2017 Pet Products Spending was $49.69B- Where did it come from…?

We looked at the Total Pet Spending for 2017 and its key demographic sources. Now we’ll start drilling down into the data. Ultimately, we will look at each individual segment but the first stop in our journey of discovery will be Pet Products – Pet Food and Supplies. This classification accounted for $49.69B (64.4%) of the $77.13 in Total Pet spending in 2017. This was up $7.35B (+17.4%) from the $42.34B that was spent in 2016. We have seen that this lift was driven by the market expansion of premium foods along with deflated prices in Supplies. Value was the key driver. Food and Supplies are the industry segments that are most familiar to consumers as they are stocked in over 200,000 U.S. retail outlets, plus the internet. Every week over 21,000,000 U.S. households buy food and/or treats for their pet children.

Pet Food spending turned around in 2017, +$4.61B, while Supplies built on a trend that began in the second half of 2016 to increase spending by $2.74B. We’ll combine the data and see where the bulk of Pet Products spending comes from.

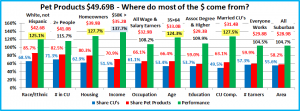

We will follow the same methodology that we used in our Total Pet analysis. First, we will look at Pet Products Spending in terms of the same 10 demographic category groups that were responsible for 60+% of Total Pet spending. A couple fall below the 60% mark for Products, but they are very close. Then we will look for the best and worst performing segments in each category and finally, the segments that generated the biggest dollar gains or losses in 2017.

The first chart details the biggest pet product spenders for each demographic category. It shows their share of CU’s, share of pet products spending and their spending performance (spending share/share of CU’s). Although their share of the total products $ may be different from their share of the Total Pet $, the biggest spending groups are the same. The categories are presented in the order that reflects their share of Total Pet Spending. This highlights the differences. In Pet Products spending, higher education and occupation are less important while marriage and age matter more. We should also note that, like Total Pet Spending, Income is the highest performing demographic characteristic. In Pet Products there are 5 groups with a performance rating of over 120%, which is up from 4 last year. However, it is one less than Total Pet. This indicates that Pet Products spending is spread a little bit more evenly across the category segments.

- Race/Ethnic – White, not Hispanic (85.7%) This is the largest group and accounts for the vast majority of spending in every segment. With a 125.1% performance rating, this category ranks #4 in terms of importance in Pet Products Spending demographic characteristics. While Hispanics, African Americans and Asian American account for over 30% of U.S. CU’s, they spend less than 15% of Pet Products $. Although pet ownership is relatively high in Hispanic American households, it is significantly lower for African Americans and Asian Americans.

- # in CU – 2+ people (82.5%) The spending numbers for Pet Products are very close to those for Total Pet, 82.7%. If you put 2 people together, pets very likely will follow. If you have a pet, you must spend money on food and supplies. Their overall performance of 115.7% is lower because performance decreases as the number of people in the CU increases. However, with performance rating of 99%, even the CU’s with 5 or more people are “earning their share”. The key is “It just takes two.”

- Housing – Homeowners (80.3%) Controlling your “own space” has long been the key to pet ownership, larger pet families and more pet spending. At 127.7% performance, homeownership moved up to second place in terms of importance for increased pet products spending. Homeownership increased by 0.5% in 2017. A big factor was the Millennials’ rate improving from 35% to 37%. Good news!

- Income – Over $50K (70.9%), up from 68.1%. Pet Parenting is common in all income groups but money does matter in spending behavior for all industry segments. With a performance rating of 137.7%, (up from 136.2%) CU income is also the single most important factor in increased Pet Products Spending. As a general rule, Higher Income = Higher Pet Products Spending. However, in 2017 much of the increase in share and performance was due to increased spending by the middle income groups, not the $150K+ elite.

- Age – 35>64 (66.4%), up from 63.5%. Their performance also increased from 117.2% to 124.3% and they “joined” the 120+% performance club at #5. Although the 35>54 group increased spending by $2.47B, the 55>64-year-old Baby Boomers generated an additional $3.65B, which was half of the total national increase.

- Occupation – All Wage & Salary Earners (66.1%), up from 64.4. Pet ownership is widespread across all segments in this group. The low performance, 108.2%, up from 105.7%, reflects this, as well as the contribution by Retirees. However, the lifts in share and performance were driven by a big spending increase from blue-collar workers.

- CU Composition – Married Couples (63.1%). Up from 61.1%. Pet parenting and marriage both represent strong commitments. Their performance increased from 125.8% to 127.5 but they fell to 3rd place. Like Homeownership, this group has been growing in importance and they both continue to battle it out for second place behind income.

- # Earners – “Everyone Works” (59.9%) down from 65.0%. Their performance is 104.5%, down from 112.8% In this group, all adults in the CU are employed. No group had a bigger drop in share or performance. This is directly a result of the great year by CU’s with 2+ people and only one earner, along with Retirees. Income is a still a priority in Pet Products but not how many people work to get it.

- Education – Associates Degree or Higher (59.0%) down from 60.3%. Their performance level also fell from 116.5% to 109.9%. Just 2 years ago this group had a performance level over 120%. In 2017 there was a big spending lift by High School Grads with some College. The current trend and situation shows that Pet Parents don’t need a College degree to recognize and buy, not just what is needed, but what is best for their Pet Children. Responsible Pet ownership is becoming even more widespread across America.

- Area – Suburban (58.2%), down from (59.6%). Their performance also fell from 108.6% to 104.7%. Suburban households are still the biggest pet spenders and under normal circumstances they had a pretty good year, +14.7%. However, their share and performance were driven down by a spectacular performance in Rural areas.

Although the biggest spending groups are the same for Pet Products as for Total Pet, there are subtle differences in market share and performance. Money still matters most but how you earn it matters less. Pet Products Spending is definitely becoming more diverse across occupations, # of earners and education levels.

Now, let’s drill deeper and look at 2017’s best and worst performing Products spending segments in each category.

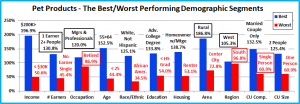

Most of the best and worst performers are the ones that we would expect. However, there are 7 that are different from 2016. That is 2 more than last year and 4 more than Total Pet. Changes from 2016 are “boxed”. We should note:

Only 2 of the Product winners are different from Total Pet – Rural and 1 Earner, 2+ CU’s. The performance of the matching segments is down slightly from Total Pet, with 2 exceptions – the Adv. College Degree and 55>64 segments. The Educated group had a big decrease, from 147.3% to 133.8% and the 55>64-year olds are up from 146.2% to 152.5%.

The average performance of the 2017 Product winners was 142.8%, up from 139.2% – 8 were up. The average for the losers was 60.0%, down from 61.3% – 3 were up. Any reduction in performance disparity is generally being made by the segments in the middle ground, especially in the Occupation and Education categories. We should also note:

- Occupation – Self-employed lost CU’s and their income and spending fell. Managers & Professionals now have the highest Income and they spent it. Retirees came in last despite a 29.4% increase in spending.

- Region – The West is back on top while the South flipped from first to last. A 96.8% performance from the loser shows that there is spending parity among the regions.

- CU Composition – Married Couples Only has back to back wins. The big news is Single Parents got out of the cellar.

- # Earners – Usually 2 or 3 Earner CU’s are on top. This year 1 Earner, 2+ people CU’s came to the forefront.

- Area – We said that the Rural areas had a great year. Their performance was second only to $200K+ incomes.

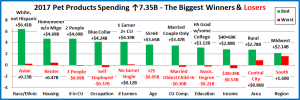

It’s time to “Show you the money”. Here are segments with the biggest $ changes in Pet Products Spending.

In this section we will see who drove the big increase. There is only one repeat from 2016 – Self-employed spending continues to fall. 7 Segments switched positions – from first to last or vice versa. However, there are also other surprises, like the performance of Blue-Collar, 1 Earner – 2+ CU’s, HS Grads w/some College and Rural.

- Race/Ethnic – 7% of Pet Products’ Spending comes from White, Non-Hispanics and 87.2% of the increase.

- Winner – White, Not Hispanic – Products Spending: $42.59B; Up $6.41B (+17.7%)

- 2016: Hispanic

- Loser – Asian – Products Spending: $1.13B; Up $0.23B (+25.1%)

- 2016: White, Not Hispanic

- Comment – All groups increased their Pet Products spending. Asian Americans finished last, but they had a 25.1% increase. Only Hispanics under performed, with a 6.4% increase.

- Winner – White, Not Hispanic – Products Spending: $42.59B; Up $6.41B (+17.7%)

- Housing – All segments had an increase in Pet Products spending in 2017.

- Winner – Homeowner w/o Mtge – Products Spending: $14.93B; Up $4.69B (+45.8%)

- 2016: Renters

- Loser – Renter – Products Spending: $9.79B; Up $0.47B (+5.1%)

- 2016: Homeowners w/o Mtge

- Comment – 47% of the Rural CU’s have paid off their mortgage. In 55>64 it is 37% and of course Retirees – 58%.

- Winner – Homeowner w/o Mtge – Products Spending: $14.93B; Up $4.69B (+45.8%)

- # in CU – It was the year of “2” as 2-person CU’s generated 64% of the increase.

- Winner – 2 People – Products: $22.52B; Up $4.69B (+26.3%)

- 2016: 4 People

- Loser – 3 People – Products: $7.33B; Down $0.09B (-1.2%)

- 2016: 5+ People

- Comment: The largest CU’s, 5+ came in second with an increase of $1.35B. 3-person CU’s had the only decrease and it was driven down by a reduction in Food spending. Even singles spent more on both Food and Supplies.

- Winner – 2 People – Products: $22.52B; Up $4.69B (+26.3%)

- Occupation – The Blue-Collar workers group is probably the biggest surprise of the report.

- Winner – Blue-Collar Workers – Products Spending: $11.22B; Up $4.24B (+42.5%)

- 2016: Tech, Sales Clerical

- Loser – Self-employed – Products Spending: $3.29B; Down $0.37B (-10.1%)

- 2016: Self-employed

- Comment – Blue-Collar workers upgraded their Food, but they also had a big increase in Supplies. Retirees had a great year in both Food and Supplies. The Self-employed decrease came only from Food as Supplies were up.

- Winner – Blue-Collar Workers – Products Spending: $11.22B; Up $4.24B (+42.5%)

- # Earners – More earners generally mean a higher income and more Spending but in 2017 all groups were up.

- Winner – 1 Earner, 2+ CU – Products Spending: $12.94B; Up $4.19B (+47.9%)

- 2016: No Earner, Single

- Loser – No Earner, Single – Products Spending: $2.85B; Up $0.12B (+4.4%)

- 2016: No Earner, 2+ in CU

- Comment – The 1 Earner, 2+ CU’s produced 57% of the increase with the biggest lifts in both Food and Supplies. The 3 earner CU’s came in second by spending $1.2B more. No earner, singles flipped from first to last, but still eked out an increase in both Food and Supplies.

- Winner – 1 Earner, 2+ CU – Products Spending: $12.94B; Up $4.19B (+47.9%)

- Age – The Boomers are back…with a big lift that flipped them from last to first!

- Winner – 55>64 yrs – Products Spending: $14.41B; Up $3.65B (+33.9%)

- 2016: 75+ yrs

- Loser – <25 yrs – Products Spending: $1.29B; Down $0.05B (-4.0%)

- 2016: 55>64 yrs

- Comment: The 35>54 age range was up $2.47B. The Under 25 group was the only segment with a decrease and it was driven down by Food. The 25>34-year olds also bought less Food, but more Supplies. These two instances of reduced Food spending were the only decreases in either segment across all age ranges.

- Winner – 55>64 yrs – Products Spending: $14.41B; Up $3.65B (+33.9%)

- CU Composition – Married Couples Only dominated, producing 47%of the increase with only 23% of the CU’s.

- Winner – Married, Couple Only – Products Spending: $16.69B; Up $3.47B (+26.3%)

- 2016: Unmarried, 2+ Adults

- Loser – Married, oldest child <6 – Products Spending: $1.28B; Down $0.30B (-19.0%)

- 2016: Married Oldest Child >18

- Comment – Married Couples with an oldest child under 6 spent -$0.53B less on Food but more on Supplies. This was the only decrease in either Food or Supplies spending across the entire demographic category.

- Winner – Married, Couple Only – Products Spending: $16.69B; Up $3.47B (+26.3%)

- Education – Higher Education has equated to increased Pet Products spending. In 2017 it became less of a factor.

- Winner – HS Grad w/some College – Products Spending: $12.35B; Up $3.12B (+33.9%)

- 2016: Assoc. Degree

- Loser – Associates Degree – Products Spending: $5.04B; Down $0.21B (-4.0%)

- 2016: BA/BS Degree

- Comment – College Grads still produced the biggest share of the increase but this year’s segment winner, HS Grads w/some College had a big increase in Food spending. This suggests that the food upgrade is becoming widespread. Assoc. Degree (the only negative group) had a big year in 2016 but value shopped for Food in 2017.

- Winner – HS Grad w/some College – Products Spending: $12.35B; Up $3.12B (+33.9%)

- Income – Income matters in Pet Products spending, but the importance of high income was dialed back in 2017.

- Winner – $40 to $69K – Products Spending: $11.29B; Up $2.80B (+33.0%)

- 2016: $70 to $99K

- Loser – $30 to $39K – Products Spending: $3.30B; Down $0.53B (-13.8%)

- 2016: $100 to $149K

- Comment – The lower middle-income group stepped up. In fact, only the $30>39K segment spent less in 2017.

- Winner – $40 to $69K – Products Spending: $11.29B; Up $2.80B (+33.0%)

- Area Type – All areas increased spending, but Central City “flipped” from first to last.

- Winner – Rural – Products Spending: $7.70B; Up $2.78B (+56.4%)

- 2016: Central City

- Loser – Central City – Products Spending: $13.05B; Up $0.86B (+7.0%)

- 2016: Suburbs >2500

- Comment –Rural won, but all areas under 2500 pop., rural or urban, generated $4.6B (62%) of the increase.

- Winner – Rural – Products Spending: $7.70B; Up $2.78B (+56.4%)

- Region – The winners and losers are always changing in this category.

- Winner – Midwest – Products Spending: $10.73B; Up $2.14B (+24.9%)

- 2016: Northeast

- Loser – South – Products Spending: $18.45B; Up $1.60B (+9.5%)

- 2016: West

- Comment – The South “lost” with a $1.6B increase. The good news was widespread in this category.

- Winner – Midwest – Products Spending: $10.73B; Up $2.14B (+24.9%)

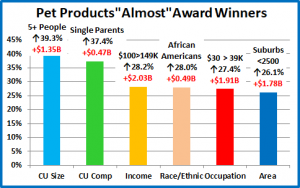

We’ve now seen the “winners” and “losers” in terms of increase/decrease in Pet Products Spending $ for 11 Demographic Categories. 2017 was a great year for Pet Products Spending and the “greatness” was in large part due to the increase being more widespread across demographics. Such winners as Blue-Collar workers, HS Grads with Some College, 1 Earner – 2+ CU’s and Rural areas give evidence to this supposition. Of course, not every good performer can be a winner but some of these “hidden” segments should be recognized for their outstanding performance. In 2017 there were a lot of them. I’ve narrowed it down to 6. They don’t win an award, but they deserve….

HONORABLE MENTION

Pet Products spending was up over $7B in 2017. The strong performance by these groups is immediately apparent and gives further evidence that the increase was demographically widespread. It was a very strong year for 2-person CU’s but also for the biggest CU’s, as 5+ people were up $1.35B (+39.3%). Single Parents are under strong financial pressure but increased spending by 37.4%. The lower middle-income group had the biggest increase but the upper middle income, $100>149K group, wasn’t far behind, up $2B (+28%). African Americans had the biggest percentage increase of any segment in the Racial/Ethnic category. Blue-Collar workers were the stars, but second place belongs to the Retirees, up $1.9B. Increased Pet Products spending in 2017 was about more space. Rural areas won the race, but Suburban areas with a population under 2500 were also up a lot, +26%. In Pet Products spending there was good news from almost everyone. Only 10 of 99 segments had a decrease, so 90% spent more.

Summary

Spending on Pet Products has been on a roller coaster ride since 2015. Many consumers upgraded to Super Premium Food and cut back on Supplies in 2015. In 2016 they value shopped for Food and Spent some of the saved money on Supplies. In 2017 there was increased availability and value in both segments. Consumers recognized the opportunity and spent $7B more.

In 2017, on the surface, big changes weren’t immediately apparent. The demographic groups responsible for most of Pet Products Spending were the same as those in 2016. However, there were changes in their spending share rankings. Marriage and Everyday Workers moved up while the number of Earners and Higher Education became less important. These were the first indications of a movement towards more spending equality in certain demographic categories. In terms of their performance, Income, Homeownership and Marriage still came out on top. However, there were now 5 groups with 120+% performance as Age Group entered the club. Total Pet has the same 5, Plus Higher Education.

When we looked at the performance of individual segments, changes started to become more apparent. Two of the new top performers were notable – 1 Earner – 2+CU’s and Rural Areas. However, when we looked at the biggest gainers in $, that’s when the changes really stood out. Many winners – Blue-Collar, 1 Earner – 2+CU’s, HS Grads w/some College, $40>69K and Rural are real evidence that spending is becoming more demographically balanced across America, especially in income, occupation and education. There was also a big spending lift in less densely populated areas.

This data raises another issue. Spending money on Food and Supplies is an absolute necessity in Pet Parenting. Obviously, your pet needs food every day so you must buy it regularly and often. Although Supply items are often more discretionary in nature, there are plenty of supplies that are necessities and many more that improve the quality of life for Pets and Pet Parents. Because of this necessity, the spending behavior on Pet Products can be an important reflection of the percentage of pet ownership in a demographic category. The APPA reported that the percentage of Pet Parenting H/H’s rose from 65% to 68% in 2017. We originally attributed the food spending increase to upgrades. Perhaps there were 2 trends going on. The Spending data provides supporting evidence for both an upgrade and new pet ownership. It also helps to identify the participants, or should I say, new Pet Parents. The Food Segment analysis should be interesting.

Finally…The “Ultimate” Pet Products Spending CU is a married couple, alone. They are in the 55 to 64 age range. They are White, but not of Hispanic origin. At least one of them has an advanced College Degree. However, only 1 works, as a manager and earns over $150K. They still have a mortgage on their house in a rural enclave in the West.