2019 Total Pet Spending was $78.44B – Where did it come from…?

Total Pet Spending in the U.S. was $78.44B in 2019, a -$0.16B (-0.02%) decrease from 2018. These figures and others in this report are calculated from data in the annual Consumer Expenditure Survey conducted by the US BLS. 2019 was essentially a “flat” year for the industry, on the surface. However, when you look at each segment there was a certain amount of turmoil. Pet Food spending rebounded after the 2018 FDA warning on grain free dog food but the new tariffs on Supplies really hit home across almost all demographics and the $ plummeted. Services spending dipped slightly after the record lift in 2018. Veterinary spending had another small increase, but it was all due to inflation. 2019 Pet Spending certainly deserves a closer look.

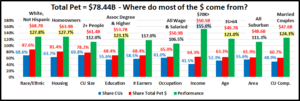

The first question is, “Who is spending most of the $78+ billion dollars?” There are of course multiple answers. We will look at Total Pet Spending in terms of 10 demographic categories. In each category we will identify the group that is responsible for most of the overall spending. Our target number was to find demographic segments in each category that account for 60% or more of the total. To get the finalists, we started with the biggest spending segment then bundled related groups until we reached at least 60%.

Knowing the specific group within each demographic category that was responsible for generating the bulk of Total Pet $ is the first step in our analysis. Next, we will drill even deeper to show the best and worst performing demographic segments and finally, the segments that generated the biggest dollar gains or losses in 2019.

In the chart that follows, the demographic categories are ranked by Total Pet market share from highest to lowest. We also included their share of total CU’s (Financially Independent Consumer Units) and their performance rating. Performance is their share of market vs their share of CU’s. This is an important number, not just for measuring the impact of a particular demographic group, but also in measuring the importance of the whole demographic category in Spending. All are large groups with a high market share. A performance score of 120+% means that this demographic is extremely important in generating increased Pet Spending. I have highlighted the 6 groups with 120+% performance.

The only group change from 2018 is that $70K> replaced $50K> as spending skewed towards higher incomes in 2019. However, there were changes in the numbers and rankings. Everyone Works, Homeowners and Suburban gained in share, ranking and performance. Married Couples and 2+ CUs fell in ranking and in all measurements. Education’s rank didn’t change but they lost share and decreased performance while 35>64 yr olds, Whites and Wage Earners gained in these 2 areas.

- Race/Ethnic – White, not Hispanic (87.6%) This is the 2nd largest group and accounts for the vast majority of Pet Spending. Their performance rating increased to 127.8% and they now rank #2 in terms of importance in Pet Spending demographic characteristics. However, they are in a virtual tie with Homeowners. Although this demographic, along with age, are 2 areas in which the consumers have no control, spending disparities within the group are enhanced by differences in other areas like Income, CU Composition and homeownership. There are also apparently cultural differences which impact Pet Spending. Asian Americans are first in income, education and spending but last in Pet Spending as a percentage of total spending – 0.33% vs a national average of 0.94%.

- Housing – Homeowners (81.4%) Controlling your “own space” has long been a key to larger pet families and more pet spending. 2019 was a bad year for renters, as their pet spending fell -$1.3B. Homeowners spent $1.14B more and the group’s performance rose to 127.7%, keeping them in 3rd place in terms of importance for increased pet spending. The homeownership rate is growing in the younger CUs but most of the pet spending lift in the group is coming from older people who have paid off their homes, whether they are retired or still working.

- # in CU – 2+ people (78.2%) Singles have the lowest performance of any group, but they continued to gain ground in 2019. This gain along with a drop in spending by 2 person CU’s caused the overall performance of 2+ CUs to drop to 112.0%. In the group, only 3 Person CUs spent more but 5+ person CUs remain the only one performing under 100%.

- Education – Associates Degree or Higher (68.4%) Higher Education level is usually tied to higher income and Pet spending. It can also be a key factor in recognizing the value in product improvements. 2019 was a mixed bag. HS Grads and those with Advanced Degrees spent $2.26B more while those with a BA/BS or Associates degree spent $1.97B less. These groups all spent more on Food and less on Supplies. The big difference was a $1.31B drop in Vet $ by the BA/BS/Assoc. group. Overall spending for the Assoc & Higher group fell -$0.97B and their performance fell from 127.5% to 123.1% – from 2nd to 5th. However, Education remains an import factor in Pet Spending.

- # Earners – “Everyone Works” (68.4%) These are CUs of any size where all adults are employed. This group’s share ranking jumped from 7th to 5th. Their performance increased from 110.3% to 117.0%, ever closer to 120%. These big gains came from a $4.4B increase by 2 earner and working single CUs. It shows a growing tie with income and also indicates the overall youth movement in pet spending. Gen X and Millennial CUs have more working adults.

- Occupation – All Wage & Salary Earners (65.0%) – An interesting year – Blue Collar & lower level White Collar workers spent more, while their bosses spent less. Overall, the group spent more but gained share largely because of big spending drops by self employed and retirees. Their performance also grew to 106.5%, but is still the lowest of any group. It remains below 110% because there is a big spending (and income) disparity within the group.

- Income – Over $70K (64.3%) With a big spending drop in the $50>69K group, a new higher dividing line made sense. Money increasingly matters in Pet Spending. With a performance rating of 155.0%, CU income is the single most important factor in increased Pet Spending. This performance is even up from 153.7% in 2018. This was largely driven by a -$1.7B spending drop in the $30>69K range, along with a strong lift from those earning $70>99K, +$1.2B.

- Age – 35>64 (63.3%) The 45>54 yr olds spent -$0.71B less but the other groups made that up. They primarily gained share because of a -$0.77B spending drop by the under 35 group. Their performance also increased from 119.5% to 121.0%. They are now officially included in the “120% Club” but are still ranked 6th in overall importance.

- Area – Suburban (61.9%) Homeownership is high and they have the “space” for pets. Their share of pet spending continues to grow. Their performance also increased from 110.0 to 111.3%. The gain in share and performance was due to a good year for Suburbs 2500> pop. All areas <2500, both rural and suburban, along with Center Cities had a bad year. Rural and Center Cities combined spending was down -$0.78B, which drove up Suburban performance.

- CU Composition – Married Couples (60.7%) With or without children, two people, committed to each other, is an ideal situation for Pet Parenting. In 2019, due in large part to a second consecutive big drop in spending by married couples only CU’s, this group fell from 9th to 10th in share of spending. A big spending lift by singles also contributed to a decrease in performance from 125.2% to 124.3%. However, they are still ranked 4th in importance.

Total Pet Spending is a sum of the spending in all four industry segments. The “big demographic spenders” listed above are determined by the total pet numbers. Although the share of spending and performance of these groups may vary between segments, in only 1 case does any group’s share of spending fall below 60%, 57.0% Married Couples, Services $. In the Services segment analysis, we also altered 2 groups to better reflect where most of the business is coming from.

The group performance is a very important measure. Any group that exceeds 120% indicates an increased concentration of the business which makes it easier for marketing to target the big spenders. Although Income over $70K is the clear winner, there are other strong performers. The high performance in 6 groups also indicates the presence of segments within these categories that are seriously underperforming. These can be identified and targeted for improvement.

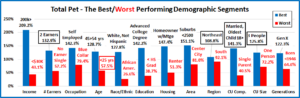

Now, let’s drill deeper and look at 2019’s best and worst performing segments in each demographic category.

Most of the best and worst performers are just who we would expect and there are only 5 that are different from 2018. Changes from 2018 are “boxed”. We should note:

- Income is important in Pet Spending, which is shown by the 209.2% performance by the $200K> group . However, all income groups over $70K have 124+% performance and it increases with income.

- # Earners – After 2 years, 2 Earners is back on top. Gen X and Millennial CUs are the most likely to have 2 workers.

- Age – The 45>54 yr olds maintained their lead over the 55>64 yr old Boomers but the under 25 group returned to the bottom because of a strong year by the oldest Americans.

- Region – With a strong year in Food and Veterinary, the Northeast replaced the usual winner, the West, at the top.

- CU Composition/Number – The performance of Married, Couple Only fell again and they were replaced by older married couples with a child. The “magic” CU number also moved up from 2 to 3.

Most expected winners are still doing well. The “new” winners reflect the growing strength of Gen X. In the next section we’ll look at the segments who literally made the biggest difference in spending in 2019.

We’ll “Show you the money”! This chart details the biggest $ changes in spending from 2018.

There was more stability in 2019. There are 24 Winners and Losers. 5 Winners and 4 Losers are repeats from 2018. Only 3 held their spot in 2018. In 2019, only 4 segments switched from winner to loser or vice versa. In 2018 it was 13.

- # Earners – The 2018 Winner and Loser kept their positions and their $ change (+ or -) increased in 2019.

- Winner – 2 Earners – Pet Spending: $33.95B; Up $2.81B (+9.0%) 2018: 2 Earners

- Loser – 1 Earner, 2+ CU – Pet Spending: $13.27B; Down -$3.55B (-21.1%) 2018: 1 Earner, 2+ CU

- Comment – Income is growing in importance in Pet spending as is the # of earners in a CU.

- CU Composition – Singles continued their strong growth while Married, Couple Only had another big $ decrease.

- Winner –– Singles – Pet Spending: $17.08; Up $2.09B (+14.0%) 2018: Singles

- Loser – Married, Couple Only – Pet Spending: $22.91B; Down -$1.67B (-6.8%) 2018: Married, Couple Only

- Comment – 2 other groups are suffering – married with an oldest child 6>17 and single parents. Couples with younger or older children spent more, as did 2+, all adult CUs.

- # in CU – Again, no change from 2018. The winner and loser stayed on their existing path.

- Winner – 1 Person – Pet Spending: $17.08B; Up $2.09B (+14.0%) 2018: 1 Person

- Loser – 2 People – Pet Spending: $31.00B; Down -$2.36B (-7.1%) 2018: 2 People

- Comment: Although 2 people CUs still spend the most, 39.5% of all Pet $, 2 is losing some of its “magic”. Only 1 and 3 person CUs spent more in 2019. All other sizes spent less.

- Income – There were no repeats or flips here but the winner & loser remain correlated to income level.

- Winner – $70 to $99K – Pet Spending: $14.15B; Up $1.23B (+9.5%) 2018: $150 to $199K

- Loser – $30 to $39K – Pet Spending: $5.05B; Down -$0.69B (-12.0%) 2018: Under $30K

- Comment – All income groups under $70K spent less, -$1.90B. Because of a total spending decrease from the $100>149K segment due to Supplies & Veterinary $, the $70K> group couldn’t quite make up the difference.

- Region – After 2 years at the top, the Midwest flipped to the bottom and the Northeast flipped to the top.

- Winner – Northeast – Pet Spending: $14.99B; Up $1.14B (+8.3%) 2018: Midwest

- Loser – Midwest – Pet Spending: $16.62B; Down -$1.13B (-6.4%) 2018: Northeast

- Comment – In 2018 the Northeast was the only region with a decrease in Total Pet $. In 2019 they were the only region to spend more. They offset the Midwest but couldn’t quite make up for -$0.17B from the South and West.

- Education – BA/BS flipped to the bottom while Advanced Degrees took over the top spot.

- Winner – College Degree – Pet Spending: $20.95B; Up $1.00B (+5.0%) 2018: BA/BS Degree

- Loser – BA/BS Degree – Pet Spending: $23.83B; Down -$1.30B (-5.2%) 2018: HS Grad w/some College

- Comment – Education matters in Pet Spending but 2019 was a “mixed bag”. Those with Advanced Degrees spent more but so did HS Grads with no degree. Assoc/BA/BS degrees along with < HS grads all spent less.

- Housing – Homeowners w/o Mtge flipped from last to first.

- Winner – Homeowner w/o Mtge – Pet Spending: $20.79B; Up $0.99B (+5.0%) 2018: Homeowner w/Mtge

- Loser – Renter – Pet Spending: $14.58B; Down -$1.29B (-8.1%) 2018: Homeowner w/o Mtge

- Comment – All Homeowners spent more. Renters actually had their first spending decrease since 2014>15.

- Race/Ethnic – White, Not Hispanics (87.6% of all Pet $) won again, but their spending lift was not quite big enough.

- Winner – White, Not Hispanic – Pet Spending: $68.73B; Up $0.87B (+1.3%) 2018: White, Not Hispanic

- Loser – African American – Pet Spending: $2.73B; Down -$0.68B (-19.9%) 2018: Asian American

- Comment – Whites and Asians spent more but couldn’t overcome a big drop by Hispanics and African Americans.

- Occupation – No repeats and an unexpected winner.

- Winner –– Technical, Sales, Clerical – Pet Spending: $13.15B; Up $0.87B (+7.1%) 2018: Self-Employed

- Loser – Managers & Professionals – Pet Spending: $25.15B; Down -$1.34B (-5.0%) 2018: Blue Collar Workers

- Comment – Along with the lower level White Collar winners, Blue Collar workers also spent more on their pets, while their “bosses”, Managers & Professionals, spent less.

- Age – A new winner and loser. Both are surprising!

- Winner – 75+ yrs – Pet Spending: $5.21B; Up $0.73B (+16.3%) 2018: 35>44 yrs

- Loser – 45>54 yrs – Pet Spending: $17.01B; Down $0.71B (-4.0%) 2018: 55>64 yrs

- Comment: Spending was on an Age Roller Coaster in 2019. Under 34 – Down -$0.77B; 35>44 – Up $0.39B; 45>54 – Down -$0.71B; 55>64 – Up $0.29B; 65>74 – Down -$0.08B; 75+ – Up $0.73B.

- Area Type – After 1 year on top, Central City flipped back to the bottom.

- Winner – Suburbs 2500> – Pet Spending: $36.16B; Up $0.70B (+2.0%) 2018: Central City

- Loser – Central City – Pet Spending: $23.07B; Down -$0.52B (-2.2%) 2018: Rural

- Comment – Suburbs 2500> have the biggest share of Pet $, 46.1%. They were also the only area with an increase.

- Generation – Both Generations held their spots at the top and bottom of the Total Pet spending change ladder.

- Winner – Gen X – Pet Spending: $25.75B; Up $0.59B (+2.4%) 2018: Gen X

- Loser – Baby Boomers – Pet Spending: $28.73B; Down -$0.88B (-3.0%) 2018: Baby Boomers

- Comment – While the pace slowed, the Boomer Bust and spending growth by Gen X continued.

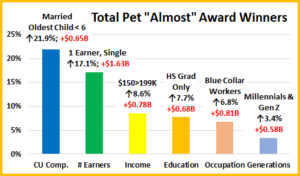

We’ve seen the best overall performers and the “winners” and “losers” in terms of increase/decrease in Total Pet Spending $ for 12 Demographic Categories. Now, here are some segments that didn’t win an award, but they deserve….

HONORABLE MENTION

Let’s start with Married, Oldest child <6. They are the repeat best performer in this “almost” group. Their spending has increased $1.58B (+76.7%) since 2017, quite an accomplishment. This group is generally younger and evidence of the increasing commitment of younger Americans to their Pet Children. That brings us to our 2nd repeat on this list. The Millennial/Gen Z group also gets honorable mention again for their $0.58B spending increase. Gen X only beat them out for the top spot by $0.01B. Overall, Singles have gotten a lot of accolades for their 2019 performance, but I have added one of their subgroups – 1 Earner, singles to the honor roll. They provided 78% of the Singles’ total Increase. We can’t forget another high income group. $150>199K was up $0.78B (+8.6%). College Grads win the awards, but Pet Parenting is widespread. High School grads with no college spent $0.68B (+7.7%) more in a tumultuous year. Finally, most pet spending is done by “white collar” workers and bosses, but there are a lot of Blue Collar pet parents too. In a flat year, they spent $0.81B (+6.8%) more on their pet children.

Summary

To properly review 2019, we must put it into context with recent history. Total Pet Spending peaked in 2018 at $78.60B, a $14.28B, 22.2% increase from 2014. However, it was not a steady rise, Total spending actually fell in 2016 and each segment had at least one down year. There were a number of factors driving both the growth and tumult within the industry. Two big positives were the movement to super premium pet foods and the rapid expansion of the number of outlets offering pet services. On the downside were value shopping, trading $ between segments and outside influences like the FDA dog food warning and tariffs. Pricing, inflation/deflation was also a negative/positive factor in some cases.

That brought us to 2019. The industry had another small decrease, -$0.16B (-0.2%) which was largely driven by a huge drop in spending in Supplies caused by Tarifflation. This affected virtually every demographic segment and caused Supplies $ to fall below 2014. Services spending also fell slightly as consumers value shopped. The good news was Pet Food bounced back from the impact of the 2018 FDA warning to reach a new record high. Veterinary $ also increased 2.7%. Unfortunately, this was entirely due to a 4.1% increase in prices. The amount of Vet Services actually decreased.

There was one change in the big demographic groups responsible for most pet spending as the <$70K income group replaced the <$50K group. Income is becoming even more important in Total Pet Spending, which is reinforced by performance. The number of most influential big groups remains 6, but income truly stands alone at the top.

In the best/worst performing segments, 3 Person and 2 Earner CUs became #1 and Gen X stayed on top, more validation of the ongoing youth movement. A surprise was the Northeast, taking over from the West, the usual winner.

The biggest $ changes saw far less turmoil than in 2018. 9 segments held their position, compared to 3 in 2018, while just 4 switched from 1st to last or vice versa. There were 13 “flips” in 2018. Singles continued their strong growth, and many winners were the “usual suspects: but there were 5 surprises – 75+ yr olds, $70>99K, Northeast, Homeowners w/o Mtges and Tech/Sales/Clerical. This was a mixture of both younger and older Americans. Of note, Baby Boomers spending continued to fall. Gen X and Millennials spent more but couldn’t quite make up the difference. Race/Ethnicity also was a factor in 2019. White, not Hispanics spent $0.87 more but Hispanics and African Americans spent $1.06B less. To get to the heart of 2019 Pet Spending, we will continue our analysis by drilling down into the individual segments.

But before we go…The “Ultimate” Total Pet Spending Consumer Unit in 2019 consists of 3 people – a married couple with a child over 18. They are in the 45 to 54 age range. They are White, but not Hispanic. At least one of them has an Advanced College Degree. The parents work in their own business and are doing well – over $200K. They’re still paying off their house located in a small suburb of a metropolitan area with a population of about 4,000,000 in the Northeast.