Retail Channel Monthly $ Update – July Final & August Advance

By 2021, the market had generally recovered from the impact of the pandemic. Now we are being hit by extreme inflation, with rates higher than we have seen in 40 years. Obviously, this can affect retail sales, so we’ll continue to track the retail market with data from two reports provided by the Census Bureau and factor in the CPI from US BLS.

The Census Bureau Reports are the Monthly and the Advance Retail Sales Reports. Both are derived from sales data gathered from retailers across the U.S. and are published monthly at the same time. The Advance Report has a smaller sample size so it can be published quickly – about 2 weeks after month end. The Monthly Final Report includes data from all respondents, so it takes longer to compile the data – about 6 weeks. Although the sample size for the Advance report is smaller, the results over the years have proven it to be statistically accurate with the final monthly reports. The biggest difference is that the full sample in the Final report allows us to “drill” a little deeper into the retail channels.

We begin with the Final Report for July and then move to the Advance Report for August. Our focus is comparing 2022 to 2021 but also YTD 2019. We’ll show both actual and the “real” change in $ as we factor inflation into the data.

Both reports include the following:

- Total Retail, Restaurants, Auto, Gas Stations and Relevant Retail (removing Restaurants, Auto and Gas)

- Individual Channel Data – This will be more detailed in the “Final” reports, and we fill focus on Pet Relevant Channels

The information will be presented in detailed charts to facilitate visual comparison between groups/channels of:

- Current Month change – % & $ vs previous month

- Current Month change – % & $ vs same month in 2021

- Current Month Real change – % vs same month in 2021 factoring in inflation

- Current YTD change – % & $ vs 2021

- Current YTD Real change – % vs 2021 factoring in inflation

- Current YTD change vs 2019 – % & $

- Current Real change YTD vs 2019 – % factoring in inflation

- Monthly & YTD $ & CPIs which are targeted by channel will also be shown. (CPI details are at the end of the report)

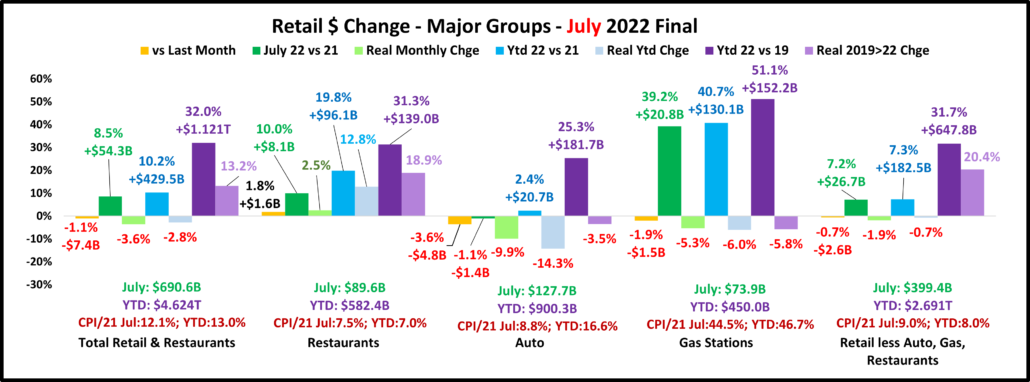

First, the July Final. Total Sales turned down for the 2nd straight month but the $ were up for July and YTD vs 2021. However, factoring inflation into the data, for the 4th straight month only Restaurants had increases in these measurements. Here is the July data for the major retail groups. (All $ are Actual, Not Seasonally Adjusted)

The July Final is $0.7B less than the Advance Report. Restaurants had the biggest change: -1.1B; Relevant Retail: +0.4B; Auto: -$0.4B; Gas Stations: +$0.4B. Sales are down again from last month in all but Restaurants, but consumers continue to spend more vs 2021, except for another dip in Auto. However, the “real” numbers tell a different story. All but Restaurants are again really down in all measurements vs 2021. Restaurants had a late recovery and half of the inflation in this group came before 2022. The inflation impact on Relevant Retail is especially significant as their Real YTD sales vs 2021 are again negative. They do have the best performance since 2019 as 64.4% of their 31.7% growth is “Real”.

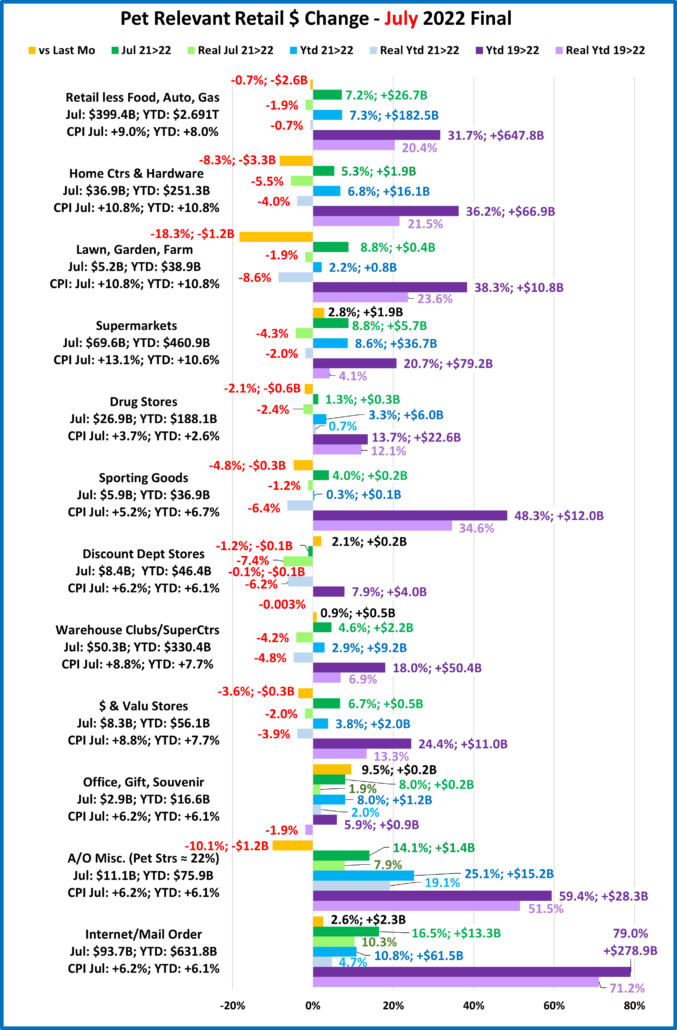

Now, let’s see how some Key Pet Relevant channels did in July.

Overall – 6 of 11 were down vs June. Vs July 2021, 10 reported more $ but only 3 were really up. In YTD vs 2021, 9 reported increases but only 4 were real. Vs 2019, only Office/Gift/Souvenir & Discount Dept Stores were “really” down.

- Building Material Stores – Their Spring lift has ended and was not as strong as last year. YTD Home Ctr/Hdwe is up 6.8% vs 21 but Farm stores are only +2.2%. The Bldg/Matl group has an inflation rate of 10.8% which produced all negative real numbers. The pandemic caused consumers to focus on their homes which produced sales growth over 36% since 2019 in both channels. Importantly, 61.1% of this lift was real, primarily because the bulk of the lift came from 20>21, prior to the inflation wave. Avg Growth Rate: HomeCtr/Hdwe: 10.9%, Real: 6.7%; Farm: 11.4, Real: 7.3%

- Food & Drug – Both channels are truly essential. Except for the pandemic food binge buying, they tend to have smaller fluctuations in $. However, they are radically different in inflation. The YTD rate for Grocery products is 4 times higher than for Drugs/Med products. Drug Store $ are down from June but up vs 21. Real sales are down vs July 2021 but 88% of their growth since 2019 is real. The Real Sales for Supermarkets are down for the month & YTD. Also, only 19.8% of their growth since 2019 is real. Avg Growth Rate: Supermarkets: +6.5%, Real: +1.4%; Drug Stores: +4.4%, Real: +3.9%.

- Sporting Goods Stores – They also benefited from the pandemic in that consumers turned to self-entertainment, especially sports & outdoor activities. Their Spring lift seems to be over and 2022 YTD sales are essentially equal to 2021. Their current inflation rate is 5.2% which is down from 7.5% in April but YTD it is still 6.7%. It was also high in 20>21, +4.8%. However, 72% of their 48% lift since 2019 is real. Their Avg Growth Rate was: +14.0%; Real: +10.4%.

- Gen Mdse Stores – Sales were up for all but $/Valu vs June. Discount Dept stores are down for the month and YTD vs 2021. All other groups are up for both. All real measurements vs 2021 are negative for all channels. Disc. Dept Stores were hurting before COVID and now their sales are “really” down from 2019. The other channels have 41% real growth. Avg Growth Rate: SupCtr/Club: 5.7%, Real: 2.2%; $/Value Strs: +7.6%, Real: +4.3%; Disc. Dept.: +2.6%, Real: -0.001%

- Office, Gift & Souvenir Stores – Their recovery didn’t start until the spring of 2021. Sales are up across the board vs June & 2021. The growth vs 2021 has been strong enough that it turned real YTD sales positive vs 2021. However, their real sales vs 2019 are still down -1.9%. Their true recovery is still a ways off. Avg Growth Rate: +1.9%, Real: -0.6%

- Internet/Mail Order – The growth of the “hero” of the Pandemic is slowing. July Sales are up vs June and 2021 but their YTD growth rate is only half of their average since 2019. However, 92% of their 79.0% growth since 2019 is real. Their Avg Growth Rates is: +21.4%, Real: +19.6%. As expected, they are by far the growth leaders since 2019.

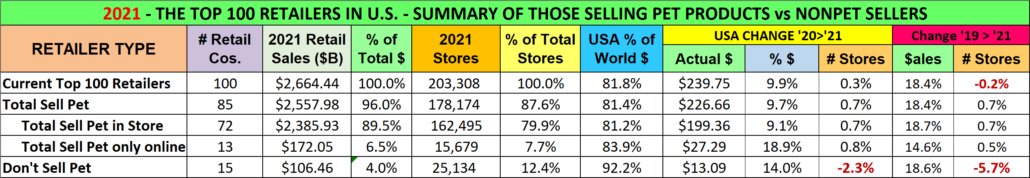

- A/O Miscellaneous – This is a group of specialty retailers. Pet Stores are 22>24% of total $. In May 2020 they began their recovery which reached a record level by December 2021 as annual sales reached $100B for the first time. In 2022, they are by far the Sales increase leaders over 2021. Their sales dipped in January from December and again in July but all measurements have been positive for every other month. Plus, 87% of their 59.4% growth since 2019 is real. Average Growth Rate is: +16.8%, Real: +14.9%. They are 2nd in growth since 2019 to the internet. I’m sure Pet Stores are helping.

There is no doubt that high inflation is an important factor in Retail. In actual $, 10 of 11 channels reported increases in monthly and YTD sales over 2021. When you factor in inflation, the number with any “real” growth falls to 4 for YTD & 3 for monthly. This is a very clear indication of the strong impact of inflation at the retail channel level. Recent data indicates that Inflation again slowed a little. Let’s look at the impact on the Advance Retail Sales numbers for August.

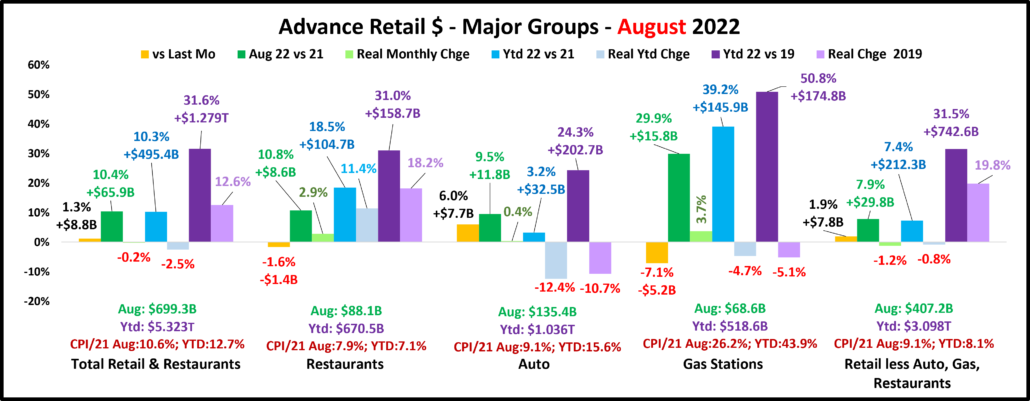

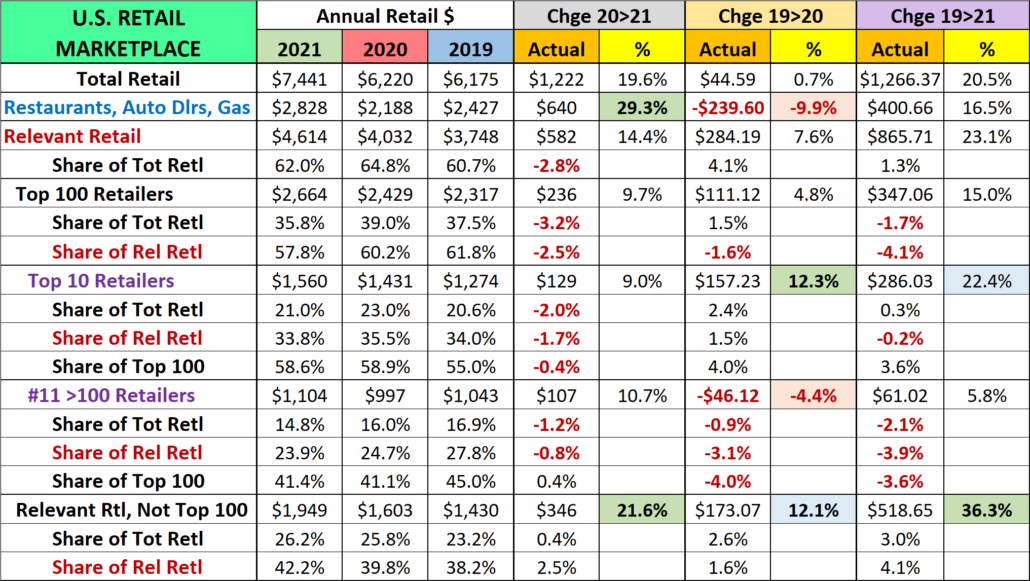

We have had memorable times since 2019. Some big negatives, including the 2 biggest monthly drops in history but a lot of positives in the Pandemic recovery. Total Retail reached $600B in a month for the first time and broke the $7 Trillion barrier in 2021. Relevant Retail was also strong as annual sales reached $4T and all big groups set annual $ales records in 2021. Now, radical inflation is a big factor with the largest increase in 40 years. At first this reduces the amount of product sold but not $ spent. This was evident again in August Relevant Retail $. There was a small overall sales increase from July and $ were up vs July 2021 for all. However, in Relevant Retail the actual amount of product sold vs 2021 fell.

Overall – Inflation Reality is still here. The monthly increase vs 2021 continues to be lower than the inflation rate. The still recovering Restaurants and Gas Stations are up double digits vs 2021 and Auto $ turned positive again. August set a new monthly $ record, but the real YTD sales vs 2021 for all but restaurants are down for the 5th straight month.

Total Retail – Every month in 2022 has set a monthly sales record. August $ are $699B, the 3rd largest of all time. 2022 has become somewhat normal as sales have stayed near the current level for 4 months. We should now expect a slight dip in September. August $ are +1.3% vs July and are up 10.4% vs August 2021 and 10.3% vs YTD 2021. However, when you factor in double digit inflation, both measurements are down for the 6th consecutive month and only 39.9% of the 31.6% growth since 2019 is real. The Avg Growth Rate is: +9.6%, Real: +4.0%. The impact of Inflation continues.

Restaurants – They were hit hard by the pandemic and didn’t truly start to recover until March 2021. Sales in the last 9 months of 2021 exceeded $70B and 2021 was the biggest year in history, $876B. January sales fell from December but then turned up, setting new all-time monthly records in March>May. $ fell in June, set a new record in July and then fell again in August. They are the only big group that is positive in all measurements vs 2021 & 2019. Inflation is high at 7.9% for August and 7.1% YTD but it is the lowest of any big group. 58.7% of their 31.0% growth since 2019 is real. Their Avg Growth Rate: +9.4%, Real: +5.7%. They only account for 12.6% of Total Retail $ales, but their strong performance helps to improve the overall retail numbers.

Auto (Motor Vehicle & Parts Dealers) – This group actively worked to overcome the stay-at-home attitude with great deals and a lot of advertising. They finished 2020 up 1% vs 2019 and hit a record $1.48T in 2021. In 2022 sales got on a rollercoaster – Jan down, Feb/Mar up, Apr>May down, June up, July down, August up. The August lift was strong, +9.5%. Their 4 down months are the only reported sales negatives by any big group vs 2021. This is bad but their real YTD sales numbers are much worse. Extremely high inflation has pushed their real YTD sales down -12.4% vs 2021, the worst of any group. Plus, their 24.3% growth since 2019 is really down -10.7%. Their Avg Growth Rate: +7.5%, Real: -3.7%. Inflation has slowed in the last 3 months. It is likely that the 4 drops in $ales vs 2021 were tied to higher inflation.

Gas Stations – Gas Stations were also hit hard. If you stay home, you drive less and obviously need less gas. This group started recovery in March 2021 and reached a record $584B for the year. Sales fell in Jan>Feb turned up in Mar>Jun then fell in Jul>Aug. They have the biggest increases vs 2021 and 2019 but it is not reality. Gasoline inflation has slowed so August $ are really up vs 2021. Inflation is still 26.2% and 43.9% YTD, by far the highest of any expenditure category. It has even caused consumers to buy 5.1% less than they did in 2019. Avg Growth Rate: +14.7%, Real: -1.7%. The YTD numbers show a big impact of inflation. Consumers spend more but buy less, even less than they bought 3 years ago.

Relevant Retail – Less Auto, Gas and Restaurants – This the “core” of U.S. retail and accounts for 60+% of Total Retail Spending. There are a variety of channels in this group, so they took a number of different paths through the pandemic. However, their only down month was April 2020. They finished 2020, up +7.1% and 2021 got even better as they reached a record $4.50T. They have led the way in Total Retail’s recovery which became widespread across the channels. Sales fell in Jan>Feb, then went on an up/down roller coaster from Mar>Aug with August up 1.9%. All months in 2022 set new records but their YTD increase is 18% below their 9.6% avg growth since 2019. Now, we’ll look at the impact of inflation. 62.9% of their 31.5% growth since 2019 is real. However real sales vs 2021 are down -1.2% for the month and -0.8% YTD. This shows that inflation is only a 2022 problem. Their Avg Growth Rate: +9.6%, Real: +6.2%. The performance of this huge group is critically important. This is where America shops. Real YTD sales are down almost 1% so the amount of products that consumers bought in 2022 is less than in 2021. They just paid more. That’s not good.

The impact of inflation is slowing slightly. All groups but Restaurants have no YTD real growth vs 2021 but only Relevant Retail is really down for the month. Auto & Gas Stations are still “really down” vs YTD 2019. We’ve now had 6 straight months of real monthly and YTD drops for Total Retail so we are still in Phase II of inflation. Consumer spending grows but the amount bought declines. With actual sales in 4 of the last 6 months down vs 2021, the Auto Group is close to Phase III, when consumers actually cut back on spending. If inflation continues, Phase III could become a reality.

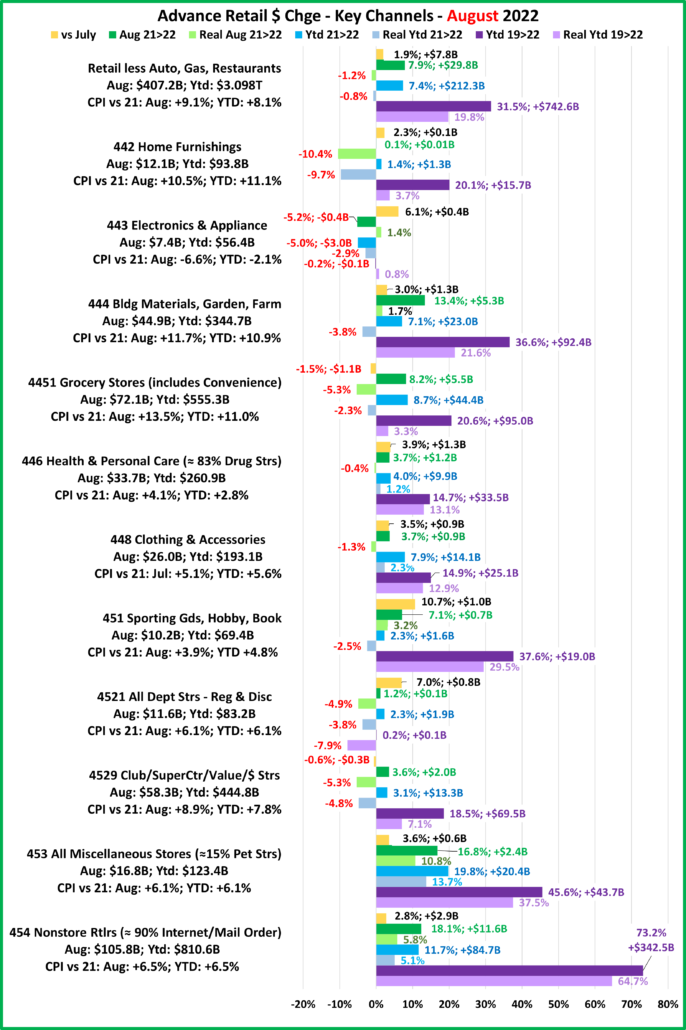

- Relevant Retail: Avg Growth Rate: +9.6%, Real: +6.2%. 9 channels were up vs July and 10 vs August 2021, producing an August $ales record. 10 were up YTD vs 2021. The negative impact of inflation is less but still there in the “real” data.

- All Dept Stores – This group was struggling before COVID, and the pandemic hit them hard. They began to recover in March 2020 and have continued to grow in 2022. Their YTD numbers have been positive vs 2019 since April but in August they are still down in “real” terms in all measurements vs both 2019 & 2021. Avg Growth: +0.06%, Real: -2.7%.

- Club/SuprCtr/$ – They fueled a big part of the overall recovery because they focus on value which has broad consumer appeal. Inflation is a big factor in their current numbers. Sales are down from July but up vs August 2021 and YTD. Their real numbers are down vs 2021 and only 38.4% of their 18.5% lift from 2019 is real. Avg Growth: +5.8%, Real: +2.3%.

- Grocery- These stores depend on frequent purchases, so except for the binge buying in 2020, their changes are usually less radical. Inflation has hit them hard. $ are down from July. Monthly & YTD increases vs 2021 are strong but inflation is stronger. Real sales are down and only 16.0% of the growth since 2019 is real. Avg Growth: +6.5%, Real: +1.1%.

- Health/Drug Stores – Many stores in this group are essential, but consumers visit far less frequently than Grocery stores. After a dip in June, sales turned up in Jul>Aug and are ahead of 2021. However, real sales vs August 21 are down. Their inflation rate is low so 89% of their 14.7% growth from 2019 is real. Their Avg Growth is: +4.7%, Real: +4.2%.

- Clothing and Accessories – They were nonessential, and clothes mattered less when you stayed home. That changed in March 2021 and resulted in explosive growth which continued through May 2022. August sales are up +3.7% from 21 but real sales are -1.3%. YTD $ are up 7.9%% and 87% of their growth from 2019 is real. Avg Growth: 4.8%, Real: 4.1%.

- Home Furnishings – They were also less impacted by COVID. Sales dipped Mar>May in 2020. Then as consumers’ focus turned to their homes, furniture became a priority. Inflation is high. Sales are up from July and vs 2021 but all of their real numbers vs 2021 are negative. Only 18.4% of their growth since 2019 is real. Avg Growth: +6.3%, Real: +1.2%.

- Electronic & Appliances – This channel has problems beyond the pandemic. Sales fell in Apr>May of 2020 and didn’t reach 2019 levels until March 2021. Sales are up from July but are down vs 2021. The July lift was not enough to keep sales positive vs 2019 but deflation kept “real” sales up for the month & YTD vs 2019. Avg Growth: -0.08%, Real: +0.3%.

- Building Material, Farm & Garden & Hardware –They truly benefited from the consumers’ focus on home. This year’s spring lift ended in May as Sales dropped in Jun>Jul. However, they turned sharply up in August. Monthly & YTD sales are up vs 2021, but when you factor in strong, double-digit inflation, the amount sold YTD vs 2021 is still down -3.8%. However, 59.0% of their strong 36.6% sales growth since 2019 is real. Their Avg Growth is: +11.0%, Real: +6.7%.

- Sporting Goods, Hobby and Book Stores – Consumers turned their attention to recreation and Sporting Goods stores sales took off. Book & Hobby Stores recovered more slowly. August sales grew 10.7% from July and are still ahead of 2021, monthly & YTD. However, real YTD $ are still down vs 2021. Inflation in this group is lower than most groups and most comes from Sporting Goods. 79% of their 37.6% growth since 2019 is real. Avg Growth is: +11.2%, Real: +9.0%.

- All Miscellaneous Stores – Pet Stores have been a key part of the strong and growing recovery of this group. They finished 2020 +0.9% but sales took off in March 21. They set a new monthly $ales record in December. Sales are up 3.6% from July and since April they have held the top spot in YTD increase vs 2021. Their YTD growth since 2019 is 2nd only to NonStore. Plus, 82.2% of the 45.6% growth since 2019 is real. Their Avg Growth is: +13.3%, Real: +11.2%.

- NonStore Retailers – 90% of their volume comes from Internet/Mail Order/TV. The pandemic accelerated online spending. They ended 2020 +21.4%. The growth continued in 2021. In December monthly sales exceeded $100B for the 1st time and they broke the $1 Trillion barrier for the year. Their YTD Growth has slowed significantly in 2022 but all measurements are positive. 88.4% of their 73.2% increase since 2019 is real. Their Avg Growth is: +20.1%, Real: +18.1%.

Note: Almost without exception, online sales by brick ‘n mortar retailers are recorded with their regular store sales.

Recap – The Retail recovery from the pandemic was largely driven by Relevant Retail. While the timing varied between channels, by the end of 2021 it had become very widespread. In late 2021 and now in 2022, a new challenge came to the forefront – extreme inflation. It isn’t the worst in history, but it is the biggest increase in prices in 40 years. Overall, it slowed in Jul>Aug but for Relevant Retail it got worse. On the surface, the impact is almost invisible. Sales in the total market and in the Relevant Retail group continue to grow but the growth rate has markedly slowed compared to last year. Overall, the market is generally in phase II of strong inflation – spending grows but the amount purchased falls. The channels in the graph illustrate this perfectly and show how widespread that it has become. 10 of 11 channels are up vs August & YTD 2021 However, when you factor in inflation, only 5 are up for August and 4 for YTD. Inflation is real and there are real and even worse consequences if it continues.

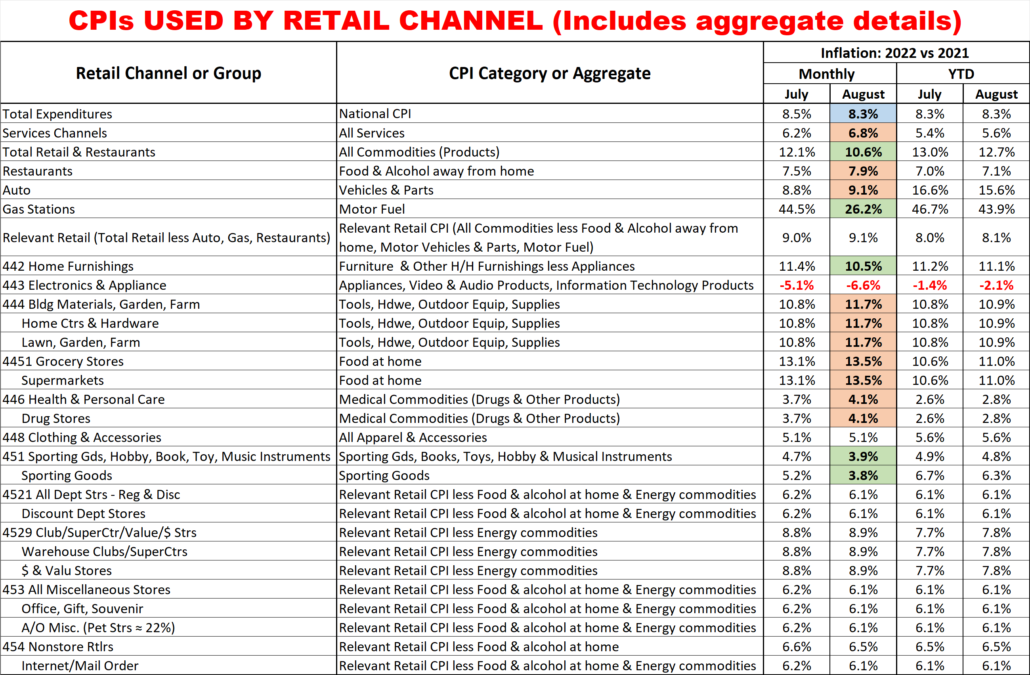

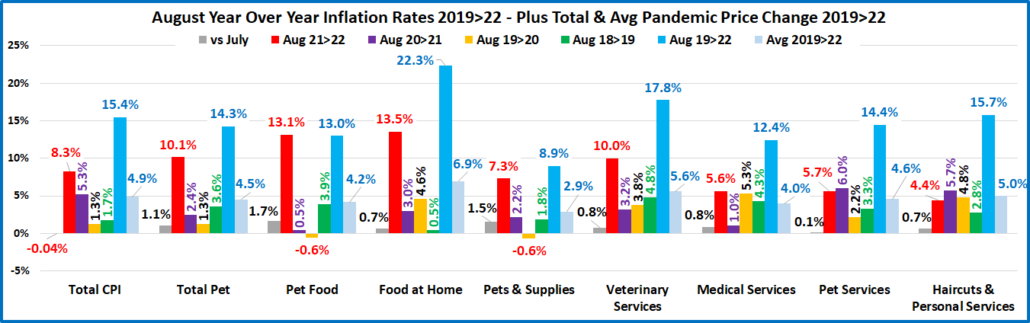

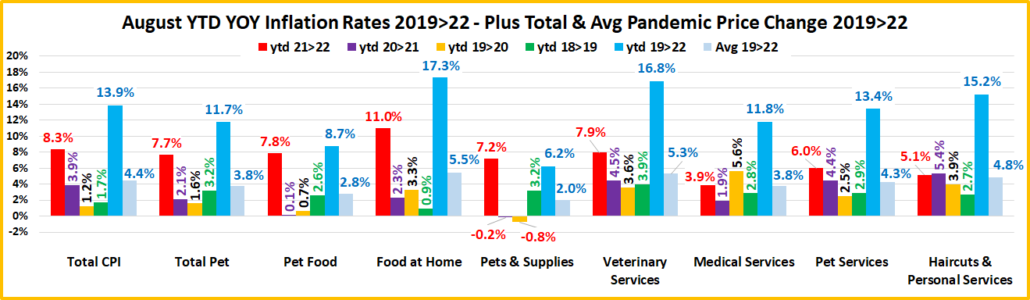

Finally, here are the details and updated inflation rates for the CPIs used to calculate the impact of inflation on retail groups and channels. This includes special aggregate CPIs created with the instruction and guidance of personnel from the US BLS. I also researched data from the last Economic Census to review the share of sales by product category for the various channels to help in selecting what expenditures to include in specific aggregates. Of course, none these specially created aggregates are 100% accurate but they are much closer than the overall CPI or available aggregates.

Monthly CPI changes of 0.2% or more are highlighted.

I’m sure that this list raises some questions. Here are some answers to some of the more obvious ones.

- Why is the group for Non-store different from the Internet?

- Non-store is not all internet. It also includes Fuel Oil Dealers, the non-motor fuel Energy Commodity.

- Why is there no Food at home included in Non-store or Internet?

- Online Grocery purchasing is becoming popular but almost all is from companies whose major business is brick ‘n mortar. These online sales are recorded under their primary channel.

- 6 Channels have the same CPI aggregate but represent a variety of business types.

- They also have a wide range of product types. Rather than try to build aggregates of a multitude of small expenditure categories, it seemed better to eliminate the biggest, influential groups that they don’t sell. This method is not perfect, but it is certainly closer than any existing aggregate.

- Why are Grocery and Supermarkets only tied to the Grocery CPI?

- According to the Economic Census, 76% of their sales comes from Grocery products. Grocery Products are the driver. The balance of their sales comes from a collection of a multitude of categories.

- What about Drug/Health Stores only being tied to Medical Commodities.

- An answer similar to the one for Grocery/Supermarkets. However, in this case Medical Commodities account for over 80% of these stores’ total sales.

- Why do SuperCtrs/Clubs and $ Stores have the same CPI?

- While the Big Stores sell much more fresh groceries, Groceries account for ¼ of $ Store sales. Both Channels generally offer most of the same product categories, but the actual product mix is different.