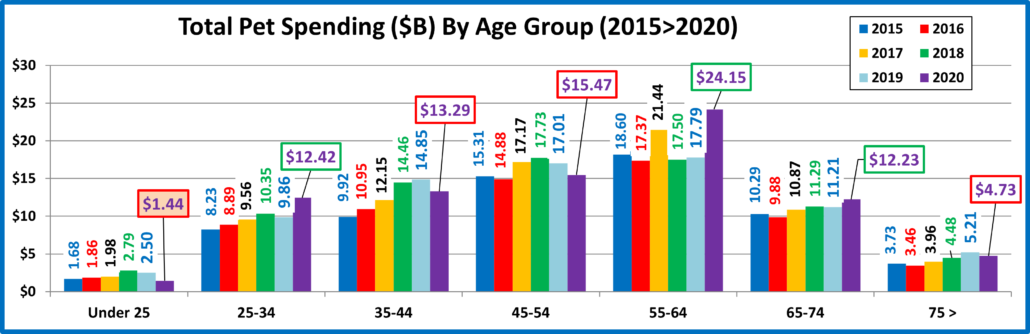

Next let’s look at 2020 Total Pet Spending by Age Group

Basically, a Generational Divide. Boomers & Millennials spent more. Everyone else spent less.

Nationally: · Total Pet: ↑$5.31B · Food: ↑$5.65B · Supplies: ↓$1.65B · Services: ↓$1.73B · Veterinary: ↑$3.05B

- <25 – (3.8% of U.S. CUs); CU Pet Spending: $283.19, -15.8%; Total $: $1.44B, ↓$1.06B (-42.3%) from…

- Food ↓$0.37B

- Supplies ↓$0.31B

- Services ↓$0.03B

- Veterinary ↓$0.35B

The biggest factor was a loss of 2M CUs (-31%) as they moved back home with their parents or grouped together.

- 25-34 – (16.0% of U.S. CUs); CU Pet Spending: $586.67, +28.7%; Total $: $12.42B, ↑$2.56B (+26.0%) from…

- Food ↑$0.87B

- Supplies ↑$0.62B

- Services ↓$0.03B

- Veterinary ↑$1.11B

These Millennials have often led the way in new food trends. Now they have stepped up in trying times. Services spending was essentially the same as 2019 but they spent over 20% more in all other segments, even Supplies.

- 35-44 – (17.0% of CUs); CU Pet Spending: $594.82, -11.0%; Total $: $13.29B, ↓$1.56B (-10.5%) from…

- Food ↓$0.61B

- Supplies ↓$0.07B

- Services ↓$0.30B

- Veterinary ↓$0.59B

This group has the largest families and is in the middle of building their careers. This makes them very sensitive to and cautionary in times of change. They are big in Supplies and that essentially didn’t change. However, they had double digit % decreases in all the other segments.

- 45-54 – (17.2% of U.S. CUs); CU Pet Spending: $690.80, -9.3%; Total $: $15.47B, ↓$1.54B (-9.0%) from…

- Food ↓$1.63B

- Supplies ↓$0.45B

- Services ↓$0.31B

- Veterinary ↑$0.85B

This group has the highest income and occupied the top spot in CU Pet Spending in 2019. In 2020 they fell to a distant second. They had double digit % decreases in 3 segments. The $0.85B increase in Veterinary Services was likely them making up for a $1B decrease in Veterinary procedures in 2019.

- 55-64 – (19.1% of U.S. CUs); CU Pet Spending: $962.48, +33.0%; Total $: $24.15B, ↑$6.36B (+35.8%) from…

- Food ↑$7.09B

- Supplies ↓$1.26B

- Services ↓$0.37B

- Veterinary ↑$0.90B

These younger Baby Boomers are especially reactive. They were the primary drivers behind the binge spending on Pet Food. They cut back spending on Supplies and reduced the frequency in Services but spending in the other “necessary” segment, Veterinary, grew 20%. The result was a 35.8% increase in Total Pet $.

- 65-74 – (15.6% of U.S. CUs); CU Pet Spending: $592.19, +3.5%; Total $: $12.44B, ↑$1.02B (+9.1%) from…

- Food ↑$0.32B

- Supplies ↑$0.11B

- Services ↓$0.28B

- Veterinary ↑$0.87B

This group is growing, +3.7% and now are all Baby Boomers. They are careful with their money, but their commitment to their pets is very apparent. They had a reduced frequency in Services but spending in all other segments grew, especially in Veterinary and Food, the “needed” segments.

- 75> – (11.2% of U.S. CUs); CU Pet Spending: $326.03, -10.5%; Total $: $4.73B, ↓$0.48B (-9.3%) from…

- Food ↓$0.02B

- Supplies ↓$0.29B

- Services ↓$0.42B

- Veterinary ↑$0.25B

Pet Parenting is more difficult, and money is tight for these oldest Pet Parents, but their commitment is still there. No binge spending, but they held their ground in Food. They cut back on Supplies and Services but had a 17% increase in Veterinary Services $ which kept their overall decrease in Total Pet under 10%.

Age Group Recap: There was an age spending pattern in Total Pet, but it was basically divided by generation. Boomers and Millennials spent $8.35B more. Everyone else spent $3.04B less. Pet Food spending had the same pattern. Other segments had different patterns. In Supplies only the 25>34 and 65>74-year-olds spent more. In Veterinary, only the <25 and 35>44-year-olds spent less. Unfortunately, Services was more consistent as all age groups spent less.

Next, we’ll look at the biggest winner and loser in each demographic category. In some cases, a clear spending pattern is evident. In those situations, segments are bundled together to reflect their shared spending behavior.

Key Demographic “Movers” for 2020.

In 2019, 50 of 96 Demographic Segments (52%) spent more on their Pets but spending fell -$0.16B (-0.2%). In 2020 only 46 of these 96 segments (48%) spent more but Total Pet Spending increased by $5.31B (+6.8%). This is very unusual to say the least. 6 segments flipped from 1st to last or vice versa and 3 segments held their spot. These are not unusual numbers. What you do see in the chart is the huge difference between the most positive and most negative segments. This suggests that the lift was very targeted. From our earlier segment analysis, we know that the driving force behind the lift was Pet Food spending, especially the binge buying that occurred in the 1st half of 2020. Let’s look at some specifics.

There are a few usual winners like:

- Homeowners

- White, Not Hispanic

- 2 Earners

- Self Employed

We should note that all racial/ethnic segments spent more which is always a good sign for the industry. There were also some winning segments that are periodically on top, whenever they are strongly motivated by events/trends:

- $100>149K

- < 2500 Population

- 55>64-year-olds

- Baby Boomers

That means that there were still some unexpected winners, like:

- Married, Oldest child 18>

- 4 people

- Less than College Grads

Now let’s look at the downside. The “usual” losers were:

- Singles

- Renters

- No Earner, Singles

This low number means that there must have been quite a few surprises, like:

- Large Suburbs

- 2 People

- 35>44

- Gen X

- College Grads

Recap: After a slight downturn in 2019, Pet Spending turned up in 2020. There is no doubt that the onset of the COVID-19 pandemic was the major factor in the turnaround. It produced mixed results among the industry segments. Services took a big negative hit due to restrictions and closures in nonessential outlets. Consumers, including Pet Parents, focused their attention and spending on the most needed Products and Services. In the Pet Industry this resulted in a 10% drop in Supplies $ but strong lifts in spending for Veterinary Services and especially Pet Food. The Pet Food $ were even stronger because Pet Parents feared possible shortages like what happened to many other essential products. This caused some very select demographics to binge buy an extra $6.77B in the 1st half of 2020. Although the 25>34-year-olds participated in this lift, the key drivers were the 55>64-year-old Baby Boomers. Boomers have a history of strong reactions to trends and outside factors. The 55>64-year-olds also have the highest income of any Boomer group so they had both the “will” and the “way” (money) to binge spend for the welfare of their pet children… and in 2020, they did!