2019 U.S. TOTAL PET SPENDING $78.44B…Down ↓$0.16B

In 2019 Total Pet Spending in the U.S. was $78.44B, a $0.16B (0.2%) decrease from 2018. This decrease comes after 2 years of increases. As usual there were many factors behind the numbers, including some outside the control of the industry. Pet Food bounced back after the 2018 FDA warning regarding grain free dog food. However, the new tariffs on supplies had a huge negative impact on spending. Veterinary prices continued to rise. Spending was up slightly but the amount purchased by consumers actually fell. The Services segment $ declined slightly but essentially held its ground at the new high level established by record spending in 2018. Here are the $ changes:

- A $2.35B (+8.1%) increase in Food

- A $2.98B (-15.1%) decrease in Supplies

- A $0.58B (+2.7%) increase in Veterinary

- A $0.10B (-1.1%) decrease in Services

Let’s see how these numbers blend together at the household (CU) level. In any given week, 27.1 Million U.S. CU’s (1/5) spent money on their Pets – food, supplies, services, veterinary or any combination – down from 27.2M in 2018.

In 2019, the average U.S. CU (pet & non-pet) spent a total of $593.51 on their Pets. This was a small -0.8% decrease from the $598.41 spent in 2018. However, this doesn’t “add up” to a 0.2% decrease in Total Pet Spending. With additional data provided from the US BLS, here is what happened.

- 0.6% more CU’s

- Spent 0.1% more $

- 0.9% less often

If 67% of U.S. CU’s are pet parents, then their annual CU Total Pet Spending was $885.84. Now, let’s look at the recent history of Total Pet Spending. The rolling chart below provides a good overview. (Note: All numbers in this report come from or are calculated by using data from the US BLS Consumer Expenditure Surveys – The 2016>2019 Totals include Veterinary Numbers from the Interview survey, rather than the Diary survey due to high variation)

- We should note a 3 year pattern since 2010. 2 years of increases (yr 1 the largest) followed by a small decrease.

- In 2014-15, the Food upgrade began, but early in 2015 consumers were trading $ in other segments to pay for it.

- In 2016, they were intensely value shopping for super premium foods. They started spending some of this saved money on Supplies and Veterinary Services, but not quite enough as spending fell slightly for the year.

- In 2017, spending took off in all but Services, especially in the 2nd half. Consumers found more $ for their Pets.

- In 2018 a spectacular lift in Services overcame the FDA issue in Food, tariffs on Supplies and inflation in Veterinary.

- In 2019 a bounce back in Food and small lift in Veterinary couldn’t overcome the drop in Supplies from “tarifflation”.

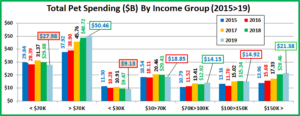

Now we’ll look at some Demographics. First, 2019 Total Pet Spending by Income Group

Spending was down under $70K but mixed in the higher income groups, with $100>150K down and the others up.

Nationally: · Total Pet: ↓$0.16B· Food: ↑$2.35B · Supplies: ↓$2.98B · Services: ↓$0.10B · Veterinary: ↑$0.58B

- < $70K – (58.5% of U.S. CUs); CU Pet Spending: $364.24, -4.9%; Total $: $27.98B, ↓$1.90B (-6.4%) ..

- Food ↓$0.63B

- Supplies ↓$1.62B

- Services ↓$0.26B

- Veterinary ↑$0.60B

Money matters a lot to this group, especially to those on the low end. You can see the impact of inflation in Supplies and Services. The drop in Food spending is a late reaction to the FDA warning by Retirees ($30>39K). The big lift in Veterinary comes mosstly from the <$30K group who were catching up after a big decrease in 2018.

- >$70K – (41.5% of U.S. CUs); CU Pet Spending: $913.12, -0.2%; Total $: $50.46B, ↑$1.74B (+3.6%) from…

- Food ↑$2.97B

- Supplies ↓$1.37B

- Services ↑$0.16B

- Veterinary ↓$0.03B

- This group continues to grow, up 3.5% in 2019. This accounted for almost all of their spending increase. They also show that income remains the single biggest factor in Pet Spending. 41% of U.S. CUs spent 64% of Total Pet $. They led the recovery in Food but were still impacted by Supplies prices. Services $ were up but Vet $ were flat.

- < $30K – (27.0% of U.S. CUs); CU Pet Spending: $262.84, +1.4%; Total $: $9.13B, ↓$0.34B (-3.6%) from…

- Food ↓$0.23B

- Supplies ↓$0.63B

- Services ↓$0.07B

- Veterinary ↑$0.58B

This lowest income group demonstrated their price sensitivity again in 2019. However, they are committed to their pets which is shown by their rebound in Vet Spending, +$0.58B, after a -$0.7B drop in 2018.

- $30>$70K – (31.5% of CUs); CU Pet Spending: $448.48, -9.2%; Total $: $18.85B, ↓$1.56B (-7.6%) from…

- Food ↓$0.40B

- Supplies ↓$0.99B

- Services ↓$0.19B

- Veterinary ↑$0.02B

This low to middle income group is also by necessity price sensitive. You see this in the drops in Supplies and Services. The drop in Food $ comes from Retirees’ ($30>39K) delayed reaction to the FDA warning. They did eke out a small, but second consecutive annual increase in Vet $. They are also committed to their pets.

- $70>$99K – (14.5% of CUs); CU Pet Spending: $737.70, +10.0%; Tot $: $14.15B, ↑$1.23B (+9.5%) from…

- Food ↑$0.62B

- Supplies ↓$0.02B

- Services ↑$0.15B

- Veterinary ↑$0.48B

This upper middle income group had a minimal negative reaction in Supplies and strong increases in all other segments. They were the best performing Pet Spending income group in 2019.

- $100K>$149K– (13.8% of CUs); CU Pet Spend: $803.77, -8.1%; Tot $: $14.92B, ↓$0.42B (-2.7%) from…

- Food ↑$0.74B

- Supplies ↓$0.67B

- Services ↑ $0.10B

- Veterinary ↓$0.59B

They were the Star of the income groups in 2015 and 2017. In 2016, they were the worst performers. 2018 saw increases in all segments but food. 2019 brought big increases in Food & Services while Vet & Supplies fell. Veterinary is a surprise. They have the money to fulfill their needs or wants, but are still very “value” conscious.

- $150K> – (13.3% of CUs); CU Pet Spending: $1219.98, -1.5%; Total $: $21.38B, ↑$0.93B (+4.5%) from…

- Food ↑$1.61B

- Supplies ↓$0.67B

- Services ↓$0.09B

- Veterinary ↑$0.08

Money Matters! They are the proof. They are the best performing income group in Total Pet Spending with 13.3% of U.S. Households generating 27.3% of all Pet $. They are also the only income group to increase annual Pet Spending every year since 2015. In fact they have furnished 69% of the Pet Industry’s $10.7B spending increase since 2015. This group is also growing. They added 0.8 million CUs in 2019, a 5.0% increase. In fact, their $0.93B increase was driven by the additional CUs. It does demonstrate that pet spending grows with consumers’ income, especially once you reach the $150K+ level.

Income Recap – The top 2 drivers in consumer spending behavior are value (quality + price) and convenience. That makes income , especially disposable income very important in Pet Spending. Overall we see a big difference in pet spending behavior at the opposite ends of the income spectrum. The <$30K group has been trending down and is now below their 2015 $. On the other hand, the $150K+ group has increased Pet Spending every year since 2015. In 2019 the increase/decrease spending dividing line is basically $70K. This line is somewhat deceptive and not rigid. While the recovery in Food was only in the $70K+ groups, tarifflation drove Supplies spending down in all groups. <$70K also spent less on Services but so did the $150K+ group. Veterinary spending increased in every income level but $100>150K CUs. 2019 Total Pet Spending was definitely mixed when we look closer at the income groups.

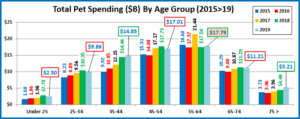

Next let’s look at 2019 Total Pet Spending by Age Group

Totally mixed results. The groups literally flipped up or down with every change in 10 year segment.

Nationally: · Total Pet: ↓$0.16B · Food: ↑$2.35B · Supplies: ↓$2.98B · Services: ↓$0.10B · Veterinary: ↑$0.58B

- <25 – (5.5% of U.S. CUs); CU Pet Spending: $336.22, -5.4%; Total $: $2.50B, ↓$0.29B (-10.5%) from…

- Food ↓$0.36B

- Supplies ↑$0.20B

- Services ↓$0.13B

- Veterinary ↑$0.002B

This youngest group dialed back spending on Food & Services which produced their 1st Total Pet decrease in 5 yrs.

- 25-34 – (16.1% of U.S. CUs); CU Pet Spending: $455.67, -6.8%; Total $: $9.86B, ↓$0.48B (-4.7%) from…

- Food ↑$0.10B

- Supplies ↓$0.65B

- Services ↓$0.04B

- Veterinary ↑$0.11B

These Millennials broke a 5 year pattern of increases. The drop was driven by Supplies. The other segments were relatively stable. Many are just starting households, so the fast rising Supplies’ prices were a big turnoff.

- 35-44 – (16.9% of CUs); CU Pet Spending: $668.50, +1.3%; Total $: $14.85B, ↑$0.39B (+2.7%) from…

- Food ↑$0.40B

- Supplies ↓$0.82B

- Services ↓$0.43B

- Veterinary ↑$1.23B

This group has the largest families and is in the middle of building their careers. This makes them very sensitive to value. You see this with the drops in the inflating, discretionary segments, Supplies & Services. However, they have a growing commitment to their pets which is evident from the big lifts in Food & Veterinary Spending.

- 45-54 – (16.8% of U.S. CUs); CU Pet Spending: $761.74, -1.0%; Total $: $17.01B, ↓$0.71B (-4.0%) from…

- Food ↑$1.20B

- Supplies ↓$0.75B

- Services ↑$0.09B

- Veterinary ↓$1.25B

This group has the highest income and occupies the top spot in CU Pet Spending. In 2018 they were briefly the leaders in Total Pet $ but they fell to #2 in 2019 because of a $2B decrease in Veterinary and Supplies spending. They are not “out of the running” yet. They had the biggest increase in Food $. We’ll see what 2020 brings.

- 55-64 – (18.6% of U.S. CUs); CU Pet Spending: $723.79, +2.0%; Total $: $17.79B, ↑$0.29B (+1.7%) from…

- Food ↑$0.81B

- Supplies ↓$0.35B

- Services ↑$0.07B

- Veterinary ↓$0.23B

These younger Baby Boomers are especially reactive in Food trends, up or down. They are committed to their Pets but value is also an important factor. They reacted negatively to inflated prices in the Supplies and Veterinary segments but still appreciated the convenience of Services. The result was a small increase in Total Pet $.

- 65-74 – (14.9% of U.S. CUs); CU Pet Spending: $572.02, -2.7%; Total $: $11.21B, ↓$0.08B (-0.7%) from…

- Food ↑$0.09B

- Supplies ↓$0.50B

- Services ↑$0.008B

- Veterinary ↑$0.33B

This group is growing, +2.1%. Many are retired and now 90% are Baby Boomers. They are careful with their money, but their commitment to their pets is very apparent as 1.04% of their total spending is on their companion animals. Their strong reaction to Supplies Price Inflation overcame small increases in every other segment.

- 75> – (11.2% of U.S. CUs); CU Pet Spending: $364.25, +9.5%; Total $: $5.21B, ↑$0.73B (+16.3%) from…

- Food ↑$0.11B

- Supplies ↓$0.11B

- Services ↑$0.34B

- Veterinary ↑$0.39B

Pet Parenting is more difficult, and money is tight for these oldest Pet Parents, but their commitment is still there. They were negatively impacted by Supplies price increases but increased their spending in the other segments. The lift was especially strong in both Service segments and pushed them to the biggest increase in Total Pet $.

Age Group Recap: There was an age spending pattern, but it was unusual. Over age 25, spending flipped up or down with every change in 10 year age group. This produced an unusual winner, 75+ year olds and an unusual loser, the high income, 45>54 year olds. There were some patterns within segments. Everyone over 25 spent more on Food and less on Supplies. The drop in Services came from those under 45. Veterinary Spending increased in all age groups except the 45>64 year olds.

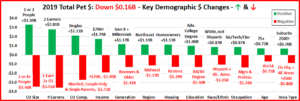

Next, we’ll look at the biggest winner and loser in each demographic category. In some cases, a clear spending pattern is evident. In those situations, segments are bundled together to reflect their shared spending behavior.

Key Demographic “Movers” for 2019.

In 2019, 50 of 96 Demographic Segments (52%) spent more on their Pets. Usually, this would produce an increase, but the size of the drops outweighed the increases, so spending fell -$0.16B (-0.2%). Let’s look at some specifics:

CU Size – 2+ are the “usual” winners but not in 2019. Singles and 3 person CU’s produced the only positives.

# of Earners – More earners usually means more income and increased pet spending. That was partially true in 2019 as 2 earners led the way. However, the results were mixed in other CUs with 1 earner, 2+ CUs finishing on the bottom.

CU Composition – An unusual result – with Singles the clear winner. They tend to be in the younger or older age groups. Married, with children CUs had mixed results. The big surprise was Married Couples only CUs, normally strong performers, were at the bottom along with Single Parents who are no strangers to the bottom of the spending ladder.

Income – While the $100>149K group spent less, the major income dividing line in Pet Spending was over/under $70K.

Generations – The results were split among age groups within generations. The older Millennials and younger Gen Xers spent more as did younger Boomers and those born before 1940. This couldn’t quite make up for the drop in spending by the older Boomers and the younger Silent Generation. Generational spending reflects the mixed bag in Total Pet $ in 2019. However, Boomers’ pet spending was down for the second consecutive year.

Region – The Northeast spent more. All other regions spent less. Although the only significant drop was in the Midwest.

Housing – Another clear divide – Homeowners ↑$; Renters ↓$

Education – Another reflection of turmoil – Adv Degree ↑$; BA/BS ↓$. Note: Less than College Grads were up $0.14B.

Racial/Ethnic – A clear racial/ethnic divide – White, not Hispanic were up +1.3%. African Americans and Hispanics combined were down -11.4%, with 65% of the decrease coming from African Americans. Note: Asians were +1.6%.

Occupation – A reversal of expectations – Lower level white collar employees spent more while their bosses spent less.

Age– As noted: Age groups had no clear pattern. 45>54 yr old Gen Xers were down while the oldest group spent more.

Area – Another simple divide: Suburbs over 2500 population, which account for 45% of CUs and 46% of Total Pet $ spent more. All other areas – Center City, Small Suburbs and Rural spent less.

Finally: Pet Spending turned slightly down in 2019. The driver was the truly widespread drop in Supplies Spending as we saw the full impact of added tariffs hit home. There was some good news as Food began recovery from the 2018 FDA grain free warning and Veterinary again posted a small increase. Also, while Services spending was down slightly, the segment held its ground at its new elevated level. 2019 Pet Spending was a truly mixed bag with few clear trends.