2019 U.S. Pet Spending by Racial/Ethnic Groups

87.6% of the $77.44B that we spent on our companion animals in 2019 was done by 68.6% of the 132.2 million financially independent Consumer Units. These “majority” CU’s are White, Not Hispanic. That means that the 41.6 million CU’s – 31.4%, which are Racial or Ethnic minorities, generated only 12.4% of Total Pet Spending.

This disparity is evidence of yet another inequity in our society. In this report, we will drill deeper to get more specifics on the Pet Spending by Hispanics (All Races), African Americans and Asians. The U.S. is growing more ethnically diverse every day, so this is a situation and an opportunity which needs to be investigated.

Note: All the numbers are calculated from or taken directly from the Annual US BLS Consumer Expenditure Survey.

Let’s get started by looking at the Racial/Ethnic make-up of the U.S.

- The White, Not Hispanic group also includes Native Americans and Pacific Islanders.

- All the growth in number of CU’s came from minorities, +874K while White CU’s decreased by -73K.

- In 2015 the White, Not Hispanic group fell below 70% of the total CU’s for the 1st time. It continues to decline.

- Asians – smallest share, but the most growth, +2.4%.

- African Americans, the second largest minority had the biggest increase in numbers.

- The Hispanic growth slowed slightly but they are still the largest minority group.

Now let’s take a look at some of the characteristics that we have found to be important in pet spending behavior.

- CU Size – Hispanics have by far the largest CU’s, 28% higher than average. However, in 2019, only 1 and 3 person CU’s spent more on their pets. 4+ people CU’s were down $1.1B

- # Children under 18 – In 2019 Married couples with children spent less with 2 exceptions – oldest child, either under 6 or over 18. Note: With significantly more children per CU than Whites, the minority share of CU’s is sure to grow. This is especially true for Hispanics, even without immigration.

- # Earners– It is more likely that all the adults work in Hispanic or Asian families. With over 40% more kids than Asians and a much lower income, this could be tough for Hispanics.

- Homeownership – Homeowners account for 81.4% of all Pet Spending. The percentage of Hispanics and African Americans that own homes is 34>40% less than Whites. Both are also twice as likely to live in a Center City than in the suburbs. Asians are also likely to be Center City dwellers. The rate of pet ownership is lower in Center Cities.

- Education is an important factor in Pet spending. it generally means higher income and helps in determining value in premium foods and Vet Services. Asians are the leaders. Hispanics have the lowest % of post High School education.

Next, we’ll compare each to the National Avg in Income, Spending, Pet Spending and Pet Share of Total $pending. CU National Averages: Income – $82,852; Total Spending – $62,949; Pet Spending – $593.51; Pet Share – 0.943%

- Asian Americans make and spend the most money…but not on their pets. This may be due to cultural differences.

- African Americans and Hispanics have lower incomes, but their overall spending is relatively in line. However, they spend significantly less on their pets. This is especially true of African Americans and indicates a significantly lower rate of pet ownership. A consumer survey from HUD on emergency disaster planning found this number to be 24%.

- The spending of White Americans is very much tied to income, except where their pets are concerned, then…$$$.

It’s time to look at actual $ spent. We’ll begin with each industry segment which will put the Total Pet $ into better perspective. We will look at 2019 $ as well as a 6 year history. There is a huge disparity in $ between Whites and Minorities but there are also significant differences in key demographic characteristics among the minority groups that affect their spending. We will use multiple graphs to drill deeper into the data. First, Recent Pet Food History…

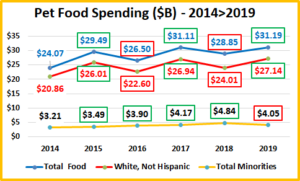

The graph shows the overall Pet Food Spending history from 2014 to 2019. You see that the White, Not Hispanic group mirrors the Super Premium spending waves, both up and down. On the other hand, Total Minority spending showed steady growth in the premium era until 2019. Their big drop in 2019 could be a late reaction to the 2018 FDA warning. From 2014>2019:

- Pet Food $ were up $7.12B (+30.0%)

- White, Not Hispanics were up $6.28B (+30.1%)

- Minorities were up $0.84B (+26.2%) – Note: In 2018, at their peak, they were up $1.63B (+50.8%).

Until 2019, Minorities showed steady growth in Pet Food Spending during the Super Premium era. They may be slower to react to food trends. Their biggest lift came in 2018 which may parallel the overall lift in 2017 due to a deeper penetration of the upgrade. The 2019 drop may be a late reaction to the FDA warning. Let’s take a closer look at 2019 and the spending history of specific minorities.

In 2019 we saw an overall rebound in Pet Food spending after the drop in 2018 due to the reaction to the FDA warning on grain free dog food. However, this pattern was not true for minorities. All groups were down in 2019. For Hispanics and African Americans, Pet Food spending fell significantly – double digit %. This was probably due to a slower reaction to the 2018 FDA warning. Spending also decreased for the high income, highly educated Asian group. This minor decrease was likely a result of value shopping. The overall minority decrease drove the White CU share of spending up to 88.2%, second only to their share of Veterinary spending. Here are the specifics:

2019 National: Avg CU spent – $236.26 (+$16.34); 2019 Total Pet Food Spending: $31.19B, Up $2.35B (+8.1%)

- White, Not Hispanic – Avg CU spent – $300.59 (+$32.22); 2019 Total Food Spending: $27.14B, Up +$3.13B (+13.0%)

- There are large subsets in this group which react quickly and strongly to trends in Pet Food.

- Total Minorities – Avg CU spent – $97.10 (-$18.88); 2019 Total Food Spending: $4.05B, Down -$0.79B (-16.3%)

- Total minorities had consistent growth for 4 years. A delayed reaction to the FDA warning generated a big drop.

- Hispanic – Avg CU spent – $121.06 (-$27.89); 2019 Total Food Spending: $2.30B, Down -$0.44B (-16.1%)

- They had the biggest $ drop after a big lift in 2018. Both are delayed reactions to the 2017 lift and 2018 drop.

- African Americans – Avg CU spent – $64.67 (-$17.86); 2019 Total Food Spending: $1.05B, Down -$0.32B (-23.4%)

- Spending began to fall in 2018. Their higher education may have made some more aware of the FDA warning.

- Asians – Avg CU spent – $108.45 (-$1.84); 2019 Total Food Spending: $0.70B, Down -$0.02B (-3.0%)

- High Income but low pet ownership. Their spending is susceptible to trends but tends to be more stable.

- 2019 Performance = Share of Spending/Share CU’s. Shows if groups are “earning their share”:

- White, Not Hispanic – 126.9%; Minorities – 41.3%; Hispanics – 54.4%; Asians – 47.0%; African Americans – 25.8%.

- Note: In 2018: Whites – 120.5%; Minorities – 48.0%; Hispanics – 71.0%; Asians – 53.3%; African Americans – 37.0%

- Spending History – From 2014 to 2019, U.S. Pet Food Spending increased $7.12B (+ 29.6%). There were 2 big spending drops – 2016 & 2018, but 3 major Super Premium waves – 2015, 2017, 2019, that produced this increase:

- White, Not Hispanic: + $6.28B (+30.1%) Their spending is reflected in the National Pattern.

- Total Minorities: +$0.84 (+26.2%) Minorities “bought in” to the upgrade but each has a different story.

- Hispanics: +$0.50B (+27.8%) Their spending basically lags 1 year behind the National pattern and peaked at +52.2% in 2018.

- African Americans: +$0.13B (+14.1%) They are the only group with 3 consecutive years of increases. Their spending peaked at +65.2% in 2017 then began to fall through 2019, probably in reaction to the FDA warning.

- Asians: +$0.21B (+42.9%) Had 2 consecutive declining years – 2016 & 2017. Generally small changes but had a big lift in 2018 which peaked their spending at +46.9%.

Although their distinctly different demographics produced different patterns, all minorities have made some level of commitment to upgrading their Pet Food. Now, let’s turn our attention to Pet Supplies. First, 2014>2019 Spending

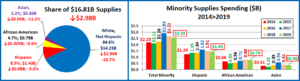

The graph shows the overall Pet Supplies Spending history from 2014 to 2019. Pet Supplies spending is more discretionary than Food, so it reacts more to price changes. You see major spending dips in 2015 and 2019 due to inflation. The White, Not Hispanic group mirrors the National pattern. However, Total Minority spending dropped in both 2018 & 2019. This reflects their price sensitivity as inflation began at mid-year 2018. Overall, from 2014>2019:

- Pet Supplies $ were down -$0.19B (-1.1%)

- White, Not Hispanics were down -$0.57B (-3.9%)

- Minorities were up $0.39B (+17.7%)

Minority Supplies spending reflects their focus on “essential” supplies. The more discretionary items are the most impacted by price swings. Note: White, Not Hispanic Spending peaked in 2018, +16.5%; Minorities, +33.2% in 2017.

Now, let’s take a closer look at 2019 and the spending history of specific minorities.

Prices started up in April of 2018. By the end of 2019 they had inflated 5.7%, the most since the great recession. This had a big impact as discretionary Supplies spending has become more price sensitive to today’s “value conscious” consumers of all income levels. All RacialEthnic groups spent less but the biggest % drops were in the higher income groups. The lower income groups, Hispanics and especially African Americans are more focused on “essential” supplies and less likely to indulge in more discretionary purchases. Minorities have their largest share of $ in Supplies. This is largely due to the lack of major product trends in the segment and their commitment to essential products. Here are the specifics:

2019 National: Avg CU spent – $127.15 (-$23.47); 2019 Total Pet Supplies Spending: $16.81B, Down $2.98B (-15.1%)

- White, Not Hispanic – Avg CU spent – $156.87 (-$31.35); 2019 Supplies Spending: $14.23B, Down -$2.86B (-16.7%)

- There are large subsets in this group which react quickly and strongly to inflation/deflation.

- Total Minorities – Avg CU spent – $62.30 (-$4.45); 2019 Supplies Spending: $2.59B, Down -$0.13B (-4.8%)

- Rising prices drove spending in all groups down.

- Hispanic – Avg CU spent – $79.97 (-$5.91); 2019 Supplies Spending: $1.43B, Down -$0.08B (-5.0%)

- They buy more discretionary supplies but are price sensitive. As prices began to rise in 2018, spending dropped.

- African Americans – Avg CU spent – $45.80 (-$1.31); 2019 Supplies Spending: $0.79B, Down -$0.01B (-0.6%)

- Their low income limits their discretionary purchases, so the rising prices had little impact on spending.

- Asians – Avg CU spent – $57.44 (-$8.80); 2019 Supplies Spending: $0.36B, Down -$0.05B (-11.2%)

- Low pet ownership, high income… but value conscious. Their $ also started to drop as prices started up in 2018.

- 2019 Performance = Share of Spending/Share CU’s. Shows if groups are “earning their share”:

- White, Not Hispanic – 123.4%; Minorities – 49.0%; Hispanics – 62.9%; Asians – 45.2%; African Americans – 36.0%.

- Note: In 2018: Whites – 125.0%; Minorities – 48.0%; Hispanics – 57.0%; Asians – 44.0%; African Americans – 31.3% The lowest income groups spent less but gained share and improved performance because the Supplies spending drop was in the most discretionary categories, which they are less likely to buy.

- Spending History – From 2014 to 2019, U.S. Supplies Spending fell $0.19B (-1.1%). Despite a deflationary spending increase wave from 2016>2018, two spending drops in 2015 and 2019, caused by inflation produced a net decrease.

- White, Not Hispanic: -$0.57B (-3.9%) They reflect and drive the National Pattern. $ Peaked at +16.5% in 2018.

- Total Minorities: +$0.39 (+17.7%) More focused on necessities, but price matters. $ peaked at +33.2% in 2017.

- Hispanics: +$0.19B (+15.3%) With deflating prices, they expanded their discretionary Supplies purchases, peaking at +30.6% in 2017. However, when prices turned up in 2018, their spending turned down.

- African Americans: +$0.13B (+19.7%) Surprisingly, the spending changes from 2014>2019 of this lowest income group exactly match the national pattern but are much less volatile because they are focused on essentials.

- Asians: +$0.05B (+16.1%) Their spending also matched the national pattern until 2018. They have the highest income but are value conscious as $ began to drop when prices turned up in 2018. 2017 Peak was +90.3%

All minorities have a commitment to essential supplies. Discretionary spending increases with income, but all groups are sensitive to some degree to the ongoing deflation/inflation trends in this segment.

Now, let’s turn our attention to Non-Vet Services. First, an overview of 2014>2019 Spending

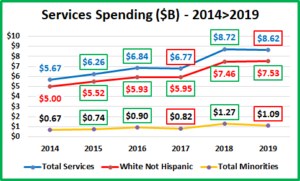

The graph shows the overall Pet Services Spending history from 2014 to 2019. Services spending is the most discretionary of any segment, so it is very dependent upon income. The two slight spending dips in 2017 and 2019 are the only decreases since the great recession. We should also note that spending increased every year for White, not Hispanics. Drops were caused by Minorities.

Overall, from 2014>2019:

- Pet Services $ were up $2.95B (+52.0%)

- White, Not Hispanics were up $2.53B (+50.6%)

- Minorities were up $0.42B (+62.7%)

With a big expansion in outlets, Services became more accessible. This ultimately drove the huge lift in 2018. Minorities $ peaked at +89.6%. The 2017 dip was due to value shopping. In 2019, rising inflation was a factor for lower income CUs.

Now, let’s take a closer look at 2019 and the spending history of specific minorities.

An increased number of outlets boosted competition and made Services more accessible and convenient for all groups. After a period of low inflation, prices turned up in May of 2018. By the end of 2019 they had inflated 5.6%, double the “normal” rate. It had less of an impact on the higher income groups, whose primary focus is convenience. However, the lower income groups, Hispanics and African Americans, saw double digit drops in Services Spending in 2019.

Here are the specifics:

2019 National: Avg CU spent – $65.22 (-$1.14); 2019 Total Pet Services Spending: $8.62B, Down $0.10B (-1.1%)

- White, Not Hispanic – Avg CU spent – $83.06 (+$0.91); 2019 Services Spending: $7.53B, Up +$0.08B (+1.0%)

- They held their ground at the new high level even as prices inflated.

- Total Minorities – Avg CU spent – $26.28 (-$4.85); 2019 Services Spending: $1.09B, Down -$0.18B (-14.2%)

- Rising prices drove spending down in low income groups, which are 85% of all minorities.

- Hispanic – Avg CU spent – $29.68 (-$7.06); 2019 Services Spending: $0.53B, Down -$0.12B (-17.6%)

- They have higher discretionary spending but are price sensitive. Rising prices caused a sharp drop in spending.

- African Americans – Avg CU spent – $18.08 (-$5.90); 2019 Services Spending: $0.31B, Down -$0.10B (-22.9%)

- Their low income limits their discretionary purchases, so the rising prices had a big impact on spending.

- Asians – Avg CU spent – $39.17 (+$4.36); 2019 Services Spending: $0.25B, Up +$0.04B (+15.3%)

- Low pet ownership, but the highest income. They appreciate the convenience – a big increase in $ in 2019.

- 2019 Performance = Share of Spending/Share CU’s. Shows if groups are “earning their share”:

- White, Not Hispanic – 127.4%; Minorities – 40.3%; Asians – 60.1%; Hispanics – 45.5%; African Americans – 27.7%.

- Note: In 2018: Whites – 123.8%; Minorities – 46.9%; Asians – 52.5%; Hispanics – 55.4%; African Americans – 36.1% Income truly matters in Services spending. Strong inflation caused a significate drop in share and performance for the lower income minorities while the higher income groups gained ground.

- Spending History – From 2014 to 2019, U.S. Services Spending grew $2.95B (+52.0%). A radically increased number of outlets offering Services made them more accessible and drove sales up in all groups.

- White, Not Hispanic: $2.53B (+50.6%) A huge share of $ and the only group to increase spending every year.

- Total Minorities: +$0.42B (+62.7%) Strong growth but price matters. $ peaked at +89.6% in 2018.

- Hispanics: +$0.25B (+89.3%) They radically expanded their Services purchases. Their spending exactly matched the national pattern, peaking at +132% in 2018 but when prices turned up in 2018, their spending fell sharply.

- African Americans: +$0.05B (+19.2%) Their spending grew spectacularly from 2015 to 2018, +95.2%. Then prices turned up which had the biggest impact on this lowest income group. Services $ dropped -22.9%.

- Asians: +$0.12B (+92.3%) They obviously appreciate the increased convenience of Services and they have the money to pay for it. Their Services $ increased +178% from 2017 to 2019.

All Pet Parents appreciate and want the convenience of Pet Services. However, it is the most discretionary of all the industry segments, so income is a definite factor in spending behavior patterns.

Now, let’s look at Veterinary Services. Here is an overview of 2014>2019 Veterinary Spending.

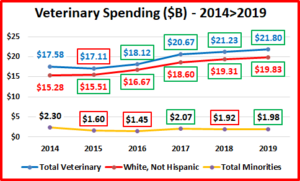

The graph shows the Veterinary Services Spending history from 2014 to 2019. Veterinary spending is a necessary expenditure, but a high inflation rate has made it more dependent upon income. Spending has only fallen once since 2014 and that was driven by minorities. In fact, Minority spending fell in 3 of the last five years but increased every year for White, not Hispanics.

Overall, from 2014>2019:

- Veterinary $ were up $4.22B (+24.0%)

- White, Not Hispanics were up $4.55B (+29.8%)

- Minorities were down -$0.32B (-13.9%)

The growth in this segment has slowed since 2017. You can see the impact of rising prices on Minority spending. There was an inflation spike in 2015 which caused the only overall decrease and the biggest $ drop for minorities.

Now, let’s take a closer look at 2019 and the spending history of specific minorities.

Strong inflation has resulted in a reduction in the frequency of Veterinary visits since the great recession. Much of the segment’s growth has just come from higher prices. In 2019 inflation reached 4.14% so the amount of Veterinary Services actually declined from 2018. The strongly rising prices especially impacted the lowest income group, African Americans. Even though spending in 2019 increased +2.7% for White, Not Hispanics they also had a net decrease in the amount of Veterinary Services. The only “true” gains came from Hispanics and Asians.

Here are the specifics:

2019 National: Avg CU spent – $164.88 (+$3.37); 2019 Veterinary Services Spending: $21.80B, Up $0.58B (+2.7%)

- White, Not Hispanic – Avg CU spent – $218.65 (+$5.93); 2019 Veterinary Spending: $19.83B, Up +$0.52B (+2.7%)

- Another small gain in dollars, keeping their string of annual increases intact.

- Total Minorities – Avg CU spent – $26.28 (-$4.85); 2019 Veterinary Spending: $1.98B, Up +$0.06B (+3.1%)

- A small gain due to increased spending by Hispanics and Asians. Minorities also had 0.9M more CUs.

- Hispanic – Avg CU spent – $65.75 (+$13.06); 2019 Veterinary Spending: $1.18B, Up +$0.12B (+27.3%)

- Inflation and delayed frequency has caused a spending roller coaster. 2019 was an “up” year.

- African Americans – Avg CU spent – $32.97 (-$15.92); 2019 Veterinary Spending: $0.57B, Down -$0.26B (-31.1%)

- Their low income contributes to even bigger swings in spending. The strong inflation caused a big decrease.

- Asians – Avg CU spent – $35.91 (+$8.61); 2019 Veterinary Spending: $0.23B, Up +$0.06B (+34.7%)

- They have high income but rising prices have produced a perfect annual up/down spending pattern.

- 2019 Performance = Share of Spending/Share CU’s. Shows if groups are “earning their share”:

- White, Not Hispanic – 132.6%; Minorities – 28.8%; Hispanics – 39.9%; Asians – 21.8%; African Americans – 20.0%.

- Note: In 2018: Whites – 131.7%; Minorities – 29.3%; Hispanics – 32.6%; Asians – 16.9%; African Americans – 30.3% Once again the change in frequency made the biggest difference. 2019 brought a big $ drop by African Americans which couldn’t be overcome by significant gains from other minorities. It is somewhat surprising that in a “need” category like Veterinary, White, Not Hispanics have their biggest share of the $. Veterinary care is needed by Pet Parents, but the frequency has become more discretionary.

- Spending History – From 2014 to 2019, Veterinary Spending rose $4.22B (+24.0%). White, not Hispanics have shown consistent growth. Minorities have been on an up & down spending rollercoaster ride which even produced an overall small decrease in spending for the whole Veterinary segment in 2015.

- White, Not Hispanic: +$4.55B (+29.8%) Over 90% of the business and annual growth since 2014.

- Total Minorities:-$0.32B (-13.9%) 2 ups and 3 downs since 2014. After 2014, $ peaked at -12.2% in 2017.

- Hispanics: +$0.62B (+110.7%) They have an up and down pattern but their spending more than doubled. This is great but somewhat deceptive. The frequency variation has caused some extremely high peaks and big drops with lower income groups. Hispanics Veterinary $ fell -$1.23B, -68.7% from 2013>2014, likely from a big drop in frequency.

- African Americans: -$0.97B (-63.0%) Also up and down spending changes but they have yet to recover from the 55% spending drop in 2015. A spike in Veterinary prices along with frequency issues likely caused that decrease.

- Asians: +$0.02B (+9.5%) Their spending turned sharply down in 2018. Inflation and reduced visit frequency even affected this highest income group. 2017 Peak was +95.2%

Income matters but inflation affects all income levels. In this necessary segment, Pet Parents don’t stop spending they just cut back on the frequency. White, Not Hispanics have a higher income and the highest level of Pet ownership. The result is that they dominate this segment with over 90% of the spending.

Now, let’s look at Total Pet. Here is an overview of 2014>2019 Spending.

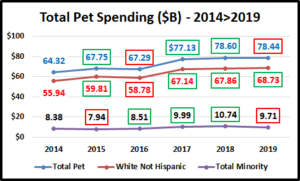

The graph shows the Total Pet Spending history from 2014 to 2019. Each Segment has a different story. The two drops in Total Pet Spending are tied to Food Value Shopping in 2016 and Supplies inflation in 2019. The White, Not Hispanic group mirrored the National pattern until 2019. Total Minority spending dropped in both 2015 & 2019. Their 2019 decrease was large enough that it drove the whole industry down. Overall, from 2014>2019:

- Total Pet $ were up $14.12B (+22.0%)

- White, Not Hispanics were up $12.79B (+22.9%)

- Minorities were up $1.33B (+15.9%)

The Total Pet spending pattern for Whites and Minorities only matched in 2017 & 2018 when both spent more. In the other years they were opposites. Spending peaked for Minorities in 2018 at 28.2%.

Now, let’s take a closer look at 2019 and the spending history of specific minorities.

There were a lot of things going on in 2019. The two biggest factors were the rebound in Pet Food spending after the FDA warning and the high inflation in Supplies prices. The reaction to these and other trends in the industry varied among Racial Ethnic groups. However, income may be the most important demographic difference. The two highest income groups, Whites and Asians spent more on their pets in 2019. However, it wasn’t enough to overcome spending decreases by the lower income groups, Hispanics and African Americans. Here are the specifics:

2019 National: Avg CU spent – $593.51 (-$4.90); 2019 Total Pet Spending: $78.44B, Down $0.16B (-0.2%)

- White, Not Hispanic – Avg CU spent – $759.17 (+$7.72); 2019 Total Pet Spending: $68.73B, Up +$0.87B (+1.3%)

- They had a huge drop in Supplies but increased $ in other segments, especially Food, with a +$3.1B spending rebound from the 2018 FDA warning.

- Total Minorities – Avg CU spent – $232.65 (-$31.38); 2019 Total Pet Spending: $9.71B, Down -$1.03B (-9.6%)

- Spending drops by the lower income groups, African Americans and Hispanics, especially in Food and Services, produced a small decrease in Total Pet Industry spending.

- Hispanic – Avg CU spent – $296.46 (-$27.80); 2019 Supplies Spending: $5.44B, Down -$0.38B (-6.5%)

- Their decrease was primarily driven by a big drop in Food, a delayed reaction to the 2018 FDA warning.

- African Americans – Avg CU spent – $161.52 (-$40.49); 2019 Total Pet Spending: $2.73B, Down -$0.68B (-19.9%)

- Spending was down in all segments, with the biggest drops in Food and Veterinary.

- Asians – Avg CU spent – $240.97 (+$2.33); 2019 Supplies Spending: $1.54B, Up +$0.03B (+2.0%)

- Lifts in Services and Veterinary Services overcame drops in Food and Supplies.

- 2019 Performance = Share of Spending/Share CU’s. Shows if groups are “earning their share”:

- White, Not Hispanic – 127.8%; Minorities – 39.4%; Hispanics – 51.2%; Asians – 41.0%; African Americans – 26.6%.

- Note: In 2018: Whites – 125.0%; Minorities – 44.2%; Hispanics – 55.4%; Asians – 41.0%; African Americans – 33.6% The lowest income groups, especially African Americans, loss considerable ground in 2019.

- Spending History – From 2014 to 2019, Total Pet Spending grew $14.12B (+22.0%). This period saw a series of up and down spending waves in Food, Supplies and Services. The annual growth was +4.1%, which is considerably below the 7.7% industry average since 1960.

- White, Not Hispanic:+$12.79B (+22.9%) They drive Pet Spending with only 1 small drop in 2016.

- Total Minorities: +$1.33 (+15.9%) Different patterns. $ peaked at +28.2% in 2018. Exceeding the rate of Whites.

- Hispanics: +$1.57B (+40.6%) They have the highest % growth and are the only group that spent more every year from 2015 to 2018. Spending fell in 2019 in all segments but Veterinary. They peaked at +50.4% in 2018.

- African Americans: -$0.65B (-19.2%) They are the only group with a decrease. This is primarily due to the big drop in Veterinary in 2015. However, they have the lowest income – the biggest factor in Pet Spending. Their spending peaked at +0.9% in 2018, but spending was up 39.2% from 2015.

- Asians: +$0.41B (+36.3%) They have the highest income, but their spending has been in an up then down pattern every year since 2014. This shows that there are other factors besides income affecting Pet spending.

In 2019 income truly mattered in Pet Spending. However, from 2014>2019 all groups but African Americans increased Pet Spending. Now, we’re going to look a little closer at the most accurate comparison, Spending Performance.

Spending performance is determined by dividing a group’s share of Total $ spent by their share of total U.S. CUs. This factors in both changes in $ spent and in the number of CU so it accurately accounts for the ongoing evolution of both the Pet Industry and U.S. Society.

The graph below shows the annual Total Pet Spending performance of all Racial/Ethnic groups from 2015 to 2019. Total Pet $ grew 15.8% during this time but Minority Pet $ grew 22.3% as they climbed up from their 2015 low point. They were aided by a +7.6% increase in CUs compared to only +1% for whites. It was a tumultuous time in the industry with two down years and big spending swings in many segments. Some of the key industry trends behind those swings were:

- Food: 2015 – the first wave of Super Premium; 2016 – Value Shopping; 2017 – Deeper market penetration of Super Premium; 2018 – FDA warning on grain free dog food; 2019 – Rebound from FDA warning.

- Supplies: 2015 – Cut back on Supplies to pay for upgraded Food; 2016>2018 Prices deflated so spending grew; 2019 – Tariffs cause strong inflation and spending dropped like a rock.

- Services – 2015>2017 rapid expansion of outlets increases availability and competitive pressure, so spending fell in 2017; 2018 – Availability “hits home” and spending explodes. 2019 brings value shopping and spending falls slightly.

- Veterinary – Inflation continues, which reduces visit frequency. Consumers just pay more so Spending goes up.

CU # Change 2015>2019

Whites: +0.9M (+1.0%); Share: 69.9% > 68.6%

All Minorities: +2.9M (+7.6%); Share: 30.1% > 31.4%

Hispanics: +1.2M (+7.1%); Share: 13.0% > 13.6%

African Americans: +1.0M (+6.3%); Share: 12.7% > 13.1%

Asians: +0.7M (+12.7%); Share: 4.4% > 4.8%

- White, Not Hispanic – This group is slowly growing in numbers but losing ground in share of CUs. They are the overwhelming, dominant force in the Pet Industry with 87.6% of Total Pet $ and at least 84.6% of each segment. They have large subgroups, so they are impacted by trends. However, their performance is still up vs 2015.

- Total Minorities – 2019 was a bad year for lower income minorities. Minorities performance had been improving but now it is essentially at the same level as 2015.

- Hispanics – They are the largest minority, with the biggest increase in numbers. Like Whites, they have an up and down performance pattern, but it is the exact opposite. They have lower income and the lowest level of education. It appears likely that they have a slower reaction to industry trends. 2019 was bad for them but they are the only minority group with improved performance over 2015.

- African Americans – The second biggest group with the second largest increase in numbers. They have by far the worst performance. Almost all the cards are demographically stacked against them in pet spending. They have the lowest income and rate of homeownership. They are the most likely to live in a center city, 50+%. In their family life, they are the least likely to be married and most likely to live alone. Also, 32% of all single parent households are African Americans. There is one anomaly, education. Education is usually tied to income. Their lowest income level does not match their level of education – income discrimination? In 2019 their performance fell below 2015.

- Asians – Their CUs are growing, but their performance is down the most from 2015. They have high income and all the key demographics for pet spending. However, they have low pet ownership primarily due to cultural differences.

Our takeaway from this analysis is that Hispanics are likely to continue to make progress. Asians will need to become more Americanized in their pet ownership to drive spending. African Americans may need some assistance or at least an equal opportunity. While their demographic issues are not caused by the Pet Industry, we certainly see their impact. The situation of African Americans is a big problem and a big opportunity – both for our society and the Pet Industry.