GLOBAL PET EXPO 2019 has it all… and more!

The premiere event of the U.S. pet industry gets under way on March 20th. This is the 61st show in a tradition that began in 1958. Both the show and the industry have grown spectacularly since then. In 1960 spending in the pet industry totaled $1.1B. In 2017 it was $77.1B, with $50B in Pet Products alone. Even accounting for inflation, pet spending has grown 80% faster than H/H income and twice as fast as H/H spending. The GPE began as the APPMA with 17 exhibitors in 30 booths. It now is approaching 1200 exhibitors who occupy over 355,000 square feet of booths plus a 30,000 square foot new product showcase.

However, like everything else, the industry’s growth was and is an evolutionary process. Perhaps, the most significant change was in our attitude towards our pets. Over the years they went from being pets to companion animals then to our pet children as pet parenting became the norm. Recently, this has gone a step further as we have personified and humanized our pets. We now project our needs to those of our pets.

The industry has also evolved as we saw the rise of pet chains and superstores and an explosion of “pet space” in mass market retailers which provided the room for the ever-growing product wants and needs of pet parents. The number of outlets selling pet supplies went from 86,000 in 1992 to over 200,000 today…plus the internet, which essentially has no limit on space. Where was GPE during this time? It was right there providing an efficient method for manufacturers to showcase their products and for attendees to view them and make informed choices to help them satisfy the growing demands of their customers…and build their businesses.

The growth has not been without traumatic events. In recent years we experienced the melamine recall which forever changed the consumers’ view of pet food. Of course, we can’t forget the great recession. The economic impact of this event focused the consumer on value (price + quality) in their buying decisions and they began to research before they buy. In 2017 the industry experienced a bit of a well disguised trauma. There was deflation in Pet products. Consumers recognized the value and spent $7.4B more on pet food and supplies. However, value comes with a price and the price was paid by manufacturers, distributors and retailers. We are now experiencing perhaps the most competitive market in history.

Some of the results of this competition are reflected in small changes at GPE. There have been a number of mergers and acquisitions and it is even tougher for new companies to get started. This has resulted in a slight drop in the actual number of exhibitor booths. However, the average booth size is up 5%. Every product that you’re looking for and plenty that you’ve never seen are at GPE, just merged into bigger spaces. Let’s take a look at what awaits you in Orlando:

First, some 2019 GPE “booth” facts: (Note: These numbers reflect committed booths as of 2/18/19 – more to come)

- 1134 booths – down 26 from the same time last year, but exhibitors are still opting in. Better late than never.

- 355,000+ sq ft of exhibit booth space (Not counting the 30,000 sq ft new product area)

- For the first time 20 x 10 is the most popular size – 394 (34.7%), reflecting the need for more space.

- Booths are also larger than 2017 – the “average” booth is over 315 sq ft, up 5% from 300 in 2018.

- Size matters – Booths 300 to 800 sq ft (27%) occupy 42% of the space. Those over 1000 sq ft (5%) cover 26%.

Will you see any new exhibitors or is it the usual group? The “usual” group is definitely there (773 from 2018) but…

- 361 (32%) of the GPE 2019 Exhibitors did not exhibit at GPE 2018 (1 in every 3 Exhibitors was not at GPE 2018!)

There are Specially Designated “Floor Sections” at GPE. Here is a brief review.

- International – Separate pavilions for 4 countries – China, Taiwan, Great Britain and Brazil, Total: 53 Booths. However, this is only about 18% of the 295 exhibitors from 25 countries outside the U.S. – GPE is truly GLOBAL!

- Natural – 166 Booths: Up 22 (+15%) “Natural” still has a very strong consumer appeal.

- Boutique – 62 Booths: Up 11 (+22%) A bit of a resurgence, but still down slightly from the peak (65) in 2014.

- Aquatic – 49 Booths but 6 are still open. Popularity of this category is trending down.

- 1st Time Exhibitors – 113 Booths: The Section is full but most of the 288+ 1st Time exhibitors are on the regular show floor. GPE is a “must do” for new companies and New – products and companies are a major focus of GPE.

There are large numbers of exhibitors in the “regular” floor space who would qualify for inclusion in these sections. You need to “work” the whole show to ensure that you get a full view of the product categories of interest to you. I will again be creating a GPE Exhibitor Visit Planner that allows attendees to plan their floor time by targeting the exhibitors with products of interest. The GPE 2019 SuperSearch will be made available on February 26th and be regularly updated with last minute changes. Now, let’s take a look at the results from this year’s research on exhibitors’ product offerings.

First, we’ll Compare Exhibitor Types – By function: By Animal type (Numbers are based assigned booths as of 2/18/19)

Because of the overall drop in booths, in this chart and others pay particular attention to the change in share. A change of (+/–) 0.5% is significant. In terms of booth count, any increase is significant and take note of any drop of 10% or more.

- Dogs Still Rule – 84% (5 out of every 6 booths) are selling dog products.

- Cats continue to gain – In 2019, Cat Products were offered by 57% of exhibitors. Up from 40% in 2014.

- Fish/Aquatic – This is category had the biggest decrease and is down 34% since 2017.

- Other Animals – A sharp decrease in both booth number and share in all but horses.

- Business Services – From POS systems to private label manufacturing, the continued strong growth reflects the growing business needs of attendees. There were only 8 exhibitors in 2014.

- Distributors – After a big lift, this segment dialed back but is still double the number that exhibited in 2014.

- Gift/Gen Mdse – This category has been slowly declining since peaking at 91 in 2016.

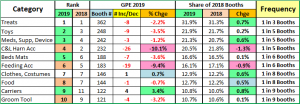

Dogs and Cats are the undisputed royalty of Pet. Because of their huge impact on the industry. I have divided the products designed for them into 32 subcategories. Let’s see how this year’s GPE Top Ten (by booth count) are doing.

While there was shuffling in the rankings, 8 of 10 categories gained share – 5 were up 0.5% or more. Carriers had the biggest gain and made it back to the top 10 after dropping out for 1 year. They replaced shampoos which fell to #12.

- Treats are still #1 and continue to gain share. 1 in 3 booths offers treats. (Many supplements are in treat form.)

- OTC Meds/Supplements/Devices continues to gain ground. In 2014 there were only 113 exhibitors.

- Food has plateaued but Feeding Accessories is falling.

- Toys – It’s not all about health and nutrition. There is still room for fun. Toys moved up to #2 because C&L’s fell.

- Apparel – This category gained in count and in share. It is driven by therapeutic devices like vests, not fashion.

- Collars, Leads & Harnesses – The biggest decrease. They are now below the 2015 level of 247.

- Beds/Mats gained in rank because of the drop in Food Accessories. They are essentially stable.

- Grooming Tools – still holding their ground.

Pet Parents’ concern for the overall health and wellness of their “pet children” is still the current biggest trend.

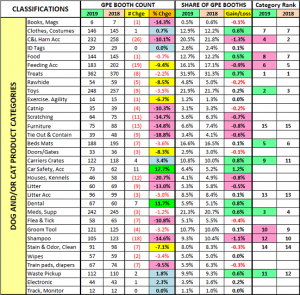

The last chart details the specifics for all 32 of the Dog/Cat product categories that I defined. Of note: All the data inputs for this report and the SuperSearch tool come from a review of the GPE online exhibitor product listings AND visits to over 1100 websites. They’re not 100% accurate, but pretty close. Which categories are of interest to your business?

GPE 2019 has it all and more, including enhanced educational offerings and the New Product Showcase. However, to reap the benefits, you need a plan. Exhibitors must showcase the “right” items. Attendees need to strategically analyze their data, determine what they need to improve their business and develop a plan to find the products to fulfill their needs. Then…execute the plan. If they do nothing else at GPE, attendees have 1 minute and 19 seconds to spend with each exhibitor. The GPE 2019 SuperSearch will be released next week. It can help. Try it out and…Good luck in Orlando!