U.S. Pet Spending: Single Pet Parents – Does Gender Matter?

The subject of this report is Single American Consumer Units (H/H’s) – 1 adult, no children or other adults. Most of our discussions on Pet Spending have focused on the various demographics segments that have 2 or more people, with or without children. There is good reason for this as they spend 80% of all Pet Dollars. However, we shouldn’t overlook the singles segment. Currently they represent 11.6% of the total U.S. population. However they are 29.5% of all Independent Financial Units (CU’s) and account for 20% of Total Pet Spending. With 29.5% of CU’s and “only”20% of Pet Spending they are not as productive as many segments. However the Total Pet Spending in 2015 by U.S. Singles was more than…

- The total of all Hispanic, African Americans & Asians

- The entire Millennial Generation.

- Single Women alone spent more than Millennials

- The whole Northeast Region of the U.S.

- Everyone earning between $100K and $150 K

- And almost equal to all CU’s with incomes over $150K

I think that they deserve a closer look. But before we get started, I want to give credit to the US BLS. All the numbers were taken from or calculated from data in their Annual Consumer Expenditure Survey and a special report on singles spending by gender. To get a valid sample size for single men and women, they combined the data from 2014 and 2015. In order to compare these numbers to overall national data for the same period I calculated the average spending for 2014-2015. Let’s first look how singles are dispersed across society by age group.

- Two peaks at either end of the age spectrum with the low point at 35>44, which is prime time for marriage & family.

- Note that single men outnumber women up to age 55 then things change radically. Longevity may be a factor.

- Actually the percent of single men remains rather stable after age 25 – ranging from 10 to 15%.

- The 51% number in the small <25 group is a bit deceptive. The bulk of singles are in the older groups. 53% of all singles are over 55 (63% of women). Over 45, the numbers jump to 66% of all singles.(58% of Men; 74% of Women)

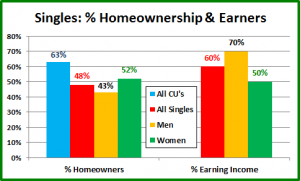

Now let’s get to know a little more about their characteristics, starting with homeownership and employment.

- Homeownership – (82.6% of all U.S. Pet Spending comes from Homeowners)

- Singles are much less likely to be a homeowner.

- Women have a higher percentage – over 50%.

- Homeownership increases with age maxing at 65>

- Only 3% of singles under 25 own a home.

- Earning Income – (83.1% of U.S. Pet Spending is done by “earners”)

- 40% of all singles don’t earn money.

- Single men are 40% more likely to be an earner.

Speaking of earning, let’s look at income and spending.

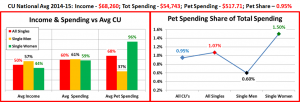

We’ll compare Singles to the National Avg in Income, Spending, Pet Spending and Pet Share of Total $pending

In the first chart we saw that Singles were significantly below par in the percentage of homeownership and “earners”. This usually results in decreased Pet Spending. Here’s how they compare on income and spending.

- Income – The average income of Singles is 50% of the National Average, about $34.5K

- At $39.4K Men make 30% more than Women at $30K

- While this seems challenging, consider the fact that all CU’s with an income of less than $70K make up 64.2% of the U.S. total. Their average income is $32.2K, but they still manage to spend 44% of all Pet $ and 49% of Pet Food.

- Total Spending – Annually, Single Men and Women spend about the same amount of money, which is high considering their income. This situation is especially pronounced among Single Women who make 30% less.

- Pet Spending – As you can see, Pets are important to Singles. To be more precise, Pets are extremely important to Single Women. They make 56% less than average. Overall they spend 41% less than average. However, when it comes to their Pets, their spending is basically on par with the total Nation. Amazing! Single Men spend less than 40% of what Single Women spend on their pets. This disparity is so great that it undoubtedly indicates that far fewer Single Men actually have a pet.

- Pet Spending as a Share of Total Spending – 1% has become the benchmark for performance. Pet Spending first reached 1% of Total Spending in 2008. Since then it has remained at or near this level. In 2014-15, the time covered by the data in this report, Pet Spending was 0.95% of Total Spending.

- Total Singles – At 1.07% they are in the elite “Top 25” of the 85 demographic segments that I monitor, but as usual the story gets more complex when you drill deeper.

- Single Women – At 1.5% they are in line for the Silver medal. Only truly Rural CU’s with a population less than 2500 and located outside of a Metropolitan Area beat them – with 1.65%.

- Single Men – At 0.6% this is the flip side. Only 5 Segments are lower, including – Hispanics, African Americans, Asians, the members of the Greatest Generation (Born before 1929) and CU’s where the oldest child is under 6.

Now we’ll “Show you the Money” as we compare Avg CU Pet Spending to Single CU’s for every age group.

Observations

Total Singles – Overall, the pattern of CU spending generally mirrors that of the National trend. Spending starts to grow in the 25>34 age group, builds to a peak at 55>64 then falls off after 65. One thing to note is the huge spending increase for Singles between age groups 25>34 and 35>44 – 50%. The National increase is only 18%. Singles acquire pets a little later than the general population.

Single Men – This pattern is markedly different. Spending triples when they reach the 25>34 age group as they are acquiring pets. However, their spending peak comes early at age 35>44. From 45>64 their spending falls off a little bit, but it is basically static. When they reach 65, spending drops 25%. The stability in the spending from 35>65 indicates that there are few new pet households but those who have pets are committed to their pets. Also, the spending drop at age 65 is less precipitous for Single Men than the overall national numbers.

Single Women – Spending takes off in the in the 25>34 age group and essentially matches the national average by age 35>44. However, it continues to accelerate after age 45 and peaks at 55>64 at a rate that is 20% above the national average. Remember, their income is still under $40K and less than half of the national average. The 50% drop after age 65 suggests that there is a significant decrease in Pet households.

Final Thoughts

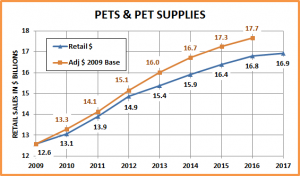

Single Pet Parents are a significant segment in the Pet Industry both in size and in spending. Here are the totals:

- 2015 Total Pet Spending for Singles was $13.45B – a 6.7% increase, despite a 1.1% drop in the number of CU’s

- This was better than the overall industry increase of 5.3% which included a 1.1% increase in CU’s.

- Based upon the US BLS special report on singles,

- Single Women accounted for $9.95B (74% the total)

- Single Men Accounted for $3.50B (26% of the total)

That’s an incredible difference, considering that these groups are close to the same size – Women – 52% of CU’s; Men – 48%. We have found that gender definitely does matter in terms of Pet Spending by Single consumers.

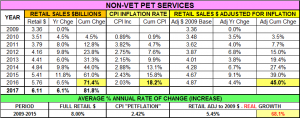

Let’s consider the experience of Pet Parenting for Singles. It’s an enormous responsibility for anyone. However, if you are single, then all the responsibilities, big and small, “belong” to you, unless you choose to hire someone to help. By the way, that does happen. $1.64B (26%) of all 2015 Pet Services Spending was by Singles.

Singles are very interested in any product or service that makes going “solo” as a Pet Parent significantly better or easier. With relatively low income, price will always matter. However, they will spend more for a product that is significantly functionally better.

In terms of reaching this group, there appear to be 3 major opportunities/challenges:

- Opportunity – Overall, the spending commitment to their Pet Children by Single Women is high but it actually increases significantly as they age. Remember, 1.5% of their Total Spending is on their Pets. However, the 45>54 age group spent 1.9% and the 55>64 group spent 2.4%. That last number is truly amazing and it’s not just %. The money is there – $3.4B – about the same as the spending for all single men. Make sure that older single Women have everything they need or want for their pets. Be especially cognizant about the Pet Parenting difficulties that arise as singles move into old age.

- Challenge – The main issue with single Men as Pet Parents seems to be getting them to participate. Pets seem to be a more natural addition to the household for women than men. Getting single men started when they are young and as they reach middle age is the challenge. Through HABRI, we have an amazing amount of scientific evidence documenting the benefits of Pets. This is further magnified by the companionship that pets provide for singles. We need to put on our marketing thinking caps and find ways to get the message across to this group.

- Income – With lower income, money will always be an issue for singles. There is also a high percentage of older adults in the group, both men and women, so some sort of Senior Discount makes sense. We need to keep singles spending and encourage transaction building. Overall, Singles didn’t participate to any great extent in the 2015 movement to upgrade to super premium food. Price was undoubtedly a major factor in that decision.

That wraps it up for this report. The Single Pet Parents demographic group definitely deserved a closer look and we certainly answered the question regarding Pet Spending and gender. Currently, it does matter and if it’s a contest, women win in a runaway.