INFLATION’S IMPACT ON RETAIL SALES GROWTH – APRIL 2025

Inflation seems simple – just compare this year’s prices to the same time last year. In fact, it is more complex. The most important thing to remember is that it is cumulative so even when the YOY rate slows, it can cause a range of issues – selling less product and even a drop in revenue. One impact that is often ignored is slowed $ growth. That is the focus of this report. In order to give an accurate reading of the situation we will include charts for the Big Retail Groups and the “Advance” Relevant Retail Channels. We will also include separate charts for Monthly & Ytd data to better show trends.

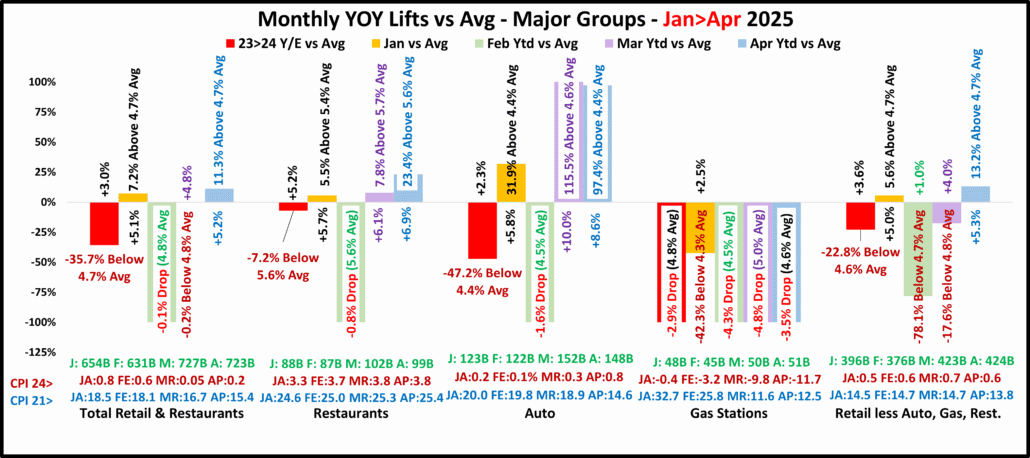

First the Jan>Apr Monthly Report for Big Groups (100% of U.S. Retail $)

We also included the Y/E numbers for 2024, both actual & average, to show our goal – Beat these lifts!

There are 3 things that immediately stand out. One is expected – a BAD February. It is often the low point of the Retail year. In 2025, the lift vs 24 was -78% below avg for Relevant Retail, but Total and all other groups had drops. The big “surprise” is January. Gas Stations had their only monthly lift in 25. It was -42% below avg but all other groups had above avg lifts. A factor is that holiday spending has moved earlier. This encourages January spending. The final “stand out” is the big Mar>Apr lift in Auto. This is due to impending tariffs. People are buying now to avoid tarifflation’s high prices.

Restaurants – The February drop was small and the other 3 months had lifts above average. The lifts consistently increased reaching +6.9% in April, 23.4% above average. If they can continue their non-February performance, they will likely have a great year.

Auto – Their pattern is almost exactly the same as Restaurants but with lifts much more above average, especially in March & April. The Mar & Apr lifts were double the average. The 25% tariff was effective 4/3/25. Consumers saved thousands of dollars.

Gas Stations – They are truly in turmoil. Their only plus month was -42% below avg and all drops were bigger than 2024.

Relevant Retail – They do about 60% of Total Retail $ so it’s no surprise that they have a similar pattern. 1 big difference is that they were +1% in Feb – no drop. The Feb & Mar lifts were below avg while the Jan & Apr lifts were above. Their 23>24 lift was above Total Retail. In 25, only Feb & Apr were bigger. The chart clearly shows their Feb>Apr progress.

Total Retail – They had a drop in February, but March was basically equal to the average and Jan & Apr were slightly above average. All non-Feb months had lifts above the annual average and were 60+% more than the actual 3.0% lift in 2024. They are making progress but it is slow.

Summary: JAN: $↓: 0; ↑Avg: 4; ↓Avg: 1; FEB: $↓: 4; ↑Avg: 0; ↓Avg: 1; MAR: $↓: 1; ↑Avg: 2; ↓Avg 2; APR: $↓: 1; ↑Avg: 4; ↓Avg: 0

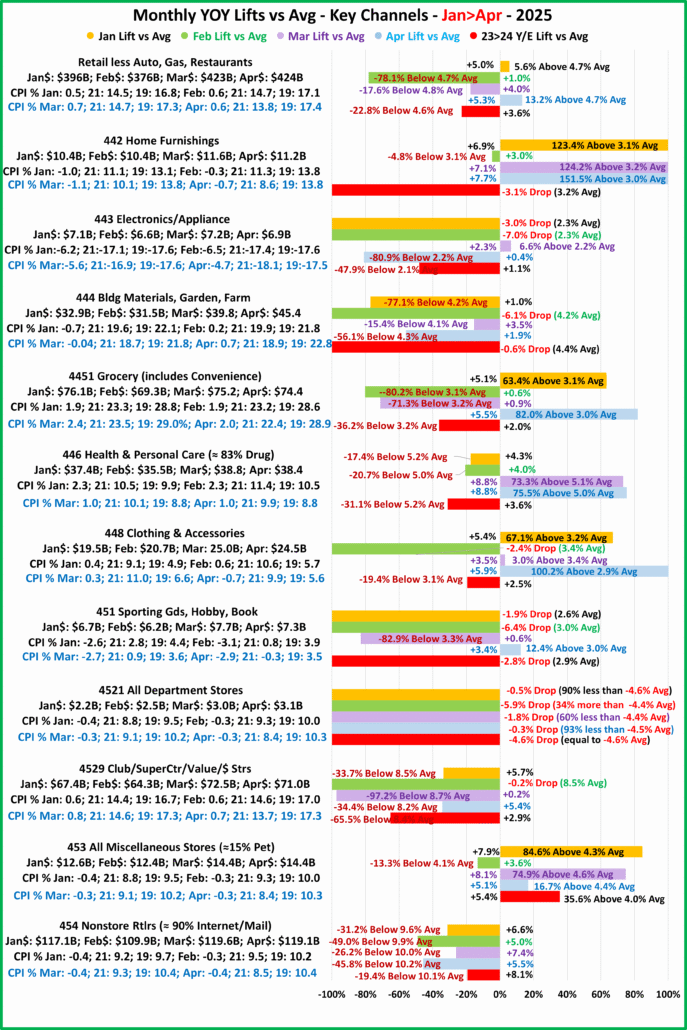

Now let’s take a closer look at Relevant Retail. We will report the same lift data for the 11 channels in our Advance Retail Sales report. They generate 98% of Relevant Retail $ so it is an accurate representation of this part of the Retail Market.

11 Relevant Retail Channels (98% of Ytd $)

Relevant Retail – Their +3.6% lift in 24 was -22.8% below average. No drops in 25. The lifts for February & March were below average but January & April were above average.

Furniture – No drops. Lifts were double the average in January, March and April. The big lifts in Mar>Apr were probably due to fear of skyrocketing prices from impending tariffs.

Electronics/Appliances – They have ongoing high deflation. $ Drops in both January & February. Sales turned positive in Mar>Apr but only the lift for March was above average.

Bldg Matl/Garden/Farm – They had the smallest of the 4 drops in 23>24, -0.6% but the 3rd biggest decrease in February, -6.1%. They had lifts in Jan, Mar & Apr but all were below average. This includes their normal Spring lift. The April increase was -56% below average. Cumulative 20% inflation was undoubtedly a factor.

Grocery – Sales were only +2% in 24, -36% below average but they surged in January to +5.1%, 63% above average. Growth slowed to less than 1% in Feb>Mar, over 70% below average. However, they had a strong rebound in April. Sales were +5.5% vs 24, 82% above average.

Health/Drug – Sales were +3.6% in 24, -31% below average. The lift grew slightly in Jan>Feb to 4+% but it was still about -20% below average. Sales surged in Mar>Apr to +8.8%, 73+% above average.

Clothing – They had a slow 24, +2.5%, -19% below average, but started 25 strong, +5.4%, 67% above average. Then sales fell -2.4% in February. In March the lift exceeded the average by 3% but they “took off” in April to +5.9%, more than double the average lift. Like Furniture, the big April lift was likely due to fear of impending tariffs.

Sport/Hobby/Book – They were -2.8% in 24. This trend continued in Jan>Feb, peaking at -6.4% in February. In March they turned slightly positive, +0.6% but this grew in April to +3.4%, 12% above average – a big turnaround.

Department Strs – It’s difficult to find something positive. They were -4.6% in 24 had drops Jan>Apr in 25. The biggest drop was -5.9% in February – no surprise. Sort of good news: 3 of drops were 60+% less than average.

Clubs/SupCtrs/Value/$ – They offer Brick ‘n Mortar value and the convenience of 1 stop shopping. They have had strong growth since their creation in the 80’s. COVID further accelerated growth so it is no surprise that all lifts are below avg. They even had a small -0.2% drop in February. Things slightly improved in March, +0.2%, then rose to +5.4% n April.

Miscellaneous – Pet Stores account for 15+% of this group’s sales. They had a -13% below average lift in February. All other measurements were above average, and their lifts peaked at +8.1% in March. They have the best performance of any channel, even Furniture Stores, and they did it without the benefit of a pre-tarifflation buying surge.

Nonstore – 90% of $ are from internet/mail order (vast majority is internet). The Internet has had strong sales growth since its inception, but it skyrocketed due to COVID’s “stay at home” behavior. They have an average lift of about 10%. Their 24 lift was +8.1%. All lifts in 25 were below this and below average – no surprise. Low: Feb +5.0%; High: Mar +7.4%

SUMMARY

23>24 – Drops: 4; Below Avg Lifts: 6; Above Avg Lifts: 1

25 Jan – Drops: 3; Below Avg: 4; Above Avg: 4 25 Feb – Drops: 6; Below Avg: 5; Above Avg: 0

25 Mar – Drops: 1; Below Avg: 5; Above Avg: 5 25 Apr – Drops: 1; Below Avg: 4; Above Avg: 6

In the above Summary, regarding Drops and Above Average lifts, green indicates the best and red is the worst. Obviously, the best month is April and the worst is February. However, the biggest positive change occurred in March. 5 channels with drops turned positive. 3 became below average and 2 above average. 3 with below average lifts moved up to above average. The classification of 3 was unchanged so 8 fueled the improvement. April was only a little better than March as 1 below average moved up. However, we should note that now more than half of the channels are above average. We also can’t forget January. There was only a slight improvement in the number of positive lifts vs Y/E 24, from 7 to 8 but the number with above average increases rose from 1 to 4 – a significant change. The situation has definitely improved since hitting bottom in February. The CPI is still low and impending tariffs have not had a significant negative impact.

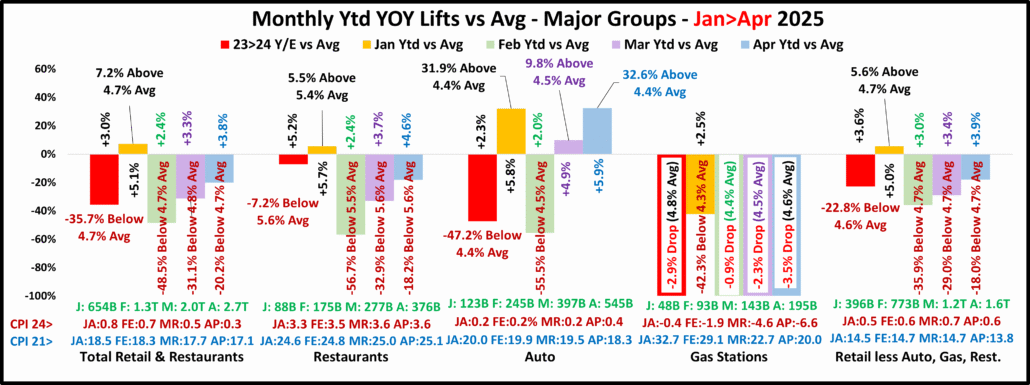

Now let’s take a different view of the data from the Big Groups and the same 11 channels. Rather than monthly sales, we we look at Ytd numbers. We will still view them monthly so we can see any trends.

The Ytd numbers are arguably the most important. In December, they become Year-End, which is the most quoted and remembered data in any year. While the monthly data shows what’s happening in the marketplace right now, the Ytd data consolidates the data. This blending reduces the impact of sales spikes – positive or negative. This can be either good or bad. The impact of the big drop in February 25 was lessened by the widespread Above Average January lift. It can also work the other way. The big February drop is still reducing the positivity of strong lifts in March and April. We’ll begin our analysis with the Big Retail Groups.

The first thing that you notice is that the spending patterns for Restaurants and Relevant & Total Retail are virtually identical. All groups had January lifts and all but Gas Stations were Above Average. However, only Auto had Above Average lifts in either March or April. Also, only Gas Stations had any sales drops.

Restaurants – Sales for 24 were +5.2%, -7% below average. They flipped in January as the lift vs last year grew to +5.7%, 5.5% above average. The lift radically slowed in February to +2.4%, -57% below average. The situation steadily improved in March & April as the YOY increase grew to +4.6%, -18% below average.

Auto – Sales were +2.3% in 24, -47% below average and the worst “positive” performance of any group. They turned it around in January with a +5.8% lift, 32% above average. The lift dropped to +2.0% in February, -55.5% below average and the smallest lift of any positive big group. Thanks to pre-tarifflation buying the YOY lift took off in March & April, reaching +5.9% in April, 33% above average. As we said, they were the only Big Group with any Non-January above average lifts.

Gas Stations – Whether you look at the data monthly or Ytd, they are doing bad. The April Ytd sales drop of -3.5% is even worse than the -2.9% at Y/E 24. That does not bode well for 2025.

Relevant Retail – Except for January, +5.0%, they seem to be stuck in the 3% lift range. April Ytd, +3.9%, did finally exceed the +3.6% in 24. This is not a surprise as April had their only non-January above average monthly lift. They have made slow but steady progress since February.

Total Retail – The pattern matches Relevant Retail but the YOY changes for all but January are smaller. The averages are about the same so Total has bigger disparities. Total also includes Auto and Gas Stations which have had extreme lifts and drops. However, they are making steady progress since February and their Ytd lift has been above 24 since March.

Summary and Comparison of Monthly to Ytd

Monthly: Drops: 6; Below Avg Lifts: 4; Above Avg Lifts: 10

Ytd: Drops: 3; Below Avg Lifts: 11; Above Avg Lifts: 6

Mon: JAN: $↓: 0; ↓Avg: 1 ↑Avg: 4; FEB: $↓: 4; ↓Avg: 1 ↑Avg: 0; MAR: $↓: 1; ↓Avg 2 ↑Avg: 2; APR: $↓: 1; ↓Avg: 0; ↑Avg: 4

Ytd: JAN: $↓: 0; ↓Avg: 1 ↑Avg: 4; FEB: $↓: 1; ↓Avg: 4 ↑Avg: 0; MAR: $↓: 1; ↓Avg 3; ↑Avg: 1; APR: $↓: 1; ↓Avg: 3; ↑Avg: 1

Obviously, January Monthly & Ytd are the same. The summary clearly shows that the Ytd report levels the Feb>Apr data. The situation doesn’t look good Ytd but both reports show that it is improving for all but Gas Stations.

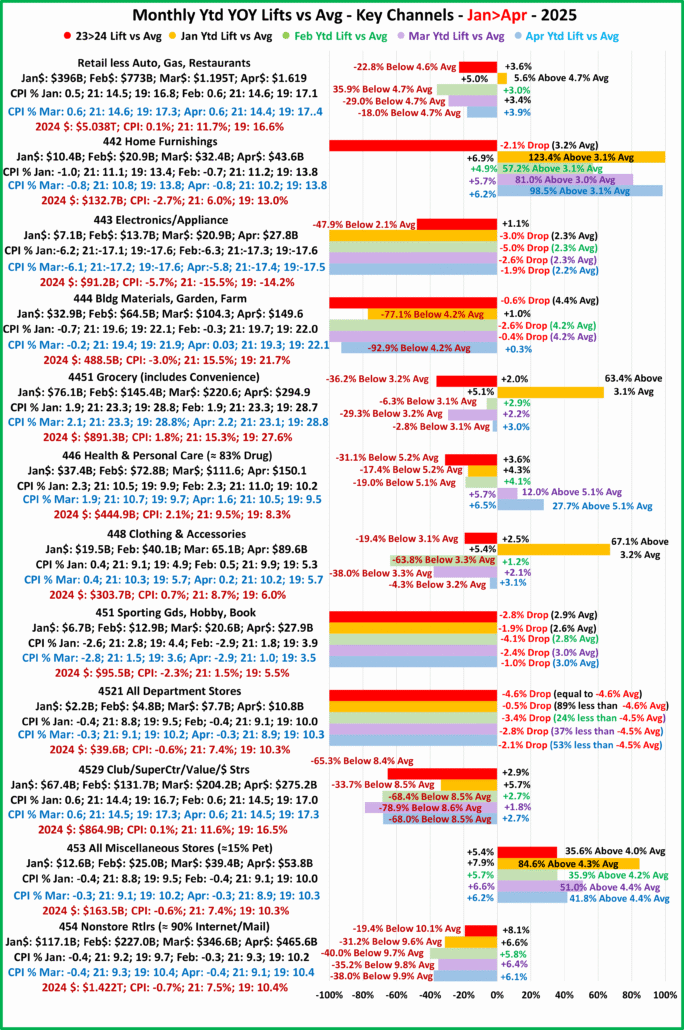

Now, Let’s look at Ytd Sales for Key Relevant Retail Channels

The Ytd chart looks a little worse than the Monthly chart. It turns out that this is true. Both charts have the same number of Below Average lifts, 41% of all entries. However, the Ytd version has 27% more drops and -20% less Above Average lifts. Ytd also has 3 channels that had drops every month in 2025. Monthly has only 1. However, Ytd has 2 channels with Above Average lifts every month. Monthly has none. It’s a complex situation. Let’s get into the specifics.

Furniture Stores – They are going strong. Their huge January lift pushed the February Ytd lift from below to above avg. Now, all months are above average. Tarifflation fear caused binge buying in Mar>Apr so the current lift is double the avg.

Electronics/Appliance – Ytd they are all negative. This version hides Mar>Apr lifts. March was even 6.6% above average. The impact in the Ytd chart was that their YOY drop slowed from -5.0% in February to -1.9% in April.

Bldg Matl/Garden/Farm – Their big February drop turned March from a below average monthly lift to a -0.4% Ytd drop. Both charts show a slight improvement in April.

Grocery – Their big January lift made their situation look significantly better in Ytd. However, it effectively hid the above average lift in April. Note: The current Ytd lift (+3.0%) is 50% above 24 Y/E and just 6% below the annual average.

Health – Both Monthly & Ytd have the same pattern – Jan>Feb, below average lifts; Mar>Apr, above avg. However, the Mar>Apr Ytd lifts are not as big as monthly – both actual and vs average.

Clothing – They had a +5.4% lift in January, 67% above avg. This eliminated the February drop in Ytd but the February drop changed Mar>Apr from above to below average in Ytd. April Ytd is 24% more than 24 & equal to the annual avg.

Sport/Hobby/Book – They had drops in Jan>Feb. Feb was -6.4%. This turned Ytd all negative. It also hid the possible start of a recovery. Mar>Apr both had monthly lifts. March was below avg but April was 12% above avg.

Department Strs – Both reports show drops every month. They have been fading for years. It continues.

Club/SupCtr/Value/$ – They offer value and convenience, the biggest shopping drivers. Some $ stores are struggling but SuperCenters are still going pretty strong. Besides the internet, one problem in sustaining strong growth is that they are running out of new customers. The Monthly report had a 0.2% drop in February and only a 0.2% lift in March. The Ytd numbers look better. There are no drops, but the April Ytd lift is only +2.7%, 68% below average.

Miscellaneous – This is probably our favorite channel because it includes pet stores. They also have great performance. In the Monthly report, the YOY lift for February was +3.6%, -13% below average. All other months are above average. The Ytd report is even better. All months are above average and April is +6.2%, 42% above average and 15% more than Y/E 24

Nonstore – They are driven by the internet which has had the strongest growth and became the biggest $ channel in 2020. The Monthly & Ytd reports have similar patterns – all months below avg. April Ytd is +6.1. That sounds great but it is -38% below average. We’re seeing that it is difficult, if not impossible to maintain double digit growth…forever.

Relevant Retail – Their $ come from a mixture of different spending patterns. They had no drops and both Monthly & Ytd show steady improvement since February. Ytd hides the Above avg April lift but it shows that the group’s performance in April now exceeds 2024…+3.9% to +3.6%. Here is a summary and comparison of Monthly to Ytd for the 11 channels.

Monthly: Drops: 11; Below Avg Lifts: 18; Above Avg Lifts: 15

Ytd: Drops: 14; Below Avg Lifts: 18; Above Avg Lifts: 12

Mon: JA $↓: 3; ↓Avg: 4 ↑Avg: 4; FE $↓: 6; ↓Avg: 5 ↑Avg: 0; MR $↓: 1; ↓Avg 5 ↑Avg: 5; AP $↓: 1; ↓Avg: 4;↑Avg: 6

Ytd: JA $↓: 3; ↓Avg: 4 ↑Avg: 4; FE $↓: 4; ↓Avg: 5 ↑Avg: 2; MR $↓: 4; ↓Avg 4;↑Avg: 3; AP $↓: 3; ↓Avg: 5;↑Avg: 3

The key differences between the Monthly & Ytd reports are in the extremes – drops & above avg lifts. Both views are critically important. Monthly shows what is currently happening in the marketplace and Ytd puts it into perspective. They also show trends over time. Ytd provides an overview while Monthly shows the details fueling the movement.

Inflation negatively affects retail growth both in the short term, with spikes or drops, and in the long term, with cumulative high prices. It can even have an impact before it happens. We are seeing this with pre-tarifflation “fear” buying. The current retail situation is not good. The YOY lifts vs 2024 are generally below the long term average for most channels. Retail seems to have “hit bottom” in February but most channels (not Gas Stations or Department stores) have showed some improvement in March and especially in April. Inflation is relatively low with some deflation, but prices are still high. We’ll continue to track the situation.

Inflation IS complex! Thanks for teasing out some of the details. What most don’t understand is the impact inflation on volume can be the result of cumulative inflation over the recent few years. You can see this in veterinary services inflation and volumes, relevant to the total cost of owning a pet. Veterinary services, as you layout, is only 30% of the total cost. Fortunately for pet owners, there is 2025 deflation in the cost of pet food, a larger contributor to the total cost of pet ownership.