2023 Pet Supplies Spending was $23.02B – Where did it come from…?

Next, we’ll turn our attention to Pets & Supplies. We’ll see differences from Pet Food as the spending in the Supplies segment is more discretionary. There are other factors too. Spending can be affected by the spending in other segments as consumers often trade $ between segments. However, the biggest factor is price. Many categories have become commoditized so price changes can impact buying behavior. In the 2nd half of 2016, deflation began, and Supplies started a 24 month lift, totaling $5B. Prices turned up in mid-2018 due to new tariffs and Supplies $ fell a record -$3B in 2019. In the 2020 pandemic, Supplies weren’t a necessity, so sales dropped -$1.7B. In 2021, Pet Parents caught up with their children’s needs and Supplies spending exploded, +$8.65B. In 2022, the “binge” was not repeated, and inflation was 7.7%. Spending fell -$1.86B. In 2023, inflation fell to 2.6% and Supplies $ grew $1.08B, 4.9% to $23.02B.

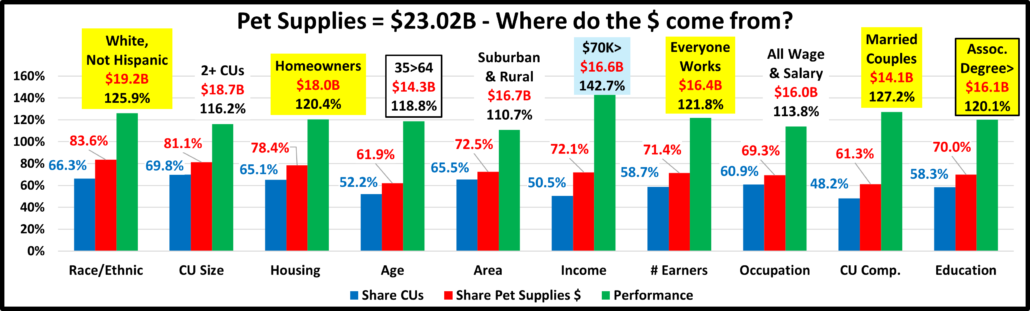

Let’s see which groups were most responsible for the bulk of Pet Supplies spending in 2023 and the $1.08B lift. The first chart details the biggest pet supplies spenders for each of 10 demographic categories. It shows their share of CU’s, share of Supplies spending and their spending performance (Share of spending/share of CU’s). 2 groups are different from Total Pet – Age & Education. The groups are presented in the order that reflects their share of Total Pet Spending. This highlights the differences in share. The biggest difference is in performance. There are 6 groups with performance of 120% or more, down from 7 in 2022, but 1 more than Total Pet and 3 more than Pet Food. The drop from 2022 indicates that Supplies spending became slightly more balanced in terms of the big groups in 2023.

- Race/Ethnic – White, not Hispanic (83.6%) up from 81.5%. This large group accounts for the vast majority of spending in every segment. Their share increased and their performance grew from 121.2% to 125.9% and they moved up from #4 to #3 in importance in spending. Minority groups account for 33.7% of all CUs but spend only 16.4% of Supplies $. Only African Americans spent less but the lifts by Hispanics & Asians were under 1%.

- # in CU – 2+ people (81.1%) down from 83.3% and their performance fell from 120.8% to 116.2% – Out of 120% Club. 2 & 4 People CUs spent less while 1 Person CUs were +18.6%. This caused the drops in share & performance.

- Housing – Homeowners (78.4%) down from 78.8%. Homeownership is a big factor in pet ownership and spending in all segments. Their performance fell to 120.4%, from 121.0% but they stayed #5 in importance. All segments spent more but the w/o Mtge lift was only +0.5%. Renters led with +6.5%. This caused the small drops.

- Age – 35>64 (61.9%) up from 61.8%. Their performance level rose to 118.8% from 118.6% and moved up from #8 to #7 in importance. Only the 25>34, 55>64 and 75+ yr-old groups spent less. All others spent more. However, most lifts were small. Only <25 (+63.1%) and 45>54 (+18.6%) had double digit % growth. The result of this mixture of spending was the miniscule increase in group share and performance.

- Area – Suburban & Rural (72.5%) up from 70.3% and their performance grew to 110.7%, from 107.3%, but they stayed last in importance. In this category, only Center City spent less, -2.8%. The big Suburbs, over 2500 population only had a 0.9% lift. This was a bit of a surprise after their -$2.74B drop in 2022. The action was in the Rural areas. They were +$1.16B (+20.6%). The gains in share and performance were due to Rural spendng.

- Income Over $70K (72.1%) up from (71.0%) A gain in share but their Performance fell from 150.2% to 142.7%. Income remains the most important factor in increased Pet Supplies Spending. Both <$70K and $70K> spent more. However, the lift for $70K> was $1.01B while <$70K was only $0.07B. Only 3 segments spent less – <$30K (-$0.07B), $40>49K (-$0.18B) & $100>149K (-$0.15B). Almost all of the lift came from $70K>. A key factor in the increase in share but drop in performance was that $70K> gained 4.5 million CUs. This gain in CU share lowered performance.

- # Earners – “Everyone Works” (71.4%) up from 69.7%. Their performance grew from 119.5% to 121.8% and they moved up from #7 to #4 in importance and joined the 120% club. In this group, all adults in the CU work. The # Earners is more important than in Food but it is income that truly matters. In the group, only 2 Earners spent less, but 1 Earner, Singles were +$0.98B. They were the primary driver in the increase in share and performance.

- Occupation – All Wage & Salary Earners (69.3%) up from 68.7%. Their performance was 113.8%, down from 114.0%. Only Tech/Sls/Cler & Self-Employed spent more. Tech/Sls/Cler was up +$1.55B. This drove the lift in share. Performance dropped in the group because they had a 1.1 million increase in CUs.

- CU Composition – Married Couples (61.3%) up from 60.7%. Their performance also increased from 127.1% to 127.2% but they stayed 2nd in importance. Only Married, Oldest Child <6 or 18> had decreases. The Married group was +0.78B, +5.9%. The “Unmarried” group was only +$0.3B, +3.5%. This resulted in the small increases in share and performance for all Married CUs.

- Education – Associate’s Degree> (70.0%) down from 72.0%. This group was expanded to reach a 60+% share. In 2023, they lost market share and their performance level also decreased from 124.8% to 120.0%. Higher Education fell from 3rd to 6th in importance. In the Education category, the only spending decreases were by HS Grads and those with an Adv. College Degree. There were big lifts by HS Grads w/some College & <HS Grads. The BA/BS group couldn’t keep up so <College were +$0.92B, +10.1% & College Grads were +$0.15, +1.2%. This caused the drops.

Pet Supplies spending still skews more towards younger and higher income CUs than Food. However, the biggest difference may be in the spending disparity in segments within the big groups. Supplies now has 6 big groups with perfomance of at least 120%. That’s down from 7 in 2022, but it’s twice as many as the 3 in Pet Food.

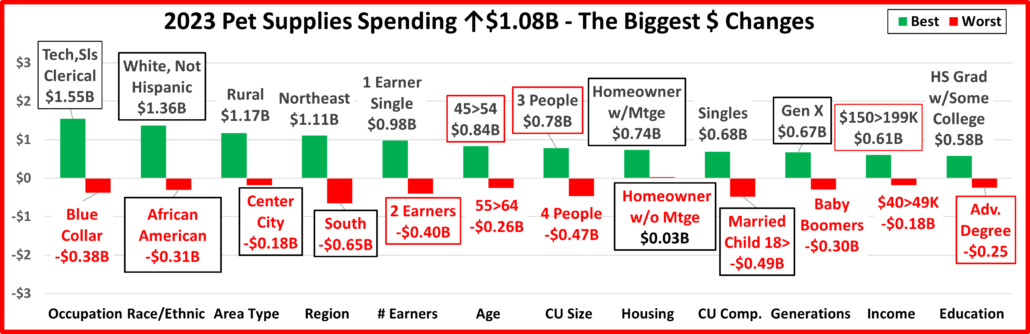

Now, we’ll look at 2023’s best and worst performing Pet Supplies spending segments in each category.

Almost all of the best and worst performers are those that we would expect. There are truly no big surprises. In Pet Supplies spending, there are 8 that are different from 2022, up from 5 last year. That is 1 less than Veterinary & 3 less than Food, but 1 more than Total Pet and 4 more than Services. They have 5 new winners. With 6, only Food has more. In terms of disparity, the difference between the avg winner & loser was 95.4%, up from 87.5% in 2022 but stlll less than 123.6% in 2021. A little less balanced at the segment level. Changes from 2021 are “boxed”. We should note:

- Income matters in Supplies spending – 220.8% performance and a disparity of 180.9%.

- Occupation – Self-Employed replaced Managers. Only White Collar Workers – at any level, perform at 100+%.

- Education – Both are new, but not a big change from Adv College Degree & <HS Grads.

- Region – The Midwest replaced the West at the top and the South returned to their usual spot at the bottom. The South is the only Regon with under 100% performance. The disparity grew to 60% from 41% in 2022.

- CU Composition – Married, Oldest Child 6>17 returned to the top while Single Parents replaced Singles at the bottom. In 2023, all Married CUs, except those with an oldest child <6, performed over 100%.

- CU Size – 3 People CUs replaced 5+ People at the top. 1 Person CUs are the only size performing <100%.

Performance Overview – While the increase in the average performance disparity was small, 95.4% from 87.5%, it was widespread – 10 of 12 categories. Only Occupation & CU Size had less disparity between segments.

Now, it’s time to “Show you the money”. Here are segments with the biggest $ changes in Pet Supplies Spending.

In 2019, Tarifflation caused a record $2.98B drop in Supplies spending. 2020 brought the pandemic and pet parents focused on “needs” so the more discretionary Supplies segment fell another $1.65B. In 2021 Pet Parents caught up on the Supplies needed by their “children” and spent a record $8.65B more. In 2022, the binge wasn’t repeated so the $ fell -$1.86B. In 2023 there was a small $1.08B lift. In the chart, there are 5 repeats from 2022 and 9 segments flipped from last to 1st or vice versa. In 2022 there was 1 repeat and 15 flips. In 2023, 65.6% of segments spent more (with inflation 54.2%) and Housing was all positive. In 22, only 52% spent more and no category was all positive. Here are the specifics:

- Occupation – Tech/Sls/Clerical flipped from last to 1st and Blue Collar replaced them at the bottom.

- Winner – Tech/Sales/Clerical– Supplies Spending: $4.37B; Up +$1.55B (+54.8%) 2022: Mgrs/Profess.

- Loser – Blue Collar – Supplies Spending: $1.02B; Down -$0.38B (-27.0%) 2022: Tech/Sls/Cler.

- Comment – Only Tech/Sls/Cler & Self-Employed spent more in 2023. Managers & Professionals are the only segment that spent more every year 2020>22. Even their spending fell -2.7% in 2023. Except for Blue Collar, all of the drops in spending were small, less than -4.5%.

- Race/Ethnic – White, Not Hispanic and African Americans swapped positions at the top and bottom.

- Winner – White, Not Hispanic – Supplies: $19.24B; Up +$1.36B (+7.6%) 2022: African Americans

- Loser – African Americans – Supplies: $0.97B; Down -$0.31B (-23.9%) 2022: White, Not Hispanic

- Comment – Their share of Pet Supplies $ rebounded to 83.3% from the 81.1% low in 2022. White, Not Hispanics still drive this discretionary segment. They have the highest % of pet ownership and the second highest income. The interaction of these two factors is very apparent in this category. Only African Americans spent less but the gains by Hispanics and Asians were <$0.02B. Whites produced 126% of the Supplies lift.

- Area Type– Center City flipped from 1st to last and Rural replaced them on top.

- Winner – Rural – Pet Supplies Spending: $6.76B; Up +$1.17B (+20.9%) 2022: Center City

- Loser – Center City – Pet Supplies Spending: $6.33B; Down -$0.18B (-2.8%) 2022: Suburbs 2500>

- Comment– Only Center City spent less but the Suburbs 2500> only spent $0.09B more. Rural (Areas <2500 Population) drove the Supplies spending lift.

- Region – The South flipped from 1st to last and the Northeast replaced them on top.

- Winner – Northeast – Pet Supplies Spending: $4.07B; Up $1.11B (+37.2%) 2022: South

- Loser – South – Pet Supplies Spending: $6.99B; Down -$0.65B (-8.5%) 2022: West

- Comment – Like 2022, 2 spent more & 2 spent less. In 2022, the South & Midwest spent $1B more. In 2023, the Midwest again spent $1B more but they were joined by the Northeast. The West spent less in both years.

- # Earners – 2 Earners stayed on the bottom but a new 1 Earner winner – Singles.

- Winner – 1 Earner, Single – Pet Supplies Spending: $3.37B; Up +$0.98B (+41.0%) 2022: 1 Earner, 2+ CU

- Loser – 2 Earners – Pet Supplies Spending: $9.22B; Down -$0.40B (-4.2%) 2022: 2 Earners

- Comment – Income is the biggest factor, but the # of Earners is still important in Supplies Spending. The ups & downs were mixed with no clear pattern. 1 Earner, Singles, No Earner, 2+ CU and 3+ Earners spent more. No Earner, Singles, 1 Earner, 2+ CU and 2 Earners spent less. Most drops were small while all lifts were 17+%.

- Age – 45>54 stayed on top while the older 55>64 replaced 35>44 on the bottom.

- Winner – 45>54 yrs – Pet Supplies Spending: $5.41B; Up $0.84B (+18.3%) 2022: 45>54 yrs

- Loser – 55>64 yrs – Pet Supplies Spending: $4.39B; Down -$0.26B (-5.6%) 2022: 35>44 yrs

- Comment: 2023 Supplies spending was an age rollercoaster. <25: +$0.40B; 25>34: -$0.17B; 35>54: +$0.95B; 55>64: -$0.26B; 65>74: +$0.25B; 75>: -$0.09B.

- # in CU – 3 People stayed on top. 4 People replaced 5+ on the bottom.

- Winner – 3 People – Pet Supplies Spending: $4.49B; Up $0.78B (+21.1%) 2022: 3 People

- Loser – 4 People – Pet Supplies Spending: $2.86B; Down -$0.47B (-14.0%) 2022: 5+ People

- Comment: 3 People CUs were the only size to spend more in 2022. In 2023, 1 and 5+ CUs also spent more. Only 2 and 4 People CUs spent less.

- Housing – The winner and loser flipped positions.

- Winner – Homeowner w/Mtge – Supplies: $12.44B; Up +$0.74B (+6.3%) 2022: Homeowner w/o Mtge

- Loser – Homeowner w/o Mtge – Supplies: $5.60B; Up +$0.03B (+0.5%) 2022: Homeowner w/Mtge

- Comment – All Housing segments spent more but all of the lifts were small. Renters finished second In $, +$0.34B but they had the biggest percentage increase, +6.8%.

- CU Composition – Married, Oldest Child 18> flipped from 1st to last. Singles replaced them on top.

- Winner – Singles – Supplies: $4.34B; Up $0.68B (+18.6%) 2022: Married, Oldest Child 18>

- Loser – Married, Oldest Child 18> – Supplies: $2.44B; Down $0.49B (-16.6%) 2022: Married, Oldest Child 6>17

- Comment – CUs with children spent -$0.06B less due to drops by Single Parents and Married couples with an oldest child under 6 or over 18. CUs with no children were +$1.14B.

- Generation – Gen X flipped from last to 1st. Boomers replaced them on the bottom.

- Winner – Gen X – Supplies: $7.71B; Up $0.67B (+9.5%) 2022: Gen Z

- Loser – Boomers – Supplies: $6.50B; Down -$0.30B (-4.3%) 2022: Gen X

- Comment – Only Boomers and those born <1946 spent less. The younger groups – Gen X, Millennials and Gen Z spent more. Gen Z’s lift was only -$0.02B behind Gen X but the percentage was much bigger, +74.9%.

- Income – $150>199K stayed on top and $40>49K replaced $200K> on the bottom.

- Winner – $150>199K – Pet Supplies Spending: $4.24B; Up +$0.61B (+16.7%) 2022: $150>199k

- Loser – $40>49K – Pet Supplies Spending: $1.06B; Down -$0.18B (-14.6%) 2022: $200K>

- Comment – All big groups <$70K, $70K>, <$100K and $100K> spent more. There were only 3 segments that spent less – <$30K, $40>49K and $100>149K. Except for $40>49K, the drops were -3.4% or less. While all big groups spent more, $150K> provided $1.0B (92.6%) of the Supplies lift.

- Education – Adv College Degrees stayed on the bottom while HS Grads w/some College replaced Associate’s on top.

- Winner – HS Grad w/some College – Supp. Spending: $4.05B; Up +$0.58B (+16.6%) 2022: Associate’s Degree

- Loser – Adv. College Degree – Supplies Spending: $5.60B; Down $0.25B (-4.3%) 2022: Adv College Degree

- Comment – HS Grads also spent less but the group w/o at least a BA/BS degree spent $0.92B more. This was 85.2% of the Total Supplies lift and certainly an unexpected pattern.

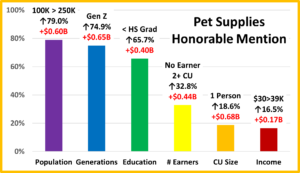

We’ve now seen the winners and losers in Pet Supplies Spending $ for 12 Demographic Categories. In 2022, despite the -$1.86B decrease, 52% of demographic segments spent more but there was no all-positive category. In 2023, there was a small lift, $1.08B, 66% of demographics spent more (54% with inflation) and Area Type was all positive. Overall, 2023 had less turmoil than 2022. In performance, there were no surprises but the disparity between winner and loser increased by 8%. The performance winners reflected the importance of income in Supplies spending. However, not every good performer can be “the” winner and some of these “hidden” segments should be recognized for their performance. They don’t win an award, but they deserve…

HONORABLE MENTION

Supplies spending is driven by income, but Pet Parenting is widespread. This is very apparent in the strong performance of these segments. All have below average incomes, with many at or near the bottom in their category. The 100>250K Small City group is a low Total Pet spender but perform above 100% in Supplies. Gen Z’s surge in commitment to their Pets continues. In recent years, the <HS Grad group has significantly increased pet spending. In 2023 they turned their attention to Supplies. No Earner, 2+ CUs turned their attention to Pets with big spending lifts in all segments. 2023 was a great “Pet” year for Singles. They also had lifts in all industry segments. The $30>39K group had double digit lifts in all but Services. This clearly demonstrates that while income may be the most important, it is not the only factor in Supplies spending. Although the lift was small, it was demographically widespread.

Summary

While Pet Food spending has shown a definite pattern, Pet Supplies have been on a roller coaster ride since 2009. Many Supplies categories have become commoditized and react strongly to changes in the CPI. Prices go up and spending goes down…and vice versa. Supplies spending has also been reactive to big spending changes in Food. Consumers spend more to upgrade their Food, so they spend less on Supplies – trading dollars. We saw this in 2015. In 2016 the situation reversed. Consumers value shopped for Food and spent some of the “saved” money on Supplies.

That brought us to 2017. Both Supplies and Food prices deflated while the inflation rate in both of the Services segments dropped to lows not seen in recent years. Value was the “word” and it was available across the market. Perhaps the biggest impact was that the upgrade to super premium Food significantly penetrated the market. This could have negatively impacted Supplies Spending, but it didn’t. Supplies’ spending increased in 93% of all demographic segments.

2018 started out as expected with a $1B increase in Supplies and a small lift in Food. Then the government got involved. In July the FDA issued a warning on grain free dog food and spending dropped over $2B. New tariffs were implemented on Supplies and spending flattened out then turned down -$0.01B in the 2nd half. The full retail impact of Tariffs hit home in 2019 when Supplies spending fell -$2.98B, affecting 97% of all demographic segments.

In 2020 The pandemic caused consumers to focus on needs. That resulted in big spending lifts for Food and Veterinary and big drops in Supplies and Services. Some good news was that Supplies spending became more balanced. The performance gap between best and worst narrowed by 10.25%.

In 2021 the overall Retail Market had recovered but with no repeat of the buying binge, Pet Food $ dropped. In Supplies, the pent-up buying desires of Pet Parents were unleashed. They bought all the Supplies items that had been on “hold” for the last 2 years. The result was the biggest spending increase in history. In 2022, the Supplies binge was also not repeated, and inflation took off, so spending fell -$1.86B. However, 52% segments still spent more on Supplies.

In 2023, inflation slowed and Supplies had a small $1.08B, 4.9% lift. 65.6% of segments spent more (54.2% with inflation) and the Housing category was all positive. At the Big Group level things were slightly more balanced with 6 performing at 120+%. (Down from 7) At the segment level, it was different. The 50/50 income spending divide increased from $114K to $117K and the disparity between the Best and Worst performers increased to 95.4% from 87.5%. The 2023 results are mixed but the recovery from the 2022 drop is under way. Ytd in 2024 inflation was only 0.7%. We’ll see what happens.

Finally – The “Ultimate” Pet Supplies Spending CU consists of 3 people – a married couple, with a child under 18. They are 45>54 yrs old. They are White, but not of Hispanic origin. They have their own business where they both work and at least one has a Associate’s Degree. Their child also works – part time and their household income is $150>199K. They live in a small suburb in the Midwest and are still paying off the mortgage on their home.