2023 Total Pet Spending was $117.60B – Where did it come from…?

Total Pet Spending in the U.S. was $117.60B in 2023, a $14.89B (14.5%) increase from 2022. These figures and others in this report are calculated from data in the annual Consumer Expenditure Survey conducted by the US BLS. 2022 had mixed results. Like the Food segment a year earlier, the 2021 binge spending on Supplies and Veterinary Services was not repeated, so spending fell in both segments. However, Pet Food bounced back with a 12.5% increase and Services continued their spectacular growth. This produced only a 2.7% increase in Total Pet Spending. In 2023, the Binge/Bust pattern was over. Even with 8% inflation, all segments had an increase in spending. The lifts for Supplies & Services were small but the Food & Vet lifts were huge. This produced the 3rd largest lift in history. 2023 deserves a closer look!

The first question is, “Who is spending most of the $117.6 billion dollars?” There are of course multiple answers. We will first look at Total Pet Spending in terms of 10 demographic categories. In each category we will identify the group that is responsible for most of the overall spending. Our goal was to find demographic segments in each category that account for 60% or more of the total. To get the finalists, we started with the biggest spending segment then bundled it with related groups until we reached at or near 60%.

Knowing the specific group within each demographic category that was responsible for generating the bulk of Total Pet $ is the first step in our analysis. Next, we will drill even deeper to show the best and worst performing demographic segments/groups and finally, the segments that generated the biggest dollar gains or losses in 2023.

In the chart that follows, the demographic categories are ranked by Total Pet market share from highest to lowest. We also included their share of total CU’s (Financially Independent Consumer Units) and their performance rating. Performance is their share of market vs their share of CU’s. This is an important number, not just for measuring the impact of a particular demographic group, but also in measuring the importance of the whole demographic category in Spending. All are large groups with a high market share. A performance score of 120+% means that this demographic is extremely important in generating increased Pet Spending. I have highlighted the 5 groups with 120+% performance.

There were 2 group changes from 2022. College Grads returned to the list as their share grew while Associate’s fell. A share loss by 45>64 and gain by 65>74 caused the age group to expand. There were also changes in the numbers and rankings. Homeowners fell from 2nd to 3rd. College Grads returned to the list at #10 but the expanded age group moved up from #10 to #4. Again only 5 made the 120%+ club. College Grads replaced Associate’s Degree> in the club. Formal higher education matters, but higher income remains the single most important factor in Total Pet Spending.

- Race/Ethnic – White, not Hispanic (82.5%) down from 83.9%. This is the 3rd largest group but it has the largest share of Pet Spending. Their performance was down from 124.9% to 124.4% and they dropped from #3 to #4 in importance. Although this demographic, along with age, are 2 areas in which the consumers have no control, spending disparities within the group are enhanced by differences in other areas like Income, CU Composition and homeownership. There are also apparently cultural differences which impact Pet Spending. Asian Americans are first in income, education and total CU spending but they’re last in Pet Spending as a percentage of total spending – 0.44% vs a national average of 1.13%.

- # in CU – 2+ people (79.7%) down from 80.8%. Singles still have by far the worst performance. In 2023, there was a 2.3% drop in the number of singles, but they spent 20.7% more on their pets. At the same time, 2+ people CUs spent 13.0% more. This explains the small drop in share and a performance decrease from 117.1% to 114.2%.

- Housing – Homeowners (79.6%) down from 81.2%. Controlling your “own space” is a key to larger pet families and more pet spending. 2023 was not a bad year for Homeowners, with & without Mtges. Homeowners spent $10.2B more but the group’s performance fell from 124.8% to 122.4%. The biggest factor in the decrease was a 24.2% lift in spending by Renters. Homeowners fell from 4th to 5th place in importance. There were some minor changes but the overall homeownership rate remained steady at 65.1%. Those w/o a Mortgage rose from 27.0% to 27.3%

- Age – 35>74 (75.4%) down from 77.1%.They lost share and their performance fell from 112.8% to 110.5%. All Age groups spent more but the lift of the 45>64 group was far below average. The youngest and oldest groups had the biggest lifts. To meet the 60% share goal, the group had to be expanded. However, Pet Spending is now more balanced by age group and age fell from 7th to 8th in importance.

- Area – Suburban & Rural (71.8%) up from 71.7% Homeownership is high and they have the “space” for pets. All areas had increases but the Suburbs had the biggest lift. Center City gained more CUs. This combination pushed Suburban/Rural’s performance up from 109.5% to 109.6%. Center City still has the worst performance at 81.8%

- Income – Over $70K (70.0%) up from 67.5%. They gained share but their performance fell to 138.6% from 142.8%. The disparity was due to a 3.2% lift in CUs. However, CU income is still by far the most important factor in increased Pet Spending. Spending was up for all groups but $40>49K. $30>39K had the biggest % lift, +46%, but all other groups <$70K had increases <5%. $70K> was up +18.6%. Income matters. $100K>: 36.4% of CUs, 55.9% of Pet $

- # Earners – “Everyone Works” (66.2%) down from 66.8%. These are CUs of any size where all adults are employed. They lost share and their performance fell again, from 114.5% to 112.8%. They dropped out of the 120+% club in 2021 and are only the 7th most important category. Income is important but # of Earners is less so. All segments spent more. The drops were due to a 37% lift from No Earner, 2+ CUs and only a 4.1% lift from 3+ Earners.

- Occupation – All Wage & Salary Earners (64.7%) down from 65.7%. Their performance also fell from 109.0% to 106.2%. All but Blue Collar workers & “All Other” spent more on their pets in 2023. However, among workers, only Tech/Sls/Clerical and Self-Employed spent more than the average increase. The drops in share & performance were due to the big spending lift from Self-Employed in conjunction with a 32% increase by Retirees. BTW: “All Other”, includes unemployed and those not working because of illness or attending school.

- CU Composition – Married Couples (61.4%) down from 61.8%. 2 people, committed to each other, is an ideal situation for Pet Parenting. In 2023, they lost share and their performance fell from 129.3% to 127.4%, but they stayed in 2nd place in importance even though College Grads returned to the list. Their lift was below average (+13.8%) and the drops in share and performance were due to big spending increases by singles and unmarried, all adult CUs.

- Education – College Grads (60.6%) up from 59.4%. Higher Education is usually tied to higher income and Pet spending. It can also be a key factor in recognizing the value in product improvements. In 2022 the Education group was expanded to hit the 60% share goal. In 2023, big lifts in the Service segments returned them to the list. Their 2023 performance fell from 127.0% to 126.7% but they are #3 in importance. In Education, only Associate’s Degree spent less. The gain in share and drop in performance is primarily due to a 2.6% increase in CUs with a college grad.

Total Pet Spending is a sum of the spending in all four industry segments. The “big demographic spenders” listed above are determined by the total pet numbers. The share of spending and performance of these groups varies between segments. In fact, in every segment we altered at least 1 group (4 in Pet Services) to better reflect where most of the business is coming from. There was some turmoil, but in 2023 Pet Spending had a great year.

Performance is an important measurement. Any group that exceeds 120% indicates an increased concentration of the business which makes it easier for marketing to target the big spenders. Income over $70K is again the clear winner, but there are other strong performers. High performance also indicates the presence of segments within these categories that are seriously underperforming. These can be identified and targeted for improvement. In 2020>2022 many of the big lifts and drops in spending came from a series of buying binge/busts which affected every segment. All segments had at least a small increase in 2023 so we may be getting closer to normal.

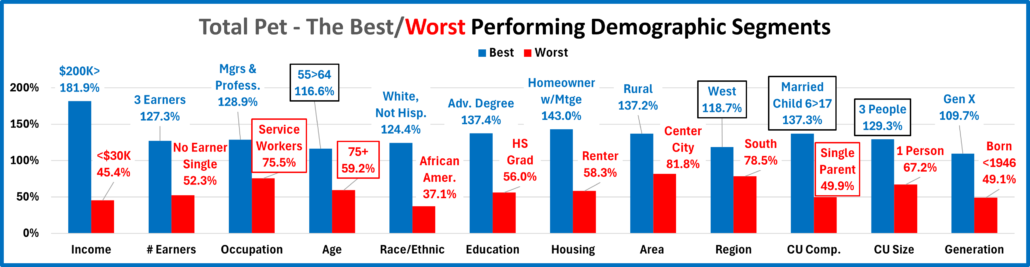

Now, let’s drill deeper and look at 2023’s best and worst performing segments in each demographic category

Most of the best and worst performers are expected but there are 4 winners & 3 losers that are different from 22 – the same as last year. The situation is definitely becoming more normal. Changes from 2022 are “boxed”.

- Income is important in Pet Spending, which is shown by the 181.9% performance by the $200K> group and wins by the high income 3 Earners, Mgrs/Prof and Adv College Degrees. All groups over $100K performed at 100+%.

- Occupation – Tech/Sls/Cler joined Mgrs/Professionals & Self-Employed as the only occupations with 100+% performance. Service Workers (75.5%) replaced Retirees at the bottom.

- Age/Generation: Gen X won again but spending moved towards their oldest members & youngest Boomers, 55>64

- Region – The West returned to the top. The Midwest also had 100+% performance.

- CU Size/Composition – The importance of children was maintained with wins by 3 People and those with an Oldest Child 6>17. Single Parents returned to the bottom. The “magic” CU number continues to fall – from 4 to 3.

The winners reflect the continued move back towards more normal spending patterns, but from slightly older CUs. In the next section we’ll look at the segments which literally made the biggest difference in spending in 2023.

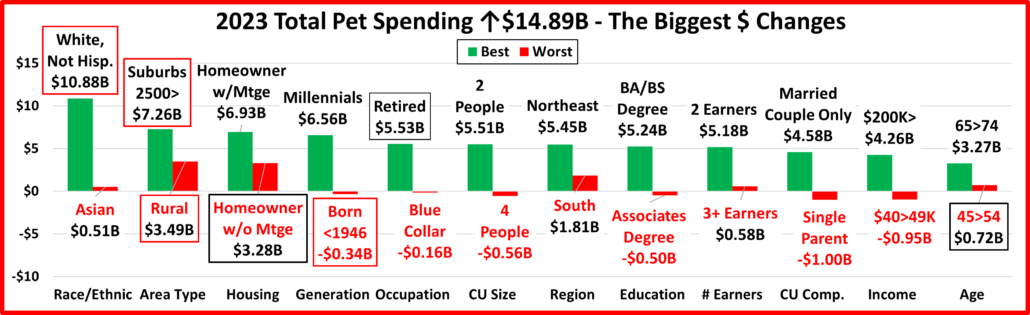

We’ll “Show you the money”! This chart details the biggest $ changes in spending from 2022.

In 2022 there was only 1 category in which all segments spent more. In 2023, there were 6 – Race, Area Type, Housing, Region, Earners and Age. There was also more stability. 4 segments held their spot from 2022 and 3 flipped from 1st to last or vice versa. In 2022, 3 segments were stable and 9 flipped. However, 83.3% were different from last year, just a little less than 87.5% in 2022. We should also note that with 8% inflation, the 14.5% Total Pet lift was really only +6.0%.

- Race/Ethnic – White, Not Hispanics stayed on top, but all segments spent more.

- Winner – White, Not Hispanic – Pet Spending: $97.06B; Up $10.88B (+12.6%) 2022: White, Not Hispanic

- Loser – Asian – Pet Spending: $3.19B; Up $0.51B (+18.9%) 2022: Hispanic

- Comment – African Americans & Hispanics were up 20+%. Asians “lost” with +18.9%. Average lift: +14.5%

- Area Type – Both winner and loser held their positions, and all segments spent more – just like 2022.

- Winner – Suburbs 2500> – Pet Spending: $53.72B; Up $7.26B (+15.6%) 2022: Suburbs 2500>

- Loser – Areas <2500 – Pet Spending: $30.67B; Up $3.49B (+12.9%) 2022: Areas <2500

- Comment – The Big Suburbs stayed in their usual spot at the top. Center City had a +$4.13B lift and Areas <2500 have fully recovered from a drop in 2021. The increases were pretty balanced, ranging from +12.9% to +15.6%.

- Housing – All spent more but Homeowners w/o Mtge flipped from 1st to last – That’s two consecutive flips for them.

- Winner – Homeowner w/Mtge – Pet Spending: $63.44B; Up $6.93B (+12.3%) 2022: Homeowner w/o Mtge

- Loser – Homeowner w/o Mtge– Pet Spending: $30.22B; Up $3.28B (+12.2%) 2022: Renter

- Comment – Homeowners w/Mtge returned to their usual spot on top. Renters were up $4.67B, +24.2%. Their lift percentage was almost double the +12.2% for Homeowners.

- Generation – These “rising stars” finally made it to the top of the chart with a $6.56B increase.

- Winner – Millennials – Pet Spending: $32.18B; Up $6.56B (+25.6%) 2022: Gen Z

- Loser – Born <1946 – Pet Spending: $4.86B; Down -$0.34B (-6.5%) 2022: Born <1946

- Comment – Boomers had the 2nd biggest lift and only the oldest generations, born <1946 spent less.

- Occupation – Retirees flipped from last to 1st – their 2nd consecutive flip.

- Winner –– Retired – Pet Spending: $22.85B; Up $5.53B (+32.0%) 2022: Managers & Professionals

- Loser – Blue Collar – Pet Spending: $6.01B; Down -$0.16B (-2.5%) 2022: Retired

- Comment– Only Blue Collar & Unemployed/All other spent less.

- # in CU – A new winner and loser but no flips.

- Winner – 2 People – Pet Spending: $45.12B; Up $5.51B (+13.9%) 2022: 3 People

- Loser – 4 People – Pet Spending: $14.79B; Down -$0.56B (-3.6%) 2022: 5+ People

- Comment: Only 4 people CUs spent less. The lift was definitely skewed towards smaller CUs. 1>3 person CUs have 77.8% of CUs but generated 94% of the lift. 1 & 3 person CUs were up 20+% – the only above average lifts.

- Region – All segments spent more and the winner and loser were both new.

- Winner – Northeast – Pet Spending: $21.92B; Up $5.45B (+33.1%) 2022: Midwest

- Loser – South – Pet Spending: $36.38B; Up $1.81B (+5.2%) 2022: West

- Comment – The West had the 2nd biggest increase, +$4.89B. They did spend less on Supplies but had a big turnaround from -$3.99B in 2022. The South spent less on Supplies and Services, the only other Segment $ drops.

- Education – Associate’s degrees flipped from 1st to last and had the only spending decrease in the category.

- Winner – BA/BS Degree – Pet Spending: $37.53B; Up $5.24B (+16.2%) 2022: Associates Degree

- Loser – Associates Degree – Pet Spending: $11.90B; Down -$0.50B (-4.0%) 2022: Adv. College Degree

- Comment – Except for HS Grads w/some College, +27.8%, the lifts from <College were all significantly below the 14.5% average. College Grads (47.8% of CUs) generated 68.9% of the Total Pet lift – 144% performance.

- # Earners – All Segments spent more. The highest income 3+ Earner segment is a bit of a surprise at the bottom.

- Winner – 2 Earners, 2+ CU – Pet Spending: $47.56B; Up $5.18B (+12.2%) 2022: 1 Earner, 2+ CU

- Loser – 3 Earners, 2+ CU – Pet Spending: $14.46B; Up $0.58B (+4.1%) 2022: No Earner, 2+ CU

- Comment – 1 Earner, Singles: 2022: -$0.48B, 2023: +$3.44B; No Earner, 2+CU: 2022: -$2.53B, 2023: +$2.84B

- CU Composition – Children became less important as the lift for Married, w/children was only 9.6%. Avg lift: 14.5%

- Winner – Married, Couple Only – Pet Spending: $33.438; Up $4.58B (+15.9%) 2022: Married, Child 18>

- Loser – Single Parent – Pet Spending: $2.99B; Down -$1.00B (-25.0%) 2022: Married, Child 6>17

- Comment – Only Married, Oldest Child 18> and Single Parents spent less. Bundled together, singles and unmarried, all adult CUs had a $7.16B (+22.7%) increase. That was 48.1% of the 22>23 Total Pet lift.

- Income – All segments but $40>49K spent more.

- Winner – $200K> – Pet Spending: $24.41B; Up $4.26B (+21.2%) 2022: $100>149K

- Loser – $40>$49K – Pet Spending: $5.25B; Down -$0.95B (-15.4%) 2022: $70>99K

- Comment – No spending rollercoaster this year. $30>39K had the biggest percentage lift, +46.0% but all other segments <$100K were below average. The $100K> segments (36.4% of CUs) generated 73.8% of the Total lift.

- Age – All groups spent more. However, the 45>54 yr-olds flipped to the bottom and 65>74 was a surprise winner.

- Winner – 65>74 yrs – Pet Spending: $19.71B; Up $3.27B (+19.9%) 2022: 45>54 yrs

- Loser – 45>54 yrs – Pet Spending: $22.51B; Up $0.72B (+3.3%) 2022: 35>44 yrs

- Comment: Only 45>64 had a below average lift. All ages from 25>74 have 90+% performance. More balanced.

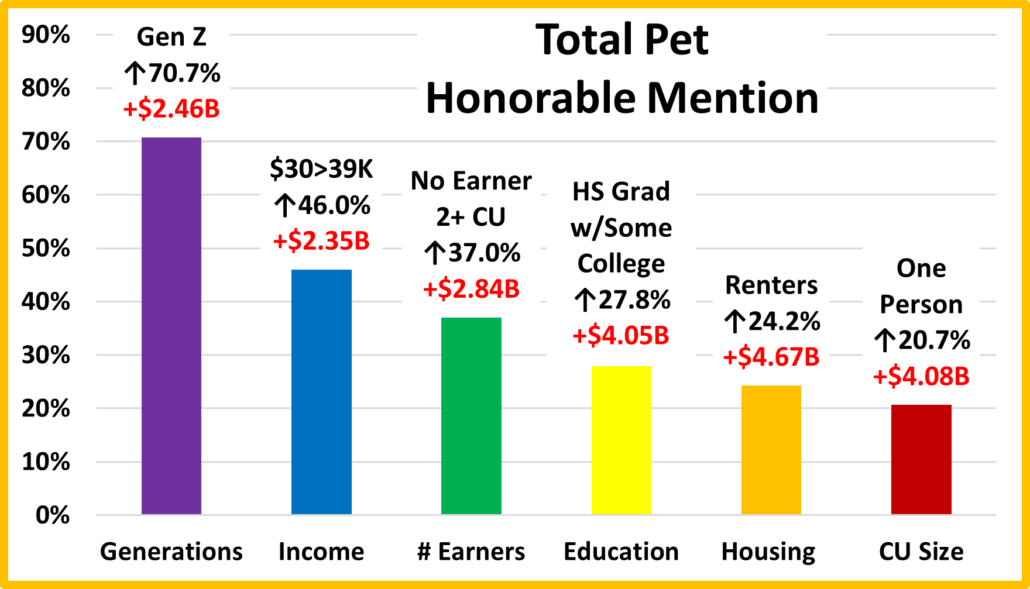

We’ve seen the best overall performers and the “winners” and “losers” in terms of increase/decrease in Total Pet Spending $ for 12 Demographic Categories. Now, here are some segments that didn’t win an award, but they deserve….

HONORABLE MENTION

2023 was a great year for segments that are usually at or near the bottom in Pet Spending. Gen Z had lifts in all segments. Only their Services lift was less than 50%. They are becoming even more committed to Pet Parenting. Big lifts by $30>39K and No Earner, 2+ CUs reflect the exceptionally strong performance of Retirees, especially the 65>74 yr old newly retired group. HS Grads w/some College are definitely in the HS Grad/College Grad gap and are rarely noticed. In 2023 they had double digit % increases in all segments. They deserve to be noticed. Renters and 1 Person CUs are usually at the bottom in spending lifts and/or performance. Both still have the lowest performance in their category but their $4B Total Pet spending increases should be noticed and applauded.

Summary

To review 2023, we must look at recent history. Total Pet Spending reached $78.60B in 2018, a $14.28B, 22.2% increase from 2014. However, it was not a steady rise, Total spending fell in 2016 and each segment had at least one down year. There were a number of factors driving both growth and tumult. Positives: The move to super premium foods and the increase in pet services outlets. Negatives: Value shopping, trading $ between segments and outside influences like the FDA dog food warning and tariffs. Pricing, inflation/deflation was also a negative/positive factor in some cases.

In 2019, the industry had another small decrease, -$0.16B (-0.2%) which was largely driven by a huge drop in spending in Supplies caused by Tarifflation. This affected virtually every demographic segment and caused Supplies $ to fall below 2014. Services spending also fell slightly as consumers value shopped. The good news was that Pet Food bounced back from the impact of the 2018 FDA warning to reach a new record high. Veterinary $ also increased 2.7%. Unfortunately, this was entirely due to a 4.1% increase in prices. The amount of Vet Services sold actually decreased.

That brings us to 2020 and the Pandemic turmoil. The effect was positive for Food and Veterinary, especially Food. Out of fear of shortages, many Pet Parents binge bought Pet Food. Spending also increased in Veterinary, as consumers focused on their Pets’ needs. The discretionary segments suffered. Supplies prices stayed high, so spending continued to decline. Services saw the biggest negative pandemic impact as many outlets were subject to closures and restrictions.

In 2021 the marketplace returned to “normal”. The Food binge buying wasn’t repeated but Pet Parents caught up with all their “children’s” wants and needs. This produced a big increase in Total Pet (+$16.23B) and in all segments but Food. Spending skewed younger and to more traditional winners, like Homeowners w/Mtges and Incomes over $200K.

In 2022, the spending lift was much smaller. Big lifts in Food & Services overcame the “binge drops” in Veterinary and Supplies and produced a 2.7% increase in Total Pet $. 72% of 96 demographic segments spent more on their pets, down from 83% in 2021. Spending became a little more balanced with strong performances by those without a college degree, Blue Collar workers, African Americans and Gen Z. Income is still important as Gen X stayed on top. Spending also skewed a little older towards the older Gen Xers, 45>54 yr olds. Baby Boomers are still the “heart” of the Pet Industry, but Gen X will likely lead CU spending for a number of years, until they are eventually displaced by the Millennials.

In 2023 Total Pet Spending took off, up $14.89B (+14.5%) to $117.6B. All segments had increases. The lifts in the more discretionary segments – Services & Supplies, were small but the Food & Veterinary lifts were huge. The Food increase even set a new record. The lift was widespread as 91% of 96 demographic segments spent more. Even considering 8% inflation, 78% spent more. Income is still the most important factor in all segments but Food and growing in importance. However, 2023 became a little more balanced in many categories, especially Age. Also, many underperforming segments, like Singles and Renters had big increases. 2023 was a great year and Gen X still spends the most Pet $ per CU.

Before we go…The Ultimate Total Pet Spending CU in 2023 has 3 people, a married couple with an oldest child 6>17. They are 55>64 yrs-old, but are Gen Xers, not Boomers. They are White, but not Hispanic. Both work and even their child has a part time job. At least one has an Advanced College Degree and is a Mgr/Professional. They earn $200K+. They still have a mortgage on their house located in an area with a population under 2500 in the West.