2023 U.S. PET SERVICES SPENDING $13.42B…Up ↑$1.05B

Except for a small decline in 2017, Non-Vet Pet Services had shown consistent, small annual growth. In 2018, that changed as spending grew a spectacular $1.95B. The number of outlets offering Pet Services has rapidly grown and more consumers have opted for this convenience. However, spending plummeted -$1.73B in 2020 due to COVID closures and restrictions. 2021>2022 brought a spectacular recovery. Spending grew $5.47B (+79%). Growth slowed in 2023, +$1.05B (+8.5%) to $13.42B. In this report we will drill down into the data to see what groups drove the 2023 lift. (Note: All numbers in this report come from or are calculated from data in the US BLS Consumer Expenditure Surveys)

Services’ Spending per CU in 2023 was $99.73, up 8.2% from $92.21 in 2022. Note: A 2023 Pet CU (68%) Spent $146.66

More specifically, the 8.5% increase in Total Pet Services spending came as a result of:

- 0.3% more CUs

- Spending 7.8% more $

- 0.4% more often

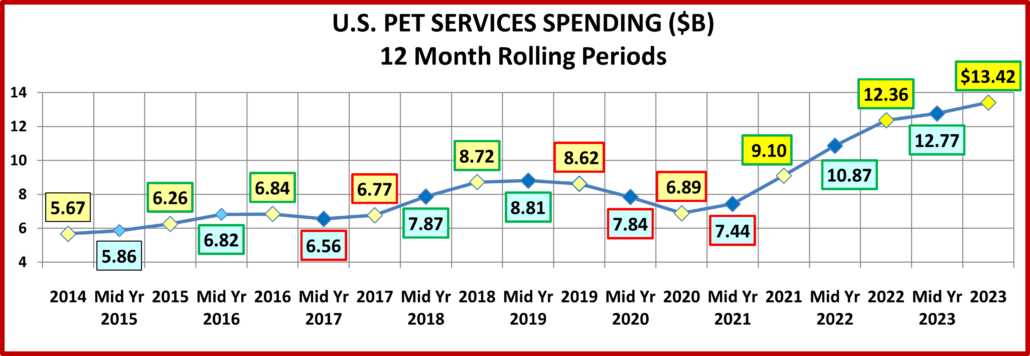

The chart below gives a visual overview of recent spending on Pet Services

After the big lift in 2018, spending stabilized in 2019. Increased availability and convenience has significantly increased Services spending. This happened despite a return to a normal inflation rate, +2.4%. However, inflation grew to 2.5+% and in the 2nd half of 2019 and spending declined slightly. The 2020 pandemic brought restrictions and closures which drove spending radically down. In 2021>2022 it grew spectacularly despite inflation rates of 4.9% in 2021 & 6.3% in 2022. In 2023, inflation was 5.7% and growth slowed. In fact the 8.5% lift was “really” only a 2.7% increase in the amount of Services bought. Now, let’s look at some demographics of 2023 Services spending.

First, by Income Group.

In 2022 all groups spent more. In 2023 <$50K & $70>100K had big drops. The biggest lifts came from higher incomes, especially $200K> which was up $1.16B. The 2023 50/50 dividing line in $ for Services was $147K. That is up radically from $134K last year and it is still by far the highest of any segment. It is readily apparent that income is overwhelmingly the primary driver in Pet Services spending.

- <30K (21.3% of CU’s) – $27.42 per CU (-12.3%) – $0.78B, ↓$0.21B (-21.4%) – This segment is shrinking and money is tight, so Services spending is less of an option. Inflation was still high and spending fell 21%. It is now below $1B.

- $30>70K (28.3% of CU’s); $50.13 per CU (+11.0%); $1.91B, Up $0.15B (+8.8%) – In 2020, they had the only increase and they are the only group to spend more in 2020, 2021, 2022 & 2023. In 23, $30>50K: ↓-$0.25B; $50>70K: +$0.4B

- $70>100K (14.1% of CU’s) – $65.67 per CU (-25.8%) – $1.24B, Down $0.43B (-25.8%) – The spending of this middle income group slowly but consistently grew 2016>19. Then it plummeted in 2020. They rebounded somewhat in 2021, but spending took off in 2022, a 61% lift. In 2023, they had the biggest drop.

- $100>150K (16.6% of CU’s) – $130.98 per CU (+6.9%) – $2.93B, Up $0.39B (+15.3%) – They had consistent growth from 2016>19. In 2020 they had the biggest drop. Consistent growth returned 2021>23 and they are now near $3B.

- $150K> (19.8% of CU’s) – $246.34 per CU (+8.2%) – $6.55B, Up $1.16B (+21.4%) – Spending fell 2019>20, then it took off in 21>23. They generate 49% of Services total $ and their CU spending is 2.5 times the national average. Note: Spending in the $150>199K segment was down -$0.01B so all of the $150K> group’s increase came from $200K>.

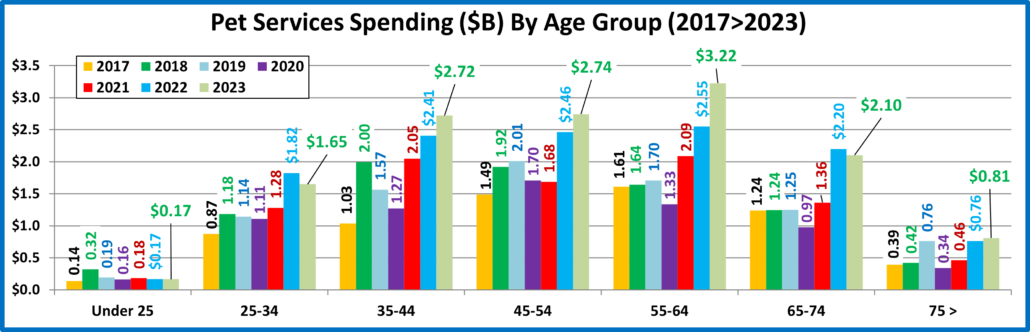

Now, let’s look at spending by Age Group.

<25, 35>64 & 75> spent more in 2023. Only 25>34 and 65>74 spent less. The biggest lift was from 55>64. The lifts from the oldest & youngest groups were minor. Spending share is relatively balanced from 35>64. Here are the specifics:

- 55>64 (17.8% of CU’s) $134.78 per CU (+29.2%) – $3.22B – Up $0.68B (+26.5%) 2017>2019 they slowly increased Services spending. A big drop in frequency drove spending down in 2020 but they had a strong recovery 21>23 and took the top spot in Services $ in 2021. They held on in 23 as 2.1% less CUs spent 16.2% more $, 11.2% more often.

- 45>54 (16.9% of CU’s)- $120.78 per CU (+11.4%) – $2.74B – Up $0.28B (+11.5%) This highest income group was #1 in Services $ in 2019 and held on in 2020 despite a 20% drop in frequency. In 2021 they had the only $ drop and fell to #3. In 2022 they moved up to #2. In 2023 0.1% more CU’s spent 12.3% more $, 0.8% less often. They are still #2.

- 35>44 (17.5% of CU’s) – $115.27 per CU (+9.2%) – $2.72B – Up $0.31B (+13.0%) A $1B increase in 2018 pushed them to #1. In 2019>20 spending fell. In 2021 they had a big increase and moved up to #2. In 2022 $ grew 17.6% but they fell to #3. In 2023 3.5% more CU’s spent 11.1% more $, 1.7% less often. They are still #3 but just $0.02B behind #2.

- 65>74 (16.0% of CU’s) – $97.47 per CU (-3.6%) – $2.10B – ↓ $0.09B (-4.2%). This group is very value conscious and had been growing in numbers until 2023. From 2017>19 their spending was stable. In 2020 it fell 20%. In 2021>22 they came back strong. In 2023 0.7% less CU’s spent 3.1% more $, 6.5% less often and Services $ fell -4.2%.

- 25>34 (15.7% of CU’s) – $78.22 per CU (-10.4%) – $1.65B – ↓ $0.18B (-9.6%). These Millennials “found” the Services segment in 2018. Their spending slowly fell in 2019>20 but reached a record high in 2021 due to an increase in frequency. In 2022 their $ surged but they fell in 2023 as 0.9% more CU’s spent 10.6% less $, 0.3% more often.

- 75> (11.6% of CU’s) – $51.85 per CU (+3.9%) – $0.81B – Up $0.05B (+6.2%) They have a big need for pet services, but money is always an issue. In 2019 they had the biggest lift but gave it all back in 2020. In 2021>22 spending surged with a big increase in frequency. In 2023 $ grew 6.2% as 2.2% more CU’s spent 15.2% more $, 9.8% less often.

- <25 (4.5% of CU’s) – $27.68 per CU (+4.5%) – $0.17B – Up $0.001B (+0.7%) After 2018 spending fell and essentially stabilized from 2019>23. They had a miniscule lift in 2023 as 3.7% less CU’s spent 13.5% less $, 20.8% more often.

Earlier, we saw that income was a big driver in Services spending, so it is no surprise that the 3 highest income age groups, 35>64, account for 64.7% of all Services $. They are also the only groups with 100+% performance ($ share/CU share) 65>74 is close, 97.7%. Pet Services offer great benefits, but you need to have/find the money to get them.

Finally, here are some key demographic “movers” that drove the lift in Pet Services Spending in 2023. The segments that are outlined in black “flipped” from 1st to last or vice versa from 2022. A red outline stayed the same.

You see a little less stability in 2023. There were 7 that held their position and 2 flips from last to 1st. In 2022, 13 held their position and there were no flips. Also, 2 categories had no segments that spent less on Services. There were 9 in 2022. In fact, in 2023, 72 of 96 segments (75%) spent more on Services than last year. In 2022 the percentage was 93%. So 2023 was not as great as 2022 but it was still good. The recovery growth has definitely slowed but it is still happening and is demographically widespread.

You see from the graph that, except for Education the winners’ changes were substantially larger than the losers’. This speaks to the strength and widespread nature of the lift. We should also note that regardless of the type of area that you live in or the number of people in your household, you spent more on Pet Services.

6 of the winners held their spot. Pet Services are a regular part of their Pet Parenting, and its importance continues to grow. The winners also demonstrate the importance of income to Services. While this segment has become more demographically widespread, higher incomes dominate. 9 of the 12 winners are either 1st or 2nd in income in their categories. The only winner that is bit of a surprise is Retired. High need, but low income – But more Boomers.

Almost all of the losers are not unexpected. Once again, if we look at income, 9 of 12 are at or near the bottom in income in their category. The other 3 also have below average incomes. Only Tech/Sls/Clerical is somewhat surprising, but their drop was very small, only -0.08B. We should also note that the biggest $ drop was by Associate’s Degree. In 2022 they more than doubled their Services spending.

In 2023, 75% of demographic segments spent more on Services than in 2022 and 99% from the low point in 2020. The segment has strongly recovered. However, when you factor 5.7% inflation into the 2023 numbers, only 32% of the 8.5% 22>23 lift was real, +2.7%. Plus, just 60% of demographic segments had a real increase in Services $. The recovery has definitely slowed. There is one spending trend that must be noted. Income continues to be the biggest factor in Services spending and its importance is growing. The 50/50 income dividing line in Services spending is now up to $147,000. That is 44% more than the average CU income and 84% more than the median income. $147K> is 22% of all CUs but accounts for 50% of Services $, 110% of the $1.05B lift from 2022 and 60% of the $6.5B increase from 2020.

Overview – After the huge lift in 2018, Services spending plateaued in 2019. That changed with the pandemic in 2020. Like many retail services segments, Pet Services outlets were deemed nonessential and subject to restrictions. This resulted in a radically reduced frequency of visits and was the biggest reason behind the 20% drop in spending.

2021 and 2022 brought a strong recovery with the 2 biggest increases in history. The segments that were hit the hardest by the pandemic generally had the strongest recovery. Both big lifts were largely driven by the same groups, but in 2022, 93% of all segments spent more. With continued high inflation, growth slowed markedly in 2023. 79% of segments had an increase in spending but only 58% had lifts that exceeded the inflation rate. Plus, the purchase frequency was only +0.4% from 22. However, one group stepped up – high income. CUs with $200K> income increased Services spending by $1.16B, 110% of the Services 22>23 lift. Pet Services have become more important to Pet Parents and the Pet Industry, but growth is increasingly being driven by high income. However, many households still find the $ to fill this need.

What i do not realize is in fact how you are no longer actually much more wellfavored than you might be right now Youre very intelligent You recognize thus considerably in relation to this topic made me in my view believe it from numerous numerous angles Its like men and women are not fascinated until it is one thing to do with Lady gaga Your own stuffs excellent All the time handle it up

I loved as much as youll receive carried out right here The sketch is tasteful your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

Your blog is a beacon of light in the often murky waters of online content. Your thoughtful analysis and insightful commentary never fail to leave a lasting impression. Keep up the amazing work!

Wonderful web site Lots of useful info here Im sending it to a few friends ans additionally sharing in delicious And obviously thanks to your effort