U.S. Total Pet Spending – By Age AND Income Group: 2016>2017

Using data from the annual Consumer Expenditure Survey conducted by the US BLS, we have done an in-depth analysis of U.S. Pet Spending in over a dozen different individual demographic categories. This has given us a better understanding of “who” is behind the strength and continued growth of the Pet Industry.

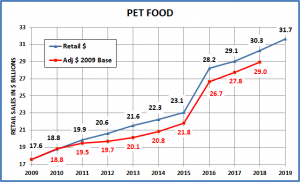

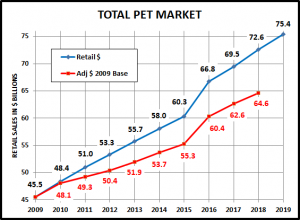

We have seen that the key demographic factor behind increased pet spending is income. At the same time, the demographic that attracts the most broadscale interest and media attention is the spending by generation. Although we can’t bundle these 2 together. The US BLS has again produced a report that combines the two most popular and impactful spending demographic measures – income and age group. To get the required sample size, they combined the data from 2016 and 2017. As you recall, Total Pet Spending averaged over $70B during this period . Unfortunately, due to the complexity of this report we only have the numbers for Total Pet, not for the individual industry segments.

Even this “simplified” report requires a rather complex analysis. We have endeavored to keep it as simple as possible to make it easier to visualize and comprehend. The data is segregated into the following groups:

Age Groups

- 25 to 34 – All Millennials

- 35 to 44 – 85% Gen Xers; 15% Millennials

- 45 to 54 – 75% Gen Xers; 25% Boomers

- 55 to 64 – All Boomers

- 65 & Over – 6 yrs of Boomers + older groups

Income Groups

- Under $30K

- $30K to $49K

- $50K to $69K

- $70K to $99K

- $100K & over

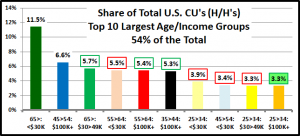

This produces 25 subgroups, accounting for 98% of Total Pet Spending. The under 25 group is not included due to a very low share of Pet Spending and an extremely small sample size in the highest income levels. It is still very complex, especially in building graphs. Therefore, we will again focus on the largest, most impactful groups. Our first chart shows the share of CU’s for the 10 largest age/income segments. There are highlights which apply to all 3 share/performance charts in the report and should help you in viewing and comparing the data.

- Outlined in green = gained share

- Outlined in red = lost share

- Filled in green = new to Top 10

Each of the age/income groups has an assigned a bar color. Ex: 55>64 $100K+ is always red. 25>34 $100K+ is orange, etc.

In terms of age, all 25>34 Income groups are a shade of yellow; 35>44 is black (only 1); 45>54 are shades of blue; 55>64 are red/pink; Over 65 are shades of green. Now that you know the “rules”, let’s get started.

- The first thing that you notice is that there is no “middle ground”. All of the 10 largest segments are either under $50K (6) or over $100K (4). Last year it was 7 to 3 but this year the high income 25>34 group replaced 35>44 <$30K.

- The 2 largest segments are at the opposite ends of the income spectrum but both “held their ground”.

- 3 of the 4 segments that gained share are $100K+. Every $100K age group from 25>64 is now in the top 10. The lift in the 65>, $30>49K group comes from Baby Boomers retiring. Average retirement income is $40K.

- All 4 of the segments that lost share are <$50K. (3 are <$30K). Most of the “losing” CUs moved up a notch in income.

- There are no big groups in the middle ground, $50>100K. Middle income America is very fractionalized by age group.

It’s not all about income and age. There are other factors that impact Pet Spending. Two of the biggest are homeownership and family size, especially the number of children in the household. The following graphs show the distribution of these two demographic measurements across income and age groups.

# of children under 18 – Larger households can create financial pressure which can impact spending on Pet “Children”. As expected, most children, at least the ones under 18, are in the 25>54 yr old group, peaking with the 35>44 yr olds. The number children tends to increase with income. However, the 25>34 yr old Millennials are an exception. CU’s with incomes below $50K have the most children. There are also two dips in the number of children – $50>69K and over $100K. Let’s see if that impacts pet spending.

% Homeownership – About 81% of Total Pet Spending comes from Homeowners. Having more space that you control has always been a key to increased pet spending. Homeownership regularly increases by age and income. For every age group, higher income means a higher percentage of homeownership. This is also true by income group as increased age shows increased homeownership, with one slight variation. In CU’s making over $100K, the 55>64 yr olds edge out the over 65 group – 94 to 93 to claim the overall title. The national homeownership average is 63%. You can see that the younger the group, the higher the required income to meet the average.

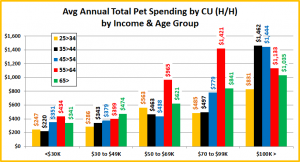

Now let’s get to the $pending. The next chart groups Pet Spending by income group so we can see if age matters.

- <$30K – This group represents almost 1/3 of all U.S. households and obviously has a financial struggle. The over 45 group has fewer children and is more likely to own a home, so they have more money and space for pets.

- $30K>49K – This is the only income group to regularly increase spending with age which puts the 65+ group on top. The average retirees’ income is $40K. Once they reach this level, the financial pressure is reduced, and they can increase their focus and spending on their pets.

- $50>69K – Every age group increases their Pet Spending but there is a big lift in the over 55 groups. Apparently, this is a significant income threshold for them in terms of Pet Spending. We also see an incredible lift in the spending by the 25 to 34-year-old Millennials. This could relate to that dip in the number of children that we noted earlier.

- $70>99K – We have reached middle income. The over 55 groups show another big increase and in fact the spending of the 55 to 64-year olds reaches the “stratosphere”. Last year they were the overall #1 Pet Spending age/income group. This year they are very close. The 25 to 44 group is still feeling strong financial pressure. The spending increase by the 35>44 yr olds slows and spending by the 25>34 yr old Millennials dips slightly – more children?

- $100K+ – $100K is a magic number. At this level Pet Spending explodes for all but the 55>64-year-old group. Their number dips to $1100 but is still equal to last year. Undoubtedly the most significant increases came from the 35>54 group. With some relief from financial pressure they focused more on their pets. Although 35>44 won the overall title with $1462, 45>54 was only $18 behind ($1.50 less per month). The only group under $1000 is the 25>34 yr olds. However, their average income is 20% below the others so $800+ spent on pets is still pretty darn good.

Now let’s look at the same data from the age group view.

- Amazingly enough the oldest group is the most stable. As their income increases, they show strong, consistent growth in pet spending. If they have more money, they spend more on their pets. It’s as simple as that.

- The 4 younger groups have different stories to tell but they have one thing in common. At some point they reach a significant threshold income and their Pet Spending explodes, sometimes doubling or more.

- The 55 to 64-year-old Boomers and the 25 to 34-year-old Millennials are the only groups that have dips in spending, but they also have 2 significant lifts. For both, the initial big increase occurs at $50>69K. The Boomers immediately follow up with another substantial jump at $70>99K. The Millennials lose a little ground then jump 70+% at $100K.

- The 35>54 group is about 80% Gen Xers. They have 2 slightly different paths but end up in almost the same place. For the 35>44 group, spending consistently grows but flattens out at $70>99K. When income reaches $100K, their spending almost triples and they finish in 1st For the older 45>54 group, spending growth is minimal until they reach $70K and it jumps +77%. However, it almost doubles at $100K putting them in 2nd place overall.

- Even with a dip by the Boomers, this view certainly reinforces $100K income as a magic level in Total Pet Spending.

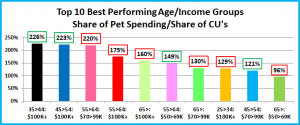

Now, we will truly “show you the money”. Here are the top 10 groups in share of Total Pet $pending.

- These 10 age/income groups account for 50% of all U.S. CU’s and 68% of Total Pet Spending.

- Money Matters Most as all 5 age groups making $100K+ are included along with 2 in the $70>99K range

- Age is still a big factor as 6 of the 10 groups are 55+ yrs old, primarily due to the Boomers

- The biggest gains are from the 35>54-year olds. They took over the top 2 spots and added a group.

Finally, let’s look at the top performers which we will define as having the highest Share of Pet $/Share of CU’s. It is the same group as last year and 8 are repeats from the chart above and have matching colors in the chart below.

- Once again age matters as only the same two under 45, over $100K income groups made the list.

- However, money matters even more in Pet Spending performance than in Pet Spending $. There are no groups making under $50K. The 2 under $50K, 65+ age groups were replaced by 2 65+ age groups making from $50 to $99K.

- Only 9 groups are “earning their share” (100+%). The groups with lower performance are losing share to the 35>54 yr olds (80% Gen Xers). The biggest gains came from the 35>44-year olds as every CU over $30K improved.

The data in this report strongly reinforces the importance of income in Pet Spending. It also gives evidence that the younger groups, primarily the Gen Xers, are beginning to step up, especially in their higher income segments. The availability of disposable income results in increased Pet Spending for every age group. Pet Spending really explodes when any group’s income meets or exceeds $100K. For the lower income groups, the amount of available disposable income varies due to circumstances. The younger groups have more pressure due to family size and building a career. The 45>64 age groups have less family pressure. The over 65 folks just need to meet some low minimum income levels. One thing is certain for everyone. When disposable income increases, one of the first places that it gets spent is on pets.