2016 Total Pet Spending was $67.29B – Where did it come from…?

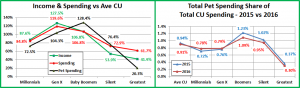

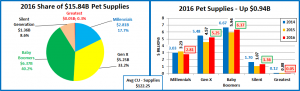

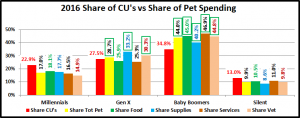

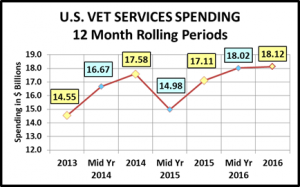

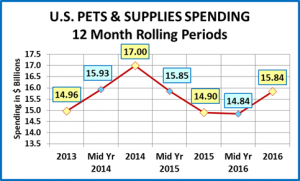

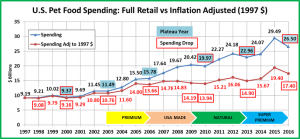

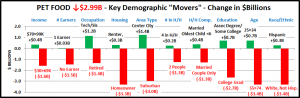

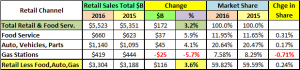

According to data from the Consumer Expenditure Survey conducted by the US BLS, 2016 Total Pet Spending in the U.S. was $67.29B, a $0.46B (-0.7%) decrease from 2015. It was an interesting year. In 2015 we saw a $5.4B increase in Pet Food spending, which came as a result a large number Pet Parents upgrading to super premium brands. To help “pay for” this increase in outlay, households cut back on their spending on Supplies and Veterinary Services. In 2016 the consumers’ focus turned to shopping for value, especially in Foods. The result was a drop of $2.99B in Pet Food Spending. However, they didn’t just pocket all of the savings. They “gave” most of it back by spending an additional $2.53B on Supplies, Services and Veterinary. In 2016, we also saw the Millennials and Gen Xers step up their spending by $2.8B. As I said, it was an interesting year and it raises some interesting questions. It definitely deserves a closer look.

The first question is, “Who is spending most of the $67+ billion dollars?” There are multiple answers. We will look at Total Pet Spending in terms of 10 demographic categories. In each category we will identify which group is responsible for most of the overall spending. Our target number was to find demographic segments in each category that account for 60% or more of the total. In some cases this was easy – Homeowners. In other situations, we had to logically bundle individual segments together to reach our 60% “minimum”. Ex: Occupation – All Wage & Salary earners.

Knowing the specific group within each demographic category that was responsible for generating the bulk of Total Pet $ is the first step in our analysis. Next we will drill even deeper to show the best and worst performing demographic segments and finally, the segments that generated the biggest dollar gains or losses in 2016.

In the chart that follows, the demographic groups appear in ranked order by Total Pet market share from highest to lowest. Also included are their share of total CU’s (Financially Independent Consumer Units) and their performance rating. Performance is their share of market vs their share of CU’s. This is a critically important number, not just for measuring the impact of a particular demographic group, but also in measuring the importance of the whole demographic category in Spending. These are all large groups with a high market share. Any group which produces a performance score over 120% means that this particular demographic measure is extremely important in generating increased Pet Spending. I have highlighted 5 performance ratings which should be noted.

- Race/Ethnic – White, not Hispanic (87.4%) This is the largest group and accounts for the vast majority of Pet Spending. With a 125.2% performance rating, this category ranks #5 in terms of importance in Pet Spending demographic characteristics. However, it is important to note that this demographic, along with age, are the 2 areas in which the consumers have no control. The disparity is enhanced by differences in income, education and homeownership. Although, apparently there are also cultural differences as Asian Americans rank first in income, education and total spending but their pet spending performance only exceeds that of African Americans. In fact, their pet spending as a percentage of total spending is 0.31%, the lowest rate of any group.

- # in CU – 2+ people (80.5%) It just takes two. More singles are adding Pets to their household. However, if you put 2 people together pets very likely will follow. Their overall performance of 114.5% is lower because performance decreases as the number of people in the CU increases, falling to 77.5% for CU’s with 5 or more people.

- Housing – Homeowners (79.8%) Controlling your “own space” has long been the key to larger pet families and more pet spending. At 127.9% performance, homeownership ranks 2nd in terms of importance for increased pet spending. The homeownership rate for Millennials is substantially lower than previous generations when they were the same age. This could have an impact on the future of the industry.

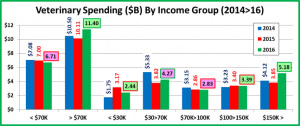

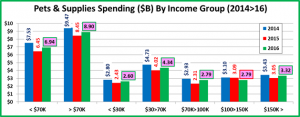

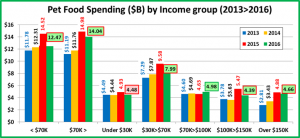

- Income – Over $50K (70.1%) Although Pet Parenting is common in all income groups, money does matter. With a performance rating of 140.1%, CU income is the single most important factor in increased Pet Spending. However, it is not the only factor. Remember that Asian Americans have the highest income but spend a relatively low amount on their pets. There is also the situation where pet spending by the $30>39K income group is higher than expected. The average income of retired persons happens to be in this range. It is difficult to change the habits of a lifetime.

- # Earners – “Everyone Works” (66.3%) This is a composite of CU’s, regardless of size, where all adults are employed. This group’s high share of overall pet spending is another indication of the growing importance of income in pet spending. However the performance of 115.2% is radically lower than that of the income category. This shows that retired folks and CU’s with 2+ people and only one earner are still a significant share of Pet spending.

- Education – Associates Degree or Higher (65.9%) All education levels certainly have pets but spending is another matter. Income generally increases with education level and so does Pet spending. Education is also a key factor in recognizing the value in product improvements, like super premium foods, even though they may come with a higher price tag. Their performance of 127.5% ranks third overall and definitely shows the importance of education in Pet Spending.

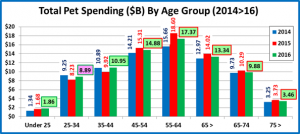

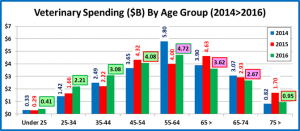

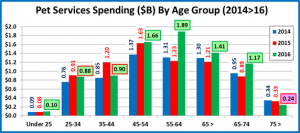

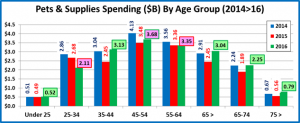

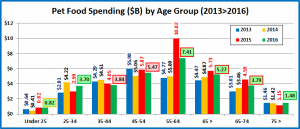

- Age – 35>64 (64.2%) This is a big change. In recent years, the 45>74 year age group dominated the spending. This was largely due to the Baby Boomers. In 2016, the younger groups stepped up their spending and it became more balanced across all industry segments. The result was that the 35>64 group edged out the 45>74 group for the top spot. Their overall performance was 118.6%, which is substantially lower than the 127.6% generated by the older group in 2015. This is an indication that Pet Spending is becoming more evenly distributed across all age groups.

- Occupation – All Wage & Salary Earners (63.7%) – Pet ownership is widespread across all segments in this group. However spending is more skewed towards white collar workers. The low performance, 104.4% shows this disparity but it also reflects the substantial contributions being made by the Self-employed and retired groups.

- CU Composition – Married Couples (61.7%) With or without children, two people, committed to each other, is an ideal situation for Pet Parenting. With a big increase in spending by unmarried 2+ adult CU’s, the performance of married CU’s fell slightly from 130.2% in 2015 to 126.9% in 2016. However, it still ranks fourth in importance.

- Area – Suburban (60.2%) Homeownership is high. Plus, this group also has the “space” for pets. The Suburbs have the largest share of spending by area for all industry segments. The relatively low performance of 109.7% indicates that Pets are “residents” of all areas. It also reflects the spending differences between different industry segments. Food spending goes up in more rural areas and pet services increases in more urban environments.

Total Pet Spending is a sum of the spending in all four industry segments. The “big demographic spenders” listed above are determined by the total pet numbers. Although the share of spending and performance of these groups may vary between segments, every one of them generates a minimum of 58.1% of the spending in every segment. As we analyze individual segments, some of the groups will change to better reflect where most of the business is coming from.

The group performance is a very important measure. Any group that exceeds 120% indicates an increased concentration of the business which makes it easier for marketing to target the big spenders. Although Income over $50K is the clear winner, Homeowners, those with at least an Assoc Degree and Married couples are essentially tied for second place. The exceptionally high performance by these groups also indicates the presence of segments within these categories that are seriously underperforming. These can be targeted for improvement.

Now, let’s drill deeper and look at 2016’s best and worst performing segments in each category.

Most of the best and worst performers are just who we would expect and there are only 3 that are different from 2015. Changes from 2015 are “boxed”. We should note:

- Income is becoming even more important as the 259% performance is up 16.7% from last year. This increase is magnified as it comes in a year in which the performance for both the average winner and average loser fell 2%.

- Occupation – The Self-employed have now occupied the top spot for two years in a row, surpassing the Managers & Professionals in 2015. At the low end, the Service Workers fell into last place. They had a huge 9% increase in the number of CU’s and with the lowest average income of any occupation, their pet spending didn’t keep pace.

- CU Composition – Last year the winner was married couples with a child over 18. This year it is the married couple only. This reflects the impact of the older groups but also the increased pet spending by the Millennials who are just getting started.

- # in CU – It just takes 2 and 2 is by far the best performing CU number, regardless if they are married or unmarried.

- Region – The West is perennially on top. Last year the South was at the bottom. This year it is the Midwest, driven down by their performance in Supplies and Services. Although 94.5% is pretty good for a lowest performance.

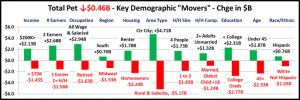

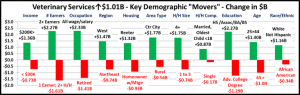

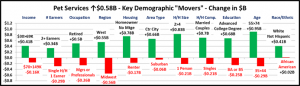

Now let’s truly “Show you the money”. In the next chart, we’ll look at the biggest $ changes in spending from 2015.

In this section we will truly see the difference between 2016 and 2015. There are 22 Winners and Losers. Only 4 are repeats. In 4 cases the segments actually switched from the biggest increase to the biggest decrease or vice versa.

- Area Type – Only the Central City showed a spending increase. It was substantial and in every industry segment.

- Winner – Central City – Pet Spending: $20.15B; Up $4.71B (+30.5%)

- 2015: Rural

- Loser – Suburbs >2500 – Pet Spending: $30.32B; Down $2.51B (-7.6%)

- 2015: All Suburbs

- Comment – The largest Suburbs (over 2500 pop.) was the only group with a spending decrease in every segment.

- Winner – Central City – Pet Spending: $20.15B; Up $4.71B (+30.5%)

- # Earners – More earners generally means a higher income and more Spending.

- Winner – 2 Earners – Pet Spending: $28.55B; Up $2.68B (+10.3%)

- 2015: 2 Earners

- Loser – 2+ in CU with 1 Earner – Pet Spending: $12.61B; Down $1.58B (-11.1%)

- 2015: 2+ in CU with 1 Earner

- Comment – We have had the same winning and losing groups for 2 consecutive years. CU income is growing in importance. The 2+ CU with 1 earner has a lot of financial pressure. 2 Earner CUs generally make more money.

- Winner – 2 Earners – Pet Spending: $28.55B; Up $2.68B (+10.3%)

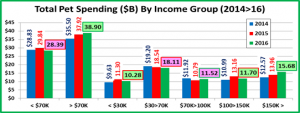

- Income – The value shopping trend caused extreme volatility across the full range of incomes.

- Winner – Over $200K – Pet Spending: $9.27B; Up $2.13B (+29.8%)

- 2015: $100 to $149K

- Loser – $100 to $149K – Pet Spending: $11.7B; Down $1.46B (-11.1%)

- 2015: $50 to $99K

- Comment – Even the over $200K value shopped for Food but they registered big increases in the other segments.

- Winner – Over $200K – Pet Spending: $9.27B; Up $2.13B (+29.8%)

- Education – All of the increases came from those with an Associates’ degree or less. College grads spent less.

- Winner – Associates Degree – Pet Spending: $8.20B; Up $2.06B (+33.5%)

- 2015: College Grads

- Loser – Advanced College Degree – Pet Spending: $17.11B; Down $1.45B (-7.8%)

- 2015: HS Grad or less

- Comment – No clear correlation as 2016 spending by industry segment was a mixed bag for each education level.

- Winner – Associates Degree – Pet Spending: $8.20B; Up $2.06B (+33.5%)

- Housing – Talk about a turnaround. Renters never win. In 2016, they had increases in every segment but Services.

- Winner – Renter – Spending: $13.6B; Up $1.78B (+15.0%)

- 2015: Homeowner w/o Mtge

- Loser – Homeowner w/Mtge – Pet Spending: $36.15B; Down $1.38B (-3.7%)

- 2015: Renter

- Comment – All groups had a lift in Supplies. In the other industry segments, the results varied widely.

- Winner – Renter – Spending: $13.6B; Up $1.78B (+15.0%)

- # in CU – Recently, increased pet spending has been moving towards smaller CU’s. In 2016, that turned around.

- Winner – 4 People – Pet Spending: $9.38B; Up $1.73B (+22.6%)

- 2015: 2 People

- Loser – 3 People – Pet Spending: $11.39B; Down $0.88B (-7.2%)

- 2015: 4+ People

- Comment: In 2015, only CU’s with 3 or fewer people had an increase. In 2016 there was only one magic number – 4 people. Every other size showed a decrease. This probably correlates with the strong performance by the 35>44 age group since they are the only age group to average between 3 and 4 people per household.

- Winner – 4 People – Pet Spending: $9.38B; Up $1.73B (+22.6%)

- Occupation – Pet Parents are widespread across occupations but income has become an increasingly bigger factor.

- Winner – Managers & Professionals– Pet Spending: $22.15B; Up $1.44B (+7.0%)

- 2015: Retired

- Loser – Retired – Pet Spending: $11.51B; Down $1.63B (-12.4%)

- 2015: Operators and Laborers

- Comment – The Retired group won 2 years in a row with big lifts in Food and Veterinary. Now they have cut back sharply on both. In 2016, getting a salary or wages became a priority. Although managers and white collar workers showed the biggest increases, only construction workers and laborers spent less on their Pets in 2016.

- Winner – Managers & Professionals– Pet Spending: $22.15B; Up $1.44B (+7.0%)

- CU Composition – Up or down, the big changes usually come from some sub-segment of married couples, until now.

- Winner – 2+ Unmarried Adults – $10.82; Up $1.32B (+13.9%)

- 2015: Married Couple Only

- Loser – Married, oldest child >18 – $6.55B; Down $1.24B (-15.9%)

- 2015: Married All Children <18

- Comment – This is another category where we see evidence of the spending increase by the younger groups. While 2+ unmarried adults come in all ages, the Millennials are markedly slower to make the marriage commitment. Additionally, the CU Composition sub-segments with all children under the age of 18 showed a pet spending increase of $1.2B. The average age of this group was just over 35.

- Winner – 2+ Unmarried Adults – $10.82; Up $1.32B (+13.9%)

- Age – There is a change “in the air” as the younger groups step up.

- Winner – 35>44 yrs – Pet Spending: $10.95B; Up $1.03B (+10.4%)

- 2015: 55>64 yrs

- Loser – 55>64 yrs – Pet Spending: $17.37B; Down $1.23B (-6.6%)

- 2015: 25>34 yrs

- Comment: This invariably comes down to a battle of the young versus the old. The older group, largely under the influence of the Baby Boomers, usually comes out on top, but not in 2016. Not only did the 35>44 year old group “win” overall, but every age group under 44 registered an increase. Every group 45 and older spent less.

- Winner – 35>44 yrs – Pet Spending: $10.95B; Up $1.03B (+10.4%)

- Race/Ethnic – The vast majority of Spending comes from the White, Not Hispanic group so any change is major.

- Winner – Hispanic – Pet Spending: $4.92B; Up $0.76B (+18.4%)

- 2015: White. Not Hispanic

- Loser – White, Not Hispanic – Pet Spending: $58.78B; Down $1.03B (-1.7%)

- 2015: African American

- Comment – Hispanic spending was flat in supplies but up significantly in all the other segments.

- Winner – Hispanic – Pet Spending: $4.92B; Up $0.76B (+18.4%)

- Region – Regions vary in size and demographics like race/ethnicity and income. The South is also growing rapidly.

- Winner – South – Pet Spending: $24.98B; Up $0.7B (+2.9%)

- 2015: South

- Loser – Midwest – Pet Spending: $13.51B; Down $1.33B (-9.0%)

- 2015: Midwest

- Comment – The South has won two years in a row, largely due to growth in CU’s. The Northeast would have won in 2016, except for a big drop in Vet $. The Midwest’s problems continue with big drops in products & Services.

- Winner – South – Pet Spending: $24.98B; Up $0.7B (+2.9%)

We’ve now seen the best overall performers and the “winners” and “losers” in terms of increase/decrease in Total Pet Spending $ for 11 Demographic Categories. Not every good performer can be a winner but some of these “hidden” segments should be recognized for their outstanding performance. They don’t win an award but they deserve….

Honorable Mention

The 2016 performance of these groups doesn’t require a lot of detailed explanation. They just demonstrate that positive spending contributions were made by more than just the “bosses” and ultra-high income groups. Pets are an integral part of the household in a wide range of demographic segments. They don’t get an award but they are all winners. The 25>34 age group and married couples with an oldest child under six also provide more evidence of the significant contribution to Pet Spending made by the younger generations in 2016.

Summary

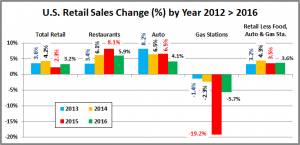

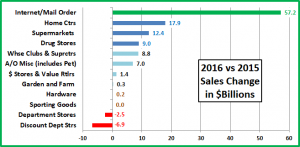

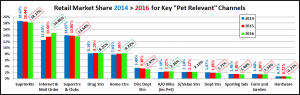

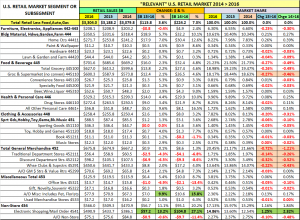

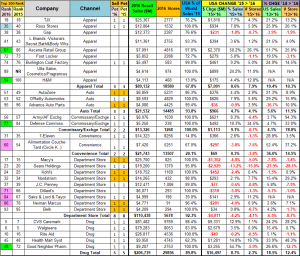

2016 saw a significant change in spending behavior which has strong implications for the future. In 2015 a large number of households opted to upgrade to Super Premium foods. This resulted in a huge increase in Food spending but reduced spending in Supplies and Veterinary Services. In 2016, consumers stuck with their food choices but began seriously looking for the best price in other outlets, including the internet. They found it and spent a lot less money on Food. This freed up funds for increased spending in the other segments. In today’s world with the internet and smart phones, value shopping is easier and it works. Pay less for the products and services that you want! This will impact the whole industry.

In 2016, on the surface, big changes weren’t as apparent. For example, the demographic groups responsible for most of Total Pet Spending were the same as those in 2015…with one exception. The 35>64 age group replaced the 45>64 group as the biggest spenders. This reflects another significant change in 2016. While the older groups were cutting back, the younger generations were stepping up their Pet Spending.

We also discovered a very important fact regarding four demographic categories with high performing large groups.

- Income

- Homeownership

- Education

- CU Composition

Increased income, homeownership, more education and being married all generate increased pet spending. These are all demographic characteristics in which the consumer has some control. The demographic segments in these categories allow industry participants to more effectively target their best customers and… those most in need of improvement.

Speaking of performance, there was also very little change in the best and worst performing individual demographic segments. The most noticeable changes occurred in $. There were some surprising winners – Central City, renters and Hispanics to name a few. As always, to get to the heart of the matter and to more actionable data you have to “drill down”. This will become even more apparent as we turn our analytical focus to the individual industry segments.

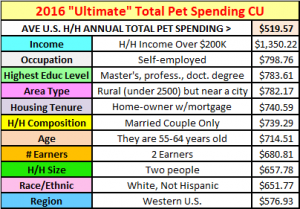

But before we go…The “Ultimate” Pet Spending Consumer Unit is down to 2 – a married couple, alone – their last child finally moved out. They are still in the 55 to 64 age range. They are White, but not of Hispanic origin. At least one of the Parents has an advanced College Degree. They both still work in their own business and it’s doing great – their income is over $200K. They’re still hoping to pay off the same house located in the lovely small suburb adjacent to a big city in the West.

Here are the “fun” facts that led to their selection.