GLOBAL PET EXPO 2023…It Has Everything You Need!

Global Pet Expo, the Pet Industry’s premiere event, is back to near “normal”. The exhibitor count is up over 35% from 2022 and should reach 1000 by showtime. This is lower than the 1173 peak in 2019 but it is still more than enough.

The world is rapidly becoming more virtual so how important is a live event? In the Pet Industry it is critical because of our attitude towards Pets and Pet Products. Pets became an integral part of our families in the 90’s as Pet Owners became Pet Parents. This relationship has grown even stronger in recent years as we now increasingly personify our pets. This is why a live show is important. Pet shows are primarily focused on Pet Products. Studies have shown that over 60% of consumers prefer to make initial buying decisions on Pet Products in person. This makes Pet Products second only to fresh groceries in this consumer behavior. This preference applies to all Pet Products buyers, not just consumers. The retailers and distributors attending GPE and SuperZoo want to see and touch a new product before they buy. Live shows are not just important, they are critical to the continued growth and strength of the Pet Industry.

The Pandemic crisis is basically over but it has raised our awareness so we are more conscious of health concerns and responsible personal interactions. These personal interactions at industry trade shows have been a key factor in the long term growth of the industry. In 2023 they will be back at full strength. Now, let’s take a brief look at what awaits attendees of GPE 2023.

As we said, the show is smaller than the 2019 peak, both in square footage (-13%) and number of exhibitors (-16%) but there is still more than enough to satisfy the needs and wants of every buyer that attends. Here are some relevant facts.

- 984+ Booths – as of 2/17 but more are still being added daily

- 314,000+ sq ft of exhibit booth space (Not counting the 45,000 sq ft new product area)

- 20 x 10 is again the most popular size – 253 (35.9%), demonstrating the need for a little more space.

- Booths are smaller – the average size is 320 sq ft, -16% from 2022, reflecting the 35+% increase in exhibitors.

- Size matters – Booths 300 to 800 sq ft (29%) occupy 45% of the space. Those over 1000 sq ft (4%) cover 23%.

Will you see any new exhibitors or is it the usual group? There have been 6 live pet trade shows from 2019>22 – 3 GPEs and 3 SZs. There are 984 exhibitors at GPE 23 but It took 2725 companies to fill all 7 shows. Of the GPE 2023 exhibitors:

- 179 (18%) – Did all 6 other shows

- 531 (54%) – Did GPE 2022

- 298 (30%) – Are new to GPE (at least from 2019>22)

- 222 (23%) – Did NO other shows from 2019>2022

The percentage of exhibitors new to GPE this year is about the same as “normal”. There is again plenty of “New” to see.

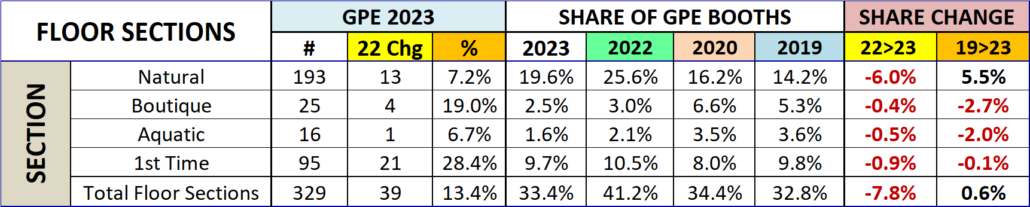

Special “Floor Sections” at GPE account for 33% of Booths, about the same as 2019>20. Due to the big change in booth count, the best way to compare GPE 2023 to previous years in this and other areas may be by share of booths.

- Natural – 193 Booths. The number of booths in this section is at an all-time high. The share has grown to 1/5 of all booths from 1/7 in 2019, reflecting the growing strength of the natural trend in our whole society.

- Boutique – 25 Booths. After a brief resurgence in 2020, the booth share of this area continues to fall. Boutique is essentially the opposite of Natural and more discretionary in a country that is increasingly focused on “needs”.

- Aquatic – 16 Booths. Popularity of this category continues to trend down.

- 1st Time Exhibitors – 95 Booths. The share is now about the same as pre-pandemic 2019 but most of the 287 exhibitors who didn’t exhibit at GPE (at least from 2019>2022) chose the regular floor or another special section. GPE is a “must do” for new companies and New – products and companies are a major focus of GPE.

- International – Although not listed as floor sections, international pavilions are back this year with China, Taiwan, Canada and Brazil participating. There are 230+ exhibitors from 25 countries outside the U.S at GPE 23.

There are large numbers of exhibitors in the “regular” floor space who would qualify for inclusion in these sections. You need to “work” the whole show to ensure that you get a full view of the product categories of interest to you. I will again be creating a GPE Exhibitor Visit Planner that allows attendees to plan their floor time by targeting the exhibitors with products of interest. The GPE 2023 SuperSearch will be made available by March 6th and be regularly updated with last minute changes. Now, let’s take a look at the results from this year’s research on exhibitors’ product offerings.

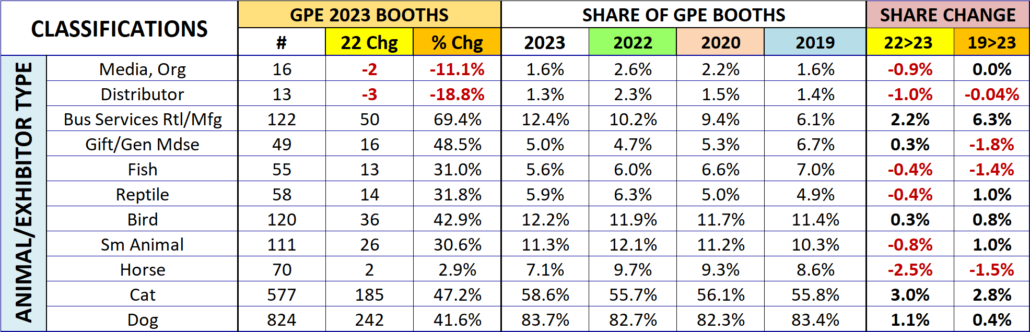

First, we’ll Compare Exhibitor Types – By function: By Animal type (Numbers are based on assigned booths as of 2/17/23)

Results were mixed. 5 categories gained share while 6 lost ground.

- Dogs Still Rule – They are still in about 83% of all booths. 5 out of every 6 booths are selling dog products.

- Cats gained ground. Cat Products are offered by 59% of exhibitors. Up from 40% back in 2014.

- Fish/Aquatic – This category continues to lose share and is down 47% since 2017.

- Other Animals – Only Birds gained share, with the biggest drop coming in Equine.

- Business Services – Inflation has driven the popularity of private label/OEM products. The huge lift in count and share reflects the changing needs in the industry. BTW, there were only 8 exhibitors in 2014.

- Distributors – The share is about the same as “normal” 2019. Only 8 exhibited in 2014.

- Gift/Gen Mdse – The share had a slight lift but has been generally declining since peaking at 7.8% in 2016.

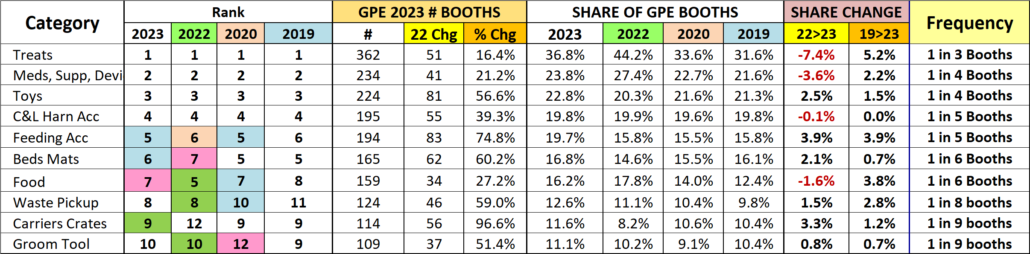

Dogs and Cats are the undisputed royalty of Pet. Because of their huge impact on the industry. I have divided the products designed for them into 33 subcategories. Let’s see how this year’s GPE Top Ten (by booth count) are doing.

The top 4 are the same as 2022 but the top 2 had the biggest losses in share. There was a slight shuffling in the rankings from 5>10 – 2 moved up in rank while Food fell. Carriers/Crates returned to the Top 10 as Apparel fell to #11.

- Treats are still #1 although their share fell by over 7%. The high share in 2022 reflects their priority. 1 in 3 booths offers treats. Many supplements are in treat form and the share of this category is still up 5+% from 2019.

- OTC Meds/Supplements/Devices has a similar pattern to Treats and also continues to grow in importance. In 2014, their share was only 11%.

- Toys – With a big gain in share, Toys held onto #3. This relates to the return of many Far East exhibitors.

- Collars, Leads & Harnesses – They held the #4 spot and their share has been stable since 2019 after falling from 22.1% in 2018. In 2016, they also had a 22.1% share but that earned them the #2 ranking.

- Feeding Acc. had the biggest share gain and moved to 5th which again reflects the increase in foreign exhibitors.

- Beds/Mats – Their share declined in 20>22 but rebounded in 2023 with the influx of Far East exhibitors.

- Food remains a priority as Pet Parents focus on nutrition, health and wellness. However, almost all is USA made.

- Waste Pickup – They have been growing in popularity. They broke into the Top 10 in 2020 and now rank 8th.

- Carriers/Crates – They dropped out of the top 10 in 2022. Once again the lack of foreign manufacturers was a big factor. In 2023 they returned to their normal #9 with a record high share.

- Grooming Tools– After years at 9/10, they fell to #12 in 2020 but have returned to their normal #10 spot.

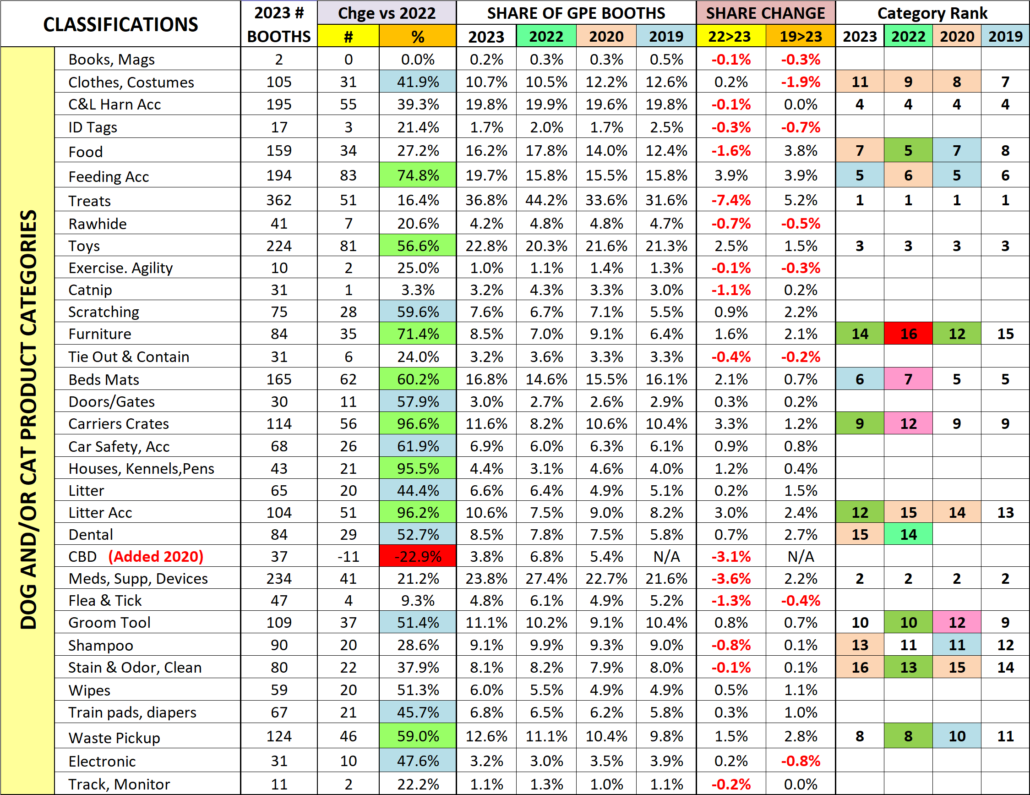

Pet Parents’ concern for the overall health and wellness of their “pet children” remains a big priority but the impact of strong Petflation has pushed the “value” of Private Label products to the forefront in many categories.

The last chart details the specifics for all 33 of the Dog/Cat product categories that I defined. Of note: All the data inputs for this report and the SuperSearch tool come from a review of the GPE online exhibitor product listings AND visits to over 1000 websites. They’re not 100% accurate, but pretty close. Which categories are of interest to your business?

GPE 2023 is the place to literally find “Everything you need!” There are products, services and education to fulfill every need and…want. There is also an abundance of “new” – both in products and the 200+ exhibitors who are new to Pet Industry shows. However, to reap the benefits, you need a plan. Exhibitors must showcase the “right” items. Attendees need to strategically analyze their data, determine what they need to improve their business and develop a plan to find the products to fulfill their needs. Then…execute the plan. If they do nothing else at GPE, attendees will have 1 minute and 28 seconds to spend at each booth. With a 35+% increase in the number of exhibitors, you definitely need a plan! The GPE 2023 SuperSearch will be available the week of March 6th. It can help. Try it out. Good luck in Orlando!

Since no Exhibitor list is available on line, you can download one by clicking the link below. It is in an excel format and is based upon data from 6 pm EST on 2/17.