Pet Products Spending by Generation: Mid-Year 2018 Update

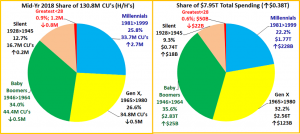

Pet Products spending totaled $51.17B for the 12-month period ending 6/30/18. This was an increase of $5.3B (+11.5%). Total U.S. spending for the period totaled $7.95 Trillion, up $370B (+4.9%). Driven by big increases in both Food and Supplies, Pet Products Spending growth far exceeded the pace of Total U.S. spending.

In this report we will update Pet Products Spending for arguably the most popular demographic measurement – by Generation. Baby Boomers built today’s Pet Industry, but they are getting old. What happens next? Gen Xers are next in line but most of the discussion revolves around Millennials. Last year at this time the Gen Xers had a big year. Are they still performing? What about the youngsters? Are they stepping up in life and spending? Have the Boomers still got it? Let’s take a closer look. The numbers come from or are calculated from data in the US BLS Consumer Expenditure Survey.

First, let’s define each generation and look side by side at their share of Consumer Units (H/H’s) and Total Spending.

Generations Defined:

- Millennials: Born 1981 and after

- In 2018, age 19 to 37

- Gen X: Born 1965 to 1980

- In 2018, age 38 to 53

- Boomers: Born 1946 to 1964

- In 2018, age 54 to 72

- Silent: Born 1928 to 1945

- In 2018, age 73 to 90

- Greatest: Born before 1928

- In 2018, age 91 and over

- Boomers are still the largest group with 44.4M CUs (34.0%) and the biggest spenders – $2.8T. Their numbers are down but their spending is still growing and over performing as their share in relation to their share of CUs is 105%.

- Gen X is the second largest CU group. Their overall numbers are down slightly as more singles “pair up”. However, their spending was up $123B to $2.56T. They are the leaders in spending performance, and it got even better, 121%.

- Millennials are the largest generation in sheer numbers, but third in CUs. More are developing financial independence as CUs grew by 2.7M – up 5M (+17%) in 2 years. They also had the biggest increase in spending +$228B. Their total spending was $1.77T – 3rd However, their spending performance is only 86%.

- The Silent generation actually gained slightly in CUs and their overall spending was up $18B so they remain a viable force in the marketplace. The Greatest Generation will soon be too small to be a measurable, separate spending group. They will be replaced by Gen Z by 2020.

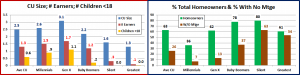

There is the obvious difference in age to be considered and differences in behavior. However, we have also learned that there are key Consumer Unit characteristics, like income, family situation and home ownership that make a difference both in Total Spending and in Pet Spending. Let’s look at some of these key differences.

- It just takes 2. CUs with 2 or more people account for 84.8% of all Pet Products Spending. (up from 81% last year)

- The size of the CU and number of children is all about Family responsibility and all the financial pressures that this generates. The CU size overall is unchanged from Mid-2017 and still peaks with the Gen Xers. However, the Boomer and Gen X generations decreased by 0.1 person. Perhaps, their Millennial kids are moving out.

- Married couples with children under 18 are an important segment, 23.4% of all CUs. They account for 26.5% of all Pet Products spending and 32.8% of Supplies Spending. However, as the number of children grows, the increased financial responsibility can slow Pet Spending.

- Boomers still average 2+ people in the CU. However, they are much less likely to have children <18 at home. As their human children leave home, they turn their attention and spending to their Pet Children who are still with them.

- Pet Products spending is also tied to the number of earners in a CU. 2+ Earner CUs account for 41% of the total but they spend 49% of Pet Products $. As you can see the “earning” is being done in America by Gen Xers, Millennials and Boomers with Gen Xers at the top, as to be expected. Boomers are down 0.1 as more move into retirement.

- Homeownership – Owning and controlling your own space has always been a key to increased Pet Ownership and spending. Homeowners currently account for 80.2% of all Pet Products Spending, which increased by $4.89B (+13.5%). Renters’ spending was up too, but only $0.4B (+4%), which highlights the importance of homeownership.

- Nationally, Homeownership remained steady at 63%. Gen Xers remain at or near the national average. Homeownership continues to increase until we reach the oldest Americans.

- The Millennials are obviously lagging behind but they did increase from 34% to 36% and are up from 32% in 2016. This is encouraging. Boomers also moved up 1% to 78%. The homeownership rate for the over 25 Millennials still remains 20% below the rate for the older generations when they were the same age.

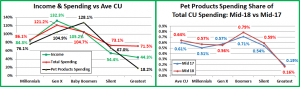

Next, we’ll compare the Generations to the National Average in Income, Spending, Pet Products Spending and Pet Products Share of Total $pending:

- CU Avg Income – $76,335

- Total Spending – $60,815

- Pet Products Spending – $391.90

- Pet Products Share of Total Spending – 0.64%

- Income – The 38>53-year-old Gen Xers are the leaders. The Boomers earn about 20% less and their income will continue to fall as they age. The big drop begins with the Silents as retirement becomes almost universal. The Millennials income is still 20% less than the Boomers and only 64% of the Gen Xers.

- Total Spending – The Gen Xers make the most and spend the most, but their spending is not out of line with their income. Boomers also spend more than the average, but their income can still support it. Spending doesn’t fall as fast as income with the older generations. In fact, they are actually deficit spending in relation to their after tax The Millennials under 25 are also in an after tax income deficit spending situation. The rising income from the 25>37 group makes up the difference and brings their overall generational spending more in line with income.

- Avg CU Pet Products Spending – The Boomers have been alone at the top since they made the move to upgrade to Super Premium Food in 2015. Their lead began dropping when they began value shopping for food in 2016 but it has bounced back with the 2nd wave of Super Premium. The Millennials are closing the gap but still trail the Gen Xers by 27% and the Boomers by 41%. The Gen Xers made a big move in Pet Products spending last year as they broke the national average for the first time since 2014. However, they lost ground this year – down to 104.9% from 112%.

- Pet Products Share of Total Spending – One measure of the level of commitment to their Pets.

- The Pet Products share of total spending increased to 0.64%. Only Boomers exceed the National Average but everyone under 91 years of age is at least 87% of the national average.

- In a flip flop from last year, Gen Xers were the only big group to decrease their pet products spending in terms of its share of their overall spending. The drop was small and should be put into perspective. This group not only makes and spends the most money, they had by far the biggest increase per CU in these areas.

- Millennials are in 3rd place in both income and total spending and moved up to 3rd place in Pet Products Spending share. Their Total Spending was up 5.5% but their Pet Products Spending was up 18.5%.

- You can see that spending for the very Oldest, “Greatest” Americans continues to drop but the 73 to 90-year-old Silent Generation is still making “noise” with their commitment to their pet companions.

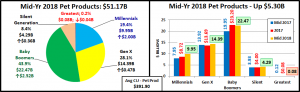

Now let’s look at Pet Products $ spent by Generation and their share of the total.

- In terms of 2018 Mid-Yr Performance, all but the Greatest were up, but the lift was driven by Boomers & Millennials.

- Boomers still have the largest share, but the Millennials gained the most, moving up to 19.4% from 17.3% last year.

- Overall – Ave CU spent $391.90 (+37.98); 2018 Mid-Yr Pet Products spending = $51.17B, Up $5.3B (+11.5%)

- The bulk of the lift is coming from 2017. July>Dec 17, Up $3.82B; Jan>Jun 2018, Up $1.48B

- Boomers – Ave CU spent $502.14 (+$56.71); 2018 Mid-Yr Pet Products spending = $22.47B, Up $2.52B (+12.6%)

- Big lift in 2017 but spending turned down in 2018. – Jul>Dec 17, Up $3.25B; Jan>Jun 18, Down $0.73B.

- Gen X – Ave CU spent $411.04 (+$14.03); 2018 Mid-Yr Pet Products Spending = $14.39B, Up $0.47B (+3.3%)

- Relatively flat but turning up in 2018. – Jul>Dec 17, Down $0.24B; Jan>Jun 18, Up $0.70B

- Millennials – Ave CU spent $298.37 (+$46.65); 2018 Mid-Yr Pet Products Spending = $9.95B, Up $2.00B (+25.2%)

- The most consistent, strong growth of any group. – Jul>Dec 17, Up $0.77B; Jan>Jun 18, Up $1.23B.

- Silent Gen. – Ave CU spent $262.63 (+$23.33); 2018 Mid-Yr Pet Products Spending = $4.29B, Up $0.36B (+9.1%)

- Growth in both halves but the bulk of the lift came in 2018. Jul>Dec 17, Up $0.07B; Jan>Jun 18, Up $0.28B.

- Greatest Gen.– Ave CU spent $71.37 (-$0.83); 2018 Mid-Yr Pet Products Spending= $0.08B, Down $0.04B (-35.3%)

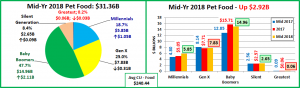

The increase was driven by Boomers in 2017 and Millennials in 2018. Let’s look at individual segments. First, Pet Food

- Boomers drove the lift in the 2nd half of 2017, then they began value shopping at the start of 2018.

- The Millennials had a big lift at the beginning of 2018. Perhaps this is the start of a Pet Food new trend?

- Overall – Ave Cu spent $240.44 (+$21.01); 2018 Mid-Yr Food spending = $31.36B, Up $2.92B (+10.2%)

- After a big lift in the 2nd half of 2017, growth slowed markedly. Jul>Dec 17 (+$2.67B); Jan>Jun 18 (+$0.25B)

- Boomers – Ave CU spent $333.30 (+$45.96); 2018 Mid-Yr Food spending= $14.96B, Up $2.11B (+16.5%)

- July>Dec 17 (+$2.86B) – Wave to Super Premium continues. Jan>Jun 2018 (-$0.75B) – In 2018: Value shopping.

- Gen X – Ave CU spent $222.45 (-$10.83); 2018 Mid-Yr Food spending= $7.83B, Down $0.32B (-3.9%)

- Some value shopping in 2nd half of 2017 then began to bounce back. Jul>Dec 17 (-$0.43B); In Jan>Jun 18 (+0.11B)

- Millennials – Ave CU spent $177.16 (+$26.95); 2018 Mid-Yr Food Spending $5.85B, Up $1.06B (+22.1%)

- Jul>Dec 17 (+$0.26B); Jan>Jun 18 (+$0.80B). Some of the lift is coming from a big increase in CUs. However, we could be seeing the start of a new food trend. Remember, Millennials pioneered the move to Super Premium.

- Silent Generation – Ave CU spent $164.31 (+$8.53); 2018 Mid-Yr Food spending $2.65B, Up $0.09B (+3.6%)

- Spending was flat in the 2nd half of 2017, then picked up in 2018. Jul>Dec 17 (+0.01B); Jan>Jun 18 (+$0.08B)

- Greatest Gen. – Ave CU spent $56.32 (-$1.57); 2018 Mid-Yr Food spending= $0.06B, ↓ $0.03B (-34.9%) – fading.

We are still seeing the impact of the 2nd wave of Super Premium in 2017. However, 2018 started off strong for Millennials while Boomers began value shopping. It could signal the beginning of a new Food trend. Now, Supplies.

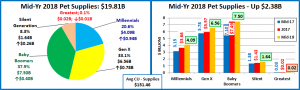

- Boomers still have the largest share but Supplies spending skews younger – Gen X and Millennials control 53.7%.

- The lift is consistent and widespread. The Oldest Americans are losing CUs, driving spending down.

- Overall – Ave CU spent $151.46 (+$16.97); 2018 Mid-Yr Supplies spending = $19.81B, Up $2.38B (+13.6%)

- Supplies spending has been strong and growing for 24 months. Jul>Dec 17 (+$1.15B); Jan>Jun 18 (+$1.23B)

- Baby Boomers – Ave CU spent $158.09 (+$10.75); 2018 Mid-Yr Supplies spending= $7.50B, Up $0.40B (+5.7%)

- With a big increase in Food $, the Supplies lift is more subdued. Jul>Dec 17 (+$0.39B); Jan>Jun 18 (+$0.01B)

- Gen X – Ave CU spent $188.59 (+$24.86); 2018 Mid-Yr Supplies spending= $6.56B, Up $0.78B (+13.4%)

- Consistent growth with biggest lift in the 1st half of 2018. Jul>Dec 2017 (+$0.19B); Jan>Jun 18 (+$0.59B)

- Millennials – Ave CU spent $121.21 (+19.70); 2018 Mid-Yr Supplies spending= $4.09B, Up $0.94B (+29.9%)

- More CUs and a strong lift in both halves. Jul>Dec 17 (+$0.51B); Jan>Jun 18 (+$0.43B)

- Silent Generation – Ave CU spent $98.32 (+14.80); 2018 Mid-Yr Supplies spending= $1.64B, Up $0.26B (+19.2%)

- Surprisingly consistent growth in both halves for this older group. Jul>Dec 17 (+$0.05B); Jan>Jun 18 (+$0.21B).

- Greatest Gen. – Ave CU spent $15.05 (+$0.74); 2018 Mid-Yr Supplies spending= $0.02B, Down $0.01B (-36.8%)

2015 saw a steep drop in Supplies spending as consumers upgraded to Super Premium Pet Food and reduced the frequency of Supplies purchases. Spending flattened out in the first half of 2016 but then this segment began a magical 24 month run. Consumers began value shopping for Pet Food and spent some saved money on Supplies. There were great values to be had as Supplies prices deflated for 22 months. This combination of circumstances generated an incredible $4.97B Supplies spending lift. The increase was driven by Gen X and Boomers, +$3.62B, but the Millennials stepped up in the last year, +$0.94B. Only the Greatest Generation spent less which was due to their declining numbers.

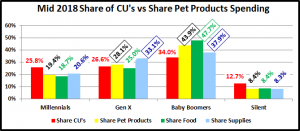

In the final chart we will compare each generation’s share of spending on Total Products, Pet Food and Pet Supplies to their share of CU’s and see “Who is earning their share?” Then we will review their actual performance numbers.

Performance = Share of Spending/Share of CU’s; 100+% indicates you are “earning your share”

If a share of market is outlined , then performance exceeds 100%.

- Greatest Generation – is not included in this section as both their market share and CU share are too small.

- Silent Generation Performance – Pet Products: 65.7%; Pet Food: 66.2%; Pet Supplies: 64.9%

- This group ranges in age from 73 to 90. Pet ownership is more difficult after age 75 and this is reflected in the low share of Pet Products spending. However, the desire and the commitment are still there. Their performance is remarkably consistent between Food and Supplies, but it is definitely dropping as they age.

- Baby Boomers Performance – Pet Products: 129.2%; Pet Food: 140.4%; Pet Supplies: 111.5 %

- The Boomers truly led the way in building the pet industry and they are still at it. They are earning their share and are the spending leader in both Food and Supplies. Driven by their 2017 spending increase in Food, their overall performance is up from last year. Ultimately this will begin to fade as they age. However, based upon their history, they will continue to perform well for many more years.

- Gen X Performance – Pet Products: 105.7%; Pet Food: 93.9%; Pet Supplies: 124.5%

- The Gen Xers are next in line and next in performance to the Boomers. They outperform the Boomers on supplies. However, their Food performance fell below 100% as they were in the value shopping phase. Gen Xers range in age from 38 to 53. They already make and spend the most money. As they grow older, their children will start to move away from home and their focus will increasingly turn to their Pet Children. Expect their overall performance to continue above the 100% level and to ultimately surpass the Boomers.

- Millennials Performance – Pet Products: 75.3%; Pet Food: 72.4%; Pet Supplies: 80.0%

-

- The Millennials are widely touted as the future of the industry. This is ultimately true, but the future is still a ways off. The Millennials are currently 19 to 37 years old. They have a lot of pets, but their responsibilities are growing, and money is still in short supply. They continue to spend a lot on Supplies as they establish pet households and seek products that make Pet Parenting easier. There is also strong evidence that they are leading the way in each new food trend. One thing is certain. Value shopping is their golden rule, especially on the internet. They are 17 years away from occupying the highest income age group. Plus, they are having children later so the spending lift from children leaving will undoubtedly be delayed. They may be 20 years away from Pet Spending dominance.

A Final Word – In the 2017 mid-year update, Pet Products Spending belonged to the Gen Xers. They produced $2.33B of a $2.41B increase with a strong performance in both Food and Supplies. This year the honor should be shared between the Boomers and the Millennials. With a huge lift in Food, Boomers accounted for 85% of the spending increase in the 2nd half of 2017. Then the Millennials stepped up to provide 83% of the lift in the 1st half of 2018. Overall the Boomers won, with a $2.52B increase. The Millennials finished 2nd, +$2.0B but they win the consistency award as they spent more in both halves in both Food and Supplies. Note: An Honorable mention should go to the Silents, who also had a small lift in both halves in both segments. Overall, it was an incredible 12 months for Pet Products spending, up $5.3B.