2016 U.S. PET SERVICES SPENDING $6.84B…UP ↑$0.58B

Non-Vet Pet Services is the smallest industry segment but it continues to grow and 2016 was another good year. Spending reached $6.84B, a 0.58B (9.3%) increase over 2015. However, you will see that, like the other Segments, consumer spending behavior is becoming increasingly more complex. (Note: All numbers in this report come from or are calculated by using data from the US BLS Consumer Expenditure Surveys)

Pet Services Spending per H/H in 2016 was $52.77, up from $48.70 in 2015. (Note: A 2016 Pet H/H (65%) Spent $81.18) More specifically, the increase in total spending came as a result of:

- 0.9% more households

- Spending 6.8% more $

- 1.5% more often

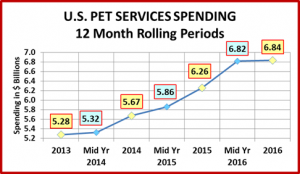

The following chart gives a visual overview of recent spending on Pet Services.

The growth has been consistent since 2013 but the pattern changed in 2016. In 2014 & 2015, the strongest lift in spending occurred in the second half. In 2016, virtually all the growth came in the first 6 months as the second half was essentially “flat”. While prices didn’t drop, the inflation rate slowed markedly at mid-yr 2016. Price may be becoming more of a factor in this segment. Now let’s look at some specific spending demographics. First, by income group.

- If outlined in green, sales were up in 2016

- If outlined in red, sales were down in 2016

- If highlighted in green, sales were up from 2014

- If highlighted in pink, sales were down from 2014

As you can see, the 2016 increase is being driven by 2 disparate groups – H/H’s just below the average income of $74K and the upper tier, those making over $150K per year. All incomes, except the $70>100K group, have increased spending on Services since 2014.

- $30>70K (31.9% of H/H’s) – $36.92 per H/H – $1.52B, Up $0.41B (+37.5%) – This group reduced food spending by $1.6B. It appears that they spent some of that savings on “needed” pet services and generated 70% of the total segment’s increase.

- $150K> (10.5% of H/H’s) – $184.62 per H/H – $2.51B, Up $0.33B (+15.4%) – Income has always been important because convenience is a big driver in this the segment and convenience costs money. In fact, the 23% of U.S. H/H’s that have an income of $100K> account for 53% of total Services’ spending. It gets even more pronounced as the over $200K group (5.6% of H/H’s) spend 24% of Services $.

- $70>100K (14.0% of H/H’s) – $50.22 per H/H – $0.91B, Down -$0.08B (-8.0%) – This group spent significantly more on Pet Products in 2016 and the spending on both of the Service segments suffered. They also have the only decrease in Services spending from 2014 which reflects the overall Pet spending behavior of these value shoppers.

- <30K (31.1% of H/H’s) – $18.78 per H/H – $0.76B, Down $0.01B (-1.3%) – The Services spending by this segment has grown since 2014 so the need is there. However, they generally don’t have the money to spare.

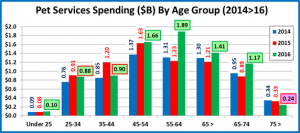

Now, let’s look at spending by Age Group.

The Age demographic reflects a more definite spending pattern than Income. Older Americans, especially those from 55>74, strongly increased spending on Services. The younger groups, particularly the 35>44 Gen Xers cut back. It should be noted that as the Baby Boomers age, the number of H/H’s over age 55 is growing. While the number under age 54 is currently shrinking. There are fewer Gen Xers. The Millennials have greater numbers but they are slower in establishing independent financial households than any group since 1880.

- 55>64 (19.0% of H/H’s) $76.69 per H/H – $1.89B – Up $0.66B (+54.0%) They spent $2.6B less on food in 2016 but used some of those savings to spend significantly more on Services. In fact, this group, which is all Baby Boomers, moved into the #1 spot in Services’ spending. They did it with 3% more H/H’s spending 35.7% more on Pet Services 11.0% more often.

- 65>74 (14.0% of H/H’s) – $65.35 per H/H – $1.17B – Up $0.28B (+32.2%). The need for Pet services by this group is growing as they age but they are just entering retirement, which impacts their ability to pay. In 2016 they also reduced their spending on Pet Food which freed up money to spend more on both Services and Supplies.

- 45>54 (18.6% of H/H’s) – $68.91 per H/H – $1.66B – Up $0.03B (+1.9%) This group has the highest income and for years has been the leader in Pet Services spending. Like many demographics, they spent less on Food in 2016. However, they did not use the savings to spend significantly more on Services.

- 35>44 (16.6% of H/H’s) – $42.00 per H/H – $0.9B – Down -$0.3B (-24.6%) The most significant drop in Services spending came from this group. In 2015 they were in a battle for 2nd place in Pet Services Spending. After 2016, they were just barely holding on to 4th place. Their Services’ spending behavior really showed an “across the board” decrease in spending and frequency. The group is slightly smaller -0.3%. They spent 14.7% less money and did it 11.4% less often.

- 25>34 (16.1% of H/H’s) – $41.97 per H/H – $0.88B – Down – $0.03B (-3.8%) Interestingly enough, the Pet Services Spending of these Millennials almost exactly matched that of the older 35>44 Gen Xers – In 2016, this group upgraded their Pet Food however the negative impact on Services spending was relatively small.

- <25 (5.6% of H/H’s) – $13.69 per H/H – $0.1B – Up $0.02B – (+19.1%) Pet Services is of minimal importance to these youngest Pet Parents but their spending has remained relatively consistent.

- 75> (10.0% of H/H’s) – $18.43 per H/H – $0.24B – Down -$0.09B (-16.5%) Taking care of our pets as we reach an advanced age is more difficult so Services can be important. However, money also becomes an issue. In 2016 this group chose to spend more on Food and Supplies

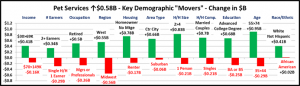

Finally, let’s take a look some other key demographic “movers” behind the 2016 Pet Services Spending increase.

Summary

Although some consumers definitely “need” the assistance of Pet Services, the spending in this segment is generally viewed as more discretionary than in any other. Convenience is often the key driver. Since convenience usually costs more money, income can make a significant difference in spending behavior. In 2016, households with incomes above $100k (20.5%) accounted for 53.3% of all Pet Services spending. This is up from 43.6% back in 2013 so the trend is actually becoming more pronounced. Not only current spending, but also the growth in the Services segment, is being driven by the over $100K households. Spending on Pet Services has increased $1.56B since 2013 and 86% of this gain came from the over $100K households.

With that being said, in 2016 there was also a window of growth in the lower middle income group, $30>69K. The effect of this can be seen in the small growth by a whole variety of demographic segments – married couples only, married couples with children of any age – as long as there were 4 or less in the total household, center city dwellers and those with an associates’ degree.

Age is also a big factor. The age groups from 45>74 are the only ones that spent more than the national average on Pet Services in 2016. They make up 51.6% of H/Hs and spent 69% of the total Services $, up from 63% in 2013. They also accounted for an incredible 90% of the Services’ spending increase since 2013. It should be noted that age and income go hand in hand with most of this group. The 45>54 group has the highest income and 55>64 ranks third. However, there is also an increasing need for Services in the 65>74 group, but with significantly reduced income. The 55>64 year old Baby Boomers saved some money in 2016 by value shopping for premium Pet Food. They spent some of this savings on additional services. The 65>74 group, with a growing number of boomers, did the same. You can see the impact of this older group in the increased spending by retirees, Homeowners with no mortgage and the 30>69K income group.

Service spending is driven both by convenience and need. The prices have been inflating at a 2.5% annual rate. With much of the spending coming from higher incomes, there has been little impact on spending. However, we have seen that price has become a major factor in the buying decisions made by virtually all Americans. In 2016 this could have finally impacted Services. While spending for those making over $200K went up $0.31B in 2016, the spending fell for the mid to upper income group making $70>149K per year. Also, the inflation rate fell to 1.5% in the second half of 2016 and has dropped even further to 1% in 2017. This is generally an indication of competitive pressure. Pet Services is the only Industry segment that has shown increased spending every year since 2011, with an average annual growth rate of 9.4%. We’ll see what 2017 brings.