2020 Top 100 U.S. Retailers – Sales: $2.4 Trillion, Up 8.5% – 152,931 Stores with Pet Products……plus the Internet!

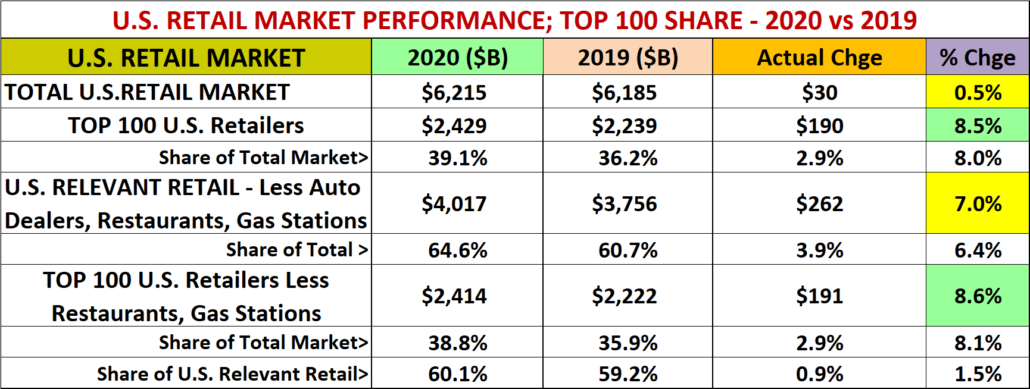

The U.S. Retail market reached $6.22 Trillion in 2020 from all channels – Auto Dealers, Supermarkets, Restaurants, Online retailers and even Pet Stores. Due to the pandemic, this year’s increase of $30B (+0.5%) was far below last year’s increase of $216B (+3.6%). The Total Retail Market was massively negatively impacted by COVID related closures and restrictions and only eked out a positive number because of increased spending in the Relevant Retail Segment. (Data courtesy of the Census Bureau’s monthly retail trade report.)

In this report we will focus on the top 100 Retailers in the U.S. Market. The base data on the Top 100 comes from Kantar Research and was published by the National Retail Federation (NRF). The criteria for inclusion was changed for 2020 as Restaurants were removed from the list. Along with 15 restaurants, 3 other retailers from 2019 didn’t make the 2020 list. In order to make more valid comparisons between 2020 and 2019, I used the data to create a revised “Restaurant Free” 2019 list. The Top 100 are the retail elite and account for 39% of the total market. The vast majority also stock and sell a lot of Pet Products. Let’s get started. The report does contain a lot of data, but we’ll break it up into smaller pieces to make it more digestible.

We’ll begin with an overview:

- The total Retail Market only grew $30B in 2020 (+0.5%) It was $216B (+3.6%) in 2019, +4.9% in 2018 and +4.3% in 2017. You can clearly see the impact of the pandemic on the Total Retail Marketplace.

- The Top 100 grew $190B (+8.5%) – almost double last year’s +4.5% and radically better than the total market.

- The Top 100 generates $2.4 Trillion in revenue, 39.1% of the total U.S. retail market – 8% more than 2019.

- Let’s make the data a bit more relevant. If you remove the revenue from Auto, Restaurant and Gas Stations, the “targeted” retail market for the Pet Industry is $4.0 Trillion – 64.6% of the total market. By the way, the gain in share is due to the loss of revenue in Restaurants and Gas Stations.

- If we also remove Restaurant & Gas Station $ from the Top 100, the remaining $2.4T is 38.8% of the total market.

- … and 60.1% of the $4.0 Trillion “target” market.

The Top 100 generally outperforms the overall market. In 2020 the difference in performance was significant. The big lift was driven by the Top 100 targeted retail group, less gas stations. Remember, the Top 100 is really a contest. Companies drop out and new ones are added. This can be the result of mergers, acquisitions or simply surging or slumping sales. In 2020 in addition to 15 restaurants being removed, 3 companies dropped out due to a big drop in sales:

- Ascena Retail Group

- Saks/Lord & Taylor

- Nieman Marcus

These companies are Apparel or Department Stores. Companies in both these groups generally fell in rank in 2020.

18 Companies were added to the top 100. Grocery – Supermarkets (9) and Convenience (2) led the way, along with:

- Pet Store

- Musical Instrument Store

- Electronics Store

- Auto Parts Store

- Apparel Stores (2)

- Alcoholic Beverage Store

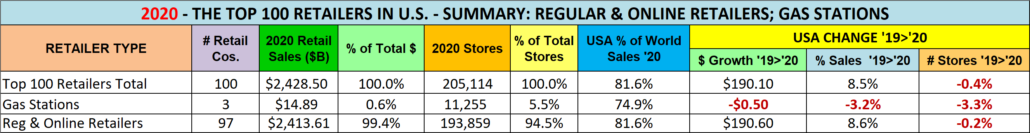

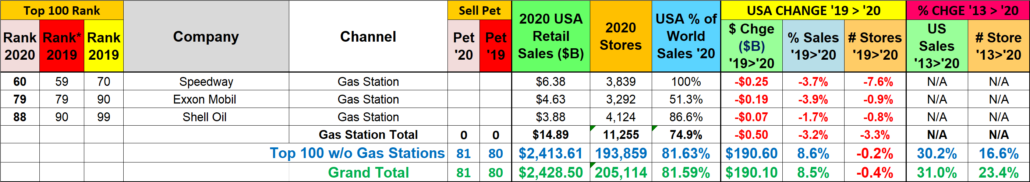

Now let’s start “drilling down” into the specifics of the 2020 Top 100. First, let’s take Gas Stations out of the mix. Here’s a summary of Regular and Online Retailers versus Gas Stations.

For Gas Stations, you can see that their share of stores (5.5%) is significantly higher than their share of sales (0.6%). The impact of the pandemic on Gas Stations is very apparent as even these 3 biggest chains lost ground in $ and stores.

The impact on regular retailers was more complex. Their sales were up $191B (8.6%) while store count fell -0.2%.

- 71 Retailers gained +$244.7B (+12.5%) in sales and +0.8%in stores.

- 26 Retailers lost -$54.1B (-20.4%) in sales and -4.7% in stores.

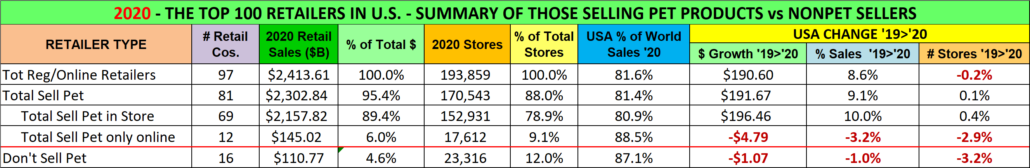

Now that we have an overview of the Top 100, let’s take a look at the “targeted” retailer segment. There are 97 total companies. How many are buying and selling Pet Products? This will reinforce how Pets have become an integral part of the American Household and how fierce that the competition for the Pet Parents’ $ has become.

- Of 97 companies, 81 are selling some Pet Products in stores and/or online – up from 69 in the 2019 list w/restaurants

- Their Total Retail Sales of all products is $2.30 Trillion which is…

- 95.4% of the total business for Regular & Online Retailers in the Top 100

- 37.0% of the Total Retail market and 57.3% of Relevant Retail – from 81 Companies who sell Pet Products.

- 69 Cos., with $2.16T sales sell pet products off the retail shelf in 152,931 stores – 600 more than they had in 2019.

- As you can see by the growth in both sales and store count, “in store” is still the best way to sell pet.

- Online only is another story and the story gets complicated.

- Amazon includes Whole Foods, which has stores so the Amazon $ are in the “Pet in Store” numbers.

- Retailers who only sell pet online are losing market share and closing stores. However, internet only retailers, like Wayfair are showing strong growth.

- Obviously, not selling pet products is not the best way to go as this group was down in sales and especially in stores.

- Their Total Retail Sales of all products is $2.30 Trillion which is…

Pet products are an integral part of the strongest retailers and are widespread across the entire U.S. marketplace. Of the Top 100, 152,900 stores carry at least some pet items at retail. There are thousands of additional “pet” outlets including 15,000 Grocery Stores, 9,000 Pet Stores, 16,000 Vet Clinics, 5,000 Pet Services businesses and more. Pet Products are on the shelf in over 200,000 U.S. brick ‘n mortar stores… plus the internet.

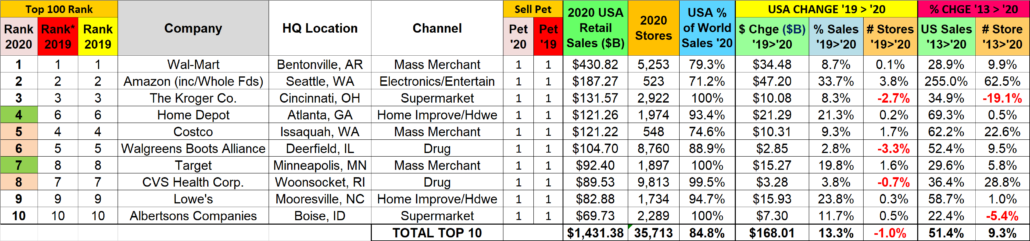

Before we analyze the whole list in greater detail let’s take a quick look at the Top 10 retailers in the U.S.

- They did $1.43 Trillion in Sales

- 58.9% of Top 100 $ales

- 23.0% of Total U.S. Retail $

- 2 up, 3 down in rank; (Group is unchanged since 2015)

- Sales are up for all. Amazon leads the way…again.

- Store count is down 360, (-1.0%)

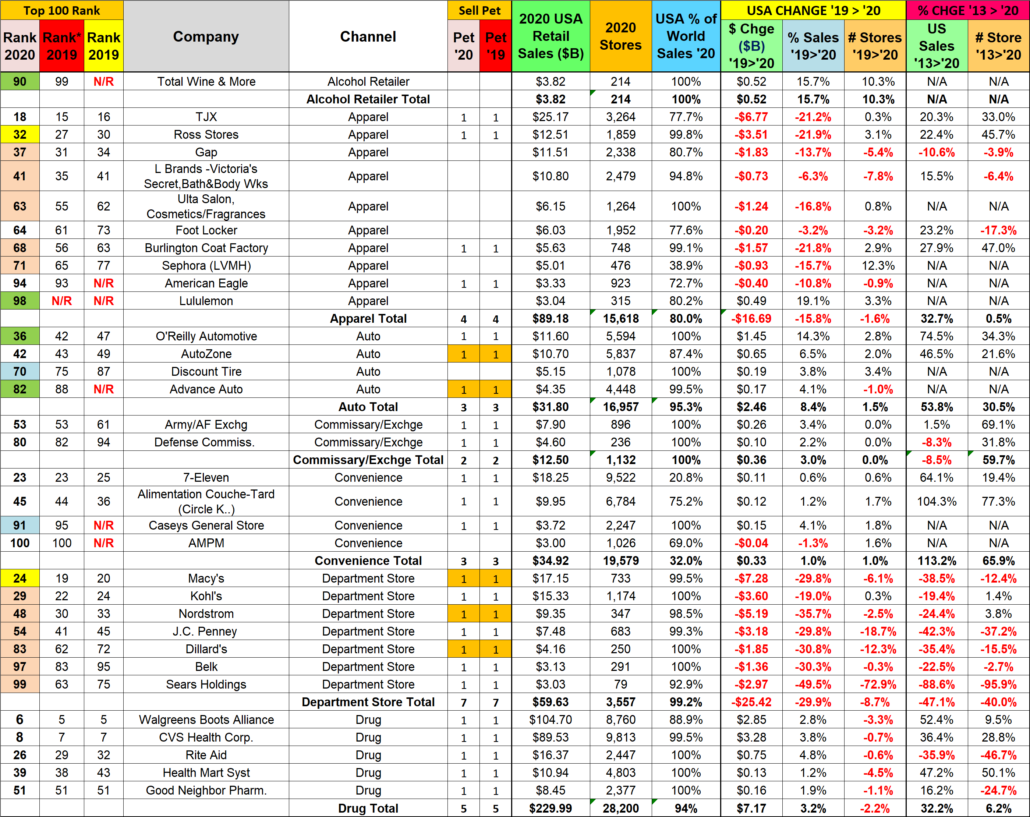

In the next section we will look at the detailed list of the top 100. We’ll sort it by retail channel with subtotals in key columns. We’ll then break it into smaller sections for comments.

I have not done a lot of highlighting however:

- Pet Columns ’20 & ‘19 – a “1” with an orange highlight indicates that products are only sold online

- Rank Columns – “Red” 2019 column is my revised 2019 list w/o restaurants. “Yellow” 2019 is the original 2019 rank with restaurants. 2020 changes in rank from the “Red” 2019 list are highlighted as follows:

- Up 4-5 spots = Lt Blue; Up 6 or more = Green

- Down 4-5 Spots = Yellow; Down 6 or more = Pink

Let’s get started. Remember online sales are included in the sales of all companies

Observations

- After a number of acquisitions over several years, Drug is still in turmoil. Now we are seeing a growing number of closures of unproductive stores. However, sales are still growing. They are still “essential” outlets.

- The decline of the Traditional Department store segment was accelerated by the pandemic. Sales were down -29.9% and stores -8.7%. Although all carry a few pet items, often online, this channel has never fully embraced Pet Products.

- Sears demise is just getting closer.

- Saks sold Lord & Taylor in November 2019 and fell off the list as did Neiman Marcus.

- Much of the growth in the Convenience Store Chains in the Top 100 in recent years has come through acquisitions. There were no major acquisitions, but 2 chains were added to the revised list. Overall, $ and stores are +1.0%.

- Military Exchanges/Commissaries have added locations in recent years, which fueled the growth in sales. In 2017 they began reducing the number of Army/AF Exchanges. By 2019 this policy had spread to all military groups. In 2020 the number of stores stabilized but sales were up for all outlets and 3.0% overall.

- Alcoholic Beverage stores make their first appearance in the Top 100 – probably due to more at home dining.

- Auto Parts Stores accelerated their $ growth from 5.5% to 8.4% and added a new chain, Advance Auto. All chains but Advance also increased their stores for a net gain of 250 (+1.5%)

- In Apparel, Ascena dropped out, but Lululemon and American Eagle were added. These stores were nonessential, so sales and rank fell for virtually all and $ were -15.8% for the channel. Store count was mixed but down -1.6% overall.

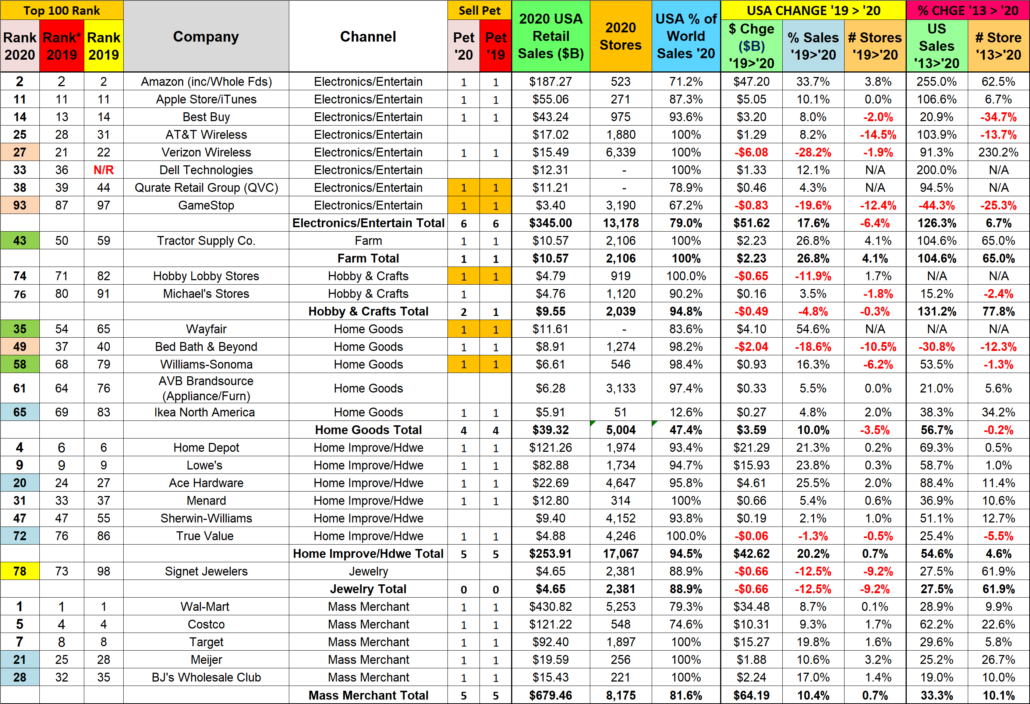

Observations

- Electronics/Entertainment was up 17.6% in sales but down -6.4% in stores which reflects the pandemic influence.

- Amazon growth accelerated in the pandemic from 20.9% in 2019 to 33.7%. With the acquisition of Whole Foods in 2017 they also have a small but growing brick ‘n mortar presence in the market.

- Only Verizon and Gamestop declined in $ and lost significant rank. Dell Technologies was added to the group.

- Signet Jewelry’s sales were down -12.5%. Their decline began in 2017 but was radically increased by COVID.

- Mass Merchants have 3 of the 7 largest volume retailers in America – Wal-Mart, Costco and Target. In recent years, Wal-mart & Costco have driven the growth in this channel. In 2020, the lift was strong across the board, +10.4%.

- Wal-Mart had a 8.7% increase in sales which is triple last year’s 2.6%. Their SuperCenter business was essential, so store sales increased, and their online sales took off. However, “regular” Discount Department Stores are losing market share. This impacts both Wal-Mart and Target so many outlets are adding more fresh groceries.

- Target posted a 4th consecutive sales increase in 2020, +19.8%, the largest in the string and for the entire group.

- Costco had another +9.3% increase. New store growth slowed but the $ are increasing, both in store and online.

- BJ’s sales were up +17.0%, the 3rd consecutive increase after a string of annual declines from 2013 to 2017.

- Meijer had +10.6% growth in sales and increased their store count by 3.2% in 2020.

- Consumers’ thoughts turned to their homes in the pandemic. This was very apparent as Home Improvement & Hardware companies increased sales by +20.2%. The big guys, Lowe’s, Home Depot & Ace led the way but only True Value had decreased sales or store count.

- Like 2018 & 2019, all Home Goods Companies but Bed Bath & Beyond increased sales. They also drove down store count. Sales were up 10.1%, but it was again driven by Wayfair, +$4.1B (+54.6%) who now ranks #35, up 19 from 2019.

- Tractor Supply $ skyrocketed, +26.8%, triple their average rate of +8.3% since 2013. They also increased stores +4.1%.

- Hobby & Crafts stores $ were down -4.8%, due to Hobby Lobby and down -0.3% in stores due to Michael’s.

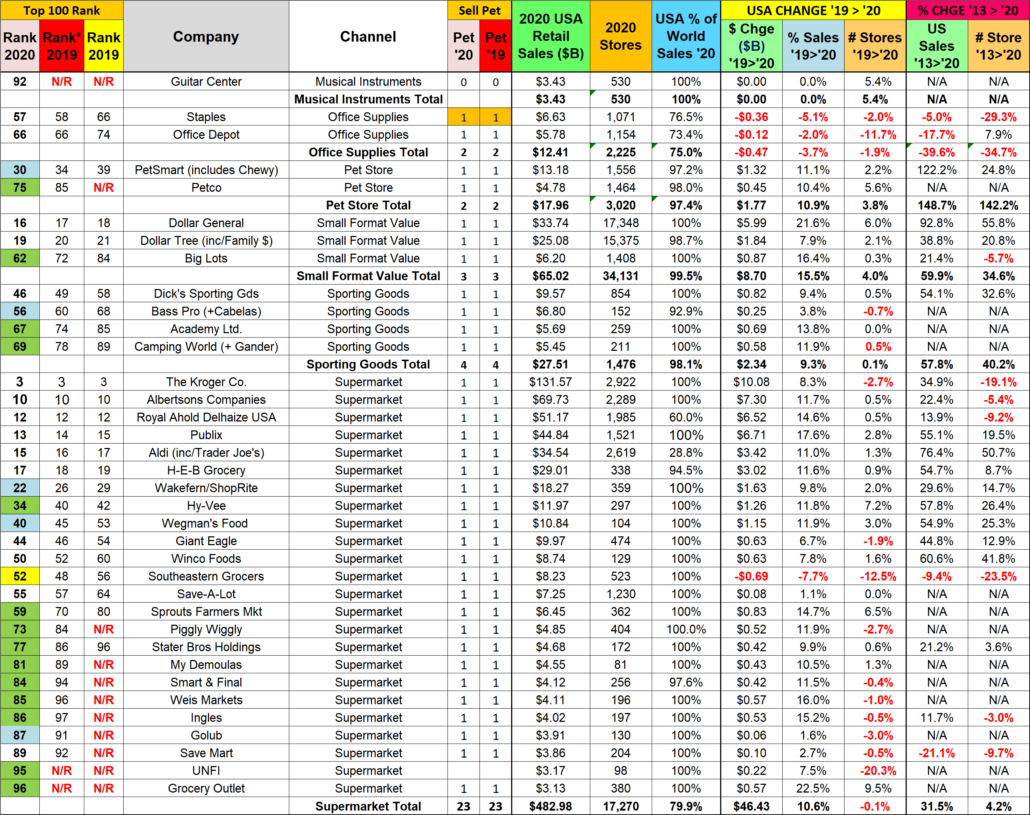

Observations

- Supermarkets – $483B in Sales; 24 Companies; With 23 Selling Pet Products in 17,000 stores. This is a very important group for the Pet Industry. With the highest frequency of consumer visits of any channel, the competition is fierce. The mergers and acquisitions have slowed. All companies but Southeastern showed increased sales, most in double digit %. Southeastern Grocers filed for bankruptcy in 2018. Store closures and reduced sales continue.

- Overall sales were up $46.4B (+10.6%) while store count fell slightly, -0.1%

- Small Format Value Stores: These stores offer both value and convenience – great consumer appeal in a pandemic.

- All companies increased sales and store count. Overall $ales were up $8.7B (+15.5%) and stores were +4.0%.

- Dollar General continues to lead the way in growth, Sales +21.6%, Stores +6.0%.

- Dollar Tree growth in sales and stores more than doubled 2019 but still lags behind Dollar General.

- Big Lots had small growth in stores but a 16.4% increase in sales, for 2 consecutive years of increases.

- Pet Stores, as essential retailers showed strong growth in 2020. Sales were up $1.8B (+10.8%) and the number of stores grew by 3.8

- After the acquisition of Chewy in 2017, PetSmart’s sales registered a huge increase. In 2020 Chewy undoubtedly produced a substantial amount of the $ growth as consumers increased online shopping.

- Petco qualified for the Top 100 for the first time in 2016. They hung on in 2017 but didn’t make the cut in 2018 & 2019. In the 2020 restaurant free list and with a pandemic surge in sales, they came back strong at #75. It is also important to note that they had a 5.6% increase in stores.

- Office Supply Stores – This channel continues its decline as Consumers accelerated their move to online ordering.

- Sporting Goods – This group also benefited in the pandemic as consumers turned their attention to personal recreation. 2 companies closed a few stores and 1 had no change but all increased sales with overall growth of $2.3B (+9.3%). By the way, the largest company, Dick’s Sporting Goods opened enough stores to push the group to +0.1%.

Gas Stations and the Totals

Gas Station Observations

Although gas stations aren’t relevant in terms of Pet Products Sales, they are relevant in our daily lives.

- Falling gas prices in 2019 flattened the revenue growth of the total Gas Station Channel. The Top 100 Gas Station sales and stores were both up that year only because Speedway acquired Andeavor Brands with their 3200+ outlets.

- 2020 brought the pandemic and gas usage plummeted. The big chains outperformed the overall channel, but all closed some outlets and had decreased sales.

- In 2021 recovery began, prices inflated and 7 Eleven bought Speedway. We’ll see the impact on the Top 100 in 2021.

Wrapping it up!

The Top 100 became the Top 100 by producing big sales numbers and their performance, except for 2018, has usually exceeded the overall market. In 2019 things returned to “normal”, +4.5% for the Top 100 vs +3.6% for Total Retail. Normal went away in 2020 with the onset of the pandemic. Restaurants and Gas Stations were hit hard by closures and consumers’ stay at home attitude. The impact on regular retailers varied widely. Essential outlets like Grocery, Supercenters/Clubs and $ Stores prospered. Retail channels like Hardware, Farm and Sporting Goods stores also benefited as consumers focused their attention on “home”. Of course, sales from internet retailers exploded and we can’t forget Pet Stores. Consumers spent more time with their pets and adopted more. This drove up product sales. The non-essential stores were a different story entirely. Department Stores, Office Supply, Apparel and Jewelry stores were hit hard. All but Apparel had been trending down for years, but the pandemic accelerated their slide.

The pandemic also caused a change in methodology for choosing the Top 100 as restaurants are now excluded from the list. Using available data, I took it upon myself to generate a revised “restaurant free” 2019 Top 100 to allow more valid comparisons between the two. This “relevant retail” Top 100 grew $191B (+8.6%) in 2020 and has been a major factor in the ongoing recovery of the U.S. Retail Marketplace.

Pet Products are an important part of the success of the Top 100. 81 companies on the list sell Pet Products in 152,931 stores and/or online. Let’s look closer at the 69 companies that stock pet products in their stores. This group generated $2.16T in total sales. How much was from pet? Let’s “Do the math”. If we take out the $18B done by PetSmart & Petco, and the remaining companies generated only 1.7% of their sales from Pet, we’re looking at $36.4B in Pet Products sales from only 67 “non-pet” sources! (Note: The 1.7% share for Pet is a low-end estimate based on data from the Economic Census.) The APPA reported $64B in Pet Products sales for 2020. That means 67 mass market retailers accounted for 56.8% of all the Pet Products sold in the U.S. in 2020. Add back Petco & PetSmart/Chewy and the Top 100 did 81.8%.

Pet Products are widespread in the retail marketplace but the $ are concentrated. Regardless of your position in the Pet Industry, monitoring the Top 100 group is important. This group reflects the triumphs, tribulations and ongoing evolution in the retail market – the growing influence of the internet and the importance of Value. The COVID-19 crisis caused turmoil in 2020. 2021 has started strong. We’ll see what changes it brings to the retail market and the Top 100.