SUPERZOO 2024 – THE SHOW & THE PET INDUSTRY ARE STRONGER THAN EVER!

SUPERZOO 2024 is only 4 weeks away. You will see in this advance look that the Pet Industry is stronger than ever as SUPERZOO 24 reflects the ever-increasing record level of Pet Products & Services sales.

The pandemic fueled the strong growth of Pet Products sales on the internet, which has continued because of value and convenience. However, most of these $ are coming from proven products. Buyers of all kinds, from consumers to chain store executives prefer to make in person buying decisions on new pet items. That’s what makes in person trade shows so important. You will see this clearly demonstrated at SUPERZOO 2024 with the strong influx of new exhibitors.

Currently SUPERZOO 2024 has 1112 exhibitors. That is equal to the pre-pandemic 2019 record. However, that record is sure to fall. There are 8 uncommitted booths, with a wait list that is now limited to 50 companies. SUPERZOO 24 will have a full house of 1120 exhibitors and set a new record. Actually, the primary reason that SUPERZOO’s growth is not even stronger is that the WPA ran out of floorspace. This situation was made even worse by many exhibitors insisting that they must have bigger booths. You will see the impact of this trend when we take a closer look at Special Floor Sections.

So how big is the SUPERZOO 2024 “full house”? There are 302,000 sq ft of booths, a 32,000 sq ft New Products Showcase, with over 1000 items, and 15,000 sq ft devoted to 28 Show Floor Education and demonstration sessions. There are also 66 educational sessions on grooming or business subjects in separate rooms off of the show floor. Combined, these sessions offer over 120 hours of valuable education. This is a great opportunity for the expected 10,000+ buyers but also a challenge. They need to make a plan to take full advantage of the amazing strength of SUPERZOO 24. Total attendance including Buyers, Exhibitors, Media/Guests is expected to be 16,000+. The show will be crowded.

New is always a focus at Pet Trade shows. That also applies to exhibitors. At SUPERZOO 2024:

- 434 Exhibitors weren’t at SZ23

- 596 weren’t at GPE24

- And 344 didn’t do either show

Plus, over 325 are SUPERZOO 1st Timers and 283 haven’t done any other major pet show, at least from 2019>2024. Those are some strong arguments for attending SUPERZOO 2024. It is definitely a “must do” for all Pet Industry participants. Now, let’s look at some specifics of what you will see there. While a change in the booth count is important, I suggest that you focus on the changes in the share of booths. Changes in this measurement will indicate how a particular group or product category is performing relative to other groups. This will help identify key trends in the industry – both positive and negative. This can be very important in corporate decision making.

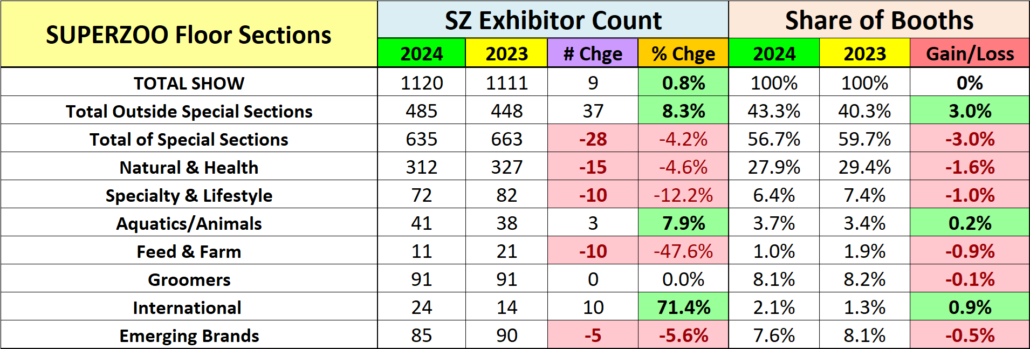

First, we’ll look at the overall show floor in terms of specialized sections.

- Because they help guide attendees’ time on the huge show floor, special sections are very important. They exceeded 50% of SUPERZOO booths for the 1st time in 2021. They are down slightly from 2023 but are still 57% of all booths.

- Natural & Health are the unquestioned biggest trends in Pet Products. WPA combined them in 2022. They almost always go together so it makes sense to put them in one section. Natural has been the biggest section for years. They are down slightly in count (bigger booths) but are still 28% of exhibitors and 31% of total booth space.

- Specialty & Lifestyle (Fashion) again lost share, -1.0%. This section continues to trend down.

- Aquatics/Animals had a small lift in booths. This is an important section as non-dog/cat pets started the industry.

- Feed & Farm had a big drop, largely because poultry products have become part of the mainstream.

- Grooming is a major focus of SUPERZOO. This section was stable with 8% of exhibitors, the 2nd largest.

- The International Pavilion is small and doesn’t reflect the importance of over 200 exhibitors from outside of the U.S.

- The small drop by Emerging Brands is not significant as most new companies choose a special section or the open floor so they can have a bigger booth. In fact, 1st Time SUPERZOO exhibitors occupy 30+% of booths at the show.

Now let’s look at the Exhibitors by type, including animal.

- All classifications but Reptile & Dog have fewer exhibitors and lost a small amount of share.

- In terms of Animals, there are still plenty of exhibitors offering products to cover every need for Pet Parents of all animal types. Dogs are still the “Pet Kings”. They gained 1.6% in share and are found in over 4 of every 5 booths.

- Business Services is again the exhibitor type leader. This segment includes companies that offer services to improve existing businesses and those that help in private label production – ingredients, packaging or finished products. In 2015 there were 65 SUPERZOO exhibitors in this category. In 2023 there were 223. In 2024, there was a small drop to 212. However, many other manufacturers also offer OEM services. The recent inflation surge and cumulative high prices have made Private Label products very appealing to consumers. Retailers also usually make more profit.

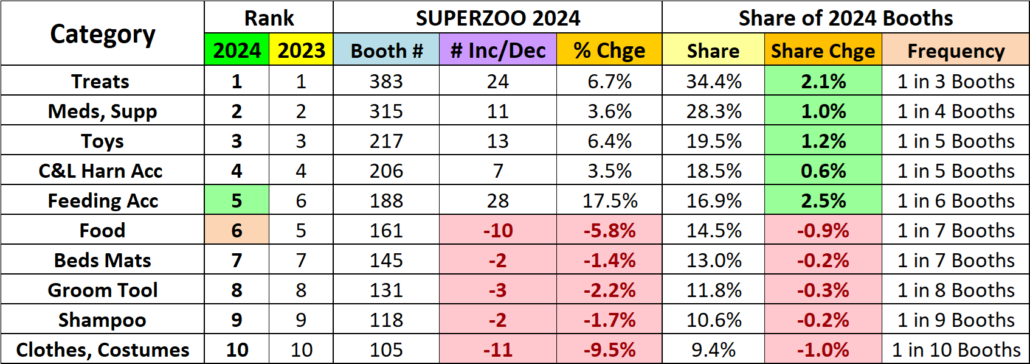

Let’s take a closer look at the “Pet Royalty”. Here are the top 10 Dog and/or Cat Categories at SUPERZOO 2024.

- This chart shows the strong performance by the top Cat & Dog products. The current top 5 grew in booths and share while #6 > 10 had small decreases. Feeding Accessories had the biggest gains.

- The categories are the same as 2023 & 2022 but only 1 moved up and 1 down one spot in ranking from 2023.

- Treats & Meds/Supp secured their place in the top 2 spots and have 98 or more booths than #3.

- Toys had a 6.4% gain in booths. They also gained 1.2% in share and stayed #3 in rank.

- Collars/Leads gained 3.5% in booths and 0.6% in share and stayed 4th in rank.

- Feeding Accessories had a 17.5% gain in booths, a 2.5% gain in share and moved up to 5th from 6th in ranking.

- Food is the biggest $ producer but had a small drop in # & share. It also fell from 5th to 6th in rank.

- Beds & Mats had 2 fewer booths and lost -0.2% in share. They held on to 7th

- Grooming Tools had 3 fewer booths and also lost -0.3% in share but stayed #8.

- Shampoos have 2 less booths and a -0.2% share loss. Both drops were slightly less than Grooming Tools.

- Apparel had the biggest drops in booths & share and only leads #11 Waste Pickup by 1. Plus, they gained 2 booths.

SUPERZOO will have a Record Exhibitor count, but the house is full. One factor slowing future growth is the increase in the average booth size. In 2024 the average SUPERZOO booth was 282 sq ft, basically 10’x30’. This is only up 3% from 2023 but it is +41% from 200 sq ft in 2016. This is a big reason why the WPA ran out of space. However, new and existing Products and Services are available to fill virtually every need or want of the attendees. Plus, the continued strength of targeted special floor sections, which helps attendees fulfill their primary needs along with a massive amount of educational sessions are 2 prime examples of the WPA’s ongoing efforts to continually improve the show.

941 exhibitors (85%) focus on Dog and/or Cat. Let’s take a closer look.

There will be more Exhibitors at SUPERRZOO 2024 than at 2023. Those offering Dog and/or Cat products grew by 12. The Dog/Cat share of exhibitors increased slightly from 83.6% to 84.6%. Dogs and Cats remain the unquestioned “royalty” of the industry. Here are some of the changes from SUPERZOO 2023

- 17 of 33 categories increased their number of exhibitors; 12 had decreases; 4 had no change

- 16 categories increased their share of total exhibitors; 13 lost share; 4 No Change

- Ranking changes: 6 up; 6 down; 21 no change

In terms of booth gains & losses, the Top 10 had 5 of the 17 increases. The biggest increase was 28 by the Feeding Accessories category (#5). The Top 10 also had 5 of the 12 category decreases but CBD Products had the biggest drop.

When you look at share gains & losses, the Top 10 had 5 of the 16 gains, including the biggest, +2.5% by Feeding Accessories and 4 of the 5 that were at least 1.0%. They had 5 of the 13 losses but the -1.8% drop by CBD Products was the largest. Apparel (#10) is the only other category to lose -1%.

The Top 10 only had 1 of the 6 increases in rank & 1 of the 6 drops, but the biggest changes were all outside the group.

All Dog & Cat product needs are much more than covered, with a lot of choices in each. We should also note that while the overall “Cat” share was -0.6%, 3 cat “driven” categories – Litter, Scratching & Furniture all gained in share.

SUPERZOO again showcases what is “happening” in the Pet Industry and offers a great opportunity for Industry participants, both exhibitors and attendees, to drive the growth of their businesses. It still takes effort and commitment from everyone, but SUPERZOO 2024 is the surest bet in Las Vegas!

Finally, the chart below details the specifics for all 33 of the Dog/Cat product categories that I defined for the Super Search Exhibitor Visit Planner. (Note: The SZ 2024 Super Search will be available at PetBusinessprofessor.com on 7/29.)