Comparing the Spending Demographics of the Industry Segments – SIDE BY SIDE

The first six reports of our Pet Spending Demographics analysis have been very detailed, data driven and intense. We looked at the industry as a whole and each of the individual Industry segments separately. 2017 was a year of Value and consumers responded with a $9.8B Pet spending increase. 2018 was a different story. We saw the very real impact of outside influence on the industry. The mid-year FDA warning on grain free dog food caused an immediate $2.3B drop in spending in the second half as many consumers reversed their 2017 upgrade. New tariffs flattened spending in Supplies in the second half, after a $1B lift in the first 6 months. Inflation increased in Veterinary and the small spending lift came almost totally from price increases. On the upside, the Service segment had the best year ever. There were unusual “heroes” and “villains” in the 2018 Pet story. Baby Boomers have long driven the growth of the industry. 2018 was their worst year ever – spending drops in every segment – Total: -$6.5B. The good news is that everyone else stepped up, especially the Gen Xers and Millennials. This produced a small increase, but these younger groups have different characteristics, so the spending demographics changed to reflect the younger lifestyle.

We have often referenced the similarities and differences in spending between Total Pet and the individual industry segments. Total Pet Spending is a sum of the parts and not all parts are equal. In this final report we are going to put the segments side by side to make the parallels, differences and changes from 2017 more readily apparent. We will address:

- “The big spenders” – those groups which account for the bulk of pet spending

- The best and worst performing segments in each of twelve demographic categories

- The segments with the biggest changes in spending $ – both positive and negative

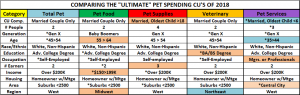

- And of course, the “Ultimate Spending CUs”

The emphasis is on “visual” side by side comparisons to allow you to quickly compare the industry segments. We’ll try to minimalize our comments. You can always reference one of the specific reports for more details. We’ll also break the charts up into smaller pieces that are demographically related to make the comparison more focused and easier.

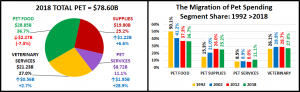

Before we get started, let’s take a look at the current market share of the industry segments. The following 2 charts show the 2018 share of spending for each segment and the evolution over the past 26 years. 1992 was the last year that the Food Segment accounted for 50% of Total Pet Spending. By the way, Total Pet Spending was $16.2B in 1992. We have come a long way – +385%; annual growth rate of 6.26%. This will help put our comparisons into better perspective.

Food: 36.7%; Down from 40.3%

Supplies: 25.2%; Up from 24.1%

Veterinary: 27.0%; Up from 26.8%

The Food segment dropped below the 40% level again, to its lowest level since 2011. In 2015 it was 43.5%, the highest level since 1998. All other segments increased share, although the Veterinary gain was slight. The biggest gain was by Services as they reached a historic new high. Prior to this year their share had been relatively stable, as was Veterinary Services. The most visible long term trend has been the decline of Food share as Supplies gained in importance. The 90’s brought “Pet Parents”, the rise of Pet Chains and Super Stores and a big expansion in the Mass Market. Retailers filled their shelves with Supplies and Consumers filled their Homes. The 2012 and 2018 shares for Food and Supplies look fairly stable but they mask an annual roller coaster ride caused by new premium food trends and deflation in Supplies.

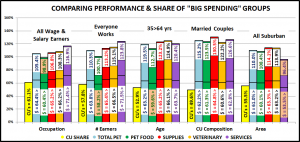

Now let’s get started with a look at the “Big Spenders”. The following 2 charts will compare the market share and performance in all Pet Industry segments by the groups responsible for the bulk of the spending in 10 demographic categories. These are the groups that we identified in our Total Pet analysis to generate at least a 60% market share of spending. As you recall, in some segments, we had to alter some groups slightly to better target the spending. However, to have a true side by side comparison we need to use the same groups for all. The market share dips below 60% in 3 situations, to a low of 53.5%. Two are related to Food, which is yet more evidence that pet parenting is demographically widespread. The other is in Services and reflects the urbanization trend. Even the low point is within 10.8% of our target and 94% of all measurements meet or exceed the 60% requirement, so the comparison is very valid.

The chart makes it especially easy to compare performance across categories. Remember, performance levels above 120% show a very high level of importance for this category in terms of increased spending. Unfortunately, it also indicates a high spending disparity among the segments within the category. There are 2 charts, each with 5 categories.

- White, Non-Hispanic – This group has an 83+% market share in every Segment. Minorities account for 31.5% of CUs but only 9 to 17% of spending in any segment. Factors: Lower income for Hispanics and African Americans and lower Pet ownership in Asians and African Americans. They maintained share in Total, but loss share in Food and Services. Food replaced Supplies at the bottom. Supplies and Veterinary gained share and slightly increased performance.

- 2+ People in CU – 2 is the magic number in pet ownership. In the past, performance has been remarkably even across all segments. This year, all segments but Supplies fell in share and performance because Singles had a great year. This group is still under 120% because spending tends to go down in larger CU’s, with the exception of 4 person CUs in Supplies. In both Service segments the performance of 5+ person CUs is actually worse than singles.

- Homeowners – Homeownership is very important in Pet Ownership and subsequently in all Pet Spending. It also increases with age. Due to the youth movement, this group’s share of spending fell below 80% for the first time. Veterinary and Supplies gained some ground, but Food and Services had big drops. It was also a pretty good year for Renters which correlates to the urbanization movement.

- Over $50K Income – INCOME MATTERS MOST IN PET SPENDING! Food still has the lowest share and performance as Pet Ownership remains common across lower incomes. The importance of income increases as spending in industry segments becomes more discretionary – like Supplies and Services, or higher priced – like Veterinary. This group gained share in all segments but Food. Performance fell slightly in all but Services due to a subpar year by some groups in the $50>99K range.

- Associates Degree or Higher – Higher education often correlates with higher income and we see a similar spending pattern. The group gained in share and performance in all segments, but especially in Food where the less educated groups reversed their 2017 upgrade. Formal Education after HS returned to prominence in all pet spending.

First Note: 2 Big groups have segments with performance under 100%. This truly indicates more balanced spending.

- All Wage & Salary Earners – Incomes vary widely in this group, so performance tends to be lower. However, all segments, but Food gained in share and performance. The drops in Food were driven by Self-employed and Retirees who were among the few groups to spend more on Pet Food.

- Everyone Works – Income is important, but the # of Earners tends to be less important, with one new exception. Younger CUs have more earners. Services spending skewed younger in 2018, in part because they recognized and needed the convenience. This was the first segment to break the 120% mark for this group.

- 35 to 64 yrs – Includes the 3 highest income segments. This group increased both share and performance in all segments but Food. Gen Xers and Millennials both had a very good year, so spending is becoming more balanced across age groups and even moving younger as the 55>64 year olds had a bad year. The exception is Food where the Boomers still dominate.

- Married Couples – Being married makes a big difference in spending in all segments. A minimum performance of 122% says it all. However, Singles had a great year in 2018, so Married Couples fell in share and performance in all but Supplies. Married Couples w/children spent more. It was Married Couples only that caused the drop.

- All Suburban – Most Pet $ are spent here but the share and performance of this group has become more volatile. Supplies and Veterinary have been fairly stable. However, in 2017 the Suburbs lost ground in Food due to a spending lift by Rural. In 2018, this turned around but was replaced by a huge lift in Services by Central City.

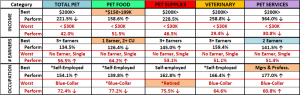

Now we’ll drill a little deeper to look at the Best and Worst performing segments in each category. Color Highlighted cells are different from Total Pet; * = New Winner/Loser; ↑↓ = 5+% Performance Change from 2017. We will divide the categories into related groups. First, those related to Income.

- Income – Higher Income = Higher Performance. Lower Income = Lower performance. Income matters and it matters most in the nonfood segments. Last year the top performer in Food was the over $200K group but it is still a high income group. The performance and disparity are astronomical in the service segments. The winning performance in these segments is dropping, but so is the losing one. This shows that gains are being made in the mid-range.

- # Earners – More earners = more income. Once again, income is even more important to the nonfood segments. In Food, the 1 Earner, 2+ CUs had a bad year as their spending fell -17.5% but they still hung on to the top spot and the performance disparity gap is closing. In Supplies and Services, the number of Earners is becoming more important.

- Occupation – Self-Employed and Mgrs & Professionals are #1 and #2 in CU income and expenditures. They now occupy all the top spots. The Self-Employed rebounded incredibly strong after a bad 2017. Blue Collar workers won in Food last year, but the victory was short lived as they dialed back their upgrade in 2018. As you can see by the arrows, the disparity is growing in 2 segments and Total Pet. This category clearly demonstrates the importance of income in Pet Spending.

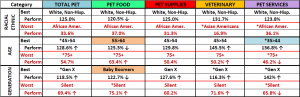

Next are demographics of which we have no control – Age, Generation and Racial/Ethnicity

- Racial/Ethnic – As expected, White Non-Hispanics are the top performer in all segments. African Americans have the lowest average income and only 25% own Pets. Asians have high income but only 24.7% own pets. (Ownership data from the 2017 American Housing Survey)

- Age – The 55>64 group had a bad year. They were replaced at the top by 35>44 in Services and 45>54 in Total. The 45>54 year olds have the highest income and the most CU expenditures. Now they are the leaders in pet spending.

- Generation – 55>64 are all Boomers. The vast majority of 45>54 and 35>44 are Gen Xers so this data closely mirrors the age group category. We should also note that Millennials got off the bottom in both Food and Services.

Now, we’ll go back to demographics in which we have some control.

- Education – Winning and losing is closely tied to more and less Education which also correlates with income.

- CU Composition – Married Couples Only had a bad year but are still on top in 3 categories. In Supplies and Services, you see the family/youth trends. Singles had a good year but are still at the bottom in 3 segments, but not Total.

- CU Size– “2” is still the top number in Pet but 2>4 are all strong. Performance drops off at both ends of the CU size spectrum – 1 or 5+.

- Housing – Homeowners w/Mortgage and Renters are the perennial winner and loser.

- Area– Areas <2500 population (which includes Rural) perform the best except for the new winner, Central City in Services. In terms of worst performer, it is Central City in the Products segments and Rural in the Services segments.

- Region – Same winners as 2017 with the West on top. The South is the overall worst but 92.5% is not too bad.

Here are two summary charts. The first compares the averages.

It is immediately apparent that the difference grows as you move from Food to Supplies to Services. Spending becomes more discretionary. The difference between winners and losers dropped significantly in Total Pet and all segments but Supplies. This indicates a growing balance in spending in these segments.

- Food – In Food the best and worst are actively moving together – more balance in more demographics.

- Supplies – In Supplies the relative performance remained rather stable. The increase in the difference came from slightly poorer performance by the worst segments.

- Veterinary – The winners performance fell significantly, and the losers turned up a little, so the gap narrowed.

- Services – The record spending increase positively affected 91% of 92 demographics segments and the Best and Worst moved closer together.

This chart shows the number of new winners/losers.