2018 Top 100 U.S. Retailers – Sales: $2.3 Trillion, Up 4.8%

The U.S. Retail market reached $6.03 Trillion in 2018 from all channels – Auto Dealers, Supermarkets, Restaurants, Online retailers and even Pet Stores. This year’s increase of $282B (+4.9%) topped last year’s increase of $235B. The increases have been steadily growing since 2015. One factor is that rising fuel prices have put Gas station revenue back on the plus side. (Data courtesy of the Census Bureau’s monthly retail trade report.)

In this report we will focus on the top 100 Retailers in the U.S. Market. These companies are the retail elite and account for 38% of the total market. The vast majority also stock and sell a lot of Pet Products. The retail market is constantly evolving which produces some turmoil – mergers, acquisitions, closures. As you will see, the Top 100 are not immune. The report does contain a lot of data, but we’ll break it up into smaller pieces to make it more digestible. All of the base data on the Top 100 comes from Kantar Research and was published by the National Retail Federation (NRF).

We’ll begin with an overview:

Observations

- The total Retail Market grew $282B in 2018 (+4.9%). In 2017 it was +4.3% and in 2016 +3.2%. Acceleration is slowing

- The Top 100 grew $104B (+4.8%). This is better than last year’s +4.3% but slightly less than the total market.

- The Top 100 generates $2.3 Trillion in revenue, 37.7% of the total U.S. retail market – the same as last year.

- Let’s make the data a bit more relevant. If you remove the revenue from Auto, Restaurant and Gas Stations, the “targeted” retail market for the Pet Industry is $3.6 Trillion – 59% of the total market. By the way, the slight drop in share is due to the 13% increase in Gas Station revenue.

- If we also remove Restaurant & Gas Station $ from the Top 100, the remaining $2.1T is 34.7% of the total market.

- … and 58.6% of the $3.6 Trillion “target” market.

The Top 100 is critically important and generally outperforms the overall market, but not in 2018. The difference was very slight. Quite frankly Gas Stations and Restaurants outside the Top 100 performed better than the biggest chains. Remember, the Top 100 is really a contest. Every year companies drop out and new ones are added. This can be the result of mergers, acquisitions or simply surging or slumping sales. Here are some changes of note in 2018:

There were 3 companies in various categories that fell off the list.

◦ Toys R Us (Closed)

◦ SUPERVALU (Moving out of retail)

◦ Petco (last year #100 – in 2018, didn’t make the cut)

There were 3 additions, primarily due to strong sales increases.

◦ Wayfair – sales surged at this internet retailer and it entered the list at #77

◦ Camping World moved into the #93 spot

◦ Stater Bros. (made it back after dropping off the list in 2017)

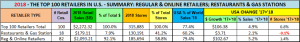

Now let’s start “drilling down” into the specifics of the 2018 Top 100. Here’s a summary of Regular and Online Retailers versus the bundled total for Restaurants & Gas Stations.

- Regular & Online Retailers have 58.8% of the stores but 92.1% of the business, up from 91.9% last year.

- Most of the increase (96.5%) is coming from Regular/online retailers. They are up 5.2% compared to +4.5% in 2017.

- Restaurant sales were up $3.6B (2.2%) in 2018 and Gas Stations turned positive, +0.15B (+1.1%).

- The overall Store count was up +0.8% after a -0.9% drop in 2017. The lift was driven by regular retailers (+1.4%). Restaurants were basically flat (+0.05%) and gas stations were down -2.0%.

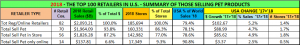

Now that we have an overview of the Top 100, let’s take a look at the “targeted” retailer segment. There are 82 total companies. How many are buying and selling Pet Products? This will reinforce how Pets have become an integral part of the American Household and how fierce that the competition for the Pet Parents’ $ has become.

- Of 82 possible companies, 70 are selling some mixture of Pet Products in stores and/or online. (up from 67 in 2017)

- Their Total Retail Sales of all products is $1.96 Trillion which is…

- 93.8% of the total business for Regular & Online Retailers in the Top 100

- 32.6% of the Entire $6.03T U.S. Retail market – from 70 Companies who sell Pet Products.

- 56 Cos., doing $1.83T in sales are selling pet products off the retail shelf in 142,982 stores – 1000 more than 2017.

- As you can see by the growth in both sales and store count, in store is still the best way to sell pet.

- Online only is another story and the story gets complicated

- Amazon includes Whole Foods, which has stores so the Amazon $ are in the “Pet in Store” numbers.

- Many traditional Retailers who only sell Pet Products online are losing market share. However, internet only retailers, like Wayfair are showing strong growth

- Their Total Retail Sales of all products is $1.96 Trillion which is…

Pet products are an integral part of the strongest retailers and are widespread across the entire U.S. marketplace. Of the Top 100, 143,000 stores carry at least some pet items at retail. There are thousands of additional “pet” outlets including 20,000 Grocery Stores, 10,000 Pet Stores, 16,000 Vet Clinics, 5,000 Pet Services businesses and more. Pet Products are on the shelf in over 200,000 U.S. brick ‘n mortar stores… plus the internet.

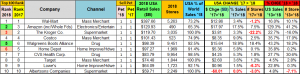

Before we analyze the whole list in greater detail let’s take a quick look at the Top 10 retailers in the U.S.

- They did $1.2 Trillion in Sales

- 52.9% of the Top 100’s $ales

- 19.9% of Total U.S. Retail $

- It’s the same list as 2015>2017, but 4 changed rank

- Amazon moved up to 2nd place

- Albertsons had the only decrease and it was minor

In the next section we will look at the detailed list of the top 100. We’ll sort it by retail channel with subtotals in key columns. We’ll then break it into smaller sections for comments.

I have not done a lot of highlighting however:

- Pet Columns ’18 & ‘17 – a “1” with an orange highlight indicates that products are only sold online

- Rank Columns – Change in rank from 2017: (Note: Acquisitions, Divestitures and Corporate Restructuring can cause big changes in ranking.)

- Up 4-5 spots = Lt Blue; Up 6 or more = Green

- Down 4-5 Spots = Yellow; Down 6 or more = Pink

Let’s get started. Remember online sales are included in the sales of all companies

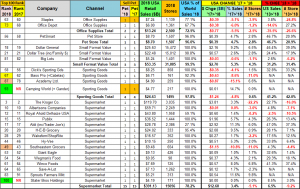

Observations

- Drug is still in turmoil with acquisitions a big factor. We see the results of the Walgreens’ acquisition of hundreds of Rite Aide stores.

- The Traditional Department store segment continues its overall decline. The “high end” Nordstrom stores were an exception with gains in both sales and number of outlets.

- Macy’s stabilized somewhat in 2018, but Sears sales and store count plummeted.

- Although all carry a few pet items, generally online, this channel has never fully embraced Pet Products.

- Much of the growth in the Convenience Store Chains in the Top 100 in recent years has come through acquisitions. This continued in 2018.

- Military Exchanges/Commissaries have added locations in recent years, which fueled the growth in sales. In 2017 they began reducing the number of Army/AF Exchanges. This trend continued in 2018 and for the second consecutive year they also opened no new Commissaries. Sales were essentially flat.

- Auto Parts Stores have become more stable as all chains increased their store count. Overall, sales were up slightly but it came from a mixed bag, ranging from O’Reilly’s +5.8% to AutoZone’s down -0.2%.

- Among Apparel retailers, the value outlets continue to show strong growth. All three of these chains carry pet products. Cosmetics stores are also showing surprising strength. Unfortunately, they don’t carry any pet items…yet.

Observations

- Amazon continues to drive the evolution of U.S. Retail. They moved into the #2 spot in 2018 and sales are up 129% in 5 years. Since the acquisition of Whole Foods in 2017 they also have a brick ‘n mortar presence in the market;

- All three of the Phone People had sales percentage increases that exceeded Amazon’s – a good year!

- QVC acquired HSN in 2017 which moved them up to #40. Sales were only up 1.8% in 2018 and they fell to #41.

- In 2018 we officially lost Toys R Us, a long-time fixture in the Top 100.

- Signet Jewelry’s sales fell 3.4% in 2018 which follows 3.9% drop in 2017.

- Mass Merchants have 2 of the 4 largest volume retailers in America – Wal-Mart and Costco. Recently, these two companies have driven the growth in this channel and 2018 was no exception, but all companies did increase sales.

- Wal-Mart had a 3.4% increase in sales which is slightly above last year’s 3.3%. Their business is mixed as SuperCenters continue to grow and their online sales are taking off. However, “regular” Discount Department Stores are losing market share. These trends impact the overall business in both Wal-Mart and Target.

- Target posted a second consecutive sales increase in 2018, after 3 years of flat or declining revenue.

- Costco continues its strong growth (+9.0%), building new stores and increasing sales – both in store and online.

- BJ’s turned it around in 2018. Sales were up 4.5% after a string of annual declines since 2013.

- All Home Improvement/Hardware companies increased sales, but overall, the category dialed back its growth a bit. There was a drop in total store count which was driven by Lowe’s and True Value. Home Depot was up over $5B (+5.8%) in revenue but Lowe’s, another Top 10 retailer, was up $1B, only +1.5%.

- All Home Goods Companies but Bed Bath & Beyond increased sales. However, 67% of the overall increase came from Wayfair who entered the Top 100 for the first time at #77.

- Tractor Supply was up 11.4% which exceeds their average annual growth rate of 9.4% since 2013.

Observations

- Supermarkets – $391B in Sales; 15 Companies; 15,000 stores; All Selling Pet Products. This is a very important group for the Pet Industry. With the highest frequency of consumer visits of any channel, the competition is fierce. The mergers and acquisitions have slowed. Kroger sold off 800+ convenience stores which accounts for the overall drop of 1000 stores in the category. SuperValu exited the retail grocery business and Stater Bros returned to the Top 100.

- Southeastern Grocers filed for bankruptcy which resulted in store closures and sharply reduced sales.

- Small Format Value Stores: Remember, this retail channel does more business than Traditional Department Stores.

- As expected, Dollar General increased its lead over Dollar Tree in Sales, Sales Increase and Store Count.

- Dollar Tree continues to increase sales and number of stores, but its growth rate has slowed.

- Big Lots cut back in stores and sales turned slightly negative, after 3 consecutive years of small increases.

- This retail channel continues to grow in numbers and popularity. They are committed to Pet Products and their focus on value appeals to today’s ever more price conscious consumers. Plus, they are easy to shop.

- Pet Stores – After the huge lift in sales caused by their acquisition of Chewy in 2017, PetSmart’s sales returned to a more normal growth rate, +4.7%. Petco made big news in 2016 by qualifying for the Top 100 for the first time at #98. This was viewed as evidence of the strength of the U.S. Pet Industry. They had a fair year in 2017 (+3.7%) but they fell to #100. In 2018, they just couldn’t keep up with the competition from 70 companies in the Top 100 selling pet products and they fell out of the Top 100. Perhaps, they will find a formula to make it back into the club.

- Office Supply Stores – This channel continues its decline as Consumers are increasingly moving to online ordering.

- Sporting Goods – Sports Authority closed in 2016 but acquisitions produced 3 Sporting Goods companies in the 2017 Top 100. However, the prosperity was short lived as sales for all 3 turned sharply down in 2018. The only positive note in the category was that Camping World made the Top 100 at #93.

Restaurants & Gas Stations and the Grand Total

Restaurant & Gas Station Observations

Although restaurants & gas stations aren’t relevant in terms of Pet Products Sales, they are relevant in our daily lives.

- In 2018 the revenue for Restaurants in the Top 100 was up 3.6%, a slight increase from 3.0% in 2017. However, it is significantly below the 5.9% increase in the total restaurant channel. Except for Subway, all restaurants in the Top 100 posted increases. Burger King almost made it back, going from down 2.1B in 2017 to up $1.3B in 2018. The other biggest increases came from Chick-fil-A, McDonalds and Starbucks, who all increased revenue by $0.9B.

- Rising gas prices in 2018 drove the revenue of the total channel up 13.2%. The Top 100 Gas Station sales are up only 1.1%. If consumers are trying to cut back on Gasoline usage, perhaps it shows up in these big chains.

Wrapping it up!

The Top 100 became the Top 100 by producing big sales numbers and their performance usually exceeds the overall market. The gap has been narrowing in recent years and in 2018 it turned negative. +4.8% for the Top 100 vs +4.9% for Total Retail. However, when you look a little closer you see that the “problem” is with the Top 100 Restaurants and Gas Stations. If you just compare the “regular” retailers – both brick ‘n mortar and internet, then the Top 100 “wins”, +5.0% to +4.3% for the total “relevant” retail market.

Pet Products are an important part of the success of the Top 100. Seventy companies on the list sell Pet Food and/or Supplies in 143,000 stores and/or online. Let’s take a closer look at the fifty-six companies that stock pet products in their stores. This group generated $1.96T in total sales. How much was from pet? Let’s “Do the math”. If we take out the $8.7B done by PetSmart and the remaining companies generated only 1.5% of their sales from Pet, we’re looking at $29B in Pet Products sales from only 55 “non-pet” sources! (Note: The 1.5% share for Pet items is a low end estimate based on data from the U.S. Economic Census.) The APPA reported $48B in Pet Products sales for 2018.

That means that 55 mass market retailers accounted for 60% of the Pet Products sold in the U.S. in 2018 and…

Pet Products are widespread in the retail marketplace but the $ are concentrated. Regardless of your position in the Pet Industry, monitoring the Top 100 group is important. This group also reflects the ongoing evolution in the retail market – the growing influence of the internet and the importance of Value. The Intense competition is evident in the number of mergers & acquisitions. In business, just like in biology, you must adapt to a changing environment or face extinction!

Finally, here is a link to download the 2018 Top 100 Retailer Excel file so you can do your own analysis.