SUPERZOO 2021 – THE PET INDUSTRY BEGINS THE JOURNEY BACK TO NORMAL

SuperZoo 2021 is only 3 weeks away. It has been 18 months since the last in person Pet Trade show, GPE 2020 and 2 years since the last SuperZoo. Pet Parents spent more time with their children during the pandemic, so the Pet Products segments prospered during this challenging time. However, pet trade shows have essentially been shut down.

Although the internet has shown exceptional growth in Pet Products sales, these $ are coming from proven products. Buyers of all kinds, from consumers to chain store executives prefer to make in person buying decisions on new pet items. Thus, the return of in person Pet Trade shows is critically important to the continued growth of the Pet Industry.

With SuperZoo 2021, the Pet Industry will begin to get “back on track” to normal. It will not be easy. Currently SuperZoo 2021 has 781 exhibitors. That is down 321 (-29.1%) from SuperZoo 2019. Of course, the ongoing reaction to the pandemic is the primary reason behind the drop in exhibitors but it is somewhat more complex. Consider:

- International Travel Restrictions have caused many exhibitors to cancel (This also happened at GPE 2020)

- The pandemic has been especially hard on startups and smaller companies.

- Some companies have decided to “play it safe” and wait until 2022.

- A non-pandemic factor: The wave of mergers and acquisitions continues.

SuperZoo is still a very powerful event. There are 220,000 sq ft of booths, a 37,000 sq ft New Products Showcase, with over 700 items – more than 2019, and 18,000 sq ft devoted to Show Floor Education and demonstrations. There are also 88 separate educational sessions on grooming or business subjects totaling 97 hours. That is powerful in every way.

New is always a focus at Pet Trade shows. That also applies to exhibitors. At SuperZoo 2021:

- 289 (37.0%) Exhibitors weren’t at SZ 2019

- 330 (42.3%) weren’t at GPE 2020

- And 205 (26.2%) didn’t do either of those show

Those are some strong arguments for attending SuperZoo 2021. Now, let’s look at some specifics of what you will see there. First, a warning: With a 29% pandemic induced drop in exhibitors, you’re going to see a lot of negative numbers when compared to SZ 2019. I suggest that you focus on share of booths. Change in this measurement will indicate how a particular group or product category is performing during difficult times.

First, we’ll look at the overall show floor in terms of specialized sections.

- The first thing that you notice is that 3 sections went away and were replaced by 4 new sections.

- Health & Wellbeing products have been showing strength for years. Good Works gives a focal point for non-profits. Farm & Feed replaces “Poultry” and Innovation Incubator includes only startups, replacing the 1st timers’ section. It doesn’t reflect the amount of 1st time exhibitors at the show, which numbers over 160 – mostly on the open floor.

- Another critical fact demonstrates the importance of targeted floor sections. For the first time…ever, the share of all special floor sections booths exceeds 50% of the booths – 51.2% to be exact.

- Natural not only gained a huge amount in share. They actually increased their number of booths. That is truly remarkable under the current circumstances and proves the importance of “Natural” in the marketplace.

- Grooming basically held its ground in share while Critter Alley lost a bit.

- The biggest share decrease was in Rodeo drive. This reflects the drop in small companies who largely fill this section.

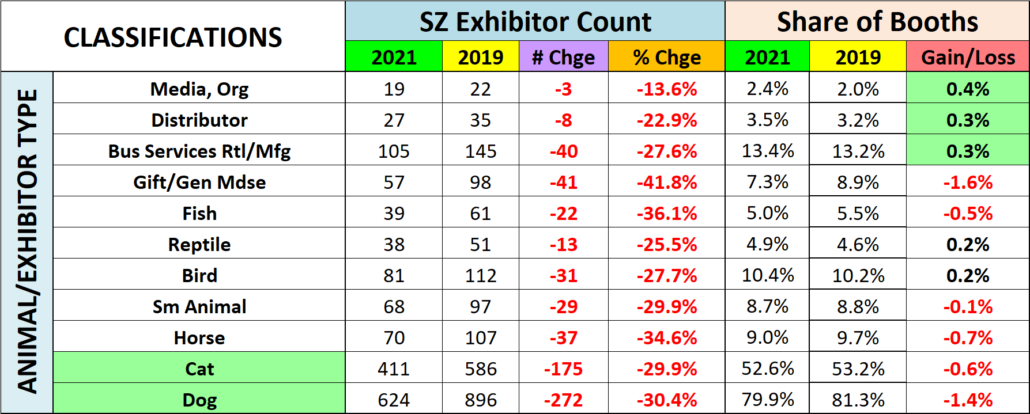

Now let’s look at the Exhibitors by type, including animal.

- Almost all media and organizations made it back to the show.

- The importance of pet retailers at the show is evident as Distributors gained share.

- Business Services continues to show strength, down in count, but still double the number from 5 years ago.

- Gifts/Gen Mdse exhibitors lost the most share, but they have been trending down since peaking at 139 in 2016.

- All animal types but Birds and Reptiles lost some share. Except for dogs, the share losses were under 1% so they were generally in line with the percentage decrease in exhibitors.

- Dogs and Cats lost the most in exhibitor count, but they remain the royalty of the Pet Industry.

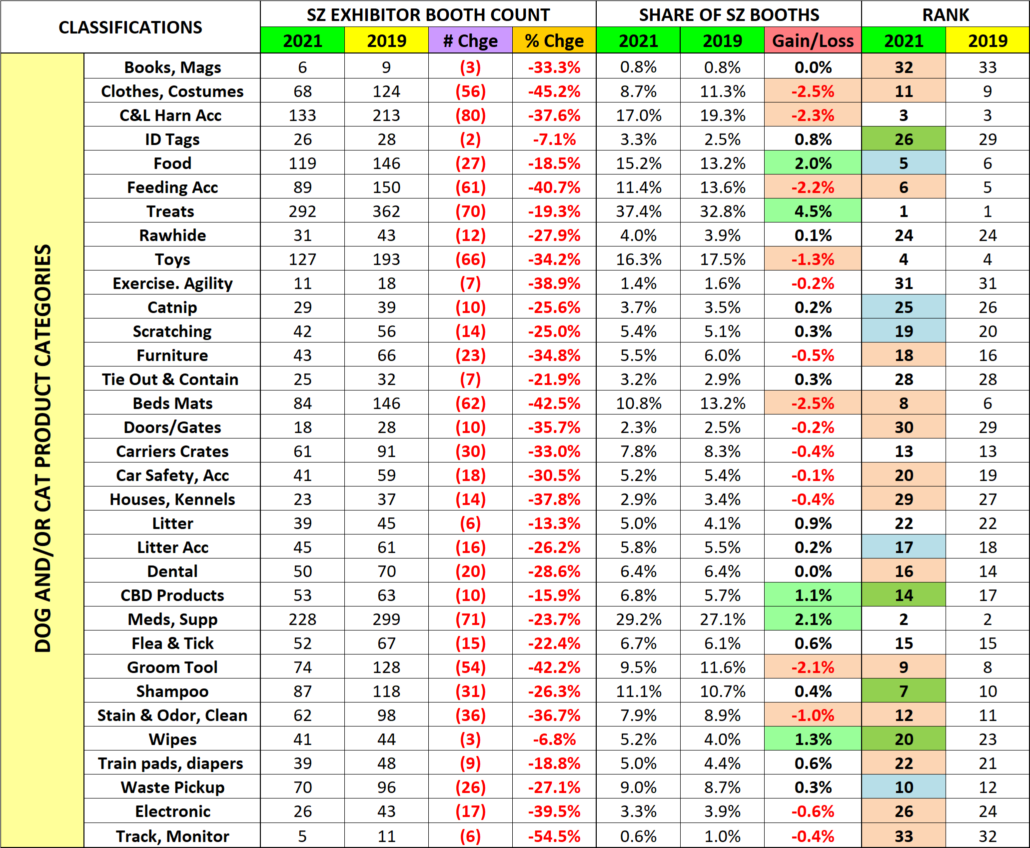

Let’s take a closer look at the “royalty”. Here are the top 10 Dog and/or Cat Categories at SuperZoo 2021.

- Apparel was replaced by Waste Pickup. There was a shuffling in the rankings from #5 to #10 – 3 gained; 3 lost.

- Meds & Supplements remain strong and continue to help Treats maintain an unparalleled prominence at #1 as Supplements are often produced in Treat form. They again rank #1 & #2 in terms of exhibitor count and share gain.

- The biggest losses in share are in Collars & Leads, Bowls, Beds and Apparel. The drop is due to a combination of losses – in International Exhibitors who focus on commodities and small fashion oriented companies.

- Premium Food has become even more important in pandemic times – gaining share and moving up in rank.

- Grooming is a mixed bag. Grooming tools dropped in rank and booth count after a reaching a record level in 2019. However, shampoo moved up 3 spots in rank. The addition of Waste pickup to the list may reflect the radical increase in Pet Parents’ “Pandemic Dog Walking”.

- Toys maintained their rank, but a question remains, “Can attendees “survive” with only 127 booths offering toys?”

SuperZoo has 29% fewer exhibitors. However, the average booth size is now 294 sq ft., up from 252 in 2019 and 50% larger than 2016. Products and services are available to fill virtually every need or want of the attendees and the show is keeping “in tune” with changes. Increasing the number of special floor sections and making them more targeted along with a massive amount of educational sessions are prime examples of the WPA’s ongoing efforts to improve the show.

653 exhibitors (84%) focus on Dog and Cat. Let’s take a closer look.

There are 321 fewer Exhibitors at SuperZoo. Those offering Dog and/or Cat products fell by 285. The Dog/Cat share fell slightly from 84.4% to 83.6% but Dogs and Cats remain the unquestioned “royalty” of the industry. Once again we will focus on change in share

- 19 of 33 (58%) Dog/Cat categories increased their share of exhibitors.

- 9 increased their share by at least 0.6% and 5 by more than 1%.

When you look at the Dog/Cat Categories making share gains, you see that again the most common thread is the health and wellness of our companion animals, including CBD products and Wipes. All of these fit right in with the ongoing trend to more nutritionally focused Super Premium Pet Food and Supplements in Treat form.

The biggest losses came from Top 10 categories – Apparel, Collars & Leads, Bowls, Toys and Beds. The drop in Grooming Tools and Stain & Odor is a bit of a surprise because virtually every other category associated with grooming and cleaning showed gains, including Litter, Shampoo, Training Pads and Waste Pickup.

SuperZoo again showcases what is “happening” in the Pet Industry and offers a great opportunity for the Industry to get “back on track” to normal. It will take effort and commitment from everyone, but SZ 2021 is the surest bet in Las Vegas!

Finally, the chart below details the specifics for all 33 of the Dog/Cat product categories that I defined for the Super Search Exhibitor Visit Planner. (Note: The SZ 2021 Super Search will be available for download at PetBusinessprofessor.com on 8/2.

THE SUPERZOO “TRAIN” DEPARTS ON 8/16. I HOPE TO SEE YOU IN VEGAS!