2023 Top 100 U.S. Retailers – Sales: $2.93 Trillion, Up 3.0%; 165,493 Stores with Pet Products……plus the Internet!

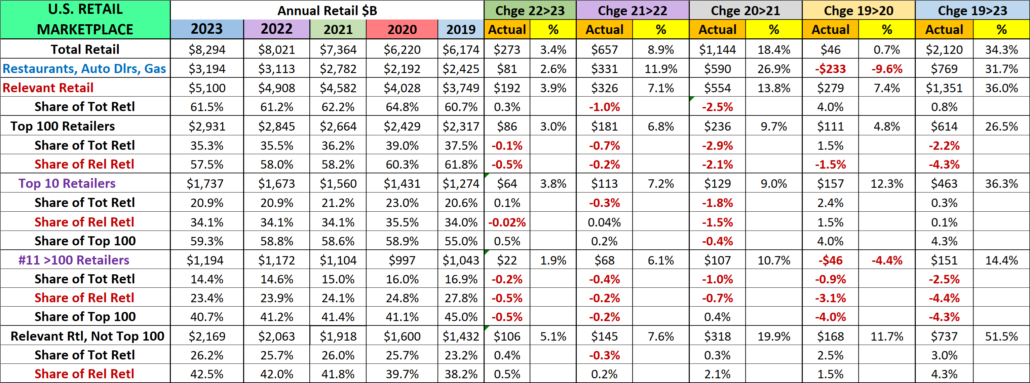

The U.S. Retail market reached $8.29 Trillion in 2023 from all channels – Auto Dealers, Supermarkets, Restaurants, Online retailers and even Pet Stores. The $273B, +3.4% lift was down significantly from the pandemic recovery lift of +$1.14T, +18.4% in 2021. However, the Total Retail market is now $2.12T, 34.3% ahead of 2019. That’s a strong annual growth rate of +7.7%. (Data courtesy of the Census Bureau’s monthly retail trade report.)

In this report we will focus on the top 100 Retailers in the U.S. Market. The base data on the Top 100 comes from Kantar Research and was published by the National Retail Federation (NRF). The historical data for some companies that weren’t in the Top 100 all years from 2019>2023 was gathered from other reliable sources. In 2020, Restaurants were removed from the list and only Convenience stores sales for Gas Stations were included. I adjusted the 2019 list to reflect this change. This change means that the Top 100 now only includes Relevant Retail companies. The Top 100 account for 35.3% of the total market. This share peaked at 39.0% during the 2020 pandemic and has slowly declined since then. However, the Top 100 are still the “Retail Elite”. The vast majority of the group also stock and sell a lot of Pet Products so their progress is critically important to the Pet Industry. Let’s get started in our analysis. The report does contain a lot of data, but we’ll break it up into smaller pieces to make it more digestible.

We will begin our report with an overview chart of the 2019>2023 annual sales history for major segments of the Retail Marketplace. The U.S. Retail market strongly recovered from the 2020 pandemic trauma and the resurgence became widespread across most channels. Our regular retail sales reports have shown that different defined retail channels often took a different path from 2019 to 2021. In the Spring of 2021 and throughout 2022 the retail market faced a new challenge – strong inflation. The YOY price increases were the largest in decades, even reaching double digits in October of 2021 (stayed for 11 months). The high rate didn’t start to slow until the July of 2022. Although the increase rate has slowed, the retail market is now feeling the impact of high cumulative inflation. The Top 100 analysis allows us to see if the company revenue size was a factor in their overall pandemic/price journey from 2019>2023. The following chart shows the annual sales and market share as well as the changes in both for large retail subgroups that are based upon the amount of their annual revenue. Note: In comments we’ll show Avg Growth Rates – Actual & Real (Inflation Related)

- The Total Retail Market grew $273B, +3.4% in 2023. That is far less than the $1.14T, +18.4% in 2021 and even below pre-pandemic years: 2019, 3.6%; 2018, 4.9%; 2017, 4.3%. However, the average growth rate from 2019>23 is 7.7%, which is almost double the 2016>19 rate of 3.9%. Factoring in inflation, Real 19>23 growth was +2.7%, exactly equal to 16>19. The impact of cumulative inflation – smaller sales increases and only 35% of 19>23 growth is real.

- The “Non-Relevant” Retail Group (Restaurants, Auto Dlrs, Gas Stations) was hit hardest by the pandemic as sales fell -9.6% in 2020. They had a strong recovery as 20>22 sales grew $932B, for an average 19>22 growth rate of 8.8%. In 23 the increase slowed to 2.6%. High inflation was a factor for all groups. Gas: +34%; Auto: +28%; Restaurants: +23%

- Relevant Retail was the hero of the pandemic as they kept Total Retail positive in 2020. Their sales surged in the 2021 recovery then radically slowed in 22 (7.1%) & 23 (3.9%). They were still up $192B producing an average growth rate since 2019 of +8.0%. Their Real growth rate (considering inflation) was +4.0%. Their share of Total Retail has stabilized but is down 3.3% from its peak in 2020. The story is a bit more complex. Let’s drill deeper into this group.

- The Top 100 Retailers make up 57.5% of Relevant Retail and 35.3% of Total Retail. Sales have grown every year since 2019 but slowed markedly in 23. Their market share has fallen since peaking in 2020 for Relevant Retail and 2019 for Total Retail. Their avg growth since 2019 is +6.1%, but Real Growth is only +2.7%. Only 44.3% of their growth is real.

- The biggest subgroup in $ales in the Top 100 is the Top 10 which accounts for 59.3% of the Top 100’s revenue, up from 55% in 2019. This group has been unchanged since 2015 and consists of Amazon, plus truly essential brick ‘n mortar retailers. Their biggest sales surge occurred in 2020 which was their peak in Retail market share. Their growth slowed in 23 but their average growth rate is +8.1%. Real growth was +4.1% – 50.6%.

- The Retailers ranked from #11 to #100 change slightly every year. Their sales in 2023 ranged from $4.1B to $69B and they accounted for 40.7% of the Top 100’s revenue. They have an unusual sales pattern in that their $46B decrease in 2020 is the only negative sales on the chart outside of the big drop by Rest/Auto/Gas. They did have a strong 10.7% increase in 2021 but that fell to 6.1% in 22 & 1.9% in 23. They have also lost market share in Total & Relevant Retail every year since 2019 but are still a big part of U.S. Retail. Avg 19>23 Growth: +3.4%; Real: 0.9% – only 26.5%.

- The Relevant Retailers outside of the Top 100 don’t get a lot of “press” but maybe they should. They currently account for 42.5% of Relevant Retail $ and 26.2% of Total Retail. They had the biggest percentage increase of any Relevant Retail subgroup overall and in all years but 2020 (2nd). Their increase since 2019 is +10.9%. Real: +6.8%, the best numbers of any group on the chart. While this performance is amazing, perhaps the most important fact is that they delivered 60% of Relevant Retail’s sales increase in 2020 and even 55% of the lift from 2019>2023.

There is no doubt that the big retailers are critical to the success of the U.S. Retail Market. However, there are sometimes “hidden heroes” that should be noted.

The Top 100 outperformed Total Retail in 2020 but not in 2021>2023. In fact, the sales growth since 2019 trails Total Retail, Relevant Retail and even Rest/Auto/Gas. It still generates 35.3% of Total U.S. Retail $ so it is still very important. We also should remember that the Top 100 is really a contest with a changing list of winners. Companies drop out and new ones are added. This can be the result of mergers, acquisitions, surging or slumping sales or even a corporate restructuring. In 2023. Overstock.com gained the rights for online sales from Bed, Bath & Beyond. Only 2 were new:

- Overstock.com (Home Gds)

- Save Mart (Supermarket) – returns after dropping off in 2022

To make room, 2 companies dropped off the list. Neither was a surprise.

- Barnes & Noble (Book Store) – Category now gone from list

- Office Depot (Office Supplies) – Only 1 left on the list.

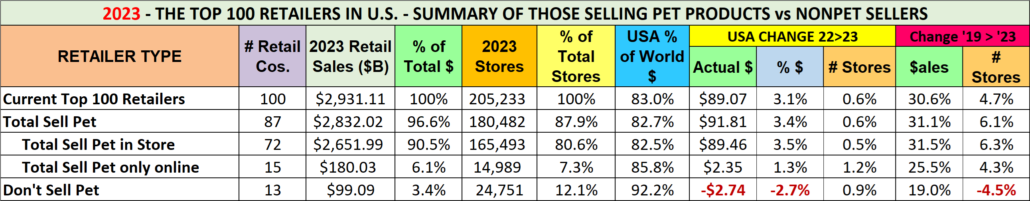

I think that we now have a good overview of U.S. Retail and the Top 100 so let’s ask and answer a very relevant question. How many Top 100 companies are buying and selling Pet Products? This will reinforce that Pets have become an integral part of the American Household and how fierce that the competition for the Pet Parents’ $ has become.

- We should note that the data in the chart only reflects the performance of the companies in the 2023 list since 2019 and is not being compared to the Top 100 list of companies from prior years

- 87 are again selling some Pet Products in stores and/or online. There is 1 more in the online only segment due to the addition of Overstock.com to the list. Note: 87 is 7 more companies than the 1st “official” all Relevant Retail Top 100 list in 2020.

- Their Total Retail Sales of all products is $2.83 Trillion which is…

- 96.6% of the total business for the Top 100

- 55.5% of Relevant Retail

- 34.1% of the Total Retail market

- 72 Cos., with $2.65T in sales sell pet products off the retail shelf in 165,493 stores – 12,000 more than 2020.

- In 2023, the current Top 100 companies made no changes in how they handle pet products.

- As you can see by the growth in both sales and store count since 2019, “in store” is still the best way to sell pet.

- Online only is another story and the story gets complicated.

- Amazon includes Whole Foods, which has stores in 45 states so the Amazon $ are in the “Pet in Store” numbers.

- 1 New Retailer in the 2023 list (Overstock.com) is online only. This group had decreased sales and closed stores in 2020. 21 & 22 brought a rebound in both areas but the sales lift slowed in 23. They still lead Non-Pet in the 19>23 $ lift.

- Their Total Retail Sales of all products is $2.83 Trillion which is…

- Some non-pet specialty retailers like Lulumon and Signet have had extraordinarily strong post pandemic growth. However, the growth in the non-pet group has slowed in 2022 and fell -2.7% in 2023. They have also closed 4.5% of their stores, which is now thankfully reversing. Perhaps, more of them will see Pet as a new growth opportunity.

The pandemic caused our Pets to become an even more important part of our households. They are truly family. Pet products have long been an integral part of the strongest retailers and are now even more widespread across the entire U.S. marketplace. Of the Top 100, 165,493 stores carry at least some pet items at retail. However, there are thousands of additional “pet” outlets including 15,000 Grocery Stores, 10,000 Pet Stores, 16,000 Vet Clinics, 6,000 Pet Services businesses and more. Pet Products are on the shelf in over 215,000 U.S. brick ‘n mortar stores… plus the internet. Pet Products have become part of the new “normal” for the majority of U.S. Retailers.

Before we analyze the whole Top 100 list in greater detail let’s take a quick look at the Top 10 retailers in the U.S.

Except for changes in rank, this group has been incredibly stable. The list has been the same since 2013, with one slight qualification. In 2015 Albertsons purchased Safeway. The new Albertsons/Safeway group replaced the stand-alone Safeway company in the list. We have again included the average annual 19>23 growth rates – both Actual & Real (Inflation was factored in using specifically targeted CPIs) Now let’s get into the numbers.

- Their Total Retail Sales were $1.74 Trillion which is:

- 59.3% of Top 100 $ales, slightly above the previous 2020 peak (58.9%) and 4.3% more than 55% in 2019.

- 34.1% of Relevant Retail, equal to 21 & 22 but down from 35.5 in 2020.

- 20.9% of Total U.S. Retail $, equal to 22, down from 21.2% in 21 and 23.0% in 20, but above 20.6% in 2019.

- In ranking, there was only 1 change. CVS & Target swapped places.

- Sales vs 22 are only down for Home Depot, Target & Lowes. All are up vs 19. The biggest growth vs 21 & 19 came from Amazon. In average growth, 4 have rates over 8%. The group averages +8.1% with +4.1% (51%) being real.

- Driven by Drug, Store count turned down -1.4% vs 22. It is still down vs 19 for 4 companies and -1.5% for the group.

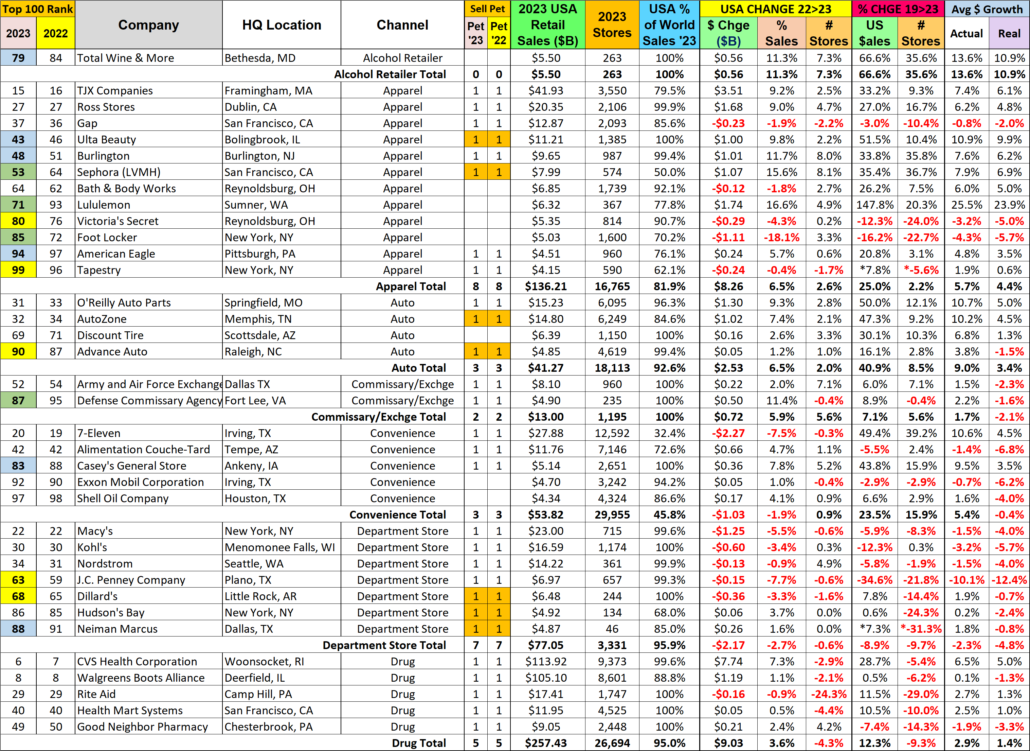

Now we’ll look at the detailed list of the top 100. It is sorted by channel groups with subtotals in key columns. The data only reflects the situation for the current 2023 Top 100 Retailers. Retailers have slightly changed in some groups through the years but there has been very little difference in group share. CPI Note: To better reflect their “real” product sales, I used a specific CPI rate for each retailer. These ranged from individual expenditures, like Alcohol at Home for Total Wine & More to specially created targeted aggregates for Superstores/Clubs. For the group, the individual inflation results were then combined to more accurately reflect the group price changes . There is not a lot of highlighting, but:

- Pet Columns ’23 & ‘22 – a “1” with an orange highlight indicates that products are only sold online.

- Rank Columns – 2023 changes in rank from the 2022 list are highlighted as follows:

- Up 3-5 spots = Lt Blue; Up 6 or more = Green

- Down 3-5 Spots = Yellow; Down 6 or more = Pink

Let’s get started. Remember, online $ are included in the sales of all companies.

Note:(*) in the 2019 columns of some companies means the 2019 base was estimated from other sources.

Observations

- Alcohol Retailers first made the list in 2020 as consumers increased dining at home. Strong growth continues.

- Apparel – They were hit hard by the pandemic, but had a strong recovery in 2021. The increase slowed to 1.9% in 2022 but came back strong in 2023, +6.5%. 6 companies had sales increases over 9% from 2022. Foot Locker had the only major decrease, -18.1%. Group Store count is up vs 22 (+2.6%) and vs 19 (+4.4%). The average group sales increase was Actual: +5.7%; Real: +4.4% (77%). The category has fewer companies than in 2021 but more than in 2019.

- Auto – This group is unchanged from 2019. Their growth slowed a little in 22 & 23 but the only negative for this group is that Advance Auto’s store count is down -1.4% from 2019. Group Avg Growth: +9.0%; Real: +3.4%. (38%).

- Book Stores – Barnes & Noble dropped off so like 2019 & 2020 no Book Stores are in the Top 100.

- Commissary/Exchanges – They were on hold from 2019>22. Both Group Sales & Store Count grew in 2023 which pushed their Avg Actual Sales to +1.7%. However, their Real Sales Avg is -2.1%.

- Convenience Stores – Sales are down in 23 due to 7-Eleven. Their 2022 acquisition of Speedway fueled most of the group’s 19>23 growth. The group’s Avg Actual Sales change: +5.4%;Real: -0.4%, due to strong inflation.

- The decline in Department Stores was accelerated by the pandemic. Sales in the category grew in 22 because of the addition of Neiman Marcus. Neiman Marcus’ sales are up again in 2023. Dillard’s & Neiman Marcus have the only significant actual growth since 19. Real growth is down for all. In fact, all group measurements are negative. J.C. Penny, a hallmark in the department store channel, has by far the worst performance.

- Drug Stores – Rite Aid filed for bankruptcy and have the only sales drop vs 22. All have been closing stores since 2019 but only Good Neighbor has lower sales. The group avg sales from 2019>23 are Actual: +2.9%; Real: + 1.4% (48% real growth). CVS has the strongest growth, but it is primarily due to acquisitions.

- Electronics/Entertainment – Sales vs 22 fell for all but Amazon but their increase was big enough to turn the group positive. Store closures continued, especially for electronics retailers.

- Amazon Retail growth increased in 23 but is still only 49% of their average 19>23 growth. However, 81% is Real.

- 3 were down vs 2019 with Qurate having the worst performance. Avg Actual: -6.7%; Real: -9.1%.

- All 5 Electronics stores were down vs 2022 but 3 were up vs 2019. They continue to close stores. However, strong deflation has pushed real sales significantly up so only Dell is “really” down vs 2019.

- Group avg growth, Actual: +9.2%; Real: +10.3%. Deflation in electronics was strong enough to impact the group.

- Farm– Tractor Supply growth slowed from 11.4% to 3.4%. Avg Actual: +14.9%; Real: +8.6% (58%). Plus, more stores.

- Hobby & Crafts– Hobby Lobby is by far the best performer. In fact, Michael’s sales are actually down vs 22. However, both continue to add stores. Avg Group Growth: 4.9%; Real: +4.7%. 96% is real.

- Home Goods – Overstock acquired the rights to Bed, Bath & Beyond’s online sales. They entered the Top 100 and their big increase is the only reason the group is up vs 22. Vs 2019, only Amway is down. Store closures slowed in 23, -0.1%, but are -2.0% vs 19. Group Avg Actual growth: +5.9%; Real: +2.5% (42%).

- Home Improvement/Hardware – Sales vs last year turned negative in 23. 4 of 7 were down but Home Depot and Lowes fueled the group drop. Store openings slowed in 23 but are still widespread.

- Sales vs 2019 is a different story. All but Menards (+8.4%) are up 21+%. Group store growth is also high, +5.8%.

- Avg Actual Growth: +7.8%; Real: +1.9% (Only 24% “Real” growth)

- Jewelry – Signet sales plummeted, and they started closing stores again. Avg: 11.6%; Real: 8.0% (69%).

- Mass Merchants have 3 of the 7 largest volume retailers in America – Wal-Mart, Costco and Target. However, the value and selection offered by the whole group has increased its importance to consumers due to the pandemic.

- In 2023 Wal-Mart $ were up 6.9%, below both the 8.7% in 2022 and their average increase in sales: +7.5%. Their business is driven by SuperCenters. Groceries drove up inflation so their real sales avg increase was 3.5%, only 47%. After a small increase last year, their store count is down vs 2022 and -0.6% from 2019.

- Costco’s 2023 $ increase was +6.8%, down radically from +16.9% in 2022 and 43% less than their 11.9% average. Average real growth was 7.8% (66%). They continue to open new stores and are now +8.3% vs 2019.

- Target – After 6 consecutive annual sales increases, sales fell -1.6% in 2023. Their growth peaked at +13.2% in 2021. Avg Growth: 8.2%; Real Growth: 4.2%, 51%. They opened a few more supercenters in 2023 and their store count is now up 4.7% from 2019. They also have added more fresh groceries to their discount stores.

- Meijer’s $ales were +3.7% from 22, down from 5.6% in 21>22 and below their avg of 5.5%. Their avg real growth is 1.7%, only 31%. They continue to open stores, +1.9% from 22 and +8.1% since 2019.

- BJ’s growth fell from +22.8% in 22 to +4.6% in 23. However, they are still the growth leader vs 2019, +62.5% in sales and +11.5% in stores. Avg growth: +12.9%; Real: +8.7%, 67%. We should note that Costco ranks 2nd in both comparisons vs 2019 and Sam’s Club is a significant share of Wal-Mart’s total sales. Mass Merchants are the biggest category and Club stores have moved to the retail forefront.

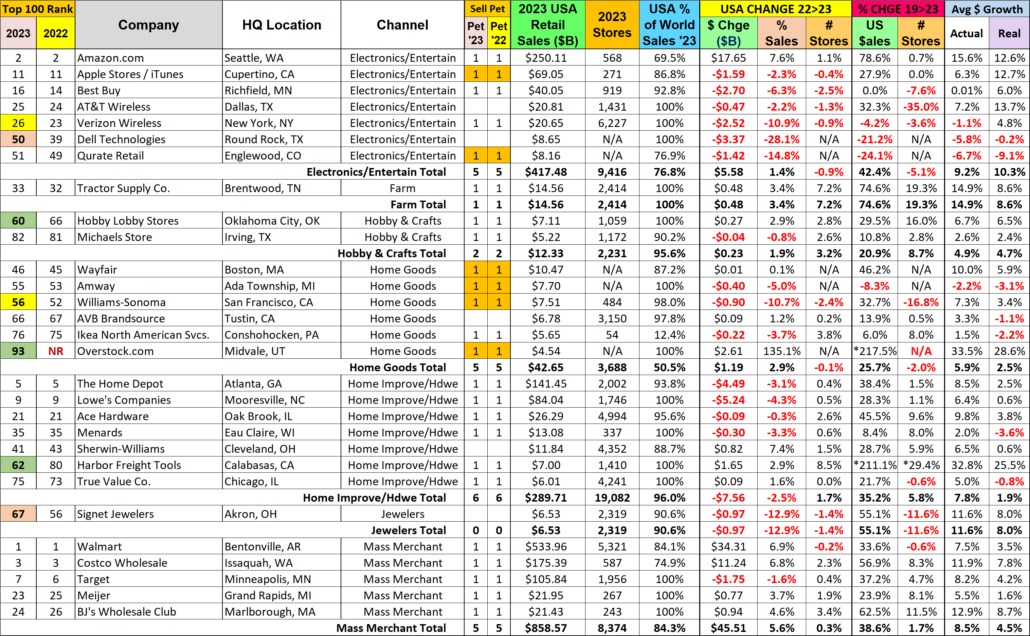

- Office Supply Stores – This channel continues its consistent decline as Consumers maintain their move to online ordering of these products. Office Depot dropped off of the list, leaving only Staples. All Staples comparisons are negative, and their Avg Growth is: -2.4%; Real: -8.7%. They also have -10.1% fewer stores than in 2019.

- Pet Stores growth in 23 was +6.0%, down from +7.3% in 21>22 and a big drop from their 21 peak, +22.3%, but they are up +54.2% from 2019. Most of the growth in all measurements is coming from Chewy’s online sales.

- As you know Chewy and PetSmart numbers are reported individually as they are separate companies.

- With the strong consumer movement to online purchasing, Chewy is still the big story in this channel. They have the most sales. Their 22>23 increase was +10.4%, down from 13.6% in 22 and +24.4% in 21, but 74% of the Pet Store group’s 2023 $ increase. Their 81.6% sales increase vs 2019 is also double that of the retail outlets. Avg Growth rate: +16.1%; Real: +11.4%. 71% of their big increase is real.

- PetSmart’s 22>23 growth was only +2.0%, less than +2.2% in 21>22 and 93% below +23.1% in 20>21. Sales are still up +35.1% from 2019 and they continue to expand their retail footprint with 3.9% more stores than in 2019. Their average growth rate is +7.8%. Real growth is +3.5%, 45%. This is far below Chewy’s, but not too bad.

- Petco’s growth since 2019, +40.7% is slightly ahead of PetSmart. At +3.7%, it was slightly below +4.1% in 21>22 and down a lot from +17.6% in 20>21. Avg growth: +8.9%; Real: +4.5%, 51%. The biggest difference from PetSmart is that Petco has cut back on their retail stores, even in 2023. Their store count is now down -8.4% from 2019.

- Small Format Value Stores – These stores offer value and convenience, but there are 2 types – Big Lots & $ Stores

- Group sales increased +3.3%, down from +7.4% in 22. Avg 19>23 Growth: +6.9%; Real: +2.9%, 42%.

- Dollar General & Dollar Tree were responsible for all of the group’s growth in both $ and stores. Vs 2019, Dollar General was the leader in both areas. Avg Growth: +8.7%; Real: +4.6%, 53%. Dollar Tree was the growth leader in 23 with +$2.3B, +8.3% vs 22. Their 19>23 Avg Growth was +6.7%; Real growth was +2.8%, 42%.

- Big Lots’ $ fell -13.6% from 22. All of their comparisons vs 22 & 19 are negative. Avg Growth: -2.9%; Real: -6.6%

- Sporting Goods – Sales vs 22: -0.2%, peaked at +13.6% in 21. Camping World & Academy were down vs 22 but all are up vs 19. The group’s store count is down due to Dick’s and Camping World. Avg $ Growth: +9.1%; Real: +4.7%, 52%.

- Dick’s has the best $ performance vs 22 & 19, despite closing 1.9% of their stores. Avg: 10.2%; Real: 6.9%, 68%.

- Camping World & Academy were both down vs 22 but up 22+% vs 2019. Academy has opened 8.9% more stores

- Bass Pro has the worst performance. They closed 3.1% of their stores in 20&21. Avg Growth: +2.5%; Real: -1.9%.

- Supermarkets – There was less turmoil than usual in this category – only minor rank changes, no drop outs and Save Mart returned to the list. Avg Growth: +6.3%; Real: 0.5%, only 8%. Store count +0.3% from 2019.

- All but Weis were up vs 2022 in $ and only Save-A-Lot and Southeastern were down vs 2019.

- Of 24 companies, only 5 cut back on stores in 2023 and 8 have fewer stores than in 2019.

- Sales continue to increase but you see a major impact of strong inflation – only 8% of the 19>23 growth is real.

- With $567B in sales from 17.5K stores, all carrying Pet Products, this group is essential both to the Retail Market and the Pet Industry.

Wrapping it up!

This report is focused on 2023 but we can also see the continued evolution of the Retail Marketplace. In 2020 many non-essential retailers were hit with restrictions and closures. On the plus side, consumers turned their focus to essentials and their homes. This helped drive incredible growth in many retail channels.

In 2021 the Total Retail market moved into a full recovery with spectacular growth. Many channels showed a strong sales rebound from 2020. Others built upon their pandemic success while many returned to a more normal growth pattern. However, a few continued to decline. The Top 100 companies had participants in all of these patterns.

In 2022 we were hit by strong inflation in many categories which slowed both actual and real growth. Inflation slowed in 23 but we still see its cumulative impact in the reduced annual increases. Plus, sales of 33 Top 100 retailers actually fell vs 2022.

The Top 100 is a contest with the winners changing slightly every year. It is a critical part of the U.S. Market, accounting for almost 60% of Relevant Retail Revenue and 35+% of Total Retail. Sales have increased annually but the Top 100’s share of Total Retail peaked in 2020 and in 2019 for Relevant Retail and has steadily declined. The Top 10 has had stronger annual growth but sales in the #11>100 group actually fell in 2020 and their 19>23 increase is only 40% of the Top 10’s lift. However, we should remember that we found a new hero in 2021 – Relevant Retail, not in the Top 100. The 19>23 Sales by these smaller guys are +51.5%, 42% more than the Top 10. Their performance continues to be amazing.

Pet Products are an important part of the success of the Top 100. 87 companies (96.6% of $) sell Pet items in 165K stores and/or online. The 72 companies that stock pet products in their stores generated $2.65T in total sales. How much was from pet? Let’s “Do the math”. If we take out the $14B done by Top 100 Pet stores and the remaining companies generated only 1.7% of their sales from Pet, we’re looking at $45B in Pet Products sales from 70 non-pet sources! (The 1.7% Pet share is based on the Economic Census.) If you add Pet Stores & Chewy into the $, Pet Products sales for the Top 100 are $68.4B. The APPA reported $96.4B in Pet Products sales for 23. That means 70 mass market retailers accounted for 46.7% of all the Pet Products sold in the U.S. and 73 Top 100 companies generated 71.0%. Pet Products are widespread in the retail market but the $ are concentrated. Pet Industry participants should monitor the Top 100.

Retail sales increases slowed in 2023 as cumulative inflation became a major factor. The situation is still evolving but the Top 100 will always be a critical part of U.S. Retail. I hope that this detailed look helped put this group into a better perspective.