The Impact of COVID-19 on Small Businesses – 6/27 Update

Small Businesses are at the core of our nation’s economy and the challenges they face are important to everyone. To better understand the impact of COVID -19 on these businesses and aid decision makers in serving their urgent needs, the U.S. Census Bureau directly reached out to small businesses. For the Survey, the Census Bureau defined a small business as a single location business with employment between 1 and 499 and receipts of at least $1,000.

Consisting of 16 questions, this 5-minute survey reached close to 1 million businesses split across a 9-week rotation to reduce burden and lessen survey fatigue. The survey included small businesses in every area of the U.S. Economy. This initial survey began in the week ending 5/2/20 and was completed in the week ending 6/27/20 so we are able to track the evolution of the COVID-19 impact over 8 full weeks.

The results are first categorized by major, 2 digit NAICS code classification. Slightly more specific data (by 3 digit NAICS code) also became available so that we are able to more closely track elements which are relevant to the Pet Industry. Here are the 14 “pet relevant” groups for which we have compiled data:

- National Avg: Covers All Major Areas with a few Exceptions like Agricultural Production and Religious Organizations

- Product Related Groups:

- 31-33: Manufacturers – All manufacturers

- 311 – Food Manufacturers (Both Human & Animal)

- 42: Wholesalers/Distributors – Wholesalers/Distributors of any type products

- 424 – Distributors of Nondurable Goods (Includes food and nondurable supplies)

- 44-45: Retail Trade – This includes everything from gas stations to Pet Stores (#453910). No restaurants

- 444 – Building Materials/Hardware/Farm

- 445 – Food & Beverage Stores

- 452 – General Merchandise Stores

- 453 – Miscellaneous Retailers (includes Pet Stores)

- 454 – Nonstore Retailers

- 31-33: Manufacturers – All manufacturers

- Services Related Groups:

- 54: Professional, Scientific and Technical Services – Legal, Advertising Agencies, etc… and Vet Clinics (#541940)

- 81: Other Services – Funeral Homes, Barber Shops, Auto Repair, etc … and Pet Care Services (#812910)

- 812 – Laundry & Personal Care (includes Pet Care Services)

The data from each group has been bundled into 3 charts showing the group’s responses to 8 particularly relevant questions about the impact of COVID-19.

Here are the charts and the questions that will be answered on each:

Chart #1: Impact of Covid-19 on Your Business

- Overall, how has this business been affected by the COVID-19 pandemic?

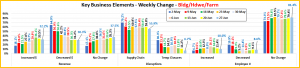

Chart #2: Key Business Elements – Weekly Changes

- In the last week, did this business have a change in operating revenues?

- In the last week, did this business have disruptions in its supply chain?

- In the last week, did this business temporarily close any of its locations for at least one day?

- In the last week, did this business have a change in the number of paid employees?

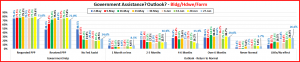

Chart #3: Government Assistance & Your Outlook For The Future

- Since 3/13, has this business requested/received financial assistance from Paycheck Protection Program (PPP)?

- Since 3/13, has this business received any financial assistance from any Federal Program?

- In your opinion, how much time will pass before this business returns to its usual level of operations?

We are not going to review each group in this report. We will take a closer look at the Overall Retail Trade (NAICS 44-45) and 3 retail subchannels – Miscellaneous Retailers (includes Pet Stores), Nonstore Retailers and Hardware/Farm Stores. We also will review Personal Care Services which includes Pet Care. At the conclusion of the report we will make the data for all 14 groups available for you to download. You can then pick the ones that are most relevant to your particular business.

A word of caution: Remember, this data is only for the small businesses in any particular classification. It doesn’t include the big chains, which could be impacted differently because of their size, capabilities or resources.

Let’s get started with the Retail Trade

- There is a big negative impact on the retail trade,76.0%. However, it is still faring better than the overall market which stands at 82.7% negative as of 6/27.

- The negativity has moderated but the readings for all response groups have basically plateaued since 6/13.

- Every measurement on this chart began moving in the right direction but most have plateaued since 6/13. In terms of revenue, 40% still showed a decrease which is still better than the national average, 42.6%. Retail outlets are also doing better than the Nation overall at generating increased $ – 29.1% to 19.7%.

- Supply chain problems are high but stable. Much of the country was opened up in June so temporary closures only affected 15.3% of businesses – a big drop from 43.7% eight weeks earlier.

- The employment situation has improved, especially in terms of businesses decreasing the number of employees. However, that situation has also become static, with the same number adding as cutting and 80% maintaining the status quo.

- 97% of retail trade businesses that applied for PPP funds have received payment. In fact, 79% of all small retail businesses have received some form of government assistance.

- In terms of outlook, although the number of businesses now expecting little or no effect by COVID-19 has grown significantly from 5.1% to 13.3%, this is a small segment. The most popular forecast (40.8%) is over 6 months for a return to normal. When you combine that with the 10.3% who believe that things will never be normal again you get over half, 51.3% who think that recovery will take considerable time. However. This is better than the overall national average of 53.6%

Now let’s drill a little deeper – Miscellaneous Stores, which includes Pet Stores

- While Pet Stores were generally deemed “essential”, most stores in this group, like gift shops, art dealers and used furniture stores were not, which explains the high initial negative impact. It did moderate slightly in May but turned sour in mid-June.

- After peaking at 16.7% on 6/6, the number of businesses reporting a positive or little no effect on their business fell to 13.2% by 6/27.

- The change in revenue started in the right direction but has basically plateaued. Although businesses reporting decreased revenue have actually increased since 6/13.

- Supply chain problems remain a big factor and they too have gotten worse since 6/13.

- Closures have been cut in half but still affect almost 1/3 of the group (31.8%)

- The employment situation has gotten significantly better but there are still twice as many businesses losing employees (14.9%) as those adding employees (7.4%).

- The PPP funds have been distributed. 96% of businesses who applied have received funds. In fact, 81.5% of this group have received some form of federal aid.

- This group’s projected recovery time has gotten worse since mid-June. Now 49.1% say that it will be over 6 months until a return to normal and 14.6% say normal will never return. That is 63.7% of these businesses.

Next, let’s look at Nonstore Retailers

- Although the negative view is less than at the beginning, it is trending up. However, so is the positive view, The biggest decrease occurred in little/no effect which fell from 14.2% to 8.7% in the week of 6/27.

- The revenue situation improved in May but has plateaued in June. 22-24% are posting increases. 35-37% report no change and about 40% are seeing decreased revenue.

- Supply chain problems increased in mid-June but improved by 6/27, Closures improved in June but were up and down on a weekly basis.

- The employment situation generally became more stable in June as hiring and layoffs both slowed. Although there was a little more turmoil in the week of 6/27.

- 98% of businesses that requested PPP have received funds and 72% of the businesses in this group have received some form of government assistance.

- Their overall projection for recovery grew worse in June. By 6/27 43.3% said it would take over 6 months and 9.7% said normal would never return. That’s 53% which is about equal to the National Average (53.6%) but worse than Total Retail (51.3%), which is somewhat surprising for a nonstore group.

Our final Retail Trade group is Hardware/Farm Stores

- Except for an uptick in negativity during the week ending 6/6, their impression of the impact of COVID-19 on their business has steadily improved. By 6/27 their negativity score (55.6%) was the lowest of any retail group that we measured, including Food & Beverage Stores at 59.4%.

- Their revenue began moving in the right direction and by 6/13 the number with increases exceeded the number with decreases. It has become relatively stable – about 33% up, 30% down and 37% with no change.

- Supply chain problems are stable, but high at 56+%. Closures are down dramatically and were only 6.7% as of 6/27.

- Hiring has slowed, after peaking during the week of 6/6 but still exceeds layoffs. 81.4% are now showing no change in the number of employees.

- 99% of businesses that have applied for PPP have received their money and 75.4% of the group has received some form of federal assistance.

- This group projects a speedier recovery than any other retail group. 38.3% expect a return to normal in 6 months or less but 26.6% say that there has been little or no effect on their business. That totals 64.9% which is much better than the National Average of 46.4% and 48.9% for Total Retail.

Finally, let’s look at the Personal Care Services Channel, which includes Pet Care Services

- This segment was hugely impacted by closures but even opening up has not much improved their assessment of the situation. The negativity is still extraordinarily high at 91.5%. Although it has moderated slightly, almost 2/3 of the businesses, 65.2% still see the situation as extremely negative.

- The revenue situation has gradually improved but 50.6% of businesses are still reporting a decrease in $ as of 6/27.

- Supply chain disruptions are improving and are lower than many other channels. Closures have decreased by 54% since May 2nd but still affect 3 in 10 businesses (30.8%).

- The employment situation is still negative – 7.8% hiring; 19.5% laying off, but it has reached its highest level of stability as 72.7% maintained the status quo in the week of 6/27.

- 94% of businesses that applied for PPP have received funds and 84.4% of the group has received some form of federal assistance, which is better than the National Average, 77.0% and the Total Retail Trade, 78.7%.

- Their outlook is rather bleak and almost the exact opposite of Hardware/Farm stores. 47.9% project over 6 months for a return to normal while 19.0% say normal will never return. That totals 66.9%, two thirds of all personal care outlets.

As you can see from our examples, the specifics can vary widely by business category. As the economy began re-opening the situation was generally improving. However, we have seen a resurgence in the virus. This is leading to reimplementation of some business restrictions and has produced an overall feeling of uncertainty among consumers. Until we have a stability in health, a return to normalcy in business will be greatly slowed. COVID-19 has had an especially negative impact on U.S. Small Businesses. Even small businesses in channels that are showing overall growth during the crisis, like Hardware/Farm and Nonstore, are having serious problems. The overall national growth in these channels is being driven by the “big guys”, like Home Depot and Amazon. The overall projection for a return to normal for small businesses is increasingly over 6 months, which would put it in 2021.

That concludes our analysis of this initial survey. As you can see the situation is far from over. Hopefully the Census bureau will conduct periodic future surveys so that we can fully monitor the progress of small businesses through this crisis.

Finally, as we said, more data is available for you. Files with the specific data/charts for all 14 business categories that we identified as relevant to the Pet Industry (including those used in this report) are available for download. Each file is a 1 page word document with 3 COVID-19 impact charts for a specific business category. There is no commentary – just data. Pick the ones that are most relevant for your business and share them with your associates. STAY SAFE!

National Average & Major Business Categories

More Defined Supply Chain Categories

Drilling Down into the Retail Trade

Finally, Personal Care Services (includes Pet Care)