Retail Channel Monthly $ Update – December Final & January Advance

Time for our monthly update on U.S. retail sales by channel. The current COVID-19 crisis has caused turmoil in the Retail Marketplace. Consumer spending behavior has changed and continues to evolve. In this report we will track the changes and migration between channels. We will do that with data from two reports provided by the U.S. Census Bureau.

The Reports are the Monthly Retail Sales Report and the Advance Retail Sales Report. Both are derived from sales data gathered from retailers across the U.S. and are published monthly at the same time. The Advance Report has a smaller sample size so it can be published quickly – approximately 2 weeks after month end. The Monthly Final Report includes data from all respondents, so it takes longer to compile the data – about 6 weeks. Although the sample size for the Advance report is smaller, the results over the years have proven it to be statistically accurate with the final monthly reports. The biggest difference is that the full sample in the Final report allows us to “drill” a little deeper into the retail channels.

We will look at the latest release of both reports. We will begin with the Final Retail Report from December and then move to the Advance Retail Report for January. This will allow us to look at both the final numbers for 2020 and do an initial comparison of January 2021 vs 2020.

Both reports include the following:

- Total Retail, Restaurants, Auto, Gas Stations and Relevant Retail (removing Restaurants, Auto and Gas)

- Individual Channel Data – This will be more detailed in the “Final” reports and we fill focus on Pet Relevant Channels

The information will be presented in detailed charts to facilitate visual comparison between groups/channels of:

- Current Month change – % & $ vs previous month

- Current Month change – % & $ vs same month one year ago.

- Current YTD change – % & $ vs 2019 (Note: In the January Advance we will compare January 2020 to 2019)

- Monthly and Year To Date $ will also be shown for each group/channel

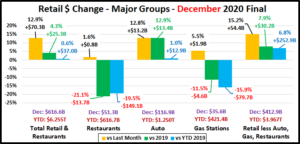

First, the December Final. U.S. Retail hit bottom in April then began to recover. December $ were up from November, and still growing vs 2019. Here are the major retail groups. (The Data in all graphs is Actual, Not Seasonally Adjusted)

The final total is $3.4B less than the Advance report projected a month ago. All but Gas Stations were down but most of the reduction came from Relevant Retail: -$2.5B; Restaurants: -$0.1B; Auto: -$0.6B; Gas Stations: N/C. All groups were up vs November and set a new record Total Retail $ peak. YTD Total $ales finished more positive vs 2019 thanks to another strong month from Relevant Retail and Auto. The Auto segment finally beat 2019 $, but Restaurants and Gas Stations are down -$229B. Relevant Retail was the driving force in turning Total YTD sales positive vs 2019.

Now, let’s see how some Key Pet Relevant channels were doing in December.

- Overall– $ in 10 of 11 groups were up vs November and 9 were up vs December 2019 and YTD. That’s very good.

- Building Material Stores – Their “Spring” lift continued through Summer, Fall and now Winter. While sales peaked in June, they’re still showing double digit % increases vs 2019. Sporting Goods stores are not included in this group, but they have a similar Spring lift pattern. Their sales took off in May, and ultimately hit a record peak in December. In June, their YTD $ vs 2019 turned positive and by yearend they were up 16.6%.

- Food & Drug – Supermarket $ slowed in Aug, Sep & Nov but turned up in October & December. They finished 2020 up +$77.7B. Drug Stores $ dipped in Aug & Nov but increased in Sep, Oct & Dec. They ended up +$17B.

- General Merchandise Stores – $ in Clubs/SuperCtrs slowed in September then grew in Oct>Dec. They finished at +$33.2B vs 2019. $ Stores sales slowed from June>Sept but grew in Oct>Dec and ended 2020 +12.0% vs 2019. Discount Dept. store sales were slowing before the pandemic. This trend continues despite their Nov>Dec lift.

- Office, Gift & Souvenir Stores– A 44% lift after a 28% November drop . A holiday lift but recovery is long way off.

- Internet/Mail Order – The pandemic has accelerated this channel’s growth vs 2019. $ hit another record peak in December. Many consumers have discovered online shopping and the behavior is likely to become habitual.

- A/O Miscellaneous – This is a group of small to midsized specialty retailers – chains and independents. It includes Florists, Art Stores and Pet Stores (22 to 24% of total $). Pet Stores were usually essential, but most stores were not. The others began reopening in May. That number grew in June and YTD $ surpassed 2019. Sales have been stable and strong vs 2019 since then and peaked in December. Their 2020 total sales were up +11.6%.

The recovery began in May and accelerated in June>July as even more businesses began to re-open. The Relevant Retail Segment was positive in all measurements in May>July. In Aug>Sept $ slowed but were still strong vs 2019. In Oct>Dec $ turned up and reached a record peak. The key drivers in the positive numbers vs 2019 were the Internet, Supermarkets, SuperCtrs/Clubs/$ Stores and Hdwe/Farm. Now, how is 2021 starting off? Here are the Advance numbers for January.

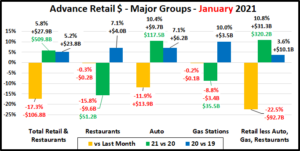

April & May 2020 were the 2 biggest spending drops in history. Then sales began to recover and in October YTD Total Retail turned positive for the 1st time since February. Sales dipped in November but not vs 2019 . In December, Total Retail set a sales record. In January, as expected, $ fell but still set a new record high. All but Gas Stations and Restaurants are up from 2020.

Total Retail – Total Retail spending hit a record $616.6B in December and 2020 finished +$37B vs 2019. As usual, $ plummeted in January but still hit a record $509B, $27.9B ahead of 2020 and $51.7B ahead of 2019. (add the $ changes in the 2 columns to get status vs 2019). Remember, the impact of the pandemic didn’t begin until March 2020.

Restaurants – Spending was basically unchanged vs December but down $9.6B versus 2020, which shows the continuing impact of the pandemic on this group. Last January, $ fell 7% from December but were up 7.1% from 2019. Normally, January and February are the 2 slowest months, but they finished on top last year. Their 2020 totals were down $149B, -19.5%. Recovery is still a long way off. If 2019 $ are the target for a return to normal, then they are only down $5.6B.

Automobile & Gas Stations – When you are staying home your car becomes less of a focus in your life. Auto Dealers began combating this attitude with fantastic deals and a lot of advertising. Monthly $ turned positive versus 2019 in June and stayed that way, finishing 2020 at +1.0% vs 2019. 2021 started even stronger, +10.4%. Gas Station $ales hit bottom in April and have been up and down ever since. However, sales have remained consistently about 16% below 2019. They finished 2020 -$79.6B (-15.9%). January began down $3.4B but we should note that $ were up $0.1B vs 2019.

Relevant Retail – Less Auto, Gas and Restaurants – Many non-essential businesses shuttered their doors in March but there was a rash of binge/panic buying for “necessities”, especially groceries, which drove spending up $19B. April brought a full month of closures and an end in binge buying, spending dropped $34B from March. In May, the overall market began to reopen so spending began to move in the right direction and growth continued through July. $ales fell in Aug/Sept but turned up again in Oct>Dec, reaching a record $412.9B in December. For 2020, they were up $252.9B, +6.8%. That brought us to January. Sales fell 22.5% (-$92.7B) from December. However, that was less than the 24.5% (-$93.7B) drop in 2020. So $ are up 10.8%, triple the 3.6% from a year ago and the Relevant Retail group now has posted positive numbers versus last year and YTD for 9 consecutive months. The primary drivers continue to be Nonstore, Grocery, SuperCenters/Clubs/$ Stores plus a radically extended “spring lift” from Hardware/Farm and Sporting Goods.

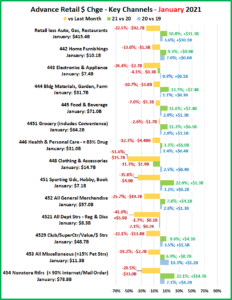

Now let’s look at what is happening in the individual retail channels. After a record December, relevant retail $ took an expected plunge in January but was still +$31.3B vs 2020. Let’s see where the $ came from. These groups are less defined than in the Final Monthly reports and we will look across the whole market, not just pet relevant outlets.

In December, all 13 channels beat last month’s $. In January they were all down. 10 channels beat January 2020 $. Last year 12 beat 2019 $. However, the 2021 increases were generally significantly higher than 2020. Clothing stores had the biggest decrease vs 2020 but Department stores are the only channel with decreases in both years.

After April’s widespread closures there was a retail surge in May, but things truly opened up in June/July. In Aug/Sept, sales slowed but growth began again in October and peaked with a record December. Relevant Retail finished up $252.9B vs 2019 and started 2021 strong, +10.8%. Essential channels are responsible for the continued lift, primarily:

- Nonstore Retailers – Even more consumers are online shopping.

- Food & Beverage, especially Grocery– Restaurant $ are still down so consumers continue to eat & drink at home.

- Bldg Materials/Garden/Farm– Their “Spring” lift continues unabated as consumers focus on their home.

- SuperCtrs/Club/Value/$ Strs – Sales slowed in April but came back in May and continue to grow vs the previous year. They turned the whole Gen Mdse channel positive. It clearly shows that value is still a consumer priority.

Regarding the Individual Large Channels

General Merchandise Stores – As expected Sales dropped in January after the holiday lift with the biggest % decrease coming from Department Stores. Their problems were amplified by the pandemic but existed before as they are the only channel down in January vs a year ago for 2 consecutive years. Club/SuperCtr/$ stores are still the big positive force. They finished 2020 up $33B, +7.4% and started off 2021 at +9.6%, considerably better than the +3.5% in January 2020.

Food and Beverage, plus Health & Personal Care Stores – The Grocery segment is still strong and growing, +11.3% in January, due to the continuing big drop in restaurant sales. Sales in the Health, Personal Care group turned positive vs 2019 in September and finished +1.7%. They started 2021 even better, +3.3%. Drug Store $ growth has been the driver.

Clothing and Accessories; Electronic & Appliances; Home Furnishings – Except for September, monthly sales have grown every month since May. All 3 channels finished the year down significant percentages in sales vs 2019. Clothing Stores have been the worst performers and that continued in January. Home Furnishing stores may be breaking the pattern in 2021. In January, their sales were up 9.3% vs 2020. Perhaps their recovery has truly begun.

Building Material, Farm & Garden & Hardware – Sales peaked in late spring, as usual. However, this channel continues to benefit from consumers turning their focus to their home needs, including house and yard repair and improvements. Their Spring lift extended into winter and they finished +$53B (+13.8%). No change for 2021 – January $ +13.7% vs 2020.

Sporting Goods, Hobby and Book Stores – Book and Hobby stores are open and sales in Sporting Goods stores have taken off as Consumers are seeking more recreation. They were down -$3.4B in April. This deficit was wiped out in September and driven by Sporting Goods stores, sales exploded in December. They ended 2020 up $4.4B, +5.5%. January 2021 sales fell 35.8% from December but they are still up an amazing 22.0% vs January 2020.

All Miscellaneous Stores – This group is mostly small to medium specialty stores – both chains and independents. Pet Stores are essential but most other stores are not, so closures hit this group particularly hard. Sales hit bottom at -$3.8B in April then began to rebound in May and grew through July when they finally beat the monthly sales for 2019. Sales seesawed up and down but finished with a strong December. They ended 2020 down $1.0B, -0.7%. They started out 2021 +6.9% but this is only about half of the +13.3% start in 2020. We’ll see how their recovery progresses in 2021.

NonStore Retailers – 90% of the volume of this group comes from Internet/Mail Order/TV businesses. The COVID-19 crisis has only accelerated the ongoing movement to online retail. In February NonStore was up 8.6% YTD. In December monthly sales exceeded $100B for the 1st time. They ended 2020 at +21.9%, +$173.9B YTD. Their increase is 69% of the total $ increase for Relevant Retail Channels. Their 2020 performance far exceeds their 12.9% annual increase in 2019 and they started off 2021 even better, +22.1%. Last January, in pre-pandemic times, they were only up 7.1%.

Note: Almost without exception, online sales by brick ‘n mortar retailers are recorded along with their store sales in their regular channel. Whether they are up or down, their online sales are included in the totals.

Recap – April and May saw the 2 biggest year over year monthly sales declines in history. Restaurants, Auto and Gas Stations increased sales from May through July, but results were mixed until yearend. The Auto segment did beat 2019 YTD $ in December, but Restaurants and Gas Stations finished down -$229B. The Relevant Retail segment was the only true positive. Sales began to recover in May and hit a record high in December. They finished 2020 up $253B but for some segments in this group there is still a long way to go. Total Retail Sales passed 2019 in October, set a new monthly $ record in December and ended the year +$37B (+0.6%) vs 2019. In 2021 Relevant Retail and Auto both began the year at +10% vs 2020, much better than last year. For Restaurants and Gas Stations the problems continue as both started off 2021 down significantly vs 2020. Thanks to Auto and Relevant Retail, Total Retail is +5.8% vs 2020. (last year they were +5.2%) However, this is an ongoing battle. We will continue to monitor the data and provide you with regular updates.