Petflation 2025 – February Update: Rose to +2.4% vs Last Year

The monthly Consumer Price Index peaked back in June 2022 at 9.1% then began to slow until it turned up in Jul/Aug 2023. Prices fell in Oct>Dec 23, then turned up Jan>Oct 24. Prices fell -0.1% in Nov, but rose 0.04% in Dec, 0.7% in Jan 25 and 0.4% in Feb to a record high. However, the CPI fell to +2.8% from +3.0% in January. Grocery prices rose 0.1% from January but YOY inflation was stable at 1.9%. After 12 months of 10+% YOY monthly increases, grocery inflation has now been below 10% for 24 months. Even minor price changes can affect consumer pet spending, especially in the discretionary pet segments, so we will continue to publish monthly reports to track petflation as it evolves in the market.

Petflation was +4.1% in Dec 21 while the overall CPI was +7.0%. The gap narrowed as Petflation accelerated and reached 96.7% of the national rate in June 22. National inflation has slowed considerably since then, but Petflation generally increased until June 23. It passed the CPI in July 22 but fell below it from Apr>Jul 24. It exceeded the CPI in August, fell below in Sep>Oct, rose above in Nov, then fell below in Dec>Feb 25. As we drill into the data, all reports will include:

- A rolling 24 month tracking of the CPI for all pet segments and the national CPI. The base number will be pre-pandemic December 2019 in this and future reports, which will facilitate comparisons.

- Monthly comparisons of 25 vs 24 which will include Pet Segments and relevant Human spending categories. Plus

- CPI change from the previous month.

- Inflation changes for recent years (23>24, 22>23, 21>22, 20>21, 19>20, 18>19)

- Total Inflation for the current month in 2025 vs 2019 and vs 2021 to see the full inflation surge.

- Average annual Year Over Year inflation rate from 2019 to 2025

- YTD comparisons

- YTD numbers for the monthly comparisons #2>4 above

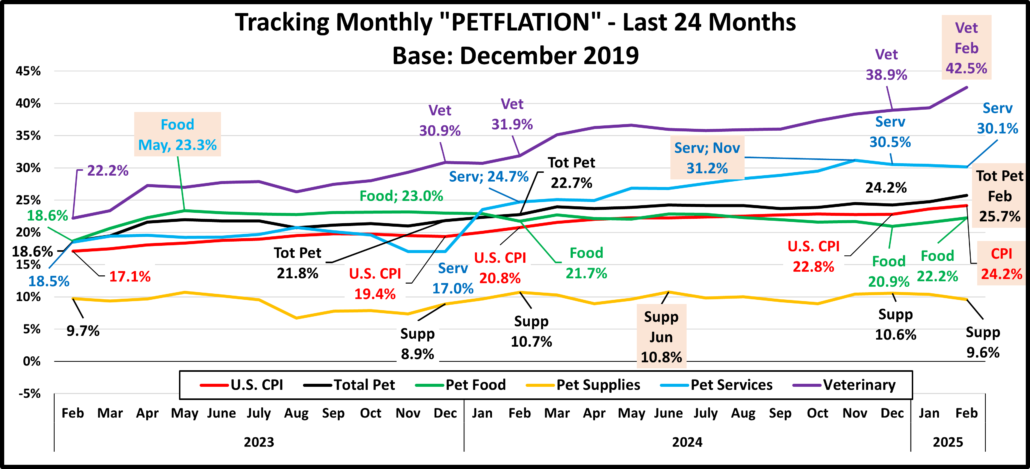

In our first graph we will track the monthly change in prices for the 24 months from Feb 23 to Feb 25. We will use December 2019 as a base number so we can track the progress from pre-pandemic times through an eventual recovery. This chart is designed to give you a visual image of the flow of pricing. You can see the similarities and differences in segment patterns and compare them to the overall U.S. CPI. The year-end numbers from 12 and 24 months earlier are included. We also included and highlighted (pink) the cumulative price peak for each segment. In Feb, Pet prices were up 0.8% from Jan. Food (+0.6%) & Vet (+2.3%) were up while Supplies (-0.7%) & Services (-0.2%) were down.

In Feb 23, the CPI was +17.1% and Pet was +18.6%. The Services segments inflated after mid-20, while Product inflation stayed low until late 21. In 22, Food prices grew but the others had mixed patterns until July 22, when all rose. In Aug>Oct Petflation took off. In Nov>Dec, Services & Food inflated while Vet & Supplies prices stabilized. In Jan>Apr 23, prices grew every month for all segments except for 1 Supplies dip. In May Product prices grew while Services slowed. In Jun/Jul this reversed. In Aug all but Services fell. In Sep/Oct this flipped. In Nov, all but Food & Vet fell. In Dec, Supp. & Vet drove prices up. In Jan>Mar 24 prices grew. In April, prices in all but Vet fell. In May, all but Food grew. In June, Products drove a lift. In July, all but Services fell. In Aug, Food drove a drop. In Sep, Products fueled a drop. Services drove a lift in Oct. In Nov, all were up. In Dec, Total Pet fell. In Jan>Feb, the segments were split but Pet hit a record high.

- U.S. CPI – The inflation rate was below 2% through 2020. It turned up in January 21 and continued to grow until flattening out in Jul>Dec 22. Prices rose Jan>Sep 23, fell Oct>Dec, rose Jan>Oct 24, fell Nov, then rose Dec>Feb to a record high but 28.1% of the increase since Dec 19 happened from Jan>Jun 22 – 10% of the time.

- Pet Food – Prices were at the Dec 19 level Apr 20>Sep 21. They grew & peaked May 23. Jun>Aug ↓, Sep>Nov↑, Dec>Feb↓, Mar↑, Apr>May↓, June↑, Jul>Oct↓, Nov↑, Dec↓, Jan>Feb↑. 99% of the lift was in 22/23.

- Pet Supplies – Supplies prices were high in Dec 19 due to tariffs. They had a deflated rollercoaster ride until mid-21 when they returned to Dec 19 prices & essentially stayed there until 22. They turned up in Jan and hit a record high. They plateaued Feb>May, grew in June, flattened in July, then turned up in Aug>Oct to a new record. Prices stabilized in Nov>Dec but grew in Jan>Feb 23. They fell in Mar, but set a new record in May. The rollercoaster continued with Dec>Feb↑, Mar/Apr↓, May/Jun↑, July↓, Aug↑, Sep/Oct↓ & Nov/Dec↑, Jan>Feb↓.

- Pet Services– Inflation is usually 2+%. Perhaps due to closures, prices increased at a lower rate in 2020. In 2021 consumer demand increased but with fewer outlets. Inflation grew in 21 with the biggest lift in Jan>Apr. Inflation was strong in 22 but prices got on a rollercoaster in Mar>Jun. They turned up Jul>Mar 23 but the rate slowed in April and prices fell in May. Jun>Aug↑, Sep>Dec↓, Jan>Mar 24↑, Apr↓, May↑, June↓, Jul>Nov↑, Dec>Feb↓.

- Veterinary – Inflation has been consistent. Prices turned up in Mar 20 and grew through 21. A surge began in Dec 21 which put them above the overall CPI. In May 22 prices fell and stabilized in June causing them to fall below the CPI. However, prices rose again and despite some dips they have stayed above the CPI since July 22. In 23>24 prices grew Jan>May, leveled Jun/Jul, fell Aug, grew Sep>Dec, fell Jan, grew Feb>May, fell Jun>Jul, grew Aug>Feb.

- Total Pet – Petflation is a sum of the segments. In Dec 21 the price surge began. In Mar>Jun 22 the segments had ups & downs, but Petflation grew again from Jul>Nov. It slowed in Dec, grew Jan>May 23 (peak), fell Jun>Aug, grew Sep/Oct, then fell in Nov. In December prices turned up and grew through March 24 to a record high. Prices fell in April, rose May>June (record), fell Jul>Sep, rose Oct>Nov, fell in Dec, then rose in Jan>Feb to a record high.

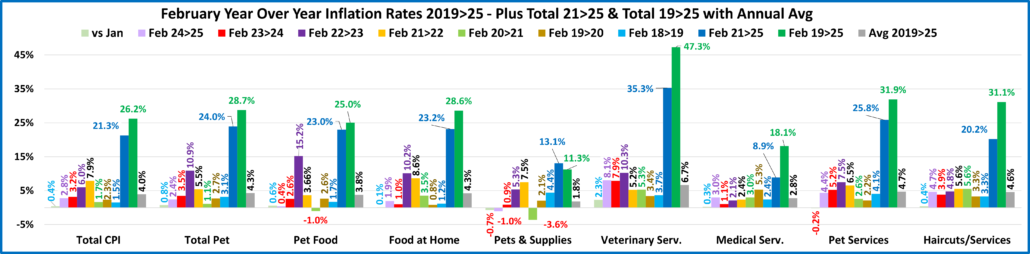

Next, we’ll turn our attention to the Year Over Year inflation rate change for February and compare it to last month, last year and to previous years. We will also show total inflation from 21>25 & 19>25. Petflation rose from 2.0% to 2.4% but it is still below the National inflation rate (by -14.3%). The chart will allow you to compare the inflation rates of 24>25 to 23>24 and other years but also see how much of the total inflation since 2019 came from the current pricing surge. We’ve included some human categories to put the pet numbers into perspective.

Overall, prices were up 0.4% from January and were +2.8% vs Feb 24, down from +3.0% last month. Grocery inflation was stable at 1.9%. Like January, only 2 had price decreases from last month – both Pet: Supplies & Services. There were also 2 drops in Oct/Nov but 3 in Aug/Sep/Dec and 5 in July. The national YOY monthly CPI rate of 2.8% is down from 3.0% and is 12.5% below the 23>24 rate and 65% less than 21>22. The 24>25 rate is above 23>24 for 4 – Groceries, Medical Services, Veterinary & Haircuts. In our 2021>2025 measurement you also can see that over 80% of the cumulative inflation since 2019 has occurred in 6 segments, 4 are Pet – all but Vet, plus Groceries & the CPI. Except for Pet & Vet Services, where prices have surged, Service Segments have generally had higher inflation rates so there was a smaller pricing lift in the recent surge. Pet Products have a very different pattern. The 21>25 inflation surge provided 98% of their overall inflation since 2019. This happened because Pet Products prices in 2021 were still recovering from a deflationary period. Services expenditures account for 63.8% of the National CPI so they are very influential. Their current CPI is +4.1% while the CPI for Commodities is 0.5%. This clearly shows that Services are driving almost all of the current 2.8% inflation. The situation in Pet is even worse. Petflation is currently 2.4%. The combined CPI for the 2 Service Segments is 6.6%, while the Pet Products CPI is -0.6%.

- U.S. CPI– Prices are +0.4% from Jan. The YOY increase is 2.8%, down from 3.0%. It peaked at +9.1% back in June 2022. The targeted inflation rate is <2% so we are still 40+% higher than the target. The February decrease follows 4 straight lifts after 6 consecutive drops from Apr>Sep. The current rate is below 23>24 but the 21>25 rate is still +21.3%, 81.3% of the total inflation since 2019. The Inflation surge hadn’t started in January 2021, +1.7%

- Pet Food– Prices are +0.6% vs Jan and +0.4% vs Feb 24, a big change from -1.1%. They are still far below the Food at Home inflation rate of +1.9%. February is the first inflationary month for Pet Food since +1.8% in March 2024 – 11 straight deflationary months. The 2021>2025 inflation surge generated 92% of the 25.0% inflation since 2019. Inflation began for Pet Food in June 2021.

- Food at Home – Prices are up +0.1% from January, but the YOY increase stayed stable at 1.9%. This is radically lower than Jul>Sep 2022 when it exceeded 13%. The 28.6% Inflation for this category since 2019 is 9% more than the national CPI but only in 5th place behind 3 Services expenditures (2 Pet) and Total Pet. 81.1% of the inflation since 2019 occurred from 2021>25. This is about the same as the CPI, but we should note that Grocery prices began inflating in 2020>21 then the rate accelerated. It appears that the pandemic supply chain issues in Food which contributed to higher prices started early and foreshadowed problems in other categories and the overall CPI surge.

- Pets & Supplies– Prices were -0.7% from January and YOY pricing flipped to -1.0% from +0.6%. They still have the lowest rate vs 2019. Prices were deflated for much of 20>21. As a result, the 2021>25 inflation surge accounted for 116% of the total price increase since 2019. Prices set a record in October 2022 then deflated. 3 monthly increases pushed them to a record high in Feb 23. Prices fell in March, rose Apr/May (record), fell Jun>Aug, grew Sep>Oct, fell Nov, grew Dec>Feb, fell Mar>Apr, rose May>Jun (record), fell July, rose Aug, fell Sep>Oct, rose Nov>Dec, fell Jan>Feb

- Veterinary Services– Prices are +2.3% from Jan (biggest lift since 2.5% in Mar 23) and +8.1% from 24, up from 6.6%. They are #1 in inflation vs 24 and still the leader since 2019 with +47.3% and since 2021, +35.3%. For Veterinary, high annual inflation is the norm. However, the rate has increased during the current surge, especially since 23. They have the highest rate in 25, and now 75% of the cumulative inflation since 2019 occurred from 2021>25.

- Medical Services – Prices turned sharply up at the start of the pandemic but then inflation slowed and fell to a low rate in 20>21. Prices rose +0.3% from Jan, and inflation vs last year rose to +3.0% from +2.7%. Medical Services are not a big part of the current surge as only 49.2% of the 18.1%, 2019>25 increase happened from 21>25.

- Pet Services – Inflation slowed in 2020 but began to grow in 21. In 24 prices surged Jan>Mar, fell in April, rose in May, fell in June, rose Jul>Nov, then fell in Dec>Feb 25. Their rate has plummeted from 11.5% in Dec to 4.4% and they fell to #3 in YOY inflation. However, 80.9% of their total 19>25 inflation is from 21>25. In Dec 23, it was 49%.

- Haircuts/Other Personal Services – Prices are +0.4% from Jan and +4.7% from Feb 24. 12 of the last 14 months have been 4.0+%. Inflation has been pretty consistent. 65.0% of the 19>25 inflation happened 21>25.

- Total Pet– Petflation rose to 2.4% from 2.0%. 2 segments had a higher rate and 2 were lower. It is 31% less than the 23>24 rate and 14% below the U.S. CPI. Plus, 2.4% is 22.6% below the 3.1% average February rate since 1997. Feb prices rose 0.8%, driven by Vet & Food. The Jan>Feb increase was expected (all yrs but 2018) but double the 97>24 0.4% average change. Another big factor in the CPI increase was that prices only rose 0.3% in Jan>Feb 24. After a strong December & January, February may be another pause in the long recovery.

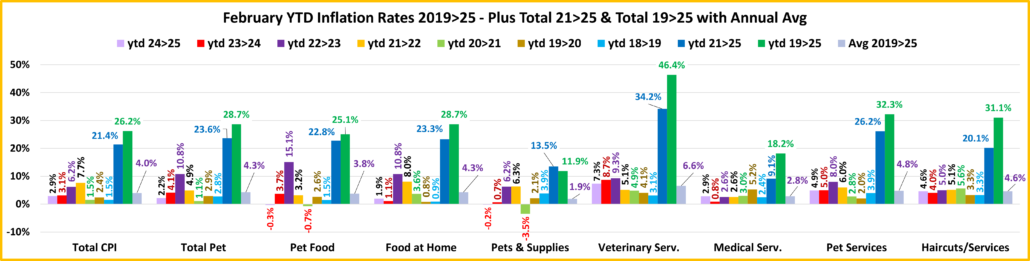

Now, let’s look at the YTD numbers.

The 24>25 rate is lower than 23>24 for all but Medical Services, Groceries & Haircuts. The 22>23 inflation rate was the highest for Groceries and all pet categories but Supplies. 21>22 has the highest rate for Pet Supplies and the National CPI. The average national inflation in the 6 years since 2019 is 4.0%. Only 3 of the categories are below that rate – Medical Services (2.8%), Pet Supplies (1.9%) and now Pet Food (3.8%). It is no surprise that Veterinary Services has the highest average rate (6.6%), but all 4 other categories are +4.3% or higher.

- U.S. CPI – The 24>25 rate is 2.9%, only down 6% from 23>24, but it is down 53% from 22>23, 62% less than 21>22 and 27.5% below the average increase from 2019>2025. However, it’s still 61% more than the average increase from 2018>2020. 82% of the 26.2% inflation since 2019 occurred from 2021>25. Inflation is a big problem that started recently.

- Pet Food – Ytd prices are still deflated -0.3%, but up from -1.1% in Jan. That’s a big change from 3.7% in 23>24, 15.1% in 22>23 and the 2.1% 2018>20 average. However, it is still higher than the -0.7% deflation in 20>21. Pet Food has the highest 22>23 rate but is only #5 in the 21>25 rates. Deflation in the 1st half of 2021 kept YTD prices low then they surged in 2022 and especially in 2023. 91% of the inflation since 2019 occurred from 2021>25.

- Food at Home – The inflation rate is up from 23>24 but at 1.9%, it is down 82% from 22>23, 76% from 21>22 and 47% from 20>21. However, it is more than double the average rate from 2018>20. It is only tied for 4th place for the highest inflation since 2019 but still beat the U.S. CPI by 10%. You can see the impact of supply chain issues on the Grocery category as 81% of the inflation since 2019 occurred from 2021>25.

- Pets & Pet Supplies – A true roller coaster, prices rose Jan>Feb 24, fell Mar>Apr, rose May>Jun, fell July, rose Aug, fell Sep>Oct, rose Nov>Dec, then fell Jan>Feb. Currently, prices are deflating vs 24. Supplies have the lowest inflation since 2019. The biggest lifts since 2019 were in 22 & 23. The 2021 deflation created an unusual situation. Prices are up 11.9% from 2019 but 113% of this lift happened from 21>25. Prices are up 13.5% from their 2021 “bottom”.

- Veterinary Services – Inflation was high in 2019 and steadily grew until it took off in late 2022. The rate may have peaked in 2023, but it is still going strong in 2025, +7.3%, the highest on the chart. They are also #1 in inflation since 2019 and since 2021. At +6.6%, they have the highest average inflation rate since 2019. It is 1.6 times higher than the National Average but 2.4 times higher than the Inflation average for Medical Services. Strong Inflation is the norm in Veterinary Services.

- Medical Services – Prices went up significantly at the beginning of the pandemic, but inflation slowed in 2021. In 2025 it is 2.9%, just slightly above the 2.8% 2019>25 average rate. However, it is being measured against 2024 when prices had the lowest inflation rate of any year at least since 2019.

- Pet Services – After falling in late 2023, prices surged in 2024, then fell in 2025. The 24>25 inflation rate of 4.9% is 2nd to Veterinary on the chart. It is only their 4th highest rate but is 1.7 times higher than their 2018>21 average rate. Pet Services is 2nd in both 19>25 and 21>25 inflation.

- Haircuts & Personal Services – The services segments, essential & non-essential, were hit hardest by the pandemic. The industry responded by raising prices. 2025 inflation is 4.6%, 18% below its 21 peak, but 39% above the 18>20 average. Consumers are paying over 30% more than in 2019, which usually reduces the purchase frequency.

- Total Pet – 2025 Petflation is 2.2%, up from 2.0% in Jan, but it is 80% less than 22>23 and even 3% lower than the 2018>21 average rate. Plus, it is 24% below the CPI. Despite the YOY lift in February, Petflation is still low. This was primarily driven by Ytd deflation in Pet Products and lower inflation in Services, while Veterinary continues to reach new record highs. The patterns were definitely mixed but the the “need” segments (Food & Vet) drove the small lift.

The Petflation recovery paused in Aug, came back Sep>Oct, paused in Nov, then resumed in Dec>Jan. With a lift to 2.4% from 2.0%, February may be another pause, but the rate is still 23% below the 25 yr monthly average. We tend to focus on monthly YOY inflation while ignoring one critical fact. Inflation is cumulative. Pet prices are 23.6% above 2021 and 28.7% higher than 2019. Those are big lifts. In fact, current prices for Total Pet & Vet are at record highs and the other segments are within 2% of the highest in history. Only Supplies prices (+11.3%) are less than 25% higher than 2019. Since price/value is the biggest driver in consumer spending, inflation will affect the Pet Industry. Services will be the least impacted as it is driven by high income CUs. Veterinary will see a reduction in visit frequency. The product segments will see a more complex reaction. Supplies will likely see a reduction in purchase frequency and some Pet Parents may even downgrade their Pet Food. Products will see a strong movement to online purchasing and private label. At SZ & GPE 24 and now GPE 25, a huge # of exhibitors offer OEM services. Strong, cumulative inflation has a widespread impact.