2023 U.S. Pet Spending by Generation – Boomers Back on Top!

In 2023 Americans spent $117.60B on our companion animals, 1.13% of $10.40T in total expenditures. Pet Spending was up $14.89B (+14.5%), much more than the $2.73B in 2022. In 2020 Consumers focused on the necessary segments – Food and Veterinary, including a Food buying binge. The discretionary segments, Supplies and Services, suffered until 2021 when Food $ fell but all other segments had record increases. In 2022, Supplies & Vet $ fell while Food & Services grew. In 2023, $ increased in all segments including a record lift in Food. This produced the huge 14.5% increase in Total Pet $.

In this report we will compare Pet Spending in 2023 vs 2022 for the most popular demographic measurement – by Generation. We will also include historical data going back to 2019 when Gen Z first had enough CUs to be recognized as a separate segment. All data comes from the US BLS Consumer Expenditure Survey.

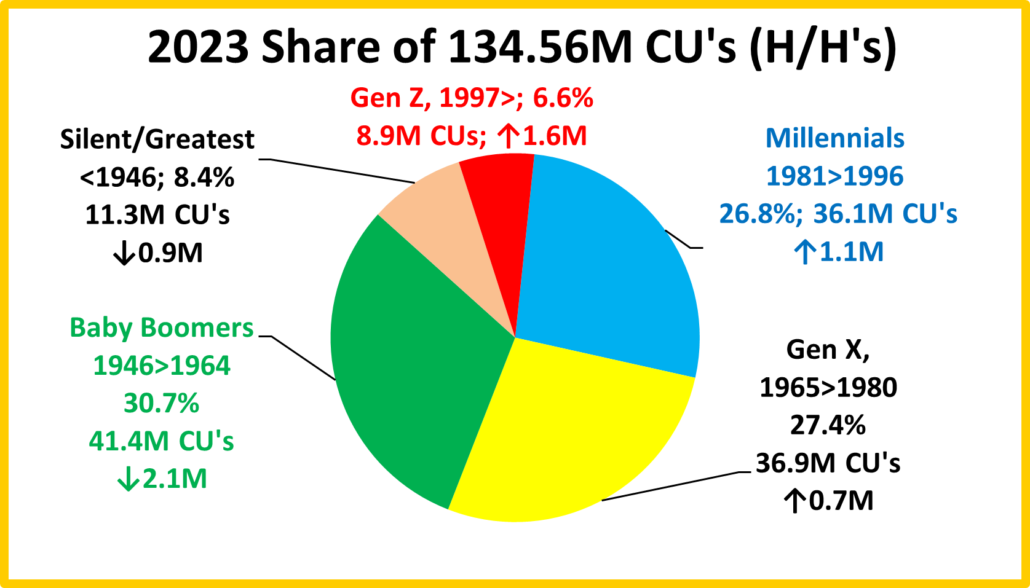

We’ll start by defining the generations and looking at their share of U.S. Consumer Units (CUs are basically households)

GENERATIONS DEFINED

Gen Z: Born after 1996

In 2023, Age 26 or less

Millennials: Born 1981 to 1996

In 2023, Age 27 to 42

Gen X: Born 1965 to 1980

In 2023, Age 43 to 58

Baby Boomers: Born 1946 to 1964

In 2023 Age 59 to 77

Silent/Greatest: Born before 1946

In 2023, Age 78+

- Baby Boomers still have the largest number of CU’s at 41.4M and 30.7% of the total. They had a 2.1M decrease in 2023 and generally have been losing ground. In fact, they have 3.8M fewer CU’s than in 2016.

- The Oldest Generations will continue to lose CUs primarily due to death or movement to permanent care facilities.

- Gen X has the second most CUs and gained a little ground in 2023.

- Millennials have the largest number of individuals, but they still rank only third in the number of CU’s.

- Gen Z gained 1.6M CUs as more of these youngsters established independent households.

Now let’s look at some key CU Characteristics (Note: Nationally, 1 change; CU Size up to 2.5 from 2.4 in 2022.)

CU size: ↑ for Millennials, ↓ for Gen X & Gen Z; # Children: Millennials ↑, Gen X ↓; # Earners: Gen Z ↑, Boomers ↓; Homeownership: ↑ for Gen X & Millennials, ↓ for Born <1946; No Mtge: ↑ for all but Gen Z (No Chge).

- CU Size – Nationally, CU size increased to 2.5 from 2.4. 2+ people CUs account for 69.8% of all U.S. CUs, (up from 69.0% in 2022) and 79.7% of pet $ (down from 80.8%) There were 1.5% more 2+ CUs and they spent 11.5% more on their pets (Natl. Avg: +14.1%). Millennials and now Gen Z are actively building their households. CU size, with all the related responsibilities, now peaks with the Millennials as Gen Xers fell from 3.0 to 2.9. CU size drops as we age but the numbers for the oldest groups are the same as 2022. However, Gen Z fell from 2.1 to 2.0.

- # Children < 18 – 27.0% of U.S. CU’s have children, the same as 2022 and they generate 30.2% of Pet Spending, down from 32.8%. There was a lift in CUs with an oldest child <6 & Single Parents. The others were down. The decrease in Total Pet Spending share was also very focused. Married couples with an oldest child 18> spent -$0.60B less. Single Parents were -$1.0B. All other CUs, with or without children, spent more. The net result was CUs with children spent $1.85B more while those without children increased spending by $13.04B. Overall there was no change in the # of children per CU. Millennials are still the leader and the only generation to average more than 1 child per CU. In 2023 they increased to 1.2 from 1.1. Gen X (#2) fell from 0.8 to 0.7. All others were unchanged.

- # Earners – Pet spending is often tied to the number of earners in a CU. In 2023, all segments in the # of Earners category spent more. 2+ earner CUs still spent the most and had the biggest increase, +$5.18B. The only changes in count were that Gen Z rose to 1.5 from 1.4 while Baby Boomers fell to 0.9 from 1.0.

- Homeownership – Owning and controlling your own space has always been a major factor in increased Pet Ownership and spending. In 2023 homeownership was unchanged at 65.1%. Millennials & Gen X had increases and Born <1946 had the only drop. The homeowners’ share of Total Pet Spending fell from 81.2% to 79.6%. The decrease happened because Homeowners’ Pet Spending increased $10.21B (12.2%), while Renters’ rose $4.67B (24.2%). We should also note that while the percentage of homeowners w/no Mtge is basically unchanged, it actually grew by 0.33%. All generations but Gen Z had slight increases.

- As expected, Gen Z are the most common renters in society. Homeownership by Millennials has moved up to 53% but it is still only 82% of the national average.

- Gen Xers have been above the national avg since 2018, and Homeownership generally increases with age.

Next, we’ll compare the Generations to the National Avg.:

In Income, Total CU Spending, Total Pet Spending and the Pet Share of Total CU Spending

CU National Avg: Income – $101,805; Total CU Spending – $77,278; Total Pet Spending – $874.16; Pet Share – 1.13%

- Income – The Gen Xers are still at the top, but their lead fell slightly. Compared to the national average, the incomes of Boomers and the Silent/Greatest fell. Millennials’ income beat the national average in 2020 and continues to grow. The income of Gen Z passed that of the oldest Americans in 2021 and as expected, continues to grow.

- Total Spending – The Gen Xers make the most and spend the most but it’s not out of line with their income. The Millennials’ increase was 50% above the national lift so it is now 5.6% above the national average. Boomers’ spending is 90.8% of the national average, down from 90.9%. Due to a big drop in spending compared to income, the oldest group is in a better position. However, they are still deficit spending vs their after tax income. With an 11.9% increase in Income and an 9.1% increase in spending, the retail importance of Millennials continues to grow.

- Pet Spending – Millennials had a 24.0% lift so now there are 3 groups exceeding the national average. Gen X stayed on top, but their lead has narrowed. Gen Z is now up to 75.3% while the oldest group fell to 50.1% from 55.6%.

- Pet Spending Share of Total Spending – The national number grew from 1.05% to 1.13%. The increase was driven by lifts from all groups but Born <1946. In 2020 Boomers were the only group to spend more than 1% of their total expenditures on their pets. In 2021 only Gen Z spent less than 1% of their total expenditures on their pets. In 2022, only Boomers and Gen X were above 1%. In 2023, all but the oldest group are above 1%. Boomers again lead with an incredible 1.33%. However, the strong commitment to their pets by Gen Z is very evident with a 1.25% score.

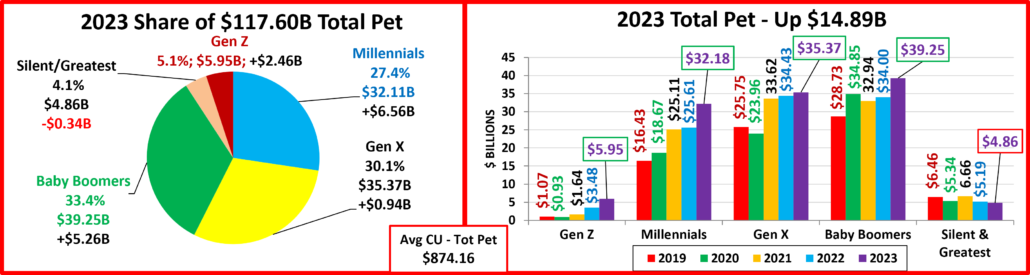

Now, let’s look at Total Pet Spending by Generation in terms of market share as well as the actual annual $ spent for 2019 through 2023. The 2023 numbers are boxed in red (decrease) or green (increase) to note the change from 2022.

- After 2 years at #2, Boomers regained the top spot in Pet Spending from Gen X and their $ exceed their 2020 binge.

- There are a variety of spending patterns. Spending in the oldest group is low and except for a surge in 2021 has been slowly falling. Millennials are the only group with consistent annual growth. Gen X also grew every year until 2020. They came back strong and moved to the top in 2021>22. They fell to #2 in 2023. The Boomers have been on a rollercoaster because they react strongly to trends and outside influences. In 2020 they drove the panic buying of Food. In 2021 their spending fell due to a big drop in Food $. In 2022 it increased but was still below 2020. In 2023 lifts in all but Supplies pushed them back to #1. Their pattern is the exact opposite of the oldest generation. Gen Z is just getting started but growing. They’re the smallest group but their 2023 spending is 3.6 times more than 2021.

- In 2023, again only the Silent/Greatest generations spent less. Millennials & Boomers had the biggest lifts.

- Silent/Greatest: -$0.34B. Boomers: +5.26B. Gen X: +0.94B. Millennials: +$6.56B. Gen Z: +$2.46B.

- Boomers – Ave CU spent $930.33 (+$139.07, 17.6%); 2023 Total Pet spending = $39.25B, Up $5.26B (+15.5%)

- 2019>23: Up $10.52B; Spending turned strongly up and they’re back to #1 in $. Plus, they’re finally above 2020.

- Gen X – Ave CU spent $969.74 (+$12.30, 1.3%); 2023 Total Pet Spending = $35.37B, Up $0.94B (+2.7%)

- 2019>23: Up $9.62B Their annual Pet spending growth since 2015 had been strong and consistent until a drop in 2020. In 2021>22 they were #1 in CU Pet spending and Total $. In 2023 they fell to #2 in Total $ but are #1 in CU.

- Millennials – Ave CU spent $898.78 (+$173.79, 24.0%); 2023 Total Pet Spending = $32.18B, Up $6.56B (+25.6%)

- 2019>23: Up $15.75B; As the income and overall spending of Millennials grows, their pet spending has also grown every year. This younger group has by far the biggest increase in $ since 2019 of any group, $15.75B, +96%

- Gen Z – Ave CU spent $658.29 (+$198.03, 43.0%); 2023 Total Pet Spending= $5.95B, Up $2.46 (+70.7%)

- 2019>23: Up $4.88B; They’re starting to build H/Hs but are now committed Pet Parents. Pet $ are +260% vs 2021

- Silent/Greatest – Ave CU spent $437.80 (+$11.95, 2.8%); 2023 Total Pet Spending = $4.86B, Down $0.34B (-6.5%)

- 2019>23: Down $1.60B; CU Spending was up, but their # of CUs continues to fall, -7.1% vs 2022 & -32.9% from 2019.

Baby Boomers took the top spot in Total Pet Spending from Gen X and the spectacular growth continued for Gen Z. Only the oldest group spent less. However, with 8.0% inflation, Gen X also really bought less Pet Products & Services in 2023.

Let’s look at the individual segments. First, Pet Food…

- Gen X had the only decrease. The Boomer lift exceeded the one from 21>22, but Millennials had the biggest increase and the younger groups have had more consistent growth. Gen Z has quadrupled their spending since 2021.

- Since 2014, Millennials’ have led the way in food trends, and they are the only group with an annual increase every year since 2016.

- Boomers – Ave CU spent $381.53 (+$65.97, 20.9%); 2023 Pet Food spending = $16.55B, Up $3.23B (+24.3%)

- 2019>2023: Up $3.99B They are again #1 in Total Food $ but they are still below their 2020 COVID panic buy.

- Millennials – Ave CU spent $357.97 (+$114.43, 47.0%); 2023 Pet Food Spending = $12.67B, Up $3.87B (+44.1%)

- 2019>2022: Up $6.88B They are the only group with increased spending every year since 2016. Their income is growing as is a commitment to their pets. They often pioneer food upgrades, and they moved up to #2 in 23.

- Gen X – Ave CU spent $320.80 (-$46.41, -12.6%); 2023 Pet Food spending = $11.43B, Down $1.65B (-12.6%)

- 2019>2022: Up $3.05B They reacted to the FDA warning by further upgrading their food. No pandemic panic buying. In 2021>22 they were the leader in CU Pet Food Spending. In 2023, they fell to 3rd. Value shopping!

- Gen Z – Ave CU spent $264.59 (+$58.56, 28.4%); 2023 Pet Food spending = $2.43B, Up $0.82B (+50.4%)

- 2019>2023: Up $2.09B; Pets are more important to these youngsters. Pet Food spending is +386% from 2021.

- Silent/Greatest – Ave CU spent $221.88 (+$67.76, 44.0%); 2023 Pet Food spending = $2.41B, Up $0.53B (+28.3%)

- 2019>2023: Down $0.07B; CU count is falling, and prices are high, but they are committed to their pets.

Pet Food Spending is driven by trends and outside influences like FDA warnings and COVID. 2023 brought a record increase. Even with 10.6% inflation, all but Gen X spent more $ and bought more food. Now, Supplies Spending.

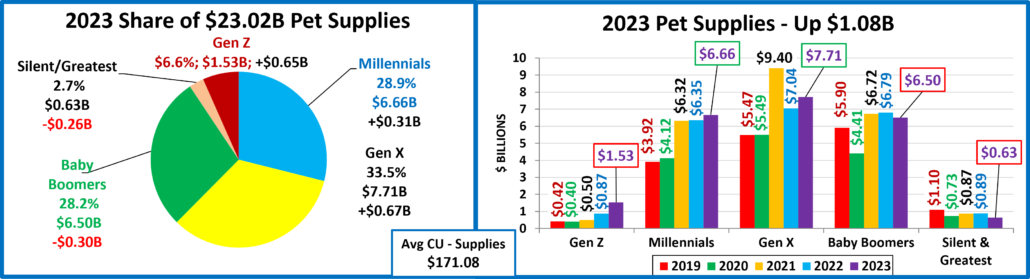

- The oldest groups spent less and Supplies spending again skewed towards the younger groups. Gen X had the biggest lift and stayed #1. Millennials passed Boomers and are now #2. Gen Z now spends 2.4 times more than the oldest group. In 2022, they spent -$0.02B less.

- Gen X – Ave CU spent $10 (+$14.46, 7.4%); 2023 Pet Supplies spending = $7.71B, Up $0.67B (+9.5%)

- 2019>2023: Up $2.24B; Gen Xers are again the leader in Supplies spending. They were affected by tarifflation in 2019 but held their ground in 2020. In 2021 spending exploded, fell in 2022, then grew in 2023 – not unexpected.

- Millennials – Ave CU spent $184.53 (+$2.76, 1.5%); 2023 Pet Supplies spending = $6.66B, Up $0.31B (+4.8%)

- 2019>2023: Up $2.74B; Millennials earn their share of Supplies $. They were the least impacted by the tariffs in 2019 and spent more in 2020. Their spending then took off in 2021 and has had slow growth in 2022>23.

- Baby Boomers – Ave CU spent $157.13 (+$0.82, 0.5%); 2023 Pet Supplies spending = $6.50B, Down $0.30B (-4.3%)

- 2019>2023: Up $0.60B In 2020 they focused on Food! In 2021, a big lift. +$0.07B in 2022 and -$0.30B in 2023.

- Gen Z – Ave CU spent $171.13 (+$52.08, 43.7%); 2023 Pet Supplies spending = $1.53B, Up $0.65B (+74.9%)

- 2019>2023: Up $1.11B; With a big increase in Food, their huge lift in Supplies is not surprising, Pets need both.

- Silent/Greatest – Ave CU spent $55.26 (-$17.38, -23.9%); 2023 Pet Supplies spending = $0.63B, Down $0.26B (-29.3%)

- 2019>2023: Down $0.47B; They’re losing CUs & were hit hard by COVID & inflation. Small lifts in 21>22. A drop in 23.

In 2019, tarifflation drove spending down in all groups. In 2020 Millennials and Gen X spent a little more while the older groups spent a lot less. In 2021 spending took off in all groups. In 2022, only Gen X spent less. In 2023, the older groups spent less, but the younger groups spent more – enough to generate a $1.08B increase.

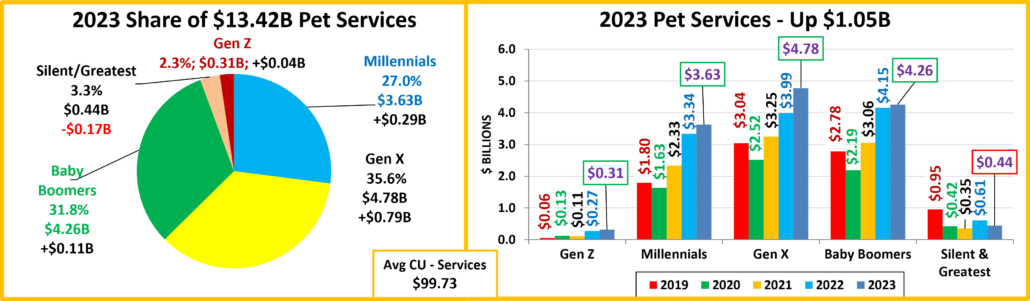

Next, we’ll turn our attention to the Service Segments. First, Non-Veterinary Pet Services

- All but the oldest spent more. Gen X had the biggest increase and became #1 in Services $.

- Gen X – Ave CU spent $129.49 (+$19.23, 17.4%); 2023 Pet Services spending = $4.78B, Up $0.79B (+19.8%)

- 2019>2023: Up $1.74B; A big drop in 2020. The 2nd biggest lifts in 21>22 but fell to #2. In 23 they are again #1.

- Baby Boomers – Ave CU spent $103.01 (+$7.45, 7.8%); 2023 Pet Services spending = $4.26B, Up $0.11B (+2.6%)

- 2019>2023: Up $1.48B; The biggest $ drop in 2020 and the biggest lifts in 2021>22. Small lift in 23, now #2 in $.

- Millennials – Ave CU spent $100.55 (+$5.05, 5.3%); 2023 Pet Services spending = $3.63B, Up $0.29B (+8.7%)

- 2019>2023: Up $1.83B; In 2020 they had the smallest decrease of any group and with the 2021>23 lifts, their spending is now double the amount in 2019.

- Silent/Greatest – Ave CU spent $38.96 (-$11.29, -22.5%); 2023 Pet Services spending = $0.61B, Down $0.17B (-28.0%)

- 2019>2023: Down $0.51B; They have the need but not the $. Their 2023 spending was 54% less than 2019.

- Gen Z – Ave CU spent $35.23 (-$2.12, -5.7%); 2023 Pet Services spending = $0.31B, Up $0.04B (+14.8%)

- 2019>2022: Up $0.25B; They still have the smallest share of the $ but their spending is 5 times more than 2019.

This segment had slow annual growth until 2017 which saw a small drop in spending due to an extremely competitive environment. In 2018, the increased number of outlets really hit home, and spending exploded. 2019 brought another small decrease as Gen Xers & Millennials looked for and found a better deal. 2020 brought pandemic restrictions and closures. 2021 saw a record lift which they exceeded in 2022. In 2023, growth slowed, and Gen X is again #1 in $.

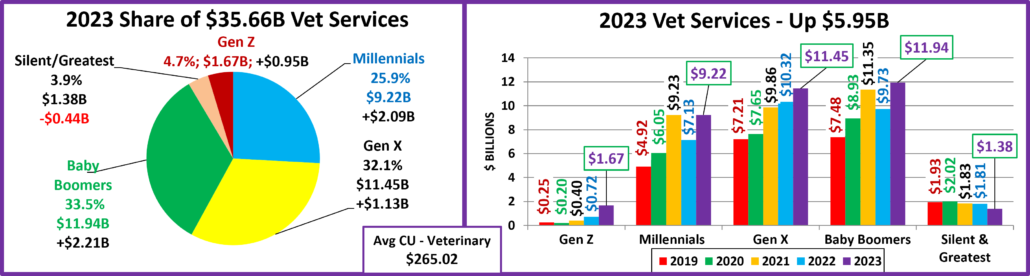

Now, Veterinary Services

- The oldest group had the only decrease. Gen X stayed on top in CU spending, but Boomers are now #1 in total $.

- Except for the 2022 drop by Millennials, the younger groups have had a growing commitment to this Pet Parenting responsibility. The combined Vet $ of Millennials, Gen Z & Gen Xers is up 80% from 2019 but 139% from 2017.

- Boomers – Ave CU spent $288.66 (+64.83, 29.0%); 2023 Veterinary spending= $11.94B, Up $2.21B (+22.7%)

- 2019>2023: Up $4.46B; In 2020, Boomers focused on Food & Veterinary. In 2021 they had a big drop in Food but a big lift in Vet $. They were the leader in Vet $ until the drop in 22 pushed them to #2. They are again #1 in 23.

- Gen X – Ave CU spent $310.35 (+$25.02, 8.8%); 2023 Veterinary spending= $11.45B, Up $1.13B (+10.9%)

- 2019>2023: Up $4.24B; They have been at the top of CU Vet spending since 2018. They are the only group with an annual increase in Vet $ every year since 2019. In 2022 they became #1 in Total $. In 2023 they fell to #2.

- Millennials – Ave CU spent $255.73 (+$51.55, 25.2%); 2023 Veterinary Spending $9.22B, Up $2.09B (+29.3%)

- 2019>2023: Up $4.30B; They had the biggest lift in 21, the biggest drop in 22 and another big lift in 23.

- Gen Z – Ave CU spent $187.34 (+$89.50, 91.5%); 2023 Veterinary spending = $1.67B, Up $0.95B (+133.0%)

- 2019>2023: Up $0.47B; Their growing commitment to Pets includes Vet Services as spending more than doubled.

- Silent/Greatest – Ave CU spent $121.70 (-$27.14, -18.2%); 2023 Veterinary spending $1.38B, Down $0.44B (-24.0%)

- 2019>2023: Down $0.55B; Their pets’ health is still a priority, but high prices & a drop in CUs drove their $ down.

Veterinary spending continues to be important to the 3 younger groups but is also a priority for Boomers as they moved back to the top in $. Even with 9.4% inflation, all but the oldest group bought more Veterinary Services.

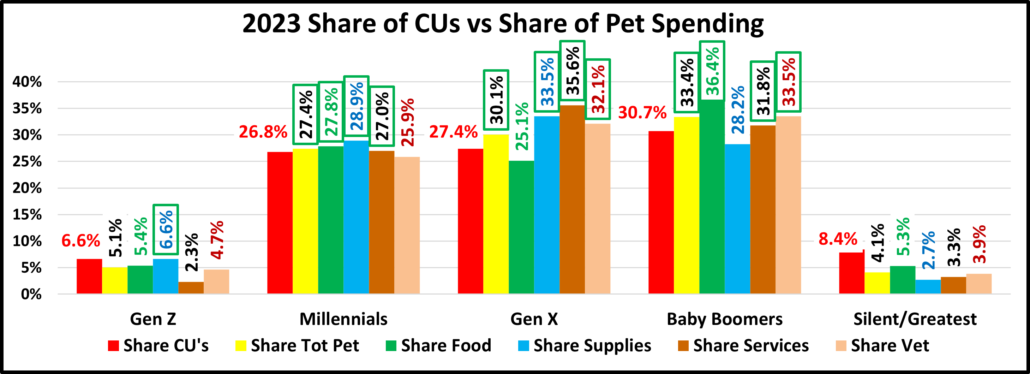

One last chart to compare the share of spending to the share of total CU’s to see who is “earning their share”.

- Gen X Performance – Total: 109.7%; Food: 91.6%; Supplies: 122.2%; Services: 129.8%; Veterinary: 117.1%

- Gen Xers stayed at the top in performance. They earned their share in Total Pet and all segments but Food. Except for the 2020 dip they increased their Total Pet Spending every year since 2016. In 2021 they had a big increase in every segment. In 2022 they had some spending dips but an overall increase as they stayed on top in Total Pet $. In 2023, they had lifts in all, but Food and they are the performance leader in all NonFood segments. Expect their commitment and pet spending to continue to grow.

- Baby Boomers Performance – Total: 108.6%; Food: 118.3%; Supplies: 91.8 %; Services: 103.3%; Veterinary: 108.9%

- Boomers led the way in building the industry and are again the “top dogs” in $. They earn their share in all but Supplies and are still the spending leader in Total Pet, Food & Veterinary. They are also the most emotional Pet Parents, so their spending is subject to radical swings like 2020’s panic, binge buying of Pet Food. They should still be a major force in the Pet Industry for many more years, but the Gen Xers are performing well, and the Millennials are also preparing to eventually take their turn at the top.

- Millennials Performance – Total: 102.1%; Food: 103.9%; Supplies: 107.9%; Services: 100.8%; Veterinary: 96.5%

- Millennials are now the only group to have increased their pet spending every year since 2016. Their spending is more evenly balanced, and their performance is 100+% in all but Veterinary. Their future as the Pet Parenting spending leaders is still aways off. Their income, home ownership and pet spending are all increasing. They are educated and well connected. Indications are that they may lead the way in adopting new trends, especially in food. Their progress is good news, but in reality, their leadership may be a decade away.

- Gen Z Performance – Total: 76.3%; Food: 80.7%; Supplies: 100.0%; Services: 35.3%; Veterinary: 70.7%

- Their getting started numbers are low in all but Supplies. 2 strong years have pushed them far above the oldsters.

- Silent/Greatest Performance – Total: 49.1%; Food: 63.0%; Supplies: 32.3%; Services: 39.1%; Veterinary: 45.9%

- Pet Parenting is more challenging in old age. Their performance continues to fall, from 55.6% in 22 to 49.1%.

Baby Boomers are still the heart of the industry and again the $ leaders, but Gen X leads in CU $. Gen X will continue to grow as they are pursued by Millennials. Both are ready, willing and able to take their turn at the top. Pet Spending has become more balanced across the generations. This bodes well for the continued strong growth of the industry